Commission

Before drawing up the write-off act, a special commission meets. They must consist of at least three people. The chairman of this commission is elected. Each member of the assembled group must be informed that reporting false information in official papers is punishable by law.

All members of the commission check the compliance of the data specified in the paper with the real state of affairs. Their signatures in the documentation indicate that they have found a complete match. If one of the commission members has a special opinion about the presented figures, then he still signs, but formalizes his position in the form of a postscript or an appendix to the act.

Sometimes the creation of a commission is prescribed in the manager’s order on holding festive events in the organization.

Product category

To correctly calculate the VAT base, the company must determine which category of goods the transferred gift belongs to. And then calculate the tax base for calculating VAT in relation to all gifts classified as intended for sale in one’s own capacity, the value of which exceeds 100 rubles.

At the same time, the company will not be able to deduct input VAT when purchasing gifts. Read about this in the letter of the Ministry of Finance of Russia dated October 23, 2014 No. 03-07-11/53626.

The possibility of deducting VAT arises only in case of refusal of the benefit provided for in Article 149 of the Tax Code. Financial department specialists have repeatedly reported this in their letters (letter of the Russian Ministry of Finance dated June 14, 2021 No. 03-07-11/36977, letter of the Russian Ministry of Finance dated February 26, 2021 No. 03-07-07/10954).

Related documents

In addition to the act of writing off gifts, the manager or other person organizing the holiday must draw up and submit for signature:

- Leader's order.

- Event program.

- List of participants at the gala lunch or dinner (if one is planned).

- Cost estimate for carrying out. It is first transmitted to the company's accounting department.

- List of gifts. The main part of it is a table with a list of recipients and their signatures. The statement is the basis for drawing up an act for writing off gifts.

Only after legally competent preparation of this documentation can you begin to draw up an act.

Recognition of implementation

In addition, VAT is charged on the value of gifts donated free of charge on the basis of subparagraph 1 of paragraph 1 of Article 146 of the Tax Code. If gifts are given as part of an advertising campaign, then VAT is charged only on the cost of the transferred goods over 100 rubles (clause 3, subclause 25, article 149 of the Tax Code of the Russian Federation). Here it is necessary to immediately make a reservation that the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33 separates the concepts of advertising materials and goods intended for sale in their own capacity.

So, for example, the transfer of catalogues, leaflets and brochures distributed free of charge to potential buyers is not subject to VAT, regardless of the amount of expenses for the acquisition (creation) of these materials, since it belongs to the category of goods not intended for sale as goods.

As for gifts such as notebooks, umbrellas, sweets, etc., the cost per unit of which exceeds 100 rubles, their transfer to potential buyers is subject to VAT in accordance with the generally established procedure.

Components

The act of writing off gifts does not have an established unified template. In accordance with the existing legislative framework, it is drawn up in free form. The main thing is that it is spelled out in the accounting policies of the organization and complies with accepted standards. All of them are spelled out in Article 9 of the Accounting Law.

The form and sample document offered for downloading contain the following parts:

- A cap. It includes: company details at the top (ideally, the act is printed on the organization’s letterhead), name of the document, its number, date of signing and city.

- Listing the composition of the commission. It must consist of at least five persons who have put their signatures on the paper. Your last name, initials and position will be enough (if the commission includes employees).

- A table describing the gifts, their value and who they were given to.

- An occasion for presenting gifts. In the attached example it is New Year.

- How many units were issued and for what amount.

- Mention of the possibility of writing off the listed values from the register.

- Signatures of the commission members. If possible, the seal of the organization.

It is worth noting that the write-off act will not have legal force without a statement of issue with the signatures of the donee.

Gifts for business partners and customers

In this case, taxation depends on whether the transferred property is a “regular” gift, or whether the gift can be regarded as advertising or entertainment expenses.

- "Ordinary" gifts.

These include, for example, New Year's souvenirs for contractors. This is the most unprofitable option for a businessman. Costs in this case cannot be deducted from the income tax base (Clause 16, Article 270 of the Tax Code of the Russian Federation).

But VAT, on the contrary, will have to be charged, because gratuitous transfer is subject to this tax (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation). The taxable base will be the market value of the gift (clause 2 of Article 154 of the Tax Code of the Russian Federation). These may be the costs of purchasing or manufacturing the goods being transferred. If the gift is purchased, then input VAT can be deducted on a general basis.

- Gifts as part of hospitality expenses.

The Tax Code of the Russian Federation does not contain a specific list of entertainment expenses. The Code includes only general wording about the costs “for the official reception of representatives of counterparties.” Therefore, the classification of certain types of expenses as entertainment expenses often becomes the subject of disputes between businessmen and inspectors.

In particular, tax authorities allow the purchase of food and alcohol to be included in entertainment expenses. But we are talking specifically about food and alcoholic beverages that were spent on treating business partners.

If, at the reception, guests are given gifts or prizes, then, according to tax authorities, they can no longer be included in the costs of holding the banquet (letter of the Ministry of Finance of the Russian Federation dated March 25, 2010 N 03-03-06/1/176).

Although there are court decisions that make it possible to classify as entertainment expenses, for example, souvenirs with the company logo that are given at receptions (Resolution of the Federal Antimonopoly Service of the Moscow Region dated January 31, 2011 No. KA-A40/17593-10).

To take into account “representative” gifts and be prepared for possible disputes with inspectors, you should complete the necessary documents:

- Order for holding an event.

- Estimated entertainment expenses, including expenses for souvenirs.

- A report on the event and actual expenses incurred.

Of course, you need to remember about the “ordinary” accounting documents that confirm the costs incurred: invoices, expense reports, cash receipts, etc.

Recognizing any entertainment expenses, one should not forget about their rationing. These costs can be taken into account for income tax only within 4% of the wage fund for the same period (clause 2 of Article 264 of the Tax Code of the Russian Federation).

There is no need to charge VAT on hospitality expenses. And the “input” tax can be deducted only within the limits of that part of the costs that is included in the 4% standard for income tax (clause 7 of Article 171 of the Tax Code of the Russian Federation).

- Gifts as part of an advertising campaign.

Souvenirs can be written off as advertising expenses only if they are intended for an indefinite number of people.

In this case, the standard also applies - the costs for profit tax can include an amount not exceeding 1% of revenue (clause 4 of Article 264 of the Tax Code of the Russian Federation)

As for VAT, it all depends on the cost of the souvenir: if it is less than 100 rubles, then the tax may not be charged (clause 25, clause 3, article 149 of the Tax Code of the Russian Federation), if more, it is necessary to charge it. In order to use this benefit, you will have to keep separate records of “expensive” and “cheap” souvenirs.

Therefore, if there are few inexpensive advertising products, then businessmen often prefer not to bother with the division of accounting and pay VAT on the entire amount.

- Taxation of personal income.

No matter how the issuance of gifts is formalized, they are always received by individuals - employees of counterparties or customers. Therefore, the question arises about taxation of the income of these recipients.

Since individuals in this case are not employees of the company, insurance premiums are not charged ( clause 1 of article 420 of the Tax Code of the Russian Federation, clause 1 of article 20.1 of the law of July 24, 1998 No. 125-FZ ).

And for calculating personal income tax, everything depends on the cost. If during the year a specific individual received property worth no more than 4,000 rubles as a gift, then income tax does not need to be charged (Clause 28, Article 217 of the Tax Code of the Russian Federation).

If the limit is exceeded, the donor becomes a tax agent for personal income tax. But it is clear that in most cases it is impossible to withhold income tax from a buyer or employee of another organization. Therefore, the donor must report this to the Federal Tax Service no later than March 1 of the following year, using form 2-NDFL with sign 2.

Personal income tax

This type of tax is charged on the amount of the gift given only if the total value of the incentives (or the cost of one given) exceeds 4 thousand rubles. Moreover, several gifts may be given at different times of the year.

If a valuable gift (worth more than 3 thousand rubles) is expressed in cash, then personal income tax on it must be transferred on the same day when it arrives in the personal bank account (or in the hands) of the recipient.

If an employee receives a valuable gift in the form of an item, then personal income tax is deducted on the next day the recipient’s funds are issued. This could be a bonus, an advance, the main part of the salary or another payment.

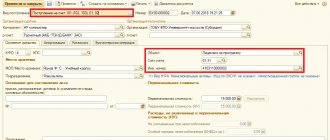

Registration of gifts in 1C: Accounting 8 ed. 3.0

The organization LLC "AvtoRemont" purchased gifts for the New Year for the most significant representatives (employees) of its business partners: Xiaomi thermal mugs in the amount of 50 pieces for a total amount of 59,000.00 rubles, including VAT 18% 9,000.00 rubles . Gifts were presented on December 24, 2021. The cost of one gift was 1,180 rubles, including VAT 18% 180.00 rubles.

According to the organization’s accounting policy, gifts for holidays are recorded in account 10.01 “Materials” before they are issued to recipients.

AvtoRemont LLC uses the general taxation system (GTS), the accrual method and PBU 18/02 (as amended).

| № | date | Operation | Dt | CT | Sum | Document 1C Create based on | Package of documents Incoming Outgoing Interior |

| 1 | Receipt of gifts to the warehouse | ||||||

| 1.1 | 03.12.2018 | Purchased gifts for business partners | 10.01 | 60.01 | 50 000,00 | Receipt (act, invoice) | Consignment note TORG-12 |

| 1.2 | 03.12.2018 | Input VAT included | 19.03 | 60.01 | 9 000,00 | ||

| 1.3 | 03.12.2018 | Input VAT is accepted for deduction | 68.02 | 19.03 | 9 000,00 | Invoice received Receipt (act, invoice) | Invoice |

| 2 | Presentation of gifts | ||||||

| 2.1 | 24.12.2018 | The cost of gifts issued is reflected in expenses | 91.02 BU - PR | 10.01 BU NU — | 50 000,00 50 000,00 50 000,00 | Free transfer Receipt (act, invoice) | Order (instruction) on the delivery of a gift Statement of accounting and transfer of gifts Accounting information |

| 2.2 | 24.12.2018 | VAT has been calculated on the gratuitous transfer of gifts | 91.02 BU PR | 68.02 BU - | 9 000,00 9 000,00 | ||

| 2.3 | 24.12.2018 | Invoice issued | — | — | 59 000,00 | Invoice issued | Invoice |

| 3 | Recognition of a permanent tax liability (PNO) | ||||||

| 3.1 | 31.12.2018 | A permanent tax liability (PNO) has been recognized in relation to the cost of gifts given (RUB 50,000.00 + RUB 9,000.00) x 20% | 99.02.3 | 68.04.2 | 11 800,00 | Regular operation “Calculation of income tax” as part of the “Month Closing” processing | Accounting information |

| 4 | Formation of tax reporting | ||||||

| 4.1 | 31.12.2018 | VAT declaration | — | — | — | Tax return for value added tax | VAT return |

| 5 | Formation of accounting (financial) statements | ||||||

| 5.1 | 31.12.2018 | Income statement | — | — | — | Financial statements | Financial statements |

Receipt of gifts to the warehouse

1.1. Gifts were purchased for business partners.

1.2. Input VAT included.

Document Receipt (act, invoice)

(Fig. 1):

- Section: Purchases – Receipts (acts, invoices)

. - Receipt

button .

Document transaction type – Goods (invoice)

. - Fill out the document:

- Specify the counterparty, agreement, warehouse, check the accounting accounts and settlement terms using the link in the “Settlements” field.

- Fill out the tabular part of the document using the Add

: - in the Nomenclature

, select incoming gifts; when creating new elements, select the type of nomenclature “Materials” (if gifts are taken into account in account 10 “Materials”); - in the Accounting Account

and

VAT Account

, check that account 10.01 “Raw materials and materials” and account 19.03 “VAT on purchased inventories” are indicated; - fill in the remaining columns (quantity, price, amount, rate and VAT amount).

button .

Rice. 1

Click the button to see the result of document processing (Fig. 2).

Rice. 2

1.3. Input VAT is accepted for deduction.

Document Invoice received

(Fig. 3):

- In the receipt document, fill in the fields Invoice No.

and

from

, then click the

Register

(Fig. 1).

Invoice received

will be automatically created , the fields of the document will be filled with data from the base document, and a link to the created document will appear in the form of the base document. - Click the link to open the document Invoice received

.

Check that the document fields are filled in and the Reflect VAT deduction in the purchase book by date of receipt

.

If you clear the checkbox, the deduction is reflected in the regulatory document Formation of purchase ledger entries

.

Rice. 3

Click the button to see the result of document processing (Fig. 4).

Rice. 4

Presentation of gifts.

2.1. The cost of gifts issued is reflected in expenses.

2.2. VAT has been calculated on the gratuitous transfer of gifts.

Document Free transfer

(Fig. 5–6):

- The document can be:

- create on the basis of the document Receipt (deed, invoice)

, in this case, information about the transferred gifts, their quantity and accounting accounts will be automatically transferred to the document from the base document; - create as a new document (section Sales - Free transfer

).

.

button .

- the Recipient

field blank. - Specify the Warehouse

from which gifts are issued. - On the Products

, fill out the tabular part using the

Add

(Fig. 5): - in the Nomenclature

, select the gifts to be transferred; - indicate the number and price of gifts, VAT rate, and account.

(Fig. 6):

- in the fields Cost account

,

VAT account,

check the accounting account (account 91.02 “Other expenses” is entered by default); - in the Other income and expenses

field, the item of other income and expenses “Expenses for the transfer of goods (work, services) free of charge and for one’s own needs” is automatically indicated by default with the item type of the same name and the

Accepted for tax accounting

(Fig. 7).

- Carry out

button . - To print a request invoice for the release of gifts from the warehouse (form M-11) and an invoice for gratuitous transfer, use the Print

.

Rice. 5

Rice. 6

Rice. 7

Click the button to see the result of document processing (Fig. 8).

The cost of gifts and VAT calculated on the transfer of gifts are not included in expenses for the purposes of calculating income tax.

Postings to the debit of account HE.01.9 are for informational purposes only. On subaccounts NOT

“Income and expenses not taken into account for tax purposes” when posting some documents, amounts of expenses that are not accepted for tax accounting are reflected.

Rice. 8

2.3. An invoice has been issued.

Document Invoice issued

(Fig. 9):

- Click the Issue an invoice

in the

Gratuitous transfer

(Fig. 5).

Invoice issued

will be automatically created , its fields will be filled with data from the base document, and a link to the created document will appear in the form of the base document. - Using the link, open the document Invoice issued

and check the completion of its fields. - Operation type code

field is filled in automatically with the value “10”, which corresponds to the shipment (transfer) of goods (performance of work, provision of services), property rights free of charge in accordance with the Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] - To print the invoice, use the Print

.

In the consolidated invoice for the gratuitous transfer of gifts, dashes will be placed in lines 6 “Buyer”, 6a “Address”, 6b “TIN/KPP of the buyer”. The invoice will be reflected in the sales book (section Reports – Sales book

). - The document does not generate transactions.

Rice. 9

Recognition of a permanent tax liability (PNO)

Processing Closing the month

(Fig. 10):

- Section Operations – Month Closing

. - Set the closing month (December 2021).

- Button Perform month closing

.

Rice. 10

3.1. A permanent tax liability (PNO) has been recognized in relation to the value of gifts given.

Regular operation “Calculation of income tax” as part of the processing “Closing the month” (Fig. 11): follow the link with the name of the regulatory operation Calculation of income tax

(Fig. 10) select

Show postings

and see the result of its execution (Fig. 11).

A permanent tax liability (PNO) has been recognized on the value of gifts and VAT calculated on gratuitous transfers (not included in expenses for calculating income tax) in the amount of 11,800.00 rubles: (50,000.00 rubles + 9,000.00 rubles. ) * tax rate 20% = RUB 11,800.00.

Rice. eleven

Formation of tax reporting

4.1. VAT declaration.

Report Tax return for value added tax

(Fig. 12):

- Section Reports – Regulated reports

. - The period for which the report is generated is the 4th quarter of 2018.

Line 010 of Section 3 of the VAT return reflects the tax base and the amount of tax calculated from the value of the gifts given.

Rice. 12

Prize - differences

The concept of “gift” includes the entire group of items that are given on occasion, on a certain date. For example, March 8, February 23, New Year, employee’s birthday. The concept of “prize” is found mainly in cultural institutions and companies that work in the field of organizing cultural events. And the prize is awarded for winning any competition. It is awarded for certain merits. So “gifts” appear much more often in the documentation. Moreover, they are officially divided into valuable and non-valuable. They differ in price at 3 thousand rubles.

Office decoration

An integral part of holiday expenses is the cost of decorating the premises. Of course, regarding March 8 and February 23, this is not very relevant, which cannot be said, for example, about the New Year. Should there be a chance to recognize these costs as expenses? Let's say right away that it is small. The Ministry of Finance considers such expenses economically unjustified.

However, you can try to justify them. This will not work for simplifiers, since their tax system assumes a closed list of costs . But subjects on OSN can try it. There are such cases in judicial practice. But you need to take into account that to a greater extent this applies to premises visited by counterparties - business partners, clients, customers. The meaning of the costs in this case is that they are aimed at creating a positive image of the organization, and this, in turn, strengthens its position in the market.

It should be taken into account that the FAS opposes the recognition of such expenses as advertising. The antimonopoly authority believes that they do not meet the definition given in the advertising law No. 338-FZ of March 3, 2006. Taking this into account, it is recommended that the costs of office decoration be reflected in accounting as other costs associated with production (subclause 49 of clause 1 of Article 264 of the Tax Code of the Russian Federation). Again, entities using the simplified tax system do not have the opportunity to take such costs into account as expenses, even though they can justify them.

Documentation procedure

Each organization may have its own approach to the basic algorithm for donating material assets and writing them off. The main thing is that he:

- Took into account the requirements of tax legislation.

- Took into account the norms of civil legislation.

- Accounted for by the accounting department on off-balance sheet account 07.

- It was taken into account when the organization paid the required insurance contributions to the pension fund.

- Was reflected in the company's accounting policies.

But under no circumstances can you do without an act for writing off gifts.

A way to include the cost of gifts and bonuses in expenses

The only way to take such expenses into account as expenses is to tie bonuses to the production achievements of employees . To do this, you will need to specify in the bonus regulations and employment contract the procedure for rewarding an employee with a gift or bonus in connection with the achievement of certain labor results.

Thus, the ability to write off holiday expenses as expenses will depend on the specific language used to designate these expenses.

As for gifts, such a design will provide another advantage - the costs will not be subject to VAT . This is due to the fact that the transfer of a gift is made within the framework of an employment relationship and therefore is not recognized as a sale. At the same time, the right to deduct VAT included in the cost of the purchased gift is retained, since its acquisition will be considered to be related to taxable reality.