Procedure for paying personal income tax upon dismissal of an employee

In 2021, the procedure for paying personal income tax has become slightly different. From this year, regardless of the method of payment to the employee of the final payment, personal income tax must be transferred no later than the next day after the dismissed employee receives this amount (Article 226 of the Tax Code of the Russian Federation). The type of remuneration does not matter. The final payment upon dismissal can be in the form of wages, vacation pay, bonuses and other payments. And the form of payment also does not matter. It doesn’t matter whether it is carried out by transfer to employees’ cards, cash issuance at the enterprise’s cash desk or in another way.

Typically, personal income tax on wages and other types of remuneration is transferred to the budget no later than the next day after receipt of wages and other types of payments (clause 6 of Article 226 of the Tax Code of the Russian Federation). In most enterprises, salaries are paid during the first half of the month from the fifth to the tenth. It should be noted that the transfer of personal income tax from the advance payment is not established by law.

The time of final payment upon dismissal does not always coincide with the time of payment of salaries to the rest of the company’s employees. This time depends on the date he submitted his resignation letter. According to the law, an employee generally must submit a resignation letter two weeks before the intended date of dismissal. And he has the right to demand full payment on the day of his dismissal. The special circumstances of the settlement with the dismissed employee forced the Ministry of Finance of the Russian Federation to set out its recommendations for resolving the issues arising in this case in the form of a special document (letter of the Ministry of Finance No. 03-04-06/4831 dated February 21, 2013).

According to this letter, the employee must receive a payment on the day of his dismissal, despite the fact that this day may not coincide with the issuance of wages at the company. On the day of dismissal, the employee is required to pay:

- wages for all days worked;

- accrued premium amounts;

- other types of debt.

Thus, according to the letter of the Ministry of Finance and in accordance with Art. 140 of the Labor Code, on the day of dismissal, the enterprise must pay its dismissed employee in full, without leaving any debt.

And also the Labor Code of the Russian Federation allows settlements with a dismissed employee within the next day after the date of dismissal. This is done so that the accounting department can make the necessary accounting calculations, in addition to wages, for example, for sick leave or accrued bonuses, for travel expenses and other similar payments.

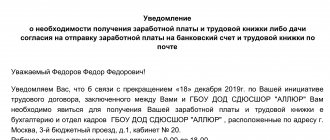

A delay in payment of full pay upon dismissal for more than one day is possible only on the initiative (fault) of the employee himself, if for some reason he did not come to receive his pay. In this case, remuneration upon dismissal is paid to the employee on the day of his arrival for this remuneration.

In any case, the timing of personal income tax transfers is strictly linked to the timing of payment of salaries and other types of remuneration upon dismissal. The enterprise is obliged to transfer to the budget the entire amount of personal income tax due on this or the next day.

If the employee does not show up for payment on the day of dismissal, the funds due to him must be deposited

Calculation of personal income tax upon dismissal of an employee

Transfer of tax on remuneration received by an employee upon dismissal is carried out in form 6-NDFL.

This form reflects the tax amounts:

- from wages;

- with compensation for unused vacation;

- from severance pay;

- from the average monthly salary for the period of searching for a new job.

Calculation of personal income tax on wages is carried out in the standard manner.

If an employee was given an advance in the amount of 40 thousand rubles on June 10, and then another 60 thousand rubles were accrued before the date of dismissal (06/28), then the amount of personal income tax will be (40 + 60) * 13% = 13 thousand rubles.

Compensation for vacation is also subject to personal income tax in the general manner (clause 4 of article 127 of the Labor Code of the Russian Federation). The time of receipt of compensation in this case is the date of actual receipt of income, which is recorded in line 100 of form 6-NDFL. The same date must be indicated in line 110 (“Calculation”). It is better that the dates of receipt of compensation and payment of personal income tax coincide, although according to the law, the time of transfer of personal income tax may be the next working day after payment of compensation (clause 7 of article 6 and clause 6 of article 226 of the Tax Code of the Russian Federation).

In columns 100 and 110 of the personal income tax calculation form-6, the same date is indicated

It should be noted that the amount subject to personal income tax can be reduced through tax deductions.

It is necessary to remove the deduction for children from the amount of taxable payments, which in 2021 amounted to 1,400 rubles per month for each minor child, as well as for students under 24 years of age.

In all cases of payment of monetary remuneration to a dismissed employee, personal income tax is withdrawn from the amount paid in the same amount as when paying monthly wages.

The calculation of the amount of personal income tax-6 in the event of dismissal of an employee is carried out in the same way as when calculating regular monthly wages

However, the Tax Code of the Russian Federation contains a list of monetary accruals on which personal income tax is not paid. Such payments include:

- state unemployment benefits;

- maternity benefit;

- pension money;

- funds paid through compulsory health insurance;

- alimony;

- various grants issued to support certain areas in science, culture and other areas of economics and public life;

- prizes and awards for outstanding achievements, including from foreign states or organizations;

- financial assistance paid by the employer to the relatives of the deceased;

- scholarships;

- profit from the sale of products produced on private farms;

- inheritance received;

- some gifts (except for real estate, cars, securities, etc.).

Composition of the taxable basis and calculation

To understand when to pay personal income tax when dismissing an employee, you need to go through the entire chain of actions associated with determining the tax base and familiarize yourself with the features of calculating tax with compensation for unused vacation. Filling out instructions for transferring funds to the budget and the deadlines for paying personal income tax upon dismissal have also undergone changes.

Calculation procedure and calculation base

The basic personal income tax rate is 13%, it is used according to Art. 224, 225 Tax Code of the Russian Federation. Different tariffs apply to certain types of income. The formula for calculations is: (D―NV)*13%, where D is the monetary expression of income, NV is tax deductions. The transfer of the fee from the remuneration received by the dismissed employee is made according to form 6-NDFL, which displays the amounts of tax collected by type of income:

- salary and bonuses for actual working hours;

- compensation for unused vacation days;

- severance pay;

- subsidy for the period of searching for a new job;

- other debts.

The tax base is reduced through tax deductions. Calculating the fee when you have to fire an employee is no different from the procedure for monthly payroll. The discrepancy between the day of dismissal and the date of pay does not relieve the employer of the obligation to issue a paycheck within the prescribed period.

Non-taxable income and tax deductions

A number of subsidies were provided that are not part of the basis for calculating the fee. Most of them are financed from the state budget. The list of such benefits is as follows:

- unemployment benefits, pregnancy benefits;

- pensions, alimony and scholarships;

- subsidies for medical insurance of company employees. With a voluntary obligation, you can return the amount paid by filling out the 3-NDFL tax return, if the agreement was concluded by the employee himself;

- material assistance provided by the organization to the relatives of the deceased person;

- inheritance received and some donated items;

- income from personal farming.

The tax deduction is provided for in Art. 218–221 Tax Code for Heroes of the Russian Federation, disabled people of the Second World War and workers with minor children. The reduction amount for the first and second child is 1400 rubles/month. In the event of an accounting error or failure to provide a tax deduction to an employee, sometimes an excessive fee is paid. Typically, the refund is made by crediting the amount in the next reporting period.

Features of taxation of vacation compensation

When an employee leaves, he almost always retains some of the unused vacation time. Some changes have been made regarding the deadline for transferring personal income tax from compensation upon dismissal. The latest is a letter from the Ministry of Finance dated May 23, 2016, which explains that income is not always taxed: its amount must be no less than three times the average monthly salary, and for workers of the Far North - six times. When establishing the terms for withholding the fee from reimbursement of unused vacation, they are guided by the following provisions:

- Compensation is paid to the dismissed employee on the final day of work along with salary and other amounts due.

- The date of receipt of final payments, including lost vacation, is the control date for calculating personal income tax.

- Tax should be withheld from the employee’s income on the date of actual payment of dismissal amounts, i.e. on the last day of work.

You can transfer the fee withheld from the issued invoice to the budget on the same date or a day later. When filling out form 6-NDFL, the date of receipt of income is recorded in line 100, and the day of deduction is written in 110. It is better that both of these numbers coincide, indicating the simultaneity of events.

Filling out a payment document

The transfer of calculated taxes is carried out by submitting a payment order to the bank. You cannot make mistakes when entering information. To make the task easier, the purpose of some document fields is given by number:

- 101, payer status: organization - code 02, individual entrepreneur - 09;

- 104, KBK budget classification code: company that is a tax agent - 1821 0100 110, individual entrepreneur - 1821 0100 110;

- 107, the period for which the fee is paid: no number is given, only the month when the income was actually received.

You can fill out the payment form using the free Federal Tax Service service on the inspection website. If the deadline for paying personal income tax upon dismissal coincides with a weekend, then the transfer is postponed until the first working day.

Main innovations

The employer is a tax agent and is obliged to calculate and withhold personal income tax from the worker and transfer it to the budget. When a citizen is dismissed, the period from the last payment of the fee to the employee’s final paid day is determined for calculations. There are several innovations, the following are of practical importance for non-specialists:

- Personal income tax must be transferred no later than 24 hours after the day of final payment.

- Employees have the right to apply for deductions for treatment and training from their employer without waiting for the end of the tax period (calendar year). A notification from the Federal Tax Service department is submitted to the accounting department, which indicates the amount for each type of social deductions, and an application to the head of the company. Starting from the current month, the tax base will decrease until the withholding is reset to zero.

Innovation regarding accounting: a new form of the annual report 6-NDFL is presented in March. Its preparation is similar to a quarterly document, it indicates: the types of income of employees and deductions that they receive, the amount of tax across the entire state - accrued and paid. It is recommended to check the data in the new report with Form 2-NDFL.