Cash transaction accountants sometimes wonder whether errors, inaccuracies and corresponding adjustments are allowed in cash transactions.

The exact answer is determined by the type of document being corrected and the significance of the detected defect.

Some clerical errors or misprints lead to obvious distortions in financial and tax reporting, others can have the most unfavorable impact on the tax obligations of a business entity, and some simply are not detected during an audit and subsequently go unnoticed.

Is it even possible to correct any cash register papers?

How can changes be made to such documentation correctly if this is not prohibited by current legislation?

Is it possible to deposit?

The absence of any adjustments in the cash transaction registers is the main requirement when a business entity prepares cash documentation.

In other words, there should be no errors, blots or corrections in the cash register papers. However, in practice, various types of amendments are still made to documents certifying the execution of cash transactions.

Sometimes for these purposes, employees of the organization use correction fluids, which is generally not acceptable.

Adjustments to PKO and RKO

If the contractor made a mistake or made a blot when filling out a cash receipt/expense order, it is strictly prohibited to make any corrections to such papers.

In RKO/PKO, the presence of any painting, crossing out or other adjustments is not allowed.

The only solution to this problem is to cross out the damaged order and issue a new document.

The crossed out (rejected) cash order should, however, be attached to the cash report generated at the end of the corresponding day.

A rejected or damaged document cannot be used to perform an outgoing/receiving transaction with cash.

How to correct an error in the cash book

The question of the possibility of edits has been resolved, now let’s reproduce the algorithm for making corrections:

Step 1.

You need to cross out the erroneously entered data.

Step 2.

Next to the crossed out erroneous data, enter the correct data. It is very important that they are readable and legible.

Step 3.

We indicate the date the corrections were made.

Step 4.

The signature of the person by whom the corrections were made is affixed, with a transcript.

Corrections must be made by the same employee who originally compiled the document. Since the cash book is maintained by a cashier or accountant (this responsibility is assigned to them by order), it is they who will have to make corrections when errors are detected.

IMPORTANT! If an error is discovered that was made several days ago, and it affects the cash balances, the data of which is transferred to subsequent sheets of the cash book, then all sheets that require such corrections are subject to correction.

The material “Cash Discipline and Responsibility for Violating It” will help you check whether you are making mistakes in cash discipline.

Responsibility for incorrectly completed cash register

There is no penalty for filling out the RKO or PKO incorrectly. However, if the document is filled out with errors, the inspection authorities may consider it missing. For example, if there is no decoding of the surname in the RKO, this means that the document was drawn up with violations. The RKO must be signed in such a way that the signature can be used to identify the signatories, that is, those persons who are responsible for processing this transaction.

Important! If there is no transcript of the signature, then the inspection authorities can equate the warrant with missing documents, and this can lead to a fine of 10 thousand rubles (120 Tax Code of the Russian Federation).

This fine may be imposed on the basis that the company’s primary documents are not properly prepared. However, the imposition of such a fine is also unlawful, since it is provided for the fact that documents are missing, and not for the fact that they are executed incorrectly. In this case, the courts may side with the organization.

What, then, can lead to incorrect drafting of RKO? A document executed in violation may cause them to lose their evidentiary value. For example, if in court it will be necessary to prove the fact of issuing cash to a certain person who declares that he did not receive any money.

What errors are there in primary documents?

Technical errors in the primary document are:

- spelling errors, typos, misprints;

- arithmetic (counting) errors;

- incorrect names of the parties to the transaction, contracts, business transactions, goods;

- other similar errors.

In other words, these are errors in the data being filled in (words and numbers).

What documents can be corrected?

When making changes to a document, the period of its preparation does not matter. Simply put, you can correct both a document drawn up on the current day and on previous days. The exception is a document on which information has already been sent to the tax authority or its existence has already affected the financial result of the institution and is taken into account in the final financial statements.

At the same time, there will be significant differences between making changes to a document drawn up on paper and a document drawn up and approved via an electronic digital signature.

How to correct an electronic document?

Electronic document management implies the use of an electronic digital signature. It verifies all cash documents without exception. Since it is legally prohibited to make changes when using this method of registering the facts of the economic life of an institution, the corrected document must be newly created and, like its incorrect counterpart, certified with an electronic signature.

The program used to create primary documents will also be important. The newly created document must contain the same details (date and number) and have a similar nature to the transaction being performed (receipt or expense). It should also contain a link to the revised document.

Filling out the cash book manually (sample algorithm for working with a document)

The changes made to Law No. 54-FZ by Law No. 290-FZ not only affected the requirements for the cash register equipment used, but also led to updated requirements for the documents generated by this equipment: cash receipts and BSO. At the same time, the BSO has become a document in the execution of which devices similar to online cash registers must be used. Accordingly, the list of details for documents generated by the new cash desks turned out to be the same (Article 4.7 of Law No. 54-FZ).

Read about what has changed for BSO with the advent of online cash registers in the article “Law on online cash registers - how to apply BSO (nuances).”

There are 2 types of actions recorded at the operating cash desk:

- Receipts using a cash receipt order (PKO) form KO-1, to which, if possible, documents are attached confirming the amount of the incoming amount. The detachable part of the PKO (receipt), containing the signatures of authorized persons and a seal, is transferred to the depositor.

- Expenses using the cash expense order (RKO) form KO-2, to which, as a rule, documents are attached confirming the amount of the amount issued (pay slips, memos, copies of orders, checks, receipts). The RKO reflects the details of the recipient’s identity document. If receipt is carried out by power of attorney, then its original (if the power of attorney is one-time) or a copy (if the power of attorney is not one-time) is attached to the RKO.

The PKO and RKO forms are established by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88 and are mandatory for use in the Russian Federation when registering income and expense transactions. Each operation requires its own separate document.

All PKOs and RKOs issued during the day are recorded in the cash book of the KO-4 form, which sums up the work for the day (receipt and expense turnover) and displays the balance at the end of the day.

PKO, RKO and cash book contain a reference to accounting accounts, the indication of which is mandatory for companies and optional for individual entrepreneurs who do not have to keep accounting (subclause 1, clause 2 of the law of December 6, 2011 No. 402-FZ).

Additionally, such forms of cash documents can also be filled out as a journal for registering incoming and outgoing cash documents of form KO-3 and a book of accounting for funds accepted and issued to other cashiers of form KO-5.

The procedure for filling out cash documents is given in Resolution of the State Statistics Committee No. 88 and instructions of the Bank of the Russian Federation No. 3210-U.

The main legal act regulating the maintenance of cash books by Russian organizations is Bank of Russia Directive No. 3210-U dated March 11, 2014 (hereinafter referred to as the Directive).

The main part of its provisions (including those directly related to the maintenance of cash books) came into force on 06/01/2014. In accordance with them, registration of cash books is mandatory for all enterprises carrying out certain transactions with cash, regardless of the form of taxation applied.

We suggest you familiarize yourself with How to reflect an advance payment in a purchase book

The use of online cash registers does not relieve the obligation to maintain a cash book.

What it is and why online cash registers were introduced, read here.

Yes, with the transition to online cash registers, the need to maintain some primary cash register has disappeared. It is now being replaced by fiscal documents that are generated and stored electronically. But this does not apply to the cash book. It is conducted through the so-called “main cash register”, in which not only settlements with customers take place, but also other cash turnover. Therefore, you need to maintain a cash book as before.

Read more about this in the article “Do I need a cash book to maintain an online cash register?”

The cash book may not be legally filled out by individual entrepreneurs who, in accordance with the established procedure, keep records of income, expenses, physical indicators and other taxable items that characterize a particular type of commercial activity (clause 4.1. Instructions). Since individual entrepreneurs are almost always required to keep records of income and expenses (both under OSN, and under Unified Agricultural Tax, Simplified Tax System, PSN) or physical indicators (with UTII), this norm can be legitimately interpreted as applying to all individual entrepreneurs.

For more information about keeping records of income and expenses by individual entrepreneurs, read the article “How to keep a book of income and expenses under the simplified tax system (sample)?”

Our task in this article is to explore how to fill out a cash book, consider a sample algorithm for entering data into it, and the procedure for handling the corresponding document.

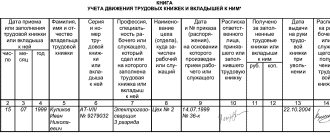

The procedure for manually maintaining a cash book requires stitching and numbering it before entering data. The main feature of the paper version of the cash book is that the document is divided into 2 parts - the main and detachable ones.

When starting a shift, the cashier must place the tear-off part of the cash book under the main one, and place carbon paper between them. Then you need to record the cash balance as of the beginning of the day. During the shift, data on PKO and RKO should be recorded in the cash book - according to the columns that we discussed above.

At the end of the shift, the cashier must count all the turnover for PKO and RKO for the day and record them in the cash book, put his signature on the document, and then take it along with the orders to the accountant.

Read about sanctions for violating the rules for conducting cash transactions in the article “Cash discipline and responsibility for its violation.”

Corrections in the cash book: sample

Now let's move on from theory to practice, and, following the instructions we previously presented, we will make changes to the cash book.

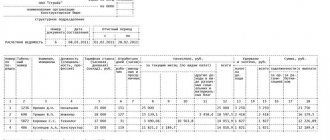

Let’s imagine that in the cash book the corresponding account was incorrectly indicated for the amount issued for the account for the consumables. This is what the cash book sheet looked like before the correction:

| Document Number | From whom it was received or to whom it was issued | Corresponding account number, subaccount | Income, rub. cop. | Expense, rub. cop. |

| Balance at the beginning of the day | 10 000 | X | ||

| Orlov K. A. | 3 000 | |||

| Total for the day: | 3 000 | |||

| Finally the rest of the day: | 7 000 | X |

Cashier Kulikova D.I.

I checked the entries in the cash book and received documents in the amount of ____-____ receipts and __one__ expenses.

Accountant Tarasova N. G.

And this is what the cash book sheet will look like after correction:

| Document Number | From whom it was received or to whom it was issued | Corresponding account number, subaccount | Income, rub. cop. | Expense, rub. cop. |

| Balance at the beginning of the day | 10 000 | X | ||

| Orlov K. A. | 51 71 | 3 000 | ||

| Total for the day: | 3 000 | |||

| Finally the rest of the day: | 7 000 | X |

Cashier Kulikova D.I.

I checked the entries in the cash book and received documents in the amount of ____-____ receipts and __one__ expenses.

Accountant Tarasova N. G.

Corrected believe Cashier Kulikova D.I. 08/23/19

Now you know exactly how to correct the error made in the cash book correctly.

Is it possible to edit?

Corrections in cash documents are undesirable.

Cash documentation has clear requirements for its design. The main rule will be the inadmissibility of adjustments. Simply put, the executed cash documents must be free of errors, blots or corrections.

But, in the course of business life, inaccuracies happen and it is important to know how to eliminate them. The use of correction fluids is prohibited. The corrected entry must be visible and also certified in the prescribed manner.

CD storage

The manager organizes and carries out the process, determines storage locations and approves the procedure for the formation and storage of cash documents in the organization. He must ensure such storage conditions that the documents are safe for the entire period established by law.

General requirements regarding storage periods are established in the Federal Law “On Bukh. accounting”, according to which primary documents and CD registers are stored in the archive for at least 5 years. After the expiration of the established period, they can be destroyed, but provided that there are no disputes or ongoing legal proceedings regarding them.

It should be noted that the period of 5 years is counted from the date of creation of the document, but from the date of the reporting year in which they were generated.

Storage can be organized both in the archive at the enterprise and with the involvement of specialized companies. They provide storage on a contractual and paid basis for as many years as you need.

The above-mentioned law establishes that when conducting cash transactions in electronic form, the shelf life of electronic media should also be the same as that of paper media - no less than 5 years. The exception is payroll, according to which employees receive their salaries. They are stored for 75 years.

CD storage must be carried out on the basis of the following rules:

- Documents must be stapled on a daily basis. The deadline for stitching is no later than the next working day.

- Inside the stitching, CDs must be selected according to the following order: in ascending order of accounting account numbers. In the sequence, first of all, according to Dt of the account, and then according to Kt.

- All sheets of stitching are subject to numbering.

- When transferred to the archive, an inventory is generated indicating the quantity and name of the CD stitching; an article can be entered in accordance with the nomenclature approved by the organization.

The procedure for conducting cash transactions and working with cash is established by document No. 3210-u dated 11/03/14 of the Central Bank of the Russian Federation. Until this year, an error made when maintaining a cash book became a serious problem for the organization. It was forbidden to make corrections. Violation of the rule resulted in a fine. Currently, the ban has been lifted, but the question of how to correct an error in the cash book in order to avoid questions during verification is relevant.

Procedure for filling out RKO

The director’s signature on the order is not required if his signature is in the appendices to the RKO. If the company does not have an accountant, then the manager’s signature will be required in any case, even if he has already signed the attachments to the order.

When working with RKO, an organization should have the following procedure:

- The cashier must check the presence of the necessary signatures, the correspondence of the amounts recorded in figures and words, and whether all the documents specified in the cash register are present. In addition, the coincidence of the full name on the document with the data of the presented ID of the recipient is checked.

- You should prepare the required amount of money for the recipient, and also obtain his signature in the cash register.

- The cashier must count the money in front of the recipient so that the recipient can observe his actions. After this, the money is issued to the recipient

- After this, the money is counted by the recipient in the presence of a cashier. If this is not done, then it will no longer be possible to file a claim.

- The last step is the signing of the cash register by the cashier.

Can consolidated accounting registers be changed?

By the instruction of the Central Bank of the Russian Federation, registered on March 11, 2014 under number 3210-U, it is strictly prohibited to correct information already entered in cash papers - completed RKO/PKO forms.

However, the same regulatory act allows for proper changes to be made to the payroll, cash register/pko register journal and, of course, the cash book.

What amendments are allowed?

Adjustment of primary accounting papers is regulated by the Law of the Russian Federation “On Accounting”, registered under number 402-FZ. Specific requirements are prescribed by Article 9 (clause 7) of this regulatory act.

Thus, it is allowed to use the following methods for correcting accounting documents:

- The first method is that the correct information is entered directly into the original (original) version of the erroneous document. Incorrect values are crossed out with a single line (the corrected value must then be read). The correct number or correct text is indicated above the crossed out value. Next to the change made, the wording “Corrected” is written, which is signed (certified) by authorized entities. Signatures are decrypted. The date of the completed adjustment is indicated.

- The second method is to draw up a corrective (corrective) document on a principle similar to the formation of an invoice for adjustment purposes.

- The third method is to cancel documents posted earlier, you should use the red reversal method.

Application procedure

Correction fluid is definitely not allowed to be used to make any changes to already compiled cash register papers.

Only corrections that are performed as follows are allowed:

- The inscription that was entered incorrectly is crossed out. However, it should be crossed out so that it is clearly legible later.

- The necessary correction is made directly above the crossed out (erroneous) inscription. Such an adjustment involves writing the correct text or the correct amount.

- On the unoccupied fields of the document being corrected or directly next to the corrected inscription, the text designation “Corrected” should be written. Responsible entities authorized to draw up cash documentation must sign this designation.

- A mandatory decoding of all affixed signatures is made, indicating the actual date of making the corresponding adjustment.

- All copies of the corrected paper are subject to similar adjustments.

Answers to common questions

Question: Is it possible to fill out part of the RKO by hand, and part on the computer?

Answer: The legislation does not establish a ban on filling out cash registers using a combined method. If it is convenient for the company, then part of the document can be filled out on the computer, and the rest by hand.

Question: In RKO, the corresponding account is indicated incorrectly. How to fix this if the employee signing this document has already quit?

Answer: No changes can be made to the RKO. In this regard, the employee who compiled the RKO must be required to provide an explanatory note, as well as draw up an accounting certificate that will explain the reasons for the discrepancy.

Rate the quality of the article. We want to become better for you: If you have not found the answer to your question, then you can get an answer to your question by calling the numbers ⇓ Free legal advice Moscow, Moscow region call

One-click call St. Petersburg, Leningrad region call: +7 (812) 317-60-16

Call in one click From other regions of the Russian Federation, call

One-click call

> Test task

How to correct an error in accounting registers?

One of the methods is called “red reversal”

Summarization of primary accounting documents occurs through accounting registers. To create such a register, all documents must be posted to the correct accounting accounts and contain correct entries.

Before forming these registers, employees of the accounting department carry out reconciliation with the concerned services. If an error is detected in the direction of underestimating the amount, additional entries are introduced into the system. It reflects the missing amount.

If an error is detected in favor of an increase, the accountant must reverse the difference between the actual amount and the one that needs to be reflected in the accounting records. The adjustment is made by an amount with a negative value. This method is called “red reversal”.

The exception to any actions aimed at adjusting amounts is the submission and approval of annual financial statements. In this case, correction is carried out on the day the inaccuracy is discovered. If the report is not approved, you can correct it by the date of the main transaction, but the postings can only be made in December of the reporting year.

Do not also forget that in order to correctly reflect the changes made in accounting programs, an accounting certificate has been developed (f. 0504833). All corrections are made through invoice correspondence and are justified by reference to the details of the document being corrected.

If the Federal Tax Service discovered an error during verification

If the tax authority discovers an error in the accounting data of the organization’s primary documents, administrative liability may be imposed. At the same time, the most common method of sanctions is fines. But in order for the imposition of a penalty to be justified, one should remember:

- The data corruption occurred twice or more;

- The distortion caused the tax base to be understated.

Tax officials are also quite critical of documents that have unreadable correctable data. The inability to unambiguously identify the document being corrected may also lead to a refusal to accept it for accounting when calculating the amount of the tax deduction.

Also, such documents will call into question the legitimacy and materiality of the transaction itself. Recognition of such transactions as fraudulent may result in the imposition of penalties. However, do not be afraid of mistakes. The main thing is to correct them competently and taking into account the current legislation.