Tax Code article on the basis of which personal income tax is refunded for education

27.02.2018

If for any reason a taxpayer has overpaid taxes, penalties, or fines to the budget, then he has the right to timely offset (refund) of these amounts (clause 5, clause 1, article 21 of the Tax Code of the Russian Federation), and the tax authority is obliged to such a return (clause 7, clause 1, article 32 of the Tax Code of the Russian Federation).

We are talking about tax overcharged by the tax authority. The rules for offset (refund) of tax amounts that the budget “owes” are established by Art. Art. 78 and 79 of the Tax Code of the Russian Federation. The first is devoted to overpaid amounts, the second to overcharged amounts.

How are these amounts different? Excessive payment of tax, as a rule, occurs when a taxpayer, calculating the amount of tax payable to the budget independently, that is, without the participation of the tax authority, for any reason, including due to ignorance of the tax law or an honest mistake, makes an error in the calculations (Definition of the Constitutional Court of the Russian Federation dated June 21, 2001 N 173-O).

How to apply for a tax deduction for education (nuances)

IMPORTANT! The specified limit is 120,000 rubles. is determined taking into account all types of social deductions for individuals. For example, a citizen, having spent 80,000 rubles in 2021. for your training and 70,000 rubles. for treatment, will be able to return tax only from 120,000 rubles. The balance is 30,000 rubles. (80,000 + 70,000 – 120,000) is not carried over to the next year.

Income tax refund for education - how it works

Important: the amount of all social tax deductions for the year, including the tax deduction for treatment - except for expensive treatment - should not exceed 120 thousand rubles (paragraph 3, paragraph 2, article 219 of the Tax Code of the Russian Federation).

This restriction also applies to expenses related to the payment of insurance premiums for the funded part of the labor pension, payment of contributions under non-state pension programs and voluntary pension insurance.

Personal income tax refund: the fastest way

You are always required to provide documents confirming expenses associated with training, payment for medical services, participation in pension programs, and settlements with the home seller.

Also, in most cases, sources are needed that indicate the legitimacy of a citizen’s communications with certain entities. For example, if personal income tax is refunded for treatment, then these may be contracts with a medical institution.

If we are talking about a property deduction, we need purchase and sale contracts for equity participation, confirming the registration of a mortgage loan.

We recommend reading: Can judicial representatives seize rights?

How is a personal income tax refund for training carried out?

When receiving a personal income tax refund for a child’s studies, a certified copy of his birth certificate and a certificate from the educational institution about full-time study should be added to the list. As for the return of personal income tax for the education of a brother or sister, their own birth certificate is also added to their birth certificate, confirming the relationship.

Income tax refund (NDFL) for training

- Citizens who pay for their own education in any form (full-time, correspondence and other types).

- Paying for the education of a child not older than twenty-four years of age (with the exception of correspondence forms of education).

- Those who have paid for the education of their siblings (or half-sisters and brothers with one common parent) are not older than twenty-four years of age.

- Guardians for the education of their pupils under eighteen years of age and former pupils under twenty-four years of age.

Consultant pulse

Keep in mind: the amount of the deduction cannot exceed 120 thousand rubles. in one year. Interestingly, this amount is the limit for all types of social deductions. That is, this includes both a medical tax deduction and a pension one. Therefore, when using several types of deductions in one period, you should be especially careful. More details about this can be found in paragraph 2 of Article 219 of the Tax Code.

Procedure and rules for providing a tax deduction for education in 2021

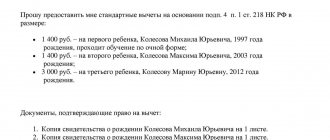

- Introductory part or header.

In the upper right corner of the document indicate the Federal Tax Service, to which the application is sent and the data of the taxpayer claiming the benefit. Information includes last name, first name, patronymic in full spelling, passport details, registration address. It is mandatory to indicate a contact telephone number necessary for communication during the verification period. - Document's name.

- A text containing a request to return the overpaid tax received after the deduction was provided to the current account.

The document must indicate the full details of the bank that opened the account for the person.

Tax deduction for education

After submitting all documents, verification will be carried out within 90 days, after which the applicant will receive a response about the decision made.

If the taxpayer receives a refusal, he should clarify the situation by personally visiting the inspectorate.

If the answer is yes, you will also need to visit the tax office to write an application and indicate to which bank account the social tax deduction for education should be transferred.

How to fill out an application for a personal income tax refund in 2021

- Inaccuracies and errors made by accounting employees when calculating personal income tax.

- Withholding tax from those types of income from which such a mandatory payment should not be collected (Article 217 of the Tax Code of the Russian Federation).

- Submission by the employee of documents to receive a tax deduction of a standard, social, property, investment or professional type (Articles 218, 219, 219.1, 220, 221 of the Tax Code of the Russian Federation).

- Transformation of an employee from a non-resident to a resident of the country (the tax rate automatically changes from 30% to 13%).

How to apply for a tax deduction for education

Legislation allows you to return a certain part of the funds spent on studies in the form of a tax deduction from the amounts that were previously paid to the state budget as taxes. It is allowed to return money spent personally on yourself, your children or brothers and sisters.

How to fill out the 3rd personal income tax return for a refund of income tax for education

- certificate of salary 2 personal income tax;

- passport;

- license and certificate;

- Contract;

- details for transferring the refund;

- checks for payment;

- reference;

- price agreement protocol or additional agreement.

To receive a tax deduction for education, certain requirements and conditions must be met.

Tax deduction for education 2021 - legal income tax refund (NDFL)

- The child, brother or sister has not reached the age of 24;

- Brother, sister, child receive full-time ;

- Educational services are provided by an officially licensed educational institution;

- In practice, it is better that you are indicated as the payer in the contract;

- Receipts and payments must also be issued to you.

Personal income tax reimbursement for training

- Own studies. In this case, the form of education does not matter - full-time, part-time, part-time, part-time, etc.

- Children's education. In this case, it is necessary to comply with the requirement - his age should not exceed 24 years . Training must be conducted face-to-face.

- Educational activities of the supervised family member. Requirement: age must not be more than 18 years , studies are carried out full-time.

- Education of the former supervised family member. Condition – age does not exceed 24 years , educational activities must take place full-time.

- Paying for your brother or sister's education. Requirement: age must not be more than twenty-four years. For the individual paying for their studies, they must be full-blooded (both parents are common) or half-bred (one common parent).

Nuances of income tax refund for education

Refund of income tax for education - this opportunity is given to us by the Tax Code of the Russian Federation. Using this method, Russian citizens will be able to compensate for part of the amounts spent on educational services. How and who can reimburse income tax for education, read our article.

Tax Code article on the basis of which personal income tax is refunded for education Link to the main publication

Source: https://yrokurista.ru/semejnoe-pravo/statya-nk-na-osnovanii-kotoroj-vozvrat-ndfl-za-obuchenie

Types of deductions

The range of tax benefits provided by the state is diverse and affects the interests of every citizen. Tax compensations are divided in legislation into several types and include property, professional, standard, investment and social tax deductions.

The law does not oblige citizens to apply for compensation. Entering information into the declaration and submitting it to the tax service is carried out by citizens on a voluntary basis.

When paying tax, citizens are interested not only in timely payment, but also in returning part of the funds; The refund of part of the previously paid tax occurs within the period established by federal laws, which should not exceed three months.

The legal principles of social deduction are enshrined in the Tax Code of the Russian Federation. This deduction can be classified as the most popular among taxpayers.

You can count on a social tax deduction if:

- financial assistance to charitable organizations operating on a non-profit basis in the interests of society, religious institutions;

- paid study (your own or close relatives: children, sisters, brothers);

- own paid treatment and treatment of close relatives, purchase of medicines;

- independently depositing funds to finance the funded part of the labor pension;

- expenses incurred under certain conditions related to voluntary insurance of one’s life or the life of close relatives, pension insurance.

Clarifications on the provision of benefits and compensation in the tax sphere are issued by the Federal Tax Service of Russia.

For treatment

Social tax deductions are provided in connection with medical expenses incurred. Their list is approved at the federal level.

You can start applying for a tax benefit when spending money on treating diseases or providing treatment assistance to close relatives, purchasing medicines and depositing funds under your voluntary insurance contracts or such contracts of close relatives.

If medical services or medications are classified as expensive, the amount of compensation may exceed the 120 thousand rubles established by law.

For education

Social tax deduction is provided for education. The recipient of the benefit can be a taxpayer who has completed paid education, or who has paid for the education of his child or close relatives - a brother or sister. The degree of relationship is not specified in the law; it is enough to have one common parent.

The calculation is based on the maximum amount that is set for the tax period. If the deduction is issued after graduation, it will be 120 thousand rubles; when receiving compensation for training close relatives - 50 thousand rubles.

Learn more about the education tax deduction

Other

To receive tax deductions for charitable expenses, it is not enough to provide financial assistance to people in need. If assistance is provided by one individual to another, then no deduction will be provided.

The law identifies the characteristics of organizations to which you can perform charitable actions and then receive social tax deductions. Among them:

- non-profit principles of existence;

- social orientation;

- activities in the field of culture, scientific activity, sports, education, protection of human rights, etc., provided for by law.

It is also possible to provide financial assistance to religious organizations.

It is important to remember that the size of the deduction received after charitable actions will not exceed 25% of the income that a person received for the year.

Social deductions related to the pension block are included in a special complex. If the taxpayer made contributions to the funded part of the pension, under non-state pension insurance agreements with insurance organizations or non-state pension funds, or to insure his own life or the life of loved ones (disabled child, spouse), he may qualify for compensation in the amount of no more than 120 thousand rubles in the tax period.

Payment of contributions to the funded part of the pension by the taxpayer’s employer deprives the latter of the opportunity to apply for benefits.

Refund of Personal Income Tax for Training Which Article of Tax Code

224 of the Tax Code of the Russian Federation, taking into account the features provided for in Art. 226 Tax Code of the Russian Federation.

Also, for the purposes of applying this chapter, tax agents are recognized as Russian organizations that transfer amounts of allowance, salary, wages, other remuneration (other payments) to military personnel and civilian personnel (federal civil servants and employees) of the Armed Forces of the Russian Federation (clause 7.1 Article 226 of the Tax Code of the Russian Federation). The withheld personal income tax must be transferred to the budget within the time limits established by paragraph.

- Deductions for professional activities (Article 221 of the Tax Code of the Russian Federation);

- Social tax deductions (Article 219 of the Tax Code of the Russian Federation);

- Deductions for carrying forward losses in transactions with securities (Article 220.1 of the Tax Code of the Russian Federation).

- Standard deductions (enshrined in Article 218 of the Tax Code of the Russian Federation);

- Deductions for acquired property (Article 220 of the Tax Code of the Russian Federation);

The procedure for returning personal income tax when receiving tax deductions

Date of publication: 06/05/2013 06:48 (archive)

Citizens who have filed a declaration in Form 3-NDFL with the declared deduction amount usually have a question: within what time frame is the personal income tax refund made? After receiving the declaration and supporting documents, the tax authorities conduct a desk audit to confirm the taxpayer’s right to a tax refund. According to Art. 88 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), its period is three months. Inspectors have the right, during a desk inspection, to familiarize themselves with the originals of those documents that were presented to them in the form of copies. Upon expiration of the audit period, the taxpayer is sent a written message about the desk tax audit of the declaration and the provision or refusal of a tax deduction. In accordance with Art. 78 of the Tax Code of the Russian Federation, the amount of overpaid tax is subject to refund upon a written application from the taxpayer within one month from the date the tax authority receives such an application. Due to the fact that the process of delivering postal correspondence from the inspection office can take quite a long period of time, we recommend that, simultaneously with submitting the 3-NDFL declaration and the necessary documents to the tax authorities, submit an application for a refund indicating the bank details to which the tax amount must be transferred . If the application was submitted along with a declaration and documents confirming the right to deduction, the month-long period for returning the money will begin to run only when the desk audit is completed. Consequently, the period for returning personal income tax amounts can be up to four months from the date of filing the declaration and application for tax refund. Additionally, we inform you that on our website there is a service “Taxpayer Personal Account for Individuals”, which allows you to track the status of a desk audit of a tax return in Form 3-NDFL. In the menu of the 3-NDFL service, the taxpayer will be able to see the registration date and registration number of the tax return, the start date of the desk audit and the stages of its consideration. In this case, the Internet service will inform you not only about the completion date of the check, but also about its results. The service also allows you to generate an application for the transfer of overpaid tax to a bank card, savings book or current account.