Counter audits are just another way to control tax authorities

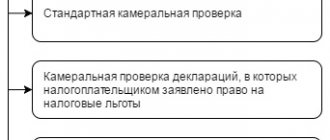

When you receive a request from the tax office to provide documents (information) about another company, you should not panic. They are checking not you, but your counterparty. Such audits are not another type of tax audit. In essence, a counter audit is the tax authority’s right to request information related to the activities of the taxpayer being audited from its counterparties. And the expression “counter audit” itself remains in use from the old editions of the Tax Code; in the current one there is no such concept now.

Article about tax audits - in the course “Everything will get out of control”

If an inspector suspects something wrong during an on-site or desk inspection, he has the right to request documents from the counterparties of the company being inspected in order to confirm the information.

The basis for conducting such tax control may be not only a desk or field tax audit, but also another justified need. Moreover, the legislation does not limit this concept, so anything can be such a necessity. The inspectors will determine this themselves based on the results of their analysis. Outside the scope of verification, they can monitor a specific transaction to confirm its reality.

In what cases are counter checks ordered?

A check may be ordered in the following situations:

- The tax office suspected that the organization was maintaining double documentation.

- The tax office discovered fictitious documents, or the unreliability of the acts was revealed.

- A discrepancy between the quarters in the reporting was discovered.

- The tax authorities suspected that the company was hiding some income. They are not fully displayed in the reporting and, accordingly, taxes are not paid in full.

- The tax office discovered that there is no agreement with the counterparty or partner, or it was discovered that this agreement was not being conducted correctly.

But how is a counter-check carried out? This is a kind of unscheduled inspection. The employee who checks the organization and the organization itself, as a tax agent, may be registered with various services. That is, the Tax Code of the Russian Federation does not regulate the fact that a counter-check should be carried out by a specific tax service.

The tax agent must take into account the following important nuances:

- A counter audit is carried out using this method, which allows you to find out information from one taxpayer about another.

- A counter inspection cannot be carried out separately from a desk inspection.

- The subject of the audit is information, as well as documentation, that reflects the financial and business relations of several different persons.

- Tax authorities do not have the right to request documents for verification without a prior written request.

What is the essence of the requirement?

A tax requirement with reference to Article 93.1 of the Tax Code of the Russian Federation means that a desk or on-site audit is being carried out on your counterparty, or tax authorities are collecting information on it as part of tax control measures.

It is important for inspectors to check the reality of the existence of a given counterparty, as well as the reality of its business transactions, and to understand whether there is any discrepancy in information about the financial component of the transaction between the parties involved in the transaction. In this case, the organization’s demand is made by the very tax office where the organization is registered for tax purposes, attaching to the request a copy of the instruction of the inspection of the taxpayer being inspected (clause 3 of Article 93.1 of the Tax Code of the Russian Federation). The order must always indicate during which tax control event the need to submit documents arose, and when requesting information regarding a specific transaction, information must be indicated that allows the identification of this transaction.

Basic Concepts

- A tax audit is an action that is procedural in nature. This check must be carried out by the tax office. The main purpose of the inspection is to identify possible violations. During this audit, tax control data is reconciled with the data reflected in reporting declarations.

- Declaration - A legal act that formulates the basic principles, as well as the goals of the two parties.

- A counter inspection is an inspection conducted by the Federal Tax Service. The goal is to study the financial and economic activities of the organization’s counterparties.

- A document is a different kind of information carrier that has details. The document records all the basic information that reflects the activity.

- Counterparty is the party with whom the contract was concluded. The counterparty can be either an individual or a legal entity who is entrusted with fulfilling various types of obligations.

Penalties

The letter of the Federal Tax Service of Russia dated June 27, 2017 No. SA-4-9 / [email protected] indicates the articles of the Tax Code of the Russian Federation, which provide for a fine and determine its size:

- For failure to submit or untimely submission of documents relating to the activities of the taxpayer being audited on the basis of clause 1 of Art. 93.1 of the Tax Code of the Russian Federation provides for a fine of 10,000 rubles (clause 2 of Article 126 of the Tax Code of the Russian Federation).

- For failure to submit or untimely submission of documents regarding a specific transaction of the taxpayer being audited on the basis of clause 2 of Art. 93.1 of the Tax Code of the Russian Federation - a fine of 5,000 rubles (clause 1 of Article 129.1 of the Tax Code of the Russian Federation).

If the organization is going to comply with the received requirement, then pay attention to the relaxation in the deadlines for providing a response, which accountants now have.

Until recently, the deadline for fulfilling a requirement was limited to five working days following the day the requirements were received. However, from September 6, 2021, the deadline for submitting documents as part of a counter-inspection has been increased to ten working days (Federal Law No. 302-FZ dated August 3, 2018). You also need to keep in mind that the tax inspectorate will not provide your organization with its decision based on the results of the counter audit, because the information received remains in the audit materials for the taxpayer being audited, and not for his counterparties.

However, violations that are identified during the “meeting” may cause an audit to be carried out in your organization. To avoid this development of events, I would recommend that when receiving a tax demand with reference to Art. 93.1 of the Tax Code of the Russian Federation, contact the counterparty to check whether the information in the documents available to both parties is correctly compiled and identical.

There is no need to be afraid of demands from the tax office. This is a work situation. Compliance with the specifics described above will remind you of the limits of the powers of the tax authorities, protect you from fines and show the path along which you can build working cooperation with the tax authorities.

Documents that may be requested during a counter-inspection

There is no strictly regulated list of documents that the tax service may request. But, as a rule, this is a package of documents that characterizes the economic activities of an organization with its counterparties. Such documents include various kinds of acts, contracts, as well as invoices that meet the requirements for counter verification.

The tax agent, upon request from the Tax Service, must submit the necessary documents no later than within 5 days from the date of the request. Moreover, original documents are not required to be presented; copies can be used. A covering letter from the tax office that carried out the audit must be added to the package of documents.

If the tax agent cannot provide the requested documents within the established period, then he has the right to file a petition requesting to extend this period. The application must indicate the date by which the entire package of documents will be provided.

The counter-inspection of the counterparty is not verified; it only requires documents. But first, the tax authorities are required to send a covering letter to the tax agent, and only in writing. This letter must be sent to the tax office with which the organization or individual is registered. The reason for this inspection must be indicated in the letter.

After receiving the letter, within 5 days, the INS sends a request to the counterparty to present the necessary documents. A wide variety of documents can be requested, as a rule, these are invoices reflecting information on the payment of taxes, documents for the transportation of goods, contracts with a transport company. The response to the request must be provided within 5 days.

If the tax agent does not respond to the request, a fine may be imposed on him. In order to comply with the legality and legality of requesting documents, you must follow the following requirements:

- The request must be presented to a representative of the organization, and in person.

- If the request was sent by mail, the counterparty must be notified of its receipt.

- The request can only be made by the tax authority with which the organization is registered.

- The notification must contain the reason for the counter-inspection, as well as a complete list of documents required for submission.

- Absolutely all requirements and data must be formulated very clearly.

Before sending documents for verification, the tax agent must make sure that the tax authorities’ requirements are legal and legitimate. It is necessary to pay attention to the following nuances:

- The NS can request documents only if there is a certificate of a counter-inspection.

- The reason for requesting documents must be indicated.

- The request must contain complete information about the details of the documents being requested.

- Declarations of the enterprise cannot be requested by the tax authorities.

As a rule, counter-verification documents can be requested in two main cases: a transaction is being concluded for a particularly large amount, and the Tax Investor has reason to believe that the agreement with the counterparty is fictitious.

Answer or refuse?

Often, accountants, having received a request for a counter audit, try to refuse to provide documents, arguing that the request goes beyond the three-year audit period. But not everything is so simple: refusal to provide documents is inappropriate here and can even lead to penalties. Why? The restrictions on the audit period established in Article 89 of the Tax Code of the Russian Federation relate only to on-site inspections in relation to the taxpayer himself and in no way apply to requests received in relation to your counterparties. This was confirmed by the Ministry of Finance of the Russian Federation in its letter dated November 23, 2009 No. 03-02-07/1-519, and to date its position on this issue has not changed. For this reason, for failure to provide documents, or for failure to report their absence (which happens in practice), the organization may face a fine.

Drawing up an explanatory note for submission to the tax office

Often, the taxpayer must attach an explanatory note for the tax authorities. Let's look at how to compose it correctly.

First of all, such a note must contain all the data about the documents being submitted and subject to verification, and its content depends directly on the type of document to which it is attached.

The explanatory note must be drawn up on an A4 sheet; if it has several pages, they must be bound and framed in a transparent cover. The pages of the explanatory note are numbered starting from the title page. The note should be written using a formal business writing style.

Mandatory information that must be contained in the note includes:

- The name of the NS inspection unit to which the note is addressed.

- Legal entity identification code.

- Details of the requirement that is the reason for drawing up this note.

- Details of the document to which the note is being drawn up.

- Data on all expenses and income of the enterprise.

- The amount of all costs or losses incurred.

- Data on existing discrepancies between accounting and tax accounting. If any exist.

Stages of the procedure

Counter checks should only be carried out if multiple requirements are taken into account. Therefore, the tax inspectors themselves must follow certain conditions. The procedure is divided into successive stages:

- Initially, various errors or dubious information are identified regarding various transactions carried out by the audited company with other companies;

- the inspector sends a request to the counterparty, on the basis of which the head of the organization must prepare a certain package of documents related to cooperation between the companies;

- the documentation must be prepared by the enterprise within five days, after which the responsible representative of the company must personally bring these papers to the Federal Tax Service office, and they can also be sent by mail using a valuable letter with a list of the attachments;

- Next, the inspector checks the documentation received from the counterparty;

- the data available in the documents of different enterprises is compared;

- Based on the results of the inspection, a conclusion is drawn up by employees of the Federal Tax Service, and it must be transmitted to both companies.

If during an inspection various violations are revealed, the companies being inspected are held administratively liable, and legal proceedings may also begin.

During a counter-inspection, the Federal Tax Service can punish counterparties only for violating the deadlines within which the company must transfer documents. This leads to the fact that the accounting department of the enterprise does not conduct a preliminary check of the documents before sending them, which can lead to negative consequences for both organizations. If serious errors are identified, inspectors may initiate an unscheduled on-site inspection of such a counterparty. Therefore, the company will not be able to escape punishment.

An inspection is carried out only if there are objective reasons, therefore, in their absence, the counterparty may refuse to provide the necessary documentation.

The final stage of the counter check

Upon completion of the counter tax audit, the authorized person must draw up an act that contains all the details of the audit conducted, as well as its results. This act will serve as direct evidence if violations are discovered during the inspection. Moreover, information on each identified offense must be reflected.

Thus, we can conclude that a counter-inspection is not mandatory, and the basis for conducting this type of inspection is the detection of various types of inaccuracies that arise in the course of the business activities of the enterprise. The tax agent may not be notified about the start of a counter audit, but if any violations are identified, he will be held responsible for them.

Purpose of the event

The essence of the counter check is to clarify various circumstances and details of a specific transaction, which for various reasons may be considered illegal. As a result of such a transaction, the company's revenue usually increases or decreases significantly. Therefore, inspectors have doubts as to whether such an operation is legal. This often leads to a reduction in the company’s tax payments.

A counter check is initiated to achieve several goals at once. These include:

- checking the authenticity and legality of documents transferred by the company;

- reviewing information in similar documents from different companies to ensure that there are no intentional corrections;

- reconciliation of information about various financial transactions performed by the company and its partners;

- confirmation of the existence of specific counterparties, as well as the fact that they are actually engaged in business activities.

If various serious violations are identified during a counter inspection, both companies are held accountable. Typically, such a study is carried out if a transaction is made for an amount exceeding 100 million rubles.

Two reasons for requesting documents

“Non-audit” requests can be received by the accounting department in two situations.

Firstly, such requests have the right to be initiated by the inspectorate, which carries out a tax audit of the counterparty (that is, another taxpayer associated with the addressee of the request).

Secondly, the inspection may request documents or information outside the framework of any tax audit, but during other tax control activities (Clause 1 of Article of the Tax Code of the Russian Federation). For example, when checking accounting and reporting data or during a pre-audit analysis (decision of the Supreme Court of the Russian Federation dated 09.23.20 No. 307-ES20-13138 in case No. A56-51770/2019, resolution of the Federal Antimonopoly Service of the Ural District dated 06.25.12 No. F09-5408 /12 in case No. A71-11479/11). But in such cases, the circle of interests of inspectors is legally limited to a specific transaction.

Determine the likelihood of an on-site tax audit and receive recommendations on the tax burden

Let's look at each of these grounds in more detail.

Is it possible to refuse to transfer documentation?

The legislation does not regulate the exact list of papers that may be requested by Federal Tax Service employees from counterparties of the company being inspected. This often leads to disagreements between inspectors and company managers, since documents are requested that are not related to various important transactions.

Often, personal documents of companies, staffing schedules or other papers are requested. Through them, inspectors check the existence of relationships between different companies. If a company refuses to prepare such documentation, it may be held liable. In this case, you will have to go to court, but usually judges side with the Federal Tax Service.

If the deadlines for submitting papers are violated, a fine of 5 thousand rubles is imposed.

What period is checked?

The period for which documents are requested must coincide with the period within which the original company is being verified. If Federal Tax Service employees require documents that are not related to this period, then this is a violation, so the company may refuse to prepare this documentation.

A company may refuse to transfer papers that relate exclusively to its business activities and do not relate to the company being inspected. In this case, the counterparty cannot be held administratively liable.

Responsibility for violations

Counterparties who refuse to hand over documents or violate deadlines for preparing papers are subject to administrative liability. In this case, a counter-on-site inspection is carried out against them, and a fine of 5 thousand rubles is imposed.

Authorized persons pay a fine in the amount of 300 to 500 rubles. Additionally, Federal Tax Service employees send a second request. Therefore, in any case, companies will have to prepare and submit the necessary documentation for study.