According to labor legislation, an employee of an organization or individual entrepreneur with whom he has an employment contract is entitled to 28 days of paid leave per year. In some cases, the number of days of paid leave may be increased. An employee has the right to vacation after six months of work, but by decision of the employer, the employee can be allowed to rest earlier. A request for leave is a statement from the employee himself, which must be approved by the employer, recording this fact in the appropriate order. Next, the company or individual entrepreneur has the obligation to calculate and pay the vacationer the due payment for the period of absence from work.

Federal law on vacations in the Russian Federation for 2021

photo from thenounproject.com

Most people prepare for vacation in advance: this is due not only to natural forethought, but also to the fact that company managers need to draw up a vacation schedule.

Who is entitled to a well-deserved rest and when?

Every year, every working person has the right to rest, which lasts twenty-eight calendar days. It can be provided after six months from the moment the person officially worked in this company. The law does not prohibit the provision of leave to those who have not yet worked for the company for the above period: this is possible by personal agreement between the employee and the head of the company.

Few people know, but an employee has the right to take paid leave in the amount of 28 calendar days, having worked for six months, not a year (Letter of Rostrud dated December 24, 2007 N 5277-6-1).

There are categories of the population that the employer is obliged to

let them go on vacation before they have worked for six months. These include:

- women going on maternity leave or just returning from it;

- people who have adopted a child (children) whose age is not more than three months;

- persons under 18 years of age.

For the second and subsequent years of work at the same enterprise, an employee can be granted leave at any time, but it must be agreed in advance with the person who draws up the schedule. Also, the time of departure for legal rest is influenced by the priority established in each specific company. The manager must notify the employee no later than two weeks before the vacation is provided.

The schedule cannot be changed unilaterally: the manager and employee must agree on any changes. Management is legally prohibited from not releasing an employee for two years in a row. But if a situation arises in the company that the employee did not have time to take the required days during the year or his presence was necessary for the company, then all unspent days are transferred to the next year. By law, they must be “taken off” within the next 12 months from the beginning of the new calendar year.

From a legal point of view, it is quite possible to divide the vacation into parts. Moreover, at least one of them must be fourteen days. At this time, an employee can be recalled to work only with his consent. Part of the rest, upon the written application of the employee, can be replaced by monetary compensation. This is not a mandatory measure, but a possible option.

There are citizens who do not have the right to recall or replace part of their vacation days with money. These include minors, employees on maternity leave, as well as people whose professional activities are directly related to dangerous and/or harmful production.

Vacation scheduling

The vacation schedule is an internal regulatory act of the organization, which fixes the procedure for providing vacations to employees. The rules for its preparation are determined by Art. 123 Labor Code of the Russian Federation. In particular, they establish that this schedule must be drawn up in December of the previous year, and its content must be agreed upon with the trade union organization. In addition, it is necessary to take into account that the provisions of Part 4 of this article of the Labor Code give some groups of employees, including pregnant women, minor workers and other categories, the right to independently choose when to go on vacation. At the same time, drawing up a schedule is mandatory for every employer.

According to current legislation, an organization has the right to independently establish the form of a document recording the priority of the duration of vacations, or use for these purposes a unified form known as Form No. T-7. At the same time, the established procedure for drawing up schedules allows for changes to the approved procedure if they are due to valid reasons for the employee or employer. However, appropriate changes can only be made with the consent of both interested parties.

Vacation pay in 2017

photo from thenounproject.com

We sorted out the deadlines. Now we need to talk about how the period of legal rest should be paid for.

According to the law, vacation pay payments in the new year 2021 are formed depending on how many days a person worked over the past year. Has the employee worked for twelve months, continuously and completely? It is important to know that when calculating vacation pay, even in this case, not only already granted rest days are excluded, but also sick leave and business trips. After all, these periods have already been paid for.

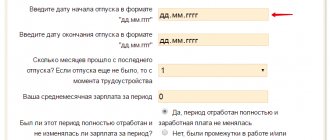

You can calculate how much money you will receive yourself. To do this, you need to multiply your average daily earnings by the number of days you plan to take.

Calculating average daily earnings is also easy: you need to divide all payments received for the period worked by the number of calendar days. In order not to calculate the ratio manually, a state standard has been established.

According to it, the average number of days in a month is 29.3. When working out the entire year, this number is multiplied by 12 (months), we get 351.6. It is on this that all funds received must be divided.

If you took sick leave during the past period, then payments for these days are deducted from the total amount.

Separately, it is necessary to say about those employees who plan to leave the company, but did not have time to take the required time off. Upon dismissal, an employee receives monetary compensation for all days that he did not have time to take off. The amount for them is calculated based on the number of days worked.

There is also a special type of vacation. In case of emergency, an employee can take one day without pay for it. Provided upon written request from the employee. The duration is agreed with the authorities. This type includes providing a maximum of five days to an employee who has had a child, died a close relative, or is about to get married.

How to take into account the annual bonus when calculating vacation pay

The annual bonus when accounting for vacation pay is taken into account in two cases:

- If the organization included this clause in the employment contract.

- If the bonus is an incentive for achieving certain labor successes.

In this case, the bonus is taken into account regardless of when it was accrued. That is, remuneration for 2021 is taken into account when calculating vacation in any month of 2021. The fact of full or partial completion of the billing period is also taken into account. If it is fully worked out, the bonus is included in the calculation of vacation pay in full in any case. If this period is not fully worked, then remuneration in full is paid only if it is accrued in accordance with the time actually worked.

Law on vacations of civil servants of the Russian Federation for 2021

photo from thenounproject.com

Changes in legislation affected almost all citizens of our country, including civil servants. The new vacation law differs from the old version in three ways.

- Employees holding senior and main positions will no longer be able to rest for 35 days. Now the same length of vacation is set for everyone - thirty calendar days.

- The rules for granting additional leave provided for length of service have also changed. If previously an employee received one additional calendar day for each year spent in the service of the state, now new standards have been introduced.

- Experience 1-5 years – 1 day;

- 5-10 years – 5 days;

- 10-15 – 7 days;

- from 15 years – 10 days.

- The duration of additional leave provided for irregular working hours is prescribed by law. Previously, only the lower limit was indicated (three days); the maximum possible period was set by a specific government agency. The amendments made strictly defined the deadline - three calendar days.

Quarterly bonus when calculating vacation pay

The general grounds for calculating quarterly bonuses in the case of vacation pay apply if the employee has worked the full estimated time. If this period is partially worked out, the remuneration is calculated taking into account the following nuances:

- If it is proportional to the time worked, then it is taken into account in full.

- If its size is fixed, then it is calculated taking into account the hours worked.

- Those months included in the calculation period are taken into account.

So, if the beginning of the billing period is November, then only two worked months are taken into account in the third bonus quarter.

When calculating vacation pay, only the quarterly bonus included in the reporting period is taken into account. Amounts accrued beyond this period are not taken into account.

One-time bonuses when calculating vacation pay

A one-time bonus is a payment that is systematic in nature. It, like other types of remuneration, is taken into account when calculating vacation pay. To calculate it, the same rules apply as in the case of other bonuses. It is taken into account in full if the billing period has been worked out in full. In this case, each case of issuing such an incentive is taken into account. If the pay period is partially worked, the bonus is calculated in accordance with the time worked.

If the duration of payment of one-time bonuses exceeds the calculation period, the amount of accrual is calculated taking into account each month of this period separately. If these two indicators are the same or the duration of the bonus period is less than the calculated one, then vacation pay is calculated in accordance with the general rules.

How to calculate vacation pay if everyone in the organization has increased their salaries

If the organization indexed the salaries of all employees, then vacation pay must be increased by the indexation factor. Calculate the indexation coefficient using the formula:

| Indexation coefficient | = | New salary | : | Old salary |

How exactly to calculate average earnings depends on the period when salaries were increased (see table below).

How to calculate average earnings if the organization has increased salaries

| When did salaries or tariffs increase? | How to recalculate average earnings for vacation pay |

| During the billing period | Multiply by the payout ratio for the period before indexation |

| After the billing period, but before the holiday | Multiply the average earnings by the coefficient |

| During vacation | Multiply by the vacation pay factor for days from the indexation date |

Example. How to calculate vacation pay if the organization has increased salaries

The employee is going on vacation from January 21, 2021; from January 10, everyone in the organization increased their salaries. The employee’s new salary was 45,000 rubles, the previous one was 42,000 rubles. We will show how an accountant will take into account the increased salary when calculating vacation pay.

The indexation coefficient is 1.07 (45,000: 42,000). Since salaries were increased after the billing period, but before the vacation, the accountant will first calculate the average earnings based on payments for the period from January to December 2021, and then multiply it by the indexation factor of 1.07.

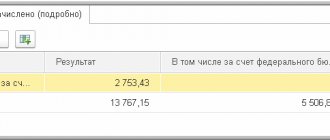

Examples of vacation pay calculations

Vacation pay is calculated separately for each employee. In this case, all his achievements during the pay period and hours worked are taken into account. Let's look at the calculation scheme using several examples.

Example 1. The full pay period has been worked. The employee wrote an application for the next vacation, which the organization must pay. It is calculated from April 18, 2017 and lasts 14 days. In 2021, the employee’s salary was 12,000 rubles, in 2021 – 15,000. In 2021, the employee was given a bonus in the amount of 4,000 rubles. In such a situation, vacation pay is calculated according to the following scheme:

12,000 x 9 + 15,000 x 3 + 4,000 = 157,000

157,000: 12: 29, 3 = 446 rubles 53 kopecks – average daily earnings.

446.53 x 14 = 6,251 rubles 42 kopecks – vacation pay.

Example 2. The billing period was interrupted by sick leave. Let’s assume that the employee’s salary data remained the same. But from November 4 to 17, 2021, he went on vacation, and from May 5 to 13 he went on sick leave.

12,000 x 11:22 = 6,000 – salary for November.

12,000 x 17: 22 = 9,272.73 – salary for May.

12,000 x 7 + 15,000 x 3 + 6,000 + 9,272.73 + 20,000 = 164,272.73

29.3: 30 x (30 – 14) = 15.6 – days worked in November.

29.3: 31 x (31 – 7) = 22.6 – days worked in May.

164 272.73: (29.3 x 10 + 15.6 + 22.6) = 496 rubles

496 x 14 = 6,944 – vacation pay

Determining the billing period

The standard billing period is the previous 12 months before the start date of the holiday. If an employee has been working at an enterprise for less than a year, the period is considered to be the entire period of work until the day of vacation.

If an employee takes a vacation on the last day of the current month, the billing period includes this month and the 11 previous ones.

Days of absence from duty are excluded from the calculation period:

- business trips;

- vacation at your own expense. This is also a leave without pay;

- temporary disability, maternity leave, days off for caring for the disabled and other situations from paragraph 5 of Regulation No. 922.

Weekends and holidays are included in the billing period.

How to calculate vacation pay if the employee received bonuses

If the employee received bonuses in the billing period before the vacation, include them in the calculation according to special rules. We have summarized the features of accounting for monthly, quarterly and annual bonuses in a table.

How to include bonuses in holiday pay calculations

| Type of award | How to include holiday pay in calculations |

| Monthly, quarterly or semi-annual bonus | Include in the calculation in full, but not more than one bonus for the same indicator. For example, an employee was awarded two bonuses for fulfilling a sales plan and one bonus for product quality. You take into account only one bonus for the completed plan and one for quality |

| Year-end bonus | Include in the calculation in full if it was accrued in the year preceding the vacation. The month in which the accrual was made does not matter |

| One-time bonus | Include in the calculation only if the bonus is provided for in the bonus regulations or other document. Do not count bonuses for birthdays or other holidays |

Example. How to calculate vacation pay if bonuses were awarded

The employee is going on vacation from January 20, 2021. The salary for days worked in 2021 amounted to 920,000 rubles. In addition, in January 2021, the employee was awarded a bonus of 28,000 rubles. for the completed plan at the end of 2021. We will show you how much the accountant will include in the calculation of vacation pay.

The average salary for vacation pay should be calculated based on payments equal to 948,000 rubles. (920,000 + 28,000). The accountant will include the January annual bonus in the calculation, since it was accrued based on the results of 2018.

How to determine the average salary for vacation pay in 2019?

Average earnings depend on the amount of accounting payments accrued in the billing period. It should be calculated using the following formula:

| Average earnings for the 12 calendar months preceding the vacation | = | The amount of payments for the 12 calendar months preceding the vacation included in the calculation | : | 12 months | : | 29,3 |

When calculating vacation pay, include all payments for time worked. These include:

- wages accrued for time worked, at piece rates or as a percentage of revenue;

- salary in non-monetary form;

- fees for media workers and arts organizations;

- allowances and additional payments for professional skills, class, length of service, work experience, knowledge of a foreign language, etc.

- additional payments for working conditions;

- bonuses and rewards provided for by the remuneration system.

What charges affect the calculation of vacation pay in 2021?

At enterprises of all forms of ownership, there is a practice of making additional payments for various reasons. Therefore, you need to clearly understand which of them (and how exactly) should be taken into account when forming vacation amounts. So:

- When making calculations, it is necessary to take into account allowances for class, length of service and complexity of the work performed;

- The bonus must be taken into account, which is added to the amount of wages. However, this case has its own specifics - if the employee received bonuses twice in one month, then only one bonus is included in the calculation of vacation pay. If the bonus amounts are not the same, then the decision on which one to add to the salary is made by the employer or the chief accountant as his legal representative;

- when calculating average earnings taking into account bonuses, the one-time bonus is divided by the number of months that appears in the formula for calculating vacation pay, and then the result is added to the monthly salary;

- An important point is the bonus accrual period. It must be remembered that only bonuses for 2021 are taken into account. For example, if in January 2021 Petrov was awarded a bonus based on work results in 2018, then it does not need to be taken into account. But the bonus that Petrov was given in March 2021 will definitely be added to.

What payments are not included in the calculation of vacation pay?

The following payments are not taken into account when calculating salary:

- One-time payments: travel allowances, payments for carrying out special assignments, bonuses for inventions and innovation proposals.

- Rewards associated with holidays (for example, an anniversary) and the employee’s active social work.

- Social benefits (pensions, government subsidies).

- Funds issued by the enterprise for travel, food, and rest of employees in sanatoriums.

- The cost of special clothing, shoes and hygiene products provided by the company.

- Material rewards for prizes in competitions and competitions.

A number of payments are not included in the list of data when calculating vacation pay.

Considering the number of various payments that an employee can receive during the year, calculating vacation pay becomes a difficult task for an accountant. Moreover, the system for calculating these rewards changes from year to year. It is possible that other innovations will come into force in 2021, about which nothing is known yet. So accountants just have to stay tuned.

How to reflect vacation pay, bonuses, and carry-over wages in the report

When drawing up a report in form 6-NDFL, the following factors are taken into account:

- The actual receipt of vacation pay is recorded as the day of payment.

- When the appropriate amount is calculated, income tax is withheld from it.

- Systematic bonuses are equated to basic income, one-time bonuses – to additional income.

The report contains data on the rolling salary. In this case, its accounting is carried out in accordance with the month of accrual. If vacation pay was overpaid, it can be issued in the form of bonuses, subject to agreement with the employer. Otherwise you will have to go to court.