When paying insurance premiums or taxes, it often happens that an organization overpays. But this overpayment can be returned. It is enough just to correctly fill out the corresponding application in the KND form 1150058.

What is this

Contents:

You need to understand that even those funds that were paid erroneously are sent to the budget. Accordingly, you cannot simply take money from it and return it to the payer. Here you will need to write a corresponding application, which is the KND form 1150058, adopted by the Federal Tax Service back in 2021. However, later some changes were made to the form. Therefore, starting from 2021, a new form should be used.

However, it is not always possible to return the overpaid amount. Thus, the Tax Code provides for the refusal to return money if there is any debt on other accounts. If a tax inspector discovers that an organization has not made any obligatory contribution to the budget, he must notify about it. Accordingly, the overpaid amount will go towards the debt.

If the amount of debt is less than the overpaid amount, the responsible persons of the Federal Tax Service make the appropriate calculations. That is, the debt is repaid first. If there is a balance, the company can take it away. In order for the tax office to return this balance, the taxpayer must receive a standard application in the KND form 1150058. In addition to the refund, the organization may ask to count this money toward future payments.

( Video : “Refund of overpaid tax”)

When is it necessary to apply for a refund of overpaid tax?

There are different situations where tax overpayment occurs.

For example, a taxpayer mistakenly transferred a tax amount greater than what he showed in the declaration. Or he filed an updated declaration with a lower tax charge than was initially shown and, accordingly, has already been transferred. In addition, it is possible that more advance payments were transferred at the end of the reporting periods than the amount of tax accrued for the tax period.

In such cases, the taxpayer should contact the tax office at the place of registration with an application for a refund of the amount of overpaid tax. The tax can be refunded within 3 years from the date of overpayment (Clause 7, Article 78 of the Tax Code of the Russian Federation).

Learn more about tax refunds in this article.

Do not forget that the tax office is obliged to independently calculate and pay interest for late repayment of the overpayment. You do not need to submit an application for this. You can learn about how interest should be calculated and what to do if the tax authorities refuse a refund from the Ready-made solution from ConsultantPlus. Trial access to K+ can be obtained for free online.

When do you need to write an application using the KND form 1150058

It is logical to assume that in order to return the money, both parties, both the organization and the tax service, must know about the overpayment. Only in this case will this application be accepted. If the fact of overpayment was discovered by the tax inspector, he must inform the organization about it within ten days. Typically, in this case, the Federal Tax Service sends the company a corresponding letter. Often, responsible employees of the organization themselves find out about the overpaid amount. In such situations, the fact of overpayment will need to be proven. To do this, it is recommended to prepare the appropriate documentation in advance.

The law defines the period during which the received application is considered and the excess amount paid is returned. Naturally, tax inspectors are obliged to remember this. There is also such a thing as a statute of limitations. For example, a company has the right to ask for a refund within three years if the overpayment was made through its fault. There are also situations where the tax service has mistakenly written off more tax than required. In this case, the tax authority is obliged to report the incident to the head of the company. After receiving this notice, the organization must submit an application within a month.

Regarding the deadlines for claims, you need to be extremely careful here. If they are violated, the tax office will not return the overpayment. Of course, in this case, you can try to go to court and prove that the claim period has not yet passed. But you should only go to court if it really didn’t go through. Otherwise, legal proceedings can be called a waste of time.

Differences between the new KND 1150058 form 2021 and the previous form

If you carefully examine the new KND form 1150058, which began to be used in 2021, you will notice that there are many changes. For greater clarity, all the differences can be seen in the table below:

Tax Refund Application Form 2020-2021

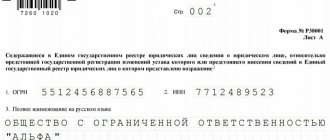

The application form for a refund of overpaid tax was approved by Federal Tax Service order dated 02/14/2017 No. ММВ-7-8/ [email protected] From 01/09/2019 it is used as amended by the Federal Tax Service order dated 11/30/2018 No. ММВ-7-8/ [email protected]

In the application form for a refund of overpaid tax, you must indicate:

- TIN, KPP (if any) of the person submitting the application (this information is indicated on all pages);

- application number, code of the tax authority to which it is submitted;

- name of the taxpayer (if it is an organization) or full name (if it is an individual entrepreneur or individual);

- payer status (from 01/09/2019);

- article of the Tax Code on the basis of which the refund is made;

- taxable period;

- OKTMO and KBK codes;

- who confirms the accuracy of the information specified in the application, telephone number.

Also on the first sheet is the signature of the applicant and the date of signing. The second page contains information about the bank account details (from 01/09/2019, the type of account is indicated as a code, and there is no field for specifying a correspondent account), the name of the recipient and information about the identity document. The third page is filled out by individuals who are not individual entrepreneurs. It also provides information about the identity document. From January 9, 2019, the individual’s place of residence is not indicated in the application. Please note that this page may not be filled out if a TIN is provided.

The application must be dated and signed by the applicant. If the application is submitted electronically, it is certified by an enhanced qualified electronic signature.

To find out whether a stamp is needed on the application, read the article “The Tax Office will accept documents without a stamp .

How to fill out an application for a refund of overpaid tax in 2021

There are no special rules for filling out this document.

Yes, they are not needed, since the form itself contains the necessary codes and tips. So, filling begins with the title page. The following data is indicated here:

- Checkpoint codes and TIN of the organization. If the application is made by an individual entrepreneur, then the checkpoint is not indicated.

- The form already contains the full name of the document. All that remains is to enter the application number in the appropriate column. Next to it indicates the code of the tax office to which the document will be submitted.

- Below is the name of the company or the full name of the individual.

- Next, the payer status is indicated.

- Below is the “Based on Article” field. Here you need to indicate the article number of the Tax Code. You can select the one you need here:

- Next, the type of amount and payment is noted.

- You must enter the amount to be returned. Not only rubles are indicated, but also kopecks.

- The period for which the overpayment occurred is indicated.

- Budget company and OKTMO codes are entered.

Next comes the division of the sheet into two parts. The left one is intended to indicate information about the payer: his full name, contacts, signature. The right side remains empty; the tax inspector will fill it out.

The second page of this form is intended to display the details of the bank through which the transfer was made. The recipient's name, account type and number, and other information are written in the corresponding lines.

The third sheet of the form remains blank if the application is submitted by an individual entrepreneur or legal entity. This sheet must be completed if the applicant is an individual. Here you need to provide information about it. Not only your full name, but also your passport details are entered.

You can compose a document on a computer or by hand. If you choose the handwritten option, you need to use a ballpoint pen with black ink. All characters must be entered in capital block letters. It is necessary to try to avoid errors and corrections. The use of a corrector is also unacceptable. If a mistake was made, you must begin filling out a new form. The completed document must be submitted to the tax office at your location.

To do this, you can use one of the convenient methods:

- ask the courier for help;

- submit the application to the inspector during a personal visit;

- use the services of an electronic reporting operator;

- register on the Federal Tax Service website, create a personal account where you can fill out and submit an application;

- send by mail.

If you choose the option of submitting your application by mail, you must order the service of a valuable letter. In this case, it is necessary to make an inventory of the contents of the envelope. When sent, the taxpayer will receive a receipt, which will serve as documentary evidence of sending the application.

Results

The resulting tax overpayment can be returned from the budget. To do this, you must submit an application in the prescribed form to the Federal Tax Service Inspectorate, indicating in this document the necessary codes, taxpayer data, the period of the overpayment, its amount and details by which the overpayment will be returned.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated February 14, 2017 N ММВ-7-8/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Sample of filling out an application for a refund of overpaid tax for 2021

and form

- Application form KND 1150058

- An example of filling out an application form for legal entities

- An example of filling out an application form for individuals

Sample application for refund of overpaid tax

First, in the upper right part of the document, information about the addressee of the application and its author is indicated. Here is the name and number of the specific tax service, as well as information about the taxpayer:

- If we are talking about an individual entrepreneur or any other citizen of the Russian Federation, then it is enough to indicate his personal data:

- surname-first name-patronymic,

- TIN,

- residence address (according to passport)

- and a contact phone number (in case the tax officer needs any clarification).

- If the application is made on behalf of an organization, then you need to write:

- its full name,

- TIN,

- Checkpoint (in accordance with the constituent documents),

- legal address

- and also a telephone number for communication.

The main part of the document concerns overpaid tax.

- First, there is a link to the article of the law that allows the return of overpaid amounts.

- Then you should note the nature of the overpayment: was the money paid voluntarily or collected, as well as the name of the tax levy.

- After this, the tax period for which the overpayment occurred is entered and the tax code according to the KBK (budget classification code) is indicated - it has periodically changing individual indicators for each tax and the OKTMO code (depending on the territory in which the tax payment was made).

- Next, in numbers and in words, the amount that the taxpayer considers overpaid and the account details for the refund are entered into the form:

- name of the bank servicing the account,

- his correspondent check,

- BIC, INN, KPP,

- taxpayer's current account number.

- After this, in the line “Recipient” the last name, first name and patronymic name of the individual entrepreneur or citizen or the name of the organization submitting the application are indicated.

- Finally, the form must be dated and signed.

Deadlines for refunding overpaid tax

There is a clearly limited period for filing an application for a refund of overpaid tax: three years.

If the fact of the overpayment was discovered later or the taxpayer for some reason was unable to apply for a refund within this period, it will hardly be possible to do anything in the future.

If the application is submitted on time and in accordance with all the rules, and the tax office did not have any questions and agreed with the taxpayer’s request, the refund must be made no later than a month after filing the application.