BASIC: taking into account related expenses when calculating income tax

Please take into account associated costs associated with the conclusion and execution of a license agreement when calculating income tax as part of other production expenses, provided that the obligation to pay them is not assigned to the licensor under the agreement (clause 1 of Article 252 of the Tax Code of the Russian Federation).

The order of their accounting depends on:

- on the type of expenses;

- method of calculating income tax.

This follows from paragraph 1 of Article 252, Article 272 and paragraph 3 of Article 273 of the Tax Code of the Russian Federation.

Depending on the type of expenses, their tax accounting may have specific features.

In particular, take into account notarial expenses for certification of documents differently, depending on where and by whom the notarial actions were performed (Article 22 of the Fundamentals of the Legislation of the Russian Federation on Notaries, subparagraph 16, paragraph 1, Article 264 and paragraph 39, Article 270 of the Tax Code of the Russian Federation).

The costs of paying the state fee for registering a license agreement for a computer program, database or integrated circuit topology should be taken into account in full as part of other expenses of the organization as a fee established by law (subclause 1, clause 1, article 264, clause 10, article 13 and subparagraph 4, paragraph 1, article 333.30 of the Tax Code of the Russian Federation).

The amount of patent and other fees for registration of licensing agreements for other types of intellectual property is established by the Regulations approved by Decree of the Government of the Russian Federation of December 10, 2008 No. 941. Take such fees into account when calculating income tax as other expenses associated with production and (or) sales (Subclause 49, Clause 1, Article 264 of the Tax Code of the Russian Federation). The fact is that they do not relate to taxes and fees (Articles 13–15 of the Tax Code of the Russian Federation).

The date of recognition of expenses associated with obtaining rights under a license agreement is determined depending on the method that the organization uses when calculating income tax.

If an organization uses the cash method, recognize expenses as they are paid (clause 3 of Article 273 of the Tax Code of the Russian Federation).

When using the accrual method, take into account the costs in the period to which they relate (paragraph 1, clause 1, article 272 of the Tax Code of the Russian Federation).

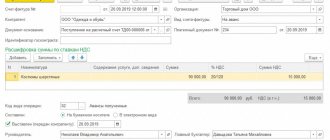

An example of how transactions to obtain a non-exclusive right to a trademark under a license agreement are reflected in tax accounting. The organization applies a general taxation system

In September, Torgovaya LLC (licensor) entered into a license agreement with Alpha LLC (licensee) for the right to use the Hermes trademark. The duration of the agreement is three years from the date of entry into force. The agreement comes into force from the moment of its state registration. Registration and payment of the fee for registering the agreement is the responsibility of the licensee.

The license agreement provides for a one-time remuneration to the licensor in the form of a one-time (lump sum) payment in the amount of 590,000 rubles. (including VAT - 90,000 rubles) after registration of the agreement.

In September, Alpha paid a fee of 10,000 rubles. for registration of the agreement.

The agreement was registered in October. Upon the entry into force of the agreement and the transfer of non-exclusive rights, the parties drew up an act of acceptance and transfer of non-exclusive rights to intellectual property.

Alpha calculates income tax on an accrual basis on a monthly basis.

In tax accounting, an organization distributes ongoing expenses in proportion to the number of days falling within the period to which such expenses relate.

When calculating income tax for October, Alpha’s accountant took into account part of the expenses:

- fees for registration of a license agreement in the amount of 128 rubles. (RUB 10,000: (366 days + 365 days + 365 days) × 14 days);

- one-time (lump sum) payment in the amount of 6387 rubles. (RUB 500,000: (366 days + 365 days + 365 days) × 14 days).

“Input” VAT related to a one-time (lump sum) payment in the amount of 90,000 rubles. accepted for deduction after signing the act of acceptance and transfer of the non-exclusive right to intellectual property.

Royalty taxation and risks

Let's look at the most common risks when paying royalties.

So, from the point of view of the tax legislation of the Russian Federation, funds in the form of royalties are recognized as income of the licensor organization and are subject to corporate income tax in accordance with the provisions of Article 250 of the Tax Code of the Russian Federation (see also legal ways to optimize income tax).

In the manner prescribed by subparagraph 3 of paragraph 4 of Article 271 of the Tax Code of the Russian Federation, the specified income is recognized on the date of settlements in accordance with the terms of concluded agreements or presentation to the taxpayer of documents serving as the basis for making calculations, or the last day of the reporting (tax) period.

Also, the payment of royalties in the Russian Federation is recognized as an expense for the licensee organization in order to form the base for corporate income tax in accordance with the provisions of paragraph 37 of Article 264 of the Tax Code of the Russian Federation.

VAT

The implementation of rights to use the results of intellectual activity is exempt from VAT in accordance with subparagraph 26 of paragraph 2 of Article 149 of the Tax Code of the Russian Federation.

However, it is worth paying attention to the fact that this rule does not apply to the transfer of all intellectual property objects, but only those named in the named article. In the case of transfer of rights to use other objects of intellectual property, VAT must be calculated in the general manner (read about dangerous and safe ways to optimize VAT).

This applies equally to both Russian and foreign organizations. In relations with foreign companies, a Russian company will act as a tax agent in accordance with the provisions of Articles 161, 310 of the Tax Code of the Russian Federation. This position, in particular, is adhered to by the Ministry of Finance of the Russian Federation in letter dated 02/01/2016 No. 03-07-08/1441.

Payment of royalties in favor of foreign organizations

In the case of royalty payments in favor of foreign organizations, additional tax legislation applies, both national and interstate.

The payment of royalties to a foreign company is for it the receipt of income from sources in the Russian Federation, and therefore, the organization paying such income can act as a tax agent in accordance with the provisions of Article 310 of the Tax Code of the Russian Federation.

At the same time, agreements on the avoidance of double taxation, as a rule, provide for conditions that allow the actual recipient of income in the form of “royalties” to tax the specified income in accordance with its national legislation.

National legislation, in turn, often provides for lower rates compared to Russian tax legislation or the absence of taxation of the corresponding group of income as a whole.

The right to calculate income tax

To confirm the right to calculate corporate income tax in the manner prescribed by the relevant double taxation agreement, a foreign company must meet certain criteria that are provided for by both national legislation and international acts.

In particular, Article 312 of the Tax Code of the Russian Federation provides for the application of a reduced rate to provide documents confirming:

- location of the foreign organization;

- actual right to receive income.

The Tax Code of the Russian Federation does not establish any special requirements for these documents. In particular, permanent residence can be confirmed by providing a certificate in the form established by the domestic legislation of a foreign state (residence certificate).

However, the Ministry of Finance of Russia in letters dated July 24, 2015 No. 03-08-05/36499, dated March 27, 2015 No. 03-08-05/16994, dated July 13, 2015 No. 03-00-08/2/40211, developed recommendations regarding the content documents submitted to confirm the right to receive income.

These documents, according to the Ministry of Finance of the Russian Federation, should contain the following information:

- about whether the recipient of the income has the right to independently dispose of and use the dividends received;

- about the occurrence of tax obligations for the recipient of income, subject to payment, the presence of which confirms the lack of savings on tax at source in the Russian Federation upon subsequent transfer of received funds to third parties (whose place of residence or registration is a state (territory) with which the Russian Federation has not concluded an international agreement);

- on the disclosure of sequences of direct and (or) indirect participation of a person who recognizes himself as the actual recipient of the paid income, documentary evidence of such sequences.

Despite the absence of clear requirements for these documents in the Tax Code of the Russian Federation, failure to submit them carries the risk of additional assessment of the amount of tax not transferred in connection with the application of the provisions provided for in an agreement with a foreign state.

Beneficial owner identification

The determining factor in this case is to establish the actual “beneficial” owner of the income received in order to determine

- country of tax payment (Russian Federation or foreign jurisdiction);

- subject of payment (Russian organization, foreign organization);

- applicable rate.

This concept is widely and successfully used by tax authorities in order to prevent the receipt of unjustified tax benefits, since taking into account by a Russian organization the costs of paying “royalties” while simultaneously reducing taxation or the absence of such taxation in a foreign jurisdiction has long been one of the most common schemes for evading taxes on territory of the Russian Federation.

The tax legislation of the Russian Federation gives the following definitions to the term “beneficial” owner:

- a person who, due to direct and (or) indirect participation in an organization, or control over an organization, or due to other circumstances, has the right to independently use and (or) dispose of income;

- a person in whose interests another person is entitled to dispose of such income (both definitions are given in accordance with paragraph 2 of Article 7 of the Tax Code of the Russian Federation);

- a person recognized as having the actual right to receive income, if such a person is the direct beneficiary of such income, that is, a person who actually benefits from the income paid and determines his further economic fate (the definition is given in accordance with paragraph 3 of Article 312 of the Tax Code of the Russian Federation).

If a foreign organization is created and exists solely to obtain tax benefits in the form of a reduced rate of taxation of income and the Russian organization’s accounting for the costs of paying royalties, the Russian organization bears the risk of additional assessment of corporate income tax.

Fact of transfer of intellectual property

The existence of the very fact of transfer of intellectual property must also be proven. If the tax authority proves that in fact no production secret or other intellectual property was transferred, the foreign organization serves as an artificially created transit link, then the tax will be assessed in the amount of over-accounted expenses.

How to avoid tax risks

In order to avoid such tax risks, when concluding relevant licensing agreements, especially with interdependent companies, a guideline can be considered the decision of the Federal Tax Service of Russia regarding Nissan Motor Rus LLC dated 02/09/2016 No. SA-4-9 / [email protected ] , issued based on the results of consideration of tax audit materials.

The tax department confirmed the legitimacy of the taxpayer’s position, based on the submitted documents confirming:

- performance by a foreign company of functions for the development of know-how and trademarks;

- conducting research activities aimed at developing and adapting technology to the needs of a specific market,

- implementation of quality control functions in relation to regional production, with the aim of increasing production efficiency and developing innovative solutions to optimize production processes.

Russian tax authorities also requested information from foreign colleagues who confirmed the right to actual income and the calculation of tax payments in relation to income received, provided for by the legislation of a foreign state.

As can be seen from this decision, the fundamental thing in this case is to prove that a foreign organization is carrying out real activities, bearing the usual risks associated with receiving income (in the form of at least paying taxes) and the absence of a transit nature of operations.

BASIS: VAT

Input VAT related to license payments and expenses associated with the conclusion of a license agreement are deductible at a time if an invoice is available and other mandatory conditions are met (clause 1 of Article 172 of the Tax Code of the Russian Federation).

If an organization has received an invoice with an allocated amount of VAT on license payments that are not subject to this tax, do not apply the deduction (clause 2 of Article 169 of the Tax Code of the Russian Federation). For more information about this, as well as about the arguments that will allow the licensee to recover the “input” tax, see Under what conditions can input VAT be deducted.

To check whether the licensor issued an invoice correctly, use the table.

Situation: will the licensee be a tax agent for VAT on payments under a license agreement concluded with a foreign licensor organization that is not registered in Russia?

An organization is required to withhold and transfer tax to the budget only if license payments are subject to VAT.

Thus, the answer to this question depends on what type of intellectual property the organization receives.

Regardless of the applied taxation regime, an organization that transfers license payments to a foreign licensor organization that is not registered in Russia is a tax agent for VAT (clause 1 of Article 161 of the Tax Code of the Russian Federation).

However, the organization is obliged to withhold and transfer tax to the budget only if license payments are subject to VAT. If license payments are not subject to VAT, there is no need to withhold this tax from them. This procedure follows from paragraph 2 of Article 161 of the Tax Code of the Russian Federation.

License payments are subject to VAT or not subject to this tax, depending on the type of intellectual property, the right to use which is transferred (subclause 1, clause 1, article 146 and subclause 26, clause 2, article 149 of the Tax Code of the Russian Federation). To determine this, see the table.

For information on the specifics of VAT withholding from license payments depending on the moment of conclusion of the license agreement, see Who is recognized as a tax agent for VAT.

VAT on contracts for the creation of computer programs and databases

Absence in paragraphs. 26 clause 2 art. 149 of the Tax Code of the Russian Federation, a direct reference to other types of agreements for the disposal of property rights to software other than a license agreement is an obstacle to the use of VAT benefits when transferring rights under such unnamed agreements.

It seems that the tax authorities cannot doubt the validity of applying the provisions of Federal Law dated July 19, 2007 N 195-FZ under an agreement on the alienation of exclusive rights, since this type of agreement is directly indicated in Articles 1233, 1234 and 1285 of the Civil Code of the Russian Federation as a contractual structure for the transfer of exclusive rights to software. At the same time, this agreement is far from the only basis for transferring exclusive rights to the new owner.

Ready-made solution for your business

Software Development Kit

A complete set of documents for secure software development. Protects you in relationships with developers, clients, freelancers and full-time programmers.

View the solution

Thus, on the basis of clause 2 of Article 1288 of the Civil Code of the Russian Federation, an author's order agreement may provide for the alienation to the customer of the exclusive right to software that should be created by the author, or the provision to the customer of the right to use this software within the limits established by the agreement. In the first case, the law establishes the application to such the agreement of the rules of the Civil Code of the Russian Federation on the agreement of alienation of exclusive rights, and in the second - the license agreement. Thus, one can reasonably believe that it is necessary to apply VAT benefits in the event of obtaining rights to computer programs and databases under a copyright order agreement.

Furthermore, in accordance with Art. 1296 of the Civil Code of the Russian Federation, in the case where a computer program or database was created under an agreement, the subject of which was its creation (by order), the exclusive right to such a program or such a database belongs to the customer, unless the agreement between the contractor (performer) and the customer provides other.

In this case, the legislator, in order to additionally protect the customer of software development, as in the case of creating a work for service, established a presumption that the exclusive rights to the work belong to the customer.

From this provision, the tax authorities conclude that within the framework of the specified agreement, the transfer of exclusive rights is not carried out, since the customer acquires exclusive rights to the software developed under the agreement by force of law (see Letter of the Ministry of Finance of the Russian Federation dated January 22, 2008 N 03-07 -11/23, Letter of the Ministry of Finance of the Russian Federation dated 04/01/2008 N 03-07-15/44, Letter of the Federal Tax Service for Moscow dated August 11, 2008 N 19-11/75222).

However, this position is not flawless. Firstly, in paragraphs. 26 clause 2 art. 149 of the Tax Code of the Russian Federation there is no indication of the specific type of agreement on the transfer of the exclusive right to computer programs and databases, under which benefits can be applied. Secondly, the conclusion that it is impossible to transfer exclusive rights to software under a contract is doubtful.

In development of the second thesis, we can refer to the fact that in terms of the subject matter, a contract for the development of programs and databases does not differ from a contract for an author's order. The distinction is made, again, only according to the subject composition: the contractor under a work contract (Article 1296 of the Civil Code of the Russian Federation) is a legal entity, and in a contract of author's order (Article 1288 of the Civil Code of the Russian Federation) - an individual. At the same time, the article on the author's order agreement contains a reference to the application to it of the provisions of the agreement on the alienation of an exclusive right or a license agreement, while Article 1296 of the Civil Code of the Russian Federation directly states that the rights belong to the customer, if the agreement between the contractor (performer) and the customer does not otherwise provided. However, establishing a presumption that the rights belong to the customer does not at all mean that he has an exclusive right from the moment the ordered software is created without transfer from the performer (contractor).

By virtue of the provisions of Articles 1255, 1257 and 1295 of the Civil Code of the Russian Federation, the copyright in the work in full initially belongs to its author. Thus, an organization acting as a performer under a contract, the subject of which was its creation (by order), must first obtain such rights from the author under a contract of author's order or on the basis of the provisions of the law on official work. Thus, the customer cannot acquire exclusive rights to the software without their transfer from the author and the contractor.

The issue can be resolved similarly under contract agreements, which did not provide for the creation of software for the customer, when the parties provided for the transfer of such a right to the customer.

However, due to the lack of law enforcement practice on this issue, in order to minimize tax risks, we recommend that when creating programs and databases, you acquire exclusive rights to them on the basis of a separate agreement on the alienation of the exclusive right. The above rules of law and the principle of freedom of contract do not prevent the parties from concluding an agreement providing for the financing of work on the creation of software with the subsequent transfer of exclusive rights to them to the customer for a separate fee.

3

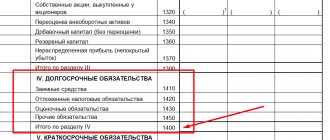

simplified tax system

If an organization pays a single tax on the difference between income and expenses, then take into account the costs associated with the acquisition of rights under a license agreement when calculating the single tax, provided that they are listed in Article 346.16 of the Tax Code of the Russian Federation.

Consider the licensor's remuneration in the form of periodic (current) payments as expenses, regardless of the type of intellectual property used (subclause 32, clause 1, article 346.16 of the Tax Code of the Russian Federation).

A one-time (fixed, lump-sum) payment can be taken into account when calculating the single tax only for certain types of intellectual property: computer programs and databases, topologies of integrated circuits, inventions, utility models and industrial designs, trade secrets (know-how) (subclause 2.1 p. 1 Article 346.16 of the Tax Code of the Russian Federation). For more information about which license payments are taken into account during simplification and which are not and on what basis, see the table.

Other costs associated with obtaining rights under a license agreement should be taken into account when calculating the single tax, provided that they are listed in Article 346.16 of the Tax Code of the Russian Federation.

However, please note that some of them can be recognized only if the requirements provided for them by Chapter 25 of the Tax Code of the Russian Federation are met. In particular, this applies to notary expenses (subclause 4, clause 1 and clause 2, article 346.16 of the Tax Code of the Russian Federation).

State fees for registration of licensing agreements for any type of intellectual property can be taken into account when calculating the single tax (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation).

However, do not take into account other fees associated with state registration of a license agreement when calculating the single tax. Such expenses are not mentioned in Article 346.16 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated April 22, 2010 No. 03-11-06/2/66).

Do not deduct input VAT related to the listed license payments. Include it in expenses when calculating the single tax. Provided that the amount of the license fee, to which VAT applies, is taken into account in expenses. This procedure follows from subparagraph 8 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation.

Consider expenses as they are paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

If an organization pays a single tax on income, then license payments for acquiring the right to use intellectual property will not affect taxation. Since with such a taxation object no expenses are taken into account. This procedure is established by paragraph 1 of Article 346.18 of the Tax Code of the Russian Federation.

An example of accounting for expenses in the form of license payments for the acquired right to use a trademark when calculating a single tax. The organization applies simplification

Torgovaya LLC (licensor) entered into a license agreement with Alpha LLC (licensee) for the right to use the Hermes trademark. The duration of the agreement is three years from the date of entry into force.

The license agreement provides for a one-time remuneration to the licensor in the form of a one-time (lump sum) payment in the amount of 590,000 rubles. (including VAT - 90,000 rubles), as well as periodic license payments in the amount of 5,900 rubles. (including VAT - 900 rubles) starting from the month following the month of conclusion of the contract.

The agreement comes into force from the moment of its state registration. The agreement was registered on January 14. Upon the entry into force of the agreement and the transfer of non-exclusive rights, the parties drew up an act of acceptance and transfer of non-exclusive rights to intellectual property. On the same day, Alpha transferred the lump sum payment.

On February 9 and March 10, Alpha transferred periodic license payments in full to Hermes.

"Alpha" calculates a single tax on the difference between income and expenses.

Alpha's accountant did not include the amount of a one-time (lump sum) payment in the amount of 500,000 rubles. (RUB 590,000 – RUB 90,000) included in expenses for the first quarter. Since this type of expenses under a license agreement for a trademark is not provided for in Article 346.16 of the Tax Code of the Russian Federation. And also did not take into account the amount of VAT in the amount of 90,000 rubles related to this remuneration.

The accountant took into account periodic license payments in monthly expenses (in February and March) in the amount of 5,900 rubles.

Thus, license payments in the amount of 11,800 rubles were taken into account as part of the expenses for the first quarter. (5900 rubles × 2 months).

VAT on technical support services and maintenance of programs and databases

In this case, the Ministry of Finance of the Russian Federation expresses the opinion that Federal Law No. 195-FZ of July 19, 2007 does not provide for exemption from VAT taxation for the execution of software installation work, as well as the provision of services for its maintenance and technical support (see Letter of the Ministry of Finance of the Russian Federation dated 21 February 2008 N 03-07-08/36, Letter of the Ministry of Finance of the Russian Federation dated January 12, 2009 N 03-07-05/01).

At the same time, such an interpretation seems to us not to be entirely justified. We can fully agree that such services should be subject to VAT if they are provided under separate contracts. However, in some cases, the acquisition of a license for complex software is made conditional on the provision of after-sales services, the cost of which was previously included in the license fee. These services are additional to the provision of the license and are aimed at increasing its consumer value.

As an option to avoid VAT tax risks, it is possible to offer the replacement of technical maintenance and product support services with warranty service provided under a license agreement. The latter is also related to ensuring the proper functioning of the software, but does not involve the collection of a separate VAT fee.

5

OSNO and UTII

The calculation of taxes when transferring license payments for the right to use intellectual property depends on the type of activity for which the intellectual property is used.

If the right is used only within the framework of activities on the general taxation system, then take into account the license payments according to the rules in force when calculating income tax and VAT (clause 9 of Article 274 and clause 7 of Article 346.26 of the Tax Code of the Russian Federation).

If the right is used only within the framework of activities on UTII, then do not take into account any expenses in the single tax base. Since the object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

Moreover, if a license agreement is concluded for the purpose of carrying out both types of activities, expenses in the form of license fees and related expenses must be distributed (clause 9 of Article 274 and clause 7 of Article 346.26 of the Tax Code of the Russian Federation).

Input VAT relating to such payments must also be allocated. Distribute VAT according to the methodology established in paragraphs 4, 4.1 of Article 170 of the Tax Code of the Russian Federation.

The amount of VAT that cannot be deducted should be added to the expenses for the activities of the organization subject to UTII (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).

License to use computer programs

A license agreement is an agreement on granting rights to use a work to a person who is not its author or other copyright holder by force of law (Clause 1 of Article 1286 of the Civil Code of the Russian Federation). A software license, depending on the scope of the licensor’s rights, can be of two types: simple (non-exclusive), which presupposes that the copyright holder retains the right to issue similar licenses to other persons; exclusive, which deprives the licensor of such a right.

In this case, the formula “1 agreement = 1 type of license” is not mandatory. By virtue of paragraph 3 of Article 1236 of the Civil Code of the Russian Federation, within the framework of 1 agreement, a combination of conditions of both types is allowed in relation to different methods of using the software.

Accounting for various types of intellectual property

For more information on accounting and taxation of rights to certain types of intellectual property, see:

- How to reflect the purchase of a computer program in accounting;

- How to reflect the purchase of a computer program in tax accounting;

- How to record the costs of purchasing a trademark.

If an organization has received the right to use intellectual property from a citizen, for more information about accounting for license payments, see:

- How to record remuneration under copyright agreements;

- How can a licensee record remuneration under a license agreement with a citizen?

GK about computer programs

The Civil Code of the Russian Federation classifies computer programs as objects of intellectual property - the results of intellectual activity (Article 1225 of the Civil Code of the Russian Federation). They are objects of copyright and are protected as literary works (clause 1 of Article 1259, 1261 of the Civil Code of the Russian Federation). Intellectual property rights are recognized for objects of intellectual property, the element of which is the exclusive right (property right) (Article 1226 of the Civil Code of the Russian Federation).

The copyright holder (licensor) may grant another person (licensee) the right to use the result of intellectual activity by concluding a license agreement within the limits established by this agreement (Clause 1 of Article 1235 of the Civil Code of the Russian Federation). This does not entail the transfer of the exclusive right to the licensee (clause 1 of Article 1233 of the Civil Code of the Russian Federation). Accordingly, the licensee can use the result of intellectual activity only within the limits of those rights and in the ways provided for in the license agreement.