Issues discussed in the material:

- What will be the taxation on employee training expenses?

- How to reflect employee training costs in accounting

- Should I pay insurance premiums for employee training expenses?

- How to take into account the costs of training employees on the simplified tax system

The qualifications of its employees play an important role in the company's activities. Their knowledge must be not only complete, but also up to date. Therefore, organizational leaders must periodically initiate training for their employees. How to do this correctly, how best to reflect the costs of employee training in accounting, is it necessary to make insurance payments given the existing costs of educational activities? We will answer these and many other questions in our article today.

Taxation of employee training expenses

The document regulating the process of sending employees of an organization for training is Article 372 of the Labor Code of the Russian Federation. The employer independently determines the need to provide education, chooses the form of professional training, retraining and the direction of advanced training for employees. In doing so, he relies on the opinion of the representative body of workers.

In accordance with Article 197 of the Labor Code of the Russian Federation, every employee of an organization has the right to professional training, retraining and advanced training. Learning a new specialty is no exception. The assignment of an employee to an educational institution is formalized by signing an additional agreement between him and the organization.

1. Education and personal income tax

According to the provisions of the twenty-first paragraph 217 of Article of the Tax Code of the Russian Federation, organizations should not deduct personal income tax on the amount of expenses for an employee’s education, provided that he is studying in basic and additional general or vocational education programs, or undergoing professional training (retraining). The regulatory documents are letters of the Ministry of Finance of the Russian Federation dated March 24, 2010 No. 03–04–07/1–15, dated May 7, 2008 No. 03–04–06–01/124.

An organization is exempt from paying tax only when its employee studies in an educational institution of the Russian Federation that has received a state license, or in a foreign educational institution that has the necessary status.

Thus, education provided by other institutions providing educational services does not relieve the employer from the obligation to pay personal income tax. In other words, the amount paid for education is part of the individual's income. The regulatory documents in this case are letters of the Ministry of Finance of the Russian Federation dated December 27, 2010 No. 03–04–05/9–754, dated September 7, 2009 No. 03–04–06–01/234.

According to the provisions of letters of the Ministry of Finance of the Russian Federation dated January 20, 2011 No. 03–04–06/6–6, dated September 10, 2009 No. 03–04–06–02/67, the enterprise’s obligation to calculate personal income tax does not depend on the existence of an employment relationship between the company making the payment educational process, and an individual receiving an education: “...if an organization compensates an employee for training expenses that he paid at his own expense, the amount of reimbursement of expenses is exempt from personal income tax taxation...”

Consequently, an enterprise is not a tax agent for personal income tax even if its training expenses are related to the education of not the employee, but his children or third parties. The regulatory document is the twenty-first paragraph 217 of Article of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated February 15, 2011 No. 03–04–06/6–28).

Rules and features of working out for training

IMPORTANT! A sample order for referral to training from ConsultantPlus is available here

Payment for training is a kind of investment by the employer. That is, the manager expects to receive bonuses from this operation in the future. This is not at all a manifestation of the employer’s altruism.

However, it is easy to imagine a situation in which a manager invests, but receives nothing due to an ungrateful employee. An employee, after completing training, may well quit and get a job at another company with his professional baggage updated at someone else’s expense. How to prevent this? The employer may specify in the contract the obligation to work for training. That is, an employee who has improved his qualifications at the expense of the company cannot just leave. He undertakes to serve a certain period of time. The possibility of setting such a condition is stipulated in Articles 197 and 199 of the Labor Code.

If an employee refuses compulsory service, he is obliged to reimburse the employer’s expenses for paying for educational services.

This rule is spelled out in Articles 207 and 249 of the Labor Code of the Russian Federation. To protect his interests, the manager must correctly formalize the agreement with the employee.

Legal registration of mining

The manager cannot oblige an employee to work off his expenses based solely on an order to send the employee for training. To do this, you will need to indicate the processing condition in one of the following documents:

- Employment contract.

- Additional agreement.

- Student agreement.

The document must include the following information:

- Specialty or area of study.

- Terms and cost of educational services.

- Obligation to work or compensate employer expenses.

The working period is determined on an individual basis. It can range from several months to several years. It all depends on the agreements between the manager and the employee. Typically, the period is determined based on the following factors:

- Cost of educational services.

- The values of the acquired knowledge.

- Duration of training.

The terms must be fixed in the agreement between the parties.

Features of collecting expenses from an employee upon dismissal

You can recover expenses from an employee for previously provided educational services only if he resigns for an unexcused reason. This rule is stipulated by Articles 207 and 249 of the Labor Code of the Russian Federation. However, the law does not specify the reasons that can be considered valid or disrespectful. These nuances are determined on the basis of existing judicial practice. For example, valid reasons for dismissal are:

- Staff reduction.

- The employee has received a medical certificate according to which he cannot continue to work in his previous position, but the employer cannot provide a suitable position.

- Conscription of an employee for military service.

An unjustified reason in this context is the employee’s unauthorized initiative or his guilty actions.

Expenses for sending an employee to a seminar

Based on the norms of subparagraph 23 of paragraph 1 of Art. 264 of the Tax Code of the Russian Federation and Resolution of the Ministry of Finance of the Russian Federation No. 03-03-06/1/137 dated February 28, 2007, costs for seminars can be attributed to the costs of training under basic (additional) vocational education programs, vocational training and retraining of workers.

However, they must meet the criteria specified in the third paragraph of Article 264 of the Tax Code of the Russian Federation:

- The educational process must be carried out under an agreement with a Russian licensed educational institution or with a foreign educational institution that has received the appropriate status in the Russian Federation.

- Employees who have entered into an employment contract with the company must receive education.

- The company paying for the training must enter into an agreement with the student, according to which he is obliged to find a job in this company and work in it for at least one year, provided that the student is not on the staff of the organization.

According to the fifteenth subparagraph of paragraph 1 of Art. 264 of the Tax Code of the Russian Federation and Resolution of the Federal Antimonopoly Service of the Moscow District dated September 23, 2009 No. KA-A40/9373-09-2, an organization can take into account the costs of training employees in an unlicensed institution as part of the costs of consulting services. To do this, an agreement with the organizer of the seminar, a plan for the seminar and an act of services rendered are sufficient. This point is regulated by the letter of the Federal Tax Service of Russia for Moscow dated June 28, 2007 No. 20-12/060987, and the resolution of the Federal Antimonopoly Service of the Moscow District dated July 15, 2011 No. KA-A40/7114-11.

In this case, the issuance by the organizer of the seminar of certificates of education received and the availability of training programs are not necessary. This is evidenced by the resolution of the Federal Antimonopoly Service of the Moscow District dated October 21, 2010 No. KA-A40/12309-10. It would not be superfluous to have an order to send an employee to a seminar.

When an employee participates in a foreign seminar, costs can be classified as expenses even if the organizer is a foreign educational institution. This point is regulated by the provisions of the letter of the Federal Tax Service of the Russian Federation for Moscow dated February 17, 2006 No. 20-12/12674.

Based on the norms of the third paragraph of Art. 264 of the Tax Code of the Russian Federation, documents confirming the fact of training can be:

- an agreement between companies on the provision of services for organizing and conducting a seminar;

- certificate of educational status of the company conducting the seminar;

- seminar program;

- order from the organization to send an employee to the seminar;

- certificate of completion of the seminar;

- act of providing educational services.

In the absence of documentation confirming the provision of services, Federal Tax Service employees do not recognize the company’s training expenses. Such documentation includes a bilateral act. The document must be drawn up in accordance with the terms of the agreement (letter of the Federal Tax Service of the Russian Federation for Moscow dated February 18, 2010 No. 16-15/017646) and in compliance with the requirements of the ninth article of Federal Law No. 402-FZ “On Accounting” dated December 6, 2011.

Special cases

Higher education

Traditionally, the close attention of inspectors is drawn to the amounts transferred to the accounts of universities when employees receive higher education. The reason is that the wording “higher education” is absent in both Article 264 of the Tax Code of the Russian Federation and Article 217 of the Tax Code of the Russian Federation. From this, tax authorities conclude that the organization that paid for the employee’s education should not take this amount into account in expenses and is obliged to withhold personal income tax.

Typically, taxpayers are able to defend the costs. To do this, it is enough to submit an agreement with the university, a copy of the educational institution’s license and an order, or another internal document on the basis of which the company paid for training. These documents prove that the costs are economically justified and documented.

The situation with personal income tax is more complicated. According to inspectors, higher education has nothing to do with general education or professional programs. Therefore, the fee paid by the employer for the employee to receive higher education is subject to personal income tax on a general basis.

True, the judges take a different point of view. Thus, one organization from Vladivostok transferred money for the training of its chief accountant in the specialty “Accounting, Analysis and Audit”. The tax authorities, followed by the first and appellate courts, came to the conclusion: since the chief accountant received a diploma of higher education, the employer is obliged to withhold and transfer personal income tax to the budget.

But the company won in the cassation court. The main argument was Article 196 of the Labor Code, which gives the employer the right to independently determine the need for training and education of personnel. This right fully applies to cases of higher education. And if the director decides that the company is interested in the chief accountant receiving higher education, then the latter does not have taxable income (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated February 14, 2013 No. F03-44/2013).

Master's degree

Until recently, taxation of amounts spent by an employer on an employee’s education in a master’s program was associated with certain difficulties. Ministry of Finance specialists did not allow vacation pay issued to an employee during additional study leave to be included in expenses.

The officials' arguments were as follows. Guarantees and compensation for employees combining work with training are provided if education of the appropriate level is received for the first time (Article 177 of the Labor Code of the Russian Federation). And a master's degree belongs to the same educational level as a bachelor's degree, namely the level of higher professional education.

This follows from paragraph 3 of Article 12 of the Federal Law of December 29, 2012 No. 273-FZ “On Education in the Russian Federation” (hereinafter referred to as Law No. 273-FZ) *. This means that when receiving a bachelor’s degree, the student has already passed this educational level, and the master’s degree is a repeat completion of this level. Therefore, the guarantee in the form of additional vacation is no longer required, and vacation expenses cannot be taken into account when taxing profits.

We invite you to read: What to do if your car tax does not arrive?

But now this ban has lost its relevance. On September 1, 2013, a new version of Article 173 of the Labor Code came into force. And from now on, it clearly states that additional study leave is granted not only when studying in a bachelor’s program, but also when studying in a master’s program. As a result, vacation pay can be safely expensed.

Postgraduate studies

https://www.youtube.com/watch?v=ytadvertiseru

An organization that paid for its employee to attend graduate school risks attracting increased attention from tax authorities. From their point of view, such training is carried out solely in the personal interests of the student, and the cost of study must be included in his taxable income.

Inspectors try to defend this position in court, but, as a rule, they fail. One of the key arguments in defense of the employer is the fact that postgraduate study, the goal of which is to obtain a PhD degree, is one of the main professional educational programs. This is enshrined in Article 3 of Law No. 273-FZ**.

Accordingly, the exemption from personal income tax provided for in subparagraph 21 of Article 217 of the Tax Code of the Russian Federation can be applied here. The main thing is that obtaining an academic degree is directly related to the professional activity of the employee at this enterprise. Such conclusions were reached, in particular, by the Federal Antimonopoly Service of the Moscow District in its resolution dated June 27, 2011 No. KA-A40/6199-11.

MBA degree

Often, conflicts with inspectors arise in a situation where an organization paid for its employee to obtain a qualifying Master of Business Administration (MBA) degree. Inspectors often believe that training in such a program is equivalent to a second higher education. And if so, then the cost of study must be included in the taxable base for personal income tax and excluded from the expenses taken into account when taxing profits.

In fact, an MBA degree means that the employee received not a second higher education, but additional professional education. This usually follows from an agreement concluded with an educational institution. It may say that the purpose of study is professional retraining, assignment of additional qualifications, etc.

Judges take this into account and confirm that tuition fees for MBA programs reduce the tax base for income tax and are exempt from personal income tax (see, for example, resolution of the Federal Antimonopoly Service of the North Caucasus District dated April 22, 2013 No. A32-23147/ 2011).

* Until September 1, 2013, the corresponding norm was contained in paragraph 5 of Article 27 of the Law of the Russian Federation of July 10, 1992 No. 3266-1 “On Education”.

** Until September 1, 2013, the corresponding norm was contained in the Federal Law of August 22, 1996 No. 125-FZ “On Higher Postgraduate Education.”

Reflection of employee training costs in accounting

The company's accounting records must reflect the costs of employee training. The expense item corresponds to ordinary activities. The form of training does not matter. The amount of costs corresponds to the amount specified in the contract for the provision of educational services in accordance with paragraphs. 5, 6, 6.1, 7 PBU 10/99, approved by the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n.

To recognize expenses, the following conditions must be met:

- expenses are carried out in accordance with a specific agreement, legislative norms and business norms;

- the amount of costs can be determined;

- the organization has made a decision to transfer an asset (or the asset has already been transferred), as a result of which there is confidence that there will be a decrease in the economic benefits of the company.

Top 3 articles that will be useful to every manager:

- How to optimize income tax: legal schemes

- How to minimize taxes and not interest the tax authorities

- Accounting for an online store: nuances and pitfalls

If these conditions are met, education expenses will meet the criteria for recognition in accounting in the period in which the services were provided. In this case, the period is determined by the date of signing the acceptance certificate for the services provided, and not by the date of payment transfer. This point is reflected in the eighteenth paragraph 18 of PBU 10/99.

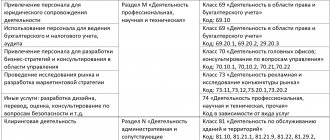

Providing accounting, accounting express audit:

How are employee training costs reflected in accounting? The postings will be as follows:

Dt 26 “General business expenses” Kt 60 “Settlements with suppliers and contractors”.

DT 20 “Main production” Kt 60 “Settlements with suppliers and contractors”.

Dt 25 “General business expenses” (depending on who the employee works for) Kt 60 “Settlements with suppliers and contractors”.

Dt 44 “Sales expenses” (if the company is a trading company) Kt 60 “Settlements with suppliers and contractors”.

The program will answer questions

- How is primary accounting organized?

- How does the current grouping and final generalization of the facts of economic life take place?

- What is included in an organization's financial statements?

- How are financial statements prepared for groups of interrelated companies considered as a single economic entity?

- How is internal control carried out at the enterprise?

- How to legally prepare documents for the tax inspectorate?

- How to carry out tax planning?

- How to objectively assess the financial condition of a company?

How to take into account the cost of training under the simplified tax system

If an organization under the simplified tax system pays for employee training, the cost of training and retraining of employees occurs in the manner prescribed by Article 264 of the Tax Code of the Russian Federation for income tax. The regulatory document is the letter of the Ministry of Finance No. 03-11-06/2/59105 dated 10/11/16.

Based on the norms of Article 264 of the Tax Code of the Russian Federation, an organization’s expenses for the education of employees can be classified as other expenses, provided that:

- an agreement has been signed with an educational institution of the Russian Federation that has received a license, or with foreign educational institutions that have the appropriate status.

- an employee of an organization or an individual who has entered into a compulsory employment agreement with it before the expiration of a three-month period from the date of completion of training is being trained, according to the terms of which this person must work in the company for at least twelve months.

In a situation where the employment contract was terminated before the expiration of a period of 1 year (except for cases beyond the control of the parties), the organization must include the amount paid for the employee’s education in non-operating income, since it was previously reflected as a company expense.

If the employment contract was never drawn up, education expenses should also be included in non-operating income of the reporting (tax) period in which the period provided for concluding the employment contract expired.

Based on the norms of Article 21, Article 217 of the Tax Code of the Russian Federation, the amount paid for training is not subject to personal income tax.

General rules

Income tax

The organization has the right to include in expenses the cost of training personnel in basic and additional professional educational programs. In addition, the company can write off as expenses the amount spent on professional training and retraining of employees. This is directly stated in subparagraph 23 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

However, such expenses cannot always be taken into account, but only if two conditions are met. The first condition is the existence of an agreement concluded with a Russian educational institution that has the appropriate license (or with a foreign educational institution that has the appropriate status). The second condition is the existence of an employment contract with the employee who is undergoing training at the expense of the company.

In addition, the organization can reduce taxable profit by the amount of vacation pay for additional vacations that are provided to students combining work and study. Such leaves relate to guarantees and compensation provided for in Chapter 26 of the Labor Code.

In general, employee training fees paid by a company or entrepreneur are considered income received in kind. As a result, the accounting department must withhold personal income tax and transfer it to the budget. This follows from subparagraph 1 of paragraph 2 of Article 211 of the Tax Code of the Russian Federation.

https://www.youtube.com/watch?v=ytcopyrightru

But there are also exceptions. Thus, the cost of study in basic and additional general education and professional educational programs is exempt from income tax. In addition, professional training and retraining in Russian educational institutions that have the appropriate license (or in foreign educational institutions that have the appropriate status) are not subject to personal income tax. This is stated in subparagraph 21 of Article 217 of the Tax Code of the Russian Federation.

We invite you to read: How to get housing for a large family from the state?

Insurance premiums for employee training expenses

The documents regulating the payment of insurance premiums for employee training expenses are: the first part of Article 7 of the Federal Law “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” No. 212-FZ dated July 24, 2009, second paragraph first paragraph of Art. 5, paragraph 1, art. 20.1 Federal Law “On compulsory social insurance against accidents at work and occupational diseases” No. 125-FZ of July 24, 1998

According to the provisions of these documents, payments and other remuneration accrued by the organization in favor of individuals within the framework of employment contracts and contracts of a civil law nature, the subject of which are the performance of work, provision of services, are subject to insurance contributions for compulsory health insurance, for compulsory social insurance in case of temporary disability and in connection with with maternity, compulsory medical insurance, as well as insurance premiums for compulsory health insurance against industrial accidents and occupational diseases.

The amounts specified in Art. 9 of Law No. 212-FZ and Art. 20.2 of Law No. 125-FZ.

These include:

- amounts paid by the organization for training employees under the basic (additional) professional education program. Regulatory document – clause 12, part 1, art. 9 of Law No. 212-FZ;

- amounts paid by the organization for training employees in basic professional educational programs, additional professional programs and basic professional training programs for personnel. Regulatory document – paragraphs. 13 clause 1 art. 20.2 of Law No. 125-FZ.

According to the above documents, all types of compensation payments related to reimbursement of expenses for professional training, retraining and advanced training of employees are exempt from insurance payments.

The Federal Insurance Service of the Russian Federation, in letter No. 14-03-11/0813985 dated November 17, 2011, established that payment for employee training, initiated by an employer who wants to improve the employee’s performance, is not subject to insurance payments. In this case, the form of training does not matter. The regulatory documents are the ninth article of Law No. 12-FZ and Article 20.2 of Law No. 125-FZ.

The Ministry of Health and Social Development of the Russian Federation adheres to the same opinion, which is reflected in clause 2.1 of letter No. 2519-19 dated 08/05/2010, clause 5 of letter No. 2538-19 dated 08/06/2010.

The FSS of the Russian Federation in letter No. 14-03-11/08-13985 dated November 17, 2011 explained that the amount of the cost of studying at universities for individuals not working in the organization (for example, family members of an employee, former employees, etc.) is also not subject to insurance premiums. This is legal, since, according to the first part 7 of Article 212 of the Federal Law and Article 20.1 of the Federal Law No. 125, the objects of taxation with insurance payments include payments and remunerations accrued to individuals under an employment contract and a civil process agreement for the provision of services and performance of work.

When it is necessary to pay

The manager independently chooses whether to pay for the employee’s training or not. This will determine all costs that will be used for training. There are 2 options when the boss pays for education:

• according to the Labor Code; • personal initiative.

According to the Labor Code of the Russian Federation, the manager must conduct mandatory retraining or advanced training if the employee is included in a special category (medical personnel, teachers). In this case, the employer will not be able to get the money spent back, even if the employee has ceased cooperation.

Management can train personnel without the services of professional organizations:

• trainings; • seminars; • instructions.

No additional license is required for such activities. Only the management must take into account the fact that the money spent cannot be returned due to the lack of a student agreement.

The manager can independently decide whether or not to pay for training for an employee, only if this is not provided for in the Labor Code of the Russian Federation. If professional training is necessary, but this point is not discussed in the law, then management decides independently on issues of payment. When management decides to pay for training, then after the employee fails to comply with the terms of the contract, they can charge the amount back.

Study leave

When sending an employee for training, the employer must provide him with study leave (hereinafter referred to as ES). It can be either paid or unpaid.

In this case, the following conditions must be met:

- The employee is sent for training by the enterprise that is his main place of work. The regulatory document is Article 287 of the Labor Code of the Russian Federation.

- The employee presented a certificate of summons from the educational institution in the approved form. The regulatory document is Article 177 of the Labor Code of the Russian Federation. The employer provides the employee with the number of vacation days that is contained in the certificate. The number of vacation days can be reduced by the employer at the request of the employee. In a situation where the total number of days of educational leave, confirmed by certificates of summons, for the current academic year exceeds the duration established by the Labor Code of the Russian Federation, the company is obliged to send the employee to a paid educational institution for the number of days that fits into the standard, and an unpaid educational institution for the remaining number of days exceeding the standard.

- The employee receives (intends to receive) education at this level for the first time. The regulatory document is Article 77 of the Labor Code of the Russian Federation.

This program is for you if you...

- Are you going to work as a private accountant or want to become an employee in Russian organizations;

- Do you plan to study the basics of accounting, the organization of primary accounting, the rules for calculating totals and balances in synthetic and analytical accounting accounts in registers, and closing turnover;

- Do you want to help enterprise management optimize tax planning and make decisions based on the real financial situation.

The course is implemented in absentia using distance learning technologies and lasts 14 weeks (670 hours).