Each full-time employee must have a personal account, which is opened at the moment the citizen is hired. To complete it, a special form T-54 is used.

Concept and purpose of an employee’s personal account

Contents:

A personal account is a document drawn up specifically to display personal information about each employee. The working hours for a specific month are indicated here. Accruals and deductions, if any, were also recorded in the reporting month. Thanks to such a document, accounting has the opportunity to timely and, most importantly, correctly perform all calculations for each employee.

In fact, a special form T-54 is called a personal account. This includes how much the employee worked, what salary he is entitled to and accrued. If any other charges are provided, they are also mentioned in the document.

It’s not for nothing that many people call this document a salary sheet. After all, it allows you to monitor all salaries and various actions with it. As you might guess, such a document is created separately for each employee. Moreover, it does not matter what his position is or how long he has been on the company’s staff.

( Video : “Personal accounts of employees”)

Personal accounts of employees: everything about the T-54 form

Employees' personal payroll accounts provide complete information regarding accruals, payments and deductions made by the enterprise for each employee during the period of his work. According to paragraph 4 of Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, maintaining such accounts is not necessary. As a rule, they are used in large enterprises and belong to the category of primary documents. Small companies or individual entrepreneurs may even limit themselves to a payroll slip (T-49 and T-51) and an employee’s personal card (T-2).

The personal account belongs to the internal documentation of the employer and is opened immediately after the employee is hired. Form T-54 must be maintained throughout the entire period of work in the organization.

A responsible accountant should be responsible for filling out personal accounts. The following documentation may serve as the basis for completion:

- waybill or route sheet;

- sick leave;

- work order for piece work;

- time sheet;

- production reports;

- other documents.

Personal accounts of employees based on wages are divided into forms T-54 and T-54a. The latter is used in the case of automated processing using computers and special programs. Moreover, this form already contains all the necessary details for calculating wages.

What is a current and personal account?

A personal or current account is a 20-digit account number of an individual. Money from the account can be spent and transferred only for personal purposes. It is not suitable for commercial activities. You can also receive salaries, pay utility checks or loans into the account. Opening such a bank account is free of charge. To receive an account, you must have any document confirming your identity with you. The best thing is a passport. But a military ID card or a migration card for non-residents of the Russian Federation will also work. You can link a debit card to your personal account for more convenient payments.

The current account is suitable for individual entrepreneurs and legal entities for doing business. It can also be opened by an individual, if they are notaries or lawyers. This account also consists of 20 digits. The package of documents for obtaining an account is larger than in the case of a personal account - an extract from the Unified State Register of Legal Entities (IP), a certificate with samples of signatures and seals, etc.

An individual needs a personal card account to receive money through payment orders. For example, accountants will require such information when transferring funds under a contract. Just the card number will not work. Entrepreneurs, insurance companies, and pension funds can also request a personal card account when making money transfers.

Features of filling out employee personal accounts

Like any other document, an employee’s personal account must be filled out according to certain rules. They must be followed to enter information correctly.

The upper part of the T-54 must contain all the necessary data: OKPO code, the department in which the employee is registered, as well as the full name of the organization itself and its organizational and legal status. Next, you must number the form and indicate the period for which payments are calculated (if the employee is new, then the date must coincide with the day of hiring; if the person has been on staff for a long time, then the correct date will be the first month of the current year). The category of personnel (employee, worker, etc.) and the employee’s personal data, such as SNILS, TIN, personnel number, presence of children, marital status and date of birth, must also be written down in the invoice.

The lower part consists of two tables. The first reflects data for calculating wages (which served as the basis for charging certain amounts to the employee), such as:

- employment order, which specifies the amount of pay and working conditions;

- vacation orders;

- amounts of income that are eligible for benefits;

- documents on deductions made, etc.

The second table directly contains the monthly calculation of all accrued amounts, deductions and the final salary amount that will be received by the employee.

Thus, Form T-54 is a kind of salary sheet with detailed information about accruals. The account must be filled out every month, and at the end of the year the total amount of all payments is added up.

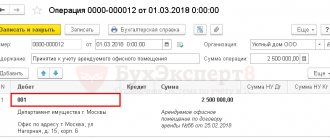

Several salary projects (personal accounts) for an employee in 1C: ZUP 3.1.8 and 1C: ZKGU 3.1.8

In this article I want to touch on an important change

for users, which occurred with the release of the 1C program: ZUP 3.1.8 and 1C: ZKGU 3.1.8

The pictures will be presented using the example of the 1C program: Salaries and personnel management 8 edition 3.1.8. Users of the program for government agencies 1C: Salaries and personnel of a government agency rev. 3.1.8 will also find this material useful, because The interface of programs for “self-accounting” and “public sector employees” is, in principle, very similar.

So now the organizations

who have several payroll projects, for example, opened in different banks,

can store information about several personal accounts of employees

in a special new workplace for working with personal accounts (

Payments Menu - See also - Personal accounts of employees

) and when paying due accruals In the pay slip, the employee

now has the opportunity to select the desired personal account

(salary project) of the employee.

This is an important innovation

, which many users were really looking forward to. As a consultant, I often received a question from users: when will this opportunity (to have several active personal accounts for an employee) be implemented in the program?

At the same time, the main salary project for an employee will still be only one personal account!

Before the release of ZUP 3.1.8, this was impossible to do; the program stored information about only one active personal account of an employee. It was assumed that an employee at a certain point in time has only one valid salary card (personal account for the salary project).

Let's see how this is implemented in the 1C program: Salaries and personnel management 8 edition 3.1.8:

Open the Payments Menu - See also - Personal accounts of employees:

Open the link:

We see a list of personal accounts of employees in the organization.

To add a personal account to an employee for another salary project, all salary projects of this organization must be entered in the “Salary Projects” directory ( Payments Menu - See also - Salary Projects

)

Return to the Employee Personal Accounts

. We are adding a personal account for employee Igor Vilenovich Bulatov in another salary project.

We make a selection by employee, click “Create”:

A “window” appears. We enter the necessary data into it:

Filled out the fields Salary project

and

personal account number

:

I would also like to draw your attention to the fact that the date of opening a personal account affects the filling out of statements - when filling out, data on personal accounts opened on the date of the statement is inserted.

Now employee Bulatov I.V. There are personal accounts for two salary projects.

You can also download data on the personal accounts of all employees under the new salary project through data exchange documents with the bank. (Menu Payments - Exchange with banks

(salary))

I repeat that you can specify only one personal account and salary project as the main one for an employee.

We are creating a statement for the advance payment for November 2021.

If the main salary project is selected in the statement, then the statement is filled out using the “Fill” button, and all employees are selected for it.

If you need to make a payment to an employee and several employees for another salary project (not the main one for the employee), then you need to select employees for it using the “Select” button.

In this case, the personal account number for this employee’s salary project will be added to the statement automatically.

That's all I wanted to tell you today. I hope that the material in my article will help you in your work. If you still have any questions on this topic, you can ask them in the comments to the article.

Two forms of personal account

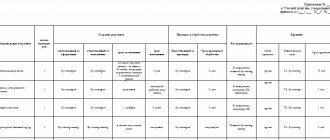

Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1 approved 2 forms of personal account:

1) Unified uniform T-54 - they mostly use it.

2) Form No. T-54a is used for automated processing of accounting data (on a computer) and contains only general details for the employee (it does not include monthly data on hours worked and monthly calculations for payments and deductions). Monthly data is printed separately (usually in the form of a pay slip) and added to the personal account.

Due to their cumbersome nature, personal accounts are usually maintained by the accounting services of large organizations.

Small companies and individual entrepreneurs in most cases, to account for payments and deductions, draw up settlement (Form No. T-51) and payment (Form No. T-53) statements or a single payroll statement (Form No. T-49), which includes payroll data and payroll.

In connection with the amendments to the Law “On Accounting”, which abolished the obligation to use most unified forms of primary accounting documents from January 1, 2013, many organizations are also developing their own forms of personal accounts, which are simpler compared to the unified one and do not require filling out so much number of details.

Why do you need the T-54a uniform if you have the T-54?

The Goskomstat Resolution No. 1 dated January 5, 2004, which approved the main part of the unified personnel reporting forms - including T-54 and T-54a, states that:

- Form T-54 is used to reflect all types of accruals and deductions on an employee’s salary based on the primary report related to production accounting and documents for payment;

- form t-54a is used as part of automated processing of accounting data on a computer, and at the same time includes conditionally permanent details for calculating wages.

Neither the Goskomstat norms nor any others in federal legislation directly prohibit the use of the T-54 form for automated accounting, and the T-54a for “manual” accounting. If you look at popular accounting programs with modules for personnel records - the same 1C - you can see that their interfaces provide for the use of both the T-54 form and the T-54a form.

Thus, the difference between the forms should be sought not so much in the way information is entered into them, but in their essentially content.

Both forms are indeed very similar - but there are differences (and in many ways may determine the advantages of one form over the other).

Form T-54a.

How are the documents similar?

Each of them contains:

- A block for displaying personal data about the employee, marital status, number of children, date of hiring and dismissal (at the top of the document).

- Table showing:

- information about hiring (details of the order, department, position, salary, allowances);

- information about vacations;

- information about standard deductions;

- information about deductions (this means deductions for debts to the employer, writs of execution, payment of voluntary contributions to various funds).

The block and table include the same “conditionally constant” data that:

- may not change at all from month to month (personal data about the employee, his contract);

- may change from month to month, but irregularly (only upon the occurrence of certain events that cause changes - for example, a person going on vacation, making deductions from his income, and others that are provided for in the form).

What is the difference between the T-54 and T-54a forms

Unlike the T-54 form, which is filled out manually, the T-54a document is used only in cases where the process of processing accounting data is automated and carried out using computer technology (CT).

This means that a personal account with the letter “a” must be printed on a printer, and a special accounting program is used to create and maintain it.

Application of the T-54a form: nuances

So, in form T-54a there is no table, which is present in form T-54, where you can list monthly data on accruals and deductions made in relation to the employee. But this is not a problem because:

- It is assumed that a personal account in form T-54a (as an option - filled out electronically) will be printed monthly on a printer.

Each paper copy, of course, must be signed by an accountant.

- It is assumed that each monthly printout of form T-54a will be accompanied by (pasted in) pay slips that reflect the following data:

- on the composition of wages,

- about deductions;

- about the total amount to be paid.

That is, in general, the same information that is contained in the second table of the T-54 form.

Goskomstat also recommends displaying on the back of the form (or on the pay slip itself, which is attached to it) various codes for the amounts paid or withheld. These can be codes entered by the organization itself or those adopted in relation to income subject to personal income tax - in accordance with the order of the Ministry of Finance of Russia dated September 10, 2015 No. ММВ-7-11 / [email protected] By the way, similar codes are subject to reflection in the second table of the T-54 form.

Note that the company will not violate anything if it prints out the T-54a report not monthly, but, for example, once a year (or at any other frequency, preferable from the point of view of personnel accounting policy). Then he will paste into it all the payslips that were compiled during the year. But it is, of course, advisable to consolidate this approach in the accounting policy in case questions arise from the inspection authorities.

Thus, Form T-54a in combination with sheets (and codes) will be functionally similar to Form No. T-54. But why then use a document with index “a”? Its use may be more preferable in cases where:

- It is more convenient for an enterprise to record wages (deductions) in registers that differ in structure from the second table of the T-54 form (and it is not very convenient for an enterprise to switch to accounting in it).

For example, if the corresponding registers are completely electronic, but are not part of the electronic T-54 (as an option, because the accounting program used does not support it - not all companies can afford expensive 1C).

- One division of the company (HR department) is responsible for recording “conditionally permanent” data - mainly, typically “personnel” (that is, not related to accounting calculations), and another is responsible for recording “non-permanent” data - mainly financial. (actually, accounting).

As a result, the division of competencies may be accompanied by a division of documentation - which is impossible if the T-54 form is used (where both “personnel” and “calculation” data are recorded on one form). When dividing documentation between departments, there will be no disputes about “we fill out this, and you fill out that.” It’s just that everyone will fill out their own type of documentation.

Thus, despite the absence of a ban on using T-54a for “paper” accounting, the form in question is best suited for electronic accounting - and has advantages over T-54 in the form of:

- the absence of a “fixed” second table - instead of which you can use any third-party electronic settlement register that is convenient for the enterprise;

- the ability to keep a document on a computer for the entire year or any other period - and only print it at the end of the period (or if otherwise necessary).

Instructions for filling out a personal account card

Title part

: The very first lines to be filled in are those containing information about the employer: name of the organization (structural unit), OKPO and OKUD code. Then information about the date of opening the account, the billing period and the employee himself is entered.

Next, fill out information about the employee: full name, date of birth, personnel number, marital status, Taxpayer Identification Number, SNILS number, position, etc.

Columns 1-8

. Contains data on hiring, transfers, dismissals, and changes in wages. The indicated columns reflect information about the order for employment (dismissal, transfer), etc., place of work (structural unit), position (specialty, profession), tariff rate, amount of allowances and additional payments.

Columns 9-16

. Contains information about the employee’s vacation: the period for which the vacation was granted, duration, date and number of the order approving the vacation.

Columns 17-21

. The indicated columns reflect information about deductions in relation to the employee (according to writs of execution, order documents, etc.).

Column 22

. The column indicates the amount of tax deduction provided to the employee.

Column 23

. The month for which the invoice is prepared is indicated in the format: 01, 02, 03, etc.

Columns 24-27

. The indicated columns reflect the days (hours) worked by the employee in the reporting month. The data is taken from the working time sheet.

Columns 28-37

. All accruals made to the employee for the reporting month are indicated: wages, bonuses, sick leave, vacation pay and other payments.

Columns 38-46

. Deductions in relation to the employee are reflected: personal income tax, alimony, advances, etc.

Columns 47-48

. These columns reflect the debt of the organization to the employee and vice versa: the employee to the organization.

Column 49

. The total amount of payments to the employee for the reporting month is indicated.

When to use the employee account form

Form T-54a is unified (approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1) and is used by an accountant to enter information about monthly accruals and deductions made for a specific employee throughout the year. Such personal accounts are created for each employed employee.

Information to be entered into form T-54a is taken from primary documents relating to the employee, as well as other documentation that takes into account actual output (work performed, amount of working time worked).

The basis for opening a personal account for an employee is an order to hire him. At enterprises with a large staff, T-54a forms are filled out personally for each employee, but if there are not so many employees, an alternative is possible - maintaining special statements.

How to upload a completed template to the system

To download the completed template, go to “Management Objects” and select the “Personal Accounts” tab.

In the “ Register of Personal Accounts ” that opens, select the “Download information” function.

In the dialog box that opens, you will be asked to select a file to download.

How to upload personal accounts to GIS Housing and Communal Services

783762

Is the T-54 form required?

The personal account form T-54 was approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

Of course, instead of the T-54 form, the employer has the right to use any other alternative register. However, the document in question meets all the characteristics of a primary document, taking into account the requirements established by the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

And, since we are talking about the certification of certain events of economic life (this includes the payment of wages), the regulatory authorities are more likely to recognize such a certification if it is produced using a unified form - than some “incomprehensible” third-party .

A personal account is opened for an employee, as a rule, immediately after his employment. The document reflects the details of the order for hiring a person, the name of his department, positions, and key indicators for calculating wages.

A personal account is a rather voluminous document, but filling it out, in general, is not difficult. At the same time, there are a number of noteworthy nuances that characterize the reflection of data in it.

General filling requirements

- Data is entered on the card in blue or black ink.

- It is not allowed to make corrections or use corrective agents, including putties.

- The document consists of a title page and a table containing 49 columns.

Filling out form T-54: nuances

When filling out the document, please keep in mind that:

- Working conditions in column 5 are the number of working hours per week, a typical schedule (for example, “five-day”).

Information on working conditions should not contradict what is reflected in the employment contract.

- Column 7 also reflects mandatory allowances (for example, for work in the Far North).

If we talk about northern allowances, they are indicated as a percentage - and since by default the allowances are supposed to be reflected in rubles, the employer will have to add an additional column to the unified form (since the existing columns cannot, as a general rule, be deleted). Likewise, this information should not contradict the terms of the employment contract (as well as, of course, the legislation on allowances).

- Column 17 for deductions does not show personal income tax amounts.

In this column the following can be recorded:

- deductions for unearned vacation pay;

- deductions for overpayment of wages;

- deductions for loans taken from the employer;

- deductions for external debts - for example, those made in accordance with writs of execution.

The total amount of deductions for the month (column 21) cannot be more than half of the employee’s accrued monthly income minus personal income tax (that is, the sum of the indicators in columns 38 and 49).

In turn, the withheld personal income tax amounts (as well as, for example, wages for the first half of the month) are shown below - in column 39. It is therefore important not to confuse the two different groups of deductions. The first can be conditionally called “debt”, and the second – “tax”.

- “Contributions” in columns 17-21 do not mean mandatory insurance contributions (pension, social, medical), but voluntary ones - for example, to a non-state pension fund or for the activities of a trade union organization.

The fact is that mandatory contributions are always paid by the employer at his own expense - these are not the employee’s expenses, and not deductions. And therefore they are not reflected in the T-54 form at all.

- Various codes (columns 28-36, 38-45, 47-48) are shown if there is a match in the list of personal income tax income codes, which is approved by Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected]

The employer also has the right to use his own codes. If they do not exist (there is nowhere to get them), then they are not given in the form.

- The form is drawn up with an open date for the end of the pay period - which is set on the day of dismissal.

The start date of the period corresponds to the date the person started working - in the first year of work. A common approach is that at the beginning of each year a new form is created (the old one is submitted to the accounting archives). In this case, the start date of the period of each new form is January 1.

- In the column “Code of place of residence” the code of the locality is indicated in accordance with the OKTMO classifier (OK 033-2013).

- It is necessary to correctly indicate the employee’s status in the “Married status” column.

Options: “married” or “single”, “married” or “single”.

- Typical categories of personnel (to be reflected on the Title Page):

- worker;

- employee;

- supervisor.

You need to choose the one that essentially corresponds to the labor functions of the person for whom the current account is opened.

- Columns 9-16 provide, among other things, information on compensation for unused vacation.

Theoretically, only they can be cited - if the employee never went on vacation before the dismissal. In this case (and in others when compensation is needed), the form reflects:

- details of the order for vacation compensation (columns 10 and 11);

- the period for which compensation was accrued (columns 12 and 13), that is, the working year;

- number of vacation days that are compensated (column 16).

Form T-54 is filled out manually using a black or blue pen. An electronic analogue of a personal account should be maintained in Form No. T-54a (note that this is not a complete analogue at all - rather, an alternative register, supplemented, moreover, by a number of other financial documents).

Form T-54. Personal account.

A personal account (Form N T-54) is used to monthly reflect information about wages paid to an employee during the calendar year. Filled out by an accounting employee.

Form T-54. Personal account. 2021 sample.

Tabular part

| Column no. | Content |

| from 1 to 8 | Details of orders for employment, transfer, dismissal and data on the basis of which wages will be calculated monthly. In our example, an employee was hired as a legal adviser (03/01/2017), and was soon appointed head of the legal department (transfer order dated 04/01/2017). |

| from 9 to 16 | Information about all vacations used, indicating details of orders. |

| from 17 to 21 | Information about deductions (for example, according to writs of execution or due to a shortage of entrusted material assets). To fill out the data, we will need an order from the manager, the date and amount of deductions. |

| 22 | Data on standard tax deductions provided. |

| 23 | Months are numbered from 01 to 12 |

| from 24 to 27 | Information on the number of hours and days worked in accordance with time sheets. |

| from 28 to 37 | The amount of wages, bonuses, financial assistance, sick leave and other payments accrued to the employee per month. |

| from 38 to 46 | Deductions for the employee, such as previously paid advances, personal income tax, etc. |

| 47 | Total data on debt (accruals minus deductions) to the employee. |

| 48 | The employee's debt to the organization. |

| 49 | The total amount we must pay the employee for the month. |

Our clients, partners, acquaintances and friends often ask us questions about correct accounting.

Therefore, we decided to launch a column in which we will talk about the most pressing accounting topics.

We invited our partner as an expert: Margarita Novoseltseva, the founder of two accounting companies - Raikiri and Do Your Business.

Margarita, chief accountant with more than 10 years of experience and more than 8 years of tax and accounting consulting experience. Author of useful articles, speaker at seminars and conferences, as well as training courses on various platforms for small and medium-sized businesses. The client portfolio includes more than 100 companies.

Personnel and Salary

A large proportion of questions asked to us are related to Personnel and Salaries.

It is with an article on this topic that I would like to start our column.

A little about myself: I am the founder of two accounting companies. We have more than 100 companies in our service. There are small ones, with a staff of 2-3 people, but there are also companies with 50-100 people. Therefore, optimizing work with the Personnel and Salaries block is very important for us!

In this article we will look at how we work with labor relations.

The difference between labor and civil law relations:

Manager's Cheat Sheet No. 6 How to register an employee for work from Nastassia Santalova

Staffing table

Today, we cannot employ an employee without a staffing table. The staffing table must be up to date, because if we did not change it in time (we did not remove an extra vacancy), we will have to submit data to the employment center.

Do you need it?