Methods of tax monitoring

Analysis of accounting and tax reporting has been the main method of work of inspection bodies for many years to identify errors and abuses committed by enterprises when conducting business activities.

The tax monitoring program provides control over reporting: the compliance of its form with regulatory documents is checked, and the completion of each field of the report is checked. The data provided by the organization is verified using a system of control ratios developed for each region. To conduct monitoring, the taxpayer provides the tax authority with real-time access to accounting and tax accounting data, which, in turn, exempts it from conducting desk and on-site tax audits and retains the ability of the tax authority to verify the completeness and timeliness of calculation (payment) of mandatory payments provided for by the tax legislation of the Russian Federation.

Several years ago, taxpayers were required to provide the tax authorities with books of purchases and sales in electronic form, which makes it possible, by comparing the data of sellers and buyers, to quickly confirm the legality of VAT deductions without carrying out complex additional measures.

ConsultantPlus experts spoke about the nuances and timing of tax monitoring. Get trial demo access to the system and upgrade to the Ready Solution for free.

How to check financial statements in the Pension Fund online

Any accountant, when preparing reports for regulatory authorities, tries to reconcile the data to the last point in order to prevent errors. Moreover, in 2021, mistakes can be expensive. For example, for false information, SZV-M will issue a fine of 500 rubles for each insured person. In this article, we will look in detail at how to avoid errors in forms for the Russian Pension Fund, as well as which services to use to check Pension Fund reports online for free.

What reports need to be submitted to the Pension Fund in 2021

With the transfer of insurance premiums under the control of the Federal Tax Service, the list of reporting to the Pension Service has changed. Policyholders are now required to provide the following information:

- SZV-M - information about insured persons. The monthly form must be submitted no later than the 15th day of the month following the reporting month.

- Information about the length of service for all employees. An annual form in which the policyholder sends information about the length of service of its employees, as well as citizens working under civil law or copyright contracts. You must report by March 1 of the following year.

- Information about the length of service of an individual. Formed at the individual request of TOPFR representatives. One of the forms of such reporting is SZV-K - information about the length of service of the insured person until December 31, 2001.

- Adjustments for past periods. Despite the fact that the administration and reporting of insurance coverage has been transferred to the Federal Tax Service, errors in the RSV-1 for 2021 and earlier periods will have to be corrected through the Pension Fund. After checking and accepting the adjustment, Pension Fund employees will independently notify the tax authorities about the changes.

- Information on additionally accrued insurance premiums and other information.

Checking PFR reports online

For insurance premium payers with fewer than 25 people, it is acceptable to provide reporting documentation on paper. Other organizations must report only electronically. If you violate this condition, the institution will be fined 1000 rubles.

It is necessary for all policyholders to check the reporting before sending it, regardless of the type of delivery (on paper, electronically), and here’s why:

- An incorrect report will not be accepted, and if you do not retake it, you will not be able to avoid a fine.

- A form with an error may be accepted, but false information may result in a fine of 500 rubles for each insured person.

- Erroneous information requires correction: generating corrective forms, wasting time.

It’s easy to eliminate such problems; to do this, you need to check the reporting in the Pension Fund online. A large number of Internet services or applications with convenient and simple interfaces will allow you to quickly identify and eliminate inaccuracies in reporting documentation.

Where to check the Pension Fund report online without registration

The Pension Fund has developed special applications: CheckXML and CheckPFR. The programs are absolutely free and are freely available on the Internet. You can download the application on the official website of the Pension Fund. To work, you need to download the program and install it on your work computer.

To eliminate systematic monitoring and updating of test programs on your work computer, use online services. For example, “BukhSoft Online”, “Kontur.Extern”, “Taxpayer Online”, “TaxKom” and others.

Example of checking using an online service

Let's look at how to check SZV-M. To do this, we will use the Pension Fund reporting tool through Contour Online.

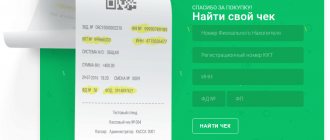

Step 1. Registering in the system is completely optional. To get started with the system, follow the link located immediately below the “Registration” button.

Step 2. On the page that opens, select the type of reporting form to be checked. For SZV-M you need to select the “Reports” button, for adjustments to insurance premiums - the “RSV-1” button.

Step 3. In the dialog box, select the report file. Validation is only possible for XML formats; any other format cannot be loaded into the system. If the file is downloaded normally, information data will appear on the page that opens: the name of the institution, the delivery period (month and year), as well as the name of the selected file. Click the “Check” button.

Step 4. The system will generate the results of the check (information about errors, the presence of warnings, compliance with the format). The protocol can be opened in a new window, following the link.

Step 5. The protocol generated by the system details all problems.

Correct and recheck the system. Files must be sent to the Pension Fund without errors.

New tax reporting monitoring program

Given the increasing awareness of controllers about the activities of taxpayers, some of them are joining the tax monitoring program on a voluntary basis. Already, more than 20 of the largest Russian companies, including representatives of the mining industry and the field of information technology and communications, have provided tax authorities with access to their reports online. The program has been operating in Russia since 2021 and is based on the experience of regulatory services in other countries.

Participants in the new monitoring program have the opportunity to request a reasoned opinion from the tax authority on the correctness of tax calculations for ongoing or planned business operations. This tool is called tax rolling. At the same time, the company will be able to correct errors in a timely manner, and in addition, will not be subject to tax sanctions if it strictly adhered to the recommendations of the tax authorities. Even if it turns out that these recommendations are not entirely correct.

Benefits of participating in the online monitoring program:

- Experience has shown that company costs associated with conducting inspections are reduced by almost 30%.

- Quick resolution of controversial issues with tax authorities.

- By showing loyalty to government agencies, an enterprise has the right to count on an appropriate reaction from the state.

In addition, the taxpayer can receive a tax rating, i.e. a comprehensive assessment of tax integrity. When assigning a rating to an organization, tax specialists study its internal control systems, calculate tax risks, evaluate relationships with tax authorities and payment discipline in paying taxes. At the same time, complete confidentiality is guaranteed.

How to check financial statements in the Pension Fund online

Any accountant, when preparing reports for regulatory authorities, tries to reconcile the data to the last point in order to prevent errors. Moreover, in 2021, mistakes can be expensive. For example, for false information, SZV-M will issue a fine of 500 rubles for each insured person. In this article, we will look in detail at how to avoid errors in forms for the Russian Pension Fund, as well as which services to use to check Pension Fund reports online for free.

What reports need to be submitted to the Pension Fund in 2021

With the transfer of insurance premiums under the control of the Federal Tax Service, the list of reporting to the Pension Service has changed. Policyholders are now required to provide the following information:

- SZV-M - information about insured persons. The monthly form must be submitted no later than the 15th day of the month following the reporting month.

- Information about the length of service for all employees. An annual form in which the policyholder sends information about the length of service of its employees, as well as citizens working under civil law or copyright contracts. You must report by March 1 of the following year.

- Information about the length of service of an individual. Formed at the individual request of TOPFR representatives. One of the forms of such reporting is SZV-K - information about the length of service of the insured person until December 31, 2001.

- Adjustments for past periods. Despite the fact that the administration and reporting of insurance coverage has been transferred to the Federal Tax Service, errors in the RSV-1 for 2021 and earlier periods will have to be corrected through the Pension Fund. After checking and accepting the adjustment, Pension Fund employees will independently notify the tax authorities about the changes.

- Information on additionally accrued insurance premiums and other information.

Checking PFR reports online

For insurance premium payers with fewer than 25 people, it is acceptable to provide reporting documentation on paper. Other organizations must report only electronically. If you violate this condition, the institution will be fined 1000 rubles.

It is necessary for all policyholders to check the reporting before sending it, regardless of the type of delivery (on paper, electronically), and here’s why:

- An incorrect report will not be accepted, and if you do not retake it, you will not be able to avoid a fine.

- A form with an error may be accepted, but false information may result in a fine of 500 rubles for each insured person.

- Erroneous information requires correction: generating corrective forms, wasting time.

It’s easy to eliminate such problems; to do this, you need to check the reporting in the Pension Fund online. A large number of Internet services or applications with convenient and simple interfaces will allow you to quickly identify and eliminate inaccuracies in reporting documentation.

Where to check the Pension Fund report online without registration

The Pension Fund has developed special applications: CheckXML and CheckPFR. The programs are absolutely free and are freely available on the Internet. You can download the application on the official website of the Pension Fund. To work, you need to download the program and install it on your work computer.

To eliminate systematic monitoring and updating of test programs on your work computer, use online services. For example, “BukhSoft Online”, “Kontur.Extern”, “Taxpayer Online”, “TaxKom” and others.

Example of checking using an online service

Let's look at how to check SZV-M. To do this, we will use the Pension Fund reporting tool through Contour Online.

Step 1. Registering in the system is completely optional. To get started with the system, follow the link located immediately below the “Registration” button.

Step 2. On the page that opens, select the type of reporting form to be checked. For SZV-M you need to select the “Reports” button, for adjustments to insurance premiums - the “RSV-1” button.

Step 3. In the dialog box, select the report file. Validation is only possible for XML formats; any other format cannot be loaded into the system. If the file is downloaded normally, information data will appear on the page that opens: the name of the institution, the delivery period (month and year), as well as the name of the selected file. Click the “Check” button.

Step 4. The system will generate the results of the check (information about errors, the presence of warnings, compliance with the format). The protocol can be opened in a new window, following the link.

Step 5. The protocol generated by the system details all problems.

Correct and recheck the system. Files must be sent to the Pension Fund without errors.

In what cases can you contact the Federal Tax Service for monitoring?

To apply to the Federal Tax Service for tax monitoring, the taxpayer must meet the following criteria (until 06/30/2021):

From July 1, 2021, the taxpayer must meet the following criteria:

An exception is made for organizations in respect of which tax monitoring is already being carried out: for acceptance by the tax authority in the manner provided for in clause 4 or clause 7 of Art. 105.27 of the Tax Code of the Russian Federation, decisions to conduct monitoring in relation to these organizations, fulfillment of the specified conditions is not necessary (clause 3 of Article 105.26 of the Tax Code of the Russian Federation).

[email protected] of the Federal Tax Service of Russia dated August 31, 2020 , by clicking on the picture below:

A sample of filling out this application is available in ConsultantPlus. If you do not have access to the system, get a trial demo access. It's free:

Results

Electronic communication methods allow controllers to quickly and efficiently monitor not only reporting, but also the financial condition of the organization. Since 2021, a tax monitoring program has been operating in Russia, which has undoubted advantages.

Sources:

Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.