The possibility of optimizing the most complex tax, which is a headache for most organizations in the general taxation system, never ceases to excite the minds of entrepreneurs. How can you avoid paying the state 18% of the amount received into the organization’s account? After all, this money is already in the account, it can be used, the company needs it so much, and without it, perhaps there will be no profit at all!

Maybe we should run to a seminar by well-known Moscow consultants who have been telling the same thing for ten years, promising to give “a complete overview of working VAT cash-out schemes”? What if VAT becomes 22%, and what if it is actually paid directly to the budget when transferring money? As always, we remove emotions and look at it objectively. For clarity, all diagrams will be illustrated in detail.

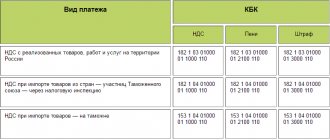

VAT payment deadlines in 2021: table for accountants

The Tax Code establishes the deadlines for transferring VAT in 2018. The tax must be paid no later than the 25th day of each month (Clause 1, Article 174 of the Tax Code of the Russian Federation). If the 25th is a day off or holiday, then the money can be transferred with impunity on the next working day. Below is a table with the deadlines for paying VAT for 2021:

| Period | First payment due date | Second payment due date | Deadline for third payment |

| 1st quarter 2021 | 25.04.2018 | 25.05.2018 | 25.06.2018 |

| 2nd quarter 2021 | 25.07.2018 | 08/27/2018 (August 25 – Saturday) | 25.09.2018 |

| 3rd quarter 2021 | 25.10.2018 | 11/26/2018 (November 25 – Sunday) | 25.12.2018 |

| 4th quarter 2021 | 25.01.2019 | 25.02.2019 | 25.03.2019 |

News about VAT tax increase

At the beginning of July, the State Duma already adopted in the first reading a draft law on increasing the VAT rate. From today's 18 percent, the tax will rise to 20%.

It is important to correctly understand how much the VAT tax will increase in Russia. A tax increase from 18 to 20 percent is an increase of two percentage points, but not two percent. In fact, VAT will increase by 11% - that’s exactly two percentage points of eighteen.

It is also worth remembering one more thing - VAT is included in the price of any product several times. The fact is that it is paid at all stages of the production of any product, its delivery to the store and sale to the final buyer. Therefore, at each of these stages, the government will take a little more money in the form of taxes, which will ultimately lead to a fairly noticeable overall increase in the price of the product.

In the first reading, 318 Duma deputies voted for increasing the VAT tax rate, 97 people were against.

According to the country's government estimates, an increase in the VAT tax will bring the treasury an additional 600-630 billion rubles every year. This money will become part of the funds needed to implement President Putin’s new May decree.

In order to report to citizens six years later that their lives have improved, they will be charged money for the formal improvement of their lives for all these years. As economists have calculated, the average Russian will pay more than 4 thousand rubles annually for the VAT increase. This is exactly what the price increase in stores will be.

Photo: pxhere.com

Deadlines for payment of “import” VAT in 2018

Legal entities purchasing products in the EAEU countries pay import VAT. We are talking about the following countries: Armenia, Belarus, Kazakhstan and Kyrgyzstan. Payment of VAT in 2021 on imports is made no later than the 20th day of the month following the month in which the goods are accepted for registration or the due date for payment under the contract has arrived (clause 19 of the Protocol to the Treaty on the Eurasian Economic Union). Here is a table with the deadlines for paying VAT in 2021 for the following objects:

| Period for which VAT is paid | Payment deadline |

| January 2018 | 20.02.2018 |

| February 2021 | 20.03.2018 |

| March 2021 | 20.04.2018 |

| April 2021 | 05/21/2018 (May 20 – Sunday) |

| May 2021 | 20.06.2018 |

| June 2021 | 20.07.2018 |

| July 2021 | 20.08.2018 |

| August 2021 | 20.09.2018 |

| September 2021 | 10/22/2018 (October 20 – Sunday) |

| October 2021 | 20.11.2018 |

| November 2021 | 20.12.2018 |

| December 2021 | 01/21/2019 (January 20 – Sunday) |

Legislative amendments have been made to the procedure for calculating and paying VAT

Publication date: 12/05/2017 10:45 (archive)

The President of the Russian Federation signed laws changing the procedure for calculating and paying VAT from 2021 to 2021.

From January 1, 2021, buyers of certain types of goods will be responsible for VAT as tax agents. (Federal Law No. 335-FZ dated November 27, 2017). The law establishes that when selling scrap and waste ferrous and non-ferrous metals on the territory of the Russian Federation (these operations will no longer be exempt from VAT), secondary aluminum and its alloys, as well as raw animal skins, the amount of VAT is calculated by tax agents - buyers of these goods. The exception is for individuals who are not individual entrepreneurs.

Tax agents are required to calculate and pay the appropriate amount of VAT to the budget, regardless of whether they perform the duties of a VAT taxpayer or not.

Tax agents applying the general tax system, simultaneously with tax calculation, have the right to declare the corresponding deduction, that is, the actual transfer of funds to the budget is not made.

From January 1, 2021, the responsibility for calculating VAT will be assigned to a foreign organization providing electronic services, regardless of who the buyer is - an individual, an individual entrepreneur or a legal entity. (Federal Law No. 335-FZ dated November 27, 2017).

In addition, the law does not recognize intermediaries who are subjects of the national payment system, as well as telecom operators specified in the Federal Law “On the National Payment System” as tax agents. This norm is effective from January 1, 2018.

The application of a zero VAT rate from January 1, 2021 has been extended to operations for the sale of goods exported under the customs procedure of re-export. At the same time, the zero VAT rate applies only if the goods previously underwent customs procedures - processing in the customs territory, free customs zone or free warehouse. (Federal Law No. 350-FZ dated November 27, 2017).

Previously, taxpayers providing services for the provision of railway rolling stock and containers for the transportation of exported goods could apply a zero VAT rate only if the rolling stock and containers were owned or leased by them. From 2021, this condition has been canceled. Thus, the circle of persons entitled to apply a zero VAT rate on this basis has expanded. (Federal Law No. 350-FZ dated November 27, 2017).

Tax-free mechanism

The next innovation related to VAT concerns foreign buyers who make purchases in Russia, as well as sellers of these goods. From January 1, 2021, a tax-free system was introduced (Law No. 341-FZ of November 27, 2021). The new rules are regulated by Article 169.1 of the Tax Code.

The tax-free system consists of refunding VAT on purchases by foreigners made in Russia. The conditions are:

- The buyer is a foreign person, a citizen of a state that is not part of the EAEU.

- Goods must be purchased within a calendar day for an amount of 10 thousand rubles or more. The price is inclusive of VAT.

- You should receive a VAT refund receipt from the seller. It is issued on the basis of one or more cash receipts upon presentation by the buyer of an identity card.

- No later than three months from the date of purchase, goods must be exported from Russia through a customs control point.

- A foreigner must apply for tax compensation no later than one year from the date of purchase.

Sellers will be able to deduct VAT returned to foreign citizens. However, for this you need to meet certain conditions:

- carry out retail trade;

- be a VAT payer;

- be included in the list approved by the Ministry of Industry and Trade.

In addition, the location of retail stores and the conditions they must meet will be determined by the Government.

VAT refund to the seller will be carried out on the basis of a tax refund check upon fulfillment of the following conditions:

- the receipt bears a mark from the customs authority regarding the export of the goods;

- The buyer is compensated for the amount of tax.

If there are inaccuracies in the tax-free check, the tax authorities do not have the right to refuse the seller a deduction. The main thing is that you can use it to install:

- seller;

- country of citizenship of the foreigner;

- Name of product;

- VAT amount.

Application of the 5% rule

The so-called 5% rule applies to entities that carry out transactions both subject to and exempt from VAT. They must keep separate records of tax amounts to determine what portion of the VAT relates to taxable transactions and can be deducted, and what is subject to inclusion in the cost of goods because it relates to non-taxable activities. If in a tax period the share of costs for transactions not subject to VAT does not exceed 5% , the entire tax can be deducted.

The condition for applying the rule looks like this:

Expenses for the period on transactions not subject to VAT / Expenses for the period related to sales * 100% ≤ 5%

When this inequality is fulfilled, the entire VAT is deductible.

This was the case before, but the Tax Code allowed not to keep separate VAT records when the 5% rule was met. Now it is mandatory to keep separate records in any case . In addition, if a product is used only in non-taxable transactions, then the 5% rule does not apply to it.

In the absence of separate accounting, VAT can neither be deducted nor included in income tax expenses.

Changes in air transportation and airport services

Subclause 22 of clause 2 of Article 149 of the Tax Code of the Russian Federation exempts from VAT aircraft maintenance services that are performed at airports and in Russian airspace. However, there is no indication of specific types of services in the Code. From January 1, 2021, the Government has the right to determine such services ; it must formalize their list in a separate document.

In addition, a zero VAT rate has been introduced for domestic air transportation of passengers and baggage in the Kaliningrad region since the beginning of this year.

Confirmation of zero rate when exporting by mail

Starting this year, the rules for confirming the zero VAT rate for the export of goods by mail . To do this you need to submit:

- original or copy of the payment order;

- optional: a customs declaration with marks from Russian customs authorities along with the accompanying CN 23 declaration (or a copy thereof);

- declaration CN 23 with marks from the Russian customs authorities.

Before these amendments came into force, it was not clearly defined what documents could be used to confirm 0% VAT for export sales by mail. Now the taxpayer has a choice. In addition, it follows from the provisions of the Code that a foreign trade contract does not need to be provided to confirm the rate.

Other changes

A couple more changes concern a narrow circle of people.

The first of them relates to special economic zones (SEZ). The gratuitous transfer to regional and municipal authorities of property created for the implementation of the agreement on the creation of a SEZ is not subject to VAT. Transferring organizations are not required to restore the amounts of VAT previously accepted for deduction on this property upon its transfer.

Another specific change is that the release of material assets from the state reserve by the responsible custodian and the borrower due to their renewal, replacement or borrowing is exempt from VAT.

Electronic services

Currently, when providing electronic services, foreign organizations calculate VAT only if the buyer of the services is an individual.

If the counterparty is a legal entity or individual entrepreneur, they act as a tax agent and withhold VAT when transferring payment under the agreement to a foreign person.

From January 1, 2021, the responsibility for calculating VAT will be assigned to a foreign organization providing electronic services, regardless of who the buyer is. (Federal Law No. 335-FZ dated November 27, 2017).

Tax agents for VAT

From January 1, 2021, buyers of certain types of goods will be responsible for VAT tax agents.

The law establishes that when selling scrap and waste of ferrous and non-ferrous metals on the territory of the Russian Federation (these operations will no longer be exempt from VAT), as well as raw animal skins, secondary aluminum and its alloys, the amount of VAT is calculated by tax agents - buyers of these goods.

The exception is for individuals who are not individual entrepreneurs.

Tax agents are required to calculate and pay the appropriate amount of VAT to the budget, regardless of whether they perform the duties of a VAT payer or not.

Tax agents applying the general tax system, simultaneously with tax calculation, have the right to declare the corresponding deduction, that is, the actual transfer of funds to the budget is not made.