Question

Please tell me the rules for filling out form 1-T (TTN). The supplier in St. Petersburg delivers the goods to the consignee in Vladivostok. It is transported in several stages: the first carrier - the supplier himself, on his own, to a transport company in St. Petersburg, then the goods are transferred for transportation to the 2nd carrier - a transport company authorized for transportation by the buyer. How to correctly fill out the unloading point in the transport section of the TTN? Do you need to indicate the address of a transport company in St. Petersburg or the address of the consignee in Vladivostok? The address of the consignee specified in section 1 of the consignment note must coincide with the unloading address when registering the delivery of goods or is this not necessary?

Rules for filling out a consignment note

The consignment note (form No. TORG-12) (for a sample of filling, see Example No. 2), in accordance with the album of unified forms for recording trade operations, approved by Resolution of the State Statistics Committee of December 25, 1998 No. 132, is used to register the sale (issue) of goods -material assets of a third party organization. Thus, TORG-12 is the primary document certifying the transfer of ownership of the goods from the seller to the buyer.

As for the TTN, in accordance with paragraph 2 of Article 785 of the Civil Code, the conclusion of a contract for the carriage of goods is confirmed by the preparation and issuance of a consignment note to the sender of the goods. In addition, as noted above, the cargo transport document is a transportation document and on its basis the cargo is written off by the consignor and received by the consignee.

Thus, both TORG-12 and TTN confirm the completion of the same business transaction - the transfer of goods by the seller to the buyer. However, the fact of transportation of goods should be documented precisely in the waybill, and TORG-12 acts as an annex to the consignment note. The fact is that, in accordance with paragraph 6 of Article 9 of Law No. 129-FZ, in order to control and streamline the processing of data on business transactions, consolidated recorded documents are compiled on the basis of primary documents. Therefore, one of the documents will be primary, and the second - summary.

In our opinion, the transport invoice will be primary in the situation under consideration, since it confirms the fact of shipment and delivery of the goods to the buyer. So, on the first page of TORG-12 there is a section “Consignment note”, in which information about the consignment note is entered.

But keep in mind that in this situation you also cannot do without TORG-12. Note that, unlike the trade invoice, the TTN does not have a column in which it is necessary to enter information about VAT in a separate line. But in accordance with paragraph 4 of Article 168 of the Tax Code, in settlement documents, primary accounting documents and invoices, VAT amounts must be highlighted on a separate line. It is on this formal basis that tax officials can refuse to deduct VAT.

As for the risks due to the absence of a specification form, they may arise from the buyer or the shipper. In the first case, due to failure to confirm the fact of transportation of the goods, in the second - due to the lack of shipping documents. In any case, even if you have a properly executed invoice and despite positive judicial practice, in order to avoid disputes with the tax authorities, we recommend that you also issue a TTN.

Differences in the content of sections of transport bills

In terms of its composition, the consignment note is divided into two sections (commodity and transport), while the consignment note consists only of the transport section.

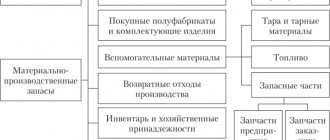

The commodity section of the cargo transport form determines the relationship between the sender of the cargo and its recipient. Based on the commodity section of the TTN, inventory items are credited and written off. The transport section of the TTN defines the relationship between the sender of the cargo and its carriers. Based on the data from the transport section of the TTN, amounts for services and cargo transportation are calculated.

The bill of lading (BW) contains only one section – transport. This is one of the differences between TTN and TN.

Who is obligated to issue a TTN: the shipper or the carrier?

Responsibility for issuing TTN:

In accordance with the provisions of section 4 of the Rules for the transportation of goods by road, approved by Order of the Minister of Investment and Development of the Republic of Kazakhstan dated April 30, 2015 No. 546:

The transportation of goods is documented by waybills, and in cases of transportation of certain types of cargo transported in bulk, it may be documented by a measurement report or a weighing report.

The shipper presents to the carrier a consignment note drawn up in four copies for the cargo presented for transportation, which is the main transportation document and according to which this cargo is written off by the consignor and received by the consignee.

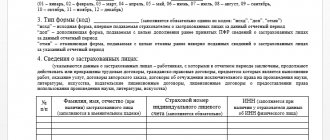

The consignment note for road transport of goods is drawn up by the consignor in four copies in the name of each consignee with the following details filled in: name of the consignee, name of the cargo, quantity, weight of the cargo transported, method of determining the weight (weighing, by stencil, standard, measurement), type of packaging , method of loading and unloading, time of delivery of the vehicle for loading and completion time of loading, downtime.

Acceptance of goods for transportation from the consignor is certified by the signature of the carrier in all copies of the consignment note.

The first copy remains with the shipper and is intended for writing off the goods presented for transportation. The second, third and fourth copies are handed over to the carrier by the shipper.

The second copy is handed over to the consignee by the carrier and is intended for the receipt of received goods.

The third and fourth copies remain with the carrier. The third copy is attached to the invoice for transportation and serves as the basis for settlement with the shipper (consignee), and the fourth copy is attached to the waybill and serves as the basis for accounting for transport work.

The shipper may issue additional copies of waybills, the number of which is established by agreement between the shipper and the carrier.

In all copies of the waybill, the shipper indicates the time of arrival, departure and downtime of the vehicle, and also indicates the method of loading, the weight of the cargo, the number of cargo pieces, the types of services performed by the carrier and certifies the waybills with a signature, seal or stamp.

A seal or stamp is not required for legal entities classified as private businesses.

Thus, since the LLP is the consignor of the goods and transfers it to the carrier. Accordingly, the LLP is obliged to issue a specification form in 4 copies in the name of each buyer who is the consignee and transfer these specification specifications to the carrier.

Consequences of failure to issue a TTN:

In accordance with the provisions of paragraph 3 of Art. 242 of the Tax Code of the Republic of Kazakhstan, deductions are made by the taxpayer for expenses actually incurred in the presence of documents confirming such expenses related to his activities aimed at generating income.

Thus, the document confirming transportation expenses is the act of work performed (services rendered), issued in accordance with the legislation of the Republic of Kazakhstan on accounting and financial reporting.

At the same time, because Industry legislation on the road transportation of goods requires an extract of the consignment note, then the consignment note, along with the specified act, is also the primary document that serves as documentary evidence for attributing transportation costs to deductions under the corporate income tax. TTN is a document confirming the actual transportation of goods by road.

Accordingly, if the LLP has a certificate of completion of work from the carrier, but in the absence of a specification form, the tax authorities, during an audit, can reasonably exclude these expenses from deductions under the CIT.

What should be indicated in the technical specifications in 2021

According to the Civil Code, a waybill is a document that confirms the transportation of goods between counterparties. TN is concluded on the basis of an agreement between the subjects. The seller undertakes to deliver the goods to the agreed destination, and the buyer agrees to pay for the goods.

The sample contains provisions on the transportation of goods by vehicle.

You must provide information about the shipper:

- Address

- Names

- Location

- Mobile number

- Bank details

Similar information is provided about the consignee. The name of the product being sent, its net and gross weight, size, and number of pieces must be recorded. Accompanying documents are attached to the waybill, for example:

- Vehicle parameters

- Declared value of the cargo

- Temperature required

- Volume

- Data on locking and sealing devices

The following information is indicated:

- Information about delivery of goods for unloading

- Information about accepting an order for execution

- Carrier and vehicle information

- The price of transportation is reflected

- The payment procedure for services is indicated

- Describes the actual condition of the cargo, packaging

The main document regulates the conditions for cargo transportation, and does not characterize the cargo. Only general information is provided about the product. Handing over the form at the unloading point by the driver confirms that the contract has been completed and the services have been provided. The contract can be drawn up by the head of the company that provides transport services.

Traffic police inspectors check documents during cargo transportation, as they confirm the legality of transportation by car. IMPORTANT! The form has legal force if all signatures are present.

Differences in information content in TN and TTN

There are also certain differences in the content of information in the TTN and TN:

- the technical specification (transport section) contains information about the product code and item number, quantity, unit price and total cost, but the technical specification does not contain this information;

- in the TN, information about the name of the cargo (clause 3) is presented by data on the type of container used for transporting the cargo and the packaging method, as well as information on the labeling of the cargo, the gross (net) weight of the cargo items, information on the volume of the cargo items and their dimensions. This data is not available in the TTN;

- the technical specification does not contain the signatures of the officials authorizing the release of the cargo, the person who released the cargo, and the accountant (chief or senior), but they are present in the technical specification (section 1);

- in the TN, unlike the TTN, there is no information about the payer indicating his name, address and bank details, in the TTN this information is present;

- The consignment note contains information about the telephone numbers of legal entities (senders, recipients and carriers of the cargo), this data is not present in the consignment note, but the telephone numbers of the persons responsible for transportation are indicated (for the sender of the cargo - in paragraph 1, for the recipient of the cargo - in paragraph 2, from the cargo carrier - in paragraph 10);

- The TN contains information about the conditions of transportation (clause 8), instructions from the sender of the cargo about the necessary parameters of the vehicle (clause 5), information about the actual condition of the cargo, the condition of seals, containers and packaging (clauses 6 and 7), reservations and comments of the carrier (clause 12 ), this information is not available in the TTN;

- the TTN indicates the total amount that the buyer must pay to the seller, i.e. this document contains the information necessary for the posting and write-off of valuables;

- the TN does not contain information about the price of the transported cargo, and therefore this document cannot be a sufficient justification for recognizing expenses. Clause 5 of the TN provides an indication of the declared value of the transported cargo, which is indicated if the sender declares the value of the cargo. These data are provided in the technical specifications in order to be able to calculate the amount of compensation for damage in the event of shortage or damage due to the fault of the cargo carrier.

We can make a general conclusion that the technical specifications contain more information that allows for better organization and control of the cargo transportation process.