You will find the 2021 reporting schedule broken down by quarter below. The information will be useful to companies and individual entrepreneurs on OSNO, simplified tax system and UTII.

This chart will help you include approximate tax amounts in your cost estimate. In the 2021 tax calendar you will find important deadlines for submitting reports to the Federal Tax Service. The 2021 reporting calendar is divided into quarters, and quarters into months. Here you will find an accountant calendar for January 2021, February, July, etc.

The 2021 accounting calendar describes the exact due dates, names of forms and persons who are required to report.

The reporting schedule for 2021 is presented in table form for the convenience of those who better perceive information in the form of tables.

In the first and second quarters, companies and individual entrepreneurs will submit annual reports in addition to quarterly reports.

Composition of the 3‑NDFL declaration

Form 3‑NDFL consists of a title page, section.

1, 2, appendices 1 – 8, as well as calculations for appendix 1 and calculations for appendix 5 (see table). Title page, sect. 1, 2 are subject to mandatory completion by taxpayers submitting a declaration; Appendices 1 – 8, calculation for Appendix 1 and calculation for Appendix 5 are filled out as necessary.

If we compare the new form 3‑NDFL with the one in force in 2021, then there are indeed fewer declaration sheets - instead of 14, only 12 (not counting the title page). At the same time, the names of the sections were replaced, which, in our opinion, is more convenient - instead of letters (sheets “A”, “B”, “C”, etc.) they became appendices 1 - 8.

| Section 3‑NDFL declaration | Name of section of the 3‑NDFL declaration | Note |

| Title page | Title page | Mandatory completion |

| Section 1 | Information on the amounts of tax subject to payment (additional payment) to the budget/refund from the budget | Mandatory completion; the amounts of tax subject to payment (addition) to the budget or refund from the budget are reflected, filled in after filling out the required number of sections. 2 based on those produced in Sect. 2 calculations |

| Section 2 | Calculation of the tax base and tax amount for income taxed at the rate of (001) __ percent | Mandatory completion; If the taxpayer received income taxed at different tax rates during the tax period, then the calculation of the tax base and the amount of tax subject to payment to the budget (refund from the budget) is filled out on a separate sheet for the amount of taxes on income taxed at each tax rate |

| Annex 1 | Income from sources in the Russian Federation | Indicates income received in the tax period from sources in the Russian Federation, taxed at tax rates of 13, 35, 30, 15 and 9% |

| Appendix 2 | Income from sources outside the Russian Federation, taxed at the rate of (001) __% | To be completed only by taxpayers who are tax residents of the Russian Federation; indicate the amount of income from all sources of payment outside the Russian Federation, taxed at the rate specified in indicator field 001 of Appendix 2; if during the tax period income was received for which different tax rates are established in the Russian Federation, then the corresponding calculations are made on separate pages of Appendix 2 |

| Appendix 3 | Income received from business, advocacy and private practice, as well as the calculation of professional tax deductions established by paragraphs 2, 3 of Article 221 of the Tax Code of the Russian Federation | Lines 010 – 100 of Appendix 3 are filled in according to the amounts of income received from the implementation of relevant activities by the following categories of taxpayers, including individual entrepreneurs, lawyers, notaries, and other persons engaged in private practice. For each type of activity, these paragraphs of Appendix 3 are filled out separately |

| Appendix 4 | Calculation of the amount of income not subject to taxation | The amounts of income that are not subject to taxation in accordance with the provisions of Art. 217 of the Tax Code of the Russian Federation , such as the amount of one-time financial assistance |

| Appendix 5 | Calculation of standard and social tax deductions, as well as investment tax deductions established by Article 219.1 of the Tax Code of the Russian Federation | Filled out by individuals – tax residents of the Russian Federation; the amounts of standard, social and investment tax deductions to which the taxpayer is entitled to claim are calculated in accordance with Art. 218 , 219 And 219.1 Tax Code of the Russian Federation; filled out on the basis of certificates of income of an individual (form 2-NDFL) and other documents available to the taxpayer |

| Appendix 6 | Calculation of property tax deductions for income from the sale of property and property rights, as well as tax deductions established by the second paragraph of subclause 2 of clause 2 of Article 220 of the Tax Code of the Russian Federation | Filled out by individuals – tax residents of the Russian Federation; in lines 010 – 040 of Appendix 6, the property tax deductions established by Art. 220 of the Tax Code of the Russian Federation , for income received from the sale of residential houses, apartments, rooms, including privatized residential premises, dachas, garden houses, land plots, as well as share(s) in the said property, taxed at a rate of 13% |

| Appendix 7 | Calculation of property tax deductions for expenses on new construction or acquisition of real estate objects | Filled out by individuals – tax residents of the Russian Federation; property tax deductions are calculated for expenses on new construction or the acquisition of a real estate object (objects) provided for in Art. 220 Tax Code of the Russian Federation |

| Appendix 8 | Calculation of expenses and deductions for transactions with securities and derivative financial instruments (DFI), as well as for transactions carried out within the framework of an investment partnership | Filled out in relation to expenses and deductions for transactions with securities, derivative financial instruments (DFI), including transactions accounted for on an individual investment account in accordance with Art. 214.1 , 214.3 , 214.4 , 214.9 of the Tax Code of the Russian Federation , as well as income from the taxpayer’s participation in investment partnerships |

| Calculation for Appendix 1 | Calculation of income from the sale of real estate objects | The income from the sale of real estate, reflected in Appendix 1, is calculated; income calculation for tax purposes is carried out for each real estate item acquired into ownership after 01/01/2016, from the alienation of which |

| In an even period, income was received, with the exception of income not subject to taxation in accordance with Art. 217.1 Tax Code of the Russian Federation | ||

| Calculation for Appendix 5 | Calculation of social tax deductions established by subparagraphs 4 and 5 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation | Designed to calculate the amounts of social tax deductions established by paragraphs. 4 and 5 paragraph 1 art. 219 of the Tax Code of the Russian Federation regarding the amounts of pension contributions paid by the taxpayer under the agreement (agreements) of non-state pension provision, insurance premiums paid by the taxpayer under the agreement of voluntary pension insurance, voluntary life insurance (if such agreements are concluded for a period of at least five years), additional insurance contributions for funded pension reflected in Appendix 5 |

Should I submit a zero form of the 6-NDFL report for 2021?

Some accountants believe that if there were no accruals of income to employees in the 4th quarter of 2021, then it is not necessary to submit a 6-NDFL calculation, because the employer was not a tax agent during this period.

But you need to remember that tax authorities can fine:

- If accruals were made in any of the previous quarters, and the calculation for the 4th quarter was not presented. In this case, the report must be submitted by filling out only the title page and section 1, since 6-NDFL is filled out on an accrual basis.

- If they decide that you forgot to report.

If you did not conduct any activity in 2021 and there were no accruals, we recommend that you notify the tax authorities that you will not submit the 6-NDFL calculation by sending them a written message in free form. If you decide to submit a zero calculation, the tax authorities are obliged to accept it (letter of the Federal Tax Service of the Russian Federation dated May 4, 2016 No. BS-4-11 / [email protected] ).

Innovations in form 3‑NDFL

In general, if you compare the sections and applications of the new form 3‑NDFL and its predecessor, you can find strong similarities.

In the new form, all the declaration sheets that were there earlier have found a place - now they are renamed into annexes or combined and adjusted. At the same time, technical corrections were made: for example, in Sect. 2 removed all formulas, in Appendix 3 the line numbers were changed, in Appendix 2 the names of the indicators were reformulated.

In addition, the number of indicators that need to be included in the declaration and that are calculated when filling it out has actually decreased; accordingly, the new form lacks a number of lines (or they are combined).

Let's look at some of the innovations in Form 3‑NDFL.

Investment tax deduction. Fundamental changes have been made to Appendix 5, former sheet “E1”. In this application, in addition to standard and social tax deductions, data on investment tax deductions established by Art. 219.1 of the Tax Code of the Russian Federation , - in part 5 of Appendix 5, which were previously in sheet “E2”.

In lines 210 - 220 of Appendix 5, the taxpayer indicates the amount of investment tax deductions established by paragraphs. 2 p. 1 art. 219.1 Tax Code of the Russian Federation :

– in line 210 – the amount of investment tax deduction in the amount of funds contributed by the taxpayer in the tax period to an individual investment account. The value of this indicator cannot exceed 400,000 rubles;

– in line 220 – the amount of investment tax deduction provided for in paragraphs. 2 p. 1 art. 219.1 of the Tax Code of the Russian Federation , provided to the taxpayer in previous tax periods, subject to restoration in accordance with the provisions of paragraphs. 4 p. 3 art. 219.1 Tax Code of the Russian Federation .

Property tax deductions for income from the sale of property. In the new format, Appendix 6 of form 3‑NDFL is presented - the former sheet “D2”.

Now the calculation of property tax deductions for income from the sale of property and property rights consists of the following blocks:

– calculation of property tax deductions established by Art. 220 of the Tax Code of the Russian Federation , for income received from the sale of residential houses, apartments, rooms, including privatized residential premises, dachas, garden houses, land plots, as well as share(s) in the said property, taxed at a rate of 13% (lines 010 – 040 );

– calculation of property tax deductions established by Art. 220 of the Tax Code of the Russian Federation , for income received from the sale of other real estate (except for residential houses, apartments, rooms, including privatized residential premises, dachas, garden houses or land plots or share(s) in the specified property) (lines 050 – 060) ;

– calculation of property tax deductions established by Art. 220 of the Tax Code of the Russian Federation , for income received from the sale of other property (lines 070 – 080);

– calculation of property tax deductions provided for in Art. 220 of the Tax Code of the Russian Federation , for income in the form of the redemption value of a land plot and (or) other real estate located on it, received by the taxpayer in cash or in kind, in the event of seizure of the specified property for state or municipal needs (line 090);

– calculation of property tax deductions provided for in paragraphs. 2.1 and 2.2 clause 2 art. 220 of the Tax Code of the Russian Federation , for income received from the sale of property (property rights) received during the liquidation of a foreign organization (termination (liquidation) of a foreign structure without forming a legal entity) by a taxpayer-shareholder (participant, shareholder, founder, controlling person of a foreign organization or controlling person a foreign structure without forming a legal entity), as well as income received from the sale of property rights (including shares, shares) acquired from a controlled foreign company (lines 100 – 110);

– calculation of actually incurred and documented expenses accepted for deduction upon the sale of a share (part thereof) in the authorized capital of the company, upon leaving the company, upon transfer of funds (property) to a member of the company in the event of liquidation of the company, upon a decrease in the nominal value of the share in the authorized capital capital of the company, when assigning rights of claim under an agreement for participation in shared construction (under an investment agreement for shared construction or under another agreement related to shared construction) (lines 120 – 150).

The total amount of property tax deductions and expenses accepted for deduction, which is determined by adding the values of indicators on lines 010 – 150, is indicated in line 160 of Appendix 6.

Calculation of property tax deductions for new construction expenses. In Appendix 7 of Form 3‑NDFL (former sheet “D1”), the number of indicators that need to be provided to obtain a property deduction for new property has been reduced.

Thus, in the new version of form 3‑NDFL there are no previously required data:

– type of ownership of the object (line 020);

– information about whether the taxpayer, in respect of whose income the declaration is being submitted, at the time of submitting the declaration is a person receiving pensions in accordance with the legislation of the Russian Federation, using his right to transfer the balance of the property tax deduction to previous tax periods (line 040);

– the date of the application for the distribution of property tax deductions (about the distribution of expenses incurred), if the property is shared jointly (without division into shares), including taking into account the provisions of civil and family legislation (line 090);

– the year in which the property tax deduction began to be used, in which the tax base was first reduced (line 110).

Transactions with securities. Appendix 8 of the new form 3‑NDFL combined sheets “Z” and “I” of the previously valid form.

Appendix 8 is completed in relation to expenses and deductions for transactions with securities, derivative financial instruments (DFI), including transactions accounted for on an individual investment account in accordance with Art. 214.1 , 214.3 , 214.4 , 214.9 of the Tax Code of the Russian Federation , as well as income from the taxpayer’s participation in investment partnerships.

Depending on the number of types of transactions with securities, the code of which is indicated on line 010 of Appendix 8 (given in Appendix 8 to the procedure for filling out the declaration), the required number of blocks of lines 010 - 070 is filled in.

Line 050 reflects the attribute of accounting for losses on income specified in line 020 of Appendix 8, received from the totality of transactions performed with securities and derivative financial instruments (DFI), as well as on REPO transactions, the object of which are securities, on securities lending transactions , for operations carried out within the investment partnership:

– 1 – if the loss (including unaccounted loss of previous years) is taken into account in the reporting tax period;

– 0 – if such loss is not taken into account.

When specifying attribute 0 in line 050, lines 051 and 052 are not filled in; when reflecting a loss accepted as a reduction in income for the totality of transactions performed, the required number of lines 051 and 052 are filled in.

For individual entrepreneurs

Individual entrepreneurs are required to submit a tax return in Form 3-NDFL only if they apply the general taxation regime, but this must be done regardless of the presence or absence of income in the tax period.

When applying special tax regimes - simplified tax system, in the form of UTII, PSNO - a personal income tax declaration is not submitted. In addition, the obligation to submit a declaration in Form 3‑NDFL may arise for an individual entrepreneur if he applies special regimes when he, as an individual, receives income for which personal income tax was not withheld, including when selling an apartment.

An individual entrepreneur is required to submit a declaration in Form 3-NDFL to the tax authority at his place of registration (place of registration) no later than April 30 of the year following the expired tax period ( Articles 227 , 229 of the Tax Code of the Russian Federation ).

For 2021, a tax return in Form 3-NDFL must be submitted by individual entrepreneurs no later than 04/30/2019.

Let us remind you that failure to submit a declaration to the tax authority on time entails the collection of a fine in the amount of 5% of the amount of personal income tax not paid on time, payable on the basis of this declaration, for each full or partial month from the day established for its submission, but no more 30% of the specified amount and not less than 1,000 rubles. ( clause 1 of article 119 of the Tax Code of the Russian Federation ).

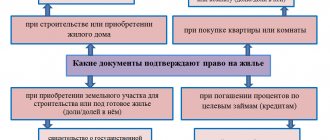

Deduction when buying an apartment

The amount of the deduction in the case of the purchase of real estate depends on the amount of funds spent on the purchase and the amount of personal income tax paid by the applicant (or on his behalf by the employer) for the reporting period. An example of filling out 3-NDFL would be relevant when purchasing an apartment, repaying a mortgage loan (to reimburse repaid loan interest) or implementing a residential construction project.

When applying for a deduction, you can offset the costs of several purchased objects within the established limits. The total maximum amount to which the property benefit applies is RUB 2 million. When repaying interest on targeted loans related to the acquisition of real estate, the limit is approved at the level of 3 million rubles. You can return 13% of these amounts, that is, 260 thousand and 390 thousand rubles. respectively.

The procedure for filling out a declaration by individual entrepreneurs

Mandatory for filling out the declaration in form 3‑NDFL are the title page, section.

1 and 2. For individual entrepreneurs, Appendix 3 is added to them, which indicates income and expenses from business activities. The immediate procedure for filling out these sections of the declaration is as follows:

1. Appendix 3.

2. Section 2.

3. Section 1.

4. Title page.

The remaining sheets of the declaration are filled out as necessary. For example, if an entrepreneur is a party to an investment partnership agreement, then on the basis of Art. 214.5 of the Tax Code of the Russian Federation , he must determine the tax base for income from participation in this agreement and pay the tax. These transactions are reflected in Appendix 8 of the declaration.

Individual entrepreneurs can fill out, generate and send a tax return to the tax authority in Form 3‑NDFL through the official website of the Federal Tax Service through the Personal Account of an individual entrepreneur.

Fill out Appendix 3 of the declaration

Lines 010 – 100 of Appendix 3 are filled in by individual entrepreneurs based on the amount of income received from the relevant activities.

Entrepreneurial activity has code 01. For each type of activity, the specified items in Appendix 3 are filled out separately. The calculation of the final data is carried out on the last completed page of Appendix 3.

| Lines of application 3 of form 3‑NDFL | Displayed information |

| 010 | Activity code in accordance with Appendix 5 to the filling procedure |

| 020 | Code of the main type of business activity in accordance with the All-Russian Classifier of Types of Economic Activities |

| 030 | The amount of income received for each type of activity |

| 040 | The amount of expenses actually incurred, taken into account as part of the professional tax deduction, for each type of activity |

| 041 | Amount of material costs |

| 042 | Amount of depreciation charges |

| 043 | The amount of expenses for payments and remuneration in favor of individuals |

| 044 | The amount of other expenses directly related to the extraction of income |

| 050 | The total amount of income, which is calculated as the sum of the indicator values of lines 030 for each type of activity |

| 060 | The amount of professional tax deduction, which is calculated as the sum of the values of the line 040 indicator for each type of activity, or in the amount of 20% of the total amount of income received from business activities (line 030 x 0.20), if expenses related to activities as an individual entrepreneur, cannot be documented |

| 070 | Amount of actually paid advance payments (based on payment documents) |

The tax return is filled out by individual entrepreneurs based on the data in the book of income and expenses and business transactions of the individual entrepreneur. Expenses directly related to the receipt of income from business activities are formed and reflected in the same way both in this tax register and in the declaration: material expenses, labor costs, depreciation deductions and other expenses. The data is taken from Sect. VI “Determination of the tax base” (Table 6‑1) of the book of income and expenses.

Adjustment of the tax base. As for lines 090 – 100 of Appendix 3 of Form 3‑NDFL, they must be filled out only by those taxpayers who made independent adjustments to the tax base and the amount of personal income tax based on the results of the expired tax period in accordance with the provisions of clause 6 of Art. 105.3 of the Tax Code of the Russian Federation in the case of using prices of goods (works, services) that do not correspond to market prices in transactions with related parties:

– line 090 indicates the amount of the adjusted tax base, if such an adjustment was made in the reporting tax period;

– line 100 reflects the amount of the adjusted tax if the tax base was adjusted in the reporting tax period.

Professional deductions. Note that Sect. 6 “Calculation of professional deductions” is filled out by individuals - tax residents of the Russian Federation who received income from sources in the Russian Federation or outside the Russian Federation. The total amount of actually incurred and documented expenses for all civil contracts (line 120), as well as for all sources of payment of income received by taxpayers in the form of royalties and remunerations for the creation, performance or other use of works of science and literature is also indicated. and art, rewards to authors of discoveries, inventions, utility models and industrial designs (line 130). The total amount of expenses for royalties, remunerations for the creation, performance or other use of works of science, literature and art, remunerations to authors of discoveries, inventions and industrial designs within the limits of the standard is indicated in line 140. The total is summed up in line 150 by adding the values of the indicators of lines 120 - 140. Previously, these data were presented in sheet “G”.

Obligation to report personal income tax

All citizens making a profit in Russia are required to pay personal income tax to the state. Typically, tax agent organizations are involved in withholding tax and transferring it to the budget. These are the taxpayers' employers or those organizations that paid them income. These same tax agents report to the Federal Tax Service on the amounts paid and the tax withheld from them.

But there are citizens who independently calculate the tax and transfer it to the budget. They have an obligation to report to the Federal Tax Service:

- if the taxpayer has the status of an individual entrepreneur and applies the general taxation system;

- if a person received income independently during the year and does not have a tax agent for any transaction.

We tell you how to fill out the 3-NDFL declaration yourself and when to submit it to avoid a fine. This can be done both on paper and electronically.

Read more: how much will you be fined if you fail to submit 3-NDFL in 2021