In 2021, there were changes in accounting legislation, which partly affected the submission of financial statements in 2021. Its composition, submission deadlines (taking into account postponements due to coronavirus, quarantine and non-working days) and forms that can be downloaded are discussed in this consultation.

Also see:

- “Form of the balance sheet in 2021: changes”

- "Income Statement: Changes from 2021"

When are Forms 3, 4 and 6 of the balance sheet prepared?

Forms 3, 4 and 6 of the balance sheet are included in the annual financial statements and are appendices to its main forms (balance sheet and income statement):

- Form 3 - statement of changes in capital;

- Form 4 - cash flow statement;

- Form 6 - report on the intended use of funds.

The application forms, as well as the main forms of accounting, are approved by Order of the Ministry of Finance of Russia “On Forms of Accounting Reports of Organizations” dated July 2, 2010 No. 66n. The same document contains a rule establishing that in a simplified version of reporting, the required forms are a balance sheet, a report on financial results and a report on the intended use of funds, and explanations for them should be drawn up only if absolutely necessary (clause 6).

IMPORTANT! When preparing reports for 2021, keep in mind that accounting forms have changed. Key differences: reporting can only be prepared in thousands of rubles; millions can no longer be used as a unit of measurement. OKVED has been replaced by OKVED 2. For other changes, see here.

Read more about existing balance sheet options in the article “Balance Sheet (Assets and Liabilities, Sections, Types).”

Since the report on the intended use of funds (Form 6) is intended for use when there is a movement of funds for a very specific purpose, it is not always used. Thus, Forms 3, 4 and 6 may not be prepared by persons reporting under the simplified form.

For information about who can use simplified reporting, read the material “Simplified reporting for small businesses” .

But the set of reports generated according to its full version will include forms 3 and 4. In this case, Form 6 and other explanations will be issued if necessary.

ConsultantPlus experts provided step-by-step instructions for filling out appendices to financial statements. Get trial access to the K+ system and proceed to the financial statements manual for 2020.

Read about the principles that serve as the basis for the formation of accounting records in the article “What requirements should accounting records satisfy?” .

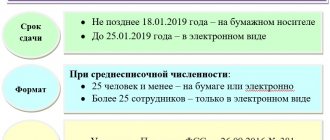

Due dates

Particular attention should be paid to reporting to tax authorities and statistics authorities on time in order to protect yourself from penalties provided for by the Code of Administrative Offenses of the Russian Federation. Reports for the past year should be submitted at the location of the organization no later than March 31 of the year following the reporting year. The deadline for submitting financial statements for 2021 is April 1, 2021, because... March 31, 2019 coincides with a public holiday.

Preparation of annual reports is a very responsible process that must be carried out in compliance with all rules and requirements established by law. Requirements are constantly changing, so it is extremely important to carefully monitor all innovations to avoid errors and violations. Remember that even if you did not conduct any activity, you are not exempt from filing zero reports.

To avoid mistakes and fines, as well as save a decent amount on a full-time accountant, we suggest turning to a team of qualified specialists for the preparation and submission of annual reports!

Select the required service and fill out the feedback form or call the number listed on the website - company employees will conduct an initial consultation and tell you about the further procedure.

Form 3 balance sheet

Form 3 of the balance sheet is the statement of changes in equity. It contains information about the equity capital of the organization, which includes (clause 66 of the PBU on accounting and accounting, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n):

- authorized (share) capital;

- Extra capital;

- Reserve capital;

- retained earnings;

- other reserves.

In addition, the report reflects information on own shares purchased from shareholders.

Form 3 consists of three sections:

1. Capital movement

This is a table that shows the change in the organization’s capital over 2 years (reporting and previous). It shows how the capital has changed (whether it has increased or decreased) and why the changes have occurred.

It's easy to fill out this section. First you need to indicate the balances as of December 31 of the year preceding the previous one. Then fill in the indicators for the previous year and display the capital balance as of December 31 of the previous year. Next, you need to reflect the movement and balance of capital at the end of the reporting year. Indicators are reflected in the corresponding columns and rows. For example, if there was an increase in additional capital due to a revaluation of property, the amount of the revaluation is reflected in the line “Revaluation of property” (column “Additional capital”).

2. Adjustments due to changes in accounting policies and correction of errors

The title of the section speaks for itself: it contains information about adjustments to the amount of capital caused by changes in accounting policies or associated with the correction of significant errors of previous years identified after the approval of last year’s financial statements. It is advisable to fill it out before section 1, since its data is used to determine the indicators of the first section.

3. Net assets

This contains information about the organization’s net assets for 3 years (the reporting year and the previous 2). The procedure for their calculation is determined by order of the Ministry of Finance of Russia dated August 28, 2014 No. 84n.

Read more about this procedure in the material “A new procedure for calculating net assets has been approved .

Form 3 can be found on our website using the link below:

Submission of annual reports

Reporting must be submitted to the tax service at the place of registration and to the territorial body of state statistics. The method of delivery is electronically via secure communication channels or on paper in person or by mail.

Please note that, starting with reporting for 2021, the obligation to submit financial statements on paper, as well as submit them to statistical authorities, is canceled. The corresponding amendments to the law have already been adopted in the first reading by the State Duma of the Russian Federation.

If an organization falls under the criteria for a mandatory audit, then an audit report must also be submitted to the territorial office of Rosstat. The auditor's report confirms the reliability of the reporting. There are two options for presenting a conclusion:

- simultaneously with financial statements;

- no later than 10 business days from the day following the date of the audit report, but no later than December 31 of the year following the reporting year.

There is no need to provide an audit report to the Federal Tax Service.

Form 4 balance sheet

A Form 4 balance sheet is the common name for the cash flow statement. It contains information about the organization's cash flows for the reporting and previous years. Cash flows are detailed in the context of current, investment and financial transactions. For each type of activity, the receipt and expenditure of funds are shown.

At the same time, current operations include operations related to the implementation of ordinary activities. For example, receipts include sales proceeds and rental payments, while payments include payments to suppliers and wages. Investment transactions are those related to the acquisition, creation or disposal of non-current assets.

As cash flows from financial transactions, flows from operations related to attracting financing on a debt or equity basis, leading to a change in the size and structure of the capital and borrowed funds of the organization (credits, borrowings, deposits, etc.) are classified.

The procedure for filling out the report is described in detail in PBU 23/2011 “Cash Flow Report” (approved by Order of the Ministry of Finance of the Russian Federation dated 02.02.2011 No. 11n).

You can also download the form on our website using the link below:

A sample of filling out a cash flow statement was prepared by ConsultantPlus experts. Get trial access to the K+ system and download the document for free:

2-NDFL from 2021

The Federal Tax Service plans to approve new income codes for 2-NDFL certificates by the end of the year.

Compensation for unused vacation will need to be coded 2013.

Severance pay, average earnings for the period of employment, as well as compensation to the manager, his deputy and the chief accountant in parts that exceed three times the average monthly salary will need to be designated by code 2014.

For bad debts of individuals that the company writes off, a new code 2611 will appear.

Form 6 balance sheet

The sixth form of balance sheet is a report on the intended use of funds, which is compiled by non-profit organizations (NPOs) and legal entities receiving any targeted funding.

For NPOs, this report is essentially the main one. In this report they disclose information about the intended use of funds received to support statutory activities. It shows the balance of targeted financing at the beginning of the reporting year, the receipt and expenditure of such funds during the reporting period and their balance at the end of the year.

Form 6, as well as the main reporting forms (balance sheet and financial results report), has 2 design options: full (Appendix 1 to Order No. 66n) and simplified (Appendix 5 to Order No. 66n). The latter may be made up of organizations that have the right to use simplified methods of accounting when preparing reports in a simplified form.

You can download both versions of Form 6 on our website using the links below:

Simplified accounting procedures for small companies

Let us recall that on June 20, 2021, Order No. 64n of the Ministry of Finance of Russia dated May 16, 2016 came into force, changing simplified accounting methods for small and non-profit organizations. This means that small companies will be able to prepare reports for 2021 using simplified forms.

A simplified reporting procedure can be used by organizations that are allowed to conduct accounting in a simplified way. Such organizations include (Article 7 of the Law of December 6, 2011 No. 402-FZ “On Accounting”):

- small businesses;

- NPO;

- organizations that have received the status of participants in the Skolkovo project.

The criteria by which companies are classified as small businesses are established by Federal Law No. 156-FZ dated June 29, 2015:

- the amount of revenue for the previous year from the sale of goods, works or services (excluding VAT) does not exceed 800 million rubles;

- the average number of employees is no more than 100 people;

- the share of third parties in the authorized capital of the company is no more than 49 percent.

Such small companies can conduct accounting in a simplified way. The indicators of the accounting reporting items also depend on the chosen method of accounting.

Important!

But the situation changes dramatically if a small company is subject to mandatory audit. In this case, the company is faced with the need to generate a complete set of financial statements, ensure that differences between accounting and tax accounting are maintained in the accounts (i.e. apply PBU 18/02*, approved by Order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n), create a reserve for vacation pay (i.e. apply PBU 8/2010, approved by Order of the Ministry of Finance of the Russian Federation dated December 13, 2010 No. 167), etc.

Note*

It is possible to refuse to use PBU 18/02 only if a small enterprise has the right to use simplified methods of accounting. And “little ones” who are subject to mandatory audit do not have the right to do this (clause 1, clause 5, article 6 of Law No. 402-FZ).

If a company applies special tax regimes (UTII, simplified tax system, unified agricultural tax), then PBU 18/02 can not be applied, having stated this in the accounting policy.

As a rule, a small enterprise with the legal form of a joint-stock company is deprived of such simplified benefits (clause 1, clause 1, article 5 of the Federal Law of December 30, 2008 No. 307-FZ “On Auditing Activities”, hereinafter referred to as Law No. 307 -FZ). At the same time, the legislation of the Russian Federation provides for a special procedure for conducting a mandatory audit in a joint-stock company, in the authorized capital of which there is a certain share of state participation (clause 4 of article 5 of Law No. 307-FZ).

The “baby” may have revenues from the sale of products (goods, works, services) for the previous reporting year amounting to more than 400 million rubles, or the amount of balance sheet assets at the end of the previous reporting year - more than 60 million rubles (clause 5, clause 1, art. 5 of Law No. 307-FZ). And in this case, a small enterprise is subject to mandatory audit and you can forget about simplified forms of accounting reporting.

Results

Forms 3, 4 and 6 are appendices to 2 main accounting reporting documents: the balance sheet and the financial results report. Forms 3 (statement of changes in capital) and 4 (statement of cash flows) are mandatory if the main reports are created in their full form. Form 6 (report on the targeted use of funds) is drawn up only if the reporting entity has funds for targeted financing. Just like the 2 main reporting forms, Form 6 can be prepared in a simplified version by an organization that has the right to maintain simplified accounting. For 2021, you must use the new edition of all specified forms.

Sources:

- Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n

- Federal Law of December 6, 2011 N 402-FZ “On Accounting”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

New form of property tax declaration

For 2021, you will need to submit a new property tax return form. The form and procedure for filling it out were approved by order of the Federal Tax Service of Russia dated March 31, 2021 No. ММВ-7-21/ [email protected] , which came into force on June 13, 2021.

The new declaration now includes section 2.1 “Information on real estate objects taxed at the average annual value.” It provides lines for entering the cadastral number, OKOF code, and the residual value of the real estate property.