Providing explanations to the tax office regarding 6-NDFL

Form 6-NDFL is submitted by tax agents quarterly, starting from 2021 (Order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11/450). After checking the received Calculation, if inconsistencies, inaccuracies or errors are detected, tax authorities can send a request for clarification, which requires a response, or for making corrections to the Calculation. Explanations regarding 6-NDFL must be provided to the tax office no later than 5 working days after receiving the request (clause 3 of Article 88 and clause 2 of Article 105.29 of the Tax Code of the Russian Federation).

There is no set form for drawing up explanations, so they can be drawn up in any form. It is important that the explanations are convincingly formulated and justified.

6-NDFL: to provide or not

Submission of the 6-NDFL calculation is the responsibility of tax agents (Article 226 of the Tax Code of the Russian Federation). To begin to fulfill this responsibility, you must:

- be a company, individual entrepreneur, a person who has established a law office, a separate division of a foreign or domestic company;

- issue income to individuals during the reporting period.

ATTENTION! Starting from the report for the 1st quarter of 2021, 6-NDFL is submitted using a new form. It is radically different from the previous one.

For more details on changes to Form 6-NDFL, see the Review from ConsultantPlus. You can get trial access to K+ for free.

For details of the duties and responsibilities of tax agents for personal income tax, see the article “Tax agent for personal income tax: who is, responsibilities and BCC” .

For tax agents, presentation of 6-NDFL:

- it is absolutely mandatory if at least one payment was made to an individual during the reporting period (the amount does not matter);

- it is possible (but not necessary) if payments were not made (in a situation of lack of staff, financial difficulties, etc.) - in the form of a zero calculation.

In the first case, failure to submit 6-NDFL within the time limits stipulated by the Tax Code of the Russian Federation may lead to 2 troubles: a fine and (or) blocking of the account.

K+ experts explained in detail how long it will take for the tax inspectorate to make a decision to suspend transactions on accounts. Get trial online access to K+ for free and proceed to the explanations.

The second situation is not a reason for negative consequences, however, various kinds of “tax surprises” can introduce chaos and confusion, which can temporarily deprive the company of the ability to function normally.

Some of these surprises include:

- high probability of rejection of zero 6-personal income tax by software at the stage of receipt of the report by tax authorities;

- factors of objective (for example, software failure) and subjective (for example, an inspector making an erroneous decision) properties.

In this situation, the suspension of account transactions may prevent the tax agent from functioning normally if the inspectors do not receive 6-NDFL from him.

Read more in the article “Is it possible to avoid blocking an account for failure to submit 6-NDFL?” .

Additional insurance, which will be discussed in the next section, will help you avoid negative consequences.

Explanations to the tax office: errors 6-NDFL

Before submitting 6-NDFL, the calculation must be checked for compliance with the control ratios (letter of the Federal Tax Service of the Russian Federation dated March 13, 2017 No. BS-4-11/4371). If this is not done, the camera will reveal, for example, a discrepancy between the 6-NDFL calculation data and the 2-NDFL certificates, or other violations due to which the calculation will not be accepted by the inspectorate. The list of main violations in form 6-NDFL was recently published by the Federal Tax Service of the Russian Federation in letter dated November 1, 2017 No. GD-4-11/22216.

A common reason for tax authorities to request clarification is a technical error in the calculation. The tax agent may make a simple typo that will distort the indicators and lead to logical inconsistencies. For example, when entering the amount of tax deductions, an extra zero was indicated, and as a result, the deductions exceeded the amount of income.

In addition to explanations to the tax office regarding 6-NDFL, a sample of which we provide, you must submit to the Federal Tax Service a corrected form with updated indicators.

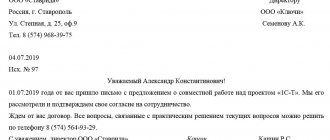

To the Head of the Federal Tax Service of Russia No. 43 for Moscow

Ref No. 12/34 dated 11/19/2017

Explanations

in the calculation we presented on form 6-NDFL for 9 months of 2017, a technical error was made - a typo, which resulted in a discrepancy: the amount of tax deductions on line 030 exceeded the amount of accrued income on line 020. Corrected calculation on form 6-NDFL for 9 months of 2021 submitted to the Federal Tax Service on November 19, 2017 (attached a copy).

Appendix: copy of the calculation in form 6-NDFL for 9 months of 2017

General Director Pavlov V.V. Pavlov

How often to submit a letter

The above letter can be written only once. In this case, the letter should indicate that the organization or individual entrepreneur will submit calculations in form 6-NDFL as soon as such an obligation arises.

However, an even more reliable option is possible - such a letter can be submitted to the inspectorate at the end of each reporting period. Thus, at the end of each reporting campaign, tax authorities will receive a “reminder” that there is no need to wait for 6-NDFL calculations from a company or individual entrepreneur.

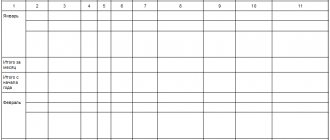

Let us remind you that the reporting periods for submitting 6-NDFL are as follows:

- I quarter;

- half year;

- nine month;

- year.

For example, you must submit 6-personal income tax for the 2nd quarter of 2021 no later than August 1, 2021. Accordingly, after August 1, 2021, you can submit such a letter to the Federal Tax Service.

Explanations if there are no errors in 6-NDFL

The Federal Tax Service can send a demand not only when obvious errors are detected, but also in a number of other cases. The reason for requesting clarification can be anything that interests the inspectors: a discrepancy between the amounts of withheld and transferred tax, withholding personal income tax earlier than the salary is paid, or the lack of transfer of tax to the budget, etc.

In this case, according to Form 6-NDFL, tax explanations are given without providing a “clarification”, because the report was drawn up correctly, but it is necessary to explain the reason for the situation that arose. For example, a discrepancy between the calculation and transfer of tax arose due to the fault of the bank, which did not transfer funds from the tax agent’s current account on time. To confirm your words, you need to attach all available documents (bank statements, copies of payment slips, etc.) to your explanations.

Explanation to the tax office for 6-NDFL: sample in the absence of data

When a company or individual entrepreneur does not make accruals and payments to individuals during the reporting year, they are not tax agents for personal income tax. In this regard, they do not have the obligation to submit tax reports, including zero calculation of 6-NDFL. Organizations and individual entrepreneurs are also not required to report this to the Federal Tax Service Inspectorate, but the inspectorate may well request clarification on this matter.

Here is an example of an explanation to the tax office for 6-NDFL in the absence of data to fill it out:

To the Head of the Federal Tax Service of Russia No. 47 for Moscow

Ref No. 12/34 dated 11/19/2017

Explanations

Volna LLC for the period from 01/01/2017 to 09/30/2017 was not a tax agent for personal income tax; personal income tax was not calculated, withheld and paid during the specified period.

In connection with the above, “Calculation of personal income tax amounts calculated and withheld by the tax agent” in form 6-NDFL for 9 months of 2021 was not provided.

General Director Lavrov A.M. Lavrov

Tax officials list common mistakes

Explanations were given by the Federal Tax Service in a letter dated July 21, 2017 No. BS-4-11 / [email protected] (for convenience, the terms have been corrected for the reporting period of 9 months - Editor’s note).

| Question | Answer |

| For promotional purposes, the company issues cash prizes to lottery participants. Prizes do not exceed 4 thousand rubles. Do I need to reflect these amounts in Form 6-NDFL? | According to the Tax Code of the Russian Federation, income not exceeding 4 thousand rubles received by a taxpayer during the tax period in the form of winnings and prizes in competitions, games and other events for the purpose of advertising goods (works, services) is not subject to personal income tax. In this regard, the organization has the right not to reflect in Form 6-NDFL the amount of cash prize received in promotions, not exceeding 4 thousand rubles per year. If the amount of the indicated income exceeds the specified limit, then it should be included in the calculation of 6-NDFL. |

| Is financial assistance for the birth of a child reflected in the first year after his birth in the amount of 5 thousand rubles in the 6-NDFL form? | Amounts of one-time payments (including in the form of financial assistance) to employees (parents, adoptive parents, guardians) at the birth (adoption) of a child, paid during the first year after birth (adoption), but not more than 50 thousand rubles per each child are not subject to personal income tax. In this regard, the employer has the right not to reflect the specified amount in 6-NDFL. |

| When is an income payment transaction considered completed for the purpose of reflecting it (filling it out) in the calculation using Form 6-NDFL? | Section 1 of the 6-NDFL calculation is compiled on an accrual basis for the first quarter, half year, 9 months and year. Section 2 reflects those transactions that were performed over the last 3 months of this period. If a tax agent performs an operation in one presentation period and completes it in another, then this operation is reflected in the presentation period in which it is completed. In this case, the operation is considered completed in the submission period, in which the deadline for transferring tax occurs in accordance with clause 6 of Art. 226 and paragraph 9 of Art. 226.1 Tax Code of the Russian Federation. Example. Payment of wages accrued for September 2021, actually paid on September 30, 2017 (refers to the presentation period for 9 months), with a transfer deadline of October 3, 2017, is reflected in section 2 of calculation 9 6-NDFL for 2017. |

| On May 5, 2017, a civil contract was concluded with an individual to carry out construction work. The acceptance certificate for works (services) was signed in June 2021, and the remuneration was paid in July 2021. In what period is this income reflected in the calculation using Form 6-NDFL? | The date of actual receipt of income in the form of remuneration for the provision of services under a civil contract is considered to be the day the money is paid. Tax agents are required to withhold personal income tax directly from the taxpayer’s income when paying them. In this case, the tax amount is transferred to the budget no later than the day following the day the income is paid. If the acceptance certificate of work (services) under a civil contract was signed in June 2021, and the remuneration was paid in July 2021, then this operation is reflected in sections 1 and 2 of the 6-NDFL calculation for 9 months of 2017. |

| An employee of the organization goes on vacation from 09/01/2017. Vacation pay for September 2021 was paid to the employee on August 25, 2017. How to reflect these amounts in the calculation using Form 6-NDFL? | The date of actual receipt of income in the form of vacation pay is the day they are paid. When paying benefits for temporary disability (including benefits for caring for a sick child) and vacation pay, tax agents are required to transfer personal income tax no later than the last day of the month in which such payments were made. If an employee’s vacation pay for September 2021 was paid on August 25, 2017, then this operation is reflected in sections 1 and 2 of the 6-NDFL calculation for 9 months of 2021. In section 2 for 9 months of 2021, this operation is reflected as follows: — line 100 indicates 08/25/2017; - on line 110 - 08/25/2017; - on line 120 - 08/31/2017; - on lines 130 and 140 - the corresponding total indicators. |

| During the time the employee is on a business trip, he is paid the average salary along with his salary. What date in the calculation of 6-NDFL on line 100 of section 2 should be indicated in relation to the amount of average earnings? | On a business trip, the employee performs job duties, and the average earnings for the days of the business trip are part of the salary. This means that the amount of average earnings accrued for the days of a business trip is recognized as the employee’s income on the last day of the month for which this income was accrued. It is this date that is reflected in line 100 of section 2 of the calculation in form 6-NDFL. |

| The organization, after submitting Form 6-NDFL to the Federal Tax Service for 9 months of 2021, discovered in the second quarter of 2021 an error leading to an underestimation of the amount of income, therefore, to an understatement of personal income tax. Is it necessary to submit a “clarification” for 6-NDFL for each submission period (for six months and 9 months)? | In this case, the tax agent should submit updated calculations for the six months and 9 months of 2017 to the tax authority. This is due to the fact that section 1 of the calculation in form 6-NDFL is compiled on an accrual basis. |

Source: Accountant Time

Explanation to the tax office regarding 6-NDFL

Calculation in form 6-NDFL is submitted by tax agents - organizations, individual entrepreneurs, notaries (engaged in private practice), lawyers (who have established law offices) and separate divisions of foreign companies in the Russian Federation that pay individuals the remuneration specified in paragraph 2 of Art. 226 of the Tax Code of the Russian Federation, and also withhold from this income and transfer it to the personal income tax budget (clause 1 of Article 226, clause 2 of Article 230 of the Tax Code of the Russian Federation).

Explanation to the tax office for 6-NDFL: sample

The calculation in form 6-NDFL is submitted to the Federal Tax Service at the place of registration of the tax agent for the 1st quarter, six months and 9 months no later than the last day of the next month, and a report on the results of the year - no later than April 1 of the next year (clause 2 of Article 230 Tax Code of the Russian Federation).

Moreover, if the last day for submitting Form 6-NDFL coincides with a weekend or holiday, then this day is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

If the average number of employees is less than 24 people inclusive, the calculation in form 6-NDFL can be submitted in paper form; if the average number of employees is 25 people or more, the report is submitted only electronically via telecommunication channels (clause 2 of Article 230 of the Tax Code of the Russian Federation).

For violation of the procedure for submitting a report in electronic form, liability is provided in the form of a fine in the amount of 200 rubles (Article 119.1 of the Tax Code of the Russian Federation).

For failure to submit a 6-NDFL calculation within the prescribed period, liability is provided in the form of a fine in the amount of 1,000 rubles for each month (full or incomplete) from the day established for submitting the report (clause 1.2 of Article 126 of the Tax Code of the Russian Federation).

Letter dated 08/01/2016 No. BS-4-11/ [email protected]

The Federal Tax Service sends for use in the work clarifications on the issues of submitting and filling out the form for calculating the amounts of personal income tax calculated and withheld by the tax agent (Form 6-NDFL).

Please bring this letter to the lower tax authorities.

Acting State Advisor of the Russian Federation, 2nd class S.L. Bondarchuk

Question 1. Are organizations and individual entrepreneurs required to submit a “zero” calculation of the amounts of personal income tax calculated and withheld by the tax agent in Form 6-NDFL (hereinafter referred to as calculation in Form 6-NDFL)?

Answer:

If a Russian organization and individual entrepreneur do not have employees and do not pay income to individuals, then the obligation to submit a calculation in Form 6-NDFL does not arise.

Rationale:

Paragraph 1 of Article 226 of the Tax Code of the Russian Federation (hereinafter referred to as the Code) provides that Russian organizations, individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices, as well as separate divisions of foreign organizations in the Russian Federation, from which or as a result of relations with which the taxpayer received the income specified in paragraph 2 of Article 226 of the Code, are recognized as tax agents in relation to such income paid to an individual, and are obliged to calculate, withhold from the taxpayer and pay the amount of tax calculated in accordance with Article 224 of the Code.

In addition, paragraph 2 of Article 2261 of the Code lists persons who are recognized as tax agents when carrying out transactions with securities and operations with financial instruments of futures transactions, when making payments on securities for the purposes of this article, as well as Articles 2141, 2143 and 2144 of the Code .

According to paragraph 3 of paragraph 2 of Article 230 of the Code, tax agents submit to the tax authority at the place of their registration a calculation of the amounts of personal income tax calculated and withheld by the tax agent (hereinafter referred to as the calculation in form 6-NDFL), for the first quarter, half a year, nine months - no later than the last day of the month following the corresponding period, for the year - no later than April 1 of the year following the expired tax period, in the form, formats and in the manner approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] “On approval of the form for calculating the amounts of personal income tax calculated and withheld by the tax agent (form 6-NDFL), the procedure for filling out and submitting it, as well as the format for presenting the calculation of the amounts of personal income tax calculated and withheld by the tax authority agent, in electronic form."

Thus, the obligation to submit to the tax authority at the place of their registration a calculation in Form 6-NDFL arises for organizations if they are recognized as tax agents in accordance with Article 226 of the Code and paragraph 2 of Article 2261 of the Code.

Question 2. A former employee of the organization received income in kind on June 1, 2021. The organization does not produce any other income for the benefit of this person. How to fill out the calculation on form 6-NDFL when paying income in kind?

Answer:

If an employee is paid income in kind on 06/01/2016, then this operation is reflected in lines 020, 040, 080 of section 1 and lines 100 - 140 of section 2 of the calculation in form 6-NDFL for the half-year of 2021.

In section 2 of the calculation in form 6-NDFL for the first half of 2021, this operation should be reflected as follows:

line 100 indicates 06/01/2016;

on lines 110, 120 – 00.00.0000;

on line 130 - the corresponding total indicator;

on line 140 – 0.

Question 3. What amounts should be included in line 030 “amount of tax deductions” of section 1 of the calculation in form 6-NDFL?

Answer:

Line 030 “Amount of tax deductions” is filled in according to the values of codes for types of taxpayer deductions approved by Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected] “On approval of codes for types of income and deductions.”

Question 4. Are income that is not subject to personal income tax subject to reflection in line 020 “Amount of accrued income”?

Answer:

The calculation according to Form 6-NDFL does not reflect income that is not subject to tax on the income of individuals listed in Article 217 of the Code.

Question 5. What amounts must be reflected in line 080 “the total amount of tax not withheld by the tax agent on an accrual basis from the beginning of the tax period” of section 1 of the calculation in form 6-NDFL?

Answer:

Line 080 “total amount of tax not withheld by the tax agent on an accrual basis from the beginning of the tax period” of section 1 of the calculation in Form 6-NDFL indicates the total amount of tax not withheld on the reporting date by the tax agent, on an accrual basis from the beginning of the tax period, taking into account the provisions paragraph 5 of Article 226 of the Code and paragraph 14 of Article 2261 of the Code.

This line reflects the total amount of tax not withheld by the tax agent from income received by individuals in kind and in the form of material benefits in the absence of payment of other income in cash.

Question 6. How to reflect the calculated amount of personal income tax on wages accrued for June, but paid in July,

on lines 070 and 080 of section 1 of the calculation in form 6-NDFL for the first half of 2021?

Answer:

Line 070 “Amount of withheld tax” of Section 1 indicates the total amount of tax withheld by the tax agent, cumulatively from the beginning of the tax period. Line 080 “Amount of tax not withheld by the tax agent” of Section 1 indicates the total amount of tax not withheld as of the reporting date by the tax agent, cumulatively from the beginning of the tax period, taking into account the provisions of paragraph 5 of Article 226 of the Code and paragraph 14 of Article 2261 of the Code.

Since the withholding of the amount of tax on income in the form of wages accrued for June, but paid in July, the tax agent must be made in July directly upon payment of wages (provided there are no income payments in January - June), in lines 070 and 080 of section 1 for the calculation of 6-NDFL for the first half of 2016, “0” is entered. This tax amount is reflected in line 040 of section 1 of the calculation in Form 6-NDFL for the first half of 2016.

At the same time, this tax amount must be reflected in line 070 of section 1, as well as the transaction itself in section 2 of the calculation in form 6-NDFL for the nine months of 2021.

Question 7. The procedure for submitting a calculation in Form 6-NDFL if the tax agent and its separate divisions (additional offices) are registered with one tax authority, but are located in different municipalities subordinate to this tax authority, since there are additional sheets for reflection of the line “Code by OKTMO” with different OKTMO is not provided

.

Answer:

The calculation in form 6-NDFL is filled out by the tax agent separately for each separate division, including those cases when separate divisions are registered with the same tax authority.

Rationale:

In accordance with the provisions of paragraph 2 of Article 230 of the Code, tax agents submit to the tax authority at the place of their registration a calculation in form 6-NDFL for the first quarter, six months, nine months - no later than the last day of the month following the corresponding period, for the year - no later April 1 of the year following the expired tax period, in the form, formats and in the manner approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

In accordance with paragraph 1 of clause 1.10 of section I of the Procedure for filling out and submitting the calculation in form 6-NDFL, approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] , the calculation form is filled out for each OKTMO separately.

Tax agents - Russian organizations with separate divisions submit calculations in form 6-NDFL in relation to employees of these separate divisions to the tax authority at the place of registration of such separate divisions, as well as in relation to individuals who received income under civil law contracts, to the tax office body at the place of registration of separate divisions that have entered into such agreements.

Tax agents - organizations classified as the largest taxpayers, having separate divisions, fill out the calculation in Form 6-NDFL separately for each separate division and submit it, including in relation to the employees of these separate divisions, to the tax authority at the place of registration as the largest taxpayer , or in relation to employees of these separate divisions to the tax authority at the place of registration of such a taxpayer in the corresponding separate division.

Question 8. An individual entrepreneur who combines two tax regimes - UTII and simplified tax system, has several retail outlets in different cities. An individual entrepreneur, as a payer of UTII, is registered with the Federal Tax Service at the place of trading activity for each outlet, and as a payer of the simplified tax system - at the place of residence of the individual entrepreneur. An individual entrepreneur has employees. Where should I pay personal income tax and, accordingly, submit a calculation using Form 6-NDFL?

Answer:

An individual entrepreneur carrying out activities using the simplified taxation system (hereinafter referred to as the simplified taxation system), transfers personal income tax on income paid to employees hired for the purpose of carrying out such activities to the budget at the place of residence of the individual entrepreneur, and on income paid to employees, those engaged in activities in respect of which the taxation system is applied in the form of a single tax on imputed income for certain types of activities (hereinafter referred to as UTII), transfers the personal income tax to the budget at the place of registration of the individual entrepreneur in connection with the implementation of such activities.

An individual entrepreneur carrying out activities using the simplified tax system submits a calculation in accordance with Form 6-NDFL in relation to employees hired for the purpose of carrying out such activities to the tax authority at the place of his residence, and in relation to income paid to employees engaged in activities in respect of which the taxation system in the form of UTII is applied, the calculation in form 6-NDFL is submitted to the tax authority at each place of registration of an individual entrepreneur in connection with the implementation of such activities.

Rationale:

In accordance with paragraph 7 of Article 226 of the Code, the total amount of tax calculated and withheld by the tax agent from the taxpayer, in respect of whom it is recognized as a source of income, is paid to the budget at the place of registration (place of residence) of the tax agent with the tax authority, unless another procedure is established by this point.

According to paragraph 4 of paragraph 7 of Article 226 of the Code, tax agents are individual entrepreneurs who are registered with the tax authority at the place of activity in connection with the application of the taxation system in the form of a single tax on imputed income for certain types of activities and (or) a patent taxation system, from the income of hired workers are required to transfer calculated and withheld tax amounts to the budget at the place of their registration in connection with the implementation of such activities.

Individual entrepreneurs are required to keep separate records of income received for each type of business activity.

At the same time, taking into account the provisions of paragraph 2 of Article 230 of the Code, tax agents - individual entrepreneurs who are registered with the tax authority at the place of activity in connection with the application of the taxation system in the form of UTII, submit a calculation of the amounts of personal income tax calculated and withheld by the tax authorities. agent (Form 6-NDFL), in relation to his employees hired for the purpose of carrying out such activities, to the tax authority at the place of his registration in connection with the implementation of such activities.

In accordance with paragraphs 1 and 5 of clause 1.10 of section II of the Procedure for filling out and submitting the calculation in form 6-NDFL, approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [ email protected] , the calculation form is filled out for each OKTMO separately.

Individual entrepreneurs who are tax agents who are registered at the place of carrying out their activities using the taxation system in the form of UTII for certain types of activities, indicate the OKTMO code at the place of registration of the individual entrepreneur in connection with the implementation of such activities; in relation to their employees, indicate the code according to OKTMO at the place of its registration in connection with the implementation of such activities.

Question 9. How to fill out the calculation using Form 6-NDFL if an anniversary bonus of 10,000 rubles was paid to an employee on May 20, 2016?

Answer:

If an employee received income in the form of an anniversary bonus in the amount of 10,000 rubles on May 20, 2016, then this operation is reflected in section 2 of the calculation in Form 6-NDFL for the first half of 2021 as follows:

line 100 indicates 05/20/2016;

on line 110 – 05/20/2016;

on line 120 – 05/23/2016 (taking into account paragraph 7 of Article 61 of the Code, the first working day following the day of tax withholding);

on line 130 – 10,000;

on line 140 – 1300.

Rationale:

In accordance with subparagraph 1 of paragraph 1 of Article 223 of the Code, the date of actual receipt of income is defined as the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties - when income is received in cash.

Thus, the date of actual receipt of income in the form of an anniversary bonus is defined as the day of payment of income in the form of an anniversary bonus to the taxpayer, including the transfer of income to the taxpayer’s bank accounts.

According to paragraph 4 of Article 226 of the Code, tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon their actual payment, taking into account the specifics established by this paragraph.

At the same time, tax agents are required to transfer the amounts of calculated and withheld tax no later than the day following the day of payment of income to the taxpayer (clause 6 of Article 226 of the Code).

Question 10. In May 2021, the employee was paid a salary of 10,000 rubles, a temporary disability benefit for the first three days was assigned at the expense of the employer of 1,000 rubles, at the expense of the Social Insurance Fund of the Russian Federation 2,000 rubles, an additional payment was accrued up to the average earnings for the period of incapacity. according to the collective agreement 2,000 rubles. No personal income tax deductions were provided. Personal income tax calculated on wages and additional payments amounted to 1,560 rubles. ((10000+2000)*13%). Personal income tax calculated on temporary disability benefits is 390 rubles. ((1000+2000)*13%).

In fact, wages and temporary disability benefits were transferred to the employee on June 15, 2016 in the amount of RUB 13,050. And also on June 15, 2016, personal income tax in the amount of 1,950 rubles was withheld and transferred to the budget. How to reflect these transactions in the calculation using Form 6-NDFL for the first half of 2021?

Answer:

The calculation according to Form 6-NDFL for the first half of 2021 is filled out as follows:

In section 1, transactions for the payment of income in the form of wages and temporary disability benefits are reflected in lines 020, 040, 070.

In this case, the operation to pay wages for May 2021 in section 2 is reflected on line 100 – 05/31/2016, on line 110 – 06/15/2016, on line 120 – 06/16/2016, on line 130 – 10000, on line 140 – 1300 .

The operation for the payment of temporary disability benefits in section 2 is reflected on line 100 - 06/15/2016, on line 110 - 06/15/2016, on line 120 - 06/30/2016, on line 130 - 3000, on line 140 - 390.

The operation to pay income in the form of an additional payment up to average earnings for the period of incapacity for work under a collective agreement in section 2 is reflected on line 100 - 06/15/2016, on line 110 - 06/15/2016, on line 120 - 06/16/2016, on line 130 - 2000, on line 140 – 260.

Rationale:

In accordance with paragraph 2 of Article 223 of the Code, the date of actual receipt of income in the form of wages is recognized as the last day of the month for which the taxpayer was accrued income for the performance of labor duties in accordance with the employment agreement (contract).

The date of actual receipt of income in the form of benefits for temporary disability, as well as in the form of additional payment up to average earnings for the period of incapacity for work under a collective agreement is determined in accordance with subparagraph 1 of paragraph 1 of Article 223 of the Code as the day of payment of these incomes, including the transfer of income to the taxpayer’s accounts in banks or on his behalf to third party accounts.

According to paragraph 4 of Article 226 of the Code, tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon their actual payment, taking into account the specifics established by this paragraph.

At the same time, tax agents are obliged to transfer the amounts of calculated and withheld tax no later than the day following the day of payment of income to the taxpayer. When paying a taxpayer income in the form of temporary disability benefits (including benefits for caring for a sick child) and in the form of vacation pay, tax agents are required to transfer the amounts of calculated and withheld tax no later than the last day of the month in which such payments were made (clause 6 of Article 226 of the Code ).

Question 11.

Is income in the form of temporary disability benefits accrued to the employee for June, but transferred on July 5, 2021, to be reflected in lines 020 and 040 of section 1 of the calculation in Form 6-NDFL for the first half of 2021?

Answer:

If income in the form of temporary disability benefits accrued to an employee for June is actually transferred in July, there are no grounds for reflecting this operation in lines 020 and 040 of the calculation in Form 6-NDFL for the first half of 2016. This operation is subject to reflection in section 1 of the calculation in form 6-NDFL for the nine months of 2021.

When filling out section 2 of the calculation in Form 6-NDFL for the nine months of 2021, the operation to pay the specified income in July is reflected as follows:

on line 100 – 07/05/2016;

on line 110 – 07/05/2016;

on line 120 – 08/01/2016 (taking into account paragraph 7 of Article 61 of the Code, the first working day following the deadline for tax transfer);

on lines 130, 140 - the corresponding total indicators.

Rationale:

In accordance with paragraph 3 of paragraph 2 of Article 230 of the Code, tax agents submit to the tax authority at the place of their registration a calculation in form 6-NDFL for the first quarter, six months, nine months - no later than the last day of the month following the corresponding period, for the year - not later than April 1 of the year following the expired tax period, in the form, formats and in the manner approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

Clause 1.1. The procedure for filling out and submitting the calculation of the amounts of personal income tax calculated and withheld by the tax agent in Form 6-NDFL, approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] established that the calculation in Form 6- Personal income tax is filled out on the basis of accounting data for income accrued and paid to individuals by a tax agent, tax deductions provided to individuals, calculated and withheld tax on personal income contained in tax accounting registers.

Section 1 of the calculation in form 6-NDFL is filled out with an accrual total for the first quarter, half a year, nine months and a year.

The date of actual receipt of income in the form of temporary disability benefits is the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties (subparagraph 1 of paragraph 1 of Article 223 of the Code).

According to paragraph 4 of Article 226 of the Code, tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon their actual payment, taking into account the specifics established by this paragraph.

When paying a taxpayer income in the form of temporary disability benefits (including benefits for caring for a sick child) and in the form of vacation pay, tax agents are required to transfer the amounts of calculated and withheld tax no later than the last day of the month in which such payments were made (clause 5 of Article 226 of the Code ).

Question 12. How to determine the period for which income was paid for the purposes of filling out form 2-NDFL and calculating 6-NDFL?

Answer:

The period for which income is paid is determined by the date of actual receipt of income, taking into account the provisions of Article 223 of the Code.

Example

:

— wages for December 2015 were paid to the employee in January 2021. The period for which the income was paid is December 2015;

— payment under a civil law agreement for services provided on 12/22/2015 was made on 02/01/2016. The period for which income was paid is February 2021;

— employee vacation pay for annual paid leave from 07/01/2016 to 07/14/2016 was transferred on 06/27/2016. The period for which income was paid is June 2021.

Explanation to the tax office for 6-NDFL: sample

If an organization (entrepreneur) does not accrue or pay income to individuals, then there is no need to submit Form 6-NDFL to the Federal Tax Service, since these companies (individual entrepreneurs) are not recognized as tax agents for personal income tax (Letter of the Federal Tax Service dated March 23, 2016 No. BS-4- 11/ [email protected] , Letter of the Federal Tax Service dated March 23, 2016 No. BS-4-11/4901, Letter of the Federal Tax Service of Russia dated May 4, 2016 No. BS-4-11/ [email protected] ).

However, the inspectors do not have information as to why the calculation in Form 6-NDFL was not submitted by the tax agent on time. And as a consequence of this, within 10 days after the day set for submitting the report, inspectors can block the bank account of the organization (IP) (clause 3.2 of Article 76 of the Tax Code of the Russian Federation).

To prevent disagreements with the tax authority and further blocking of the account, you should send an explanatory letter to the Federal Tax Service in any form indicating the reasons for not submitting the calculation in Form 6-NDFL.

If an organization (entrepreneur) decides to send a zero calculation of 6-NDFL to the tax authority, then the inspectors will accept the report in the prescribed manner (Letter of the Federal Tax Service of Russia dated May 4, 2016 No. BS-4-11 / [email protected] ). Although the presentation of a zero calculation of 6-NDFL is incorrect.

What even the tax authorities themselves doubt

After the introduction of Form 6-NDFL, the completion of which raises numerous questions, the Federal Tax Service issued a large number of letters of clarification. However, even fiscal officials cannot always immediately understand all the nuances of filling out this form.

The Federal Tax Service, in its letter No. ГД-4-11/ [email protected] dated 10/05/2017, admitted that it does not know how to fill out 6-NDFL in the event of a payment to a dismissed employee to recalculate the average earnings for the period he was on a business trip.

A company in which bonuses are sometimes awarded after the dismissal of employees turned to the tax authorities with a question.

For example, the date of dismissal and final payment of the employee is 01/15/2017; in the month of dismissal from January 11 to 12, 2021, the employee was on a business trip. During the final payroll calculation, the employee is accrued and paid for the time he was on a business trip (minus the withheld personal income tax) based on the average earnings calculated for the last 12 calendar months. Based on the order dated 02/25/2017, a bonus was paid (minus the withheld personal income tax) on 02/27/2017 based on the results of work for 2021. At the end of the reporting month, an additional calculation of the amount of average earnings for the time spent on a business trip is made, since at the time of the final calculation the amount of payment on average earnings was calculated without taking into account the bonus based on the results of work for the year (clause “n” clause 2, clause 15 of Regulation No. 922, Letter of Rostrud dated 05/03/2007 No. 1253-6-1). On March 10, 2017, the additional accrued amount was paid (minus the withheld personal income tax).

Tax officials responded that a request had been prepared to the Ministry of Finance regarding the issue of determining the date of actual receipt when an organization pays income in the form of average earnings during the employee’s stay on a business trip.

In this regard, regarding the reflection in section 2 of the calculation in Form 6-NDFL of the operation to pay a dismissed employee of the organization the additional accrued amount of average earnings for the time the employee was on a business trip, additional information will be provided.

Explanation as an inevitable document

After passing f. 6-NDFL, tax authorities study it without the presence of a company specialist. The tax inspector often has questions about the submitted document, or the company itself has discovered errors and inaccuracies in the report that has already been submitted.

It becomes inevitable to write a letter of explanation for the calculation of personal income tax.

The form of the explanation and its content are not regulated by either instructions or regulatory documents. There are also no methodological instructions. Therefore, an employee of the enterprise, most likely an accountant, has to independently generate the text.

It is necessary to write the explanation in such a way that the tax office no longer has any questions. You need to approach the formation of the text of a document from approximately the same positions as the motivation in the tax audit process.

Explanation of zero calculation

All tax agents provide the 6-NDFL calculation form. This need is enshrined in Art. 230 NK. Employers or customers who pay wages to their employees are tax agents.

If no payments were made during the reporting period, then f. There is no need to submit 6-NDFL. Indeed, in such a situation, companies or individual entrepreneurs no longer act as tax agents.

There is no need to send forms with zero indicators to the tax authorities. But it still won’t hurt to provide an explanation indicating the reasons for the absence of the document. This will serve as reinsurance against additional stress, the appearance of which is inevitable after communicating with the tax authorities.

The letter is drawn up in the following format:

To the Head of the Federal Tax Service of the Russian Federation No. 7

according to Saratov R. M. Revov

From

Address (legal, actual):

About the absence of the need to provide f. 6-NDFL for the first quarter of 2021

In the first quarter of 2021, there were no payroll payments or related deductions. Income tax was not transferred to the budget. Therefore, the company did not provide a calculation according to f. 6-NDFL for the first quarter of the current year.

Director ________________________________ P. A. Voitenkov

Explanation of calculations with errors

Tax inspectors, when checking F. 6-NDFL, compare the presented figures with previously submitted reports automatically. First of all, we study the indicators recorded in lines 070 and 120. The first indicates the amount of personal income tax, the second indicates the date of transfer to the budget.

When might questions arise from tax authorities? Possible situations are:

- The amount of tax withheld exceeds that paid to the budget.

- There is no personal income tax payment.

- Inaccuracies were found in the recording of details.

- Arithmetic or logical errors in calculations.

- The KBK was incorrectly indicated when transferring personal income tax.

- Dates in section two f. 6-NDFL are placed incorrectly.

When the tax agent agrees with the identified errors, he must prepare and submit an updated calculation within five working days. No further explanation is required.

Controversial points, inconsistencies or contradictions are best explained in writing. The explanatory note must be written correctly and provide justifications and arguments.

It is necessary to indicate the details of the company and the name of the manager. It is necessary to supplement the explanation with supporting documents. The more of them are presented, the easier it is to prove the company is right.

Care and accuracy when drawing up reports and explanatory notes will help avoid problems with the tax authorities.

Explanations to the tax office for 6-NDFL: sample 1

According to the 6-NDFL calculation, inspectors immediately figure out that the company paid the tax late. To do this, tax officials look at how much tax and what payment deadline the company has written down in lines 070 and 120. These indicators are compared with the amounts and dates of payments in the budget settlement card. If the tax withheld is more than the tax paid, inspectors require an explanation. You must answer in free form. See sample below.

Explanations to the tax office for 6-NDFL Sample 1

Limited Liability Company "Company"

Moscow, st. Basmannaya, 25

To the Head of the Federal Tax Service of Russia No. 1 for Moscow

Ref. No. 87 from 11/14/16

In response to the request for explanations dated November 11, 2016 No. 254, LLC "Company" reports.

We present an updated calculation in which personal income tax was excluded from the salary for September from line 070. At the same time, we inform you that we do not consider this procedure for filling out line 070 to be unreliable information, since in the order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] there are no clear rules for filling it out.

1. Copy of payment order for personal income tax payment No. 381 dated September 30, 2016.

2. Copy of the bank statement for 09/30/16.

General Director Astakhov I.I. Astakhov

Why do you need a letter about zero 6-personal income tax?

Let us say right away that the Tax Code of the Russian Federation does not provide for the sending or submission of any letters about zero calculations of 6-NDFL. However, the advisability of submitting such a letter is due to the following.

The fact is that without waiting for the calculation of 6-NDFL, the tax office has the right to block the current account of an organization or individual entrepreneur. Blocking is possible if the 6-NDFL calculation is not submitted within 10 working days from the date of the deadline for its submission (See “Penalties for late submission of 6-NDFL in 2021”). After all, the inspectorate simply will not know whether the organization or individual entrepreneur is a tax agent or whether they simply forgot to submit 6-NDFL.

Unfortunately, there is a possibility of such a development of events. And in order to protect the business, it makes sense to submit a free-form letter to the tax office, in which it is reported that the organization or individual entrepreneur has neither employees nor contractors and therefore 6-NDFL is not submitted.

Let's give an example of such a letter.

Explanations to the tax office for 6-NDFL: sample 2

The company may also have been confused about how to fill out the withheld tax in line 070 of the 6-NDFL calculation. First, the entire tax that was withheld until the date of the calculation was recorded in line 070. Then line 070 coincided with line 040 (calculated tax). Then the Federal Tax Service clarified that in line 070 it is necessary to fill out only the tax that the company withheld on the last day of the reporting period (letter dated May 24, 2016 No. BS-4-11/9194). The companies redid the reports, and lines 040 and 070 no longer matched. Now inspectors are demanding to know why. To answer the requirement, write explanations in free form.

Please note in your explanation that there are no errors in the calculation. And the numbers in lines 040 and 070 should not match. This follows from the control ratios (letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11/ [email protected] ).

Tell the inspectors that in line 040 the company recorded tax calculated on the income that employees received during the reporting period. Next, explain that in line 070 the company showed the tax that it withheld during the reporting period. For this reason, the numbers in lines 040 and 070 do not match. That is, explain why the information in lines 040 and 070 is different. Otherwise, if you simply say that there are no errors in the calculation, the inspectors will again demand an explanation.

In the explanations, it is worth giving a calculation of the difference and referring to letters from the Federal Tax Service on how to fill out lines 040 and 070. This way, inspectors will immediately see that everything is in order in the calculation and will not ask additional questions.

Explanations to the tax office for 6-NDFL Sample 2

Limited Liability Company “Company”

127138, Moscow, st. Basmannaya, 25

To the Head of the Federal Tax Service of Russia No. 8 for Moscow

Ref. No. 142/О from 09.08.16

about the different amount of tax in lines 040 and 070 of the 6-NDFL calculation

In accordance with the control ratios, the difference in the lines is not an error (letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11 / [email protected] ).

General Director I.I. Astakhov

Covering letter for the updated calculation of form 6-personal income tax - all about taxes

It is not always possible for even an experienced accountant to fill out 6-NDFL without a single mistake the first time. Unfortunately, they are difficult to avoid, and sometimes you become aware of them after sending the documentation to the tax office. In such a situation, the only way out is to adjust the 6-NDFL.

In what cases does adjustment not help?

There are a number of errors due to which it is subsequently necessary to urgently begin filling out the adjustment document. But there are also errors that cannot be corrected with the help of clarification. These include an incorrectly entered TIN, INFS code, and an error in specifying the period for which the form is filled out.

All these shortcomings are in fact serious errors, due to which the INFS will refuse to accept the primary report submitted to it. In this case, it is important for the employer to remember the reporting deadline. If there is the slightest delay in transferring documents to the tax office, a fine may be imposed on him.

For what errors is a clarification submitted for 6-NDFL?

In other cases, errors identified in the form can be corrected by clarification on 6-NDFL. It is worth noting that it will be better for the reporting person if all the shortcomings are identified by himself rather than later by the tax authorities. The reason for this is Art. 126 NK. It talks about the fine that must be assessed to the reporting person for providing false information.

You will have to fill out and send a corrective report to the tax office if the following errors were made in the main form 6-NDFL:

- Checkpoint . Such an error is not critical, so the Federal Tax Service will accept such a document. But care should be taken to provide updated information in a timely manner.

- OKTMO . A document from the Federal Tax Service Inspectorate may receive a document regarding its clarification only if this code is not included in the territory under the supervision of the Federal Tax Service Inspectorate. But if the specified code turns out to be within the scope of the INFS, then the reporting person expects an accrual that will be carried out by the INFS according to the previously incorrectly indicated OKTMO.

- If the company has separate divisions that are registered with one Federal Tax Service. Reporting should be completed for each division in a separate form. If information about all divisions located on the territory of one Federal Tax Service Inspectorate is provided in a single document, correction of the error is possible only through correction documents.

- Incorrectly reflected rates and providing them in undivided form . Information on different rates must be provided in different sheets of the report.

- The number of persons to whom certain types of payments were made by the company . As well as the withholding of taxes from them, which should have been carried out and transferred to the tax office within the time allocated for this. If such errors are identified, you should be prepared for claims that will definitely be brought by the Federal Tax Service due to inconsistency of the information included in the report.

Special situations and penalties

These include several types:

- If you mistakenly enter OKTMO , which is assigned to the territory under the supervision of the Federal Tax Service, to which the document was transferred, you should first take care of eliminating the possibility of accrual of the amount on it. To do this, using an erroneously entered code, a clarification with zero values is filled in. This measure allows you to cancel a previously entered erroneous code. Then it is advisable to also submit a letter to the Federal Tax Service Inspectorate, which should contain an explanation containing the reason for canceling the previously submitted report. At the same time, you should also try to submit the report with the OKTMO code entered correctly. Any delay in transmitting this document will result in a fine.

- In the event of an error manifested in combining information that must be divided into special divisions, the clarification is completed only in relation to the previously sent report. To other departments, reports are submitted in the primary version. The reports must be submitted on time; failure to comply with the deadline will result in a fine.

- Erroneous use of the right to fail to submit reports . This situation arises when an employer during a certain period does not have employees for whom income was previously paid, and he decides to exercise the right not to provide 6-NDFL. But for some reason, he lost sight of some types of accruals that were made during the reporting period. The reporting subsequently submitted by him will be primary. If the document is submitted after the allotted period, the employer will be required to pay a fine. You can insure yourself against such a nuisance by filing zero reports. In this case, the reporting will be accepted by the tax authorities, and if previously unaccounted income is identified, you can safely send an updated document.

When an adjustment is completed

The updated document has no differences from filling out the primary 6-NDFL. The whole point of the document is that the previously specified data is provided again, but in the correct form.

https://www..com/watch?v=FFU5tJ4EtDY

But when the 6-personal income tax adjustment must be submitted, how can you ensure that there is no penalty for the error? You need to detect the error yourself in a timely manner - before it is detected in the INFS. If, before checking a document with an error, a clarifying document is submitted to the INFS, the employer will be able to avoid punishment.

Excellent video about the updated adjustment declaration:

Source:

Sample explanation to the tax office for 6-NDFL

The employer, according to clause 2 of Art. 230 of the Tax Code of the Russian Federation, is obliged to submit a report in form 6-NDFL to the Federal Tax Service. If, for some reason, the employer did not provide the tax office with a calculation in Form 6-NDFL or errors were identified in the calculation, then he must provide an explanation to the tax office.

In what cases are explanations drawn up for the tax office regarding 6-personal income tax?

In the explanation, it is necessary to indicate an explanation of the reason for non-submission of reports or errors made in the provided calculation of 6-NDFL. Otherwise, the employer may be held accountable for failure to submit this report (clause 1.2 of Article 126 of the Tax Code of the Russian Federation) or seize the current accounts (clause 3.2 of Article 76 of the Tax Code of the Russian Federation).

Employers who, for any reason, did not start operations or ceased operations in the year preceding the reporting period are exempt from filing a report in Form 6-NDFL. Such employers do not have the data to fill out the form, but it is better for them to provide explanations to the tax office in order to avoid penalties.

The explanatory note is addressed to the head of the tax office. There is no strict form for drawing up an explanatory note to form 6-NDFL. The text of the explanatory note is drawn up arbitrarily, which reflects the reason why the employer did not submit a report in Form 6-NDFL for the reporting period or an explanation of the errors identified in the report.

Get 267 video lessons on 1C for free:

Further, the explanatory note is drawn up on letterhead, which reflects the basic data (full name, TIN, legal address, contact information), registered, signed by the head of the organization and certified with a seal.

You can submit an explanatory note to the tax office in different ways, for example:

- in electronic form via telecommunication channels (TCS);

- by mail (it is advisable to keep a copy of the explanatory note);

- take it to the tax office by hand or via courier.

The most common situations when an employer needs to provide an explanatory note are:

- inevitable document;

- explanations for the zero report;

- explanations of identified errors in the report;

- discrepancy in performance;

- discrepancy between the dates indicated in lines 100, 110 and 120;

- deadline for submitting the report and so on.

If a tax inspector identifies an error in the report, the employer can submit corrective reporting within five working days, in accordance with clause 3 of Art.

88 of the Tax Code of the Russian Federation, therefore, the employer is not obliged to present an explanatory note.

If the employer does not submit a corrective report or explanatory note within the specified period, then he may be fined 5,000.00 rubles, according to Art. 129.01 Tax Code of the Russian Federation.

In the case of a zero report, the tax office is obliged to accept such a report on the basis of letter No. BS-4-11/7928 of the Federal Tax Service of Russia dated May 4, 2016.

Sample explanations on 6-NDFL for the tax office

Let's take a closer look at the most common cases of explanations to the tax office regarding the calculation of 6-NDFL with samples of filling out:

- organizations that did not start operations in the reporting period:

- detection of errors in indicators in the calculation of 6-NDFL:

Source:

Explanation to the tax office regarding 6-NDFL: how to explain the discrepancies

The organization often receives requests from the tax office to provide explanations of discrepancies in the calculation of 6-NDFL. There are different situations when data inconsistencies, errors or inaccuracies may arise. Let's take a closer look at how to write an explanation to the tax office regarding 6-NDFL in 2021 if you find discrepancies and how to explain them.

Tax inspectors reconcile 6-NDFL as part of a desk audit. The report indicators are checked according to control ratios (Letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11 / [email protected] ). If there are discrepancies, the Federal Tax Service will request clarification or clarification. Submit your updated calculation if there really is an error. Otherwise, explain the reasons for the discrepancy in the letter.

Download a detailed example of filling out 6-NDFL>>>

Urgent news for all payroll accountants: the Ministry of Finance insists on personal income tax and contributions from accountable amounts. Read more in the Russian Tax Courier magazine.

Explanations on contradictions in 6-NDFL, which are not an error>>>

Letter to the tax office stating that there is no obligation to submit 6-NDFL>>>

How to write an explanation to the tax office regarding 6-NDFL in case of mistakes made

To draw up an explanatory note to the Federal Tax Service regarding 6-NDFL, you do not need to use any specific form; it does not exist. Everything is done in free form, but following several rules:

- The letter to the tax office must contain all the main details of the company (TIN, KPP, OGRN);

- Full name of the enterprise;

- Address at the place of registration and telephone number;

- Registration number, date of compilation, manager’s signature and seal (if any);

- In the explanatory note, briefly state the essence of the error and an explanation for it.

Below we will present to your attention samples of explanations to the tax office for 6-NDFL for frequently encountered situations.

Reason #1. How to explain discrepancies if tax has not been paid (error in payments, late transfer)

Inspectors may request clarification if the amount of the transferred tax does not correspond to the data in the payer’s personal card.

This may be an incorrect KBK, tax details, etc. In this case, it is necessary to clarify the payment by submitting an application and writing an explanation to the tax office under 6-NDFL for the tax not transferred on time:

explanations for incorrectly specified KBK>>>

Important ! If the OKTMO or checkpoint was indicated incorrectly, then you need to submit an updated calculation.

In addition, the tax may indeed not have been paid or paid later due to various circumstances, for example, there were no funds in the current account, then use the following template for explanations for 6-NDFL:

Download an explanation template for non-payment of personal income tax>>>

Reason #2. Incorrect dates in lines 100,110,120: preparing explanations for the tax office

Inspectors will request clarification if dates in the report in Section 2 are incorrect. However, in practice this means submitting an updated calculation. This is due to the fact that incorrectly indicated dates will be included in the settlement card and mutual settlements with the organization will be incorrect.

Source: https://nalogmak.ru/drugoe/soprovoditelnoe-pismo-k-utochnennomu-raschetu-formy-6-ndfl-vse-o-nalogah.html