How to prove the costs of repairs done on your own

You can confirm the costs of repairs made by the company itself using a defect sheet. This is the main document that will allow you to justify the costs of any property repairs - current or major. Therefore, if in the appropriate situation the accounting department does not draw up such a document, it makes a serious mistake.

By presenting the statement to the tax inspectors, the accountant will demonstrate that such work was really necessary and that it was just a repair, and not a modernization or reconstruction. And the spent funds are written off at a time in full compliance with the requirements of the Tax Code.

In general, the list of documents that must be used in tax accounting to confirm expenses for the repair of fixed assets is not established in the code. For these purposes, it only allows access to documents that indirectly confirm expenses (clause 1 of Article 252 of the Tax Code of the Russian Federation).

For example, the fact of repair will be confirmed by the following documents:

– order from the head of the company to carry out repairs;

– schedule of repair work and estimate and technical documentation reflecting the stages of repair work, labor costs, list and cost of materials and the total cost of repair work;

– invoice for the release of materials to the third party in form No. M-15, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a;

– act of acceptance and delivery of repaired, reconstructed, modernized fixed assets in form No. OS-3, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7;

– an inventory card for recording a fixed asset object in form No. OS-6 (approved by Resolution of the State Statistics Committee of Russia No. 7), where information about the repairs carried out is entered.

But, let us repeat: it is the report on the identified faults (defects) of the fixed asset, or in other words, the defective statement, that will allow us to distinguish repairs from modernization. Moreover, officials have repeatedly confirmed that the costs of repairing a broken fixed asset can be safely recognized as part of others if there is a defective statement. In particular, this conclusion is contained in the letter of the Ministry of Finance of Russia dated December 4, 2008 No. 03-03-06/4/94. The basis in this case will be Article 260 of the Tax Code of the Russian Federation.

There is no strictly approved form for a document that will confirm detected defects. The company's accountant can independently develop the required form. In this case, you need to check that your own form contains all the mandatory details listed in paragraph 2 of Article 9 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”.

Please note: some accountants, to confirm repair costs, use a report on identified equipment defects (form No. OS-16), approved by the same Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7. However, we do not recommend doing this.

The fact is that this form is used to identify equipment defects during installation, adjustment or testing, as well as based on inspection results. This form has nothing to do with repairs. That is, in case of breakdowns during operation, it is not applied.

Alternatively, form No. OS-16 can be taken as a basis, excluding unnecessary columns from it and adding your own. Current legislation does not prohibit this at all. The main thing is that the report must indicate the identified defects of the fixed asset. As well as suggestions on how to eliminate such defects.

Such paper will indicate that the company has rightfully written off repair costs.

The number of copies of the defective statement depends on who owns the property being repaired and who will do the repairs. If a company decides to repair its own fixed asset on its own, one copy is enough.

If the work will be performed by a third-party organization, it is better to fill out several forms - one for yourself and one for the contractor. In this case, the documents must be signed by representatives of all parties involved. The same applies to situations where a company is renovating a leased property.

Source

Design bureau or private specialist?

When contacting a design studio or construction company, first of all, you need to check whether this organization has permission and admission from the SRO to the work being carried out. If you contact those who have this clearance, you can be sure that the specialist in the project takes into account all laws, norms and rules. You must understand that in some cases, after the development and implementation of a project by a private specialist, it is impossible to legitimize the redevelopment. If you sell an apartment with uncoordinated architectural changes, you will lose in price (you can lose about 15% of the cost).

Designer apartment renovation - from idea to execution

How to select a team for repairs and monitor their work?

Proper documentation of repairs of fixed assets - download sample documents

Based on the legislative provisions of the Russian Federation (Article 9 of the Law of December 6, 2011 No. 402-FZ), any operation relating to the repair of fixed assets requires registration using primary documents.

And here it is worth considering such an important point: both the movement of property and its acceptance after restoration work are subject to mandatory documentation.

The amounts that will be spent on current repairs can be written off in tax accounting as other expenses (clause 1 of article 260, clause 1 of article 264 of the Tax Code of the Russian Federation).

And it does not matter at all who will perform these works - the company independently or a third-party contractor.

To take into account the costs of repair work for tax purposes, you must provide documentary justification for the need for repairs.

In other words, it will be necessary to provide evidence that without repair work it is not possible to continue to use this property for work.

Previously, it was necessary to collect a huge amount of paperwork, but now this is far from the most difficult procedure.

What kind of documentation for the repair of fixed assets is provided for today?

What documents need to be completed so that the accountant can correctly take into account the costs of work in accounting and reduce the taxable base in tax accounting by their amount.

What documents need to be completed?

You can confirm the fact that repairs are needed using a report on the calculated problems and defects of the fixed asset. In other words, we are talking about a defective statement.

In some industries, such documents have a special unified form. Let’s say that registration of damage to lifting and transport equipment of sea trade ports is possible using a defective statement approved using Resolution of the Ministry of Transport of Russia dated January 9, 2004 No. 2.

If we are talking about pipeline elements of thermal power plants, it can be reflected in the list of pipeline defects. That is, each case is individual.

If there is no unified form of document proving the presence of identified defects, it is possible to develop a form independently.

For example, an act on identified defects of a fixed asset item or a defect sheet. The report must contain a list of all faults and ideas on how they can be eliminated.

How many copies of the report on identified faults and defects of fixed assets must be drawn up?

Here you need to look at the following points:

- Who owns the property?

- Who will carry out the repair of fixed assets?

If you plan to repair your own OS objects using household methods, in other words, do it yourself, creating one copy is enough.

If the repair work will be carried out by contractors, the document must be drawn up according to the number of parties involved in the process.

Each party must have their own copy with all signatures affixed.

If the latest equipment is subject to repair, damage to which is discovered during installation, it is worth using a report on the calculated defects of the equipment to fix them. For example, form No. OS-16 can be used.

This must be done with those objects that are not yet considered fixed assets (that is, not registered).

After preparing the defective statement, a repair order is prepared, on the basis of which the OS object is transferred to the contractors for restoration.

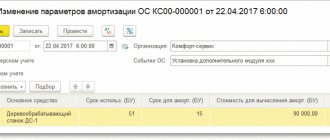

The repaired fixed asset is accepted according to the OS-3 act. Next, information is entered into the OS-6 inventory card.

How to fill out a defective statement?

There is no unified (standard) form for this document. It is also worth mentioning that there are some exceptions (for example, a defective statement approved by Resolution of the Ministry of Transport dated January 1, 2004 No. 2 - this document made it possible to document defects in lifting and transport equipment of sea trade ports).

This document is often used in accounting - this is the so-called primary documentation (since it guarantees the recording of specific business transactions in the institution).

Thus, the best option is to draw up a template for the document in question, based on the provisions and requirements of Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402.

The defective statement must include information about:

- what is the name of the document;

- when it was compiled;

- what is the name of the organization that issued this document;

- description of the OS object.

In relation to the fixed asset, you should indicate:

- Name;

- information about its defects and violations;

- the reasons why these defects occurred;

- types of repair work, the main task of which is to eliminate the indicated defects or damage;

- a reflection of the fact that it is not possible to eliminate a particular defect - that is, from the conclusion that the corresponding object has been written off;

- deadlines for eliminating identified and identified problems.

The defective statement should also indicate:

- what is the value of the natural or financial measurement of a fact of economic life with the designation of measurement units;

- what positions are occupied by the persons responsible for the business operation and the competence of its implementation;

- Signatures of the above persons. They must be deciphered - with full name, display of current positions.

This is a standard mandatory list of provisions that must be included in the defective statement. Additions and adjustments are possible.

defective statement for repairing fixed assets - word.

Sample order

Immediately after drawing up the defective statement, the boss must begin issuing an order to carry out repairs.

The order states by what method the OS will be repaired - independently or with the help of contractors.

It is also necessary to take into account the following important point: the period for carrying out this procedure, information about the persons who are responsible for the organizational process of repair work, as well as other information must be indicated.

order for OS repair – word.

How to draw up an acceptance certificate for a renovated object?

For acceptance and commissioning of the repaired fixed asset, an acceptance certificate is drawn up.

In this case, you can use the standard OS-3 form or develop your own form.

An act is drawn up in one copy if the OS is being repaired on its own.

If the repair is carried out by a third-party contractor, then two copies are required: one for each party.

This act must include information about the fixed asset at the time of transfer and acceptance after repair, as well as information about the costs incurred.

acceptance certificate for repaired fixed assets, form OS-3 – word.

How to reflect repair work on the OS in the inventory card?

To reflect information about repairs, you need to use an inventory card for recording a fixed asset - that is, a specialized form OS-6 or OS-6b, if we are talking about a small enterprise.

Do-it-yourself repairs

Should an institution prepare an estimate when carrying out repairs?

Expert of the Legal Consulting Service GARANT

Gurashvili Roman

Response quality control:

Reviewer of the Legal Consulting Service GARANT

Advisor to the State Civil Service of the Russian Federation, 2nd class Anna Shershneva

The preschool educational institution carried out routine repairs on its own (by the employees of the institution) without drawing up an estimate. To carry out repairs, building materials (paint, boards, nails) were purchased from budget funds. Should an institution prepare an estimate when carrying out repairs?

Having considered the issue, we came to the following conclusion:

There is no direct indication in the regulatory documents for drawing up an estimate when carrying out routine repairs using an economic method (on your own). But in order to control the effective use of funds of a budgetary institution by a local act, it can independently develop and approve a list of documents to confirm the validity of repairs, as well as to plan the list and volumes of materials to be written off.

Rationale for the conclusion:

The forms of primary accounting documents for public sector organizations are established in accordance with the budget legislation of the Russian Federation (Part 4, Article 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”).

The list of forms of primary accounting documents used by state (municipal) institutions and the Guidelines for their application were approved by Order of the Ministry of Finance of Russia dated March 30, 2015 N 52n. The forms of primary accounting documents accepted for accounting by a budgetary institution must contain the mandatory details provided for in Part 2 of Art. 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” (this requirement is also “duplicated” in clause 25 of the Standard “Conceptual Framework.”).

The issuance of construction materials to employees of the institution for the purpose of carrying out routine repairs of the premises in an economic way, including the return of remaining materials to the warehouse, is formalized by the Request-invoice (f. 0504204) and (or) the Statement for the issuance of material assets for the needs of the institution (f. 0504210).

To formalize the decision on the write-off of inventories, the Act on the write-off of inventories (f. 0504230) is used. It serves as the basis for recording in the accounting records of the institution the disposal of inventories from the accounting accounts. The act on the write-off of inventories (f. 0504230) is drawn up by the institution’s commission for the receipt and disposal of assets and approved by the head of the institution. Documents justifying the write-off of inventories may be attached to it.

There is no direct indication in the regulatory documents for drawing up an estimate when carrying out routine repairs using an economic method (on your own). But in order to avoid claims and disagreements on the part of the inspection authorities (see, for example, clause 3.1 of the Report approved by the decision of the Kasimov City Duma of the Ryazan region dated March 26, 2015 N 19/3), when carrying out repairs, the organization faces the following tasks:

1) justification for the need for repairs, determination of planned indicators that will be used when carrying out routine repairs (list and volumes of planned work and the corresponding volumes and names of building materials);

2) control over the compliance of the quantities and names of building materials written off from the register with the volumes of work actually performed.

The need to solve the above problems is determined, in particular, by the requirements for the effective use of funds from a budgetary institution.

To solve the first problem, the institution can draw up a defective statement. A unified form of the primary accounting document “Defective Statement” has not been established, but this does not prevent the use of document forms independently developed by the institution. The practice of using a defective list indicates that this document is used to assess the expected volume of repair work for the purpose of planning the purchase of materials, work, and services. However, it should be understood that the defective statement does not record the fact of economic life - the implementation of repairs. In other words, it is not a primary accounting document (see letter of the Ministry of Finance of Russia dated January 14, 2019 N 02-07-10/868). At the same time, the defective statement may be an appendix to the primary accounting document. In this case, the procedure for compiling and generating a defective statement must be enshrined in the local act of the institution.

To solve the problem of monitoring the compliance of the quantity of building materials written off from registration, an act can be drawn up, drawn up in a form also approved by a local act.

In conclusion, we draw your attention to the fact that the above discussed only the general rules that should guide budgetary institutions when documenting operations related to the write-off of inventories when carrying out routine repairs in an economic way. At the same time, specific lists of documents (as well as the procedure for filling them out) that must be drawn up when carrying out routine repairs (including in an economic way) can be determined by the authorized body of the relevant public legal entity, the body exercising the functions and powers of the founder, or at a departmental level.

Repairs in rented premises

According to the general rule, stated in Article 616 of the Civil Code, when renting property, responsibilities for its repair are distributed as follows: current repairs are the responsibility of the tenant, and major repairs remain with the lessor.

Usually, when leasing office real estate, these rules remain unchanged, since the lease terms are most often short, and it is inappropriate to shift major repairs to the tenant (and the Civil Code of the Russian Federation allows this). In such a situation, the accountant of the organization renting the premises, when carrying out repairs, needs to clearly understand what kind of work relates to the current repair. After all, if an organization “accidentally” carries out major repairs, there may be problems with taking into account expenses for tax purposes, since the tenant had no obligation to carry out such repairs. Consequently, the expenses may be considered unjustified (Article 252 of the Tax Code of the Russian Federation).

The situation is similar for the landlord. Here it is important to understand which of the tenant’s requirements for repairs must be met, because these requirements relate to major repairs, and which requirements are not justified. Accordingly, for the landlord, the tax accounting of repair costs will depend on the correct answer to this question.

Draw up and print a lease agreement for free using a ready-made template