Journal-order form of accounting

The form of accounting in which all data on business transactions is taken into account and systematized in journals for recording business transactions is called journal-order.

The basic principles are:

- Entries are made exclusively on credit accounts, indicating correspondence on debit.

- Synthetic and analytical accounting records are combined in a single accounting system.

- Data is reflected in accounting documents in the context of indicators necessary for control and reporting.

- You can apply combined journals to related accounts.

- You can create them monthly.

It is not necessary to use this form of accounting. An organization can keep records using a memorial order form, which is based on drawing up memorial orders for each business transaction. This type has a number of disadvantages: a significant lag between analytical accounting and synthetic accounting, as well as increased labor intensity: you have to duplicate records several times.

Features of reflecting accounting entries

Each production action must be documented. Changes arising from the operation are of a dual nature and occur in two interrelated accounting objects. A characteristic feature of the operation is that it is shown on the accounts twice: in debit and credit. This relationship represents the correspondence of accounts.

Transactions are reflected on accounts at the time of their occurrence, i.e., as they are completed. Double entry reveals the opposite nature of the asset and liability accounts, linking them to the form of the balance sheet.

On the left they reflect the balances of the property (debit), on the right - the sources of its appearance (credit).

Correspondent accounts and balance form a single system, connected by double entry, which is based on three principles:

- Duality of reflection;

- Fixation of amounts for Dt and Ct accounts;

- In both accounts, changes are shown in the same amount.

For control, the registration of the action in accounting is repeated twice. First of all, it is reflected as a fait accompli confirmed by documents, then - by the distribution of amounts among correspondent accounts.

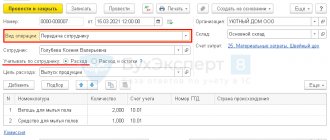

Example 2. Posting

Reasoning:

The changes affected two accounts: account. 10 — balances of inventory items and invoices increased. 60 - the debt to the supplier has increased.

Account 10 - active, takes into account assets, growth is put in Dt;

Account 60 - passive, height - according to Kt.

The increase in assets and liabilities corresponds to operations of the third type. The posting is written as follows: Dt 10 Kt 60.

Magazine forms

For public sector employees, the Ministry of Finance developed and recommended unified forms (Orders No. 123n dated September 23, 2005 and No. 25N dated February 10, 2006). But it is not necessary to use them (No. 402-FZ dated December 6, 2011). The organization has the right to independently develop and approve forms for accounting journals. But for this they should be approved by a separate order of the manager or in the form of an appendix to the accounting policy.

An example of filling out business transaction logs

See also current examples based on:

- primary cash documentation in the article “How to correctly fill out a cash book”;

- waybills in the article “How to correctly fill out the waybill logbook.”

Download

About the author of the article

Evdokimova Natalya

Accountant expert

Since 2021 - author and scientific editor of electronic journals on accounting and taxation. But until that time, she kept accounting and tax records in the public sector, including as the chief accountant.

Other articles by the author on gosuchetnik.ru

The article was prepared using materials from ConsultantPlus. Get access The article was prepared using materials from ConsultantPlus. Get access

List of current journals

State employees use these types.

| Magazine number | Type of operations |

| №1 | Cash desk and cash flow |

| №2 | Bank current accounts |

| №3 | Calculations with accountable persons |

| №4 | Settlements with suppliers and contractors |

| №5 | settlements with debtors on income |

| №6 | Calculations for wages, scholarships, allowances |

| №7 | Disposal and transfer of non-financial assets |

| №8 | Settlements for other transactions |

| №9 | Validation |

Non-profit organizations use others.

| Name of journal-order | Contents of operations |

| JO No. 1 | Cash flow at the institution's cash desk |

| JO No. 2 | Current accounts |

| JO No. 3 | Special bank accounts |

| JO No. 4 | Payments for loans and borrowings (short-term and long-term) |

| JO No. 6 | Settlements with suppliers and contractors |

| JO No. 7 | Calculations with accountable persons |

| JO No. 8 | Calculations for taxes and fees, intra-business transactions, calculations for advances |

| JO No. 10 | Primary production |

| ZhO No. 11 | Accounting for finished products (goods, works or services) |

| JO No. 12 | Accounting for target financing |

| ZhO No. 13 | Fixed assets and depreciation |

| JO No. 15 | Retained earnings (uncovered loss) |

| JO No. 16 | Investment in non-current assets |

Types of accounting transactions

Depending on the interaction of assets and sources, there are 4 types of operations.

- Active - affect the composition of funds, i.e., the balance sheet asset, without affecting the results. These include actions to use inventory items, liquidate accounts receivable, receive money from a bank account to the cash desk, issue money on account, etc.

The first type of change is reflected by the formula:

A + ΔI – ΔI = P, where

A - balance sheet asset;

P - passive;

ΔИ - change in property due to economic action.

- Passive operations affect the sources of formation of assets, i.e., the liability side of the balance sheet. The result is constant. Such operations include: deductions from earnings, the formation of reserves or the accrual of dividends from profits for distribution, replenishment of the authorized capital from additional funds, etc.

This type of operation can be reflected as follows:

A = P + ΔI – ΔI.

- Active-passive increasing - increase the asset, liability and currency by an identical amount. These include: repayment of debt on deposits in the authorized capital, accrual of depreciation of fixed assets, advances from buyers, receipt of borrowed funds, etc.

This type of operation looks like this:

A + ΔI = P + ΔI.

- Active-passive decreasing - reduce the asset, liability and balance sheet total by the same amount. This is the payment of earnings, payment of debts to creditors.

A – ΔI = P – ΔI.

Example 1. Type 4 operation

Based on bills and bank statements, 214 thousand rubles were transferred to the supplier. for the materials received. The result of the operation will be a change in two items: the asset account will decrease. 51 by 214 thousand rubles, in liabilities the account will decrease. 62 for 214 thousand rubles. The asset and liability totals changed by an equal amount. The balance identity is preserved.

Consideration of four types of business transactions led to the following conclusions:

- Each fact of activity is reflected in at least two balance sheet items;

- Changes to the asset (types 1, 2) do not change the currency of the document;

- Changes in assets and liabilities (types 3, 4) change the currency by the same amount;

- Any operations maintain equality of balance sheet totals.

Table. Examples of postings by type of operation.

| Content | Debit | deviation | Credit | deviation |

| Type 1. | ||||

| Raw materials transferred to production | 20 | + | 10 | — |

| Payment received from buyer | 51 | + | 60 | — |

| Received money in cash | 50 | + | 51 | — |

| Type 2. | ||||

| Personal income tax withheld from salary | 70 | — | 68 | + |

| The reserve is replenished from profits to be distributed | 84 | — | 82 | + |

| Advance paid to supplier using borrowed funds | 60 | — | 66 | + |

| Type 3. | ||||

| Received materials from supplier | 10 | + | 60 | + |

| Salary accrued | 20 | + | 70 | + |

| The loan amount has been credited to the account | 51 | + | 66 | + |

| Type 4. | ||||

| Loan repaid | 66 | — | 51 | — |

| Employees' salaries transferred | 70 | — | 51 | — |

| Payment has been made to the supplier for the goods | 51 | — | 60 | — |

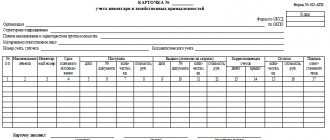

Features of the formation of accounting registers

Law No. 402-FZ establishes mandatory requirements for accounting documentation. Regardless of what type of form was chosen by the organization: unified or developed independently.

Mandatory register details:

- The name of the document and its form.

- Full name of the institution.

- Start date and end date of journal entries. The period for which it was formed.

- Type of grouping of accounting objects (chronological or systematic grouping).

- Indication of the unit of measurement of accounting objects, or the monetary value of the measurement.

- Indication of officials responsible for maintaining the register.

- Signatures of responsible persons.

Registration logs are compiled on paper or electronically. For the latter, you will need an electronic signature to certify the document. Without a signature (electronic or handwritten), the journal order is considered invalid.

Corrections are permitted. They can only be entered by the person responsible for maintaining the journal. Next to it, you should indicate the date and certify the correctional entry with a signature, with a description of the position and full name of the person responsible.

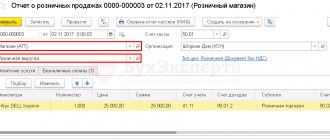

Trade management configuration

“My Business” automates commodity accounting.

You do not have to manually enter received and sold goods - just upload an invoice or invoice for the program to calculate the receipt and expense of inventory items. Using merchandise accounting, you can:

- Track accounts receivable and movements within a warehouse or between warehouses

- Control the balance of goods and receive information about those goods that are time to purchase

- Create price lists for clients and issue invoices using the prices specified in the price list

- Print price tags for your products

- Upload product images for easy navigation through the warehouse

- Send clients a list of products to order from you

- Receiving orders from customers

- Generating an order document for a supplier

- Assembling the buyer's order

- Creating a catalog of goods storage locations

- Working with commodity analytics (Stale goods, minimum balances of goods, minus balances of goods, formation of ABC analysis for goods)

All commodity accounting data is displayed in online accounting by default. There is no need to separately import information and transfer information from primary documents to reporting.

Open API and ready-made integrations with business services500 RUR/month500 RUR/monthFilling rules

Each magazine has its own filling requirements. Let's take a closer look at the basic filling rules.

Journal of registration of incoming and outgoing cash orders (JO No. 1)

We make entries based on the cashier’s report, confirmed by the relevant documents (RKO and PKO) at the end of the working day. If movements at the cash register are insignificant, it is allowed to make entries in the register 3-5 days in advance, according to several reports at the same time. Then in the “Date” field we indicate the period for which we are making records. For example, 3-6 or 20-23.

Magazine order 2

Entries are made on the basis of bank statements and other supporting documents (checks, personal account statements). It is allowed to make one entry on several bank statements. In this case, in the “date” field, be sure to indicate the start and end date of the statements.

Magazine order 6

We fill out the register based on documents confirming settlements with suppliers and contractors. Merging records is not allowed. The final balances of the previous period are transferred to the next register, in the “Balance at the beginning of the month” field.

Magazine order 7

We register settlements with accountable persons. We make separate entries for each advance report. Concatenation or grouping of rows is not allowed.

Magazine order 8

We indicate data for each operation:

- advance payments and settlements with contractors and suppliers (issued and received);

- settlements with budgets for taxes and fees;

- settlements with various creditors and debtors;

- on-farm operations.

Magazine order 10

We make records of expenses for our own production, in the context of each business transaction (depreciation, wages of production personnel, materials, deferred expenses, etc.).

Journal warrant 11

We reflect data on accounting of finished products. It is allowed to enter generalized information. The form of the journal is developed by the organization independently, taking into account the specific features of the activity (production).

How to download a document?

Wait for the download links to load, they will appear on this place very soon

After the links appear, download the format you need

Don’t forget to “Say Thank You”, your vote helps shape our document ratings

Agreement-example.ru is a database of more than 5 thousand standard samples of contracts and documents, daily updates and a large community uniting legal experts. The site contains a wide variety of agreements, contracts, agreements, statements, acts, accounting and financial documents, questionnaires, powers of attorney and many other samples that may be required in the life of every person. Thank you for your participation. Please note that the sample document presented is a typical document, it reflects the essential conditions, but does not take into account the specific situation. If you need an individual document for you, it is better to contact qualified specialists.

Documents that may also interest you:

- Book (magazine) of accounting by numbers, types and models and securing weapons and equipment. Form N 28

- Book (magazine) for issuing weapons and ammunition

- Book (journal) of accounting of products containing precious metals in the Federal Service for Technical and Export Control

- Book (journal) for recording the receipt of scrap and waste of precious metals and waste of precious metals at the Federal Service for Technical and Export Control

- Book (journal) of accounting for shipment of scrap and waste of precious metals to processing organizations in the Federal Service for Technical and Export Control

- Book (journal) of registration of job descriptions

- A book of alphabetical records of citizens undergoing military training at a military training center (at a military department)

- Book of analytical accounting of deposited wages, allowances and scholarships

- Book of issuing cases (orders)

- Book of issuance and acceptance of weapons, ammunition and special means in the organization of federal postal services

- Book of issuance and acceptance of weapons. Form N 5

- Book of issuing and receiving weapons and ammunition

- Book of issuing route sheets and one-time passes in the internal troops of the Ministry of Internal Affairs of Russia

- Book of issuing service certificates to Rostrud officials (state labor inspectors in a constituent entity of the Russian Federation)

- Book of fulfillment of customer orders. Specialized form N 8-RT