Print (Ctrl+P)

1C: Accounting enterprise 3.0

In accounting, strict reporting forms (hereinafter referred to as SSR) are accounted for separately from other printed products (items) in off-balance sheet account 006. Double entry does not apply. Please note that the first subconto of this account is the BSO directory. This directory contains a list of types of BSO that are used at the enterprise - forms of work books, inserts for them, certificates, diplomas, licenses, certificates, forms of certificates of incapacity for work, receipts, insurance policies and other BSO.

To add information about BSO to the standard configuration of “1C: Accounting Enterprise 3.0”, you need to enter the directory “Strict reporting forms” through the “All functions” menu and find the general section “Directories”, which contains the directory “Strict reporting forms”;

According to the order of the Ministry of Finance of the Russian Federation dated December 1, 2010 N 157n, BSO must comply with the conditions given in paragraph 118 of the instructions, approved. by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n, namely:

- must be printed in a form approved by a legal act of the authority;

- have a number, series, degree of protection;

- stored, issued and destroyed in accordance with special requirements.

Accounting for strict reporting forms

The subsystem is designed to account for strict reporting forms (SRF). The subsystem provides accounting of BSO by series and numbers.

The directory “ Strict reporting forms ” is intended for maintaining a list of BSO.

The document “ Receipt of BSO ” is intended to be reflected in the accounting of receipt of BSO. From the document you can print out the receipt order M-4 and the accounting certificate (f. 0504833).

The document “ Internal movement of BSO ” is intended to reflect in the accounting of movements of BSO between financially responsible persons (if accounting is kept on account 03.1 by division, then also movement between divisions) within one organization. From the document you can print out the demand invoice M-11 and the accounting certificate (f. 0504833).

The document “ Write-off of BSO ” is intended to reflect in the accounting the facts of write-off of BSO. From the document you can print out the act of writing off strict reporting forms (f. 0504816) and the accounting certificate (f. 0504833).

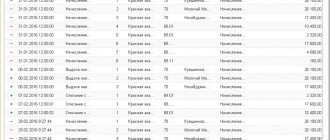

The report “ BSO Accounting Book ” forms a book of accounting of strict reporting forms (f. 0504045).

How to achieve detailed analytics of BSO disposal

Disposal of BSO is always a credit to account 006, regardless of the reason for disposal. To have a clear picture of what happened to the BSO and why the forms were written off off-balance sheet, it is recommended:

- enter a separate off-balance sheet account, giving it an individual name (for example, “Disposal of BSO” or “Operations with BSO”);

- open subaccounts for an open off-balance sheet account according to the types of reasons for the disposal of BSO (for example, BSO.01 - use of BSO, BSO.02 - shortage of BSO, etc.);

- when disposing of BSO, use the following account correspondence: for normal use of BSO - Dt BSO.01 Kt 006, in case of shortage - Dt BSO.02 Kt 006, etc.

As a result, the necessary analytics of BSO retirement will be organized, allowing you to quickly analyze this process. To make the information available for analysis, you can generate a “Summary transactions” report.

How to formalize and reflect in accounting the write-off of unused SSBs? The answer to this question is in ConsultantPlus. Study the material by getting trial access to the K+ system for free.

An open off-balance sheet account and subaccounts to it must be entered into the 1C chart of accounts. This is done manually in user mode.

Accounting for treasury property - a new subsystem

The subsystem is designed to maintain records of treasury property. To enable the subsystem, you must enable the “Keep records of treasury property” checkbox in setting up accounting parameters (section “Setup and Administration”).

Setting up analytical and inventory accounting of treasury property is carried out for each organization.

Receipt of treasury property

The following documents are intended to reflect the facts of receipt of treasury property:

- Acceptance of IC objects for registration (except buildings and structures)

- Acceptance for registration of buildings (structures) of the IC

- Acceptance for accounting of groups of IC objects

- Receipt order M-4 (treasury property)

From the documents you can print out a printed form of transfer and acceptance acts OS-1 or a receipt order M-4, as well as an accounting certificate (f. 0504833).

Transfer of treasury property

The following documents are intended to reflect the facts of the transfer of treasury property:

- Transfer of IC objects (except buildings and structures)

- Transfer of buildings (structures) to IC

- Transferring groups of IR objects

- Vacation invoice M-15 (treasury property)

From the documents, you can print a printed form of transfer and acceptance acts OS-1 or an invoice for the release of materials on the M-15 side, in accordance with the name of each document, and an accounting certificate (f. 0504833).

Write-off of treasury property

The following documents are intended to reflect the facts of write-off of treasury property:

- Write-off of IC objects

- Write-off of vehicles (treasury property)

- Write-off of groups of IC objects

- Claim-invoice (treasury property)

From the documents, you can print a printed form of write-off acts OS-4 or a claim invoice M-11, in accordance with the name of each document, and an accounting certificate (f. 0504833).

Depreciation of treasury property

For the monthly calculation of depreciation of treasury property, the document “Calculation of depreciation of treasury property” is intended. Based on the document, you can print the “Depreciation Statement” and an accounting certificate (f. 0504833).

Accounting for strict reporting forms in 1C Accounting 8

In today’s article we will look at accounting for strict reporting forms in 1C: Accounting 8. This method of accounting for BSO is also suitable for configurations 1C: UTP 8 and 1C: UPP 8.

1. All information about strict reporting forms in 1C is stored in the “Nomenclature” directory. In this reference book, on the “Basic” tab, you need to check the “Strict accounting form” checkbox, and if necessary, “Accounted for at nominal value” (Fig. 1).

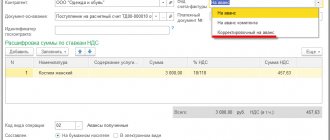

2. Let’s move on to the topic of how to capitalize strict reporting forms in 1C. To do this, go to the “Receipt of goods and services” document, type of operation - “Strict accounting forms”.

The “Price” and “Amount” columns are filled with data for accounting on the balance sheet account. In the “Account Account” column, enter the account value. Fill in the columns “Nominal price” and “Nominal amount” with the appropriate information if you take into account BSO at nominal value. Enter the off-balance sheet account in the appropriate column.

When posting a document, all the necessary movements in regulated accounting will be generated, which you can see in Fig. 3.

3. In order to formalize the movement of BSO between warehouses, go to the “Warehouse” menu - document “Movement of goods” - type of operation “Strict accounting forms”. All information on the forms is filled out on the “Forms” tab.

4. In order to write off used forms, go to the document “Write-off of goods” - type of operation “Strict accounting forms”. On the “Account” tab, the fields must be filled in in accordance with the data specified in the “Receipt of goods and services” document (Fig. 2). Forms are written off from the account at an average cost.

5. When posting the document, all the necessary movements in regulated accounting will be generated. You can see the result in Fig. 5.

We tried to answer the question as fully as possible how to take into account strict reporting forms in 1C. We hope our article was useful to you

source

Accounting for settlements with accountable persons - a new subsystem

The document “ Application for advance payment ” is intended for filling out an application for an advance payment to an accountable person. Based on the document, you can enter a Cash Order or a Statement for issuing money from the cash register to accountable persons .

The document “ Advance report ” is intended for processing settlements with accountable persons in terms of travel expenses, payment for work (services) of third-party organizations, and posting fixed assets, intangible assets, materials, and food products received from accountable persons to the warehouse.

Settlements with counterparties

Payments for collection

New documents have been added to the application:

- Collection order

- Statement of acceptance, refusal of acceptance

- Letter of Credit

- Payment request

The documents are used when making non-cash payments in accordance with the requirements of the “Regulations on the rules for transferring funds” (approved by the Bank of Russia on June 19, 2012 N 383-P).

Automatic offset of advances

In standard transactions for the receipt of goods and materials, works, services, reflecting receipts from suppliers (account 302.00), the ability to automatically offset the issued advance has been added.

In standard transactions for the sale of inventory, works, and services that reflect sales to the buyer (invoice 205.00), the ability to automatically offset the advance received has been added.

Reconciliation of mutual settlements for inventoryization

The document “ Act of Reconciliation of Mutual Settlements ” is intended for reconciliation of mutual settlements of the organization with counterparties and the generation of a printed form of the act.

Cash desk of the organization

Cash register inventory

The document “ Cash Inventory ” is intended to reflect in accounting the results of an inventory of funds, monetary documents, and strict reporting forms located in the organization’s cash register.

From the document you can create an Inventory list f. 0504088, Inventory list (matching sheet) f. 0504086.

Printing cash receipts using a fiscal registrar

Implemented connection of a fiscal registrar and printing of receipts directly from the program.

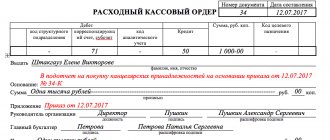

In the document “ Cash receipt order ”, click the “Print check” button to print a check for receipt of funds on the fiscal registrar.

In the document “ Expense cash order ”, clicking the “Print check” button prints a check for the refund of funds on the fiscal registrar.

Popular books

Checklist “Salary in Trade Management”

Calculate your salary without errors, using step-by-step instructions from our specialists.

Checklist “Salaries in 1C:Enterprise Accounting 2.0”

Pay your salary in 1C:Enterprise and don’t forget anything with detailed instructions for action.

Initial settings “Accounting for Ukraine, ed. 2.0"

Customize your configuration and work in comfort. Save time and nerves with our book.

Working with primary documents in “Accounting (rev. 2.0)”

The manual will be useful for novice accountants and those who are just mastering 1C:Enterprise.

In today’s article we will look at accounting for strict reporting forms in 1C:Enterprise Accounting 8. This method of accounting for BSO is also suitable for configurations 1C:Enterprise UTP 8 and 1C:Enterprise UPP 8.

Accounting for payments for educational services

The new document “ Planned payment receipts (education) ” is intended to record the schedule of payment receipts from students for subsequent monitoring of timely payment.

The new report “ Statement of payers for education services ” is designed to display information about payers for a student by period.

The new report “ Information about payers for education services ” is designed to display a list of students indicating information about the payer as of a specified date. Two report options are available: “Payer by student” and “Students by payer”.

The new report “ Planned payment arrears (education) ” is designed to monitor payment receipts according to the schedule specified by the “Planned payment receipts (education)” document.

How to capitalize strict reporting forms in 1C:Enterprise

Let's move on to the topic of how to post strict reporting forms in 1C:Enterprise. To do this, go to the “Receipt of goods and services” document, type of operation - “Strict accounting forms”.

The “Price” and “Amount” columns are filled with data for accounting on the balance sheet account. In the “Account Account” column, enter the account value. Fill in the columns “Nominal price” and “Nominal amount” with the appropriate information if you take into account BSO at nominal value. Enter the off-balance sheet account in the appropriate column.

When posting a document, all the necessary movements in regulated accounting will be generated, which you can see in Fig. 3.

"Fig. 3 - Document posting summary"

Tax and statistical reporting

Expanding the range of regulated reporting forms

The following have been added to the regulated reporting forms:

- Statistics form 1-INVEST “Information on investments in Russia from abroad and investments from Russia abroad”, approved by Rosstat order No. 423 dated July 27, 2012; The form is used starting with reporting for the 1st quarter of 2013.

- Statistics form No. 11 (brief) “Information on the availability and movement of fixed assets (funds) of non-profit organizations”, approved by Rosstat order No. 406 dated July 27, 2012; The form is used starting with reporting for 2012.

- Statistics form 3-F “Information on overdue wages”, approved by Rosstat order No. 407 dated July 24, 2012; The form is used starting with reporting for January 2013.

- Statistics form P-4 “Information on the number, wages and movement of workers”, approved by Rosstat order No. 407 dated July 24, 2012; The form is used starting with reporting for January 2013.

- Statistics form P-6 “Information on financial investments”, approved by Rosstat order No. 423 dated July 27, 2012; The form is used starting with reporting for the 1st quarter of 2013.

- Statistics form Appendix No. 3 to form P-1 “Information on the volume of paid services to the population by type,” approved by Rosstat order No. 422 dated July 27, 2012. The form is used starting with reporting for January 2013.

Changes in electronic submission of regulated reporting forms

Uploading the Statement on the import of goods and payment of indirect taxes (introduced by the Protocol of December 11, 2009 “On the exchange of information in electronic form between the tax authorities of the member states of the Customs Union on the paid amounts of indirect taxes”) is implemented in version 5.06 format in accordance with the order of the Federal Tax Service of Russia dated 08/30/2012 No. ММВ-7-6/ [email protected] In accordance with the order, format version 5.06 is used for Applications submitted after 10/01/2012.

Methodological changes

In Form-4 of the FSS of the Russian Federation (approved by order of the Ministry of Health and Social Development of Russia dated March 12, 2012 No. 216n), a check of control ratios is implemented in accordance with the algorithms given in the order of the FSS of Russia dated March 14, 2012 No. 87. The check is performed either manually - using the “Check” button in the top command panel of the report form, or automatically - during the process of uploading the form in electronic form or when preparing a printed form. The test results are displayed in a separate window, which reflects both completed and erroneous relationships.

The declaration on indirect taxes (value added tax and excise taxes) when importing goods into the territory of the Russian Federation from the territory of member states of the customs union (approved by order of the Ministry of Finance of Russia dated July 7, 2010 No. 69n) was amended in accordance with the letter of the Federal Tax Service of Russia dated August 20. 2012 No. ED-4-3/ [email protected]

Technological changes

The downloading of packages for submitting reports to the Federal Tax Service in a universal format for submission at the place of request has been implemented. Requirements for the composition of electronic documents certified by the digital signature of a tax authority official, submitted by the taxpayer at the place of request, are posted on the website of the Federal Tax Service of Russia at the address: www.nalog.ru/html/docs/treb1.doc.

The ability to import external files for downloading statistical reporting forms, the implementation of which is not available in standard configurations, has been implemented.

Improved diagnostics for errors in loading external exchange components.

Accounting for travel documents

Expenses for an employee’s travel to the place of business trip and back to the place of permanent work are included in business trip expenses (clause 12, clause 1, article 264 of the Tax Code of the Russian Federation). Travel documents (air and train tickets) can be purchased by an employee sent on a business trip independently. In this case, the employer is obliged to reimburse the employee for these expenses (Article 168 of the Labor Code of the Russian Federation). An organization can also purchase travel documents through specialized transport agencies.

Travel documents are issued on strict reporting forms (clause 2 of the Regulations on the implementation of cash payments and (or) payments using payment cards without the use of cash register equipment, approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359). The basis for deducting VAT on the costs of transporting employees to the place of business trip and back is a travel document in which the tax is highlighted as a separate line. Such a ticket or a copy thereof is registered in the purchase book after approval of the employee’s advance report (clause 18 of the Rules for maintaining the purchase book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

Often all travel documents are purchased in paperless form (electronic tickets). In this case, strict reporting documents are:

- route receipt of an electronic air ticket (clause 2 of the order of the Ministry of Transport of Russia dated November 8, 2006 No. 134);

- e-railway ticket coupon (clause 2 of Order No. 322 of the Ministry of Transport of Russia dated August 21, 2012).

According to the explanations of the Ministry of Finance of Russia, when purchasing air tickets electronically, the amount of VAT allocated as a separate line in the itinerary receipt of an electronic passenger ticket printed on paper is accepted for deduction (see letters dated January 30, 2015 No. 03-07-11/3522, dated 07/30/2014 No. 03-07-11/37594). In practice, this clarification also applies to the e-railway ticket coupon.

If an employee flies on a business trip by plane, then to confirm the costs of the flight, in addition to the itinerary receipt of the electronic air ticket, a boarding pass is also required. At the same time, the organization has the right to justify the consumption of air transportation services with any other documents that directly or indirectly confirm the fact of use of purchased air tickets (letter of the Ministry of Finance of Russia dated December 18, 2017 No. 03-03-RZ/84409).

If an employee goes on a business trip by rail, then the document confirming his travel expenses will be the control coupon of an electronic travel document (letter of the Ministry of Finance dated April 14, 2014 No. 03-03-07/16777).

No documents evidencing payment for an electronic ticket (for example, a bank card statement) are required to confirm these expenses (letter of the Ministry of Finance of Russia dated December 18, 2017 No. 03-03-RZ/84409).

The current legislation does not contain special rules regulating the procedure for recording electronic travel tickets. The purchase of an electronic travel ticket can be counted as receipt of a monetary document (since the electronic ticket fully meets its criteria) or as an advance payment for transport services (since the services are consumed later). Thus, the procedure for reflecting these transactions in the organization’s accounting records must be reflected in the accounting policy.

Example 2

| An employee of Confetprom LLC was sent on a business trip to Ufa from 04/09/2018 to 04/11/2018 (for 3 days). The daily allowance, according to the organization’s regulations on business trips, is 700 rubles. RUB 9,000 was transferred to the employee’s personal account for the report. A round-trip e-ticket was purchased by the organization through a transport agency. The cost of an air ticket on the route Moscow - Ufa - Moscow is 10,574 rubles. The amount of VAT (10%) is highlighted on the ticket as a separate line and amounts to 930 rubles. The cost of the service fee charged by the transport agency is 295 rubles. (including VAT 18%). In accordance with the accounting policy of the organization, electronic travel tickets are accounted for as monetary documents. Upon returning from a business trip, the reporting person submits an advance report, to which he attaches documents, including a boarding pass and documents from the hotel service provider (in the amount of RUB 7,000 excluding VAT). |

The transfer of funds to the employee's personal account, confirmed by a bank statement, is reflected in the document Write-off from current account with the transaction type Transfer to an accountable person. In the Recipient field, the accountable person is indicated, which is selected from the Individuals directory.

After posting the document Write-off from the current account, an accounting entry is generated:

Debit 71.01 Credit 51 - for the amount of funds issued for the report (9,000 rubles).

Settlements with the transagency can be made on account 76.05 using the following documents:

- Debiting from a current account with the transaction type Payment to supplier - to register payment;

- Receipt of monetary documents with the transaction type Receipt from the supplier - upon receipt of monetary documents;

- Receipt (act, invoice) with transaction type Services - to reflect expenses for transagency services.

In this case, the agreement with the transagency should look like:

- With the supplier - in the documents Write-off from the current account with the transaction type Payment to the supplier and Receipt (act, invoice);

- Other - in the documents Receipt of monetary documents and Write-off from the current account with the transaction type Other settlements with counterparties.

Thus, settlements with the transagency in Example 2 are carried out under two contracts with different types.

Payment to the transagency is registered by the document Debit from the current account with the transaction type Payment to the supplier (under an agreement with the type With supplier). After posting the document, an accounting entry will be generated:

Debit 76.05 Credit 51 - for the cost of air tickets, taking into account the service fee charged (RUB 10,869).

After posting the standard document Receipt (act, invoice) with the transaction type Services, the following entries are entered into the accounting register:

Debit 76.05 Credit 76.05 - for the amount of the offset advance (295 rubles). The offset is carried out between the settlement documents Receipt (act, invoice) and Write-off from the current account; Debit 26 Credit 76.05 - for the cost of transagency services excluding VAT (250 rubles); Debit 19.04 Credit 76.05 - for the cost of VAT (45 rubles).

The purchase of an electronic ticket is reflected in the document Receipt of monetary documents with the transaction type Receipt from the supplier. In Example 2, the monetary document has the form Tickets. When posting a document, the following entry is entered into the accounting register:

Debit 50.03 Credit 76.05 - for the amount of the ticket received (RUB 10,574) in the amount of 1 piece.

Under an agreement with the type Other, the advance payment does not offset. To offset an advance payment to a supplier (under an agreement with the type With supplier), you can use the document Adjustment of debt with the transaction type Debt write-off, after which the posting will be generated:

Debit 76.05 Credit 76.05 - for the amount of the offset advance (RUB 10,574). The offset is performed between the settlement documents Receipt of cash documents and Write-off from the current account. After completing this operation, the account 76.05 is closed.

The issuance of an electronic ticket to an accountable person is documented in the document Issuance of monetary documents with the transaction type Issue to an accountable person and is reflected by the posting:

Debit 71.01 Credit 50.03 - for the amount of the monetary document issued to the employee for reporting (RUB 10,574) in the amount of 1 piece.

Upon returning from a business trip, the reporting person submits an advance report. To include business trip expenses in expenses and account for input VAT, an Advance Report document is created. On the Advances tab, use the Add button to specify the following documents:

- Issuance of monetary documents, according to which the accountable person received a travel document;

- A debit from the current account, according to which funds were transferred to the employee’s bank card.

Information about business trip expenses (travel, accommodation and daily allowance) is reflected on the Other tab. This tab is filled out in accordance with the documents submitted by the accountable person. The following data is indicated in the fields (Fig. 5):

Rice. 5. Tabular part on the “Other” tab of the “Advance report” document

| Field | Data |

| "Document (expense)" | Enter information about primary documents |

| "Nomenclature" | The element corresponding to the flow rate is selected from the “Nomenclature” directory |

| "Amount", "VAT" | The amount and tax rate for the document are indicated, the “Total” field is calculated automatically |

| "Provider" | The counterparty is selected from the directory of the same name (for daily allowances this field is not filled in) |

| "SF" and "BSO" | Flags are set to register an electronic ticket as a strict reporting form. In this case, the “Invoice Details” field will be filled in automatically using the number and date of the BSO from the “Document (expense)” field. After executing the “Write” command, a link to the created “Invoice (strict reporting form)” document is automatically added to the “Invoice Details” field of the “Advance Report” document. |

| "Cost Account/Division" | Indicate the accounting expense account, the debit of which will include business trip expenses (for example, 26 “General business expenses”). If records are kept by division, the corresponding division is indicated |

| "Subconto" | The analytics for the cost account are indicated (for account 26 cost item “Travel expenses”) |

| “NU Cost Account” and “NU Subconto” | By default, they are filled in according to accounting data. They can be edited if necessary |

| "VAT invoice" | By default, account 19.04 “VAT on purchased services” is installed (if necessary, you can select a different VAT account) |

When posting the Advance Report document, the following transactions are generated:

Debit 26 Credit 71.01 - for the cost of an air ticket excluding VAT (9,644 rubles); Debit 19.04 Credit 71.01 - for the amount of VAT (930 rubles); Debit 26 Credit 71.01 - for the cost of living (RUB 7,000); Debit 26 Credit 71.01 - for the amount of daily allowance (RUB 2,100).

The deduction of VAT on an electronic air ticket will be reflected by the date of the advance report if the Reflect the deduction of VAT in the purchase book by the date of receipt in the form of an Invoice document (strict reporting form) is checked.

If the flag is cleared, the deduction can be reflected in the document Formation of purchase ledger entries.

To view the status of settlements with an accountable person, you can use the report Turnover balance sheet for account 71.01 “Settlements with accountable persons”.

In the balance sheet for account 71.01, the credit balance is 100 rubles. This means that the organization must pay the overspending of funds to the accountable person (in cash from the cash register or by transfer to the employee’s bank card).