The procedure for drawing up estimates for organizations using the simplified taxation system (STS) is generally the same as for other organizations, the same collections of prices, adjustment factors, methodological documents, etc. The features of the estimate according to the simplified tax system are the reduction coefficients to the norms of overhead costs and estimated profits and compensation for VAT, which is included in the materials and operation of the machines.

This article will tell you how to create an estimate using the simplified tax system in the Turbo Estimator program.

There are several methods for creating estimates for a company using the simplified tax system. Such an estimate can be made either on the basis of a template or by changing the formulas for calculating some parameters.

Documents for tax refund

The VAT refund is received by the payer of the fee. Can an individual entrepreneur return VAT if he operates on a patent, on UTII, under a simplified scheme or on Unified Agricultural Tax? He cannot do this. It is possible to offset costs by increasing the price of the product or service offered. The main document when paying tax is the invoice. When drawing up and submitting a document to the tax service about the deduction of accrued tax, the required amount of funds is indicated.

How to return VAT for an individual entrepreneur to OSNO? Recovering the tax won't be easy. The inspector checks the documents carefully, so you need to ensure that they are formatted correctly. Compensation for OSNO goes like this: if VAT is negative, this must be reflected in the declaration. After checking the documents, the tax office will determine the validity of the refund.

After 3 months, the businessman can apply for a tax refund. The funds are returned, taking them into account instead of taxes or penalties. If there is no debt, the money can be transferred to the entrepreneur’s current account.

Is it possible to return VAT to an individual entrepreneur before the audit is completed? You can return the money within 10 days after making a positive decision if you submit a declaration, a bank guarantee, or an application for VAT refund to the Federal Tax Service (Article 176 of the Tax Code of the Russian Federation).

Application for changing the taxation regime according to the simplified tax system

When conducting business, there is a need to change the type of taxation and apply “income” or “income minus expenses” as the optimal form. The right to change the form and switch to a simplified taxation system with another object is granted annually from the beginning of the calendar year (Article 346.14 of the Tax Code of the Russian Federation). The right to transfer from the beginning of the calendar year is explained by the tax period of the single tax paid when maintaining the simplified tax system.

A notification of a change in the object of taxation from the beginning of a new calendar period is submitted to the Federal Tax Service by December 31 of the current year. There is no transfer to another facility during the annual period. Application form to the Federal Tax Service – form No. 26.2-6.

The document states:

- name of the organization or last name, first name, patronymic details of the individual entrepreneur;

- selected object of taxation;

- the period from the beginning of which the change is made.

The form must be submitted in person on paper, by post or electronically by means of communication and if the taxpayer has a personal account.

Consent to change the object of taxation from the Federal Tax Service is not required. The receipt of a notification by the tax inspectorate and the start of use of another object of the organization or individual entrepreneur is not reported. When sending by mail, the date of sending the registered letter is taken into account. To confirm the sending of the document, you will need to fill out an inventory of the attachment (available in letters with declared value) and a receipt. A properly executed postal item guarantees the rights of the taxpayer.

The transition from the simplified tax system to another type of taxation is carried out after the end of the calendar year (tax period). Notification must be made by January 15 of the year following the end of the calendar year. The notification form is presented on form No. 26.2-3. The document contains information about the enterprise, the period of termination of the simplified tax system, contact phone number and information of the applicant.

During the year, the application of the simplified tax system is not waived, except in cases where the organization or individual entrepreneur has exceeded the limit values. The company carries out an automatic transition to OSNO.

If the indicators are exceeded, the enterprise:

- must notify the Federal Tax Service of violations of the conditions for applying the simplified tax system.

- reform the accounting of indicators in the manner prescribed for OSNO.

- submit reports to the Federal Tax Service according to taxes paid when maintaining OSNO.

- pay accrued taxes and penalties received for late payment.

A taxpayer making an automatic transition to OSNO has the right to offset advance payments made when paying a single tax. A repeated transition to a simplified taxation system is made after the expiration of the next calendar year. To notify the Federal Tax Service, a special form No. 26.2-2 is used. The taxpayer is obliged to submit a single tax return early within a period not exceeding the 25th day of the month following the end of the quarter in which the right to use the simplified tax system was lost.

If a taxpayer ceases maintaining the simplified tax system in connection with the liquidation of an organization or individual entrepreneur, the tax authority will need to be notified about this no later than 15 days from the date of termination of activities for the type of taxation. When determining the end date, weekends or holidays are taken into account. The deadline for submitting a notice of termination of activity under the simplified tax system is the first working day.

How to return VAT

In what situation does a businessman become entitled to a reduced tax rate?

It could be:

- on a universal basis;

- upon application.

Regardless of the chosen method, tax is refunded:

- to a current account;

- towards future tax payments.

How to return VAT on the purchase of a car as an individual entrepreneur? According to the law, an individual entrepreneur can apply for a refund of part of the money paid when purchasing a car.

To do this you need to provide:

- contract for the purchase of a vehicle,

- invoice;

- invoice;

- payment order to pay an invoice;

- confirmation of vehicle registration.

They confirm that the car was purchased for traveling purposes. For the purchase of a car, you can return VAT by placing the car on the organization’s balance sheet.

As for the acquisition of real estate, an individual can reduce the amount of income tax in the same way as in the case of a purchase and sale transaction for relatives and non-working citizens. The purchase and sale of commercial real estate includes payment of VAT.

When purchasing commercial real estate, the process goes like this:

- invoicing VAT to the buyer;

- he pays the tax to the seller;

- the seller contributes money to the budget.

The interest rate will be 18% based on Article 164 of the Tax Code of the Russian Federation. The buyer is issued an invoice including VAT. And then the difference of the reduced VAT by the amount of the tax deduction is sent to the budget.

On video: VAT in 5 minutes. Basic course. Tax deductions and refunds.

Simplified taxation system of the Tax Code of the Russian Federation

The use of the simplified tax system is permitted for enterprises of all forms of ownership, with the exception of companies operating in the following areas:

- banking sector;

- insurance;

- investment and pension non-state funds;

- pawnshops;

- production of excisable goods (there is no restriction for sale);

- extraction and sale of subsoil mineral resources (excluding common ones);

- lawyer and notary practice;

- other types established by Art. 346.12 of the Internal Revenue Code.

In addition to restrictions on types of activities for the use of the simplified tax system, there are maximum revenue indicators, exceeding which for 9 months does not allow switching to a special form of taxation and deprives the right to use the simplified tax system if the annual figure is exceeded. The amount of the maximum income for 9 months for the transition to the simplified tax system and annual revenue is indexed annually.

In Art. 346.12 of the Tax Code of the Russian Federation legislated restrictions regarding the performance indicators of an enterprise when maintaining the simplified tax system:

- The average number of employees, calculated using the statistical method. The maximum number of persons in an organization or individual entrepreneur should not exceed 100 people for each reporting and tax period. When combining the simplified tax system with other taxation systems, the headcount is calculated for the company as a whole.

- The value of fixed assets on record. The maximum residual value of assets should not exceed 100 million rubles. The limit is determined by the funds subject to depreciation. When calculating the maximum value, the cost of fixed assets is taken into account for the enterprise as a whole.

The taxpayer has the opportunity to choose a tax regime. The choice is made based on considerations that are most favorable for the business. The forms differ in the volume of document flow, the need to account for expenses and the size of the rate. Used as an object

- Income received from activities.

Expenses do not participate in determining the tax base. The simplified taxation system for an LLC or individual entrepreneur with the object “income” has no obligation to account for costs. The form is used by enterprises that do not have significant expenses and staff of accountants for accounting. Most often, the simplified tax system with the object “income” is used in the service sector. The single tax rate for the “income” object is set at 6% of the revenue received. By decision of regional authorities, the rate can be reduced to 1% of income.

- Income reduced by expenses incurred.

The most commonly used option. Costs must be economically justified and documented. To determine the base, expenses corresponding to the closed list established in Chapter are taken into account. 26.2 Tax Code of the Russian Federation. The established rate of 15% of the difference between income and expenses can be reduced in the regions to 5%. Rate reductions are primarily made for certain types of activities when it is necessary to stimulate them. The tax rate is differentiated annually.

The simplified taxation system is characterized by the cash method of accounting for income and expenses. When maintaining the cash method, the following provisions are taken into account:

- Income is recorded in accounting as payment is received for goods sold, work performed and services rendered. Advance payments are also included in revenue for tax purposes.

- Expenses are accepted for write-off after they have actually been incurred and payment has been made to the supplier of goods, works, and services. For example, during commodity exchange transactions, in order to accept the cost of goods as expenses, an enterprise must purchase inventory materials, make payments to the supplier and transfer ownership to the buyer.

A number of expenses determined in accordance with Chapter 25 are recognized using the accrual method. The simplified taxation system of the Tax Code of the Russian Federation uses the provisions of the chapter on income tax in cases where Chapter 26 is directly indicated. For example, when writing off depreciation charges as expenses, the amounts of the monthly write-off rate are taken into account. The cash method of the simplified tax system is expressed in the condition of payment to the OS supplier of the purchase amount, after which depreciation can be taken into account as expenses. In this case, the amount accrued before payment is fully taken into account in expenses after payment is made.

VAT refund procedure: stages

VAT refund occurs as follows:

- documents are submitted to the Federal Tax Service;

- the fiscal authority checks the papers;

- a decision is made;

- money is returned.

Stage No. 1. If the amount of tax deductions is greater than the VAT payable, a tax refund application is submitted. The following documents will be required:

- Handwritten statement.

- Declaration indicating the amount of return.

Stage No. 2. After submitting the application, tax specialists conduct an audit. At this time, additional documents may be needed: acts, invoices, contracts. If there are no violations, the tax service makes a decision within a week.

Stage No. 3. After receiving the notification, the Federal Tax Service confirms the right to receive a full or partial VAT refund.

Stage No. 4. If a positive decision is made, funds are credited to the company's account. This happens within 24 hours after the decision to return is made.

On video: Calculation of VAT in Kazakhstan

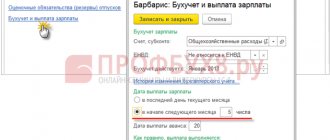

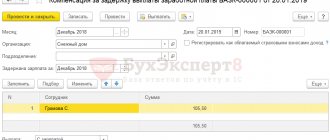

We prepare an estimate with “invisible VAT” in the FER/TER estimates

Unfortunately, this template for the simplified tax system and the explanations given above do not always solve all problems. Often, customers or inspectors agree to pay compensation, but categorically do not want to see it in the estimate. That is, they require that the amount of VAT compensation be “dissolved” in the estimate. This is completely incorrect and such an estimate will not pass automated verification, but it is often easier to do as the customer requires than to prove something to him.

To “dissolve” VAT in the estimate, you will have to use a standard template and add formulas for calculating the operation of machines, the cost of materials, overhead costs and estimated profit. First, we’ll do this for one quote, and then use the “Propagate” function to get the necessary calculation in the remaining quotes.

In the IEM cell, it is necessary to add a coefficient of 1.18 to the formula. It should look like this: =ONCLOL*(TEM*PEM+TZPM*(PZPM-PEM))*1.18.

In the iMR cell we also add 1.18. It turns out = ONKOL * TMR * PMR * 1.18.

In the INR cell, you only need to include VAT on the specific gravity of materials. Formula: =(IZP+IZPM)*NR/100+(((IZP+IZPM)*NR/100)*0.1712)*1.18

Also for the ISP cell: =(IZP+IZPM)*SP/100+(((IZP+IZPM)*SP/100)*0.15)*1.18

Now let's distribute the changed formulas to all cells. Stand on the IEM cell, select the entire estimate (Ctrl+A) and spread (Shift+Ctrl+=) the calculation formula in the IEM cell to the remaining similar cells of the estimate. Repeat the propagation operation for the iMR, iNR, and iSP cells.

ATTENTION: If there are allocated or free resources in the estimate, the modification of the IMP cell and its distribution for such resources must be performed separately.

What should an individual entrepreneur do on the simplified tax system?

How to return VAT to an individual entrepreneur using the simplified tax system? Businessmen who use the simplified tax system no longer need to pay double tax. VAT is not taken into account if the buyer is invoiced for a product or service. There will be zero tax for the enterprise when the company sells medical goods. This also includes services and work that are important during the football championship next year.

On the simplified tax system, the benefit is retained if the business is related to suburban passenger transportation. A 10% reduction occurs for air transport. This also includes the transfer of livestock or poultry if there is a lease with the right to buy in the future.

The simplified form must indicate:

- who is taking part;

- purpose and terms of the agreement;

- time of completion;

- price;

- on the basis of which VAT is reduced.

Special cases of tax refund

Import VAT can be deducted while the businessman is at customs.

For this:

- accept goods for accounting;

- confirm payment of VAT with documents;

- provide a contract and invoice;

- submit a customs declaration on paper or electronically;

- prepare payment documents.

Export VAT is obtained using a zero rate.

To do this you will need:

- prepare documents;

- no later than 6 months after export of the goods, submit a declaration and documents to the Federal Tax Service.

If the contract for services is concluded under leasing, the amount is subject to VAT. An invoice is provided to process tax deductions and refunds. The amount is reflected in the declaration.

How to return VAT to an individual entrepreneur on OSNO illegally taken for 2015? In the fall of 2016, according to the law, an individual entrepreneur on the OSN can reduce income by the amount of expenses incurred by him. Contributions are calculated according to new rules based on Resolution 27-P. This does not apply to the periods 2014 and 2015. An entrepreneur can submit documents to the court.

On video: VAT in Europe

Pros and cons of VAT for individual entrepreneurs

Working with VAT allows you to subsequently issue a deduction. By paying this tax, the supplier will be able to find more serious clients who also pay VAT and receive a deduction, acting as a buyer. Many people believe that it is difficult to achieve VAT payment, since you need to maintain income, expenses, receive an invoice and support it with reporting papers. However, reporting is not difficult. In this case, you can use the services of an accountant. It is important to adhere to deadlines to avoid paying fines later.

Results

The use of the “simplified tax” makes the payer of the simplified tax system a non-payer of VAT. However, there are a number of exceptions to this rule, which oblige not only the payment of value added tax, but also the filing of a declaration on it. At the same time, “simplified” people do not have the right to deduct any amounts of tax. Thus, they cannot incur refundable VAT.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.