What reports to submit to the Pension Fund in 2021

In 2021, employers submit monthly, quarterly and one-time reports to the Pension Fund.

Breaking news for accounting reporting: “Tax officials are demanding new clarifications on reporting.” Read more in the Russian Tax Courier magazine.

- employers submit a report using the SZV-M form. Compared to 2017, the report form has not changed. And the deadline for sending in 2021 has been changed. Now it must be sent to the Pension Fund no later than the 15th day of the month following the reporting month (clause 2.2 of Article 11 of Law No. 27-FZ).

SZV-M can be compiled in one of 2 options:

- If the organization employs up to 24 people, then the report can be compiled on paper. You can submit such a report in one of the following ways: Bring it in person to the Pension Fund,

- Send by mail,

- Using the DSV-3 form, employers who pay additional insurance premiums report to the Pension Fund in accordance with Law No. 56-FZ of April 30, 2008. The deadline for submitting this report is no later than 20 days after the end of the reporting quarter.

Starting from 2021, all employers submit new annual reports to the Pension Fund of the Russian Federation using the SZV-STAZH form. Policyholders submit the report by March 1 of the year following the reporting year. Thus, the report for 2021 is sent to the Pension Fund by March 1, 2021.

SZV-STAZH is submitted to the Pension Fund in 2 more cases:

| Reason for sending the report to the Pension Fund | Report submission deadline |

| An employee retires | Within 3 days after the employee’s request |

| Liquidation of an organization | 30 days after approval of the liquidation balance sheet, but no later than the date of transfer of liquidation documents to the Federal Tax Service |

The employer not only submits the SZV-STAZH form to the Pension Fund, but also issues it to the employee:

- Upon dismissal,

- At the employee’s request - within 5 days after the employee’s request (Clause 4, Article 11 of Law No. 27-FZ).

The rules for compiling SZV-STAZH are the same as SZV-M:

- If the number of personnel is up to 24 people, the report can be submitted on paper,

- With a workforce of 25 or more people – via electronic channels.

There is a group of reports to the Pension Fund of the Russian Federation, which are submitted not by all employers, but only by those who have a need:

| Report | Form | When to take it |

| Questionnaire of the insured person | ADV-1 | If you hire an employee who does not have SNILS |

| Application for exchange of insurance certificate | ADV-2 | If the employee’s personal data has changed, for example, last name, first name or patronymic |

| Application for issuance of a duplicate insurance certificate | ADV-3 | If the employee has lost or damaged the insurance certificate (SNILS) |

| Information about work experience until 2002 | SZV-K | At the request of the Pension Fund |

These forms can be submitted in paper or electronic form. Both the employer and the employee can apply to the Pension Fund with the ADV-1 questionnaire and the ADV-2 and ADV-3 applications.

Let's now see what timeframes to send reports to the pension fund in 2021.

What reports does the Pension Fund accept?

Until 2021 inclusive, the Pension Fund accepted reports on insurance contributions for compulsory pension and health insurance.

And all employers transferred these contributions to the regional branches of the fund. However, as a result of a large-scale reform, from January 1, 2017, these functions were transferred to the Federal Tax Service. Therefore, starting from 2021, both reporting on contributions and payments themselves are accepted by the tax office. The Pension Fund currently provides personalized accounting data and information on labor activity. There are two main reports: SZV-M and SZV-STAZH. All organizations and individual employers are required to take them. From 2021, a report in the SZV-TD form has been added. In addition, there are a number of forms that are filled out in certain cases: upon request, in order to clarify data, replace SNILS, or when an employee retires.

Reports to the Pension Fund in 2021: deadlines for submission

So, there are 2 mandatory reports left for employers to the Pension Fund:

| Report | Frequency of sending | Dispatch times |

| SZV-M | Monthly | Until the 15th day of the month following the reporting month |

| SZV-STAZH | Annually | Until March 1 of the year following the reporting year |

The remaining reports are not submitted by all employers, but only by those who have such an obligation.

Insureds send the SZV-M form to the Pension Fund of the Russian Federation every month before the 15th day of the month following the reporting month. If the deadline for sending falls on a weekend or non-working holiday, the deadline is postponed to the next business day.

There will be 4 such transfers in 2021:

- April 15 – Sunday, you can report for March until April 16,

- July 15 – Sunday, you can report for June until July 16,

- September 15 – Saturday, you can report for August until September 17,

- December 15 is Saturday, you can report for November until December 17.

Taking into account postponements in 2021, submit SZV-M within the following deadlines:

| Reporting month 2021 | Last day for submission in 2021 |

| January | February, 15 |

| February | March 15th |

| March | April 16 |

| April | May 15 |

| May | June 15 |

| June | July 16 |

| July | August 15 |

| August | September 17 |

| September | October 15 |

| October | 15th of November |

| November | December 17 |

| December | January 15, 2021 |

SZV-STAZH is submitted once a year before March 1 of the year following the reporting year. The transfer rule also applies to this report, but in both 2021 and 2021 the deadline falls on a business day:

| SZV-STAZH | Recipient | Deadline for dispatch and issue |

| Annual report 2021 | Pension Fund | March 1, 2021 |

| Annual report 2021 | Pension Fund | March 1, 2021 |

| When an employee retires | Pension Fund | Within 3 days after the employee’s request |

| Upon dismissal of an employee | Worker | Last day of work |

| At the employee's request | Worker | within 5 days after the employee’s request |

| Upon liquidation of a company | Pension Fund | 30 days after approval of the liquidation balance sheet, but no later than the date of transfer of liquidation documents to the Federal Tax Service |

If your organization transfers additional insurance premiums, send the DSV-3 report within the following deadlines:

| Reporting quarter 2021 | Last day for submission in 2021 |

| 1st quarter | 20 April |

| 2nd quarter | July 20 |

| 3rd quarter | October 22 (since October 20 is a Saturday) |

| 4th quarter | January 21, 2021 (since January 20 is Sunday) |

Download and keep in a visible place a memo on the deadlines for submitting reports to the pension fund in 2021:

Submitting reports to the tax office (IFNS)

| Report type | Period | Due dates |

| Certificates 2-NDFL | For 2021 (if it is impossible to withhold personal income tax from income) | No later than 03/01/2018 |

| For 2021 (for all income paid) | No later than 04/02/2018 | |

| Calculation of 6-NDFL | For 2021 | No later than 04/02/2018 |

| For the first quarter of 2021 | No later than 05/03/2018 | |

| For the first half of 2021 | No later than July 31, 2018 | |

| For 9 months of 2021 | No later than 10/31/2018 | |

| Calculation of insurance premiums | For 2021 | No later than 01/30/2018 |

| For the first quarter of 2021 | No later than 05/03/2018 | |

| For the first half of 2021 | No later than July 30, 2018 | |

| For 9 months of 2021 | No later than 10/30/2018 | |

| Income tax return (for quarterly reporting) | For 2021 | No later than March 28, 2018 |

| For the first quarter of 2021 | No later than 04/28/2018 | |

| For January – February 2021 | No later than March 28, 2018 | |

| For January – March 2021 | No later than 04/28/2018 | |

| For January – April 2021 | No later than 05/28/2018 | |

| For January – May 2021 | No later than June 28, 2018 | |

| For January – June 2021 | No later than July 30, 2018 | |

| For January – July 2021 | No later than 08/28/2018 | |

| For January – August 2021 | No later than September 28, 2018 | |

| For January – September 2021 | No later than October 29, 2018 | |

| For January – October 2021 | No later than November 29, 2018 | |

| For January – November 2021 | No later than December 28, 2018 | |

| VAT declaration | For the fourth quarter of 2021 | No later than 01/25/2018 |

| For the first quarter of 2021 | No later than 04/25/2018 | |

| For the second quarter of 2021 | No later than July 25, 2018 | |

| For the third quarter of 2021 | No later than October 25, 2018 | |

| Journal of received and issued invoices | For the fourth quarter of 2021 | No later than 01/22/2018 |

| For the first quarter of 2021 | No later than 04/20/2018 | |

| For the second quarter of 2021 | No later than July 20, 2018 | |

| For the third quarter of 2021 | No later than October 22, 2018 | |

| Tax declaration under the simplified tax system | For 2021 (represented by organizations) | No later than 04/02/2018 |

| For 2021 (represented by individual entrepreneurs) | No later than 05/03/2018 | |

| Declaration on UTII | For the fourth quarter of 2021 | No later than 01/22/2018 |

| For the first quarter of 2021 | No later than 04/20/2018 | |

| For the second quarter of 2021 | No later than July 20, 2018 | |

| For the third quarter of 2021 | No later than October 22, 2018 | |

| Declaration on Unified Agricultural Tax | For 2021 | No later than 04/02/2018 |

| Declaration on property tax of organizations | For 2021 | No later than March 30, 2018 |

| Calculation of advances for corporate property tax (submitted if the law of the constituent entity of the Russian Federation establishes reporting periods) | For the first quarter of 2021 | No later than 05/03/2018 |

| For the first half of 2021 | No later than July 30, 2018 | |

| For 9 months of 2021 | No later than 10/30/2018 | |

| Transport tax declaration (submitted only by organizations) | For 2021 | No later than 02/01/2018 |

| Land tax declaration (submitted only by organizations) | For 2021 | No later than 02/01/2018 |

| Single simplified declaration | For 2021 | No later than 01/22/2018 |

| For the first quarter of 2021 | No later than 04/20/2018 | |

| For the first half of 2021 | No later than July 20, 2018 | |

| For 9 months of 2021 | No later than October 22, 2018 | |

| Declaration in form 3-NDFL (submit only individual entrepreneurs) | For 2021 | No later than 05/03/2018 |

SZV-M report

Form SZV-M was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 No. 83. It is submitted by all economic entities, except for individual entrepreneurs that do not have employees. The report must be submitted even in the absence of wage payments, when the employee is on vacation or on maternity leave. The due date is monthly until the 15th of the next month. This report must be submitted to the Pension Fund for 2021 (more precisely, for December) by January 15, 2021.

SZV-M contains personalized accounting information. This is one of the easiest forms to fill out.

In the first section, you need to fill in the organization’s data: registration number in the Pension Fund of the Russian Federation, short name, TIN and KPP.

The second section indicates the reporting period.

The third section reflects the type of form: original, supplementary or canceling.

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

The fourth section is filled out in the form of a table, where each line corresponds to one employee. Information about the employee is entered in the columns: serial number, full name, SNILS number and INN.

For late submission of SZV-M, the organization must pay 500 rubles for each employee for whom information was not submitted or was submitted but with errors (Article 17 of Law No. 27-FZ).

SZV-experience report

This form of reporting to the Pension Fund for 2021 was approved by Resolution of the Pension Fund Board dated December 6, 2018 No. 507p. Organizations are required to report annually on each employee with whom an employment contract has been concluded. A report for the year in the SZV-experience form must be submitted to the Pension Fund no later than March 1 of the next year.

This report to the Pension Fund for the year contains data that allows you to track the insurance length of employees and the contributions paid for them. Based on this information, insurance pensions will subsequently be assigned. Therefore, in some cases, the form is not submitted on the established general date, but when one of the employees retires. Then the employer is obliged to submit the SZV-experience to the Pension Fund within three days to determine the amount of the pension.

The first section is filled in with information about the policyholder: registration number in the Pension Fund of the Russian Federation, short name of the organization and INN/KPP. Also in this section there is a mark about the type of form: outgoing, supplementary or pension assignment.

The second section shows the reporting period.

The third section concerns information about employees. For each employee, the full name, SNILS, period of work are indicated in the format DD.MM.YYYY and codes are entered that characterize individual parts of this period.

The fourth and fifth sections contain information about accrued and paid insurance premiums.

For late submission and false information, the organization will pay a fine of 500 rubles for each employee.

New in 2-NDFL

By Order of the Federal Tax Service of Russia No. ММВ-7-11/19 dated January 17, 2021, changes were made to the form and procedure for filling out 2-NDFL.

Some of the changes also apply to companies formed as a result of reorganization. The lines “Form of reorganization/liquidation” and “TIN/KPP of the reorganized organization” were added to the title part of the report. The amendments were made in connection with the introduction of clause 5 of Art. 230 of the Tax Code of the Russian Federation, a new procedure for submitting reports in the event of reorganization of a tax agent.

The new report no longer contains data on the residential address of the citizen for whom the certificate was issued.

There are also new deduction codes that need to be taken into account when filling out the certificate.

Other forms

In addition to SZV-M and SZV-stazh, there are several additional forms of pension reporting:

- ADV-2 is filled out by the organization if it is necessary to replace SNILS due to a change in full name, date of birth, gender, place of birth. Submitted within two weeks from the date the employee writes the application.

- SZV-K is compiled in response to a request from the Pension Fund for the provision of information on employees for the period before January 1, 2002. It must be submitted within the time specified in the request.

- SZV-ISH contains information on income and contributions for periods before 2017, if the policyholder has discovered that he has not previously submitted the necessary information.

- SZV-KORR is submitted to clarify the data on the employee’s account. There is no deadline for submission, since the request is submitted at the initiative of the employer.

- A model of the pension file is submitted to the Pension Fund when the employee retires. It contains the necessary information for its appointment.

***

Reporting to the Pension Fund for 2021 must be submitted in two forms - SZV-M by January 15 and SZV-stazh by March 1, 2021. In case of late submission, a fine of 500 rubles will be charged for each employee. If the number is large, the overall fine can be significant. The remaining forms are submitted in specific situations on the personal initiative of the organization or at the request of the Pension Fund.

***

There are even more materials on the topic in the “Documents” section.

Budget deficit and forced reform

The main problem of the Pension Fund remains budget imbalance, which creates threats to the stability of the financial system. In 2021, the Pension Fund deficit exceeded 220 billion rubles. Experts believe that this trend will continue in the medium term. As a result, the government will have to look for additional resources to finance pension payments.

Slowing inflation will reduce the rate of pension indexation, analysts say. Next year, pension payments will be increased by 4-5%, which is the minimum value in recent years. Despite the moderate rise in prices, the fund's expenses will exceed the level of income. In addition, the government will not be able to ensure a real increase in the incomes of pensioners over the coming years.

The latest news from the Russian Pension Fund confirms the presence of negative trends in the field of social security. Despite the layoffs of 12 thousand employees, next year the PFR budget deficit will be about 200 billion rubles. At the same time, the average pension will reach 14 thousand rubles.

Given the further deterioration of demographic factors, the current pension system needs large-scale reforms. Experts expect the start of the reform, which will affect the work of the Pension Fund as early as January 1.

Zero form and suspension of activities

Let’s say right away that the question of whether it is necessary to take zero SZV-M in 2018 does not yet find a clear answer in practice. And the point is this.

Economic entities may be faced with a situation where they need to suspend activities. In this case:

- there is staff;

- he does not perform labor functions;

- The accounting department does not calculate insurance premiums.

As a result, it is not clear whether it is necessary to submit a zero SZV-M in 2021, in which the “Information about insured persons” block should be left empty.

There was no clear answer to the question of whether zero SZV-Ms are surrendered for a long time, since the opinions of the Pension Fund and its territorial bodies often contradicted each other. Thus, initially in 2021, it was permissible to send a report to the fund without a block of information about the insured persons. That is, in essence, the delivery of a zero SZV-M:

However, according to another, more widespread opinion, a report must be submitted if there are insured persons. Namely:

1. Those working under an employment or civil contract.

2. Receiving income from the enterprise.

If the company's activities are temporarily suspended for 2021, employees will still continue to be insured. Submission of the SZV-M form with their listing in this case is required.

Tariffs and BCC for 2021 for contributions

Insurance contributions are special deductions made by employers from salaries and other income of employees to ensure:

- compulsory pension insurance;

- compulsory health insurance;

- compulsory social insurance.

Accrued insurance premiums are paid to an extra-budgetary fund or to the Federal Tax Service.

The rates and deadlines for payment of insurance premiums in 2021 are established by Ch. 34 Tax Code of the Russian Federation.

We remind you that from 2021, insurance premiums are transferred not to the Pension Fund, but to the tax service. You will find a table with insurance premium rates relevant for employers in 2021 below.

For individual entrepreneurs, the Tax Code of the Russian Federation establishes fixed mandatory payments: 29,354 rubles. pension and 6,884 rubles. medical.

| Type of contributions | Taxable base | Bid, % |

| OPS | Up to RUB 1,150,000 | 22 |

| More than 1,150,000 rub. | 10 | |

| Additional contributions to the Pension Fund | Full payment amount | 0–10 |

| Compulsory medical insurance | Full payment amount | 5,1 |

| VNiM | Up to 865,000 rub. | 2,9 |

| More than 865,000 rub. | Not credited | |

| NSiPZ | Full payment amount | 0,2–8,5 |

To transfer contributions, employers use special codes - KBK. In order not to confuse the KBK for the Pension Fund of the Russian Federation used by legal entities before 2021 with the KBK for 2021 for the Federal Tax Service, use the table below, in which we have collected the codes that are relevant this year.

| Insurance contributions for employers | |

| Contribution | KBK |

| OPS | 18210202010061010160 |

| Compulsory medical insurance | 18210202101081013160 |

| VNiM | 18210202090071010160 |

| NSiPZ | 39310202050071000160 |

| Insurance premiums for individual entrepreneurs “for yourself” | |

| Contribution | KBK |

| OPS | 18210202140061110160 |

| Compulsory medical insurance | 18210202103081013160 |

Zero report on the sole founder - general director

For an organization whose founder is the general director as a single person, the presence/absence of an agreement with him does not matter. According to clarification No. 08-22/6356, submission of SZV-M with it to the Pension Fund is mandatory.

But there is still a controversial situation: after all, when specifying the founding director in SZV-M, it is necessary to simultaneously reflect information about his experience in the calculation of insurance premiums.

In July 2021, additional clarifications from the Pension Fund appeared on whether zero reporting is submitted to SZV-M for the general director. According to them, if a company, for certain circumstances, does not conduct financial and economic activities, there is no need to submit a zero SZV-M to the general director without an agreement.

ADVICE

We still recommend that you play it safe and submit such a report.

As was said, the question of whether the “Information about insured persons” section can be left blank did not have a clear answer for a long time. Companies still submitted a zero SZV-M, which reflected information only about the general director.

According to the letter of the Ministry of Labor dated July 7, 2021 No. 21-3/10/B-4587, which was signed by Deputy Minister A.N. Prudov, officials considered the situation when the general director does not enter into an employment contract with the organization and does not receive income.

Based on these explanations, we can conclude: when the general director - who is also the founder and the only employee - did not sign an employment contract with the enterprise and did not receive cash payments, the organization does not file reports on the insured persons.

The central office of the Pension Fund responded to the position of the Ministry of Labor and changed its mind. According to the PFR letter No. LCh-08-26/9856 dated July 13, 2016, in such situations the SZV-M report does not need to be submitted.

In connection with the change in position, the Pension Fund sent corresponding recommendations to its territorial divisions. Some of the branches notified legal entities and individual entrepreneurs of the change in the position of the Pension Fund.

Based on the latest clarifications, policyholders are exempt from paying precisely zero bills. This follows from the letter of the Pension Fund of July 13, 2016 No. LCH-08-26/9856. However, many accountants prefer to play it safe and submit this SZV-M form.

Also see “Zero SZV-M: is it necessary to submit it and how to fill it out.”

What are the deadlines for reporting to the Pension Fund in 2021?

To understand the deadlines for submitting the Pension Fund in 2021, you need to know the list of submitted forms. For each of the documents, legislative norms provide for their own frequency and date of data submission. All insurers are required to provide information, that is, those organizations and entrepreneurs that employ employees, including under employment and civil law contracts.

Report to the Pension Fund in 2021 monthly

Types of reporting to the Pension Fund:

- Monthly form SZV-M - the obligation to submit is approved in clause 2.2 of the article. 11 of Law No. 27-FZ of 04/01/96. The general deadline for submitting the report to the Pension Fund is until the 15th day following the reporting period. The frequency of document submission is monthly. Information can be submitted “on paper” or electronically, provided the number of hired specialists is up to 24 people. Only in electronic format using TCS will employers with a staff of 25 people or more have to report.

- Annual form SZV-STAZH - the obligation to submit the document is approved in clause 2 of the article. 11 of Law No. 27-FZ. The general deadline for submitting a new report to the Pension Fund (valid from 2021 when submitting data for 2021) is until March 1 of the reporting year. The employer will have to submit the document in the event of an employee’s retirement - 3 days are allotted for registration from the date of the individual’s application, as well as in the event of liquidation of the company. In the second situation, the total dispatch period is 30 days. from the moment of approval of the liquidation balance sheet (interim) of the company, but before the transfer of documentation to the tax office. In addition, the employer is obliged to provide the specialist with a copy of the form upon dismissal or upon personal written request (within 5 days). The submission format depends on the number of staff: up to 24 people. – you can report “on paper”, over 24 people. – only electronically.

- Quarterly form DSV-3 - the obligation to submit a document when employers pay additional amounts of contributions is approved in clause 2.1 of the stat. 11 of Law No. 27-FZ. The general deadline for submitting reports to the Pension Fund is set until the 20th day of the month following the reporting quarter.

- The accompanying form EDV-1 is not submitted on its own, but as an annex to SZV-STAZH, SZV-ISKH or SZV-KORR. The mandatory deadline for submitting the document is March 1 of the reporting year. If the specified forms are submitted not for the year, but in the middle of the period, the deadlines for submitting reports to the Pension Fund in part EFA-1 coincide with the deadline for SZV-STAZH.

Conclusion - after changing the mechanism for administering contributions in 2017, the deadlines for submitting reporting forms also changed. If previously information on contributions was submitted as part of the DAM, the deadline for submitting the Pension Fund for the 4th quarter of 2021 was set until February 15/20, 2021 when submitted “on paper” / electronically. Now the DAM is submitted only to the Federal Tax Service, and the deadline for submitting reports to the Pension Fund depends on the type of document according to the list presented above.

Deadlines for submitting monthly reports to the Pension Fund of Russia 2018

| Type of reporting form | Period for submitting data to the Pension Fund (in 2021) | Standard deadline for data submission, taking into account the transfer of days |

| f. SZV-M monthly – submitted to the fund by all employers | January | 15.02 |

| February | 15.03 | |

| March | 16.04 (April 15th – Sunday) | |

| April | 15.05 | |

| May | 15.06 | |

| June | 16.07 (15th July – Sunday) | |

| July | 15.08 | |

| August | 17.09 (September 15th – Saturday) | |

| September | 15.10 | |

| October | 15.11 | |

| November | 17.12 (December 15th – Saturday) | |

| December | 01/15/2019 |

Note! In 2021, it is also necessary to report for December 2021. The deadline for submitting the document is 01/15/2018.

Quarterly deadlines for submitting reports in 2021 to the Pension Fund of Russia

| Type of reporting form | Period for submitting data to the Pension Fund (in 2021) | Standard deadline for data submission, taking into account the transfer of days |

| f. DSV-3 quarterly - submitted to the fund by those employers who transfer additional contributions to the state for the funded part | 1 sq. | 20.04 |

| 2 sq. | 20.07 | |

| 3 sq. | 22.10 (October 20 – Saturday) | |

| 4 sq. | 01/21/19 (January 20th – Sunday) |

Annual deadlines for submitting reports to the Pension Fund of Russia for 2018

If the SZV-STAZH report is submitted to the Pension Fund, the deadlines for submission in 2018 are set until March 1, 2021 when submitting data for 2021. When the report is submitted to the Pension Fund for 2021, the deadlines are approved until March 1, 2021. Such dates are the same for policyholders who submit information “on paper” and those who transmit data via TKS, that is, electronically. The filing date is determined individually in the following cases:

- In case of official liquidation of a legal entity or termination of the business activities of an individual in the status of an individual entrepreneur - within a 30-day period from the approval of the PLB (interim liquidation balance sheet) or approval of the decision on the termination of the citizen’s business activities. But no later than the date of transfer of documentation on the liquidation of the entity to the control body.

- In case of official reorganization of a legal entity - within a 30-day period from the date of approval of the act (transfer) or balance sheet (separation). But no later than the date of transfer of documentation on state registration of the new legal entity to the control body.

- If the employment (civil) relationship with a specialist is terminated, on the last day of employment of such an employee, the form is issued “in hand.”

- When submitting a written request from an employee, the form is issued “in hand” within a 5-day period from the receipt of such a request.

- When a specialist retires - within a 3-day period from the date of the individual’s application.

Reforms on the agenda

Officials continue to discuss the format of future pension reform, which will solve the accumulated problems in this area. The most painful issue remains the increase in the retirement age.

The economic bloc and many experts insist on the need for a gradual increase in the retirement age for all categories of citizens. This measure is forced, since a further increase in the number of pensioners per worker is fraught with a deterioration in the financial position of the Pension Fund. Supporters of this initiative propose to launch reforms following the example of adjusting the age limit for civil servants.

The latest news about the upcoming reform is Vladimir Putin’s August address to the people, in which the president called on citizens to understand the need for such unpopular measures and explained what innovations should be expected from January 1.

The main news is a gradual increase in the retirement age to 60 years for women and 65 years for men. They promise to add it gradually, increasing the figure annually by 1 year.

At the same time, residents of the outback will receive a special pension supplement of 25%.

The president also proposed introducing the concept of “pre-retirement age.” This new category will include citizens who have 5 years left until retirement (men 60-65 years old and women 55-60 years old). For people of pre-retirement age the following will be introduced:

- Increased unemployment benefits, which will amount to 11,280 rubles.

- Benefits for real estate and land, which were previously available only to pensioners.

- Guarantees of social protection in the form of liability for employers for dismissal or refusal to hire a person falling into the specified category.

According to calculations, a complete transition to the new system will occur by 2028.

We invite you to learn more about the upcoming changes by watching the video of the President’s August speech:

Officials are also discussing the future of the funded system. At the same time, representatives of the Ministry of Finance and the Central Bank propose to switch to a mechanism for the formation of individual savings next year.

Responsibility for violation of deadlines for submitting reports to the Pension Fund of Russia

Sometimes, due to various circumstances, the employer does not have time to report to the Pension Fund on time. If the deadline for submitting a report to the Pension Fund is missed, what liability awaits the policyholder?

Fines for violating regulatory deadlines

First of all, the consequences in the form of penalties are faced by those companies that are late in submitting their financial statements to the Pension Fund. SZV-M i f. SZV-STAGE. For failure to comply with regulatory deadlines or for submitting data incompletely or falsely, a fine of 500 rubles will be imposed. for each insured individual (Article 17 of Law No. 27-FZ). In practice, this means that a sanction must be paid for each employee for whom incorrect information was submitted or the report was submitted late.

For example, you must submit the form for September 2021 by October 15th. But the company sent the document only on October 28th. The number of insured individuals is currently 35 people. This means that the Pension Fund of the Russian Federation will impose a demand on the policyholder to pay a sanction in the amount of 17,500 rubles. = 500 rub. x 35 people

Penalties for non-compliance with the mandatory format

If a company is required to report only electronically, but in fact sent the reports (SZV-STAZH, SZV-M, etc.) on paper, such actions will not be in vain. The employer will have to pay a penalty of 1000 rubles. (Article 17 of Law No. 27-FZ). This amount is collected not from the number of employees of the company, but from the enterprise as a whole. This measure of liability also applies to entrepreneurs if the number of hired specialists exceeds 24 people.

Fine for failure to issue f. SZV-STAZH upon dismissal

In accordance with paragraph 4 of Art. 11 of Law No. 27-FZ, when terminating an employment relationship with an individual, the employer is obliged to give him a copy of the form. Since this obligation is approved at the legislative level, failure to provide information may result in a fine. The amount of the sanction is established in Part 1 of Stat. 5.27 of the Code of Administrative Offenses and amounts to:

- For official employees of the employer - 1000-5000 rubles. or announcement of a warning.

- For legal entities – 30,000-50,000 rubles.

- For entrepreneurs – 1000-5000 rubles.

Repeated offenses will result in increased penalties. The legal entity will have to pay 50,000-70,000 rubles; entrepreneur or official - 10,000-20,000 rubles. In addition, the official may be subject to liability in the form of disqualification for a period of 1-3 years.

Who is at risk of having their bank account blocked?

The Pension Fund currently does not block policyholders' accounts. The Federal Tax Service may impose an arrest if the deadline for filing the DAM is violated. Such an innovation in clause 3.2 of Art. 76 of the Tax Code introduced Law No. 232-FZ of July 29, 2018. According to the amendments to the legislation, failure to provide the DAM within a 10-day period from the generally established period threatens the violator with the suspension of transactions on bank accounts.

Samples of reporting to the Pension Fund for the 4th quarter of 2018

This section provides samples of filling out forms available for downloading:

Sample of filling out the SZV-MS form Complies with all legal requirements. Download for free Sample of filling out the ADV-2 form Complies with all legal requirements. Download for free Sample of filling out the SZV-ISH form Complies with all legal requirements. Download for free a sample of filling out the SZV-STAZH form. Complies with all legal requirements. Download for free Sample of filling out the SZV-KORRS form Complies with all legal requirements. Download for free

You can compile, check and submit any report in the BukhSoft program. To report using the SZV-M form, simply click on the button below:

Prepare and submit SZV-M

Table. Submitting reports to the Pension Fund of Russia

| Reporting type | Purpose | Deadline |

| SZV-M Report on SZV-M | Information about your employees: full name, SNILS, INN | Monthly no later than the 15th day of the month after the reporting month. Provide employees with copies of information if they request it and upon termination. |

| SZV-STAZH How to pass SZV-STAZH | Data on the insurance length of employees, including those retiring | Annually no later than March 1 after the reporting year. Important: if an employee retires, submit the report within 3 calendar days from the date he applied Provide employees with copies of information if they request it and upon termination. |

| ADV-2 Check ADV-2 online | Change of SNILS of an employee whose: full name, date and place of birth, gender have changed | Within 2 weeks from the date the employee contacted the company |

| SZV-K Test SZV-K online | Information on length of service and earnings for periods of work and/or other activities before 01/01/2002 for employees for whom a request was received from the Pension Fund of Russia | According to the request of the Pension Fund |

| SZV-ISKH1 Check report online | Information on income, accrued and paid insurance premiums for employees, if not reported before 2021 | No deadlines have been set. Submit it as soon as you find out that you haven’t reported until 2021 |

| SZV-KORR Check SZV-KORR | Correcting data on a citizen’s individual personal account | At any time on your own initiative |

| Layout of pension case | Full details for pension assignment | When an employee retires |

See the link for how to fill out the SZV EXPERIENCE correctly.

How to fill out SZV-M

All Russian and foreign companies, including their separate divisions, as well as individual entrepreneurs, notaries, lawyers, detectives who have hired personnel, are required to submit the form to the territorial offices of the Pension Fund. It contains information on all individuals with whom employment or civil law contracts have been concluded. Report whether the company was in business or not.

SZV-M consists of:

- “Insured details”;

- “Reporting period”;

- “Form type”;

- “Information about employees.”

Take information about the policyholder's details from the documents given in the table:

Table. Details of the policyholder in the reporting of the Pension Fund of Russia

| Props | Source |

| Registration number of the policyholder in the Pension Fund of Russia | Extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs. If an individual entrepreneur registered and hired workers before 2021, the Pension Fund assigned him two registration numbers: as an entrepreneur and as an employer. The reporting must include the registration number, which is indicated in the extract from the Unified State Register of Individual Entrepreneurs. |

| Name of company or individual entrepreneur | Charter (certificate of registration of an individual, passport). You can indicate the full name of the company according to the charter, or you can indicate a short name |

| TIN | Certificate of registration with the tax authorities |

| checkpoint | Certificate of registration with the tax authorities. The IP field “KPP” is not filled in |

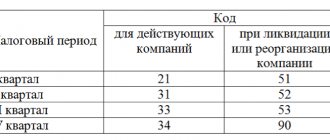

The reporting period is a month. To show its code, see the table:

Table. Deadline codes for submitting reports to the Pension Fund

In the “Calendar Year” field, indicate the year for which you are reporting. For the current year - “2018”.

The “Form Type” section provides three codes:

- “iskhd” (initial), when information about employees for the reporting year is presented for the first time;

- “additional” (additional), if you are supplementing a form previously submitted and accepted by the Pension Fund;

- “cancel” (cancelling), when you cancel previously submitted information about the insured person.

In “Information about individuals” provide the following information about employees:

- Full name in the nominative case;

- TIN, if available (if not, leave the field blank);

- SNILS number.

The employee's full name must be indicated in the form in which they are listed in SNILS. Otherwise, the Foundation will find the error and indicate it by sending the appropriate receipt. In this case, the report will not be accepted. This will result in a fine.

Please note: the form must include information about the general director, who is the sole founder, and members of the board of directors.

After all, for the purposes of the mandatory pension, the director is an insured person. In this case, there is an employment relationship with the company regardless of the existence of an employment contract and payment of wages.

In the second case, the relationship is civil. The board of directors performs management functions and is paid remuneration.

After entering the basic data, put the date of compilation and signature of the director of the company, individual entrepreneur or their authorized representatives at the bottom of the form.

Example

The company (the policyholder) has two employees - a director and a chief accountant.

Policyholder details: TIN – 7725694537, KPP – 773265842, Pension Fund registration number – 256-256-325648.

Information about employees:

- Borisov Vladimir Ivanovich (director) - SNILS - 256-128-569 45, TIN 269856354896;

- Pavlova Irina Aleksandrovna (chief accountant) - SNILS - 259-256-823 98, TIN 269845398765.

On January 15, 2021 (Monday), the company submitted to the territorial branch of the Pension Fund of the Russian Federation a report completed and signed by the head of the company to the Pension Fund of the Russian Federation for the 4th quarter of 2021.

Submitting reports via Russian Post

Another way to submit reports is to send documents by registered mail via Russian Post. To do this, you will need to print out the reporting on paper, certify it with a signature and seal (if possible) and take it to the post office.

In this case, do not forget to first fill out the investment inventory and print it in 2 copies. Next, you will need to buy an envelope and fill it out.

Details and addresses of the Federal Tax Service, Rosstat and extra-budgetary funds can be found at the following links:

- addresses of Federal Tax Service inspections

- addresses of Pension Fund branches

- addresses of FSS branches

Check the addresses of Rosstat branches on the websites of the territorial bodies of the department.

The report with a description of the contents and the completed envelope is handed over to the post office employee. He will check the inventory with the documents, sign and return 1 inventory form. It must be preserved, since it may be required in controversial cases to confirm the submission of reports.

Please note that a postal employee has the right to request a power of attorney to send correspondence on behalf of the organization, as well as a passport. Therefore, when submitting reports via mail, you must have these documents with you. Instead of a power of attorney, you can submit an extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs.

Considering the queues and operating practices of the Russian Post, it is better not to postpone submitting reports until the last day. We also draw your attention to the fact that postal services are paid.

Reports to the Pension Fund: types, procedure and deadlines for filing, fines

Reporting to the Pension Fund in 2021 is divided into four types - these are reports provided:

- monthly;

- quarterly;

- once a year;

- at the request of the Pension Fund or in connection with a specific need.

For each type of reporting, deadlines for submission are regulated. Violation of deadlines, as well as submission of false or incomplete information, entails the imposition of fines on responsible persons and officials. Pension Fund fines have their own peculiarity - they are calculated depending on the number of insured persons. The penalty amount is calculated based on 500 rubles for each insured employee (Article 17 of the law on persuance accounting dated April 1, 1996 No. 27-FZ).

Monthly reporting

The monthly type of reporting to the Pension Fund includes information in the SZV-M form, including data on the insured persons: their full name, SNILS numbers and Taxpayer Identification Number (approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p).

There have been no changes in the form and content of this report form, but the deadline for its submission has been adjusted in 2021. The generated report must be submitted no later than the 15th day of each month following the reporting month. This requirement is established by paragraph 2.2 of Art. 11 of the Law on personalized accounting No. 27-FZ.

Quarterly reporting

The reporting that the employer submits to the Pension Fund on a quarterly basis is form DSV-3 (approved by Resolution of the Pension Fund Board of June 9, 2016 No. 482p).

This is a register of insured persons for whom additional insurance contributions are transferred to the funded part of the pension. His employer is obliged to hand over only if in the reporting period the contributions provided for by the provisions of Law No. 56-FZ of April 30, 2008 were paid. The deadline for its submission is no later than the 20th day of the month following the reporting quarter. That is, this reporting is not for everyone.

Annual reporting

The updated legislation obliges the employee to submit a new type of reporting - in the form SZV-STAZH. In 2021, this report was presented by policyholders for the first time. Previously, the employer reflected the data indicated in this form as part of the RSV-1 report, but now they are displayed in a separate type of report, for which the Pension Fund, by Resolution No. 3p of January 11, 2017, approved a separate form of the form.

The new report reflects the basic information on the insurance experience of the enterprise’s employees, and must be submitted by the policyholder no later than March 1 of the year following the reporting year.

However, in two cases this information must be submitted before the end of the reporting period:

- when assigning a pension to the insured person, it is provided to the Pension Fund within 3 calendar days from the moment the employee contacts the employer;

- in case of reorganization or complete liquidation of an enterprise - within a month after the separation or liquidation balance sheet is approved, but no later than the date indicated in the act of transferring the relevant documents to the Federal Tax Service inspectorate.

The policyholder is obliged to hand over the completed SZV-STAZH to the employee (clause 4 of Article 11 of Law No. 27-FZ):

- on the day of expiration of the employment contract (dismissal),

- upon personal written request - at the request of an employee who continues to work at the enterprise, a completed and stamped report is issued no later than 5 working days from the date of application.

One-time submitted documents

The one-time group includes a number of documents submitted to the Pension Fund when a specific need arises. These include, in particular:

- form ADV-1 (questionnaire of the insured person) - drawn up if an employee is hired with an incomplete package of documents required for employment (without SNILS);

- form ADV-2 (application for replacement of SNILS) - drawn up when the personal data of the insured person changes (change of full name, etc.);

- form ADV-3 (application for the issuance of a duplicate SNILS) - drawn up if an employee loses or damages an insurance certificate;

- form SZV-K (information about the employee’s insurance experience as of January 2002) - compiled at the individual request of the Pension Fund of Russia.

Individual pension

The economic crisis has become a real test for the funded pension system. The authorities were forced to freeze the accumulated savings, using these funds to patch holes in the state budget. Such measures actually discredited the formation of the funded part of pensions. As a result, officials plan to launch a reform that will create a new tool for creating individual pensions.

The Ministry of Finance and the Central Bank propose to introduce a new instrument - individual pension capital (IPC), which will allow restarting the savings system. At the same time, the state will be able to create additional incentives for citizens using a system of tax deductions. Employers will also be able to participate in co-financing pensions, receiving certain benefits from the government.

All working citizens will automatically be connected to the mechanism for forming their own accumulative capital, which will significantly expand the number of participants in the new system. At the same time, citizens will be able to independently adjust the amount of contributions, taking an active part in the formation of future pensions. It is the involvement of citizens that will lead to fundamental changes in the field of pensions, officials believe.

Don't miss: Taxes and fees for companies and individual entrepreneurs

Representatives of the Pension Fund of the Russian Federation support the initiative of the Ministry of Finance, but propose to further discuss the future system of deductions. Compensation cannot be made through insurance premiums, as this will negatively affect the fund's budget. The Pension Fund believes that pension deductions should be financed from income taxes.

Watch a video about the Pension Fund and pensions: