Let's consider the situation with returns. These operations always raise many questions. Return is the transfer of goods from the buyer to the seller if facts of improper fulfillment by the seller of their obligations under the purchase and sale agreement listed in the Civil Code of the Russian Federation are revealed.

These are the following cases:

- approval of the order, the seller’s obligation to transfer the goods free from the rights of third parties was violated (Article 460 of the Civil Code of the Russian Federation);

- the seller’s obligation to transfer accessories or documents related to the goods within the period established by the contract has been violated (Article 464 of the Civil Code of the Russian Federation);

- the conditions regarding the quantity of goods were violated (Article 466 of the Civil Code of the Russian Federation);

- the conditions regarding the assortment of goods were violated (clauses 1 and 2 of Article 468 of the Civil Code of the Russian Federation);

- goods of inadequate quality were transferred (clause 2 of Article 475 of the Civil Code of the Russian Federation);

- the packaging of the goods has been violated (clause 2 of Article 480 of the Civil Code of the Russian Federation);

- the conditions for containers and/or packaging of goods were violated (Article 482 of the Civil Code of the Russian Federation).

If the buyer, when returning, does not make any claims to the seller (for quality, suitability, etc.), in accordance with the above-mentioned violations, then this return should be considered a normal sale.

And in this case, the buyer needs to issue an invoice for the shipment of goods received from him in the TORG-12 form. In this article we will focus on returns to the supplier and the reflection of various options in the 1C: Accounting 8 program, edition 2.0.

When accepting goods for accounting, the buyer registers an invoice in the purchase book and VAT is fully deductible (clause 1 of Article 172 of the Tax Code of the Russian Federation), and when returning goods, he issues an invoice to the supplier for the return, which is registered in the sales book.

In the buyer’s accounting, the return of goods is recorded by postings to the debit of account 76.02 “Calculations for claims” and the credit of account 41.01 “Goods in warehouses”.

Sometimes, due to the large turnover, it is inconvenient to allocate calculations for returns to a separate accounting account 76.02, since it will be constantly necessary to make offsets with account 60. Therefore, this article will tell you how you can reflect returns through 60 accounts.

Returns occur in different situations: before or after payment for the goods received. Therefore, we will consider various options.

In our case, we will assume that all goods purchased from the supplier were accepted for accounting on 41 accounts on the balance sheet of the enterprise.

Refund of advance payment from supplier: accounting and tax accounting

An advance or prepayment is a payment that is received by the supplier (seller) before the date of actual shipment of products or before the provision of services (clause 1 of Article 487 of the Civil Code). If the supplier (performer) has not fulfilled its obligations within the period established by the contract, then it must return the funds received from the buyer (customer). How to reflect such a refund of advance payment from the supplier in the buyer’s accounting and tax records?

Accounting

To keep records of advances issued to other enterprises, the purchasing enterprise uses subaccount 60-2 “Calculations for advances issued.” The debit of this subaccount reflects the occurrence of receivables (transfer of advance payments), and the credit reflects the repayment or write-off of debt.

Example

On February 10, 2014, Kalina LLC transferred an advance payment for goods in the amount of RUB 236,000 to Ryabina LLC. According to the terms of the contract, the delivery of goods was to occur before April 10, 2014.

However, the delivery never took place. LLC "Kalina" turned to LLC "Ryabina" with a demand to return the transferred prepayment. On April 15, the prepayment was returned to the account of Kalina LLC.

The return of the prepayment from the supplier will be reflected by the following posting:

Debit 51 – Credit 60-2 – in the amount of 236,000 rubles. – return of advance payment from the supplier.

The presence or absence of other entries depends on whether VAT was deducted from the advance payment issued or not.

VAT accounting

When receiving an advance payment from the buyer, the supplier must charge VAT (at the calculated rate of 18/118 or 10/110, the tax base is the amount of the prepayment) and pay it to the budget (Article 154 of the Tax Code). Also, the seller must issue an invoice and send it to the buyer within five days (Article 168 of the Tax Code).

In turn, the buyer, having received an invoice issued by the seller for advance payment, has the right to accept VAT for deduction without waiting for the moment of receipt of the goods (if the goods will be used in transactions subject to VAT and the supply agreement contains a condition for advance payment, clause 9 of Art. 172 NK).

This is not an obligation, but a right of the buyer, which allows you to quickly exercise the right to deduction if the transfer of the advance payment and the shipment of the goods were in different quarters.

Continuing our previous example, we can imagine 2 possible situations:

1. Kalina LLC did not accept VAT from the advance payment for deduction. Then, when the prepayment is returned, there will be no additional transactions.

2. Kalina LLC received an invoice and accepted VAT from the advance payment issued for deduction:

Debit 68-2 – Credit 76VA – in the amount of 36,000 rubles. – accepted for deduction of VAT on the advance payment issued (in 1C: Accounting, enter the statement where the advance was paid, then in Operations “Enter based on”, select “Invoice received”).

In this case, when returning the advance, the VAT accepted for deduction must be restored.

Debit 76VA – Credit 68-2 – in the amount of 36,000 rubles. – VAT, previously accepted for deduction, has been restored

Please note: the right to deduct VAT from advances issued can be used selectively, depending on the situation - the advance was closed with shipment in the same quarter or not.

Tax accounting

From the point of view of calculating income tax, the return of an advance from a supplier does not entail tax consequences. This is due to the fact that when making an advance payment, the buyer does not incur any expenses.

For organizations and individual entrepreneurs working on the simplified tax system, the return of an advance from a supplier does not entail tax consequences. Despite the use of the cash method, no expenses arise when transferring prepayments, because materials have not yet been received, goods, services have not been provided, etc. Therefore, the returned advance is not recorded in KUDiR, and in the accounting (in the bank statement) there must be a note clarifying the meaning of the transfer of money received.

Read more about deducting VAT on advances paid to a supplier here. How to take into account cash bonuses (discounts) provided by the supplier, see here.

What system do you work with your suppliers on – advance payments or post-payment? Please share in the comments!

You might be interested in:

Registration of transactions for returning goods from the buyer (VAT payer) in 1C Accounting 8 edition 3.0

In the trading activities of an enterprise, it is often necessary to deal with the operations of returning goods from customers or returning goods to suppliers. Returns of goods may occur for various reasons. For example like this:

- The buyer did not receive comprehensive information about the main properties of the goods (clause 3 of article 495 of the Civil Code of the Russian Federation);

- The required quantity of goods was not transferred (Article 466 of the Civil Code of the Russian Federation). In this case, at the time of acceptance, an act is drawn up, on the basis of which you can refuse the entire shipment and request the money back, or demand that the missing goods be sent;

- Incorrect packaging of goods (Article 480 of the Civil Code). The buyer has the right to demand a reduction in the price of the product or to complete it. If the supplier does not cooperate, write a return claim, etc.

- When a product arrives of poor quality (Article 475 of the Civil Code of the Russian Federation).

In this article we will look at an example of reflecting in the 1C Accounting 8.3 program the return of goods from a buyer who uses the general VAT payer taxation system.

Submit your application

Example.

The Inkom Plus organization sold a batch of goods in the amount of 25 pieces to the buyer. in the amount of 37,500 rubles (including 6,750 rubles - VAT 18%). The item was pre-paid. After accepting the goods, the buyer discovered that there were 5 defective items. In accordance with the contract, the low-quality goods were returned from the buyer and the buyer issued an invoice for the return.

In accordance with paragraph 1 and paragraph 2 of Art. 475 of the Civil Code of the Russian Federation, in the event of a significant violation of the requirements for the quality of goods, the buyer has the right, at his choice:

- refuse to fulfill the purchase and sale agreement and demand the return of the amount of money paid for the goods;

- demand replacement of goods of inadequate quality with goods that comply with the contract.

In case of inadequate quality of part of the goods included in the set (Article 479 of the Civil Code of the Russian Federation), the buyer has the right to exercise the rights provided for in paragraphs 1 and 2 of this article in relation to this part of the goods.

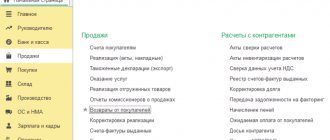

For example, we need to sell a product. Let's go to the "Sales" section and create a document "Sales (act, invoice)" with the type of operation Goods. Let's select a buyer, indicate the contract with the buyer and fill out the Products tabular section. We will process the document and issue an invoice for implementation. The execution of the implementation document and the result of its implementation are presented in Fig. 1.

Picture 1.

The buyer returned 5 pcs. low-quality goods. To make it easier for you to return a product from a buyer, you can use the following procedure. Let's go to the document log of the "Sales" section. Let us select with the cursor the previously created document “Sales (act, invoice)” dated January 25, 2017. and based on the document we will create a document “Return of goods from the buyer”. The created document will be automatically filled with the implementation document data. In the tabular part, we only need to adjust the quantity of the returned goods. We will register an invoice from the buyer.

When posting the document, a reversal will occur in the debit of account 90.02.1 of the cost of goods sold and the account will increase. 41, also on the credit of account 90.01.1, part of the proceeds in correspondence with the account is reversed. 62.01 (mutual settlements with customers), part of the offset is reversed on the debit of account 62.02 and the credit of account 62.01. Part of the accrued VAT is reversed (Dt 90.03 - Kt 68.02). Also, when posting the document, an accumulation register “VAT presented” will be generated. The execution of a document for returning goods and the result of its implementation are presented in Fig. 2.

Figure 2.

In accordance with paragraph 1, clause 5, art. 171 of the Tax Code of the Russian Federation, the amounts of VAT presented by the seller to the buyer and paid by the seller to the budget when selling goods are subject to deduction in the event of the return of these goods (including during the warranty period) to the seller or refusal of them.

According to paragraph 4 of Art. 172 of the Tax Code of the Russian Federation, the specified deduction is made in full after the corresponding adjustment operations are reflected in the accounting in connection with the return of goods or refusal of goods (work, services), but no later than one year from the date of return or refusal.

Consequently, all requirements for deducting VAT amounts on the return of goods have been met. In the program, VAT can be deducted using the regulatory document “Creating purchase ledger entries” or directly using the “Invoice received” document, with the “Reflect VAT deduction in the purchase ledger by the date of receipt” checkbox enabled.

In accordance with the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] , shipment (transfer) or purchase of goods (work, services), property rights, transactions taxed at a rate of 0%, intermediary transactions involving sale and/or acquisition of goods (work, services), property rights on behalf of the commission agent (agent) or on the basis of transport expedition contracts, operations for the return of goods by the taxpayer-buyer to the seller or receipt by the seller of goods from a specified person, with the exception of operations indicated by the codes: 06; 10; 13; 14; 15; 16; 27; compilation or receipt of a single adjustment invoice is entered with the transaction type code “01”.

When posting the document “Invoice received” in accounting, VAT will be deducted (Dt68.02 - Kt19.03), the “VAT Presented” register will be written off and an entry will be created in the “VAT Purchases” register (Purchases Book). The generated document “Invoice received” and the result of its execution are shown in Fig. 3.

Figure 3.

To complete the example, let’s generate the “Purchase Book” report and make sure the result is correct. Rice. 4.

Figure 4.

Dear readers! You can get answers to questions about working with any 1C software products on our 1C Consultation Line. We are waiting for your call!