Purpose of the document

A loan agreement is a binding document not only for the lender, but also for the loan recipient. This is where the rights and obligations of each party are stated. In accordance with it, the borrower undertakes to return the borrowed amount or valuables in their original form within a predetermined period. The lender undertakes to transfer property or money, and not to demand their return in advance, provided that the other party complies with the main provisions of the document.

Many people do not understand the documents or do not want to do this, so they often have a question regarding loan agreements: what is it? It's quite easy to understand. There are different ways to conclude a document, so it is not necessary to draw up a written agreement, since an oral agreement is considered a common action.

A written document must be drawn up if the amount being loaned exceeds the minimum wage by 10 times or more. The same applies to situations where the value of the transferred property exceeds this indicator.

Regardless of the size of the loan, a written agreement is required if a legal entity is one of the parties. A special receipt drawn up by the borrower serves as confirmation of the agreement. It may be replaced by another suitable document serving as confirmation of the transferred amount or valuable item by the lender.

Features of the document

It is a correctly drawn up agreement that acts as a regulator of relations between the parties. It is a guarantee that the funds issued will actually be returned back to the owner. Most often we encounter cash loans when money is transferred from one person or company to another citizen or organization.

It is the loan agreement that is considered the most popular; before using it, you just need to understand what a loan agreement is, what main points it should contain, and how to make it have legal force. If the basic drafting rules are violated, then there is a high probability that the lender, if the borrower fails to repay his funds, will not even be able to go to court to resolve the conflict situation.

It is allowed for a cash loan agreement to contain accurate and detailed information about the interest accrued on the debt, if this is agreed upon in advance by the two parties. If there is no corresponding clause stating that the document is interest-free, then the lender has the right to receive income from the loan of money.

It is best to notarize the drawn up agreement, since if such an agreement exists, there will be no difficulties in using it in court if the borrower refuses to repay the debt. However, when contacting a notary, there is a need to pay for the services of this specialist, as well as a state fee.

Can interest be written down in the document?

Before you sign a loan agreement, you need to decide whether the lender will require the borrower to pay interest. The following parameters are taken into account here:

- if the agreement does not contain special clauses on the basis of which it becomes clear that the loan is interest-free, then the lender has the right to demand that the borrower pay certain interest;

- if interest is not specified exactly, then its amount is calculated taking into account the level of the discount rate of the Central Bank of the Russian Federation, unless a different amount is agreed upon by the parties;

- since the Central Bank rate is taken into account, the interest rate may change, which the borrower must take into account;

- The Central Bank rate is taken into account only if funds were transferred in rubles and not in any foreign currency.

Knowing how to correctly determine interest, each borrower can independently calculate how much interest should be given along with borrowed funds to the lender.

How to collect a debt under a loan agreement between individuals

If a document is not notarized, how to collect the debt in this case? According to the law, the notarization procedure is purely voluntary and cannot be mandatory. The only requirement that makes the process legally competent is the presence of a receipt confirming the full repayment of the debt by the borrower.

At the same time, most experts in the field of finance and banking recommend a notarized version of the agreement. The form is drawn up in three identical copies. It is also preferable to transfer money in the presence of a notary.

A document certified by a notary acquires legal force only if the subject of the loan is handed over to the party who needs it. Until this point, the transaction cannot be classified as fully completed. In addition, judicial practice proves that notarization proves the legal purity of the contract. Consequently, in the event of a trial, there will be much fewer questions regarding such documents.

A loan agreement is a civilized method of formalizing contractual obligations, but only if everything is done correctly. The process of completing the procedure is simple; the main thing is to comply with all the requirements that guarantee respect for the rights of its participants. Signing the document will take a couple of minutes, but in the event of an unfavorable development of the situation, it will provide a real opportunity to repay the debt, which without documents is almost impossible to repay. Its notarial confirmation will minimize the difficulties associated with forced repayment of the debt.

What actions must be taken before signing the contract?

Before signing a document, both parties take into account the following factors:

- if the borrower is a citizen who is officially married, then he must obtain permission from his spouse to sign the agreement;

- It is advisable to contact a notary for certification, and this is beneficial for the lender, since not only will the document have legal force, but there will also be a writ of execution on the basis of which enforcement proceedings can begin without a court decision, so funds will be recovered in case of violation of the terms of the agreement borrower;

- the lender (before a cash loan agreement is drawn up) must ensure the solvency and optimal financial position of the borrower in order to avoid problems associated with non-repayment of the debt in the future;

- if the borrower is a person with whom the lender is not familiar, then it is important to study his passport details, as well as clarify his place of residence and some other important points that help increase the likelihood of repayment;

- a copy of the borrower’s passport is made, and it is also advisable to copy his TIN, since these are the documents that are necessary for the bailiffs to begin enforcement proceedings, which will allow the collection of debts if the borrower refuses to follow the main points of the already drawn up and signed agreement;

- a correctly executed document is signed by the parties in the presence of each other, since otherwise the borrower can prove that he did not perform this action.

If you know how to draw up a document and what nuances should be taken into account before signing it, then you can protect yourself from fraud.

Appeal to the Civil Code of the Russian Federation in case of disputes

Not only the lender can express claims regarding the fulfillment of obligations under the agreement. If the borrower believes that he has not received the financial services specified in the loan agreement or has not received them in full, he has the right, in accordance with the Civil Code, to apply to the lender for resolution of the conflict. If the lender does not recognize the existence of a conflict and does not want to resolve it through an amicable agreement, the borrower has the right to appeal to the courts.

Necessary:

- apply;

- provide documentary evidence of the transaction;

- indicate violations and complaints.

The court will consider the case, check the agreement for compliance with the articles of the Civil Code and make a decision in favor of the right side. The party filing the claim is not always in a winning position.

This is just some information about loans, gleaned from the Civil Code. It should be remembered that the conclusion of financial transactions, especially large sums, must be carried out competently and must be recorded in writing.

Consequences for violating the clauses of the document

If one of the parties violates the basic terms of the loan agreement, then each of them is assigned its own consequences. If the borrower is the defaulter, the lender has the right to demand payment of inflation costs, as well as charge interest on late payments.

Additionally, in the process of drawing up this document, each party may make the other liable for certain violations. For example, if there are delays, fines or penalties may be assessed. The penalty is expressed as a percentage of the unpaid debt.

It is allowed to increase the limitation period in the case of loan agreements. According to the law, this period is generally three years, during which time the lender can apply to the court to collect the debt. If you go to court after three years, the borrower has the right to satisfy the demands of the other party in connection with the expiration of this period. However, if the drawn up agreement contains information about increasing this period, for example, up to 5 years, then the lender can apply to the court for recovery during this time.

Thus, if a loan is issued under certain conditions, it is advisable to immediately draw up an official document represented by a loan agreement. It is recommended to notarize it, as well as to specify in it the main conditions and nuances of the transfer and return of money, which include accrued interest, loan term, responsibilities of the parties and other important aspects of the process. If everything is done correctly, the lender will be protected from possible non-repayment of borrowed funds.

How to register correctly

1. Inform employees about the possibility of obtaining a loan. If the company is small, it is enough to verbally tell employees about this opportunity. And the issuance of a loan should be formalized by an application, agreement, order, etc. (I'll come back to this later). If the company is large, the possibility and procedure for providing loans can be provided for in local regulations. For example, create a “Regulation on the procedure for granting and repaying loans” or a “Collective agreement with employees.” But the presence of these documents is not required.

2. To apply for a loan, you will need:

- Application from an employee in any form requesting a loan

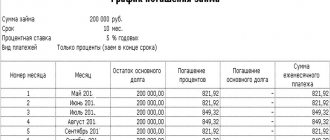

- Loan agreement. To avoid misunderstandings, be sure to specify in the contract: the type (interest-bearing or interest-free) and amount of the loan, the loan term and the procedure (schedule) for repaying the money. Separately describe the procedure for repaying the loan in the event of an employee’s dismissal. Indicate where (to whom) the loan should be transferred if the funds are transferred not to the employee, but to a third party, for example, to a developer. Write down any other special conditions in the contract. For example, you can describe penalties if an employee does not work for the company for 3 years, during which he was supposed to repay the loan

- Order to provide a loan to an employee.

3. Select a loan disbursement method. In Belarus, a loan can be issued to a resident employee only in Belarusian rubles (but in the agreement the amounts can be linked to equivalent values in foreign currency). You can issue a loan in two ways:

- In cash from the organization's cash desk. To do this, you will need: an expense cash order (hereinafter referred to as RKO), if we are talking about issuing a loan to one employee, or a payroll + RKO, if the employer issues a loan to several employees at once.

- In non-cash form - by transfer to the card account of the employee or the organization specified by the employee. For example: when issuing a loan to purchase a home, the tenant can transfer the money directly to the developer.

An employee can also repay a loan in different ways:

- Transfer money to the company account

- Deposit cash into the organization's cash desk to repay the loan

- The company may deduct loan payments from the employee's salary each month. But for this option, additional documents will be required: application + order (the employee must write an application in any form with a request to deduct the loan amount from his salary, and the employer must issue an order to deduct from wages).

Features of creating a receipt

In the process of drawing up a loan agreement, it is important to draw up a receipt. It is a significant document, so you need to know how to draw it up correctly so that it has legal force and can be used by each party as proof of its innocence if any disagreements arise.

The receipt is drawn up immediately upon the formation of the loan agreement. It must be formed in accordance with the registration rules, since this determines whether it will be possible to repay borrowed funds with its help in the future. The receipt is effectively used in court, serving as evidence that the funds under the agreement were actually transferred to the borrower, therefore he is obliged to return them in full, as well as accrued interest according to the terms of the agreement.

You must write a receipt even if a notarized document is being drawn up. It confirms the very fact of transfer of money from the lender to the borrower.

What are the requirements for a receipt?

A receipt for a loan of money must be written in accordance with certain requirements and rules in order for it to have legal force, so the following points are taken into account:

- the place where the document was drawn up is indicated, the address must be reliable and accurate;

- the full name of each person participating in the transaction is written down, and this applies to both the lender and the borrower, and information is indicated without any abbreviations, and they must fully correspond to the data that is available in citizens’ passports;

- the full amount of the loan transferred from one person to another is written, and it is also advisable to duplicate the numbers in written words to prevent forgery;

- the date when the funds were transferred to the borrower is indicated;

- at the end of this document the borrower puts his signature, which fully corresponds to the signature in the passport;

- if a receipt is made on a computer, then at the bottom of the text the borrower must write his full name by hand. and sign.

It is not difficult to draw up a receipt, and the parties may additionally agree to include additional requirements in this document, which include:

- The exact date by which the funds must be fully returned. In this case, the possibility of returning the money in partial payments or in full at the end of the specified period may be indicated. It is advisable to indicate the exact date to avoid confusion. If there is no such date on the receipt, then the borrower must return the money within 30 days after the lender requests it.

- The amount of interest accrued for the use of borrowed funds. As a rule, a monthly rate is determined, but it is possible to set a rate for any period.

- A fine or penalty is indicated if the borrower violates the basic requirements of the contract, as a result of which he does not pay the funds on time. The fine is a fixed amount, and the penalty is calculated depending on the selected percentage.

Thus, a correctly written document acts as a guarantee for the lender that the funds issued to the borrower will be returned in accordance with all conditions agreed in advance. It is the agreement and receipt that are used in court, so if they are available and thanks to the correct writing, no problems with collection through the court will arise.

How money is returned using a receipt

If this document is drawn up, then it is important to understand in advance how the money lent is returned under it. If there is a trusting relationship between the two parties, then usually no problems arise. If they are strangers to each other, then difficulties often arise with the return of funds. For example, a borrower may lose his job or get sick, but the lender still demands the debt back.

If the borrower does not return the money in accordance with the data contained in the agreement and receipt, then the lender has the right to go to court for forced collection. If all the documents are official and correctly drawn up, no difficulties arise in court, so a decision that is positive for the creditor is made. Enforcement proceedings begin, according to which bailiffs have the right to use various methods to facilitate the repayment of the debt.

Thus, when transferring funds on loan to an individual or legal entity, a loan agreement is drawn up. Along with it, a receipt should be made as proof of the transfer of money. These documents must be drawn up only in accordance with certain rules and requirements, since only then will they have legal force and therefore can be used in court by the creditor. It is best to notarize them, since in this case, if one of the parties violates the clauses of the agreement, the other has the right to go to court, where the agreement and receipt will serve as evidence.

Concept and nature of agreement

A loan is a financial transaction during which one person, who is also the lender, lends to another person, the borrower, a certain amount of money, in the form of a thing or some kind of property.

A loan agreement is a written agreement that describes all the nuances of the above transaction. It is signed by both parties, and comes into force not from the moment of signing, but when the borrower receives the subject of the transaction in hand.

The parties to such a transaction can be both citizens and legal entities and individual entrepreneurs. The only difference will be in the nuances of concluding the contract.

Reflection in the law

Since this is a legal transaction, it must be regulated by the norms of current legislation. The basic law, which presents all the main points of concluding a loan agreement, is the Civil Code of the Russian Federation.

Specifically, the loan is regulated by paragraph 1 of Chapter 42 of the Civil Code of the Russian Federation.

All the nuances of concluding such a transaction are presented here, the essential and additional terms of the agreement are described, as well as the procedure for concluding it with various subjects of economic life.

Depending on what is the subject of the transaction, who the parties are, and the type of loan, there are some “narrow” laws that should be addressed.

For example, if a government loan agreement is concluded, then you should pay attention to the Federal Law of April 22, 1996 No. 39-FZ.

Video: consideration of the main nuances when concluding a loan agreement

The following varieties

The loan agreement can be concluded on different conditions. All nuances depend on the subject of the transaction, terms and purposes of use, and other factors.

So, loans can be divided as follows:

| Paid or interest | that is, issuing a loan implies receiving profit from the borrower in the form of interest for using the subject of the transaction |

| Interest-free | no profit is expected. Such loans are common between the parties to the transaction, who have a certain amount of trust between them. |

| Target | are issued for a specific purpose, and the use of the subject of the agreement for other purposes is prohibited |

| Commodity | the subject of the transaction is a product, and such loans are issued directly by the suppliers of this product. Now such borrowing is gaining momentum and is becoming popular among counterparties who have been cooperating with each other for a long time |

| State | one of the parties to the transaction is the state, represented by authorities at various levels |

| Bond | these are loans that are issued in the form of securities to achieve certain goals to support government projects and programs |

Each type of loan agreement is concluded in the presence or absence of certain conditions. The law does not prohibit the lender from receiving a certain amount of interest from the borrower for the fact that the latter uses the subject of the transaction.

The amount of interest is set by agreement of the parties or may be equal to the key rate on the day the contract is signed.

An interest-free loan can also be issued subject to certain conditions:

- The loan amount cannot exceed 50 minimum wages established at the federal level on the day the transaction is concluded.

- If the subject is things or some property, then the loan will a priori be interest-free.

If the subject of the transaction is things or property, then it is necessary to indicate certain generic characteristics by which this thing or property can be easily identified.