The Federal Tax Service does not advise companies to cooperate with partners who have a mark of false information in the Unified State Register of Legal Entities. This mark warns that working with a counterparty is risky (information on the Federal Tax Service website dated 09/01/17).

Tax officials recommend checking partners every quarter. But it is not enough to break through the counterparty only on the nalog.ru website. There are many more official resources that need to be studied: registers of unscrupulous suppliers, the Prosecutor General’s Office, bailiff services, etc. Although you can do it easier - use the “Checking counterparties” service on rnk.1cont.ru. It combines all known legal sources about counterparties.

Exercise due diligence when selecting contractors.

The concepts of “due diligence” and “unjustified tax benefit” were first introduced by Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 N 53 “On the assessment by arbitration courts of the validity of a taxpayer receiving a tax benefit.” The Plenum pointed out that when assessing the activities of a company, one must look at 2 (two) important aspects of its life:

- The reality of the transaction;

- Exercise due diligence.

Paragraph 10 of Resolution No. 53 clarifies that a tax benefit can be recognized as unjustified only if inspectors prove the following:

- the taxpayer acted without due diligence and care;

- the taxpayer should have been aware of violations committed by the counterparty.

This position is still relevant today! Tax officials are trying to prove the fact that the transaction is fictitious (unreal) and the lack of due diligence. Taxpayers are trying to prove that they showed this very diligence and that at the time of the transaction no negative business factors were identified.

Here are some court decisions where exercise of caution has helped taxpayers in disputes with the tax inspectorate.

- Determination of the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation dated November 29, 2016 N 305-KG16-10399 in case N A40-71125/2015

- Resolution of the Arbitration Court of the Moscow Region dated March 31, 2015 in case No. A41-26399/14 for ANT Firm LLC

- Resolution of the Court of Justice of the West Siberian District dated 07/08/2016 N F04-2454/2016 in case N A46-9814/2015

Connection with ephemera

In its recommendations, the Federal Tax Service cites several signs that an organization is cooperating with fly-by-night companies in order to obtain illegal tax benefits. In particular, this will be evidenced by the complex, confusing and repetitive nature of the taxpayer’s actions within the tax scheme.

All unusual schemes that do not occur within the normal course of business will automatically come to the attention of tax authorities and investigators. Also, illegal schemes involving one-day schemes are indicated by the common personnel of the taxpayer and his counterparties, common property, common staff of lawyers, consultants, accountants, communications equipment, contracts with providers, IP addresses, etc.

The Federal Tax Service recommends that if signs of cooperation with one-day scams are identified, the investigative authorities are immediately informed about this in order to carry out operational investigative measures. Final doubts about the payer’s integrity will be dispelled during an inspection/search of offices and a survey/interrogation of employees. At the same time, inspections of the premises will be carried out with the involvement of IT specialists who will be able to prevent the destruction of evidence on digital media.

Direct evidence of illegal activity includes, in particular, the presence of “black” accounting, the discovery of seals and documentation of shell companies on the territory.

In addition, tax authorities are advised to treat the discovery of debit cards in offices as an aggravating circumstance. The cards, according to tax officials, are further evidence that the taxpayer is engaged in illegal cash withdrawals.

The presence of the above circumstances has a real prospect of bringing to responsibility. All that remains is to prove the presence of intent to implement an illegal tax scheme.

Why do you need to check the supplier before the transaction?

In my opinion, caution in choosing a supplier, carried out before the start of the relationship, helps to minimize:

- Banking risks;

- Tax risks;

- Entrepreneurial risks.

Banking risks are associated with the possibility of receiving “Refusals to carry out transactions.” If the supplier is not reliable from the point of view of banks, then by making a payment for him, it is quite possible to get an entry in the “black list” N 639-P. This has a bad effect on business, as it leads to additional losses and blocking of bank accounts.

Tax risks are associated with the fact that when making transactions with an unreliable partner, you can lose expenses that reduce the tax base and VAT. In addition, you will have to pay penalties and fines. If you are unable to pay your tax obligations, you may be subject to subsidiary liability.

Entrepreneurial risks are always associated with the fact that by trusting someone who does not deserve this trust, you can lose your property. When assessing the possibility of concluding a contract, you need to pay attention to the solvency of the applicant and the ability to fulfill its obligations under the contract. Many of the above risks can be avoided if you responsibly choose who to do business with. Excellent price quality of a transaction is not the main sign of a successful transaction. We need to think about its further consequences and understand all the risks.

Self-identification of risks

Of course, enterprises should not wait for inspections by regulatory authorities. Each payer has the right to use those criteria that allow the most effective verification of the counterparty for good faith.

There is an order of the Federal Tax Service No. 93-06-333 dated May 30, 2007, which contains explanations about the conditions under which a taxpayer can be considered to have checked the reliability of his potential partner. Using a fairly large number of methods will allow you to protect yourself from claims from financial authorities and ensure the elimination of risks for your business. Let's take a closer look at them.

Regulations for verification of counterparties. How will it help?

Let’s imagine a situation where a company has a clearly defined procedure for analyzing a candidate before concluding a contract. Employees follow internal requirements and cut off many dangerous options in the bud. For example, when concluding a contract for processing products, you are offered an excellent price, but upon initial inspection it turns out that the processor does not have

- required production capacity;

- human resources;

- the required OKVED code to complete the transaction.

Most likely, such a candidate is unlikely to cope with the task assigned to him. It may be necessary to continue further search for someone who will meet all the necessary conditions.

Extract from the Unified State Register of Legal Entities

How can a counterparty be verified? The Unified State Register of Legal Entities provides information on the registration of business entities. If a potential partner attaches to all the documents he has collected a recently received extract confirming that he is registered with the state, then this will also be the basis for considering him reliable. In addition, this document can be used to check the details of the counterparty, which he indicates in contracts.

Such an extract can either be provided by the partner himself or obtained from the tax authority or on the appropriate resource.

Regulations for verification of counterparties. What must be included in it?

It is important to pay sufficient attention to the following factors:

The procedure for checking a candidate before making a transaction:

- How is the verification carried out?

- What facts of the availability of property, capacities, warehouse areas and other resources may be, how this is recorded: photos, video shooting of objects, etc.

- What Internet resources should be used, what to pay special attention to, how information is recorded.

Storage order and volume of required information:

- As a rule, an organization that cares about reducing its risks establishes the maintenance of “personal files” for everyone with whom contracts were signed. “Personal files” collect all the data obtained during the analysis. These are documents, photos, videos and other documents that we managed to collect.

- When checking a counterparty on online resources, it is important to correctly record the information received. To do this, screenshots are generated, which are printed and signed by the responsible persons. Do not forget that the time for drawing up the document must precede the signing of the contract. This is the only way to prove that all precautions were taken before the transaction, and not during the tax audit.

Signs of dishonesty of the counterparty, what to pay special attention to.

Such markers of bad faith were pointed out by the 53rd Plenum of the Supreme Arbitration Court of October 12, 2006. It would be useful to include them in your internal Regulations and strictly analyze the activities of the audited companies:

- failure to fulfill the terms of the transaction due to inconsistency in the time and location of property and material resources;

- lack of the required conditions for achieving results due to a lack of managerial or technical personnel, fixed assets, production assets, warehouses, vehicles;

- there are no mandatory expenses for the type of activity;

- there are no production capacities and other required resources in sufficient quantities;

- the organization was created less than 6 months before the business transaction;

- irregular nature of activity; violation of the law in the past;

- one-time, non-typical nature of the operation;

- carrying out the transaction at a place other than the location of the counterparty;

- using a chain of intermediaries.

Perhaps the mere presence of some of the above factors in a candidate does not mean that he cannot be worked with. But, if several factors indicate this, and in some cases one is enough, then, most likely, you should think about it and refuse further cooperation.

You can find more detailed information on what to look for when assessing a candidate for a deal in my article:

How to exercise due diligence when choosing a counterparty?

How can a business respond to the requirements of the Federal Tax Service?

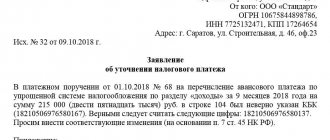

Until now, a considerable number of taxpayers reduce the work of checking counterparties to simply collecting basic information from publicly available sources. This is a necessary, but, alas, in 2021 it is no longer a sufficient part of the work. It includes searching for a counterparty by TIN, searching for tax debts, checking the number of directors and their addresses, checking management in the register of disqualified persons and more. These and other summary data can be found on the company card in the Kontur.Focus system.

When checking potential business partners, an entrepreneur must consider:

- legislative norms

- clarifications from the regulatory agency

- judicial practice

The optimal strategy today would be to develop a system of measures that would include not only identifying and assessing publicly available basic information, but also preparing evidence that the intended counterparty has a sufficient number of labor and other resources to complete the task.

You will need to find answers to the following questions. Does the partner pay all applicable taxes? What documents will confirm this without violating trade secrets? Does the partner involve other contractors in performing the requested work? Do you know the entire contract chain?

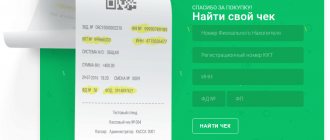

Here are the online portals that I recommend using when checking a counterparty!

When analyzing the possibility of working with a particular partner, use:

- https://pb.nalog.ru/ - “Transparent Business” service, the current status of the counterparty, its tax system are checked, an extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs is saved

- https://service.nalog.ru/svl.do - the absence of information about disqualified managers and owners of companies is checked

- https://fssprus.ru/iss/ - service of the Bailiff Service, checking the availability of writs of execution.

- https://kad.arbitr.ru/ - information about the counterparty’s participation in arbitration processes is checked

- https://www.vestnik-gosreg.ru/ - information about non-operating legal entities and companies that are in one or another stage of liquidation is checked.

- https://services.fms.gov.ru/info-service.htm?sid=2000 - information about the validity of the passport of the manager/owner of the company is checked

- https://service.nalog.ru/bi.do - information about the blocking of company accounts by the Federal Tax Service (presence of unpaid taxes or unfiled reports)

In the “personal file” of the new partner, along with the agreement, place printouts from the official sources above for storage.

Attention, be careful!

1. Remember that no amount of printouts from commercial systems can prove that you carefully and carefully approached the selection of a candidate. Courts do not accept such evidence and here's why. As you know, all commercial systems take information from official sources. Data may be distorted, truncated, or not updated. Commercial systems are not responsible for incorrect information. Technical glitch and that's it! Therefore, use and record in your “personal file” screenshots and documents only from official websites of government services.

2. Remember, you need to be careful when choosing a counterparty not on formal grounds ! Many businessmen believe that it is enough to request copies of constituent documents, certificates of state registration. registration and extract from the Unified State Register of Legal Entities and everything will be in chocolate! This approach is a utopia. Arbitration practice confirms this:

- AS of the Krasnodar Territory in case A32-2566/2016;

- AS of Moscow in case A40-112921/16-20-966.

Formal collection of evidence is not enough; other verification actions are also required. Write them down in your internal regulations and follow them. This is the only way to protect your business from fines and additional charges!

A matter of particular importance

Today there are many unreliable organizations that are called fly-by-night organizations. They are the ones who can cause damage to the other party to the contract. At the same time, the state will receive less taxes, and a conscientious businessman will have problems in the form of a huge number of questions from regulatory organizations. Subsequently, this results in additional taxes, refusal to refund VAT amounts, and is also fraught with the imposition of considerable penalties.

Checking the counterparty for good faith is not the responsibility of the enterprise. Legislative acts do not provide for such a procedure. However, it would still be wiser and safer for every businessman to spend some time collecting information about his partners. From this we can conclude that checking the counterparty for good faith can be considered mandatory. When carrying out such a procedure, it will always be possible to prove to regulatory authorities that the company showed diligence before executing the transaction. After all, based on examples of practice, it becomes clear that the same level of responsibility is assigned to companies that deliberately entered into a relationship with a fly-by-night organization, and to those that did not learn about its dishonesty in advance and did not take the necessary precautions.