Last update: 09/15/2020

Question:

I bought an apartment for myself and my child. Is it possible to get a tax deduction for children? And how to apply for a personal income tax refund when buying an apartment only for a child?

Answer:

Yes, parents can receive a tax deduction for their children if they include them among the owners when buying an apartment (for example, in shares). Moreover, it does not matter whether the child owns only a share of the apartment (along with the shares of the father and mother) or whether the property is entirely registered in the child’s name.

How it's done? There are some peculiarities here.

Since January 2014, more or less clear guidelines on this matter have appeared in the law. It says that parents who buy an apartment as the property of their minor children have the right to receive a property tax deduction the restrictions specified in the same article . And the limitation is the maximum possible deduction amount available to one person when buying a home - this is 2,000,000 rubles .

In other words, if a child under 18 years of age becomes the owner of the purchased property, then due to the fact that he himself does not earn money and cannot exercise his right to deduction, he, as it were, transfers the exercise of this right to his parents. And the father or mother receives a property deduction not only for their share, but also for the child’s share .

The child's share in some cases (see example below) allows parents to increase the amount of deduction available to them to the maximum. And from this maximum, issue yourself a personal income tax refund (13% of the deduction amount) for the purchase of an apartment. This usually happens when the parent’s share in the purchased property does not allow him to receive a tax deduction to the maximum extent. Then the parent supplements his deduction amount (for example, 1.2 million rubles for his share) with the deduction amount for the child’s share (0.8 million rubles). As a result, the maximum possible amount of tax is returned to the family = (1.2 million + 0.8 million) x 13% = 260,000 rubles.

What you need to know about the rights of minor children in an apartment purchase and sale transaction - see the Glossary at the link.

The owners of the purchased apartment may also include several minor children . Then the parents can, by agreement, distribute among themselves property deductions for the shares of their children, increasing each of their deductions. But regardless of whether a deduction is claimed for one or more children, its amount cannot exceed the limit of 2,000,000 rubles. per parent .

At the same time, the child’s formal consent to the transfer of his property deduction is not required at all; the parents themselves have the right to decide for him.

To make it clearer, below is a clear example of calculating the property tax deduction when purchasing an apartment with registration of a share of ownership for a child.

And for those who do not really understand what this deduction is and how it is applied, we advise you to first read about it in the Glossary - Tax deductions when buying an apartment (personal income tax refund).

Do you own an apartment? Don't forget about real estate taxes. When and how much to pay, what benefits exist - see the link.

This type of deduction can be used both when purchasing an apartment on the primary market (under an Equity Participation Agreement) and on the secondary market (under a Sale and Purchase Agreement).

The right to this deduction arises at the moment when:

- the shareholder signs the Apartment Acceptance and Transfer Certificate (in the primary market); or

- at the time of registration of ownership of the buyer (in the secondary market).

A property deduction (personal income tax refund) is provided to each owner (including a minor child) in the amount of expenses incurred for the purchase of housing, but not more than 2,000,000 rubles. (maximum).

By “expenses incurred” for each owner is meant (for tax purposes) the corresponding amount of his share, expressed in rubles. For example, 1/3 of a share in an apartment purchased for 9 million rubles. implies that the owner of this share “incurred expenses” of 3 million rubles. Of these, from 2 million rubles. he can get back 13%.

it is impossible for the parent to receive a tax deduction for the child’s share , since the amount of deduction available to the parent is already maximum.

You can increase your deduction amount at the expense of the children’s share only when purchasing an apartment of lower cost, when the parents’ shares expressed in rubles are less than 2,000,000 rubles . Then the children “come to their aid.”

How to buy an apartment for a child? Is it possible to register ownership only in his name, and how to do this correctly?

Legislative acts

Since the purchase of an apartment is a property precedent, and a tax deduction in favor of the buyer is a tax benefit, the legislative acts include Civil and Tax Law, as well as special orders of the Government of the Russian Federation. Among them, the main ones can be identified:

- Articles 624 of the Civil Code of the Russian Federation, 131 of the Civil Code of the Russian Federation determine the legal norms for registration of purchased real estate.

- Articles 220 of the Tax Code of the Russian Federation, 222 of the Tax Code of the Russian Federation, announce general procedural norms: paragraph 6 of Art. 220 of the Tax Code of the Russian Federation, announces the admissibility of filing a tax deduction from the child’s share - to the parent (adoptive parent) or guardian;

- paragraph 2 art. 220 of the Tax Code of the Russian Federation determines the admissibility and regulates the norms for the transfer of tax periods.

- No. 03-04-05/7-194, dated 02/17/12;

In addition to these sources, you should take into account the norms of Article 35 of the Family Code and Article 40 of the RF IC (if a marriage contract was drawn up).

For parents deprived of parental rights or limited in rights, the provisions of Articles , , and 39 of the RF IC come into force.

Persons who have lost parental legal capacity by a court decision do not receive benefits, including tax benefits, provided for this category of citizens.

If part of the amount is paid by maternity capital

Expert opinion

Romanov Stanislav Semenovich

Lawyer with 8 years of experience. Specialization: criminal law. Extensive experience in protecting legal interests.

In such a situation, it becomes impossible to obtain a property deduction from the full amount of the cost of the apartment. Before submitting an application, you must subtract the amount of maternity capital from the price of the apartment.

The difference that results will be considered as expenses. This indicator will need to be included in the application for the deduction. 13% will be returned from it.

Deduction amount

The buyer of an apartment has the right to claim 13% of the cost of the purchased apartment . This cost is calculated from the amount specified in the sales contract registered with Rosreestr and confirmed by payment documents.

In this case, the cost of the acquired real estate should not exceed 2,000,000 rubles . If it is higher than the established limit, then the calculation is made from the maximum cost.

The regulations in force until 2014 set this bar not for the owner, but for the object. The same regulation applies to property transactions completed before 2014.

The purchase of real estate made after a specified period allows you to focus on the owner, who can receive a deduction for the purchase of real estate, calculated from 2 million, and when applying for a mortgage - from 3 million, taking into account the interest paid . Since when registering real estate with children, a precedent for shared ownership arises based on the provisions of Article 250 of the Civil Code of the Russian Federation, this point plays a significant role (how to get a tax deduction when purchasing under a shared ownership agreement?).

If the apartment is re-registered by purchase and sale from parents to children, the right to a tax benefit is lost.

If you were not present at the transaction

It happens that it is not possible to come to a purchase and sale transaction, and then the buyer draws up a power of attorney for a friend or relative so that he transfers the money. In this case, the owner will still have the right to deduct. To prove to the tax authorities that these are your expenses, and not a friend or relative, attach to other documents a copy of the power of attorney, which states that you trust to pay your money for the apartment. Also attach a bank document, from which it is clear that the money was withdrawn from your account.

Features and differences in registration procedures

Based on the nuances of real rights, which follow from the peculiarities of registering ownership when buying a home and the size of the established shares, specific characteristics of the designated procedure also follow.

Receipt by one parent and child

In a complete family where one or more children are being raised, it is allowed to register accommodation for one parent and one of the minor family members . If the marriage breaks up, then purchasing an apartment in shares with a child is also permissible, since children do not lose property rights in relation to both parents.

When a minor is raised by a single mother, she can also arrange an apartment in shares with the child.

In this case, the parent who is a co-owner of the minor has the right:

- Make a deduction for both shares - your part and the part belonging to the co-owner who is incompetent due to age.

- Register your own and your child’s share without exceeding the established limits; the child will be able to receive the rest upon reaching adulthood.

- Receive your own deduction , and leave the baby’s share until he comes of age, which he will subsequently register for himself.

- Register only the share belonging to the child , if it is significantly larger and reaches the maximum value limit.

In this case, it is not allowed to exceed the established maximum.

Example . The mother rented out an apartment in equal shares with her 5-year-old daughter. The cost of the apartment is 5 million. In this case, she can only get a deduction from two million, using part of her own share. The balance will be canceled, and the daughter will be able to apply for a deduction no earlier than after 13 years. As a result, at the moment, it is permissible to receive 260 thousand rubles in return.

Receipt of deductions by spouses and their children

If an apartment worth 5 million is purchased by a family of 4 people, the picture will turn out differently. In this case, Article 35 of the RF IC comes into force, which allows, at the discretion of the owners, to transfer from husband to wife and vice versa, the authority to draw up a deduction from their own share.

Receipt of deductions can be regulated:

- In equal or unequal parts , if the shares in the right are not distributed.

- In proportion to the established shares , registering deductions for children for one or both parents.

- Create a deduction for one child for both parents , and leave the deduction for the second for subsequent tax periods.

- Do not apply for a tax benefit , leaving it until the children reach adulthood.

- Complete your deductions , supplementing them with a portion of the children’s property return.

Example . The standard situation will be as follows. Everyone gets an equal share of the property - 25% of the rights. The cost of one share is 175,000 rubles. It is allowed to receive from each share 13% of the original amount, which is 22,750 rubles.

Since this amount is close to the maximum, parents will be able to apply for a tax benefit for children only partially - from 25,000 rubles, which will amount to 3,350 rubles. The owners themselves will be able to register the remainder upon reaching legal age.

We talked about how to get a property deduction for a spouse in this article.

If the apartment is registered only for the child

In this situation, you should find out how to get a deduction for the purchase of an apartment for a child and other possible registration of rights:

- Receive a deduction for both parents , and carry the remainder until the child reaches adulthood.

- Receive a deduction for one of the parents , transferring the balance in the same way until the child reaches adulthood.

- Do not receive a deduction , leaving this tax benefit to the child when he reaches adulthood.

The advisability of choosing one of the options may be related to both the current financial state of the family and other priorities.

Example . If we take as a basis a residential premises worth 5 million, registered in the name of our only son, then it is advisable to take advantage of the benefits provided by Article 35 of the RF IC and issue a deduction:

- 2,000,000 – for the father;

- in the same amount - for the mother;

- leave a million until my son comes of age.

You can also leave 2 million for the child, and one of the parents receive a refund from one.

Shifting the tax period until the owner reaches the age of majority does not lose his legal capacity.

When should you apply?

Some parents, even knowing about the possibility of receiving a child deduction, do not take advantage of it. To make the right choice, you need to know about important nuances:

- The child does not lose his right to a deduction . And this became possible precisely thanks to the previous limitation. If the deductions were summed up, it is unlikely that the child could receive this benefit for himself in adulthood.

These two rules make it possible to understand when it makes sense to issue a deduction for a child, and when it is inappropriate. Property returns for children should be made if:

- you bought inexpensive real estate (that is, if your share does not cover the maximum deduction amount, then it makes sense to get a refund for the child);

- all or most of the housing is owned by minor children;

- You can receive your child’s share before his or her 18th birthday.

There are also more complex cases when one of the parents is not the owner of the apartment. Then it makes sense for the latter to receive a preference for children.

Conditions for receiving a property return

When applying for a tax benefit, you must comply with the procedure established by law. The grounds for receipt and refusal are regulated as follows :

- The benefit is provided only to taxpayers of the Russian Federation and applies to real estate acquired in Russia.

- A citizen must have a permanent official place of work in accordance with Labor legislation and a salary not lower than the established minimum wage (minimum wage).

- The refund amount to one recipient cannot exceed 260 thousand rubles.

- The benefit is provided only once in a lifetime, but allows for the transfer of lost funds to subsequent objects.

- Spouses who purchased housing during an official marriage can regulate the amount of the amount received at their discretion.

- It is prohibited to issue a property return when purchasing housing from close relatives: parents, children, spouses.

We talked about whether it is possible to legally receive a deduction when buying an apartment from relatives here.

Document verification deadlines

Typically, the duration of document verification from the date of submission is at least 3 months. In addition, an additional month is provided by law for the transfer of funds to the applicant’s account.

The Tax Service issues a notification within 30 days that the corresponding right is granted. The document must be given to the employer. After receiving this notification, representatives of the accounting department stop deducting personal income tax from the employee’s salary.

They do this until, from the beginning of the year, cumulative earnings are greater than the deduction amount stated in the notification. It also happens that it is not possible to use the entire deduction for a single year.

In this case, the balance is carried over to the next one. True, in order to receive it, you will have to visit the tax service again to receive a notification.

It is convenient to fill out an application to confirm your rights to deduction from your employer on the website nalog.ru, in the payer’s personal account. From the same website you can immediately send it to the department. This function eliminates the need to draw up a declaration.

How to get a tax deduction for a child when buying an apartment?

In order to apply for a tax deduction when purchasing an apartment for a minor child and receive a refund of 13% of the cost of the property, you need:

- official registration of a share for a child;

- he must not be 18 years old.

Option 1 – Contact the tax authority

Citizens who want to apply for a tax deduction when buying an apartment for children apply to the local branch of the Federal Tax Service (FTS) at their place of registration and permanent residence, even if the property is registered in another Subject of the Federation.

An appeal is allowed no earlier than one year after registration of the property transaction in Rosreestr.

Statement

The application is written to the head of the Federal Tax Service department and submitted to the general department . A free form of drafting is allowed, with the obligatory indication of the specifics of registration of joint property with the child (or other) and the conditions under which the applicant claims a tax benefit.

At the end of the application there is a date and signature.

Download an application for a tax deduction when purchasing an apartment: form, sample filling.

Sample of filling out an application for a tax deduction

Documentation

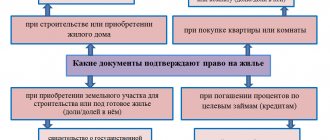

Also, in order to apply for a property deduction when purchasing an apartment for a child, you should attach a package of documentation consisting of the following :

- passport;

- child's birth certificate (or passport);

- purchase and sale agreement (original and copy);

- document certifying payment;

- your certificate of ownership of a share in the right and (or) a child;

- certificate from the accounting department in form 2-NDFL.

A declaration in form 3-NDFL is prepared or filled out in advance at the tax office, where information about the expenses incurred is entered.

Tax return in form 3-NDFL: form, example of filling.

This is what a sample of filling out a declaration on form 3-NDFL looks like

Certificate of income of an individual, form 2-NDFL: form, sample filling.

Sample of filling out a certificate of income in form 2-NDFL

State duty and deadlines

There is no fee charged for income tax refunds when purchasing an apartment for children.

Preparation of permitting documentation is carried out within one to one and a half months.

Receipt

The accrual is made once a year and is transferred to the applicant’s personal account in one payment . The established amount does not exceed the funds that the buyer paid as tax for the previous tax period. The procedure usually extends over several years until the accrued deduction is fully repaid.

The application must be submitted with the accompanying documentation annually, updating the information.

Option 2 – Applying at your place of work

In this case, the home buyer turns to the head of the company (organization) where he works on a permanent basis. You can apply directly after purchasing an apartment, without waiting for the tax period.

Application and documents

Submitted to the employer, written in his name and certified as such.

Compiled in free form, with the obligatory indication of:

- terms of purchase and registration;

- distribution of shares;

- claims for the amount of deduction from one’s own share and the share of the child (children).

In conclusion, a date and signature are placed with a transcript of the surname.

Application to an employer for a tax deduction: form, sample.

An example sample of filling out an application to an employer for a property tax deduction for personal income tax

Documents are attached to the application in the same volume as in the previous case.

State duty and deadlines

The employer, like the tax office, does not charge fees, performing the required actions free of charge.

The registration period consists:

- from the transfer of the application to the Federal Tax Service by the head;

- consideration of the request by the tax authority.

And it can last from one to two months.

Receipt

Immediately after receiving permission from the tax office, the employer stops transferring previously deducted income taxes, adding this amount to the monthly salary .

Property income tax refund when purchasing an apartment for a child does not exceed the monthly amount allocated for withholding. These funds are transferred to the recipient :

- until settlements are completed;

- until termination of work in this institution.

Upon dismissal, you must obtain a certificate from the accounting department about the refund amounts received; in a new place, you must complete documentation using the same algorithm.

Who is entitled to this benefit?

Tax refunds are not available to all individuals. Tax legislation establishes a number of mandatory criteria that a person claiming a deduction must meet.

In addition to purchasing an apartment, these criteria are:

- presence of Russian citizenship;

- official employment.

Of course, when it comes to registering an apartment for children, there can be no talk of official employment. Only in exceptional cases do children aged 15–16 years have a place to work. But the main condition for obtaining a deduction is the age of majority. So such persons do not receive a deduction even if they have a job.

But this does not mean that they are not entitled to the deduction itself. Only it is registered in the name of the parents. Thus, the deduction is transferred to other persons.

This cannot be a basis for expanding the maximum limits for the provision of deductions. The law limits personal income tax deductions to 2 million rubles.

So if the parents have previously exhausted this limit, then the refund will be denied. When the refund has been used only partially, it is subsequently provided according to the remaining balance of the limit.

To summarize the above, it should be noted that recipients of personal income tax returns must meet the following basic criteria:

- Be citizens of Russia and have a Russian passport with you. Foreigners and stateless persons are not entitled to a refund.

- Buy an apartment in accordance with the procedure established by law, including a share in it or on the basis of common ownership.

- Be a personal income tax payer. This tax is paid on wages and other income and is subject to withholding at the time of payment of wages or independent payment on other income.

Does the child lose the right to deduction in this case?

This question does not have a significant underlying basis that would make it possible to clearly prohibit whether a tax deduction can be obtained when purchasing an apartment for children in the future. If the legislative framework does not change before the owner reaches the age of majority , a tax deduction for the purchase of an apartment will be provided to the child at any convenient time, after :

- he will turn 18 years old;

- he will officially get a job.

The tax deduction for the purchase of an apartment for a child is based on legal norms that take into account that when purchasing real estate in the name of children, parents invest money.

Example

As a rule, benefits are received over more than one year. You can only return 13% of your annual earnings. The remaining amount is paid in the following periods. And if for any reason the applicant loses his job or becomes disabled, then he loses all preferences, since he does not remit personal income tax.

Documents for granting benefits can be sent in the following ways:

- By mail.

- Upon personal visit to the Federal Tax Service.

- Through the “Personal Account” of the tax office.

Sending by postal order requires care and the correct postal address. A personal visit has a number of advantages, since you can ask questions, but at the same time waste time in queues. The most convenient way to submit the documentation package is via the Internet. All scans will need to be certified with a qualified digital signature.