- General provisions of the MB-6 form

- Nuances of filling out a personal PPE registration card

- Organization of accounting of issued PPE

- The procedure for signing the MB-6 form

Personal protective equipment is used at all industrial facilities where there is a potential risk to the health and life of workers.

In addition, such means are used when working with electric current and gas networks. The issuance of personal protective equipment (hereinafter referred to as PPE) is subject to strict accounting. Therefore, in each case, you should fill out the employee’s personal card. A personal registration card for the issuance of PPE (Form MB-6) is issued in each case of use of protective clothing and protective equipment. Each employee has a personal card for recording the issuance of personal protective equipment (Form MB-6), which is a standard form. In the personal record card for the issuance of PPE (form MB-6), entries are made about each such issue. A personal card for recording the issuance of PPE (Form MB-6) is provided for by by-law - order of the Ministry of Health and Social Development of Russia No. 290n dated 06/01/2009.

If document maintenance is violated, the company may be subject to administrative liability. In cases of injury to an employee, criminal prosecution is possible - Article 143 of the Criminal Code of the Russian Federation.

What are considered low-value and wearable items?

Organizations, as a rule, have quite a lot of property and not all property, objects and products fall into this category.

But there are signs by which you can distinguish this group of goods from the rest:

- first of all, these are those items that last less than one year and need constant replacement (regardless of how much they cost), for example, bags, nets, seines, stationery, detergents and cleaning products, etc.;

- The same list includes products with a relatively low cost (no more than 40 thousand rubles), which are not taken into account on the balance sheet of the enterprise as fixed assets, including some types of workwear and shoes, computer and office equipment, bedding, dishes, household equipment, various spare parts, etc.

Drill Kosgu 310 or 340 in 2021

This means that the accounting policy can provide for an additional criterion (for example, cost), subject to which the instrument will be accounted for as fixed assets.

Check the correct choice of code using the transition keys (compare the name, industry affiliation and functional purpose with the descriptions given there).

In particular, this includes diagnostic and measuring equipment, tire fitting, lifting and other special equipment. It is used for repair and maintenance of motor vehicles.

Often, managers of the public sector, financiers and economists, have operational questions, the solution to which has already been found among their colleagues. We have opened a single platform for you to openly discuss budget issues.

In the classifier of fixed assets (OK 013-2014 (SNS 2008)), the switch can be classified in the group “Communication facilities that perform the function of switching systems,” number 320.26.30.11.110. The useful life exceeds 12 months, so the asset must be accounted for as a fixed asset according to KOSGU 310.

The second question is household equipment. What does it have to do with it? These are household items that are not used in the production process, but which are difficult to do without during the work process. Thus, all office and industrial premises need cleaning, disinfection products, etc.

In addition, using the reverse transition key from OKOF OK (SNS 2008) to OKOF OK, approved by order of the Federal Agency for Technical Regulation and Metrology dated April 21, 2016 N 458, the codes from subsection 12 “Structures” are matched. Many elements of sports equipment are listed in the National Standard of the Russian Federation GOST R3 “Sports equipment and inventory.

We help with advice on legal situations for all citizens. You can do it in any way convenient for you.

Why do you need the MB-2 form?

Like any other property, low-value and wearable items are used in work by employees of the enterprise. The period for their use is quite often limited in time, and they must be issued only against receipt.

Most often, the MB-2 form is issued for such things as bags, gloves, stationery, hygiene products, etc.

The accounting card, which refers to primary documentation, allows you to track where, for what purposes and in what quantity items considered of low value were transferred. This also includes information about who and when they were issued, and when and to what extent they were returned.

Thus, property is accounted for in the current activities of the company and used products are written off.

Requirements that must be observed when drawing up a document

When drawing up a card, you must adhere to the following series of requirements:

- Maintain a distance between the text and the edges of the page that is strictly established by Russian legislation.

- The card must be issued on high-quality white A4 paper (state symbols of the Russian Federation on the sheet are not acceptable).

- Enter data into the card by typewriting or print it using a computer.

- The text of the document must contain clear, not blurred lines, letters, numbers and other characters.

- Sections and subsections must have headings.

- The calendar date is written in numbers only.

- Each signature must be decrypted.

How to create a card, document features

If you found yourself on this site, it means that you most likely needed to create an accounting card for low-value and high-wear items.

First of all, let's say that now almost any internal documents can be made in free form (since 2013, the mandatory use of unified forms has been abolished at the legislative level).

- You can create your own accounting card in any form, but if your company has its own template developed and approved in the accounting policy, draw up the document according to its type. In addition, many companies prefer to use previously commonly used standard forms, in this case it is the MB-2 form. This is due to the fact that you don’t need to think much about the structure and content of the card; the finished sample is convenient and easy to fill out, which greatly facilitates the work of storekeepers and other employees of the organization who use this document.

- The next point regarding the design: information in the form can be entered by hand (without blots, errors or edits, legible and understandable) or on the computer, but if you created an electronic form, it must be printed. This is necessary so that responsible persons can sign their autographs under it.

- Place a stamp on a document only when the requirement to use stamps for approval of documentation is specified in the local regulations of the enterprise.

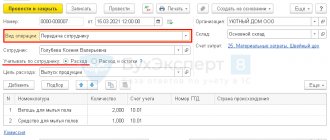

Documenting

When issuing inventory from a warehouse, a demand invoice is drawn up in form No. M-11 (instructions approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a). In it, indicate the name of the unit to which the inventory was issued, the account number on which the costs of maintaining this unit are taken into account (for example, account 25 when transferring inventory to the equipment operation department) (clauses 97 and 98 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28 2001 No. 119n).

If inventory is released from a warehouse to an intermediate division of the organization (for example, to the administration department), then at the time of transfer it is not known how much each division of the organization will consume (for example, accounting, purchasing department). In this case, as each department spends it, it is necessary to draw up acts (reports) in any form. They should indicate the name, quantity, cost of the inventory and confirm the feasibility of its use. Based on these acts (reports), write off the cost of inventory and household supplies as expenses. This procedure follows from paragraphs 97 and 98 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Sample of filling out form MB-2 - cards for recording low-value and wearable items

Finally we come to the main part of our article - the example.

Creating an accounting card for low-value and wearable items, although it is not a particularly difficult task, still this document has its own subtleties that are worth focusing on. Using our recommendations and based on the sample presented below, you can easily create the card you need.

At the very beginning of the document you must:

- assign it a number;

- write the name of the organization and the structural unit in which the form is issued;

- On the right side, enter the OKPO code of the enterprise in the table, in the table below - the date of filling out the form, the structural unit and the personnel number of the recipient, fill out all other cells as necessary;

- Under the table, enter the recipient's last name, first name, patronymic, his profession and position.

Then we go to the main table of the document - here we enter in order:

- name of a low-value or rapidly wearing item, its nomenclature (inventory) number;

- information about when, to whom and in what quantity it was issued;

- then upon returning the goods back - similar information about the return;

- the person who received the product (as a rule, this is the head of a team, workshop, section, etc.) must put his signature in the appropriate “windows”;

- information about the disposal act (date, number), service life of the product and, if necessary, information about the passport (not all material and technical assets have this document).

Be sure to sign the back of the form and decipher your signature.

Let's talk about tools (Lukinova L.G.)

The choice of tool is based on the parameters of the work performed. The tasks of a cordless screwdriver can be varied; you should pay attention to the key parameters.

The tool has a maximum torque, this parameter may vary depending on the equipment. When you need to work with soft materials such as drywall, a compact screwdriver with a power of up to 30 Nm is suitable.

In our article you will find specific recommendations in case you encounter a similar problem. And to make the information as accessible as possible, we gave examples and told how to act if a company purchased curtains, signs, a system unit and other equally important property.

Battery types determine the most important parameters - the operating time of the screwdriver, the need for a complete discharge, charge duration, service life and the price of the electric tool itself. Today there are four types of batteries:

- Lithium-ion , designated as a li-ion battery, holds a charge for quite a long time compared to others, also accumulates it quickly and does not require complete discharge. Today, this is the most effective option for construction and electrical installation operations; its main disadvantage is its high cost, so it is better not to choose screwdrivers with such a battery for single jobs.

- Lithium polymer , designated as li-pol battery, has the largest capacity among rechargeable batteries for screwdrivers, but it fails faster than others.

- Nickel-cadmium batteries , designated as ni-cd batteries, have the longest service life, about 5 years, compared to about 3 years for others. This option is also low cost. Disadvantages include a long charging period and the need for a complete discharge.

- Nickel-metal hydride batteries , designated as ni-mh batteries, are characterized by good battery capacity, unlike other models, they have significantly less weight with the same battery capacity. Due to this, such a cordless screwdriver is smaller in size, but also much more expensive.

On the eve of the New Year, the topic of gifts is more relevant than ever. To make the right choice, we scan our colleagues, friends, acquaintances, and try to be attentive to their dreams, desires and interests. What to do if scanning failed?

Purpose of the inventory and household supplies card

This card is a specialized form of primary accounting documentation. In the course of their activities, agricultural organizations widely use various equipment and household supplies - means of labor that are used many times during the production process, but do not change their properties and purpose. Only after a specified period of time has passed after the start of operation do they begin to lose their technical characteristics. For example, these are metalwork tools, farming tools, various instruments, industrial and household equipment.

Download the card form on our website:

The inventory and household supplies accounting card takes into account labor tools whose useful life exceeds 12 months and whose cost is no more than 2,000 rubles. That is, the card is intended for accounting for low-value fixed assets. It allows you to obtain operational data on the availability of inventory and household supplies of a certain production area and maintain proper control over the movement of such property.

IMPORTANT! Currently, the limit on the cost of inventory for accounting in a card (2,000 rubles), established back in 2003, is irrelevant. Therefore, the card can take into account those low-value fixed assets whose value does not exceed the value limit established by the accounting policy for such assets.

In accounting, an organization can use a unified document form or an independently developed one, which must contain mandatory details.

KOSGU for the purchase of equipment

Typically, administration and accounting work using computers, monitors, laptops, copiers, scanners, power supplies and other equipment. It should be classified as a special device.

Brushes, mops, shovels, dustpans, rakes, vacuum cleaners - everything you need to always keep your office and surrounding area clean. Sometimes you even need a grass clipper, scythe or sickle.

A more powerful screwdriver will undoubtedly be a better choice if you have the budget. A capacious battery and durable design make it a favorite among competitors.

All rights to materials posted on the site are protected in accordance with the legislation of the Russian Federation, including copyright and related rights. The exception is agricultural machinery and implements; construction power tools; working, breeding and productive livestock; library collection, etc., which are classified as fixed assets regardless of their cost.

Special equipment and household appliances do not immediately lose their shape, like, for example, materials and raw materials; therefore, they must be taken into account in production costs in a special way. It is customary to reflect such costs in the company's turnover through depreciation.

Thus, when deciding whether to classify property as fixed assets or inventories, the norms of Instruction No. 157n take precedence over the provisions of OKOF. According to the decision made by the institution, the property listed in the question, acquired in 2017, is classified as fixed assets. The OKOF code can be searched by the name of the fixed asset or by its purpose.

This subarticle is used if the building is owned by several owners, and the costs of its operation are borne by only one of the owners, and all other owners compensate him for expenses in proportion to the shares of consumption.

In order to choose the most suitable model, you need to decide on the existing options for screwdrivers and their purpose. First, choose what you will use it for.

Don’t forget about such items as: hole punchers, binders, archival boxes, staplers of all sizes, sets of pens/refills/ink, special pens, galleys, perforations.

As a result, we can distinguish between ordinary and special tools. The first includes a tool of human labor or a machine mechanism for performing certain works. The second includes technical means that have individual (unique) properties and are intended to provide conditions for the production (production) of specific types of products (performance of work, provision of services).

However, the expenses under consideration are not included in any of the subgroups 210 - 243, while at the same time, type of expenses 244 “Other purchase of goods, works and services to meet state (municipal) needs” reflect the expenses of the budgets of the budget system of the Russian Federation for the purchase of goods, works , services for state (municipal) needs not classified as other elements of types of expenses.

Example 1. An organization purchased a used vehicle at a price of 600 thousand rubles. Upon acceptance and handover, it turned out that, apart from a spare wheel and a jack, there was nothing else in the trunk of the car. Therefore, it was decided to purchase a set of keys and necessary accessories, with which you can eliminate minor problems on the road. The cost of a set of keys and accessories was 10 thousand rubles.

If these items are taken into account by the organization as part of the inventory, their cost will be written off from account 10 “Materials” as they are transferred from the organization’s warehouse to operation.

Later in the article we will look at examples of reflecting expenses under KOSGU 310 and 340. But since the new Instruction 209n has been in effect since 2021, we advise you to test yourself on the use of other articles of KOSGU. See an overview of the most popular controversial issues regarding the attribution of expenses according to KOSGU from the practice of your colleagues.

Let us remind you that the links between CWR and KOSGU that are in effect in 2021 are given in Appendix No. 5 to Instructions No. 65n. If a combination of CVR and KOSGU, not named in this appendix, is used in the accounting account or planning documents, auditors may raise the question of a violation of the procedure for applying the CBC.

The institution's commission may make a different decision and include signs or signs in the OS. For example, hanging signs that are not attached to the surface, or facade signs. Expenditures on such plates are carried out according to article KOSGU 310 “Increase in the cost of fixed assets”.

Doubts often arise when choosing between 225 and 310 KOSGU (between repair and modernization (reconstruction, retrofitting), as well as between 225 and 226 KOSGU. Why such difficulties arise and how an accountant can “get away with it”, let’s look at the example of work situations.

In the event that expenses increase the cost of a building leased or used for free, they are charged to code 310.

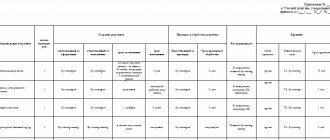

Explanations for filling out the card

To enter data into the card, inventory and accessories should be grouped according to the same type of application or the same cost. The card indicates the name of the property group and its purpose.

The card is issued in one copy for each financially responsible person. Data on the receipt and disposal of inventory is entered into the card on the basis of primary documents.

The front side of the form is intended to indicate:

- asset name,

- inventory number,

- service life,

- details of the document for admission,

- cost,

- issuance data,

- invoice correspondence,

- the remainder of the materiel value,

- signature of the responsible person.

Information about the disposal of the asset is entered on the back of the card. Disposal is carried out on the basis of a decision of a special commission and is documented in an act.

How to draw up a write-off act, see the article “Act for write-off of fixed assets - a sample of filling out.”

Certificate of write-off of equipment that has become unusable

Using this link you can download “” for free in doc format, 12.0 KB in size. All organizations are faced with the need to write off old equipment.

Computers, office equipment and other property must be disposed of according to a write-off report. Correct write-off requires an expert opinion on the condition of the equipment, which contains an assessment confirming the impossibility of further use. A specially created commission or an invited expert organization draws up a technical inspection report, on the basis of which it is possible to write off fixed assets from the balance sheet and dispose of them.

Property tax has to be paid for equipment that has not been written off but is out of order or obsolete. You can write off fixed assets gradually - through depreciation, but there is a shorter way - drawing up an equipment write-off act. It is recommended to write off material assets that:

- obsolete;

- extremely worn out;

- damaged when repair is impossible or economically unfeasible.

- do not exist based on inventory results;

- cannot be used because they have become unusable;

Every year, the head of the organization must issue an order appointing a commission to write off fixed assets.

The chairman of such a commission is, as a rule, a deputy director, and the members of the commission are the chief accountant, economists and engineers.

In most cases, fixed assets are subject to write-off in the following cases:

- It is impossible or economically infeasible to restore the object.

- The property fell into disrepair.

- Equipment does not exist as a single entity.

All three circumstances must be present, otherwise the write-off will be illegal.

For example, you cannot write off a computer on the grounds that its performance is not sufficient to run a program. The hardware remains suitable for lower performance programs such as word processing or email.

The legislative framework

Order of the Ministry of Agriculture No. 750 dated May 16, 2003 suggests using specialized form No. 423-APK. However, since it relates to primary documentation, you can develop the form yourself.

You can also take as a basis the intersectoral form No. MB-2 from the appendix to the Resolution of the State Statistics Committee of the Russian Federation No. 71 of October 30, 1997. It is simpler and more personalized.

Sample of filling out the MB-2 form

The personal instrument issuance card is designed to control inventory with a small book value. Until 2003, there was even a limit - no more than 2000 rubles. Now this rule does not apply. Each company can set its own limits in accordance with its accounting policies.

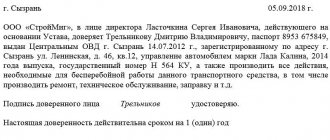

Procedure and standards for issuing personal protective equipment (PPE)

Working clothes, special footwear and safety equipment are issued free of charge to workers and employees only in those professions for which the issuance is provided for by standard industry standards for the free issuance of PPE.

It is important that workers and employees actually use PPE, and do not use faulty, unrepaired or contaminated ones.

The warm work clothes and safety footwear required by the standards must be issued to workers and employees upon the onset of the cold season, and with the onset of warm weather, they must be handed over for organized storage until the next season.

Washing, disinfection, and repair of workwear and safety equipment are carried out within the time limits agreed upon with the authorized personnel of the team.

The main regulatory legal act regulating the procedure for providing workers with PPE is the Intersectoral Rules for Providing Workers with Special Clothing, Special Footwear and Other Personal Protective Equipment, approved by Order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n.

How to fill out

A typical card for recording an employee's instrument has two sides. On the front (after the name of the organization and structural unit, as well as the full name of the financially responsible person) information about the equipment issued should be placed:

- his name;

- inventory number;

- useful life;

- information about receipt (when, in what quantity and at what cost);

- similar information about the issue;

- relevant entries (debit and credit);

- data on balances (by quantity and value);

- signature MOL.

If necessary, you can add a column with information about the employee who receives the inventory. This will allow you to track not only the period of use and the degree of wear, but also who is responsible for possible damage or theft.

The reverse side of 423-APK should only be filled out when it is time to write off a means of production. The initial data must be taken from the conclusion of a specially assembled commission.

Form 423-APK

Write-off of office supplies: accounting entries

There are three ways to write off office supplies (the chosen method must be fixed in the accounting policy):

- Using the FIFO method (in chronological order of receipt and write-off).

- At average cost.

Calculation takes place

- the weighted assessment method - based on information about the price and number of units of goods at the beginning of the month and all receipts during the billing period;

- using the sliding valuation method - the number of units and the price of office supplies at the beginning of the month and all receipts until the day they are written off.

At the cost of a unit of goods (not advisable in this case). Stationery must be written off at the moment when they are transferred to employees for use (the basis for issuance will be a demand invoice in form M-11 or its own form of a similar document with the company’s details).

| Operation | Accounting entry |

| Stationery supplies were handed over to employees for use | D 26 (44) K 10 |

If in a company that maintains accounting in a simplified manner, office supplies are written off as expenses for ordinary activities immediately upon acquisition, then accounting entries are not needed when issuing items to employees for use. Firms with a simplified taxation regime recognize prices for office supplies as expenses only after payment has been made, if there is an invoice.

At an enterprise under the general taxation regime (OSNO), the prices of office supplies are included in expenses on the day they are transferred to employees, and VAT will be deducted after the receipt of an invoice from the supplier.

Example of writing off office supplies

The HR department needed stationery, they were written off as general business production in the amount of two packages of paper and one box of pencils in the amount of 800 rubles.

| Operation | Amount (rub.) | Reason for write-off | Debit | Credit |

| Payment for office supplies has been received by the supplier. | 800 | Request-invoice | 26 | 10.01 |

perforator.jpg

Related publications

It is almost impossible to imagine the company’s activities without the use of tools and various equipment. Depending on the company’s field of activity, a tool can be expensive, specific, used to perform certain special tasks or for household purposes, and used, for example, for minor repairs. In any case, the company must organize control over the safety of the instrument.

The procedure for storing tools must be organized by the company itself. A convenient way is to record the issued instrument in special accounting documents. For example, in order to monitor the safety of tools, an organization can keep a log of issued tools or cards for recording the issue of tools (for example, create personal cards for each employee and reflect the tools received in their hands). What information needs to be included in the accounting card, how to draw up the document correctly? Let's take a closer look.

Elements of the PPE issuance log

The document is quite simple. Its form consists of two sheets: the cover and the main tabular part. The cover should have:

- Document's name. It is printed in the center of the sheet. Without a number.

- The name of the organization in which it is conducted. If necessary, a structural unit (if there are several journals).

- What date did the magazine start and finish? The second date is usually entered after the fact. Filling out the internal part of the document is possible (and is done) without an end date.

The second sheet of the journal for recording the issuance of personal protective equipment is a sample for filling out subsequent ones. It contains the following fields to fill out:

- Serial number. The document uses continuous numbering.

- Name of protective equipment (gloves, helmet, goggles, suit, etc.).

- Date of issue.

- Service life of a specific product. It can be viewed in the attached documents upon purchase.

- Full name of the recipient of the PPE.

- Signature of the employee who received the item.

- Name and signature of the person who issued the issuance.

- Note. This column most often indicates the basis for issuance. This may be an order from the head of the institution or some provision on extradition. The numbers and dates of these documents are entered in the last column of the journal.