List of sales of services not subject to taxation

Benefits on taxes and fees, together with excise taxes , represent certain advantages that can be provided to certain categories of taxpayers. The benefit can be expressed in complete exemption from payment of the prescribed excise , or in payment of a smaller amount.

The list of basic services that will not be subject to taxation mainly includes government services or services provided by third-party organizations that are necessary to ensure the normal functioning of government agencies, local governments, etc.

For example, services for the supply to Russia of critical medical equipment necessary to maintain and improve the existing healthcare system will not be subject to the corresponding taxes and excise taxes.

The list of this equipment and other related sales services in the field of healthcare has been approved by the current tax authorities.

In this case, exemption from taxation, on a par with excise taxes , will occur solely on the basis of a valid certificate, which will contain the established OKP code

Other services may also participate in the tax exemption procedure, the main thing is that this exemption is supported by appropriate grounds and documentary evidence.

exempt from taxation may be included in the taxation system, including excise taxes , if the essence or other important circumstances characterizing these services have changed.

What goods are not subject to excise tax?

Most consumer goods are not subject to excise tax. The Tax Code of the Russian Federation provides a relatively short list of PT.

They are included in this list due to:

- with the importance of limiting the consumption of goods, the use of which may harm human health or the environment;

- preventing the receipt of excessive amounts of profit that are not due to the efficiency of the manufacturer’s activities;

- with the need for state regulation of certain socio-economic processes;

- conditioned by other tax and social government objectives.

List of transactions not subject to taxation

The current tax legislation of the Russian Federation defines transactions that are not subject to taxation in accordance with the existing grounds. This means that the implementation of these operations does not require the taxpayer to pay taxes and fees that were provided for.

Transactions not subject to VAT are expressed as follows:

- import of certain medical goods into the territory of the Russian Federation and their sale , the code of which is included in the current list;

- provision and sale of certain medical services by public clinics or private organizations. The code and list of these services are approved by the current tax legislation of the Russian Federation;

- implementation of patient care services in public and private clinics. In this case, the need for this care must be confirmed by an appropriate conclusion from an authorized health care institution. They are also assigned a code for the required services;

- implementation of services for the support and maintenance of children in special educational institutions, conducting appropriate classes with minor children not only in educational institutions, but also in additional leisure centers - clubs, sections, etc.;

- sale of certain food products that are the result of the activities of canteens in educational and medical institutions, catering organizations, etc.;

- transport services with the appropriate code for regular transportation of passengers by land and other transport, including commuter trains, sea and river vessels;

- sale of funeral services, the code and list of which are determined by the Government of the Russian Federation;

- services directly related to the creation, delivery and sale of coins made of precious metals, which have been recognized as a legitimate and legal form of payment in the Russian Federation;

- implementation of services that relate to the repair and regular maintenance of certain household goods regularly used by citizens, without charging additional fees for these repair actions.

1.2. Features of determining the tax base for excisable goods

When importing excisable goods into the Russian Federation, excise taxes:

- are paid - when they are moved under the customs regime of release for free circulation, when moved under the processing regime for domestic consumption, when processed products are released for free circulation;

- are not paid - when they are placed under the regimes of transit, customs warehouse, re-export, duty-free trade, free warehouse.

When importing excisable goods into the territory of the Russian Federation, the tax base is determined for excisable goods:

- with fixed (specific) rates - as the volume of imported goods in physical terms;

- with ad valorem (percentage) rates - as the sum of their customs value and customs duty;

- with combined rates - as the volume of imported excisable goods in physical terms when applying the fixed (specific) component of the tax rate and as the estimated cost of imported excisable goods, calculated on the basis of maximum retail prices, when applying the ad valorem (in percentage) component of the tax rate.

The tax base is determined separately for each batch of excisable goods imported into the customs territory of the Russian Federation.1

If one consignment of excisable goods imported into the customs territory of the Russian Federation contains excisable goods, the import of which is subject to different tax rates, the tax base is determined separately for each group of these goods. In a similar manner, the tax base is also determined if the consignment of excisable goods imported into the customs territory of the Russian Federation contains excisable goods that were previously exported from the customs territory of the Russian Federation for processing outside the customs territory of the Russian Federation.

Accounting for transactions subject to and non-taxation

Each previously carried out accounting transaction, regardless of whether it is subject to taxation or not, must be correctly recorded and registered accordingly. In the event that a taxpayer participates both in transactions that are not subject to taxation and in opposite ones, their accounting must be kept separately.

Competent accounting, carried out in accordance with the requirements of the current tax legislation, allows you to more quickly and correctly generate financial statements for a certain time period and helps to avoid multiple violations and fines that can be detected during an organized audit.

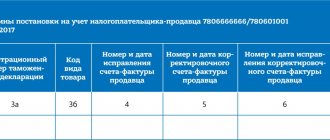

Accounting for transactions includes the following information, which must be included in the relevant accounting documents:

- the date when the sale of certain services was carried out, as well as their essence and other features;

- complete data about the transaction performed - its code in the relevant state list, features of the implementation, information about the supplier or contractor, information about a previously concluded agreement, etc.;

- information about whether the goods supplied, services provided, or work performed for this operation are a legal object of taxation or not;

- information on tax exemption, or on the establishment of certain tax benefits, if any, indicating the relevant legal grounds. In this case, the tax amount paid and the amount of the established benefit are indicated;

- other information that may be directly related to the features of accounting for the operation, its stages, established procedure, etc.

What are “excise” benefits and how are they classified?

Excise tax benefits are benefits provided by the state to individual taxpayers:

- putting them in a more advantageous position in comparison with other excise tax payers;

- allowing you not to pay excise tax, use a zero tax rate, reduce the accrued excise tax by deductions or return previously paid amounts;

- representing an element of tax policy pursuing economic goals, for example, stimulating exports, etc.

“Excise” benefits are not included in a separate article of the Tax Code of the Russian Federation, but a description of possible relaxations and benefits for excise tax payers can be seen:

- in art. establishing the list of transactions exempt from excise taxes. 183 Tax Code of the Russian Federation;

- in the text of individual articles dedicated to excise taxes of the chapter of the Tax Code of the Russian Federation - for example, in Art. 182 and others;

- from the content of other regulatory documents - for example, the Customs Code (TC), decisions of the Board of the Eurasian Economic Commission, etc.

How the rights of constituent entities of the Russian Federation to establish tax benefits are expanded - see the article “State Tax Policy for 2016–2018.”

Excise benefits can be classified in different ways. For example, the grouping of benefits for the import of excisable goods (ET) into the territory of the Russian Federation according to the type of regulatory document establishing excise tax benefits is as follows:

- benefits provided for by the legislative acts of the Russian Federation (in relation to PT imported into the Russian Federation and intended for the performance of work under PSA - production sharing agreements);

- benefits provided for by international treaties of the Russian Federation (for the import of food products by international companies, etc.);

- benefits provided for by other documents - for example, those providing for the procedure for paying excise duty on food products imported into the customs territory of the EEC.

Find out how various indicators are classified from the articles posted on our portal:

- “Classification of costs in management accounting (nuances)”;

- “The classification of fixed assets by depreciation groups has been updated”;

- “Currency transactions: concept, types, classifications.”

You can learn about certain types of “excise” benefits from the next section.

Refusal or suspension of exemption for transactions not subject to taxation

A legal taxpayer who directly participates in and carries out transactions that are not subject to taxation has the legal right to refuse the function of exempting these transactions from the taxation procedure. To do this, the interested person will need to contact the appropriate tax authority located at the place of registration or registration of the taxpayer.

The appeal can be made no later than the first day of the tax period in which the taxpayer wishes to waive the right to exemption from taxation. At the same time, the current tax legislation of the Russian Federation allows both the possibility of complete refusal and temporary suspension of tax exemption.

When contacting the tax authority, the taxpayer will need to draw up an appropriate application and submit it to an authorized person.

The application should indicate all important information: information about the taxpayer, the period of suspension of the exemption, or its complete termination, the existing grounds, data on the transactions in respect of which this exemption was valid, their code according to the relevant list, subject, features, etc.

Satisfying the applicant's demands and confirming the refusal of release or its temporary suspension, however, will not be possible in all cases. This can be carried out only in relation to certain transactions, the full list, implementation and code of which are established by the norms of the current tax legislation. It is not permissible that the fact of exemption or non-exemption of these transactions from taxation directly depends on who exactly is the legal purchaser of these goods, works or services.

Excise taxes

Excise taxes | Excise rates | Examples

Chapter 22 of the Tax Code of the Russian Federation “Excise taxes”

Taxpayers

The following persons are recognized as taxpayers if they carry out transactions subject to taxation:

- Organizations

- Individual entrepreneurs

- Persons recognized as taxpayers in connection with the movement of goods across the customs border of the Russian Federation:

- declarant is a person who declares goods or on whose behalf goods are declared;

- customs representative (broker) - he bears joint and several liability with the declarant for payment;

- owner of a temporary storage warehouse;

- owner of the customs warehouse; e) carrier;

- persons illegally moving goods and vehicles,

- persons involved in the illegal movement of goods and vehicles across the customs border, if they knew or should have known about the illegality of such movement;

- when importing - persons who acquired ownership or possession of illegally imported goods and vehicles, if at the time of acquisition they knew or should have known about the illegality of such import (Article 81 of the Labor Code of the Customs Union), i.e. unscrupulous purchasers of goods.

Object of taxation

The following transactions are recognized as the object of taxation:

- sales on the territory of the Russian Federation by persons of excisable goods produced by them;

- sale by persons of confiscated or ownerless excisable goods transferred to them on the basis of sentences or court decisions;

- transfer on the territory of the Russian Federation by persons of excisable goods produced by them from customer-supplied raw materials to the owner of the specified raw materials or to other persons;

- transfer within the structure of the organization of produced excisable goods for further production of non-excisable goods (except for straight-run gasoline and ethyl alcohol);

- transfer of excisable goods on the territory of the Russian Federation for one’s own needs;

- transfer on the territory of the Russian Federation of excisable goods to the authorized (share) capital of organizations, mutual funds of cooperatives, as a contribution under a simple partnership agreement;

- transfer by an organization of excisable goods produced by it to its participant when he leaves the organization, as well as transfer within the framework of a simple partnership agreement, when separating his share from the common property or dividing such property;

- transfer of produced excisable goods for processing on a toll basis;

- import of excisable goods into the customs territory of the Russian Federation;

- receipt of denatured ethyl alcohol by an organization that has a certificate for the production of non-alcohol-containing products

- receipt of straight-run gasoline by an organization that has a certificate for processing straight-run gasoline.

Transactions not subject to taxation (exempt from taxation) Features of taxation when moving excisable goods across the customs border of the Russian Federation

The tax base

The tax base is determined separately for each type of excisable product. Determination of the tax base for the sale (transfer) or receipt of excisable goods

The tax base for the sale of excisable goods, for which ad valorem (in percentage) tax rates are established, is increased by the amounts received for the sold excisable goods in the form of financial assistance, advance or other payments received to pay for future deliveries of excisable goods, to replenish funds special purpose, to increase income, in the form of interest (discount) on bills, interest on trade credit, or otherwise related to payment for sold excisable goods.

In relation to excisable goods for which different tax rates are established, the tax base is determined in relation to each tax rate.

Determination of the tax base for the import of excisable goods into the customs territory of the Russian Federation

Taxable period

The tax period is a calendar month.

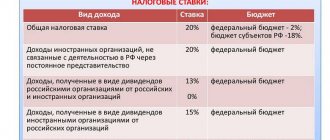

Tax rates

Taxation of excisable goods is carried out at the following tax rates

Procedure for calculating excise tax

The amount of excise duty on excisable goods for which fixed tax rates are established is calculated as the product of the corresponding tax rate and the tax base. The amount of excise duty on excisable goods for which ad valorem (in percentage) tax rates are established is calculated as the percentage share of the tax base corresponding to the tax rate.

The amount of excise duty on excisable goods in respect of which combined tax rates are established is calculated as the amount obtained as a result of the addition of excise duty amounts calculated as the product of a fixed tax rate and the volume of excisable goods sold in kind and as the corresponding ad valorem (in percentage) tax interest rate share of the maximum retail price of such goods

The total amount of excise tax when carrying out transactions with excisable petroleum products is determined separately from the amount of excise tax on other excisable goods.

The amount of excise duty is calculated based on the results of each tax period in relation to all transactions for the sale of excisable goods, the date of sale (transfer) of which relates to the corresponding tax period.

Amounts of excise tax calculated by the taxpayer upon the sale of excisable goods (except for sales on a gratuitous basis) and presented to the buyer are attributed to the taxpayer as expenses accepted for deduction when calculating corporate income tax. Amounts of excise duty calculated by the taxpayer for transactions of transfer of excisable goods recognized as an object of taxation, as well as for their sale on a gratuitous basis, are attributed to the taxpayer at the expense of the appropriate sources, at the expense of which expenses on these excisable goods are attributed. The excise tax amounts charged by the taxpayer to the buyer when selling excisable goods are taken into account by the buyer in the cost of the purchased excisable goods. The amounts of excise tax actually paid when importing excisable goods into the customs territory of the Russian Federation are taken into account in the cost of these excisable goods. The amounts of excise tax presented by the taxpayer to the owner of the toll-provided raw materials (materials) are attributed by the owner of the toll-provided raw materials (materials) to the cost of excisable goods produced from the specified raw materials (materials), with the exception of cases of transfer of excisable goods produced from toll-provided raw materials for further production of excisable goods. The amounts of excise tax presented to the buyer upon acquisition of the specified goods, the amounts of excise tax payable upon import customs territory of the Russian Federation or presented to the owner of customer-supplied raw materials (materials) when transferring excisable goods used as raw materials for the production of other excisable goods. This provision applies if the excise tax rates on excisable goods used as raw materials and the excise tax rates on excisable goods produced from these raw materials are determined for the same unit of measurement of the tax base. Upon receipt (receipt) of denatured ethyl alcohol by an organization that has a certificate for the production of non-alcohol-containing products and when receiving straight-run gasoline by an organization that has a certificate for processing straight-run gasoline, the amount of excise tax is taken into account in the following order:

- the amount of excise tax calculated by the taxpayer on the denatured alcohol received, when the taxpayer further uses the denatured ethyl alcohol received by him as a raw material for the production of non-alcohol-containing products, is not included in the cost of the transferred denatured alcohol.

- the amount of excise tax calculated by the taxpayer on transactions involving the received straight-run gasoline is not included in the cost of the transferred straight-run gasoline upon further use (including when transferred for processing on a toll basis) of the received straight-run gasoline as a raw material for the production of petrochemical products. Otherwise, it is included in the cost of the transferred straight-run gasoline.

The amount of excise tax is included by the seller in the price of the goods and is highlighted as a separate line in payment documents, primary accounting documents and invoices. The amounts of excise tax accepted for deduction when calculating corporate income tax, upon submission of documents confirming the right to a tax deduction, are accordingly subject to adjustment for tax purposes for corporate income tax and deduction at the time of submission of these documents.

The amount of excise tax imposed by the seller on the buyer

Tax deductions

The taxpayer has the right to reduce the amount of excise duty by tax deductions. Deductions of excise tax amounts are carried out in the following order

Amount of excise duty payable

The amount of excise tax payable is determined at the end of each tax period as the amount of calculated excise tax reduced by tax deductions. If the amount of tax deductions in a tax period exceeds the calculated amount of excise tax, the taxpayer does not pay excise tax in this tax period. In this case, the excess amount is subject to offset against current or upcoming excise duty payments in the next tax period. Amount of excise tax to be refunded

Tax exemption

The legal procedure for exempting certain transactions from taxation consists in completely removing from the taxpayer certain tax obligations in relation to these transactions.

The decision on tax exemption is made by an authorized person - an employee of the tax authority. In this case, the initiator of this procedure must be the taxpayer, who submits a written application to the relevant tax organization.

In the application, he indicates the code of transactions that, in his opinion, should be exempt from the taxation procedure. Along with a written application, the taxpayer must submit all the necessary documents, the list of which is approved by current tax regulations.

These documents include: accounting data for a certain time period, extracts from the balance sheet and sales ledger, an extract from the journal of current expenses and income.

In this case, a representative of the tax authority has the right to request other documents confirming the legitimate right of the taxpayer to be exempt from taxation.

A decision on refusal can be issued by an authorized person if the taxpayer has not submitted the necessary documents, or if it turns out that the information contained in them is unreliable.