Cases of returning goods

In accordance with the norms of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), the return of goods can be carried out:

- according to the law: if the goods were delivered of inadequate quality or not at all what was specified in the contract (i.e., there is a failure to fulfill the contract);

- an agreement (such a clause on the return of goods of proper quality may be specified in the contract, or may exist in the form of implementing the rules on the buyer’s responsibility if he does not pay the full amount for it on time).

Based on Art. 454 of the Civil Code of the Russian Federation, the seller transfers the goods to the buyer, who pays for it and takes ownership of it. At the same time, in accordance with Art. 223 of the Civil Code of the Russian Federation, the moment of transfer of goods is at the same time the moment of transfer of ownership of it from the seller to the buyer. In addition, the contract may establish another moment for the transfer of ownership.

The grounds for returning goods are given in the Civil Code of the Russian Federation. So, a refund can be made:

- in case of short delivery of goods (Articles 465 and 466 of the Civil Code of the Russian Federation);

- deliveries with a violation of the assortment (Articles 467 and 468 of the Civil Code of the Russian Federation);

- deliveries without proper packaging or in violation of the integrity of the packaging (Articles 481 and 482 of the Civil Code of the Russian Federation);

- the presence of a marriage (Article 475 of the Civil Code of the Russian Federation);

- detection of shortages (Articles 479 and 480 of the Civil Code of the Russian Federation);

- if the seller did not transfer accessories or documents related to the goods within the prescribed period (Article 464 of the Civil Code of the Russian Federation).

The contract may also provide for other grounds for returning goods.

In these cases, the buyer has the right to refuse to accept the goods and is not obliged to pay its cost, while the received advance payment must be returned by the seller upon the buyer’s first request.

Registration of goods return

1. Having discovered the supply of low-quality goods, it is necessary to draw up a defect identification report.

2. It is usually drawn up by the buyer and signed by both parties

3. When returning a defective product that was previously accepted by the buyer for accounting, in addition to the acceptance certificate for the defective product, the TORG-12 form is also filled out, on which the note is made: “Return of goods”

Important! The invoice should indicate that a report on the identified deficiencies has been drawn up and a claim has been filed with the supplier. In this case, the act itself must be drawn up immediately after the discovery of deficiencies.

If all documents are drawn up in accordance with the law, the buyer has a chance to get his money back through the court if the issue cannot be resolved peacefully.

When returning a quality product by mutual agreement, the parties must sign a return agreement. The transfer of goods itself is formalized by drawing up a consignment note (the TORG-12 form is most often used, on which the note: “Return” is made).

SITUATION 1. Return of defective goods to the supplier - VAT payer

The supplier himself issues an adjustment invoice, which will reflect the decrease in the quantity of previously shipped goods. Based on this adjustment invoice, the supplier deducts VAT on goods returned by the simplifier.

If the simplifier returns all the goods received under the invoice, then the supplier registers his invoice in the purchase book, which he compiled when shipping the goods to the buyer. That is, the supplier does not even need to issue an adjustment invoice.

Please note that the tax accounting of a simplifier does not reflect the return of a defective product (if it was purchased for resale):

- the cost of returned goods is not taken into account in the costs of the simplifier, since their return does not equate to a sale;

- money received from the supplier for returned goods does not need to be included in income.

And if a simplifier who uses the “income-expenditure” simplified tax system returns defective raw materials and materials to the supplier, then the situation changes. Let us remind you that the cost of raw materials and materials is taken into account as part of material costs as soon as the raw materials and materials are received and paid for. The amount of VAT on them is also written off as expenses. Therefore, in this case, the simplifier must reduce the amount of previously recognized expenses by the cost of the returned raw materials and materials. After all, these expenses can no longer be called economically justified. It is also necessary to restore the amounts of the “accompanying” value added tax.

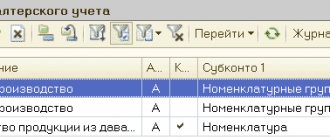

VAT on inventories

Working on the simplified tax system, the company acquires materials for production, goods, work and services.

It includes input VAT on materials in “simplified” expenses in full in the period when the materials are paid to the seller and posted to the warehouse. The company includes input VAT on goods purchased for resale in expenses in proportion to the cost of goods paid to the seller and shipped to the buyer.

However, the organization may not use part of the resources during the period of work under the “simplified” tax regime, and will do this under the general tax regime. Since inventories were not included in expenses when calculating the single tax, the company has the right to deduct VAT on them when it becomes a tax payer. This allows you to do this in paragraph 6 of Article 346.25 of the Tax Code.

The fact is that the resources will now be used in operations subject to VAT. Such a deduction can be applied from the first quarter, in which work on the general mode is resumed (letter of the Ministry of Finance of the Russian Federation dated March 15, 2011 No. 03-07-11/53).

In its later letter dated December 30, 2015 No. 03-11-06/2/77709, the Ministry of Finance confirmed this position. A former “simplified” person can deduct input VAT on goods purchased during the period of application of the simplified tax system, but not used in work under the special regime, after the transition to the general taxation system. Provided that he did not write off these amounts as expenses taken into account when calculating the “simplified” tax.

A more complex option is also possible, when a company buys inventories under the general regime, accepts VAT on them for deduction, and then becomes a payer of the simplified tax system. The company recovers the deductible VAT and takes it into account as part of other expenses. At the same time, part of the goods purchased under the general regime of activity, and the other - after returning to the general taxation system.

In this situation, be careful: it will not be possible to deduct the restored VAT on inventories that were not used while working on the simplified system. Since this is not provided for by the Tax Code.

Such explanations are given by financiers in letters dated June 23, 2010 No. 03-07-11/265, dated January 27, 2010 No. 03-07-14/03, dated June 30, 2009 No. 03-11-06/3/174.

But in letter dated March 26, 2012 No. 03-07-11/84, the financial department considered a different situation. A company that operated under the general taxation regime restored VAT when switching to the simplified tax system, but did not take it into account in other expenses. However, even in this case, financiers argue: VAT restored during the transition to the simplified tax system and not included in other expenses will not be deducted when returning to the general regime.

EXAMPLE In November last year, Progress JSC, working in general mode, bought for 118,000 rubles.

(including VAT - 18,000 rubles) goods. We didn’t have time to sell them last year. I’ve been working in this mode for six months since the beginning of this year. During this time, goods worth 60,000 rubles were sold. Then the company was forced to return to paying regular taxes. The accountant reflected transactions with this batch of goods with postings: in November DEBIT 41 CREDIT 60

- 100,000 rubles.

(118,000 – 18,000) – goods are accepted for accounting; DEBIT 19 CREDIT 60

– 18,000 rub.

– VAT on goods is taken into account; DEBIT 68 CREDIT 19

– 18,000 rub.

– accepted for deduction of VAT on goods; DEBIT 60 CREDIT 51

– 118,000 rub.

– goods have been paid to the supplier; December 31 DEBIT 19 CREDIT 68 subaccount “VAT calculations”

– 18,000 rubles.

– input VAT on goods has been restored; DEBIT 91-2 CREDIT 19

– 18,000 rub. – the restored VAT is written off as other expenses. An invoice for the amount of VAT equal to 18,000 rubles is entered into the sales book.

Return of low-quality goods

If the buyer discovers a defect in the product, he may ask:

- Replace it with a product of the same or another brand. If the price of the goods is different, then he pays extra or you return the difference to him.

- Reduce the price for which he bought the product.

- Eliminate product defects free of charge or reimburse the buyer for the costs of correcting them.

- Refunding money for an item is the most common problem.

If the customer knew about the defect when purchasing, you are not obligated to accept the product and return the money. For example, in some stores they sell discounted goods and immediately talk about its shortcomings. Then they cannot be a reason for a return.

To find out the reason for the marriage, you can conduct an examination at your own expense. If it turns out that the buyer himself damaged the goods, do not accept it back and ask for reimbursement of the cost of the examination. The buyer is obliged to do this.

Return of goods to supplier documentation 2021-2021

There is no need for any paperwork here. But in other circumstances, you need to know what documents are used to document the return of goods to the supplier. Please be aware that the buyer’s refusal to accept the goods for the reasons listed in the list means that the sales contract is terminated. Even if the contract did not specify the reasons for termination or was not drawn up in paper form at all, the buyer can still exercise this right, because this is provided for by Civil Law.

Based on the results of the on-site inspection, the Federal Tax Service assessed additional VAT, penalties and a fine to the company, indicating that the deduction was illegal, since there was no invoice from the buyer. Courts of three instances (case No. A41-53485/2021). 808 The individual entrepreneur (borrower), applying the general tax regime, entered into a trade loan agreement with a citizen of the People's Republic of China (lender), according to which the lender transfers 724 tons of soybeans to the entrepreneur, and the entrepreneur undertakes to later return the same amount of soybeans.

The position of the Ministry of Finance and the Federal Tax Service regarding the return of goods with VAT simplified

In all situations when it comes to returning goods, the Federal Tax Service and the Ministry of Finance of Russia use two concepts: return of goods and reverse sales. At the same time, according to both the financial and fiscal departments, the return of goods takes place if the goods and materials were not capitalized by the buyer. But if the goods were accepted for registration by the buyer and then returned to the seller, then reverse sales take place. And an agreement with the seller to return the goods if for some reason it was not sold is nothing more than a sale.

But such differences (return of goods or their resale) are important if the buyer is subject to the general taxation system.

For more information, see the material “What is the procedure for accounting for VAT when returning goods to a supplier?” .

However, the financial department has already explained more than once what to do if the goods are returned by a simplifier who does not apply the deduction because he is not a VAT payer.

The Ministry of Finance of Russia, in its letter No. 03-07-15/8473 dated March 19, 2013, clearly indicated that it does not matter what kind of goods the simplifier returns (posted or not), the procedure for issuing invoices for the seller will be the same.

The Federal Tax Service of Russia, in its letter dated May 14, 2013 No. ED-4-3/ [email protected], confirmed compliance with the standards specified by the Ministry of Finance. At the same time, the fiscal department reminded that the seller can apply a deduction for returned goods only for a year from the date of formalized refusal of the goods or its return by the buyer (clause 4 of Article 172 of the Tax Code of the Russian Federation).

Simplified taxation system, general concept

The simplified tax system is one of the taxation systems that can be used by both organizations and individual entrepreneurs, usually running small and medium-sized businesses, and also subject to certain conditions:

- The limited liability company should not contain other organizations that own more than 25% of the authorized capital

- An LLC does not have the right to open branches, but if it does, it is necessary to switch to another tax system

- The number of employees should not exceed one hundred people

- Income from activities per year no more than 150 million rubles

- You can also switch to this system if your income for nine months after submitting the application is no more than 112.5 million.

Important! This system may imply “income” or “income-expenses”. The difference is that if you use the simplified tax system for income, you pay 4% of all income to your current account (the rate depends on the region), and if you have income minus expenses, you have the right to deduct them from income.

The declaration under the simplified system is submitted to the tax office at the end of the year. Advance payments must be made quarterly, which are calculated using the formula .

Common cases of returning goods

According to the Civil Code, goods can be returned in the following cases:

- if the product was delivered of poor quality or not what was specified in the order

- if the goods were not paid within the period established by the contract

- According to the law, the goods are shipped when they are fully paid for

Returns can be made:

- in case of short delivery;

- deliveries with a violation of the assortment

- deliveries without proper packaging or in violation of the integrity of the packaging

- presence of marriage);

- shortage detection

- if the seller did not transfer accessories or documents related to the goods within the prescribed period.

Important! In any of the listed cases, the buyer has the right to refuse the goods and not pay its cost, but if there was an advance payment, the seller is obliged to return it to the buyer.

Returning unsold goods to the seller

The return to the supplier of unsold goods, to which the buyer has no quality claims, is a sale under the purchase and sale agreement, in accordance with Article 454 of the Civil Code of the Russian Federation, since in this situation the supplier organization, for its part, complies with all the terms of the supply agreement, in particular the quality of the goods meets the requirements specified in the contract.

In this case, the buyer, who has become a seller upon return, first reads out the “input” VAT when purchasing the goods, and then puts the same amount of VAT to be charged when selling the goods (returning unsold goods). The former seller, on the contrary, first charges VAT payable to the budget when selling goods, and then deducts it when goods are received.

The buyer applies a simplified taxation system.

If the buyer applies a simplified taxation system and therefore is not a VAT payer, therefore, when returning unsold goods, VAT is not charged and no invoice is issued.

In this case, the original seller of goods loses VAT, since when selling goods, VAT was paid to the budget, and when receiving unsold goods back, he cannot deduct VAT, since there is no invoice.

However, if the buyer decides to highlight the VAT amount as a separate line in the shipping documents and issue an invoice when returning unsold goods to his seller, then the purchasing organization using the simplified taxation system must take into account the following:

firstly: according to subparagraph 1, paragraph 5 of Article 173 of Chapter 21 of the Tax Code of the Russian Federation, it is necessary to pay VAT to the budget;

secondly: the amount of VAT paid to the budget is not recognized as an expense for tax purposes, since organizations using the “simplified tax” are not recognized as VAT payers, with the exception of VAT when importing goods into the territory of the Russian Federation, therefore, when calculating the single tax, the amount of VAT paid cannot be included included in expenses in accordance with subparagraph 22 of paragraph 1 of Article 346.16 of Chapter 26.2 of the Tax Code of the Russian Federation.

The Ministry of Finance holds a similar point of view on this issue. For example, the letter of the Ministry of Finance of the Russian Federation dated April 16, 2004 No. 04-03-11/61 states that the amounts of value added tax allocated in invoices issued to buyers of goods (works, services) at their own request by organizations applying the simplified taxation system and paid by them to the budget should not be taken into account when determining the object of taxation for a single tax as part of expenses.

Book of accounting of income and expenses of the purchasing organization “A”

Income and expenses

(Section I)

| Registration | Sum | |||||

| № p/p | Date and number of the primary document | Contents of operation | Income Total | Including income taken into account when calculating the single tax | Expenses Total | Including expenses, taken into account when calculating the single tax |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1 | 15.05.04 №17 | The goods have been paid for and received | 15,000 rubles | 15,000 rubles | ||

| 2 | 15.05.04 №17 | VAT on paid and capitalized goods | 2,700 rubles | 2,700 rubles | ||

| 3 | 30.05.04 №78 | Received from the supplier for returned goods, including VAT 18% | 17,700 rubles | 17,700 rubles | ||

| 4 | 30.05.04 №133 | VAT paid to the budget | 2,700 rubles | |||

| Total for 1st half of the year | 17,700 rubles | 17,700 rubles | 20,400 rubles | 17,700 rubles | ||

The seller uses a simplified taxation system.

If the seller applies a simplified taxation system and therefore is not a VAT payer, therefore, when selling goods, the VAT amount in shipping documents is not allocated as a separate line and an invoice is not issued. In this regard, when returning unsold goods, the buyer of goods loses VAT, since when purchasing the goods, VAT was not paid to the budget, therefore, there is no “input” VAT, and when transferring unsold goods back, the organization must charge VAT to the budget, since it is a payer VAT.

Example.

Seller organization "A", using a simplified taxation system, sold goods under a sales contract in the amount of 11,800 rubles to buyer organization "B", which is under the regular taxation system. On May 27, 2004, organization “B” returns all unsold goods to organization “A”. The return was agreed upon by the parties, there are no quality claims. At the time of return the goods had not been paid for. On May 30, 2004, organization “B” sent a letter to organization “A” with a request to offset mutual claims in the amount of 11,800 rubles.

Book of accounting of income and expenses of the selling organization “A”:

Income and expenses

(Section I)

| Registration | Sum | |||||

| № p/p | Date and number of the primary document | Contents of operation | Income Total | Including income taken into account when calculating the single tax | Expenses Total | Including expenses, taken into account when calculating the single tax |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1 | 30.05.2004 №72 | Income from the sale of goods – offset of mutual claims | 11,800 rubles | 11,800 rubles | ||

| 2 | 30.05.2004 №72 | The goods were received from the supplier and paid by offsetting mutual claims | 10,000 rubles | 10,000 rubles | ||

| 3 | 30.05.2004 №72 | VAT on goods received from the supplier and paid by offsetting mutual claims | 1,800 rubles | 1,800 rubles | ||

| Total for 1st half of the year | 11,800 rubles | 11,800 rubles | 11,800 rubles | 11,800 rubles | ||

Accounting for transactions with purchasing organization “B”:

| Account correspondence | Amount, rubles | Business transaction | ||

| Debit | Credit | |||

| The product was purchased from a seller who applies a simplified taxation system | ||||

| 41 "Products" | 60 “Settlements with suppliers and contractors” | 11 800 | Received goods from supplier | |

| Returning unsold goods to the seller | ||||

| 62 “Settlements with buyers and customers” | 90/1 “Revenue” | 11 800 | *Proceeds from sales of goods | |

| 90/2 “Cost of sales” | 41/1 “Goods in warehouses” | 11 800 | The purchase price of the goods has been written off | |

| 90/3 "VAT" | 68 "VAT" | 1800 | VAT charged | |

| 60 “Settlements with suppliers and contractors” | 62 “Settlements with buyers and customers” | 11800 | Settlement of mutual claims | |

Please note that when monitoring the completeness of tax calculation, tax authorities have the right to check the correctness of the application of transaction prices in the event that, within a short period of time, the prices applied by the taxpayer for identical (similar) goods deviate by more than 20 percent upward or downward from the level of prices used by the taxpayer for identical (homogeneous) goods (subclause 4 of clause 2 of Article 40 of the Tax Code of the Russian Federation). At the same time, tax authorities may simultaneously refuse to take into account for income tax the negative difference between sales income and purchase price, as it is not economically justified.

In order for the purchasing organization to avoid paying VAT on returned goods for which there are no quality claims, we recommend concluding a purchase and sale agreement with a special transfer of ownership or a commission agreement if the seller of the goods is organizations or individual entrepreneurs using a simplified system.

Return of quality goods

If a quality product does not suit the buyer in color or size, he can ask to exchange it for a suitable product. You may have three reasons for refusal:

- More than 14 days have passed since the date of purchase.

- The product has lost its appearance. For example, a customer brought shoes with worn soles or a shirt without a button.

- The product cannot be exchanged or returned by law. For example, cosmetics, underwear or jewelry. Remember that you can refuse for this reason only if the product is of high quality. List of goods that cannot be returned

If there are no reasons for refusal, you must exchange the product for one suitable for the buyer. And in his absence - return the money.

Returning goods from a simplifier

In Chapter 21 of the Tax Code of the Russian Federation there are no exceptions for the procedure for sellers to apply deductions when returning goods from a buyer who is on a simplified taxation system and therefore is not a VAT payer. To explain to taxpayers how to proceed in this situation, the Ministry of Finance has provided two options for the development of events, regardless of whether the goods accepted or not accepted for accounting by the buyer are returned (letter No. 03-07-15/8473):

- when the buyer returns the entire product;

- when the buyer returns the goods partially.

The seller has the right to a deduction in accordance with clause 5 of Art. 171 Tax Code of the Russian Federation. In the purchase book, he makes an entry either on the basis of a previously issued invoice or on the basis of an adjustment invoice. This will be discussed in more detail below.

Find out how to keep VAT records in a simplified manner here.

Full refund

In this case, the financial department (and after it the Federal Tax Service of Russia) recommends that the seller be guided by the standards specified in clause 5 of Art. 171 Tax Code of the Russian Federation. In this case, the invoice registered by the seller in the sales book when shipping goods is registered by him in the purchase book as the right to tax deductions arises, taking into account the provisions of clause 4 of Art. 172 of the Tax Code of the Russian Federation.

We will tell you more about the sales book and the purchase book here.

Return in parts

If the delivered goods are not returned in their entirety, but only in some part (and the reason for the return is unimportant), then there is a decrease in the quantity, and therefore in the cost, of previously shipped goods. This means, in accordance with paragraph 13 of Art. 171 and paragraph 10 of Art. 172 of the Tax Code of the Russian Federation, the seller must issue an adjustment invoice when returning goods from a buyer who is not a VAT payer.

Find out about the adjustment invoice from the article “What is an adjustment invoice and when is it needed”.

The value indicated on the adjustment invoices must correspond to the amount for which the goods were returned from the buyer.

It is important that the buyer registers the returned goods and prepares the necessary supporting documents.

VAT on non-current assets

According to tax authorities, the fate of VAT on fixed assets and intangible assets depends on the period of their purchase (creation, construction, etc.):

- before switching to “simplified”;

- while working on "simplified".

The asset was purchased before the transition to the simplified system

Suppose a company acquired a non-current asset using the general taxation system. On the eve of the transition to the “simplified” system, she restored the input VAT, writing it off as other expenses.

If a company, having worked under the simplified system, decides to return to the general taxation system, it will not be able to deduct the previously restored VAT. This conclusion is made by specialists from the Ministry of Finance in letters dated June 23, 2010 No. 03-07-11/265, dated January 27, 2010 No. 03-07-14/03, dated June 30, 2009 No. 03-11-06/3/174 . This point of view is also supported by the judges. In the resolution of the FAS of the East Siberian District dated February 10, 2010 in case No. A33-8485/2009, they indicate: since the amounts of VAT on goods and fixed assets restored during the transition to the special regime were taken into account in other expenses in accordance with Article 264 of the Tax Code, The company does not have the right to deduct taxes.

Nevertheless, both in this situation and in the situation with the restored tax on mineral production, the position of financiers is not indisputable.

The Tax Code contains general conditions for deducting VAT. With regard to the tax previously restored during the transition to the simplified tax system, the code does not provide for any special features. When returning from the special regime to the general regime, the company again begins to use goods or fixed assets in activities subject to VAT. As a result, the right to deduction arises. In addition, there is no prohibition in the Tax Code on re-deducting a tax that was previously restored.

Let us note that earlier financiers expressed the opposite point of view. In a letter dated April 16, 2004 No. 04-03-11/61, they indicated that VAT, previously accepted for deduction, but restored during the transition to the simplified tax system, in the event of a transition to the general regime and the use of goods, works, services for taxable transactions tax is deductible. In this case, the calculation of the amount of VAT subject to deduction on depreciable property is made taking into account the residual value of such property.

So, if a company, when returning to the general taxation regime, declares for deduction of VAT on goods (including non-current assets), previously restored during the transition to the simplified tax system, then disagreements with the inspectors are possible. She will most likely have to defend her right to deduct taxes in court.

Return of goods under simplification

In this case, the buyer, who has become a seller upon return, first reads out the “input” VAT when purchasing the goods, and then puts the same amount of VAT to be charged when selling the goods (returning unsold goods). The former seller, on the contrary, first charges VAT payable to the budget when selling goods, and then deducts it when goods are received.

In this case, the original seller of goods loses VAT, since when selling goods, VAT was paid to the budget, and when receiving unsold goods back, he cannot deduct VAT, since there is no invoice.

Return

Before raising the issue of VAT refund under the simplified tax system, you should first understand the issue of its refund in general. Value added tax is a fee for the opportunity to put a markup on a product or service.

Thanks to this, the profit of the legal entity increases and working capital increases. But the end consumer pays this tax, since it is included in the price of the product or service. An entrepreneur, when filling out a tax return, sets the amount of this tax for refund.

If one party to the transaction works according to the simplified tax system, then the second will not be able to submit VAT for refund, since it is not in the estimate or in the invoice for payment. There are cases when an enterprise with a simplified tax system enters VAT into an invoice or estimate so that the transaction partner can accept it for deduction.

Failure to pay this tax and file a return may result in a fine. Today, there are many examples where such manipulations led not only to fines, but also to more serious consequences, especially when it came to large transactions.

To protect yourself when working with a counterparty, it is better for an entrepreneur with a simplified tax system to request a written application for the inclusion of VAT in the invoice from the transaction partner. Arbitration practice has already encountered cases where the absence of such a letter led to undesirable consequences.

Reflection in accounting

In the event of returning goods that have not been received by the buyer, the seller makes adjustments in accounting:

Dt 62 Kt 90 (reversal) - revenue from the sale of low-quality goods has been reduced;

Dt 90 Kt 41 (reversal) - the cost of low-quality goods has been reduced;

Dt 90 Kt 68.2 (reversal) - reduced VAT on shipped low-quality goods;

Dt 62 Kt 51(50) - the buyer’s money was returned.

If a quality product that has been accepted by the buyer for registration is returned, the following entries are used:

Dt 41 Kt 60 - the seller accepted the goods returned by the buyer for registration;

Dt 19 Kt 60 - VAT included;

Dt 62 Kt 51 - the seller returned the money to the buyer for the returned goods;

Dt 60 Kt 62 - debt adjustment.

The following materials will tell you about the nuances of using the simplified tax system:

- “Is a cash register needed under the simplified tax system in 2019?”;

- “The Ministry of Finance denies individual entrepreneurs using the simplified tax system the right to accept business travel expenses”;

- “They want to allow simplifiers not to submit reports.”

Buyer refund rules

How to correctly issue a refund to a buyer depends on when he contacted you.

Return on the day of purchase

If the customer paid in cash, give him the money directly from the cash register drawer. When paying for goods by card, refunds are also made by bank transfer - just cancel the transaction. In both cases, do not forget to punch the check at the cash register with the sign “return of receipt”.

Return another day

If the customer returns the item on another day, money cannot be taken from the cash register drawer. Issue money from the main cash register - this is what all cash in the organization is called. If you have an LLC, write out an expense cash order or RKO. Individual entrepreneurs do not need to do this, since they are not required to observe cash discipline.

Read more about this in the article “Cash discipline”

If the buyer paid for the goods using a bank card, return the money back to it. In this case, cash cannot be issued; this is prohibited by the Directive of the Central Bank of the Russian Federation. How exactly to return money to the buyer’s card, check with the support of the bank with which you have an acquiring agreement. If you cannot return the money back to the card, withdraw the money from the current account and return it to the buyer.