Why does this activity exist?

The category dedicated to insurance is quite extensive and includes a wide range of its varieties.

This can include both medical insurance for individuals and the process of insuring various categories of property. Insurance allows, with the help of regular insurance premiums, to ensure financial stability at the time of the occurrence of an insured event. The entrepreneur’s income lies in the fact that insured events do not always occur, but the insured pay insurance premiums regularly.

It is worth noting that the insurance process has not just a specific, but a deep meaning. Insurance premiums are usually not very high and depend on what a person wants to insure, but material compensation is quite impressive. There may be a risk of being deceived by unscrupulous users, with which entrepreneurs who have chosen this category of activity should be especially careful.

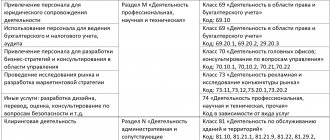

Selection of codes

In the insurance industry

In the field of real estate

In the field of trade

82.99 Activities providing other business support services, not elsewhere classified

Other agency services

96.09 Provision of other personal services not elsewhere classified

The codes correspond to the new edition of OKVED 2

FILESDownload OKVED codes for the services of a realtor, trade, insurance agent in .PDFDownload OKVED codes for the services of a realtor, trade, insurance agent in .JPG

OKVED codes for car insurance

The choice of OKVED code for motor insurance depends on the nature of the services. If we are talking about the field of compulsory motor liability insurance, they use the code 65.12.3, which includes all agents working in the field of civil liability insurance.

For a CASCO policy that provides insurance protection for owners of motor vehicles of a property nature, code 66.03.2 is used.

The distribution of insurance activities according to OKVED makes it possible to distinguish between the working conditions of agents and companies. This system establishes a uniform procedure for the provision of this type of service.

How is it deciphered?

In order to understand what type of insurance activity a certain code refers to, it is worth considering the decoding of OKVED 65.12:

- This code belongs to the large section K. It is dedicated to insurance and financial activities of the entrepreneurial type. The sections serve to conveniently guide users through the expanses of the all-Russian classifier.

- – this code indicates that the activity is carried out in the field of insurance, as well as reinsurance, non-state insurance funds. This category does not include state pension provision, as well as social security.

- 1 – specifically indicates the insurance process as the main activity.

- 12 – this category combines all types of insurance, not including life insurance.

Like all other sections of the classifier, business insurance activities have some detail by type of insurance provided. Specification is achieved by specifying the third part of the code, after the period, in the form of a specific number. Thus, the process of health insurance is indicated by number 1 in the third part. Property insurance is carried out under the number 2. Accident and illness insurance - 4. Traveler insurance - 6.

So, OKVED 65.12 denotes activities devoted to insurance of individuals; this includes all types of insurance, including risk insurance, as well as travel insurance. The amount of insurance premiums mainly depends on what payments are implied at the time of the insured event, as well as the volumes that are insured, for example, when it comes to property.

OKVED codes for insurance

According to the OKVED classifier, agents of insurance organizations must indicate the corresponding codes by type of activity when registering a company at the time of registration with the tax department.

Life insurance

This type of insurance activity assumes the long-term nature of insurance services, taking into account two invariant risks:

- survival;

- lethal outcome.

According to the agreements specified in the OKVED position, it is possible to take into account other types of dangers associated with the infliction of serious bodily injury, death caused by an accident and other circumstances.

The policyholder makes contributions on a regular basis, usually monthly. This type of insurance allows you to minimize or provide for the insufficiency of state methods of insurance protection. By contacting insurance agents, the client receives the opportunity for the beneficiary to pay a lump sum payment, assign a lifelong benefit or annuity, taking into account the terms of the signed agreement.

Insurance other than life insurance

According to OKVED, all other types of activities in this area fall under the specified types of insurance services. Next, this insurance is discussed in detail, taking into account its inherent features.

Medical insurance

Medical insurance, in accordance with OKVED, is divided into two subgroups:

- mandatory - a type of insurance services of the state insurance sector, provided for all Russian citizens and foreigners employed in the territory of the Russian Federation;

- voluntary – concluded at the request of citizens, with the possibility of inclusion in the terms of the medical care policy, in addition to the standard set of additional services.

Compulsory medical insurance (CHI) is provided through the creation and operation of a fund, which includes contributions from employers for recruited personnel. These funds, government assistance and other appropriations are used to provide the necessary assistance to citizens.

Related article: How the insurance market works in France

Holders of a compulsory medical insurance policy have access to medical assistance with the following measures:

- hospitalization and ambulance services, if necessary;

- outpatient and inpatient content;

- provision of other services in accordance with the standard set established by law.

Help is provided without regard to gender, nationality, or other differences.

With voluntary insurance, a citizen has the right to contact an insurance agent to conclude an agreement on his own initiative. The content of a voluntary policy includes a number of additional services that significantly expand the capabilities of compulsory insurance.

In some cases, employers who want to additionally protect the involved personnel turn to insurance agents regarding voluntary health insurance. But such treatment depends solely on the goodwill of the owner of the enterprise.

Property insurance

Owners of said property resort to insurance protection of personal property when contacting insurance company agents. These can be individuals, individual entrepreneurs or organizations. One of the most popular types of insurance services under OKVED is the protection of real estate. This allows you to eliminate the risks of property damage as a result of unexpected incidents.

When insuring large industrial facilities, the owner can resort to double insurance, with the involvement of agents of two or more organizations, in order to reimburse the cost of the insured property through several contracts when risks occur.

Double insurance requires following the following rules:

- when contacting another insurance agent, the first one is notified of this fact in writing;

- Compensation for damage from an insured event is carried out by each of the insurers on a proportional basis.

Each of the agents (SC) contributes part of the amount, according to the distribution under the terms of the concluded contracts.

Property insurance, taking into account the nature of the property, is divided into separate subtypes. These types of activities may involve the conclusion of insurance contracts in relation to real estate, industrial complexes, household property, vehicles and other property.

The terms of insurance, taking into account the type of activity of the agent, are prescribed in the contract, which defines the rights and obligations of each party.

Civil liability insurance

This type of insurance activity, in accordance with OKVED, involves protection from improper performance of their duties by certain persons, public and private organizations, individual entrepreneurs providing clients with services of inadequate quality.

One of the most common types of this type of service according to OKVED is OSAGO. This insurance covers the losses of the injured driver as a result of an accident at the expense of the insurance agent of the person responsible for the accident.

Russian legislation provides for mandatory “motor citizenship” for all car owners. At the same time, legislative regulation determines the principles for forming the cost of an insurance contract, the conditions for this activity for insurance agents, the formula for calculating the price of the policy and other important points.

Related article: Responsibilities of the policyholder and the insurer

The possibility of providing such services extends to commercial organizations and insurance agents who have received the appropriate license.

The motorist has the right to independently choose an agent and insurance company, taking into account his own preferences from among those working in a particular region.

In addition to compulsory motor liability insurance, motor carriers and transport companies of other types of transport insure civil liability. Also, the specified insurance activity, according to OKVED, is in demand by other companies to insure clients against receiving services of inadequate quality.

More information about compulsory liability insurance can be found here.

Accident and illness insurance

This type of insurance activity, according to OKVED, is among the mandatory social protection measures established at the state level. Contributions to the Social Insurance Fund are made by all enterprises, taking into account the degree of danger of the activity being carried out (consider the appropriate classification according to OKVED), for each hired employee.

The more harmful and dangerous the production, the greater the percentage of insurance premiums that must be paid.

These funds provide for the provision of the following support measures to victims of accidents and occupational diseases during production activities:

- one-time payments, taking into account the amount of damage caused to health;

- monthly deductions (as a percentage of average monthly earnings depending on harm to health) - recourse;

- issuing sanatorium vouchers to restore health;

- purchasing medicines, etc.

The degree of health loss is determined by a qualifying medical commission, with the issuance of an appropriate conclusion.

Also from this fund, funds are paid to support the employee in the event of illness or when sick leave (sick leave) is opened.

Risk insurance

Any type of insurance activity according to OKVED involves protection against various risks. But then a division occurs, taking into account the objects of insurance. It also determines the nature of the risks affecting the loss suffered by the insured person.

Insurance for a traveler traveling outside of their permanent residence

In accordance with OKVED, insurance coverage for travelers leaving their permanent place of residence includes possible payment for medical services. Russian citizens traveling around the country or traveling outside the state may encounter the need for such assistance.

Related article: Features of voluntary personal insurance

Some countries (the European Union and others) require insurance contracts when applying for an entry visa. This insurance guarantees payment to medical clinics if the traveler needs to seek emergency care during the trip.

Other types of insurance not included in other groups

In addition to the listed varieties, there is insurance activity that does not fall under the listed positions. For such services, a separate OKVED code is provided, excluding all other insurance services.

One of such insurance is protection by insurance agents of business risk associated with the following factors:

- a decrease in production due to the general crisis of the industry;

- the ruin of an entrepreneur;

- violation of the terms of agreements on the part of partners;

- prosecutions;

- unforeseen circumstances of force majeure.

If such risks occur, the entrepreneur can partially or fully compensate for the possible damage through an agreement with the insurance agent.

You can learn about business risk insurance here.