Drawing up primary documents is as easy as shelling pears with us. Don't want your annual reports to be lame? We will correctly compile the primary documentation!

Legislation obliges company owners to prepare primary documents for each transaction performed. At the same time, he constantly changes the rules for filling them out. Every manager should know what documents these are, their forms, and what they are needed for. To avoid negative consequences from a tax audit, in which our lawyers are also actively involved.

Basic Documentation Concepts

- Primary documentation (PD) is evidence recorded on paper that certain business transactions took place.

- Primary accounting is the initial stage of recording transactions that characterize the actions taking place in companies.

- A business transaction is an event that results in a change in the assets or capital of a company.

Usually the following scheme operates at the enterprise:

- Employees receive accounting data;

- Preliminary processing of received information and documentation is carried out;

- Primary documentation is prepared;

- It is approved by management or authorized employees;

- The process of processing PD and performing related actions begins.

PD accounting, like accounting in general, is a mandatory requirement of Article 18 of the Law “On Accounting”.

Primary documentation is:

- One-time, needed once to confirm the operation.

- Cumulative, it turns out to be necessary for a certain period if operations are carried out more than once. Information from it is transferred to the register.

Lesson 5 Summary

- An accountant has the right to make an accounting entry only on the basis of a primary document.

- The documentation must be completed correctly using a standard or free form with a mandatory set of details.

- Documents can be signed by the manager, as well as a limited number of persons appointed by order.

- Each document is checked for errors, recorded in a journal, filed in a folder and stored until the expiration date.

- The minimum retention period for most accounting source documents is 5 years.

- You can store documentation in an office in a room with the right conditions or in an archival company.

- Papers with expired shelf life must be destroyed, for which an expert commission is appointed.

Requirements for maintaining primary accounting records

- PD is issued when the operation is performed; or immediately upon its completion.

- There are standardized forms for filling out PD. The law allows you to use forms approved by Rosstat or forms of your own design approved by your superiors. The form of some documents cannot be changed.

Important! Goskomstat forms have data coding zones; they are filled out in accordance with all-Russian classifiers (OK). Codes that do not refer to OK are needed to summarize and systematize data when processed by computer technology. Such codes must be set according to the rules adopted by the company. PD processing process:

| PD processing stage | Process description |

| Taxation | Evaluation of the transaction described on paper, indicating prices and amounts |

| Grouping | Distribution of documents according to the presence of a certain general characteristic |

| Account assignment | Credit and debit designation |

| Cancellation | Mark “paid” to prevent repeated payment of invoices |

It is only legal to seize personal data by tax services in the presence of their leaders. An accountant is allowed to make copies of personal data only under the control of representatives of the tax service and if there are good reasons for doing so.

Entera

Installing the Entera service is quite simple, it took no more than 15 minutes. To use the services there is no need to purchase a license; payment is made only for processed pages.

The program has one of the most convenient interfaces that allows you to control the accuracy of recognition (for each line of the document a tooltip appears indicating the corresponding line of the scan) and carry out group comparison of documents.

Entera developers have “trained” their product to recognize non-standard and unclear documents with a high degree of accuracy (it is enough that the characters are readable) and to determine their type well. When testing the program, there was almost no need to make manual adjustments.

The service includes: mathematical verification of tables, reconciliation with the Unified State Register of Legal Entities and verification of bank details, which further minimizes errors.

True, such high quality recognition takes a little longer compared to other programs. One page will have to “wait” for about a minute.

A big advantage of Entera in terms of time saving is the ability to batch process documents. You don’t have to bother with each sheet separately, but load a stack of papers at once. The service has a function for recognizing tangled pages and automatically matching them within one package of documents.

Launching in cloud-based 1C is as easy as in regular 1C, and integration with online accounting “My Business” takes 1 minute.

Among the limitations, it is worth noting that to work with the service you need an Internet connection, since it is located on a remote server.

Correcting errors in primary documentation

Article 9 of the Law “On Accounting” prohibits correcting errors in accounting data, however, it happens that an error was still made, and now there is nothing left but to correct it correctly. Errors based on their causes are divided into three types:

- those that arose due to the illiteracy of the accountant;

- which resulted from the careless attitude of an accounting employee;

- arising due to a malfunction of computer equipment.

Sequence of actions when correcting an error in a PD:

- Cross out the incorrect entry with a thin line so that it is visible;

- Write above the correction what needs to be written down;

- Mark “Corrected to believe” in the fields of the form;

- Leave the signature of the responsible employee, surname and initials;

- Indicate the date of correction.

Efsol, aka 42clouds

The Efsol service was one of the first to appear on the Russian market. Due to the fact that it has existed for quite a long time, the creators of the service took into account the experience of a large number of users. But at the same time, the program uses older technologies and is not flexible to accounting innovations.

Efsol pleased me with its simple launch and quick integration with 1C. The undoubted advantages of the program: convenient and simple interface, control of duplicates, choice of the type of documents to be created, a unified dictionary of comparisons and mathematical verification of the tabular part of documents.

Efsol quickly recognizes good quality pages and allows you to create most of the document forms existing in 1C from them.

The main disadvantage is that documents of average quality are poorly recognized and unclear and non-standard documents are not recognized at all.

If you come across any of them among the accountant’s documents, you need to be prepared to enter their data manually. Moreover, you will be able to find out about the recognition result only by uploading documents to the service and paying for these pages.

In addition, the service is not designed to quickly process a stack of documents at the same time - each of them will need to be dealt with separately. The interface is not optimized and requires many common manual steps.

Data storage is possible only in the Efsol proprietary cloud.

Regarding the cost of services, it is important to note that in addition to paying for recognition of each page, to use this service you must additionally purchase an annual license for each workplace, which may not be affordable for small companies.

In general, we can say that the Efsol service is well implemented and is capable of solving many basic problems of standard accounting, but without fine-tuning for narrow accounting problems.

Rules for working with incoming documentation

When working, follow these steps:

| Step | Action | Description of action |

| 1 | Determine if this is an accounting document | The paper must contain data on the commission of the household. events. For example, a check provides information about the expenditure of money; the invoice reports the movement of goods and materials. |

| 2 | See if a document has been sent to your company | The documentation must contain your details or come to a specific employee of the company. It’s definitely worth checking, because... An error may occur, or documents for the purchase of goods and materials may be specifically issued to the company in order to increase tax deductions, or the supplier issues invoices, although no contract has been concluded with him. |

| 3 | Check the details are correct | There is no need to worry about the details of the counterparty; he is responsible for their correct indication, but the details of your company are worth checking. Maybe the document was sent to a company with a similar name. Perhaps the documentation came from a non-existent company. It is also necessary to ensure that the signatures of authorized persons are genuine; a facsimile signature is not permitted. The seal must match the document on which it is affixed. Often a company has many seals and an error occurs. |

| 4 | Check the integrity of the enclosed papers and their condition | If there are missing papers or you find damage, draw up a document and send a copy to the recipient. If it is marked “personally”, opening the letter is prohibited. The envelope can be destroyed, except in cases where the stamp shows the time of sending or receiving, in which case it is attached to the document. |

| 5 | Make sure that the event reflected in the document took place | Your company's specialists must confirm the accuracy of the document. Documentation of goods acceptance will be certified by the warehouse manager, and the terms of the contract will be certified by the marketing specialist. It happens that the supplier issues an invoice (accidentally or deliberately) for goods that he did not deliver, or their quantity does not match the one actually delivered. |

| 6 | Determine whether a document belongs to a specific period | If the document is old and you accept it, you will have to adjust the reports for the period when it should have been processed. The main thing is not to count the document twice. |

| 7 | Define accounting section | Accounting sections are regulated. As for the papers upon receipt of inventory items, you need to decide what the brought inventory items will serve the company: material, goods, fixed assets, intangible assets or services. The material is used in production, consumed and changes shape. The goods are purchased for sale. The main means is a labor tool for the work process, which does not change shape and is not consumed, but undergoes wear and tear. |

| 8 | Decide in which register to file the paper | You need to file documents as quickly as possible so as not to lose them. If there are documents that require revision, you need to create a special folder for them. |

How long to store - terms

Depending on the type and purpose of the document, it must be stored for a certain period of time. Storage periods are determined by various regulations, including:

- Federal Law of October 22, 2004 No. 125-FZ “On Archival Affairs in the Russian Federation”,

- Federal Law dated December 6, 2011 No. 402-FZ;

- A list of standard management archival documents approved by Order of the Russian Archive of December 20, 2019 No. 236.

For most accounting documents, the retention period is 5 years; cash and banking documentation is also stored for 5 years. Personnel documentation must be stored for at least 5 years, and individual documents for 75 years (personal files, personal cards, employment contracts).

It must be counted starting from January 1 of the year following the year the paper was issued.

Separate documentation must be kept on a permanent basis:

- financial statements;

- income/expense books;

- documentation relating to foreign exchange transactions;

- annual statements of insurance premiums;

- documentation regarding the results of inventory, revaluation;

- certain types of contracts.

Procedure and methods of archival storage

The task of any enterprise is to store documentation in such a way that it is safe and sound. Even after several years, the information on paper should be easy to read.

To do this, it is necessary to provide appropriate conditions for archival storage.

There are two archival storage methods:

- Office , when an organization allocates a place on the territory of the organization, provides proper conditions there in terms of temperature, humidity, fire safety, lighting, places convenient shelves, cabinets, racks for storing folders in this place, draws up a list of cases for quickly navigating a large volume of documentary information;

- Offsite , when an organization chooses a specialized archival company that provides proper and high-quality storage.

The second method of archival storage is, of course, convenient. There is no need to free up space in the office, appoint a responsible person, or create special conditions. You can be sure that the documents are in order, everything is safe and sound.

The only negative is the additional costs of paying for the services of archival companies. This minus can cover a lot of advantages obtained from transferring storage responsibilities to another person - there is more space in the office, employees are busy with their direct responsibilities.

In practice, primary documents that are stored on the territory of the organization are often in very poor condition, the information is not readable, forms disappear, are lost, and it is difficult to find anything.

Rules for working with outgoing documentation

In addition to incoming documentation, it is worth discussing outgoing documentation, because for companies that receive documents from you, it will be processed according to all the rules described above. So, processing of outgoing documents occurs in the following order:

- The responsible employee draws up a draft version of the documentation;

- Then the project is prepared;

- Documents are sent to the manager for approval;

- The document receives certification, is drawn up in accordance with all the rules and

- Sent to the recipient.

Registration

Registering a document is assigning an index (number) to it and putting it on the document, followed by recording brief data about it in a journal (on a card) or on a computer. Registration is necessary to ensure the safety of documents, prompt search, accounting and control.

Currently, three document registration systems are in use:

Centralized - in which the registration of all documents of the organization is carried out in one place, for example, in the office, or by one employee, for example, a secretary-assistant.

Decentralized - in which registration of documents is carried out in structural units by department secretaries.

Mixed - in which one part of the documents is registered centrally, the other part - in structural divisions.

An important principle of document registration is one-time use. Each document is registered only once. When registering, documents are divided into several groups, each of which is registered separately, for example:

- incoming documents

- outgoing documents

- internal documents

- commercial contracts

- documents marked “CT” (“Confidential”)

When registering each group of documents, unified unified methods for assigning numbers (indices) must be used. For internal documents and commercial contracts, sequential numbering is usually used. A serial number is assigned according to the journal, starting with No. 1 (or No. 01) from the first of January of each year to December 31.

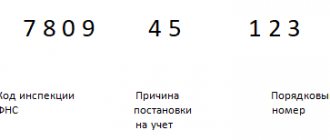

Incoming and outgoing documents must have registration numbers, consisting of the serial number of the document, the symbol of the structural unit or official, the number of the case in which the document or its copy will be filed. For example, document number 01-05/134 includes:

- 01 — structural unit index

- 05 - case number according to nomenclature

- 134 - serial number of the document according to the registration log

In the practical activities of office management services, two forms of document registration are most widespread - journal and card. An automated registration form is also beginning to be introduced. Most often, especially in small companies, journals are used: a log of incoming documents, a log of outgoing documents, logs of internal documents (a log of orders for core activities, a log of orders for personnel), etc.

As an example, here is the form of the log of incoming documents:

When the number of document accounting units exceeds a thousand, it is advisable to use a card registration form. Card forms are printed on thick paper in A5 (148 x 210 mm) or A6 (105 x 148 mm) format. The number of copies of the registration card per document is usually 2-3 pieces. One is placed in the deadline file, the other in the information and reference file, the third can be transferred to the executor along with the document.

Below is a sample registration card:

Planning the company's document flow

For the order and speed of accounting, the deadline and procedure for transferring PD that has been verified and processed to accountants is approved. In order to rationally organize accounting, ensure the veracity of information, quickly find those responsible for completing the task and the place where the document was lost, a document flow schedule is introduced, which indicates:

- date and place of submission of the document,

- employees who completed and submitted the PD;

- accounting records carried out on the basis of transferred securities;

- place and time of storage of the “primary” material.

So, the accountant will receive documents verified:

- according to form;

- arithmetically;

- by content.

Destruction

After the expiration of the established storage period, you can destroy the document, since it is no longer needed, and it is better to free up space.

Destruction must also be carried out according to established rules. You can't just take the paper, tear it up and throw it in the trash.

An expert commission should be appointed that:

- will check the documentation,

- will select the one for which the shelf life has expired and draw up a list of them,

- draw up an act of destruction;

- packs the papers in a special folder;

- will issue an invoice for recycling.

Further, unnecessary documentation is destroyed using our own means or the efforts of third-party companies.

Methods for destroying documents:

- burning;

- grinding;

- chemical disposal.

How primary documents are restored

There are no clear regulations regarding the restoration of the “primary” one. However, there are recommendations reflected in the Letter of the Department of Tax Administration of Russia for Moscow dated September 13, 2002 No. 26-12/43411.

- A commission should be appointed to investigate the reasons for the disappearance or death of the “primary”. If necessary, you can involve investigative authorities, security and fire supervision.

- You also need to try to restore at least some documents by requesting bank statements, contacting counterparties for copies of invoices, etc. 3. Correct the income tax return, because Undocumented waste will not be recognized as expenses when accounting for taxes.

- Allow the tax representative to independently assess the amount of payments to the budget. He will be guided by the documents you have and data on similar taxpayers (clause 7, clause 1, article 31 of the Tax Code of the Russian Federation).

- Pay a fine if imposed by the tax service (Article 120 of the Tax Code of the Russian Federation).

Typical mistakes when maintaining primary documentation

- An accounting employee fills out forms that are not approved by Rosstat or by order of the head of the enterprise.

- Lack of organization details in the PD or incorrect indication of them.

- There is no signature from an authorized employee, or the signature of an employee who does not have the right to certify the PD is affixed.

- There are amendments to the cash documents.

- Records in the PD were made in pencil.

- There are no dashes in the blank columns of the completed forms.

- The seal is missing.