The standard unified form KM-1 is called “Act on transferring the readings of summing cash counters to zero and registering control counters of a cash register” and is filled out when resetting the counters of cash registers in organizations.

In other words, it is used when commissioning a new cash register, replacing fiscal memory, as well as when taking inventory of a cash register.

Any types of repairs of cash register equipment that require resetting the counters are also possible only after a preliminary report has been drawn up in the KM-1 form in accordance with all established rules.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Both legal entities (organizations and enterprises) and individual entrepreneurs can use the KM-1 form when resetting meters - the filling procedure is the same for them.

This document must be prepared in two copies. One of them is transferred to the organization for the maintenance of cash register equipment, with which the company that owns the cash register has a maintenance agreement, and the second remains with the company itself. Form KM-1 is filled out in the presence of a tax inspector from the tax service in which the company that owns the cash register or its structural division is registered.

Innovations from 2017-2021

According to the explanations of the tax inspectorate (letter of the Federal Tax Service of the Russian Federation dated September 26, 2016 No. ED-4-20 / [email protected] and the Ministry of Finance of the Russian Federation No. 03-01-15/19821 dated April 4, 2017), the transition to online cash registers is made by filling out a cashier’s certificate report -operator optional (all information about ongoing cash register transactions is stored in your personal account on the Federal Tax Service Inspectorate website).

What documents are not needed at online checkout?

According to the letter of the Federal Tax Service of Russia dated September 26, 2016 No. ED-4-20 / [email protected] , 9 unified documents are optional for registration:

- Form No. KM-1 - act on the translation of cash register meter readings.

- Form No. KM-2 - an act on taking readings from KKM control meters when handing over the cash register for repairs and when returning it to the company.

- Form No. KM-3 - act of returning money to the client.

- Form No. KM-4 - journal of the cashier-operator.

- Form No. KM-5 - register of cash registers operating without a cashier-operator.

- Form No. KM-6 - certificate-report.

- Form No. KM-7 - information about cash register meters and the company’s revenue volume.

- Form No. KM-8 - call log for technical specialists.

- Form No. KM-9 - act on checking cash at the cash register.

The following documents are required for online checkout:

- cash book (individual entrepreneurs are kept at will);

- PKO and RKO.

The cash book reflects data on cash inflows and outflows. It records the details of the PKO and RKO, the recipient, and the one who deposits the funds.

Ministry of Finance about the optional use of the KM-4 form and other forms for cash registers

It became known that the Ministry of Finance does not consider it obligatory to use the KM-4 form “Journal of the cashier-operator” when registering transactions with cash register systems. How, in this case, to reflect operations that are carried out through cash register systems?

Economic entities are accustomed to the fact that when accounting for monetary settlements with the population when carrying out trade operations using cash registers, they must use the forms that are listed in Section. 1.1 Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132 “On approval of unified forms of primary accounting documentation for recording trade operations”:

- KM-1 “Act on transferring the readings of summing cash counters to zeros and registering control counters of a cash register”;

- KM-2 “Act on taking readings from control and summing cash counters when handing over (sending) a cash register for repair and when returning it to the organization”;

- KM-3 “Act on the return of funds to buyers (clients) for unused cash receipts”;

- KM-4 “Journal of cashier-operator”;

- KM-5 “Logbook for recording the readings of summing cash and control counters of cash register machines operating without a cashier-operator”;

- KM-6 “Certificate-report of cashier-operator”;

- KM-7 “Information on meter readings of cash register machines and the organization’s revenue”;

- KM-8 “Logbook for recording calls of technical specialists and recording work performed”;

- KM-9 “Act on checking cash in the cash register.”

The last form in this list is used to reflect the results of a sudden check of the actual availability of funds in the cash register of a trade organization or entrepreneur and is filled out by representatives of the controlling organization based on the results of the check.

But the remaining forms during this check must be presented by the person being checked, first correctly filled out and executed. So, the Letter of the Ministry of Finance of Russia dated September 16, 2016 No. 03‑01‑15/54413 states that, according to clause 1 of Art. 1 of the Federal Law of May 22, 2003 No. 54-FZ “On the use of cash register equipment when making cash payments and (or) settlements using electronic means of payment”, the legislation of the Russian Federation on the use of cash register systems consists of this law and the normative regulations adopted in accordance with it legal acts.

Taking into account the fact that Resolution of the State Statistics Committee of Russia No. 132 is not a regulatory legal act adopted in accordance with Federal Law No. 54-FZ, it, according to financiers, does not apply to the legislation of the Russian Federation on the use of cash register systems and, therefore, is not subject to mandatory application.

It can be assumed that this clarification was caused precisely by the appearance in Federal Law No. 54-FZ of an indication of what regulations the legislation on CCP consists of. It is present in the new version of the law, which, on the basis of Federal Law dated July 3, 2016 No. 290-FZ, has been in force since July 15, 2016. There was no such provision in the previous edition.

It turns out that in order for a normative act to relate to the legislation on the application of cash registers, it must contain a reference to Federal Law No. 54-FZ. But in Resolution of the State Statistics Committee of Russia No. 132 there is no such reference.

So, is it no longer necessary to use the forms specified in the CCP? We need to figure it out.

In the previous edition of Federal Law No. 54-FZ in Art. 5 listed the responsibilities of organizations and individual entrepreneurs using CCP. One of these responsibilities was the provision, maintenance and storage in the prescribed manner of documentation related to the acquisition and registration, commissioning and use of cash register systems. The law did not say what specific documentation we were talking about.

The new version of the law is even more stingy on this score. In the same article. 5 users are required to:

- provide to the tax authorities, upon their requests, information and (or) documents related to the use of cash registers, when they exercise control and supervision over the use of cash registers;

- provide officials of tax authorities, when exercising control and supervision over the use of cash registers, unhindered access to it and the fiscal storage, including using technical means, and provide these officials with documentation for them.

Again, it is not deciphered what refers to the mentioned documents and documentation.

The Decree of the Government of the Russian Federation dated July 23, 2007 No. 470 “On approval of the Regulations on the registration and use of cash register equipment used by organizations and individual entrepreneurs” (it states that it was adopted in accordance with Federal Law No. 54-FZ) only talks about such a document as a cash register passport.

True, the Standard Rules for the Operation of Cash Registers when Carrying Out Cash Settlements with the Population[1] (hereinafter referred to as the Standard Rules) have not lost force. Perhaps this is the most detailed document closest to the practical activities of taxpayers, which explains how to use cash registers from a fiscal point of view. And it even has a reference to the fact that it was adopted in accordance with the law regulating the use of cash registers, however, this refers to the law that was in force before the adoption of Federal Law No. 54-FZ.

The Model Rules, among other things, mention situations in which certain forms must be filled out and indicate which ones. These forms are given directly in the named document. However, instead of these forms, those named in Resolution of the State Statistics Committee of Russia No. 132 have been used in recent years (see letters of the Ministry of Taxes of Russia dated 08.27.1999 No. VG-6-16/685, Federal Tax Service of Russia dated 06.23.2014 No. ED-4 -2/11941).

But clause 3.4 of the Model Rules quite clearly states that the administration creates a cashier-operator book for the cash register, which must be laced, numbered and sealed with the signatures of the tax inspector, director and chief (senior) accountant of the enterprise and seal. That is (taking into account Resolution of the State Statistics Committee of Russia No. 132) we were, of course, talking about the KM-4 form (see Letter of the Ministry of Finance of Russia dated June 11, 2009 No. 03-01-15/6-311).

In addition, it is necessary to mention two more regulatory documents, which indicate that their implementation is regulated, in particular, by Federal Law No. 54-FZ:

- Administrative regulations for the execution by the Federal Tax Service of the state function of exercising control and supervision over the completeness of accounting for cash proceeds in organizations and individual entrepreneurs[2];

- Administrative regulations for the execution by the Federal Tax Service of the state function of monitoring and supervising compliance with the requirements for cash register equipment, the procedure and conditions for its registration and use[3].

Both of these documents, as well as Federal Law No. 54-FZ, establish that specialists of the territorial Federal Tax Service Inspectorate, when performing relevant government functions, have the right to request for inspection documentation from the inspected object related to the use of cash registers and accounting for funds (registration, re-registration, verification serviceability, repair, maintenance, replacement of software and hardware, commissioning, use, storage and decommissioning of cash registers, the progress of its registration of payment information and its storage).

And then they directly indicate that the number of documents being checked includes, in particular, the cashier-operator’s journal, an act on the return of money to buyers (clients) for unused cash receipts, a certificate-report of the cashier-operator, information about the readings of cash register counters cars and the organization's revenue. In other words, these are exactly the forms discussed in the Model Rules. But these forms themselves are not given in these administrative regulations; they also do not contain references to Resolution of the State Statistics Committee of Russia No. 132 or to other documents.

Of course, in connection with the upcoming widespread transition of taxpayers to the use of online cash registers, this documentation will likely lose much of its significance for tax authorities in terms of monitoring the use of cash registers. But there is no need to talk about its complete abolition, at least for now, especially since some, although not numerous, categories of taxpayers, even after 07/01/2017, will have the right to work on cash registers “in the old fashioned way”, that is, without transmitting fiscal data to tax authorities through operator. And they cannot avoid using the cashier-operator’s journal and other documents related to the use of cash register systems.

But another matter is in what form these documents should now be drawn up. And what is important here is not only the explanation of the Ministry of Finance that the forms given in Resolution of the State Statistics Committee of Russia No. 132 do not need to be used. By the way, this resolution, like many other similar documents adopted by the said department, became optional for application in connection with the adoption of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”.

According to paragraph 4 of Art. 9 of the said law, the forms of primary accounting documents are determined by the head of the economic entity on the proposal of the official who is entrusted with maintaining accounting records. There is no obligation to use unified forms approved by Rosstat.

True, the Ministry of Finance in Information No. PZ-10/2012 indicated that the forms of documents used as primary accounting documents established by authorized bodies in accordance with and on the basis of other federal laws continue to be mandatory.

In this regard, the Federal Tax Service, in Letter No. ED-4-2/11941 dated June 23, 2014, explained that the Standard Instructions and Resolution of the State Statistics Committee of Russia No. 132 were developed in order to implement the provisions of the legislation on the use of cash register systems and on the basis of it. But now the Ministry of Finance has refuted this statement, at least to the extent that the mentioned resolution is based on federal legislation on cash register systems.

* * *

All of the above has led us to the following conclusion. The use of documents related to the use of cash register systems is necessary, and in the minimum composition that is defined in the Model Rules and the mentioned administrative regulations. But, in our opinion, the forms of these documents approved by any authorized body are currently not available.

Therefore, any person using CCP now has the right to develop their own primary documents related to the use of CCP, as long as they contain the mandatory details provided for in paragraph 2 of Art. 9 of Federal Law No. 402-FZ. At the same time, each economic entity has the right to decide for itself whether it should accept these primary documents in the form given in Resolution of the State Statistics Committee of Russia No. 132 (there is no prohibition on the use of unified forms in this capacity), especially since these documents must comply with the requirements for indicating information in them established by the Model Rules. Obviously, it is the unified forms that best meet the specified requirements.

[1] Approved by the Ministry of Finance of Russia on August 30, 1993 No. 104.

[2] Approved by Order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n.

[3] Approved by Order of the Ministry of Finance of Russia dated October 17, 2011 No. 132n.

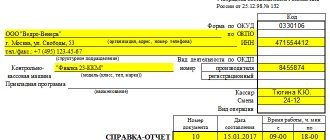

What is a certificate in the KM-6 form?

The job of a cashier is difficult and responsible. In their work, these specialists are guided by Law No. 54-FZ and Directives of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014. Cashiers are faced with numerous reports that show cash register movements. Every cashier is faced or has encountered the preparation of the KM-6 form. This is an important document for the cashier, his report on the amounts posted at the cash register.

Initially, the report was compiled only on cash revenue, but with the development of technology and the advent of payments using bank cards, such information also began to be displayed in the certificate report.

The form of the certificate - report was approved by Resolution of the State Statistics Committee No. 132 of December 25, 1998. At the same time, the company can use in its work both a unified form and a report form developed at the enterprise. This possibility is enshrined in the Letter of the Federal Tax Service of the Russian Federation No. ED-4-20 / [email protected] dated September 26, 2016. However, it is worth considering that the report form developed at the enterprise must necessarily contain the key details of the unified document.

Is it necessary to lead?

Form KM-6 is an important reporting document for the cashier, which indicates the amount of daily revenue. These report certificates are of great importance when carrying out inspections by supervisory authorities.

Based on them, a complete picture of the completeness of the reflection of the enterprise’s revenue is compiled. Certificates are also required when drawing up a summary report.

The question of whether to fill out a report is ambiguous.

The absence of this form does not entail the application of penalties; in many organizations it is simply not needed; private entrepreneurs, as a rule, do without it.

If the supervisory authorities, when carrying out control activities, discover the absence of a certificate-report, then this fact will be considered an aggravating circumstance.

The director of the company will be in trouble, and he, in turn, will transfer all the blame to the cashier.

In addition to the KM-6 report, the KM-7 form can be drawn up - information about cash register counter readings and revenue must be filled out if the enterprise has two or more cash registers.

Why is the KM-6 form needed?

Certificate form KM-6 is the main reporting document of the cashier. It indicates the revenue received and is handed over to the manager along with the revenue. If the proceeds are given to collectors, then a corresponding note is required in the certificate-report.

In the work of inspection bodies, such certificates play a very important role. It is on their basis that a conclusion is made about the completeness of revenue reflection. In addition, information from the KM-6 certificate is used to fill out a summary report. This report includes data on the status of cash register meters and the income of the enterprise.

Instructions for filling out the front side of the act according to form KM-1

The form itself is not particularly complex and for the most part is quite understandable even for less experienced professionals.

Filling out the header of the document

The first part includes information about the company that owns the cash register whose counters have been reset.

Here you need to enter the full name of the enterprise indicating its organizational and legal status (IE, LLC, CJSC, JSC), as well as its address and telephone number (mobile or landline - it does not matter, this information is needed in case the regulatory authorities there will be questions later).

Nearby, in the appropriate cells, you need to enter the OKPO code (can be found in the registration documents), as well as the TIN of the individual entrepreneur or legal entity. If the cash register belongs to a structural unit, you must indicate it too, with the full name and address of its location.

Next, enter the name of the cash register (according to the passport) and the number assigned by the manufacturer - here you need to put the serial number of the cash register (usually it is indicated on the body of the cash register). Next to it, you should note the name of the application computer program that is used at the enterprise (most often it is 1C of various versions).

The main part of the KM-1 act is the table

The second part of this document is the main one. In the “Document number” cell you need to enter the number “1”, and in the “Date of compilation” line - the date of registration of the cash register with the territorial tax office (exactly the date of registration of the cash register for tax purposes!). It is important to take into account one point: the date of drawing up this act should be no earlier than one day before the registration of the cash register with the tax service.

Next, you must indicate the full name of the tax inspector present when resetting the meters and drawing up this act, the number of his official ID, as well as the tax service that he represents.

After this, you need to enter the readings of the control counters before and after zeroing (this must be done in both numbers and words), as well as the readings of the main summing money counter (also in numbers and words).

Features of the help report

The cashier-operator's certificate-report has several characteristic features:

- the KM-6 form, approved by the State Statistics Committee of the Russian Federation in 1998, is unified;

- errors when filling out, as well as deviations from the generally accepted format, may result in a fine during the work of inspection bodies;

- KM-6 must be filled out daily (or at the end of each shift), and simultaneous filling out of certificates for 2 or more days/shifts is not allowed;

- The document must be submitted simultaneously with the proceeds - either to the chief cashier of the company or to the bank;

- The certificate must be kept for exactly 5 years, after which it loses its value.

Important! Column 4 is filled in only when using outdated cash register equipment. If modern devices have been installed in the organization over the past 12 years, then this section should be left blank.

General filling rules

In order to avoid mistakes when entering information into the KM-6 form, you must follow the general rules:

The first line of the report should contain the name, address (legal or actual - it doesn’t matter, the main thing is that it is the same in all reports) and telephone number of the enterprise. If there is a separate division, then its name must also be indicated.

If the KM-6 form is filled out by an individual entrepreneur, then he must indicate all the necessary information in the same order. This is a common mistake - many individual entrepreneurs believe that they can deviate from the unified form, because they work for themselves. The document must indicate the name, registration number and number of the CCP manufacturer. You must indicate the exact date of completion and certificate number. Revenue must be reported in numerical form and in words. The signature of the author of the certificate report is a required element.

How to fill?

To prevent errors when filling out the certificate form, you must follow the general rules. The help report is presented in the form of 3 blocks: line, table and summary.

The first line of the document indicates the name of the company, its address (must be identical in all documentation), and telephone number. The name of the individual unit is also indicated.

For individual entrepreneurs, similar rules apply as for legal entities. In a number of situations, individual entrepreneurs mistakenly assume the use of a similar form, but this report is drawn up only on the approved form.

Below is the TIN of the enterprise, structural unit (if any). In the field intended for entering information about cash register equipment, enter its brand (type, model) and serial number in accordance with the available cash register documentation.

The “Application program” line is not filled in if it is not used in the work. Next, the surname and initials of the cashier are entered in the appropriate line; if there are several cashiers, then the field remains blank.

The “shift” cell records the report number, which, as a rule, begins with the letter “Z”.

The next field contains the document details: number, date, start and completion time of work. Don't forget to fill out this information.

The tabular part of the help report is divided into 10 columns:

- 1 — serial number of the control counter;

- 2, 3 — department and section number, respectively;

- 4 - remains empty when using modern cash registers;

- 5 - readings of the cash counter at the beginning of the shift, day (the amount from column 9 of the cashier’s journal of the last shift, a similar amount is written in the morning X-report, in the GROSS TOTAL line;

- 6 - meter readings at the end of the working day, GROSS TOTAL line of the Z-report;

- 7 - enter the revenue for the shift, the sum of all punched checks, the difference between columns 5 and 6;

- 8 - the amount of all refunds and erroneously issued checks, information is displayed in the KM-3 act, to which all checks confirming the return are attached, the information must match the amount from column 15 of the KM-4 journal;

- 9 - cashier's surname;

- 10 – cashier’s signature.

The total expressions of columns 7 and 8 are recorded in the resulting field.

The cashier generates a Z-report from cash register equipment at the end of the working day (shift). It displays information about all cash transactions. Based on the balance recorded in the Z-report, the cashier reconciles the available cash and then transfers it to the responsible persons, the bank.

The cashier removes the X-report from the cash register to determine the cash in the cash register during the work shift (day). An unlimited number of it can be generated, information about such actions is not displayed, and revenue is not reset.

You can put dashes in the empty lines of the KM-6 certificate so that supervisory authorities do not have questions about the document being unfilled.

In the final block, the amount of revenue is written down in words. The “accepted” line contains the details of the receipt order.

If the report is handed over to the collector, then information about the transfer of proceeds to the bank is entered; when transferring it to the chief cashier, this line is not filled in.

Next, the cashier, senior cashier and head of the company put their signatures; if these positions are combined by one employee, then the signature is affixed three times.

Filling out a line help topic

For the convenience of presenting information, we will reflect the order of filling out this section in the table.

| Help column | How to fill it out |

| Organization | In this column you must write down the name of the company or entrepreneur. The full name must be indicated. In addition, you also need to enter your phone number here. |

| TIN | In this field we indicate the identification number of the organization or entrepreneur |

| Structural subdivision | Not all organizations have such divisions. However, if they exist, then you need to record this information in the report, that is, indicate the structural unit where the revenue was received for the day |

| Information about CCP | In this column we indicate which cash register model is used. Such information is presented both in the documents for the cash register and in the cashier’s journal, on page 1 |

| Cash desk number | This information is usually provided by the senior cashier (it is recorded on page 1 of the cashier's journal). If you cannot obtain information in this way, you will have to look for the cash register number in the documents for it |

| Application program | Application programs are not always used with cash registers. If such programs are not used when using a cash register, then the column is not filled in |

| Cashier | This column is not filled in if there are several cashiers. If there is 1 person working, then you need to write down his last name, first name and patronymic |

| Change | In this column we indicate the number of the Z-report. As a rule, it starts with the letter Z and is written like this: Z00012 |

| IMPORTANT! When drawing up a certificate report, we must indicate its serial number, date, start and end time of preparation |

Filling out the help table section

Here is a breakdown of the columns in the table.

| Help column | How to fill it out |

| Column 4 | As mentioned above, this column is filled out quite rarely, only when using very old cash registers. If the cash register used in the organization was released no earlier than 2004, then the data is not entered in the column |

| Column 5 | Here you need to enter the amount of cash at the beginning of the shift. This data can be taken from the cashier's journal or in the report that was compiled in the morning. We will be interested in the line GROSS - TOTAL |

| Column 6 | In this column we enter data from the Z-report, along the line GROSS - TOTAL |

| Column 7 | This column indicates the total amount from the Z-report, taking into account the refunds made |

| Column 8 | We fill in if there are returns (we take them from Z-reports). We will not fill out this column if there have been no returns. |

| Column 9 | In this field you need to indicate the name of the cashier who is preparing the report |

| Column 10 | The cashier - the preparer of the report puts his signature, thereby certifying that the information contained in it is correct |

| Total line | In this column we reflect the total amount that was obtained based on the results of columns 7 and 8 |

Completing the final help section

Let us show the completion of the third, final part in the table.

| Field value | How to fill it out |

| Total revenue | Here we reflect the amount of revenue received per day. The value of the indicator is written in words |

| The amount that is accepted and entered into the cash register | This field is often left empty, however, if a receipt order is issued, you will have to fill it out. This happens quite rarely in life |

| Amount deposited in the bank | As can be seen from the name of the line, it is filled in only when the proceeds are delivered to the bank or when transferred to a collector. In this case, information about the details of the bank where the proceeds are deposited is entered into the settlement certificate. Otherwise the line remains empty |

| Receipt number | The line with the receipt number is mutually linked with the line about accepting the amount of money at the cash register, so in most cases it is also not filled in |

After filling out all the necessary lines, we write down who is the senior cashier, cashier and head of the company. These persons must sign the report and indicate the transcript of the signature.

Sample of filling out a certificate-report of a cashier-operator (form KM-6)

Here is a sample, KM-6 can be found further down the page.

Who should sign the KM-1 form

Since cash registers are devices subject to strict government control, any actions with them must be strictly recorded and certified by all interested parties. In particular, after resetting the cash counters, the act must be signed by members of a specially created commission, who must be present during this operation. This commission usually includes:

- representative of the tax office;

- head of the organization that owns the cash register equipment;

- chief accountant of the organization;

- senior cashier;

- cashier.

What to do with the KM-6 form after filling it out

The completed document must be given to the chief cashier, if the company has one. The chief cashier passes the certificate report to the general director or accountant. If there is no such cashier, then the cashier-operator gives the document directly to the accountant or director. The certificate must be kept for 5 years.

Important! Individual entrepreneurs, as a rule, are triune. An individual entrepreneur is his own cashier-operator, accountant and manager. Therefore, he gives the document directly to the bank.

Features of using a certificate in the KM-6 form

| Filling conditions | Decoding |

| Who fills out the certificate | Since the preparation of this report is related to the material side of the company’s activities, its preparation should be carried out by the financially responsible person. The cashier is just such a person |

| How information is filled out | All data is entered into the certificate form using a pen with blue or black ink. |

| Are blots allowed when filling out the form? | Since this document is very important and concerns the financial sector, it must be filled out in legible handwriting, preferably without errors or blots. If regulatory authorities find corrections, a fine may be imposed |

| Certificate preparation period | Such certificates are prepared every day |

| Who is the report sent to? | The completed certificate along with the cash is handed over to the senior cashier, accountant or director of the enterprise. It is also given to the bank |

| Certificate storage period | Certificate – the report must be kept by the company for 5 years |

Errors when filling out and how are changes and additions made to the KM-9 form?

The peculiarity of filling out the KM-9 form is the fact of surprise, and therefore each of the meanings of the act has its own limit on the permissibility of correction.

| Indicators | Possibility of error correction |

| Organization Credentials | There is |

| Registration of the act (date, number) | There is |

| KKM readings at the beginning of the shift | There is |

| CCT readings at the start of the inspection | No |

| Actual cash at the beginning of the audit | No |

| Amount of cash according to accounting data | There is |

| Calculation of total values according to the act data | There is |

Corrections in unacceptable cases may mean falsification of values, and therefore have a negative impact on the business reputation of the company being inspected.

Corrections of identified errors in act indicators are carried out in such a way that the original data is readable. To confirm the corrections, a member of the commission writes “Believe the corrected. Signature".

Is it possible not to fill out the KM-6 form?

This question is ambiguous. On the one hand, no one is fined for the absence of a certificate-report. Many enterprises simply do not require it, and individual entrepreneurs most often do without it. But if the check reveals the absence of such certificates, then this will be considered an “aggravating circumstance.” The manager will have problems, and naturally he will blame the cashier-operator who did not fill out the KM-6 form.

No cash transactions

If no cash transactions were carried out during the working day (shift), then a certificate-report of the cashier-operator is not drawn up.

Cashier-operator journal for online cash register

The cashier-operator's journal is an optional form of filling out according to the letter of the Federal Tax Service of Russia dated September 26, 2016 No. ED-4-20 / [email protected] Because the data that was previously recorded in the journal is now sent to the Federal Tax Service online.

Why do you need a cashier-operator’s journal and who should have it?

The cashier-operator's journal is needed for the online cash register to take into account the receipt and expenditure of cash. Despite the fact that since July 2017 it is optional, it will be useful for internal accounting.

The log is kept by an employee who serves customers using cash registers. The document is kept by the manager or chief accountant.

If you still decide to conduct it, then read the instructions below.

How and when to fill out the cashier-operator log

Companies and entrepreneurs decide for themselves what rules to use to fill out the journal. But they must definitely follow the template from Resolution No. 132.

The description of the KM-4 register states that the cashier-operator's book is maintained by the cashier every day. The entry is made in the journal using a ballpoint or blue ink pen.

If you are correcting a record, be sure to obtain a visa from your boss or chief accountant.

Until July 1, 2021, maintaining a cashier-operator journal for an online cash register required: firmware, numbering and registration with the tax office. Now registration is not needed, and numbering and lacing is carried out at the request of the individual entrepreneur and organization.

The requirements for maintaining KM-4 oblige the cashier to fill out the journal after removing the Z-report.

Step-by-step algorithm for filling the PKO

Account cash warrant

According to Directive No. 3210-U, an expense cash order is issued when cash is issued from the cash register. You cannot make corrections to a completed form.

Step-by-step algorithm for filling out RKO

Coaxial and high-frequency communication cables - Cables KM-4 and KM-4-60

Page 12 of 38

Trunk coaxial cables types KM-4 and KM-4-60 The cables are intended for use on the backbone primary communication network in analog transmission systems in the frequency range up to 60 MHz and digital transmission systems with a speed of 140 Mbit/s. Depending on the sheath, the cables have the following grades: KM-4 - in a lead sheath, with standardized electrical characteristics up to 140 MHz; KM-4-60 - the same, with standardized electrical characteristics up to 60 MHz; KMA-4 - in an aluminum shell, up to 140 MHz; KMA-4-60 - the same, up to 60 MHz; KME-4—in a double metal shell (aluminum, lead), with standardized electrical characteristics up to 140 MHz. Depending on the installation conditions (GOST 10971-78), 40 brands of cables with different types of protective covers are provided. The preferred areas of application of coaxial cables of types KM-4 and KM-4-60 are listed in table. 4.4.

Table 4.4 Brands and preferred areas of application of coaxial cables of types KM-4 and KM-4-60

| Cable brands | Type of shell and protective cover | Preferred area of application |

| KMG-4 KMG-4-60 | Lead sheathed cables without protective cover | For installation in cable ducts, pipes, blocks, collectors, tunnels and indoors in the absence of mechanical stress on the cable and operation in an environment neutral with respect to the sheath, in areas not characterized by increased electromagnetic influence |

| KMGShp-4 KMGShp-4-60 | Lead-sheathed cables with protective cover type Shp | For installation in cable ducts, pipes, blocks, in the absence of mechanical stress on the cable and operation in an environment that is aggressive towards the sheath, in areas not characterized by increased electromagnetic influence |

| K'MAShp-4 KMAShp-4-60 | Cables in an aluminum sheath with a protective cover type Shp | The same applies to laying over bridges and in soils, if the cable is not subjected to large tensile forces |

| KMB-4 KMB-4-60 | Lead-sheathed cables with protective cover type B | For laying in soils that are neutral with respect to the lead sheath, if the cable is not subject to significant tensile forces, in areas not characterized by increased electromagnetic influence |

| KMBl-4 KMBl-4-60 | The same, with a protective cover type Bl | The same, but in soils that are aggressive towards the lead sheath |

| KMBShp-4 KMBShp-4-60 | The same, with a protective cover type Шп | The same, but in soils that are aggressive towards steel armor |

| KMBp-4 KMBYa44-60 | The same, with a protective cover type Bp | The same, but in soils that are aggressive towards the lead sheath |

| KMBpShp-4 KMBpShp-4-60 | The same, with a protective cover type BpShl |

| KMBG-4 KMBG-4-60 | The same, with a protective cover type BG |

| KMABpShp-4 KMABpShp-4-60 | Cables in aluminum sheath with protective cover type BpShp |

| KMABp-4 KMABp-4-60 | The same, with a protective cover type Bp |

| KMABpG-4 KMABp G-4-60 | The same, with a protective cover type BpG |

| KMAKpShp-4 KMAKpShp-4-60 | The same, with a protective cover type KpShp |

| KMK-4 KMK-4-60 | The same, in a lead sheath with a protective cover type K |

| KMKl-4 KMKl-4-60 | The same, with a protective cover type Kl |

| KMKpShp-4 KMKpShp-4-60 | The same, with a protective cover type KpShp |

| The same, but in soils that are aggressive towards lead sheathing and steel armor |

| For laying in fire hazardous areas, mines, tunnels, channels and collectors, if the cable is not subjected to large tensile forces, in areas not characterized by increased electromagnetic influence |

| For laying in soils of all categories, except those subject to permafrost deformations, in areas characterized by increased electromagnetic influence, in water when crossing shallow swamps, non-navigable and non-floating rivers with calm water flow |

| The same, but in soils that are non-aggressive towards steel armor |

| For installation in fire hazardous areas, mines, tunnels, channels and collectors, if the cable is not subjected to high tensile forces, in conditions characterized by increased electromagnetic influence |

| For laying through mountain, navigable and rafting rivers, flooded and swampy floodplains, in swamps more than 2 m deep, soils subject to frozen deformations and in the presence of large tensile forces, in areas characterized by increased electromagnetic influence |

| The same, but in areas not characterized by increased electromagnetic influence |

| The same applies to soils with an increased corrosion hazard in relation to the lead sheath. |

| The same, but in soils with an increased corrosion hazard in relation to the lead sheath and steel armor |

| Cable brands | Type of shell and protective cover | Preferred area of application |

| KMEB-4 | Cables in a double metal sheath (aluminum-lead) with a protective cover type B | For installation in areas with frequent thunderstorms, increased influence of power lines and electricity. and. etc., in soils that are neutral with respect to lead and aluminum sheaths, if the cable is not subjected to significant tensile or compressive forces |

| KMEBL-4 | The same with a protective cover type Bl | The same, in soils that are non-aggressive towards steel armor |

| KMEBL-4 | The same, with a protective cover type Bp | Same |

| K'MEBShp-4 | The same, with a protective cover type BShp | The same, but in soils that are aggressive towards the steel shell |

| KMEBpShp-4 | The same, with a protective cover type BpShp | The same, but in soils that are aggressive towards the shell and steel armor |

| KMEKpShp-4 | The same, with a protective cover type KpShp | The same, for laying through mountain, navigable and rafting rivers, flooded and swampy floodplains, swamps more than 2 m deep, in soils that are aggressive towards steel armor, subject to frozen deformations and in the presence of large tensile forces |

| KMEC-4 | The same, with a protective cover type K | The same, but in soils neutral with respect to steel armor |

| KMBlG-4 | Lead-sheathed cable with protective cover type BlG | For laying in fire hazardous areas, mines, tunnels, channels and collectors, if the cable is not subjected to large tensile forces, in areas not characterized by increased electromagnetic influence |

Cable marking means: K—coaxial; M - main; A - aluminum shell; E - double metal shell (aluminum, lead); B, Bp, Shp, BpShp, K, KpShp, etc. - types of protective covers (GOST 7006-72); 4 - four coaxial pairs. The core of cables of types KM-4, KMA-4 and KME-4 is the same and contains four coaxial pairs 2.58/9.4 mm, five star quads with copper conductors with a diameter of 0.9 mm with air-paper, cord-paper or polyethylene isolation. The core of cables of types KM-4-60 and KMA-4-60 differs from the core of cables of types KM-4, KMA-4 and KME-4 in the size of coaxial pairs (2.64/9.5 mm). The design of coaxial pairs 2.58/9.4 and 2.64/9.5 mm is shown in table. 4.1, and star fours - in table. 4.2. Insulation of cores of four different colors. The veins of the first pair of the quad, located diagonally, are red and yellow (natural), and the second pair are blue (violet) and green.

Table 4.5 Structural dimensions and weight of core elements of coaxial cable types (KM-4 and KM-4-60)

| KM-4 | KM-4-60 | |||

| Core elements and material | size, mm | weight, kg/km | size, mm | weight, kg/km |

| Core elements Central quad 1X4X0.9: with cord-paper insulation (cordel diameter 0.6, paper tape 0.12, insulated core 2.35); | 4,8 | |||

| with polyethylene insulation (insulation thickness 0.6, insulated core %,) | 5,1 | |||

| Diameter of a layer of four coaxial pairs and four quads of belt insulation: | 27,0 | 28,0 | ||

| thickness of one polyethylene terephthalate tape | 0,025 | _ | 0,025 | _ |

| thickness of four paper tapes KMP-1210 | 0,6 | _ | 0,6 | _ |

| core diameter along belt insulation | 28,2 | — | 29,3 | — |

| Core material Copper four coaxial pairs | 476 | 488 | ||

| Copper star quads 5X4X0.9 | — | 116 | — | 116 |

| Steel (screen tape 0.15x15) | — | 223 | — | 225 |

| Polyethylene (coaxial and symmetrical pair insulation) | — | 18 | — | 72 |

| Paper tape (coaxial and symmetrical pair insulation) | — | 56 | — | 34 |

| Cable paper (belt insulation) | ___ | 38 | ___ | 43 |

| Total core mass | — | 927 | — | 978 |

The color of the yarn in the first central four is yellow, in the second - red, in the third - green, in the fourth - white, in the fifth - brown (black). The following numbering of coaxial pairs is adopted in the cables: I - between the red and green (blue) quads; coaxial pair II - between white and brown (black) quads; coaxial pair III - between the green (blue) and white quads; coaxial pair IV - between the brown (black) and red quads. The structural dimensions and weight of the core elements of coaxial cables of types KM-4 and KM-4-60 are given in table. 4.6, and in table. 4.6 and 4.7, respectively, the structural dimensions of the elements and the weight of materials of coaxial cables. Cross sections of cables of types KM-4, KMA-4 and KME-4 are shown in Fig. 4.2—4.4 respectively. The construction length of cables of all brands, except for cables with type K armor, is not less than 600 m. It is allowed to ship cables to one address with the following lengths:

- . 599 m in an amount of no more than 20% of cables with 2.58/9.4 mm pairs in a lead sheath; 200... 399 m no more than 20% and sections 400... 599 m long no more than 30% of cables in aluminum, double and lead sheaths with hose-type protective covers;

- 595 m no more than 20% of cables with 2.64/9.5 mm pairs in lead and aluminum sheaths of all brands, except cables with type K armor;

- . 199 m no more than 10% of the total length of the cable batch. The construction length of cables with type K armor is at least 400 m; Sections of length 100...399 m are allowed, not more than 100% of the total length of cables with type K armor.

The cables are supplied on wooden drums No. 18 with a volute in accordance with GOST 5151-79.

Rice. 4.2. Coaxial cable type KM-4: 1 - armored wire; 2 - outer cover (jute); 3 - pillow; 4 — two armored belts; 5 - lead sheath; 6 - waist insulation. Coloring of symmetrical fours from end A: 1 - yellow; 2 - red; 3 - blue; 4 - white; 5 - brown

Structural dimensions, mm, of elements of coaxial cables of types KM-4 or KM-4-60

| Diameter according to waist insulation | Metal shell | Pillow | Armor | Outer cover | Cable outer diameter | ||||||

| Cable brand | Thickness | Shell diameter | Thickness of polyethylene new hose (tape) | Total thickness | Diameter according to the pillow | Thickness | Diameter according to armor | Thickness of polyethylene new hose | Total cover thickness | ||

| KMG-4 | 28,2 | 1,65 | 31,5 | 31,5 | |||||||

| KMGShp-4 | 28,2 | 1,37 | 31,0 | — | — | — | — | — | 1,6 | 2L | 35,2 35,6 |

| KMASHp-4 | 28,2 | 1,40 | 31,4 | — | — | — | — | — | 1,6 | 2,1 | |

| KMB-4 | 28,2 | 1,37 | 31,0 | — | 2,0 | 35 | 2X0.5 | 37,0 | — | 2,2 | 41,4 |

| KMBl-4 | 28,2 | 1,37 | 31,0 | 0,45 | 2,5 | 36 | 2 X 0.5 | 38 | — | 2,2 | 42,4 |

| KMBShp-4 | 28,2 | 1,37 | 31,0 | — | 2,0 | 35 | 2X0.5 | 37 | 2,1 | 2,6 | 42,2 |

| KMBp-4 | 28,2 | 1,37 | 31,0 | 1,6 | 3,6 | 38,2 | 2X0.5 | 40,2 | — | 2,2 | 44,6 |

| KMBpShp-4 | 28,2 | 1,37 | 31,0 | 1,6 | 3,6 | 38,2 | 2X0.5 | 40,2 | 2,4 | 2,9 | 46,0 |

| KMBlG-4 | 28,2 28,2 | 1,37 | 31,0 | — | 2,0 | 35,0 | 2X0.5 | 37 | — | — | 37,0 |

| KMABpShp-4 | 1,4 | 3U4 | 1,6 | 3,6 | 38,6 | 2×0,5 | 40,6 | 2,4 | 2,9 | 46,4 | |

| KMABp-4 | 28,2 | 1,4 | 31,4 | 1,6 | 3,6 | 38,6 | 2×0,5 | 40,6 | — | 2,2 | 45,0 |

| KMABpG-4 | 28,2 | 1,4 | 31,4 | 1,6 | 3,6 | 38,6 | 2X0.5 | 40,6 | — | — | 40,6 |

| KMAKpShp-4 | 28,2 | 1,4 | 31,4 | 1,6 | 3,6 | 38,6 | 4 | 46,6 | 2,4 | 2,9 | 52,4 |

| KMK-4 | 28,2 | 1,65 | 33,0 | — | 2,0 | 37,0 | 4 | 45,0 | — | 2,0 | 49,0 |

| KMKl-4 | 28,2 | 1,65 | 33,0 | — | 2,5 | 38,0 | 4 | 46,0 | — | 2,0 | 50,0 |

| KMKpShp-4 | 28,2 | 1,65 | 33,0 | 1,4 | 2,6 | 38,2 | 4 | 46,2 | 1,8 | 1,9 | 50,0 |

| KMEB-4 | 28,2 | aluminum 1.3 | 34,2 | 2,0 | 38,2 | 2×0,5 | 40,2 | — | 2,2 | 44,6 | |

| KMEBl-4 KMEBp-4 | 28,2 | lead 1.49 Same | 34,2 | 1,6 | 3,6 2,0 | 41,4 | 2x0.5 | 43,4 | — | 2,2 | 47,8 |

| KMEBShp-4 | 28,2 | « | 34,2 | — | 38,2 | 2X0.5 | 40,2 | 2,4 | 2,9 | 46,0 | |

| KMEKpShp-4 | 28,2 | « | 34,2 | 1,6 | 3,6 | 41,4 | 2X0.5 | 43,4 | 2,4 | 2,9 | 49,2 |

| KMEBpShp-4 | 28,2 | « | 34,2 | 1,4 | 2,6 | 39,4 | 4 | 47,4 | 1,8 | 1.9 | 51,2 |

| KMEC-4 | 28,2 | « | 34,2 | — | 2,0 | 38,4 | 4 | 46,4 | — | 1,9 | 50,2 |

| KMBlG-4 | 28,2 | 1,37 | 31,0 | 1 | 2,5 | 36,0 | 2X0.5 | 38,0 | 38,0 | ||

Notes: 1. For cables of all brands of type KM-4-60 with pairs 2.64/9.5 mm, the thickness of metal sheaths, polyethylene hoses, steel tapes and insulating coatings (cable paper, cable yarn, bitumen compound) is the same as and for cables of the corresponding brands, type KM-4 with pairs of 2.58/9.4 mm.

2. The diameters of cables of all brands of type KM-4-60 for belt insulation, cushion, armor, outer cover and overall diameter by 3. . . 4% more cables type KM-4 of the corresponding brands

Weight of materials, kg/mm, coaxial cables of types KM-4 and KM-4-60 Table 4.7

| Cable brand | Lead | Aluminum | Copper | Steel | Polyethylene | Bonded paper | cable paper | cable yarn | Bitumen (semi-tar) | Total cable weight | ||

| screen | armor | isolation | hose | |||||||||

| KMG-4 | 1851 | 592 | 223 | 18 | 100 | 2784 | ||||||

| KMG-4-60 | 1919 | — | 694 | 228 | — | 75 | — | — | 77 | — | 2903 | |

| KMGShp-4 | 1523 | — | 592 | 223 | — | 18 | 162 | — | 94 | — | 50 | 2668 |

| KMGShp-4-60 | 1579 | — | 604 | 228 | — | 72 | 169 | — | 67 | — | 52 | 2783 |

| KMASHp-4 | — | 392 | 592 | 223 | — | 18 | 163 | — | 94 | — | 51 adhesives | 1533 |

| KM1AShp-4-60 | — | 406 | 604 | 228 | — | 72 | 169 | —· | 77 | — | 51 adhesives | 1607 |

| KMB-4 | 1523 | — | 592 | 223 | 644 | 18 | — | 66 | 94 | 138 | 198 (69) | 3606 |

| KMB-4-60 | 1579 | — | 604 | 228 | 666 | 72 | — | 68 | 77 | 142 | 202 (71) | 3750 |

| KMBl-4 | 1523 | — | 592 | 223 | 644 | 27 | — | 66 | 94 | 138 | 198 (69) | 3615 |

| KMBl-4-60 | 1579 | — | 604 | 228 | 666 | 81 | — | 68 | 77 | 142 | 202 (71) | 3759 |

| K]MBShp-4 | 1523 | — | 592 | 223 | 644 | 18 | 268 | 100 | 94 | _ | 169 | 3633 |

| KMBShp-4-60 | 1579 | — | 604 | 228 | 664 | 72 | 275 | 103 | 77 | — | 170 | 3774 |

| KMBp-4 | 1523 | — | 592 | 223 | 701 | 18 | 162 | BUT | 94 | 146 | 214 (64) | 3898 |

| KMBp-4-60 | 1579 | — | 604 | 228 | 721 | 72 | 167 | 113 | 77 | 150 | 218 (65) | 4046 |

| KMBpShp-4 | 1523 | — | 592 | 223 | 701 | 18 | 495 | 110 | 94 | — | 179 | 3937 |

| KMBpShp-4-60 | 1579 | — | 604 | 228 | 721 | 72 | 508 | 113 | 77 | ___ ___ | 182 | 4086 |

| KMBG-4 | 1523 | — | 562 | 223 | 644 | 18 | — | 66 | 94 | — | 167 | 3329 |

| KMBG-4-60 | 1579 | — | 604 | 228 | 666 | 72 | — | 68 | 77 | — | 169 | 3465 |

| K|MABpShp-4 | — | 392 | 592 | 223 | 708 | 18 | 499 | 111 | 94 | — | 178 adhesive composition | 2815 |

| KMABpShp-4-60 | 406 | 604 | 228 | 728 | 72 | 513 | 114 | 77 | 181 adhesives | 2923 | ||

| KMABp-4 | — | 392 | 592 | 223 | 708 |

| KMABp-4-60 | — | 406 | 604 | 228 | 728 |

| KMABpG-4 | — | 392 | 592 | 223 | 708 |

| KMABpG-4-60 | — | 406 | 604 | 228 | 728 |

| KMAKpShp-4 | _ | 392 | 592 | 223 | 3464 |

| KMAKpShp-4-60 | — | 496 | 604 | 228 | 3566 |

| ΚΜιΚ-4 | 1851 | — | 592 | 223 | 3260 |

| KMK-4-60 | 1920 | — | 604 | 228 | 3362 |

| KMKl-4 | 1851 | — | 592 | 223 | 3462 |

| KMKl-4-60 | 1920 | — | 604 | 228 | 3566 |

| KMKttShp-4 | 1851 | — | 592 | 223 | 3362 |

| KMKiShp-4-60 | 1919 | — | 604 | 228 | 3464 |

| KMEB-4 | 1918 | 363 | 592 | 223 | 701 |

| KMEBL-4 | 1918 | 363 | 592 | 223 | 758 |

| KMEBp-4 | 1918 | 363 | 592 | 223 | 758 |

| KMEBShp-4 | 1918 | 363 | 592 | 223 | 701 |

| KM0BpShp-4 | 1918 | 363 | 592 | 223 | 758 |

| |KMEKpShp-4 | 1918 | 363 | 592 | 223 | 3464 |

| KMEC-4 | 1918 | 363 | 592 | 223 | 3362 |

| KMBlG-4 | 1523 | 592 | 223 | 644 |

| 18 | 163 | Ill | 94 | 147 | (65) 213 adhesive composition | 2776 |

| 72 | 169 | 114 | 77 | 151 | 216 (66) adhesive composition | 2882 |

| 18 | 163 | 111 | 94 | — | 174 adhesive composition | 2415 |

| 72 | 169 | 114 | 77 | — | 174 adhesive composition | 2512 |

| 18 | 521 | 88 | 94 | — | 122 (86) | 5600 |

| 72 | 534 | 90 | 77 | — | 126 (87) | 5790 |

| 18 | — | 85 | 94 | 126 | 120 (87) | 6500 |

| 72 | — | 88 | 77 | 128 | 1122 (82) | 6700 |

| 28 | — | 86 | 94 | 130 | 150 (116) | 6780 |

| 84 | — | 89 | 77 | 132 | 153 (117) | 7020 |

| 18 | 418 | 114 | 94 | — | 135 (73) | 6880 |

| 72 | 428 | 118 | 77 | — | 139 (75) | 7124 |

| 18 | 73 | 94 | 149 | 216 (68) adhesive composition | 4465 | |

| 28 | 73 | 94 | 149 | 215 (68) adhesive composition | 4475 | |

| 18 | 177 | 119 | 94 | 160 | 230 (72) adhesive composition | 4780 |

| 18 | 333 | 111 | 94 | — | 186 adhesive composition | 4539 |

| 18 | 534 | 119 | 94 | — | 197 adhesive composition | 4816 |

| 18 | 428 | 120 | 94 | — | 139 (75) | 7434 |

| 18 | —. | 73 | 94 | 128 | 122 (83) | 7020 |

| 27 | 66 | 94 | 167 | 3338 |

Rice. 4.3. Coaxial trunk cables in an aluminum sheath, type KMA-4: 1 - core; 2 - waist insulation; 3 - aluminum shell; 4 — adhesive composition; 5 — plastic tape; 6 - polyethylene hose; 7 - crepe paper; 8, 10 - bituminous composition or bitumen; 9 — armor made of steel tapes; 10 - impregnated cable yarn; 12 — anti-stick coating; 13 - adhesive composition or bitumen; 14 — plastic tape; 15 — polyethylene hose; 16 - armor made of galvanized steel round wires. Coloring of symmetrical fours: 1 - yellow; 2 - red; 3 - green; 4 - white; 5 - brown

Rice. 4.4. Coaxial trunk cables in a double sheath (aluminum-lead) type KME-4: 1 - armored wire; 2 - outer cover; 3 - pillow; 4 - polyethylene hose; 5 — two armored belts; 6 - aluminum shell; 7 - lead sheath; 8 - pillow

Brands and preferred areas of application of cables type MKT-4 and MKTA-4 Table 4.8

| Cable brands | Type of shell and protective cover | Preferred area of application |

| MKTS-4 | Lead sheathed cables without protective cover | For installation in cable ducts |

| MKTS-B | Lead-sheathed cables with protective cover type B | For laying in the ground |

| MKTSBG-4 | The same, with a protective cover type BG | For installation in collectors, shafts, tunnels, channels, fire hazardous areas, in conditions characterized by increased electromagnetic influence |

| M.KTSBL-4 | The same, with a protective cover type Bl | For laying in the ground and soils that are aggressive towards the lead sheath |

| MKTSK-4 | The same, with a protective cover type k | For river crossings |

| MKTOcl-4 | The same, with a protective cover type Kl | The same, in the soils of the bottom of a river, lake, aggressive towards the lead shell |

| MKTSB'p-4 | The same, with a protective cover type Bp | For laying in the ground and soils that are particularly aggressive towards the lead sheath |

| MKTSBpG-4 | The same, with a protective cover type BpG | The same as for the MKTSBG cable, but in conditions that are aggressive towards the lead sheath |

| MKTSShp-4 | The same, with a protective cover type Шп | For installation in sewers, pipes, blocks in the absence of mechanical stress on the cable and operation in an environment aggressive towards the lead sheath, as well as in areas not characterized by increased electromagnetic influence |

| MKTSShv-4 | The same, with a protective cover type Shv | For inputting MKTSB-4 cables into amplification points |

| MKTASHp-4 | Cables in an aluminum sheath with a protective cover type Shp | For installation in cable ducts, pipes, blocks, along bridges in the absence of mechanical stress on the cable, in stable soils of groups I-III without rocky inclusions and floating objects, if the cable is not subjected to large tensile forces and in areas not characterized by increased electromagnetic influence |

| MK'TABp-4 | The same, with a protective cover type Bp | The same as for cable brand MKTOBp-4 |

| MKTABpShp4 | The same, with a protective cover type BpShp | The same as for MKTSBp cable, but in soils that are aggressive to steel armor |

- Back

- Forward

Common mistakes when filling out

Newbie cashiers sometimes make the ridiculous mistake of entering their own TIN instead of the company’s TIN. Of course this is wrong. The identification number must always belong to the company.

Columns 5 and 6 of the main table should not be confused. Column 5 contains the GROSS TOTAL of the X-report, and column 6 - the GROSS TOTAL of the Z-report. It can't be the other way around. This mistake is often made due to inattention.

Other errors are due to inattention when entering numerical values. For example, you can confuse the date or make a mistake when entering the amount. Such errors are unacceptable, so the cashier should check everything properly.

Important! If there are typos in the KM-6 form itself, then no one will punish the cashier for them. A fine can only be issued for errors in the information that the cashier-operator personally entered.

Important points

If the cash register operator's journal is lost, a specialist from the cash register technical service center is called, he takes down a fiscal report (or a report from the EKLZ unit, if the company has a modern cash register with the letter “K”) from the cash register for the entire period from which the journal was lost.

But it would be better to check the dates with the tax inspector; the procedure for restoring the cashier-operator’s journal is not recorded anywhere, each department may present its own requirements.

Then a free form application is written to the tax office about the loss of the cashier-operator’s journal, a power of attorney is issued with a seal for the registration of the cashier-operator’s journal (for the organization), a new journal is purchased and with the fiscal report removed (or with a report from the EKLZ unit).

Then you should contact the Federal Tax Service again (the date the fiscal report was taken), where, based on the documents submitted, they will issue a new cashier-operator journal.

Features of filling out the “zeroing” act

Act KM-1 was drawn up in the form of a bilateral document, for the completion of which a special commission was created. Its composition necessarily included an employee of the Federal Tax Service. The completed act was also signed by the manager, chief accountant and cashiers of the business entity using the cash register.

In the header of the form, when filling out the column with the KKM registration number, the serial number under which the car was registered with the tax office was indicated.

To learn how new-style cash registers are registered, read the article “What documents are needed to register an online cash register?”

Let's summarize

- Until July 1, 2021, when working with cash registers, 9 unified documents were mandatory: KM-1 - KM-9. After the introduction of online cash registers, they are no longer needed, because the cash register system sends this data to the Federal Tax Service automatically via the Internet.

- The following are required for registration: cash book, incoming and outgoing cash order.

- Individual entrepreneurs keep a cash book at will, as well as a journal for the cashier-operator. These documents are useful for internal accounting.

- For companies, maintaining a cash book is mandatory, but the cashier-operator's journal is optional.

- Registration of cash receipts or expenditures without orders is prohibited.

Sources

- https://Online-kassa.ru/blog/zhurnal-kassira-operatsionista-i-drugie-dokumenty-pri-onlajn-kasse/

- https://nalog-spravka.ru/spravka-otchyot-kassira-operacionista-km-6.html

- https://nalog.wiki/spravka-otchet-kassira-operacionista/

- https://praktibuh.ru/buhuchet/denezhnye-sredstva/nalichnye/dok/spravka-otchet-kassira-operatsionista-km-6.html

- https://assistentus.ru/forma/km-6-spravka-kassira-operacionista/

- https://blanki.biz/kkt/km-6/