Computers become obsolete faster morally than physically. Often the PC does not have any breakdowns and works properly, but some programs or equipment cannot function on it. In this case, it is possible to modernize (upgrade) the computer. In this article we will talk about upgrading a computer/laptop and accounting entries when it is carried out.

Also see:

- Sample act for writing off computer equipment

- What could be the reasons for writing off a computer?

Concept, classification and valuation of fixed assets

Computer technology includes analog and analog-digital machines for automatic data processing, computing electronic, electromechanical and mechanical complexes and machines, devices designed to automate the processes of storing, retrieving and processing data related to solving various problems.

Office equipment includes duplicating and copying equipment, office automatic telephone exchanges, typewriters, calculators and other equipment.

5) Vehicles, which include: vehicles designed to move people and goods - railway and rolling stock; rolling stock of water transport, road, air, urban transport; floor-mounted production vehicles, as well as other types of vehicles.

At the same time, automobile and tractor trailers, specialized and converted railway cars, the main purpose of which is to perform production or household functions, and not to transport goods and people (mobile power plants, mobile transformer installations, mobile workshops, laboratory cars, mobile diagnostic installations, carriage houses, etc.) are considered mobile enterprises

appropriate purpose, and not vehicles, and are accounted for as building and equipment.

6) Industrial and household inventory, which includes:

-production equipment - technical items that are involved in the production process, but cannot be classified as equipment or structures (containers for storing liquids, devices and containers for bulk, piece materials, not related to structures, devices and furniture, employees to facilitate production operations (tables, counters, racks, etc.);

-household equipment - office and household items that are not directly involved in the production process.

7) Working, productive and breeding livestock (except for young animals and cattle for slaughter), which include: horses, oxen, camels, donkeys, cows, sheep, stallions - producers, bulls - producers and other working, productive and breeding livestock.

Perennial plantings, which include all types of artificial perennial plantings, regardless of their age, landscaping and decorative plantings on streets, squares, parks, gardens, squares, on the territory of enterprises, in the courtyards of residential buildings; hedges, shelterbelts, plantings intended to strengthen sand and river banks, etc.

Perennial plantings, which include all types of artificial perennial plantings, regardless of their age, landscaping and decorative plantings on streets, squares, parks, gardens, squares, on the territory of enterprises, in the courtyards of residential buildings; hedges, shelterbelts, plantings intended to strengthen sand and river banks, etc.

Which entry should be used to reflect in accounting the work related to computer modernization?

The first thing you need to pay attention to is that work on routine computer repairs is written off as expenses for the current period and does not in any way affect its initial cost. Carrying out modernization work helps to increase the initial cost of this asset.

Note! The assessment of modernization costs in tax accounting may differ from accounting data.

The presence of this “gap” is associated with different rules for forming the initial cost. For example, in accounting, the initial cost is formed taking into account the amount differences, and in tax accounting they are included in non-operating income and expenses.

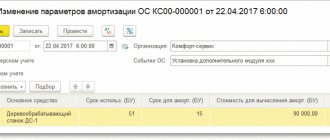

When carrying out modernization work on computer equipment, you can also increase its useful life. This condition is not mandatory.

Computer accounting and tax accounting

P.; artificial plantings of botanical gardens, scientific research institutions and educational institutions for scientific research purposes.

9) Other fixed assets.

Depending on their purpose in production and economic activity, fixed assets are divided into production and non-production.

The main means of production include: machines, machine tools, apparatus, tools, as well as buildings of main and auxiliary workshops, services intended for the production process, warehouse buildings, tanks, vehicles used for moving and storing objects and products of labor. Non-production fixed assets are not directly involved in the production process, but they are used for the cultural and everyday needs of enterprise employees (fixed assets for housing and communal services, clinics, clubs, kindergartens, etc.).

Go to page: 12

345

- Add your publication

registration is required for this

The solution "Odineskin: Equipment Accounting 2.0" allows you to automate the accounting of equipment, computers, office equipment and any other material assets in the enterprise.

The configuration allows:

- Organize a reporting system at the enterprise and accounting for materials.

- Keep records of computers, any equipment, furniture, software using barcoding technology. Including using data collection programs.

- Keep records of user requests and receive reports on completed requests, their completion time, etc.

Allows you to maintain simplified document flow in the enterprise, take into account user requests, and control tasks for employees.

- Keep records of requests to equipment suppliers

Ability to track the execution of requests. Built-in email client allows you to send requests directly from 1C.

- Receive reporting in quantitative and total terms

Obtaining balances and turnover from any selections and groupings of data. A large number of printed forms for documents and directory elements.

- Ability to track equipment under repair

Ability to track repair time. Repair providers: warranty, internal repairs, etc.

- Carry out automatic inventory at the enterprise

Automatic import of data from Everest and Aida software. Automatic distribution of inventory lists to accountable persons.

- Label printing.

Accounting press and publications

"Financial newspaper. Regional issue", 2006, N 7

REPLACING THE MONITOR WHEN COMPUTER REPAIR:

ACCOUNTING AND TAX ACCOUNTING

(End. See “Financial newspaper” for the beginning. Regional issue, 2006, No. 6)

The position of the official bodies on this matter consistently boils down to the following: “A computer is accounted for as a single inventory item of fixed assets, since any part of it cannot perform its functions separately” (Letter of the Ministry of Taxes and Taxes of Russia dated 05.08.2004 N 02-5-11/ [ email protected] , Letters of the Ministry of Finance of Russia dated 05/27/2005 N 03-03-01-04/4/67, dated 04/01/2005 N 03-03-01-04/2/54, dated 03/30/2005 N 03-03- 01-04/1/140, dated 06/22/2004 N 03-02-04/5).

In our opinion, this position does not comply with legal norms and is based on the initial decisions of law enforcement practice, in which the new norms were not sufficiently studied, and payers carelessly fulfilled the requirements for documenting accounting transactions.

However, in the Letter of the Ministry of Finance of Russia dated May 27, 2005 N 03-03-01-04/4/67, there are also useful conclusions that you can agree with and use in your work:

“Replacing any part in a computer may change the performance characteristics of the computer. Obsolescence of a computer as an object of fixed assets occurs several times faster than physical wear and tear. When distinguishing between modernization and repair of a computer, the decisive factor is not how its operational characteristics have changed, but the fact that the operability of the inventory object remains intact, without changing the performance of its functions as a whole.

...the costs of replacing failed elements of computer equipment are included in the costs of repairing fixed assets, taken into account in the manner established by Art. 260 of the Code."

Based on the norms of paragraph 2 of Art. 257 of the Tax Code of the Russian Federation and the conclusions from the above Letter, it is impossible to recognize the replacement of a monitor due to a breakdown by upgrading a computer and increasing its initial cost, since the initial cost of fixed assets changes in cases of completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation of relevant facilities and other similar reasons. Work on completion, additional equipment, and modernization includes work caused by a change in the technological or service purpose of equipment, a building, structure or other object of depreciable fixed assets, increased loads and (or) other new qualities.

Thus, a replacement due to the breakdown of computer parts must be recognized as a repair (Articles 260, 324 of the Tax Code of the Russian Federation), and the organization must correctly draw up the documents.

Let’s look at specific examples to see if it’s profitable to immediately write off a new monitor that costs more than 10,000 rubles.

If at the time of repair the computer is listed at zero cost and was not initially recognized as depreciable, then there are two options for reflecting this operation in accounting in connection with replacing a monitor costing more than 10,000 rubles. At the same time, tax accounting for repairs of property that is not recognized as depreciable does not provide for any possible optimization options.

Example 1. An organization received a complete used computer worth 6,500 rubles. and upon commissioning was completely written off as costs. In accounting, it is registered with the accounting department. Six months later, the monitor failed and a new one was purchased at a cost of 13,500 rubles. in view of VAT. Is it possible to write off a new monitor right away? How to properly capitalize it?

Solution. The cost of this computer in accounting is zero, since it was written off at the time of capitalization, and therefore cannot be changed, although its service life has not yet expired. To complete the repair procedure (write-off from the control of the financially responsible person) of a part previously included in the initially formed cost of the computer, the fact of breakdown and the need for replacement is confirmed by a defective certificate of the reasons for the disposal (breakdown) of the monitor that was part of the computer listed at zero cost with the assigned inventory number.

In tax accounting, the cost of the monitor is 11,441 rubles. should be classified as depreciable property (clause 1 of Article 256 of the Tax Code of the Russian Federation), the period of its use can be established as part of the third group of the Classification of fixed assets. According to the decision of the manager, this can be a period from 36 to 60 months, based on which the amount of depreciation according to the monitor should be included in the reduction of the tax base for income tax. For example, with 36 months in tax accounting, 1/36th part will be written off monthly - 318 rubles.

There are two possible solutions in accounting.

Option 1. The new monitor is capitalized as an independent fixed asset object and assigned an inventory number. The period of use is 36 months, as in tax accounting. The following entries are made in accounting:

——————————————————————————————————————T——————T——— ———T———————————¬ | Contents of operations | Debit|Credit|Amount, rub.| +——————————————————————————————————————+——————+——— ———+———————————+ |Purchased the monitor as an object | 08 | 60 | 11 441 | | fixed asset | | | | +——————————————————————————————————————+——————+——— ———+———————————+ |VAT reflected on the purchased monitor| 19 | 60 | 2,059 | +——————————————————————————————————————+——————+——— ———+———————————+ |The monitor was put into operation as | 01 | 08 | 11 441 | |object of fixed asset | | | | +——————————————————————————————————————+——————+——— ———+———————————+ |Depreciation accrued over time | 26 | 02 | 318 | |use (monthly) | | | | L——————————————————————————————————————+——————+——— ———+————————————

Option 2. The monitor is registered (regardless of its cost) as a component for computer repair.

In accounting, costs for the repair of fixed assets are included in expenses for ordinary activities (clause 7 of PBU 10/99), repair costs in this case are written off to account 26, since the computer is listed in the accounting department.

According to PBU 18/02, expenses recognized in accounting in one reporting period, and in tax accounting in subsequent reporting periods, are deductible temporary differences that lead to the formation of a deferred tax asset (clauses 8, 11, 14 PBU 18/ 02). Deductible temporary differences in the amount of RUB 11,441 arose in accounting. and a deferred tax asset in the amount of RUB 2,745. (RUB 11,441 x 24%). The reduction of this difference will be carried out within 36 months until full repayment. The monthly reduction amount is 318 rubles. (RUB 11,441: 36 months). The following entries are made in accounting:

——————————————————————————————————————T——————T——— ———T———————————¬ | Contents of operations | Debit|Credit|Amount, rub.| +——————————————————————————————————————+——————+——— ———+———————————+ |Purchased the monitor as a component | 10—5 | 60 | 11 441 | |computer repair part | | | | +——————————————————————————————————————+——————+——— ———+———————————+ |VAT reflected on the purchased monitor| 19 | 60 | 2,059 | +——————————————————————————————————————+——————+——— ———+———————————+ |Repair cost written off | 26 | 10—5 | 11 441 | |(at one time) | | | | +——————————————————————————————————————+——————+——— ———+———————————+ |Deferred tax asset reflected | 09 | 68 | 2,745 | +——————————————————————————————————————+——————+——— ———+———————————+ |Decreased deferred tax asset | 68 | 09 | 76.32| |(monthly) | | | | L——————————————————————————————————————+——————+——— ———+————————————

Thus, the organization does not have the benefit of reducing the tax base for income tax, however, with option 1, the benefit is obvious in reducing the labor intensity of accounting work, when there is no need to apply PBU 18/02. Therefore, option 1 should be considered the most optimal.

If at the time of repair the computer is listed at its residual value and is initially recognized as depreciable, then there are two possible options for reflecting in accounting and tax accounting the computer repair performed in connection with the replacement of a monitor costing more than 10,000 rubles. depending on the initial registration - as a single inventory object or in parts, as different accounting objects. In this case, it is possible to avoid the use of PBU 18/02, since no accounting differences arise.

Example 2. In May 2002, a computer was purchased, which was initially capitalized as a single inventory item. It included (data excluding VAT):

processor (system unit) 10,000

monitor 5 000

keyboard 200

mouse 50

—————— 15 250

It was put into operation as a single object for which depreciation was calculated. The useful life is 60 months. In December 2005, the old monitor broke down (there is a defect report) and a new one was purchased for 12,000 rubles. How to record the purchase of a new monitor?

Solution. When reflecting repairs, the original cost of the computer does not change. In accounting and tax accounting, you can reflect a 100% one-time write-off of the new monitor.

In tax accounting, repair costs are recognized in accordance with Art. Art. 260, 324 of the Tax Code of the Russian Federation, regardless of its cost, despite the fact that the cost of the replaced part exceeds 10,000 rubles.

The following entries are made in accounting:

——————————————————————————————————————T——————T——— ———T———————————¬ | Contents of operations | Debit|Credit|Amount, rub.| +——————————————————————————————————————+——————+——— ———+———————————+ |From June 2002 to May 2007 | | | | | Depreciation has been calculated on the computer | 26 | 02 | 254 | |(monthly for 60 months) | | | | +——————————————————————————————————————+——————+——— ———+———————————+ |December 2005 | | | | |Purchased a monitor as a component | 10—5 | 60 | 10 170 | |computer repair part | | | | +——————————————————————————————————————+——————+——— ———+———————————+ |VAT reflected on the purchased monitor| 19 | 60 | 1,830 | +——————————————————————————————————————+——————+——— ———+———————————+ |Repair cost written off | 26 | 10—5 | 10 170 | |(at one time) | | | | L——————————————————————————————————————+——————+——— ———+————————————

From this example it is clear that writing off the cost of the monitor as an expense allows you to reduce the tax base for income tax.

Example 3. In May 2002, a computer was purchased, which was initially capitalized in parts as different accounting objects. It included (data excluding VAT):

processor 10,000

monitor 5 000

keyboard 200

mouse 50

—————— 15 250

It was simultaneously put into operation in parts, with the monitor, keyboard and mouse as objects costing less than 10,000 rubles. were written off immediately, and the period of use was set only for the processor with the assignment of a separate inventory number (60 months - 5 years, the maximum possible both in accounting and tax accounting). In December 2005, the old monitor broke down (there is a defect report) and the monitor was purchased for 12,000 rubles. in view of VAT. Its useful life is set at 37 months in accounting and tax accounting. How to reflect the purchase of a new monitor?

Solution. In May 2002, according to the Classification of Fixed Assets, the processor was classified in the third group under code 14 3020000 with a useful life of 5 years.

The number of months of operation of the processor as part of an operating computer until the monitor fails is June 2002 to December 2005, i.e. 43 months. The remaining useful life of the processor is 17 months.

In accounting and tax accounting, depreciation continues to accrue for the processor, and the monitor is accounted for as a separate inventory item of a fixed asset and as part of depreciable property, also with depreciation accrual.

About changes made to PBU 6/01

The changes introduced by Order of the Ministry of Finance of Russia dated December 12, 2005 N 147n and which came into force starting from the financial statements of 2006, only confirm the conclusions that we came to in our examples.

Thus, the limit on the value of a fixed asset has been increased to 20,000 rubles. (clause 5 of PBU 6/01). An organization may establish an increased limit in its accounting policies starting from 2006. However, given the discrepancy between the limit in tax accounting for classifying objects as depreciable property, it is better not to increase it, since when reflecting fixed assets in accounting as part of inventories, differences will inevitably arise, which will lead to the application of PBU 18/02. At the same time, the tax base for income tax will not decrease.

According to clause 6 of PBU 6/01, the condition for a significant difference in the useful life of a new independently accounted fixed asset item has been changed. The level of materiality, as a general rule, in accounting is 5% of the original position, therefore, when drawing up orders to establish the terms of use of individual objects, this should be taken into account in relation to the number of months of use of the computer.

In paragraph 29 of PBU 6/01, a useful, in our opinion, change was also made. The previous rather pretentious formulation recognized the disposal of fixed assets in the form of write-off in the event of moral and physical depreciation - this meant that in order to be reflected in accounting, the fact of both moral and physical depreciation was necessary. Now disposal takes place in the event of termination of use due to moral or physical wear and tear - this is very important, i.e. To reflect disposal, it is enough to document either moral or physical wear and tear.

When using examples in work in connection with the acceptance of property for accounting after January 1, 2006, the above should be applied taking into account the amendments made to PBU 6/01.

I.Zhadan

Auditor

Signed for seal

15.02.2006

—————————————————————————————————————————————————————————————————— ———————————————————— ——

ACCOUNTING and POSTING purchase of a laptop over 40,000-100,000 rubles.

Label templates are "drawn" in custom mode

Work with any printers installed in the system is supported. The user can independently edit and create an unlimited number of labels.

- Using thin and web clients

This feature is very useful for geographically distributed companies. It is enough to have a centralized server with a database and access to it from the Internet, after which you can connect to the database from anywhere in the world using a standard web browser. Access is also possible through a “thin client”, which is faster than a web client or terminal.

- Synchronization with standard 1C configurations

Using the standard “Universal Data Exchange” processing, we transfer departments and employees to the “Equipment Accounting 2.0” configuration.

Allows you to design the composition of equipment at future workplaces, thereby simplifying further accounting.

- Printable form layouts editable in user mode.

Any layout supplied by the configuration can be edited by the user: pictures, comments, footnotes can be added.

- Built-in scheme for working with the program

A visual scheme of work allows you to quickly master all the mechanisms of working with the program.

- Accounting for consumables

Dedicated subsystem for accounting costs for cartridges (toners, photo drums, magnetic rollers, etc.) and other consumables (paper, thermal film, office supplies, etc.)

- A set of functions for the system administrator

Ability to use operating system commands - ping, rdp (remote desktop), as well as working with the radmin system.

- File storage subsystem

The configuration allows you to store files, with or without reference to database objects, with the ability to view and edit.

previous()all

≡ to the list of articles

Issue No. 3. Registers in 1C

The word “registers” is unclear to users, and sometimes even to novice programmers. We will try to reveal it in this article. Let's consider the design of accumulation registers.

Household modernization way

When a computer or laptop stops performing its tasks or starts to slow down, there are three options:

- Replacing an old computer with a new one.

- Come to terms with slow-operating technology.

- PC modernization (upgrade).

In the first case, you will be faced with a write-off of your computer.

You can read how to do this correctly in our article “How to properly write off computer equipment.”

No matter how expensive a computer is, sooner or later its performance will begin to decline. If possible, full-time IT specialists try to replace old hardware with new ones and start first of all with the processor.

The economic method differs from the contracting method in that in the economic method, the work is performed by company employees. When contracting, a third-party contractor.

When IT specialists bought a new processor, credit it to account 10:

- Debit 10 Credit 71, 60, 76 – the cost of the processor is reflected;

- Debit 19 Credit 60, 76 – the amount of VAT (if any) is reflected.

When installing a processor or other part in a PC, entries are made in account 08:

Debit 08 – Credit 10

And when checking the advanced computer in operation and handing it over to an employee, the following wiring is done:

Debit 01 Credit 08 - the initial cost of the company increases by the costs of its modernization.

Transfer of equipment for installation

The next stage is installation or assembly of equipment. Naturally, we will collect them from the material assets received from the supplier, which are already on account 07.

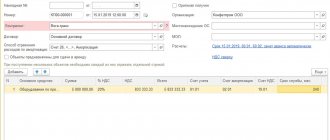

The 1C document that will help us assemble is called “Transfer of equipment for installation”; in the interface it is located on the “OS and Intangible Materials” tab. Let's create a new document:

The construction object, in this case, is just a new OS made from components. In the “Equipment” tabular section, you need to indicate the quantities of the item and the accounting account - 07.

In wiring, the 1C 8.3 system will generate wiring 08.03-07, that is, the transfer of components for assembly:

If you plan to involve a third-party service provider in the assembly of components, this operation can also be reflected on account 08.03, using the document “Receipt of goods and services”, where the value of the subconto will be our new computer.

Postings for upgrading a computer

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| Routine computer repair (in-house) | ||||

| 23 | 70 | 45 000,00 | Salary was accrued to the system administrator who carried out routine computer repairs | Payroll |

| 23 | 69 | 13 500,00 | Insurance premiums for the salary of the system administrator have been calculated | Payroll |

| 23 | 10-01 | 7 800,00 | Spare parts necessary for computer repair have been written off. | Invoice |

| Routine computer repair (involvement of outside organizations) | ||||

| 23 | 60.1 | 12 711,86 | Computer repair service provided (excluding VAT) | Certificate of completion |

| 19 | 60.1 | 2 288,14 | VAT allocated for computer repair services | Invoice |

| 60.1 | 51 | 15 000,00 | Payment for services of a repair organization 12711.86 + 2288.14 = 15000.00 rubles. | Payment order |

| Upgrading your computer | ||||

| 02-01 | 01.09 | 20 000,00 | The share of depreciation charges is written off | Depreciation sheet, accounting certificate |

| 91-02 | 01.09 | 7 200,00 | The residual value of retiring parts has been written off | Write-off act, accounting certificate |

| 91.02 | 23 | 1 500,00 | Costs associated with equipment dismantling are written off | Accounting information |

| 60.01 | 51 | 12 980,00 | Purchased components necessary to upgrade the computer | Payment order |

| 10.01,10.05,10.06 | 60-01 | 11 000,00 | The materials necessary for the modernization of this fixed asset have been capitalized (the cost is indicated without VAT) 12980.00 - 18% VAT (RUB 1980.00) = RUB 11000.00. | Invoice |

| 19 | 60.01 | 1 980,00 | VAT is charged on the amount of spare parts received | Invoice |

| 08.03 | 10.01,10.05,10.06 | 11 000,00 | The materials necessary for upgrading the computer have been written off | Invoice, accounting certificate |

| 08.03 | 23 | 7 500,00 | The production costs that occurred during the modernization of this asset were written off | Accounting information |

| 01 | 08.03 | 18 500,00 | The initial cost of the computer was increased by the cost of the modernization: RUB 11,000.00 + 7,500.00 = RUB 18,500.00. | Accounting information |

Acceptance for accounting of fixed assets assembled from components in 1C 8.3

Let's do this using the document “Acceptance for accounting of fixed assets” (tab Fixed Assets and Intangible Assets):

On the first tab “Non-current asset” you need to indicate the type of operation “Construction object”, in the construction object field indicate our computer and click on the “Calculate amounts” button. If everything is done correctly, the cost of the OS should be filled in automatically.

We will write down the document, but we will not carry it out yet.

That’s all on this tab, let’s go to the “Fixed Assets” tab:

As you can see, the value is not filled in yet. To fill it out, you need to create a new directory element “Fixed Assets” (previously only the Construction Object was created):

Where we indicate its name and OS accounting group.

Let's return to the OS acceptance document and go to the "Accounting" tab:

Here you need to fill out the fixed assets accounting and depreciation accounts, the account for reflecting depreciation expenses, and the useful life of the collected fixed asset.

Similarly, fill out the “Tax Accounting” tab:

That's all. The OS from the components has been accepted for accounting. Depreciation will be taken into account monthly at the end of the month.

Let's look at the postings of this document:

We see wiring 01.01-08.03.

Based on materials from: programmist1s.ru

Computer repair: types and differences

One of the most important tasks of an accountant is the correct execution of accounting transactions related to the repair and modernization of computer equipment. Before you begin to display computer repair operations, you need to consider a number of factors:

- Type of repair: current or major (modernization);

- Repair work is carried out using the organization itself or through the services of specialized companies.

These points in accounting are very important, since the order in which these transactions are displayed in tax accounting and in accounting are radically different. A correctly set goal for repairs can help in resolving this issue:

- Elimination of problems that have arisen that make it difficult or even impossible to further operate this fixed asset;

- Improving the characteristics and changing the purpose of this fixed asset.

That is, if the inherent physical wear and tear of a part is a breakdown of a computer element, then this will be considered a routine computer repair. If a computer part changes due to obsolescence, then this will be its modernization.

The modernization of this non-current asset includes the following types of work:

- Increased the amount of RAM or hard drive;

- Replacing with a faster and more powerful processor;

- Replacing the motherboard and video card with a faster one;

- Replacing the monitor with a model that has a larger diagonal.