Often, when conducting on-site or desk audits, the Federal Tax Service Inspectorate requests from companies many copies of documents, i.e. copies, the information in which completely coincides with the original. Do I need to certify copies of documents for the tax office?

Yes need. Documents should be submitted to the Federal Tax Service Inspectorate in the form of certified paper copies (Clause 2 of Article 93 of the Tax Code of the Russian Federation). Certification of information in copies is a mandatory action to ensure their legal significance. They should be submitted in full as requested by the Federal Tax Service, in accordance with the criteria existing today. We will learn how to properly certify copies for the tax authorities and what to follow when doing so.

How to certify a copy

A certified copy is the same document with special marks that give it a legal basis for action. Therefore, in order to document expenses, copies of documents can be used, but only certified in accordance with the established procedure.

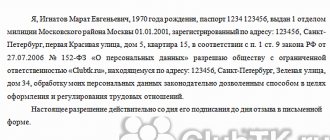

Requirements for document preparation were approved by order of Rosstandart of Russia dated December 8, 2016 No. 2004-st. With this order, the new GOST R 7.0.97-2016 is in effect from July 1, 2021. According to GOST, to certify a copy of a document to the original, the “signature” requisite must be:

- the word “True”;

- position of the person who certified the copy;

- his handwritten signature;

- decryption of signature (initials, surname);

- date of certification of the copy;

- an inscription indicating the storage location of the document from which the copy was made (if the copy is issued for submission to another organization).

If the organization has a seal, its affixing is mandatory, since according to GOST, the seal certifies the authenticity of the official’s signature.

Let us remind you that from April 7, 2015, LLCs and JSCs are not required to have a seal.

A stamp may be used to mark the certification of the copy.

A sample copy certification note is presented below.

note

If a copy of a document must be sent to another organization, then the rules require indicating the place where the original copy of the document, for example, a work book, is stored.

Submission of documents in electronic form

You can transfer the required documents to tax authorities in paperless form via telecommunication channels (TCS) using an enhanced qualified electronic signature (ECES) through an electronic document management operator (EDO) or through the website of the Federal Tax Service of Russia (for details about this method, see the link ).

Find out how to obtain an electronic signature from the publication .

Thanks to this opportunity you:

- avoid technical errors by using electronic formats;

- save your resources (no need to print documents and come to the inspection or post office to transfer (send) them);

- You are guaranteed to receive confirmation of document delivery.

To prepare and submit documents you have:

- 5 working days if the tax authorities are waiting for documents (information) from you about a specific transaction or counterparty in respect of which an audit is being carried out;

- 10 working days if documents are requested as part of a desk or on-site inspection of your company.

The deadlines are counted from the date of receipt of the request for the submission of documents.

If the document is multi-page

On copies of multi-page documents, a mark confirming the certification of the copy is placed on each sheet of the document or on the last sheet of a bound or otherwise bound document.

A record of the location of the original is placed on the last sheet of the document.

On the reverse side of the last sheet, a paper sticker in the form of a rectangle is pasted at the place of fastening. The sticker should cover the place where the firmware is attached. The ends of the stitching threads may extend beyond the sticker. The “certification” inscription is sealed with the seal of the organization, if available.

New rules for processing documents requested by the Federal Tax Service

The work of certifying copies has become significantly easier with the introduction of new requirements. Until recently, the Federal Tax Service required each copy to be certified as a general binding. By letter of the Ministry of Finance of the Russian Federation dated October 29, 2015 No. 03-02-RZ/62336, changes were made to this procedure - it is allowed to file copied documents in volumes of 150 sheets and to certify the entire file.

, put into effect by Order No. ММВ-7-2/ [email protected] from 01/04/2019, confirm the above instructions of the Ministry of Finance. All copies must be formed into volumes, in each of which the number of sheets should not exceed 150. The exception is multi-page documents consisting of a larger number of sheets - they do not need to be torn into different volumes, but can be bound together in one book. The grouped documents should be:

- continuous numbering with Arabic numerals (starting with one);

- sew the sheets with a strong thread, bring its ends to the back of the last copy and tie them;

- In the place of fastening on the reverse side of the sheet, glue a paper sticker on which to make a certification inscription consisting of:

the name of the position of the person certifying the authenticity of the documents (or an indication that the inscription was made by an individual entrepreneur, private practitioner or other person);

- his painting, surname and initials;

- notes on the number of sheets in the volume (in numbers and words);

- date of signing.

Special requirements are imposed on the location of the signature on the sticker - it should not be completely located on it, but extend beyond it. There is no need to affix a seal to the document, since many enterprises today do without it.

How to certify a copy for the tax office - a sample certification inscription:

Laced and numbered 28 (Twenty eight) sheets

IP Fedorenko N.I.

01/25/2019 Fedorenko

The existing condition of GOST R7.0.97-2016 to be placed on the certification sticker is not commented on by tax authorities in any way, so its absence should not be regarded as a violation. There is no requirement to indicate the storage location of the original documents submitted to the tax authorities.

The bound copies must be fastened so that the binder does not fall apart when working with documents, and each sheet can be studied and copied freely. All inscriptions, marks, visas, resolutions must be clearly visible.

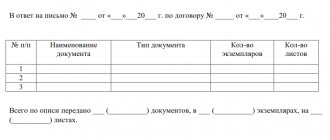

Prepared volumes with copied documents are submitted to the Federal Tax Service Inspectorate with a cover letter, the text of which indicates the basis for their submission - the Federal Tax Service Inspectorate's requirement and its details, and also an inventory of the submitted documents - the number of binders and the number of sheets in each of them and their total number.

Letter of the Ministry of Finance of the Russian Federation No. 03-02-РЗ/62336 established more stringent requirements, for example, the dimensions of the paper sticker, the length of the ends of the threads, and sealing. The latest order of the Federal Tax Service does not contain them.

What are the consequences of breaking the rules?

The requirement to properly certify documents issued to employees is established by Article 62 of the Labor Code. An improperly certified copy is considered invalid. Such an error can be qualified as a failure by the employer to fulfill an established obligation. Responsibility for this is provided for in Article 5.27 of the Code of Administrative Offenses of the Russian Federation:

- warning or imposition of an administrative fine on officials and individual entrepreneurs in the amount of 1,000 to 5,000 thousand rubles;

- for legal entities - a fine of 30,000 to 50,000 rubles.

In case of repeated violation (clause 2 of article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- an administrative fine for officials and individual entrepreneurs in the amount of 10,000 to 20,000 rubles or disqualification for a period of one to three years;

- for legal entities - a fine of 50,000 to 70,000 rubles.

Expert “NA” E.V. Chimidova

Document submission methods

If various documents were required during the desk audit, they can be provided to the tax office in the following ways (subclause 1, clause 2, article 93 of the Tax Code of the Russian Federation):

- paper certified photocopies are transferred personally by the taxpayer or through a representative to the tax office or by registered mail by mail (subclause 2, clause 2, article 93 of the Tax Code of the Russian Federation);

- in electronic form in a special format and in accordance with the procedure approved by order of the Federal Tax Service of Russia dated February 17, 2011 No. ММВ-7-2/ [email protected] ;

- in electronic form through the taxpayer’s personal account;

- in the form of scanned images via TKS or through the taxpayer’s personal account.

The taxpayer himself has the right to choose which method to transfer documents to him at the requests and requirements of tax authorities (letter of the Federal Tax Service of Russia dated November 25, 2014 No. ED-4-2/24315).

NOTE! Taxpayers who are required to submit reports only electronically do not have the right to send notifications about the impossibility of submitting the documents requested by the Federal Tax Service by mail.

See here for details.

IMPORTANT! Explanations for VAT can only be submitted in electronic format. See this article for details.

Find out what opportunities electronic personal accounts provide from the following materials:

- “The procedure for filling out the 3-NDFL declaration in your personal account”;

- “Plato system - user’s personal account (nuances)”.

The list of documents that the Federal Tax Service may require depends on the type of event carried out by the tax authorities. What documents to prepare as part of inspections (on-site or office), outside inspections, during counter inspections, ConsultantPlus experts tell in detail. Get trial access and start exploring the Ready Solution for free.

Results

If the tax authorities have asked you for documents, you can submit them on paper or electronically. Paper copies must be certified by the signature of the manager and sewn in a certain way, and can be brought to the tax office in person (or through a representative) or sent by registered mail.

When transferring documents electronically, you need to take into account the requirements of the order of the Federal Tax Service of Russia dated February 17, 2011 No. ММВ-7-2/ [email protected]

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated February 17, 2011 No. ММВ-7-2/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to make copies of documents

If the legislation does not provide for a copy of documents certified by a notary, then tax inspectors do not have the right to demand certified copies (subparagraph 2, paragraph 2, article 93 of the Tax Code of the Russian Federation, additionally letter of the Ministry of Finance of Russia dated December 7, 2009 No. 03-04-05-01/886 ).

Therefore, tax inspectors are provided with copies of documents certified by the manager.

A multi-page copy of the document must be bound and a single certification inscription must be placed on the firmware. The sheets are numbered and the total quantity is indicated on the certification inscription. It is necessary to stitch the sheets in such a way that subsequently there is no embroidering of the bundle, and there is free access for photocopying any sheet. All dates and signatures must be clearly visible on the copy of the document (letter from the Ministry of Finance of Russia dated 08/07/2014 No. 03-02-RZ/39142, Federal Tax Service of Russia dated 09/13/2012 No. AS-4-2 / [email protected] (clause 21) ).

If there are several documents, then the copies are certified separately and a certification inscription is placed on each one. The financial department reports this in its letters dated May 11, 2012 No. 03-02-07/1-122, dated October 24, 2011 No. 03-02-07/1-374, dated November 30, 2010 No. 03-02-07/1 -549 <1>, as well as the tax department in a letter dated 10/02/2012 No. AS-4-2/16459. The judicial authorities adhere to the same position (resolution of the Federal Antimonopoly Service of the Moscow District dated November 5, 2009 No. KA-A41/11390-09).

—————

<1> These letters refer to counter checks. Since the conditions for submitting documents at the request of the tax authorities are the same, they can also be applied to desk audits (clause 2 of Article 93, subclause 3 of clause 5 of Article 93.1 of the Tax Code of the Russian Federation).

You should not use used sheets to copy documents. On the reverse side there is information about the executor of the document - last name, initials and telephone number (letter dated 02/01/2010 No. 03-02-07/1-35).

ConsultantPlus expert M.A. Klimova answers about the specifics of preparing responses to the requirements of the Federal Tax Service. Get free trial access to the system and go to the video lecture.

Demanding a scanned version of a document is illegal

The actions of tax inspectors are considered unlawful if, in addition to a certified copy of documents, a scanned version of the document on disk or in electronic form is requested.

Tax legislation does not provide for the presentation of a scanned version of a document on disk or in electronic form if a paper copy was previously provided (Article 93 of the Tax Code of the Russian Federation).

What fines can a company expect if it fails to submit counter-verification documents, see the article “What is the fine for failure to provide counter-verification documents?” .

Find out what time frame it takes to prepare and submit documents to the tax authorities here .

We discussed in this publication when it is possible not to comply with the requirements of the tax authorities.

Should be sewn

The Ministry of Finance has several requirements for bound copies of documents. Firstly, the text of the document, all dates, visas and resolutions must be freely readable. Secondly, the pages should be bound in such a way that they can be easily photocopied. Thirdly, the firmware must be strong enough so that a stack of copies does not fall apart when read. And lastly, all pages of the document should be numbered and the total number of sheets should be indicated.

All information necessary for tax authorities must be present on the document. Since you do not need to duplicate it on each sheet, you can place it on the back of the last sheet or on a separate sheet. It is necessary to indicate the details: “Signature”, “Correct”, the position of the person who certified the copy, his personal signature and its transcript, the date of certification of the document. You should also put on the document the inscription: “Total numbered, laced, sealed__ sheets.” The number of sheets should be indicated in words. In addition, the documents must be accompanied by a covering letter and a list of all submitted papers.

The document does not have any legal consequences, but the recommendations should be followed so as not to spoil relations with the inspector

The rules recommended by the Ministry of Finance are already actively used in business document flow. Their use in communication with tax authorities will simplify the work of organizations. “The tax authority, in its recommendations, supports the methods of certifying documents existing in business practice. In particular, it is possible to certify each individual sheet of a copy of a document, as well as to certify a multi-page document and certify it as a whole. If we consider a new method for tax audits of certifying a document in its entirety, it significantly facilitates the provision of voluminous documents, as it saves the time of the organization’s specialists in preparing the requested papers. It’s enough to stitch the document and put the required certification mark on the stitching,” says Elizaveta Seitbekova, manager of the BUSINESS STUDIO AF.

Experts say that the document does not have legal consequences for companies, therefore the use of the standards recommended by the Ministry of Finance is safe for companies and does not face fines. “Even if a taxpayer, for example, stitches a stack of documents in a way that is inconvenient for copying, or makes a mistake in numbering the sheets, the tax office will not be able to refuse to accept them if the firmware is properly certified. And what it means to “exclude the possibility of mechanical destruction (embroidery) of the binder (pack) when studying a copy of the document” is not at all clear. What are the criteria here, and how should all this relate to the intensity of the inspector’s examination of documents? In general, the document does not have any legal consequences, but the recommendations should be followed so as not to spoil relations with the inspector,” says Alexander Votintsev, coordinator of the Sverdlovsk regional branch of the Chamber of Tax Consultants.