We've played enough

Simferopol resident Vasily buys lottery tickets every week, and not for one or two, but for several thousand rubles at once.

“I have my own method for calculating combinations, and so far it hasn’t let me down,” he says. - Most often, the winnings are small - up to 1-2 thousand rubles, but there are also large ones, so at the end of the month I am not left with a loss.

There are plenty of such gamblers in Crimea. According to information from the Office of the Federal Tax Service of Russia in the Republic of Kazakhstan in 2021 (information for last year will be known only in mid-2018), the total amount of income of Crimean residents who won in bookmakers and sweepstakes exceeded 200 million rubles. There were about 9 thousand lucky people, and the average winnings reached 24 thousand rubles per person. The largest winning amount is more than 200 thousand.

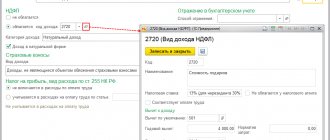

Features of paying tax at a rate of 35%

As a rule, the organizers of promotions and promotional giveaways formulate the conditions in such a way that the amount of tax is already taken into account in the cost of the prize.

This means that the winner receives the amount that was originally promised, and the tax is paid by the organizer.

Moreover, from a legal point of view, everything looks like the tax is withheld from the winnings and paid by the person who received the income. The form of the winnings in this case does not matter: it could be a car, an apartment, money, services (for example, a tourist trip to an exotic country), or others.

Passport game

“We sell about 380 thousand tickets a year, about 90 thousand of them are winning,” says Elena Prin, director of the FSUE Crimean Post. — The maximum payout amount for winnings at post offices for lottery tickets is 10,000 rubles, for non-draw tickets — 1,000. The average payout amount at our company at the end of 2021 was 63 rubles. If the winnings are more than 10 thousand, the participant applies for payment directly to the organizer of the state lottery.

Starting this year, in order to sell the cheapest lottery ticket worth 20 rubles or pay out winnings, the operator must identify the buyer. This is a requirement of the amended Federal Law No. 115 “On combating money laundering and the financing of terrorism.” It provides that receiving money in the form of a fee for participating in a lottery, including in electronic form, and paying out winnings are transactions with funds or other property subject to mandatory control.

Buyers must present a passport, and the lottery operator or distributor must record passport data, both when purchasing a ticket and when paying out winnings.

“Identifying a client now takes about 7-10 minutes, this does not take into account the time spent on explaining why all this is needed,” she continues. — Previously, it took less than a minute to sell a ticket. Thus, taking into account the number of tickets sold and winnings paid out in 2021, identification had to be carried out more than 460 thousand times. With its introduction, sales fell; we, as a state-owned enterprise, are losing part of the income that allows us to maintain post offices in the most remote settlements of the peninsula.

In addition to two large enterprises - Crimea Post and Crimea Lotto - tickets in the republic are also sold by individual entrepreneurs who have agreements with the organizers of state lotteries. Such requirements are not imposed on them, which puts distributors in unequal conditions, because buyers will probably stop purchasing tickets at post offices where they are required to have a passport.

How to distinguish a lottery from a promotion or competition

Since the tax rate varies significantly depending on the type of drawing, it is important to understand the differences between the two.

Only the state organizes lotteries. They are entrusted to operators - specialized companies that are officially allowed to engage in this type of activity. Operators are appointed by local authorities, a corresponding agreement is concluded with them, and the conditions for holding lotteries are officially approved. The lottery ticket must contain the following information:

- name of the authority that organized the lottery;

- name of the operating company;

- number and cost of the lottery ticket.

Only if the above conditions are met, the drawing is called a lottery. Accordingly, the amounts won will be subject to income tax at a rate of 13% (for non-residents - 30%).

Otherwise, the event cannot be considered a lottery. Even if participants are encouraged to purchase tickets, this may only be a promotion, competition or other event organized by a commercial enterprise. Such sweepstakes are often held by hypermarkets, retailers, large retail chains, product manufacturers and service providers. Winnings in this case are taxed at a rate of 35%.

Pay and sleep well

By the way, Crimeans often do not know that winning the lottery is income on which they are required to pay taxes.

“As a rule, personal income tax is withheld by the organizers of promotions and lotteries, who are tax agents,” said acting. O. Head of the Department of Taxation of Personal Income and Administration of Insurance Contributions of the Federal Tax Service of Russia in the Republic of Kazakhstan Svetlana Abileva. — But if the winnings are not in cash, but in property form (for example, a car or household appliances), the organizer of the promotion submits information to the tax authorities and notifies the recipient of the need to pay tax.

Personal income tax on income in the form of winnings or prizes in promotions is calculated at an increased rate of 35 percent, and on lottery winnings or gambling - 13 percent.

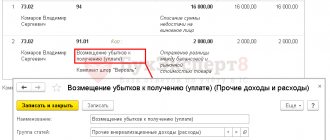

“Tax agents are the organizers of sweepstakes, that is, they independently withhold personal income tax from winnings,” Abileva continues. — In the case of gambling, the recipient of the winnings needs to declare income and pay personal income tax on their own. Winnings or prizes from participation in a gambling game are taxed minus the bet made by the participant. That is, in addition to the tax-free 4 thousand rubles, the amount of the bet will be deducted from the winnings, and 13 percent of personal income tax will be deducted from the remaining amount. If the lottery winnings amounted to more than 15 thousand rubles, the organizer of the drawing will pay the tax for you. And if from four to 15 thousand, you will have to do it.

The hardest part to pay taxes on is lottery and gambling winnings, because their lucky recipients are slow to declare the income. Just like those who win a one-time amount less than the tax-free 4 thousand rubles, but in total at the end of the year they accumulate substantial winnings that are not included in the reporting due to fragmentation.

“If a person does not declare income on his own, we remind him of this, since we have information provided by the organizers of the lottery and promotion,” continues Svetlana Abileva. “In addition, internal information resources allow us to see that a person registered in Crimea received income in some other region. We involve him in declaring such income. In addition, we monitor open information on the Internet: what promotions are held, who wins them. If we identify facts of non-payment of personal income tax, we charge not only a tax, but also a fine in the amount of 20 percent of the lost amount, but not less than 1 thousand rubles.

Tax on winnings in other countries of the world

Now let's look at what happens abroad from a tax perspective. For example, let’s look at the most common countries and lotteries, since it’s physically impossible to sort everything out.

Tax-free lotteries around the world

Amounts won and prizes in lottery draws in countries such as France, Hungary, New Zealand, Great Britain, Australia, South Africa, Canada, and Ireland are not subject to taxation. But such games and their accountability to states have their pitfalls. So, if you win a prize and there is no tax under the laws of that country, this does not mean that in the country where you are a citizen, you do not have to pay anything on the winnings received. In order to know exactly your rights and obligations regarding the taxation of lottery winnings, it is imperative to obtain qualified advice from a specialist.

The following is a complete list of lottery games that are not subject to taxation.

| Australia – Monday Lotto | Australia – Saturday Lotto |

| Australia – Wednesday Lotto | Australia Powerball |

| Austria - Lotto | Austria - Euromillions |

| Australia – Oz Lotto | Brazil – Mega Sena* |

| Brazil – Dupla Sena* | Brazil - Quina* |

| Hungary - Hatoslotto | Hungary - Otosloto |

| UK - Euromillions | UK - Lotto |

| UK - Thunderball | Germany - Lotto |

| Spain - Euromillions** | Spain - EuroJackpot** |

| Ireland - Lotto | Canada - Lotto 6/49 |

| New Zealand - Powerball | Ontario - Ontario 49 |

| France - Euromillions | France - Lotto |

| South Africa - Lotto | South Africa - Powerball |

* There is a practice of deducting the tax payment even before the jackpot amount is announced to the players. Naturally, the initial figures for the monetary fund were higher, since they took into account the state tax. Once the winner is known, there will be no need to make any additional recalculations. This tax collection system works in Brazil.

** In addition to Spain, lottery fans from almost all countries can apply for a refund of the full amount of tax paid in order to eliminate the possibility of double taxation.

Lottery taxes and their interpretation abroad

Like all taxes, lottery royalties are determined and collected by local (federal) governments, depending on where the ticket was physically purchased. The taxes that a player can deal with are divided into the following subtypes:

Local taxation

This is a fee collected before the winner receives the winning amount. This type of duty exists in the United States of America and many other countries. For example, if a player hits the Mega Millions jackpot of several millions, then the government and the lottery company's withholdings could reach 30%. This means that the amount that the winner pockets will in no way be equal to the originally announced jackpot.

18 and older

At the end of February, the State Duma of the Russian Federation introduced legislative changes to the procedure for purchasing lottery tickets and paying out winnings, which will come into force in March. Now only citizens who have reached the age of 18 will be able to take part in the lottery, including the electronic one - payment, transfer or provision of winnings to minors is prohibited.

If the winnings exceed 15 thousand rubles, identification will be mandatory, if less - only in case of doubt about the participant’s age.

Meanwhile

In 2021, 837 individuals became winners in lotteries and promotions in Crimea, receiving a total income of more than 6 million rubles. The largest winning amount is 350 thousand rubles, and the average per person is 7.6 thousand rubles.

Even if luck smiles on you through the kiosk window, do not forget about the obligation to pay tax on your winnings.

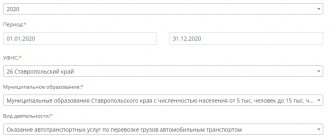

Winnings up to RUB 15,000: self-payment

In the amount of up to 15,000 rubles, each lottery winning is subject to personal income tax, which the winner must calculate and pay independently (subclause 5, clause 1, article 228 of the Tax Code of the Russian Federation). And in the next tax period (year) submit a declaration in form 3-NDFL:

Also see “Form and sample of filling out 3-NDFL in 2021.”

Restrictions during the competition:

No special permits or licenses are required to conduct the competition. The legislation does not contain restrictions on holding a competition by individual entrepreneurs. No site rules or public offer agreements are required. It is enough only to publish an announcement about the competition, which will contain the above conditions, as well as publication of the results.

It should be borne in mind that payment of remuneration is mandatory. If the organizer of the competition refuses to pay the remuneration, the winner has the right to demand payment of the remuneration in court.

The announcement of a public competition must contain

- the task to be completed by the participants;

- criteria for evaluating the results of work (for example, through public voting by site users);

- the procedure for evaluating the results of work (for example, after 3 days from the end of the submission of work, votes are counted);

- place, date and procedure for their submission (for example, to an email address within ___, or on the website);

- size, form and deadline for payment of the award (cash reward in the amount of 1,000,000 rubles, paid by _________);

- the procedure and deadline for announcing the results of the competition (for example, on the website within 2 days from the end of the vote evaluation), publication of the decision on payment of the award;

Without this minimum, the competition may be declared invalid. The announcement may also contain other conditions for the competition, for example, establishing requirements for participants, restrictions, format of submitted works, etc.

You may be interested in the service: Representation in court in civil cases.

Also, the announcement of the competition should indicate that when conducting the competition, the participants and the organizer of the competition undertake to be guided by the exclusive right of the Russian Federation.

The legislation of the Russian Federation does not establish any special requirements for photo competitions.

State lottery programs

Such well-known lotteries as “Gosloto”, “Golden Key”, “Golden Horseshoe”, “Stoloto”, etc. are among the so-called risky lotteries. To take part in them, a person needs to spend money. For example, you need to purchase a lottery ticket.

Tax rates

The fee is 13%. Look at the terms and conditions carefully. It indicates whether the organizers will pay the tax or you will be forced to calculate and pay it yourself. The usual practice is for a person to pay himself.

There is one more subtle point. The value of 13% is valid for residents of the Russian Federation, that is, persons living in the country for at least 184 days a year. These may also be foreign citizens. If a person, no matter whether he is a Russian citizen or not, lives less than 184 days, then the rate will be already 30%.

Some features of payouts for risky lotteries

- You are required to pay duties on any amount received, even the most insignificant, even, for example, 100 rubles. But in practice, few people do this. There is very little chance that tax inspectors will be interested in such a meager amount. That is, this is a question of civil liability. But be prepared for the fact that if this fact comes to light, the fines will be many times greater than what you received;

- If you were lucky several times during the year, the total amount is calculated and the duty is calculated from it;

- If you spent more than you won, you still have to pay. For example, you spent 1000 rubles on lottery tickets, but received only 200 rubles. So, from these 200 rubles. payment of tax is required.

TV games, quiz shows

The amount of the fee depends on whether the event is a promotional event, as indicated in the rules of the event. For example, a TV from a specific company is offered as a prize. During the organization and conduct, information about the manufacturer and seller is provided. Then this promotional event and payments will be 35%. If the gift is simply a TV without specifying the brand, then 13%.

It should be noted that the taxation of the gaming business in Russia is quite flexible and the personal income tax is relatively small.

Responsibility measures

- The penalty for late filing of a return is 5% of the fee that must be paid. Calculated for each month of delay. It cannot exceed 30% of the fee and be less than 100 rubles;

- The penalty for evasion is 20% of the tax amount. If it is proven that the evasion was malicious, the sanctions will increase to 40%;

- In addition, penalties are charged for each day of delay. They are calculated as follows: the refinancing interest rate is divided by 300;

- If the debt exceeds 300 thousand rubles, the violator faces imprisonment for up to 1 year or a fine of 100 to 300 thousand rubles, and this does not cancel the obligation to pay the principal debt.