By its Order No. 485 dated August 6, 2018, Rosstat approved new forms of statistical reporting on the number of employees, wages and working conditions.

In particular, Form 1-T with data on working conditions and compensation for “harmful workers” will now need to be submitted on January 21, rather than January 19. Moreover, general filing grounds are established for all companies, including those that did not work for part of the reporting period. When submitting such companies, they must indicate the period during which they did not operate.

The same grounds are provided for when submitting Form 3-F, which contains information about overdue wages. In addition, it is provided that when closing an OP, data on arrears that arose in a separate division are reflected at its location at the time the debt arose.

As for less important changes, in form P-4 with information on the number and salary of employees and form P-4 (NZ) with data on part-time employment and personnel movement, instead of the words “previous year”, “2017” is entered.

Forms have been updated from the 2021 report:

- No. 1-T “Information on the number and wages of employees”;

- No. 1-T (working conditions) “Information on the state of working conditions and compensation for work with harmful and (or) dangerous working conditions”;

- No. 2-GS (ГЗ) “Information on additional professional education of federal state civil servants and state civil servants of the constituent entities of the Russian Federation”;

- No. 2-MS “Information on additional professional education of municipal employees”;

- No. 1-T (GMS) “Information on the number and remuneration of employees of state bodies and local governments by personnel categories.”

Starting in 2021, the order introduces new monthly reporting forms:

- No. 3-F “Information on overdue wages”;

- No. 1-Z “Labor Force Sample Survey Questionnaire”;

- No. 1-PR “Information on the suspension (strike) and resumption of work of labor collectives”;

- No. P-4 “Information on the number and wages of employees.”

Form P-4: what is it for, when and how to submit it

The updated statistical form P-4 was approved by order No. 412 of July 24, 2020, and instructions for filling out the new form P-4 in statistics in 2021 were approved by orders of Rosstat:

- No. 412 dated July 24, 2020;

- No. 711 dated November 27, 2019.

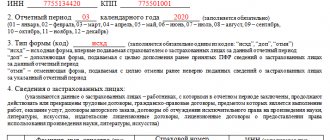

It is used to provide statistical data on the number and wages of employees of an enterprise. All representatives of large businesses and government organizations are required to submit it to Rosstat, except for small enterprises, public organizations, cooperatives and individual entrepreneurs. But this possibility of non-provision must be previously agreed with Rosstat.

Use the reporting calendar from ConsultantPlus for free for the entire 2021. In it you will find deadlines for submitting all reports, current forms and instructions for filling out.

Many people are confused about whether the P-4 report to Rosstat is monthly or quarterly. According to the instructions, it is handed over either way. Delivery deadlines depend on the number of employees:

- if the company has less than 15 people, then statistical data is submitted once a quarter - before the 15th day of the month following the previous quarter;

- if the organization employs more than 15 people, then the information is submitted monthly - before the 15th day of the month following the reporting month.

The innovation is that companies with a mining license are required to submit a report monthly, regardless of the number of employees. The same obligation has appeared for organizations registered or reorganized in the current or previous year.

Regulatory bodies of Rosstat have established deadlines for submitting P-4 monthly and quarterly:

- April 15 - for March or the first quarter;

- May 15 - for April;

- June 15 - for May;

- July 16 - for June or Q2;

- August 15 - for July;

- September 15 - for August;

- October 15 - for September or for the third quarter;

- November 15 - for October;

- December 15 - for November;

- January 15, 2022 - for December or IV quarter.

IMPORTANT!

In 2021, reporting to Rosstat is submitted only in electronic form (Law No. 500-FZ of December 30, 2020). The data is certified by digital signature and sent to the territorial statistics department via TCS channels. If the employer sends information in an incorrect form, he will receive a warning on the P-4 report on headcount and wages, and the next time he will be fined for the incorrect form.

Please note that the deadline for submitting P-4 for July 2021 falls on August 15, Sunday. It is rescheduled to Monday, August 16th.

Who submits the report on the number of employees and wages

Reporting on the number of employees and their wages is submitted by:

- representatives of medium and large businesses and their separate divisions;

- state organizations;

- temporarily non-working organizations - on a general basis, indicating from what time they have not been working;

- bankrupt organizations until a liquidation entry is made in the Unified State Register of Legal Entities.

We are relieved of the obligation to send form P-4 to the statistical authorities:

- individual entrepreneurs;

- small business representatives;

- public organizations;

- cooperatives.

IMPORTANT!

It is easy to verify the obligation to report to the employer on the Rosstat website using a special service. You need a TIN and the name of the organization.

From this it is clear how P-4 differs from P-4 (NZ) - in the composition of the reporting information and respondents.

How to fill out the P-4 statistical report

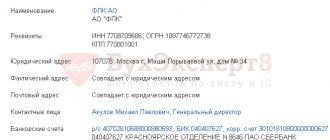

Statistical form P-4 consists of two pages. The first of these is the title page. It is necessary to fill in the following fields:

- reporting period;

- Business name;

- mailing address;

- OKPO code.

The title page is filled out as follows:

from ConsultantPlus

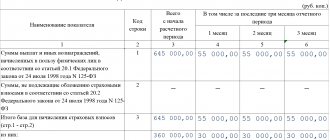

The second page consists of two tables reflecting the number of employees, hours worked and accrued wages. Look at an example of how to fill out Form P-4 for statistics in 2021, for May of this year. The first table contains the following information (by column):

- A - type of activity of the company (for each type - a separate line and data);

- B - the OKVED code is indicated for each type of activity;

- 1 – includes the sum of columns 2-4;

- 2 - indicates the average number of employees;

- 3 — average number of external part-time workers;

- 4 – average number of employees at the GPC.

The second table includes the following columns:

- 5, 6 - the number of man-hours actually worked is indicated (those on vacation, in session, on sick leave and those aimed at improving their qualifications outside of work are not included);

- 7 - data on the wage fund;

- 8 — wage fund for payroll employees;

- 9 - information on remuneration of external part-time workers;

- 10 - indicates wages for performing work under GPC contracts, for employees with whom employment contracts have not been concluded, accrued with a delay in the amount of wages (for example, for unused vacation);

- 11 - the amount of social payments (material assistance, incentives, benefits, etc.).

If you are reporting on the results of the quarter, fill out the report according to the same rules. But include information for three months at once in the report.

Use free access to instructions from ConsultantPlus to fill out reports correctly.

What is the average headcount and how to calculate it

Many reports require determining the average number of employees. For this purpose, it is necessary to sum up the number of hired personnel for each day of the calendar month and divide the resulting value by the number of days in the period. Information about the actual presence of employees at workplaces is usually obtained from the working time sheet.

Depending on what kind of report is to be completed, the value of the average number can be determined for a month, quarter or calendar year.

Calculation of average headcount

Form P-4 (NZ): what is the difference, who takes it and when

Employers are asked to regularly report data not only on wages, but also on underemployment and employee movement. The same order of Rosstat No. 412 dated July 24, 2020 introduced new instructions for filling out the P-4 (NZ) report in statistics in 2021 for organizations.

All organizations with more than 15 employees, including persons working part-time and under GPC contracts, submit a statistical report. If the organization has not entered part-time work for anyone, submit a report in which only the title page is filled in, and the rest are blank or with zeros. Additionally, there is no need to write a letter to Rosstat about the absence of indicators (see Rosstat order No. 412 dated July 24, 2020).

The instructions establish the frequency of submitting the P-4 (NZ) report to statistics - a quarterly form. Nobody rents it out monthly. Rosstat has established that organizations report statistics in 2021 by the 8th day of the month following the end of the quarter. This applies to both the paper form (which is temporarily used until further notice) and the electronic form. The deadline is determined by the date the respondent sent the report.

Here is the current reporting schedule for organizations on employee wages:

| Quarter | Deadline for submitting form No. P-4 (NZ) in 2021 |

| I | 01/11/2021 (for the fourth quarter of 2021, postponed from the weekend on January 8) |

| II | 08.04.2021 |

| III | 08.07.2021 |

| IV | 08.10.2021 |

| I | 01/10/2022 (for the fourth quarter of 2021, postponed from the weekend on January 8) |

Do not forget about the new obligation to submit statistical reporting only in electronic form through the TOGS portal.

What to write in sections

On the title page of the P-4 (NZ) report form, type information about the period for which you are submitting the report - year and quarter. Next, enter the name of your company. First write it in full, then abbreviate it in brackets.

Please provide your company's mailing address. If the actual address does not coincide with the legal address, then write the actual postal address with a zip code. For separate structural divisions of the company, indicate the actual address of the branch with postal code. If you are filling out a report for a separate division, write down the name of the branch or separate structural division and the legal entity to which it belongs.

In the report sheet P-4 (NZ) with indicators, do not change the OKEI code - this is a unit of measurement. The report is submitted in relation to employees - people in the company, therefore whole units are indicated. Fill out all lines in relation to employees, not personnel procedures.

In lines 01–03

indicate the number of employees who worked part-time in the quarter. In the same lines, take into account part-time workers and part-time workers during the period of parental leave (clause 11 of the Instructions, approved by Order No. 566).

Line 04

– empty. Do not fill out or delete, it must remain blank on the approved form. You cannot change the form of the report for Rosstat, make additions or remove lines (clause 22 of order No. 566).

On line 05

indicate how many people took personal leave, not how many days of leave you provided to each employee. For example, if in the third quarter you twice granted unpaid leave to one employee and issued two orders for this, then enter the number 1 in line 05. If the same employee took leave at his own expense and worked part-time, take into account only one once in lines 01, 02 or 05, depending on whether he was on vacation longer or on part-time work (clause 14 of order No. 566).

On lines 06–12

write down how many employees were hired and fired. Indicate only data in the reporting quarter by payroll. The company's headcount includes all employees and owners of organizations receiving salaries from the company. The payroll does not include external part-time workers and performers under the GAP (clause 22 of Order No. 566).

On line 13

indicate the total number of employees of the company on the 30th or 31st day of the last month in the reporting quarter. Do not take into account personnel movements after the end of the quarter on the date of submission of the report to Rosstat; you will submit this information in the next report. Do not include in line 13 employees who left on the last day of the reporting quarter. Take these workers into account in line 08 (clause 22 of Order No. 566).

On line 14

list the new employees you plan to hire in the next quarter. In this case, it does not matter whether the staff unit is occupied or vacant (clause 23 of Order No. 566). That is, the indicator in this line does not necessarily have to coincide with the actual number of vacancies on staff.

On line 15

reflect how many company employees you plan to fire in the next quarter, no matter for what reason. In this indicator, do not include only workers whose employment contract is expiring and those who plan to retire in the next quarter (clause 24 of Order No. 566).

On lines 16 and 17

reflect the number of employees on maternity leave. If the father or other relatives took parental leave, do not take them into account in the report (clause 25 of Order No. 566). Women who work part-time or less than a week during maternity leave should be counted in line 02.

Lines 21 and 22

fill out on the basis of contracts for paid services or on outsourcing terms between organizations, and not with individuals (clause 27 of Order No. 566).

If during the quarter the company did not have a single personnel event that is taken into account in the P-4 (NZ) report, send a signed blank form or an official letter to the territorial office of Rosstat about the absence of indicators in the reporting period (clause 3 of Order No. 566). In an empty form, leave the lines blank and do not enter zeros.

How to fill out

Separate instructions have not been prepared for employers on how to fill out the P-4 (NZ) report in 2021, but general instructions are contained in Rosstat Order No. 412. The form is simple, and no special comments are needed: all the necessary explanations are given in the form itself.

The report consists of two pages, the first of which is the title page. As in the previous form, the title page indicates:

- reporting period;

- Business name;

- mailing address;

- code for the 2nd quarter of the year for P-4 (NZ);

- OKPO code.

On the second page of P-4 (NZ) there is a table. It contains data on underemployment and movement of workers. The table consists of three columns and almost 30 numbered rows.

IMPORTANT!

Starting with the quarterly report for the first quarter of 2021, Rosstat Order No. 412 dated July 24, 2020 approved a new report form P-4 (NZ).

Submit to statistics

The report in form P-4 (NZ) is signed by the general director, personnel officer or accountant, “loaded” with personnel work, who has been appointed responsible. It’s better to issue a power of attorney for yourself, then you won’t have to re-sign the report from the director if Rosstat doesn’t accept it the first time. In addition, if you are responsible, it will be you, and not the director, who Rosstat employees will turn to for clarification. This way you will avoid unnecessary questions from management and, accordingly, hasty claims out of the blue.

P-4 (NZ) can be submitted to Rosstat electronically or on paper. The first option (in theory) allows you to reduce financial and time costs. However, in practice it is more convenient to submit the report in person or by mail. After all, you will not be able to send a report electronically without the help of information specialists. You will also need permission from the director to purchase electronic information security services. To send P-4 (NZ) electronically, you must first purchase an enhanced qualified electronic signature from a Certification Center that cooperates with Rosstat, and then install the above-mentioned cryptographic protection on your computer to save documents electronically. Finally, you need to register on the website of the regional branch of Rosstat, set up an Internet browser on your computer and attach an electronic signature certificate (clause 7 and clause 12 of Government Decree No. 620 dated 18.08.2008, clauses 2.5 and 3.5.3 of the Unified Format, approved By Order of Rosstat dated July 7, 2011 No. 313).

There is also some intermediate, third option - to use the services of paid Internet services. They will transmit your report to statistics without your registration on the website of the Rosstat branch. In addition, commercial assistant services check your report before sending it, which means you will avoid communication with Rosstat employees. However, you still need to complete the report yourself and correct it if you make an error. So if you need help and the director doesn’t mind, you can pay for the service, but it will not save you from working with the report completely.

PS

Submit report P-4 (NZ) using the new form starting from the first quarter of 2019. Now you need to report according to the old rules. In order for Rosstat to accept the P-4 (NZ) report, you need to fill out the title page and columns of the form without errors. If you make typos in the report, submit it late or do not fill out all the details, the official will pay a fine of up to 20,000 rubles, and the company – up to 70,000 rubles. (Article 13.19 of the Administrative Code).

Sergey Danilov,

PB correspondent