KBK 2013 for payment of PF and Compulsory Medical Insurance

The table shows the KBK budget classification codes for 2013 for payment of insurance premiums of the Pension Fund of the Russian Federation and the Medical Insurance Fund, taking into account the adopted additions for 2013.

Budget classification code of the Russian Federation | Budget classification code name | |

| 392 | 1 02 02010 0b 1000 160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for payment of the insurance part of the labor pension |

| 392 | 1 02 02010 0b 2000 160 | Penalties accrued on the insurance part of the labor pension |

| 392 | 1 02 02010 0b 3000 160 | Fines assessed on the insurance part of the labor pension |

| 392 | 1 02 02020 0b 1000 160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension |

| 392 | 1 0200 160 | Penalties accrued on the funded part of the labor pension |

| 392 | 1 0200 160 | Fines calculated on the funded part of the labor pension |

| 392 | 1 1600 140 | Monetary penalties (fines) for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Pension Fund of the Russian Federation) |

| 392 | 1 1600 140 | Monetary penalties (fines) imposed by the Pension Fund of the Russian Federation and its territorial bodies in accordance with Articles 48-5 1 of the Federal Law of July 24, 2009 No. 212-FZ |

| 392 | 1 0211 160 | Insurance premiums for compulsory health insurance of the working population received from payers |

| 392 | 1 0211 160 | Penalties for compulsory health insurance of the working population received from payers |

| 392 | 10202101083011160 | Fines for compulsory health insurance of the working population, received from payers |

| 392 | 1 0212 160 | Insurance premiums for compulsory health insurance of the working population, previously credited to the budgets of territorial compulsory health insurance funds (for billing periods expired before January 1, 2012) |

| 392 | 1 0212 160 | Penalties for compulsory health insurance of the working population, previously credited to the budgets of territorial compulsory health insurance funds (for billing periods expired before January 1, 2012) |

| 392 | 1 0212 160 | Fines for compulsory health insurance of the working population, previously credited to the budgets of territorial compulsory health insurance funds (for billing periods expired before January 1, 2012) |

| 392 | 1 0200 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in subparagraph 1 of paragraph 1 of Article 27 of the Federal Law “0 labor pensions of the Russian Federation”, credited to the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension for billing periods since 2013 . Additional tariff according to list 1. New KBK 2013 |

| 392 | 1 0200 160 | Penalties accrued on the insurance part of the labor pension, according to the additional tariff (clause 1, clause 1, article 27 of the Federal Law “0 labor pensions of the Russian Federation”) For billing periods since 2013. Additional tariff according to list 1. New KBK 2013. |

| Budget classification code of the Russian Federation | Budget classification code name | |

| 392 | 1 0200 160 | Fines accrued on the insurance part of the labor pension, according to the additional tariff (clause 1, clause 1, article 27 of the Federal Law “On Labor Pensions of the Russian Federation”) For billing periods since 2013 Additional tariff according to list 1. New KBK 2013. |

| 392 | 1 0200 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in subparagraphs 2-18 of paragraph 1 of Article 27 of the Federal Law “On Labor Pensions of the Russian Federation”, credited to the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension. 3a billing periods from 2013. Additional tariff for list 2 and small lists. New KBK 2013. |

| 392 | 1 0200 160 | Penalties accrued on the insurance part of the labor pension, according to the additional tariff (clauses 2-18, clause 1, article 27 of the Federal Law “On Labor Pensions of the Russian Federation”), For billing periods since 2013, additional tariff for list 2 and small lists. New KBK 2013. |

| 392 | 1 0200 160 | Fines accrued on the insurance part of the labor pension, according to the additional tariff (clauses 2-18 and 1 of Article 27 of the Federal Law “On Labor Pensions of the Russian Federation”), for the billing periods of 2013. Additional tariff for list 2 and small lists. New KBK 2013. |

| 392 | 1 0200 160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for payment of the insurance part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

| 392 | 1 02 0203106 2000 160 | Penalties accrued on the insurance part of the labor pension (for billing periods from 2002 to 2009 inclusive). |

| 392 | 1 0200 160 | Fines assessed on the insurance part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

| 392 | 1 0200 160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

| 392 | 1 0200 160 | Penalties accrued on the funded part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

| 392 | 1 0200 160 | Fines accrued on the funded part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

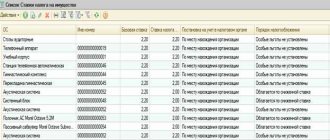

How to set insurance premium rates for 2013 in 1C Accounting 8.2

It will also be useful to fill out payment orders in 1C.

Buh-Ved.RU

From January 1, 2013, new budget classification codes for insurance contributions for compulsory pension insurance were introduced in accordance with

- Federal Law No. 218-FZ dated December 3, 2012 “On the budget of the Pension Fund of the Russian Federation for 2013 and for the planning period of 2014 and 2015”,

- Order of the Ministry of Finance dated December 21, 2012 No. 171n “On approval of the Instructions on the procedure for applying the budget classification of the Russian Federation for 2013 and for the planning period of 2014 and 2015”

See “Directory of compliance of tax declaration (calculation) codes (KND) with budget classification codes (KBK) used in tax declarations (calculations)” for 2013.

| Since January 1, 2013, the authorities of the Pension Fund of Russia have been administering the receipt of insurance contributions for compulsory pension insurance for billing periods from 2002 to 2009 inclusive , the administrator of which was previously the authorities of the Federal Tax Service. | |

| 392 1 0200 160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for payment of the insurance part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

| 392 1 0200 160 | Penalties on insurance premiums for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for payment of the insurance part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

| 392 1 0200 160 | Penalties on insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

| 392 1 0200 160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

| 392 1 0200 160 | Penalties on insurance premiums for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

| 392 1 0200 160 | Penalties on insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

| BCC for insurance premiums for compulsory pension insurance in the amount determined based on the cost of the insurance year is applied by individual entrepreneurs only to pay arrears for billing periods expired before January 1, 2013 | |

| 392 1 0200 160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension (for billing periods expired before January 1, 2013) |

| 392 1 0200 160 | Penalties on insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for payment of the insurance part of the labor pension (for billing periods expired before January 1, 2013) |

| 392 1 0200 160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension (for billing periods expired before January 1, 2013) |

| 392 1 0200 160 | Penalties on insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension (for billing periods expired before January 1, 2013) |

| From January 1, 2013, individual entrepreneurs must pay insurance premiums for compulsory pension insurance in a fixed amount for the following BCCs | |

| 392 1 0200 160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension |

| 392 1 0200 160 | Penalties on insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension |

| 392 1 0200 160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension |

| 392 1 0200 160 | Penalties on insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension |

| From January 1, 2013, new BCCs are being introduced for the payment of insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraph 1 of Article 27 of the Federal Law “On Labor Pensions”, credited to the Pension Fund budget | |

| 392 1 0200 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in subparagraph 1 of paragraph 1 of Article 27 of the Federal Law “On Labor Pensions in the Russian Federation”, credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension |

| 392 1 0200 160 | Penalties on insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in subparagraph 1 of paragraph 1 of Article 27 of the Federal Law “On Labor Pensions in the Russian Federation”, credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension |

| 392 1 0200 160 | Penalties for insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in subparagraph 1 of paragraph 1 of Article 27 of the Federal Law “On Labor Pensions in the Russian Federation”, credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension |

| 392 1 0200 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in subparagraphs 2-18 of paragraph 1 of Article 27 of the Federal Law “On Labor Pensions in the Russian Federation”, credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension |

| 392 1 0200 160 | Penalties on insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in subparagraphs 2-18 of paragraph 1 of Article 27 of the Federal Law “On Labor Pensions in the Russian Federation”, credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pensions |

| 392 1 0200 160 | Penalties for insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in subparagraphs 2-18 of paragraph 1 of Article 27 of the Federal Law “On Labor Pensions in the Russian Federation”, credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pensions |

Budget classification codes for insurance contributions for compulsory pension insurance and compulsory health insurance, applied in 2011 and not specified above, continue to be applied in 2013.

KBK codes for 2013 for legal entities

Here you will find a directory of KBK budget classification codes for 2013 for legal entities with the ability to search for a specific section

| Corporate income tax | Personal income tax (NDFL) | Value added tax (VAT) | Government duty |

| Simplified taxation system (STS) | Unified tax on imputed income for certain types of activities (UTII) | Unified Agricultural Tax (USAT) | Land tax |

Corporate income tax

| Name of income | Budget classification codes |

| Corporate income tax credited to the federal budget | 182 1 0100 110 |

| Penalties and interest on corporate income tax credited to the federal budget | 182 1 0100 110 |

| Amounts of monetary penalties (fines) for corporate income tax credited to the federal budget | 182 1 0100 110 |

| Corporate income tax credited to the budgets of constituent entities of the Russian Federation | 182 1 0100 110 |

| Penalties and interest on corporate income tax credited to the budgets of constituent entities of the Russian Federation | 182 1 0100 110 |

| Amounts of monetary penalties (fines) for corporate income tax credited to the budgets of the constituent entities of the Russian Federation | 182 1 0100 110 |

| Tax on the profits of organizations when implementing production sharing agreements concluded before the entry into force of the Federal Law “On Production Sharing Agreements” and not providing for special tax rates for crediting the specified tax to the federal budget and the budgets of the constituent entities of the Russian Federation | 182 1 0100 110 |

| Penalties and interest on corporate income tax when executing production sharing agreements concluded before the entry into force of the Federal Law “On Production Sharing Agreements” and not providing for special tax rates for crediting the specified tax to the federal budget and budgets of the constituent entities of the Russian Federation | 182 1 0100 110 |

| Amounts of monetary penalties (fines) for corporate income tax when implementing production sharing agreements concluded before the entry into force of the Federal Law “On Production Sharing Agreements” and not providing for special tax rates for crediting the specified tax to the federal budget and the budgets of the constituent entities of the Russian Federation | 182 1 0100 110 |

| Corporate income tax on the income of foreign organizations not related to activities in the Russian Federation through a permanent establishment, with the exception of income received in the form of dividends and interest on state and municipal securities | 182 1 0100 110 |

| Penalties and interest on corporate income tax on income of foreign organizations not related to activities in the Russian Federation through a permanent establishment, with the exception of income received in the form of dividends and interest on state and municipal securities | 182 1 0100 110 |

| Amounts of monetary penalties (fines) for corporate income tax on income of foreign organizations not related to activities in the Russian Federation through a permanent representative office, with the exception of income received in the form of dividends and interest on state and municipal securities | 182 1 0100 110 |

| Corporate income tax on income received in the form of dividends from Russian organizations by Russian organizations | 182 1 0100 110 |

| Penalties and interest on corporate income tax on income received in the form of dividends from Russian organizations by Russian organizations | 182 1 0100 110 |

| Amounts of monetary penalties (fines) for corporate income tax on income received in the form of dividends from Russian organizations by Russian organizations | 182 1 0100 110 |

| Corporate income tax on income received in the form of dividends from Russian organizations by foreign organizations | 182 1 0100 110 |

| Penalties and interest on corporate income tax on income received in the form of dividends from Russian organizations by foreign organizations | 182 1 0100 110 |

| Amounts of monetary penalties (fines) for corporate income tax on income received in the form of dividends from Russian organizations by foreign organizations | 182 1 0100 110 |

| Corporate income tax on income received in the form of dividends from foreign organizations by Russian organizations | 182 1 0100 110 |

| Penalties and interest on corporate income tax on income received in the form of dividends from foreign organizations by Russian organizations | 182 1 0100 110 |

| Amounts of monetary penalties (fines) for corporate income tax on income received in the form of dividends from foreign organizations by Russian organizations | 182 1 0100 110 |

| Corporate income tax on income received in the form of interest on state and municipal securities | 182 1 0100 110 |

| Penalties and interest on corporate income tax on income received in the form of interest on state and municipal securities | 182 1 0100 110 |

| Amounts of monetary penalties (fines) for corporate income tax on income received in the form of interest on state and municipal securities | 182 1 0100 110 |

Personal income tax (NDFL)

| Name of income | Budget classification codes |

| Personal income tax on income the source of which is a tax agent, with the exception of income in respect of which the calculation and payment of tax are carried out in accordance with Articles 227, 2271 and 228 of the Tax Code of the Russian Federation | 182 1 0100 110 |

| Penalties and interest on personal income tax on income the source of which is a tax agent, with the exception of income in respect of which tax is calculated and paid in accordance with Articles 227, 2271 and 228 of the Tax Code of the Russian Federation | 182 1 0100 110 |

| Amounts of monetary penalties (fines) for personal income tax on income the source of which is a tax agent, with the exception of income in respect of which tax is calculated and paid in accordance with Articles 227, 2271 and 228 of the Tax Code of the Russian Federation | 182 1 0100 110 |

Value added tax (VAT)

| Name of income | Budget classification codes |

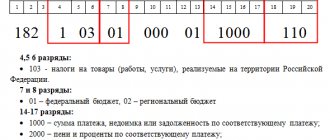

| Value added tax on goods (work, services) sold on the territory of the Russian Federation | 182 1 0300 110 |

| Penalties and interest on value added tax on goods (work, services) sold on the territory of the Russian Federation | 182 1 0300 110 |

| Amounts of monetary penalties (fines) for value added tax on goods (work, services) sold on the territory of the Russian Federation | 182 1 0300 110 |

Simplified taxation system (STS)

| Name of income | Budget classification codes |

| Tax levied on taxpayers who have chosen income as an object of taxation | 182 1 0500 110 |

| Penalties and interest on taxes levied on taxpayers who have chosen income as the object of taxation | 182 1 0500 110 |

| Amounts of monetary penalties (fines) for taxes levied on taxpayers who have chosen income as an object of taxation | 182 1 0500 110 |

| Tax levied on taxpayers who have chosen income as the object of taxation (for tax periods expiring before January 1, 2011) | 182 1 0500 110 |

| Penalties and interest on taxes levied on taxpayers who have chosen income as an object of taxation (for tax periods expiring before January 1, 2011) | 182 1 0500 110 |

| Amounts of monetary penalties (fines) for taxes levied on taxpayers who have chosen income as an object of taxation (for tax periods expired before January 1, 2011) | 182 1 0500 110 |

| A tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses | 182 1 0500 110 |

| Penalties and interest on taxes levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses | 182 1 0500 110 |

| Amounts of monetary penalties (fines) for taxes levied on taxpayers who have chosen income reduced by the amount of expenses as an object of taxation | 182 1 0500 110 |

| Tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (for tax periods expiring before January 1, 2011) | 182 1 0500 110 |

| Penalties and interest on taxes levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (for tax periods expiring before January 1, 2011) | 182 1 0500 110 |

| Amounts of monetary penalties (fines) for taxes levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (for tax periods expired before January 1, 2011) | 182 1 0500 110 |

| Minimum tax credited to the budgets of state extra-budgetary funds (paid (collected) for tax periods expired before January 1, 2011) | 182 1 0500 110 |

| Penalties and interest on the minimum tax credited to the budgets of state extra-budgetary funds (paid (collected) for tax periods expired before January 1, 2011) | 182 1 0500 110 |

| Amounts of monetary penalties (fines) for the minimum tax credited to the budgets of state extra-budgetary funds (paid (collected) for tax periods expired before January 1, 2011) | 182 1 0500 110 |

| Minimum tax credited to the budgets of the constituent entities of the Russian Federation | 182 1 0500 110 |

| Penalties and interest on the minimum tax credited to the budgets of the constituent entities of the Russian Federation | 182 1 0500 110 |

| Amounts of monetary penalties (fines) for the minimum tax credited to the budgets of the constituent entities of the Russian Federation | 182 1 0500 110 |

Unified tax on imputed income for certain types of activities (UTII)

| Name of income | Budget classification codes |

| Single tax on imputed income for certain types of activities | 182 1 0500 110 |

| Penalties and interest on the single tax on imputed income for certain types of activities | 182 1 0500 110 |

| Amounts of monetary penalties (fines) for the single tax on imputed income for certain types of activities | 182 1 0500 110 |

| Single tax on imputed income for certain types of activities (for tax periods expired before January 1, 2011) | 182 1 0500 110 |

| Penalties and interest on the single tax on imputed income for certain types of activities (for tax periods expired before January 1, 2011) | 182 1 0500 110 |

| Amounts of monetary penalties (fines) for the single tax on imputed income for certain types of activities (for tax periods expired before January 1, 2011) | 182 1 0500 110 |

Unified Agricultural Tax (USAT)

| Name of income | Budget classification codes |

| Unified agricultural tax | 182 1 0500 110 |

| Penalties and interest on the single agricultural tax | 182 1 0500 110 |

| Amounts of monetary penalties (fines) for the unified agricultural tax | 182 1 0500 110 |

| Unified agricultural tax (for tax periods expired before January 1, 2011) | 182 1 0500 110 |

| Penalties and interest on the single agricultural tax (for tax periods expired before January 1, 2011) | 182 1 0500 110 |

| Amounts of monetary penalties (fines) for the unified agricultural tax (for tax periods expired before January 1, 2011) | 182 1 0500 110 |

Government duty

| Name of income | Budget classification codes |

| State duty on cases considered in arbitration courts | 182 1 0800 110 |

| State duty on cases considered by the Constitutional Court of the Russian Federation | 182 1 0800 110 |

| State duty on cases considered by constitutional (statutory) courts of constituent entities of the Russian Federation | 182 1 0800 110 |

| State duty on cases heard in courts of general jurisdiction by magistrates (with the exception of the Supreme Court of the Russian Federation) | 182 1 0800 110 |

| State duty on cases considered by the Supreme Court of the Russian Federation | 182 1 0800 110 |

| State duty for state registration of a legal entity, individuals as individual entrepreneurs, changes made to the constituent documents of a legal entity, for state registration of liquidation of a legal entity and other legally significant actions | 182 1 0800 110 |

| State duty for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of legal entities | 182 1 0800 110 |

| State duty for carrying out actions related to licensing, with certification in cases where such certification is provided for by the legislation of the Russian Federation, credited to the federal budget (state duty for granting a license) | 182 1 0800 110 |

| State duty for carrying out actions related to licensing, with certification in cases where such certification is provided for by the legislation of the Russian Federation, credited to the federal budget (state duty for re-issuing a document confirming the presence of a license and (or) annex to such a document in connection with making additions to information about the addresses of places of implementation of the licensed type of activity, about the work performed and about the services provided as part of the licensed type of activity, including about educational programs being implemented) | 182 1 0800 110 |

| State duty for carrying out actions related to licensing, with certification in cases where such certification is provided for by the legislation of the Russian Federation, credited to the federal budget (state duty for re-issuing a document confirming the presence of a license and (or) annex to such a document in other cases ) | 182 1 0800 110 |

| State duty for carrying out actions related to licensing, with certification in cases where such certification is provided for by the legislation of the Russian Federation, credited to the federal budget (state duty for issuing a duplicate document confirming the presence of a license) | 182 1 0800 110 |

| Other state fees for state registration, as well as for performing other legally significant actions | 182 1 0839 110 |

| State fee for re-issuance of a certificate of registration with the tax authority | 182 1 0800 110 |

| State duty for consideration of an application for concluding a pricing agreement, an application for amendments to a pricing agreement | 182 1 0800 110 |

Land tax

| Name of income | Budget classification codes |

| Land tax levied at rates established in accordance with subparagraph 1 of paragraph 1 of Art. 394 of the Tax Code of the Russian Federation and applied to taxation objects located within the boundaries of intracity municipalities of federal cities of Moscow and St. Petersburg | 182 1 0600 110 |

| Penalties and interest on land tax levied at rates established in accordance with subparagraph 1 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to taxation objects located within the boundaries of intra-city municipalities of the federal cities of Moscow and St. Petersburg | 182 1 0600 110 |

| Amounts of monetary penalties (fines) for land tax levied at rates established in accordance with subparagraph 1 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to taxation objects located within the boundaries of intra-city municipalities of federal cities of Moscow and St. Petersburg | 182 1 0600 110 |

| Land tax levied at rates established in accordance with subparagraph 1 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to taxable objects located within the boundaries of urban districts | 182 1 0600 110 |

| Penalties and interest on land tax levied at rates established in accordance with subparagraph 1 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to taxable objects located within the boundaries of urban districts | 182 1 0600 110 |

| Amounts of monetary penalties (fines) for land tax levied at rates established in accordance with subparagraph 1 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to taxable objects located within the boundaries of urban districts | 182 1 0600 110 |

| Land tax levied at rates established in accordance with subparagraph 1 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to tax objects located within the boundaries of inter-settlement territories | 182 1 0600 110 |

| Penalties and interest on land tax levied at rates established in accordance with subparagraph 1 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to tax objects located within the boundaries of inter-settlement territories | 182 1 0600 110 |

| Amounts of monetary penalties (fines) for land tax levied at rates established in accordance with subparagraph 1 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to tax objects located within the boundaries of intersettlement territories | 182 1 0600 110 |

| Land tax levied at rates established in accordance with subparagraph 1 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to tax objects located within the boundaries of settlements | 182 1 0600 110 |

| Penalties and interest on land tax levied at rates established in accordance with subparagraph 1 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to taxable objects located within the boundaries of settlements | 182 1 0600 110 |

| Amounts of monetary penalties (fines) for land tax levied at rates established in accordance with subparagraph 1 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to taxable objects located within the boundaries of settlements | 182 1 0600 110 |

| Land tax levied at rates established in accordance with subparagraph 2 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to taxable objects located within the boundaries of intra-city municipalities of the federal cities of Moscow and St. Petersburg | 182 1 0600 110 |

| Penalties and interest on land tax, levied at rates established in accordance with subparagraph 2 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to taxable objects located within the boundaries of intra-city municipalities of the federal cities of Moscow and St. Petersburg | 182 1 0600 110 |

| Amounts of monetary penalties (fines) for land tax levied at rates established in accordance with subparagraph 2 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to taxation objects located within the boundaries of intra-city municipalities of federal cities of Moscow and St. Petersburg | 182 1 0600 110 |

| Land tax levied at rates established in accordance with subparagraph 2 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to taxable objects located within the boundaries of urban districts | 182 1 0600 110 |

| Penalties and interest on land tax levied at rates established in accordance with subparagraph 2 of clause 1 of Art. 394 of the Tax Code of the Russian Federation and applied to taxable objects located within the boundaries of urban districts | 182 1 0600 110 |

| Amounts of monetary penalties (fines) for land tax levied at rates established in accordance with subparagraph 2 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to taxable objects located within the boundaries of urban districts | 182 1 0600 110 |

| Land tax levied at rates established in accordance with subparagraph 2 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to tax objects located within the boundaries of inter-settlement territories | 182 1 0600 110 |

| Penalties and interest on land tax levied at rates established in accordance with subparagraph 2 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to taxable objects located within the boundaries of inter-settlement territories | 182 1 0600 110 |

| Amounts of monetary penalties (fines) for land tax levied at rates established in accordance with subparagraph 2 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to tax objects located within the boundaries of intersettlement territories | 182 1 0600 110 |

| Land tax levied at rates established in accordance with subparagraph 2 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to tax objects located within the boundaries of settlements | 182 1 0600 110 |

| Penalties and interest on land tax levied at rates established in accordance with subparagraph 2 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to taxable objects located within the boundaries of settlements | 182 1 0600 110 |

| Amounts of monetary penalties (fines) for land tax levied at rates established in accordance with subparagraph 2 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation and applied to tax objects located within the boundaries of settlements | 182 1 0600 110 |

How to correctly fill out a personal income tax payment order in 2021

Tax deductions of all types: standard, social, property, professional - will be applied only to income reflected in the main base.

Calculation of personal income tax

But personal income tax will be calculated not for each individual tax base, but for total income in all tax bases, taxed at the same rate.

This means that in 2021, for tax residents, we will not calculate tax separately from salaries, but separately from dividends, but will calculate accrued wages and other work-related payments and dividends from the total income. Tax calculation will continue to be made at each time the taxpayer receives income, on an accrual basis from the beginning of the year, taking into account the previously withheld tax amount.

Calculation of personal income tax on the income of tax non-residents will be carried out in the same manner: separately dividends at a rate of 15%, separately other income at a rate of 30%.

The progressive personal income tax scale is very simple. As long as the taxable income of the taxpayer, taking into account deductions of all types, on an accrual basis from the beginning of the year does not exceed 5 million rubles, personal income tax is calculated at a rate of 13%. As soon as taxable income exceeds 5 million rubles, personal income tax is calculated as 650 thousand rubles plus 15% of the amount exceeding 5 million rubles.

The difference between the cumulative personal income tax calculated and the tax transferred to the budget for the previous period of the year is paid to the budget. Payment of tax on amounts of income taxed at different rates will be made using different payment orders and, most likely, according to different BCCs.

Changing the rules for calculating personal income tax will require changes to all tax reporting. Perhaps the Federal Tax Service will come up with new reporting forms or abolish existing ones. Let's get ready.

It is worth noting that a bill is being discussed here that has not even passed the first reading. It is possible that changes will be made to it during the discussion. After the final version of the law is adopted, we intend to return to its discussion.

The deadline for paying the fee is specified in Part 6 of Art. 226 of the Tax Code of the Russian Federation - no later than the day following the day of payment of the amount of income to the taxpayer. In accordance with the letter of the Federal Tax Service No. BS-4-11/320 dated January 15, 2016, no tax is paid on the advance, with the exception of the case of transfer of the advance on the last day of the month. Vacation and sick leave benefits are also subject to this mandatory fee, but it is paid no later than the last day of the month in which they were paid to the taxpayer. You can calculate the tax amount using a calculator.

When filling out a payment slip for personal income tax, KBC is required to indicate the correct codes in order to avoid the accrual of penalties for late fulfillment of financial obligations. To avoid mistakes when filling out a payment order, check the table.

| Type of tax, payment | Code in 2021 |

| Personal income tax on employee income | 182 1 0100 110 |

| Penalty | 182 1 0100 110 |

| Fines | 182 1 0100 110 |

| Collection from individual entrepreneurs to OSN | 182 1 0100 110 |

| Penalty | 182 1 0100 110 |

| Fines | 182 1 0100 110 |

BCC “Penalty Tax Penalties”, as well as BCC for fines, differ from the basic values.

Code values often change (in this case, the Ministry of Finance issues an explanatory order), but sometimes they are retained for a longer period. Thus, in 2021, the same BCCs for personal income tax apply as in 2021, in accordance with Order of the Ministry of Finance No. 132n dated 06/08/2018.