The return on invested capital ratio shows whether the funds invested in a project or business will bring profit. It is not considered as a single value: most often it is compared with the indicators of competitors, industry averages, and also evaluated over time. The basis for the calculation is information from forms No. 1 and No. 2: operating profit (form 2), equity capital (form 1) and long-term liabilities (form 1).

Before investing in a project, startup, business, or marketing campaign, it is important to evaluate the profitability or unprofitability of such an event. It is possible to calculate the NPV indicator, but there is not always enough information to evaluate it, and the algorithm for determining it is very complex. To quickly assess the feasibility of financial investments, it is best to choose the return on invested capital indicator.

Return on invested capital (ROIC, ROI, RIC - Return On Invested Capital) is a financial indicator that shows how many rubles of profit each investment made in a project will bring.

Reference! ROIC in economics literature and applied research is often called “return on invested capital,” “return on investment,” “return on invested capital,” or “rate of return,” as well as Return On Investment, Return On Total Capital, ROTC.

Return on invested capital characterizes the return provided by the financial resources invested in the business. In this case, only those investments that were directed to the main activities of the company are taken into account.

Reference! Invested capital is the sum of equity and long-term liabilities that were used to finance the main activities of the company. If shareholders' funds are sent directly to production, then the RIC indicator is applicable to them.

The indicator allows you to evaluate not only the profitability of the invested project or business, but also the efficiency of using the financial resources invested in them.

Negative equity on balance sheet

Sergei Cheremushkin

In practice, there are often “miracles” (in the bad sense of the word), which in principle should not exist. One of them is negative equity. In theory, if a company's equity falls to zero and the owners do not contribute additional capital, it becomes the property of creditors. In fact, such companies can exist for some time, some of them even survive and subsequently achieve positive financial results. The problem is what to do with the relative indicators of financial performance that describe the activities of such unusual organizations. For example, the return on equity indicator ROE turns out to be negative in the case of a profit and negative equity, and, on the contrary, in the presence of losses, it is positive. If you don't go into detail and look at profitability for a group of companies, you can fall into a trap. Of course, such an error will later be discovered, but the very fact that the usual method of calculation leads to absurd conclusions is important. Not a single financial indicator that deals with equity capital is designed for its negative values. Equity actually cannot be negative for limited companies! Owners may lose all invested capital, but no more. The remaining losses fall on creditors. Therefore, the error lies not in financial indicators (ROE, EVA, etc.), but in the imperfection of the accounting system. And you have to put up with this. Therefore, when calculating return on equity, you should use something like this formula =IF(Equity In the case of economic added value (residual income), it will not be possible to calculate the WACC cost of capital rate. Do not think of using a negative equity value as a calculation of the weighting coefficient, since the result will be greatly distorted. It will be necessary either to restore the accumulated losses, as a result of which negative equity is formed, or to transfer the negative capital of non-creditors. In fact, the problem is much deeper. Accumulated losses and asset impairments always unjustifiably reduce the amount of equity for the purposes of assessing the return on investments. From the point of view of determining the residual value of the property (liquidation value of the business), everything is correct. But when assessing profitability, the goal is to determine what percentage the business brings in relation to the amount invested in it. This is where the trap lies. Let's say that at the beginning of 2008 the equity capital was 200 million rubles. This year 40 million rubles were received. net profit (10 million is distributed to the owners, 30 is added to the balance sheet as retained earnings). Profitability will be 20%. Everything is simple here. Now, suppose that in 2009 the company suffered a huge loss of 100 million rubles. Profitability in 2009 will be -43.5% (-100/230). Own capital at the beginning of 2010 will be 130 million rubles. In 2010, the company again returned to normal operation and at the end of the year showed 40 million rubles. net profit. But now the same amount of profit gives a profitability of 30.77% (40/130), 10.77% higher than in 2008. Is it correct? Yes and no. Judging from the point of view of the initially invested (and later reinvested) capital, the level of profitability remained the same, the assets performed with the same success (or rather, somewhat worse, since another 30 million rubles were reinvested and income should also “drip” onto them ). And it turns out that the previous loss led to a sharp rise in profitability. Only managers should not be praised for this. They didn't work miracles. This is only related to mathematics. On the other hand, if in fact half of the capital was lost in 2009, then the financial result in 2010 is calculated relative to the amount that investors could hope to get back if the company were liquidated at the end of 2009. The question is whether to count against the amount initially invested or against the balance of the investment at the end of each period.

Adjustments

After determining the amount that needs to be invested to receive benefits, it is necessary to make some adjustments to take into account other possible income/expenses.

Off-balance sheet reserves

This includes assets that are not used under normal circumstances but may be needed.

For example, a reserve for doubtful debts - those that with a high degree of probability cannot be repaid by the enterprise. The amount of invested capital must be increased by the amount of such reserves.

Off-balance sheet assets

These include those that are not on the company’s balance sheet, but will be used.

For example, operating lease funds, assets held in storage or temporary service, pledges, guarantees given by the enterprise, etc. The amount of such expenses must be taken into account when calculating invested capital.

Assets held for sale

They do not generate income, but must be taken into account to avoid financial losses associated with their sale.

Other comprehensive income (loss)

Such items are not reflected in the enterprise’s reports, since they are impermanent: they depend on current circumstances. But when planning investments they must be taken into account.

Write-off of assets

Deferred compensation assets

These are assets that do not participate in the formation of financial results. Therefore, the balance sheet of the enterprise must be reduced by their amount.

Deferred tax assets and liabilities

They arise if the enterprise’s income for the reporting period is less than the taxable minimum. They affect the size of the assets, but do not increase the actual income; they must be deducted from the investment amount.

Deferred liabilities are created when reportable income exceeds taxable income. It turns out that the company will have to pay the tax difference in the future, which means that their amount must be deducted from the invested capital.

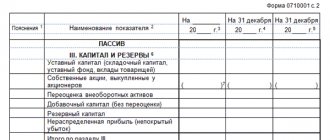

Section 3 of the balance sheet

Section 3 of the balance sheet is called “Capital and Reserves”. The name speaks for itself and suggests what data will be collected here. This is the passive side of the document, reflecting the organization’s own funds and borrowed funds.

These funds are generated from the following sources:

- Authorized capital;

- Additional funds;

- Reserve Fund;

- Profit remaining after distribution.

The financial result is formed as the difference between what the company owns and its debts. If a company has more liabilities than its cash fund, we can talk about losses. If there is more money than debts, then this is profit.

Read on topic: Balance sheet for the year

The section includes 6 lines and a seventh final line. Each of them, except the last one, is tied to a specific account. Therefore, filling out the form will not be difficult. You just need to correctly transfer the balance from your accounts.

| Line | Check |

| Authorized capital (share capital, authorized capital, contributions of partners) | Kt 80 |

| Own shares purchased from shareholders | Dt 81 (negative number is placed in parentheses) |

| Revaluation of non-current assets | Kt 83 (only the difference between revaluation and original cost) |

| Extra capital | Kt 83 everything else except revaluation of VA |

| Reserve capital | Kt 82 |

| Retained earnings (uncovered loss) | Possible options: Kt 84 and Kt 99; Dt 84 and Dt 99; Kt 84 minus Dt 99; Kt 99 minus Dt 84 |

If during the reporting period additional funds were contributed to the management company, but they are not reflected in the statutory documents, then a special column will have to be allocated for them. You can’t just add them to the Criminal Code. This remark also applies to interim dividends.

Line by line filling out section 3 of the balance sheet

When completing the third section of the balance sheet, please note that the form itself does not indicate line codes. However, they must be reflected when submitting a report to the Federal Tax Service and Rosstat. The necessary figures are contained in Appendix 4 of Order of the Ministry of Finance No. 66 dated July 2, 2010. (as amended on 04/06/2015)

Indicators are entered according to three dates. For example, for the 2019 balance sheet, this is the reporting date, 12/31/2018 and 12/21/2017.

| Column name | Code | What amounts to include |

| Authorized capital | These are funds contributed by the organizers of the company when it was created. The collected amount must certainly be recorded in the constituent documents. You can't just change numbers. Any increase or decrease in capital goes through registration with the Federal Tax Service. Important! If a certain amount of the Criminal Code exists only on paper. That is, the founder has not yet listed it. Or someone owes money to the management company. All this is written in other lines. 1310 and the data of the constituent document must match. | |

| Own shares purchased from shareholders | If the company is one of the types of joint-stock companies, then in this column enter the price of shares purchased from their holders. After purchase, they will be sold again or reset to zero. (The number is placed in parentheses.) | |

| Revaluation of non-current assets | If during the reporting period you revalued fixed assets or non-current assets that increased in value, this result will have to be entered into the balance sheet. It is the growth that is shown. | |

| Additional capital (without revaluation) | This is a financial increase for the company (not to be confused with profit), but this cannot include the revaluation of fixed assets and VA. What data is reflected in the column:

| |

| Reserve capital | This part is intended more for JSC. Since they have an obligation to create a reserve fund (minimum 5% of profits annually). LLCs do this at their own discretion. Transfer the figure from the balance according to Kt82 here. This money can be spent to compensate for losses, to purchase shares (if there is no other way out), or to pay off bonds. | |

| Retained earnings (uncovered loss) | The monetary result of the company's work during the reporting period. If it is positive, it is a profit, if negative, it is a loss. A zero indicator is extremely rare. Be careful! Negative data is given in parentheses. There is no minus before the number. |

Since the column “Retained earnings (uncovered loss)” is the most important. It makes sense to dwell on its filling. This is what we did next.

How to attract investment

The structure of investments in fixed capital consists of the entrepreneur’s own funds, which he is able to invest in a future project, and attracted investments . The number of people who need money for business significantly exceeds the number of those who can give this money. A problem arises: how to interest an investor to invest free funds in your idea? To do this, the entrepreneur should:

- Create a business plan.

- Clearly determine the size of the required investment.

- Clearly define the nature of the benefit or the monetary value of the return for the investor from the investment made.

- Write down investment conditions that will be clear and transparent.

- Determine cooperation for the period when the agreement will no longer be valid.

Remember: only the investor bears the risk in such a partnership . If the activity turns out to be unprofitable, then he will not receive his income, but the entrepreneur will not owe him anything. This is why investors so carefully choose the project in which they want to invest. It must be financially attractive.

Features of working with column 1370 of Section 3 of the balance sheet

Column 1370 is issued by all enterprises without exception. It does not matter that by the time of the report the expected profit has not been received. In this case, enter a negative value, but without the minus sign. Simply enclose the desired amount in parentheses. For example: (25,000).

1370 is data for account 84, if you draw up a balance sheet as of December 31 of the reporting year. To get the full picture, first close accounts such as 90, 91, 99.

- If the result is positive, the balance will hang according to Kt84;

- If the result is negative, the remainder is taken according to Dt84.

Depending on whether Dt or Kt of account 84 is included in your balance, the final column under code 1300 will either increase or decrease. But here everything is clear: we add the profit to the total, and subtract the loss.

If you need to submit interim results to the Federal Tax Service, account 99 “Profits and losses” is also involved in the preparation of this line. This is where you report your financial results throughout the year.

Equity on the balance sheet - what is it?

Shareholders' equity is the total of a company's assets minus its total liabilities. It is one of the most common financial ratios used by analysts to determine the financial health of a company.

Shareholders' equity represents the net cost of a company, or the amount that would be returned to shareholders if all of the company's assets were liquidated and all debts were paid off.

The concept of fixed capital

Fixed capital is the totality of expenses necessary to start a business and begin its operation or to modernize it . Fixed capital assets include equipment for production, inventory, and transport.

For example, let's say you want to create a pizza delivery service. To do this, you will need baking equipment and a machine to deliver the product to customers. They constitute the fixed capital. Assets that are used to produce products and pay for themselves in one cycle of their life cycle are called working capital. In our example, these are costs for dough, filling, and more.

The components of fixed capital can be tangible and intangible, and their service life in business, unlike working capital, is several years. Fixed capital assets tend to wear out. A competent manager must calculate the level of depreciation and take it into account in the cost of production.

What it is

Equity can be negative or positive. If the ratio is positive, it means the company has more than enough assets to cover its liabilities. If this indicator is negative, the company has debts that outweigh its assets.

In general, a company with negative equity is not considered a safe investment choice because either its total assets are too low or its total liabilities are too high. In either case, the company has more debt than its current assets can satisfy, putting them at risk of loan default and bankruptcy.

Equity is used in accounting in several ways. Often the word "equity" is used to refer to the ownership interest in a business. Examples include share capital or equity.

Sometimes capital is used to refer to a set of liabilities:

Assets = Liabilities + Equity becomes assets = Shares

Sources of investment

Funds for a company can come not only from outside investors. The structure of investments in fixed capital includes the receipt of funds from:

- income deductions;

- depreciation payments;

- enterprise assets;

- charitable contributions;

- other instruments (company shares, patents, mutual funds).

The structure of investments in fixed capital is developed taking into account:

- economic sectors;

- source of financing;

- type of economic activity and fund.

Analysis of changes in the structure over the period of time under study allows us to draw conclusions about the level of investment activity and the predisposition of investors. For example, there may be an increase in investment in residential construction and a decrease in investment in non-residential buildings.

The structure of investment in fixed capital by source of financing may show a change towards investment of own funds and a decrease in government loans.

Similar articles:

- where and how to find an investor –

Calculation methods

All the information needed to calculate a company's equity is available on its balance sheet. The calculation involves determining the companies' total assets and total liabilities, including current and long-term assets.

Current assets include retained earnings, stockholders' equity, and other cash held in bank and savings accounts, stocks, bonds, and money market accounts.

Long-term assets include equipment, property, illiquid investments and vehicles. Current liabilities include any payments and interest on loans in the current year, accounts payable, wages, operating expenses and insurance premiums.

Long-term liabilities include any debts that are not due in the current year, such as mortgages, loans and payments to bondholders.

Own capital is reflected in line 1300 of the balance sheet. The traditional calculation is as follows:

Equity = value in line 1300

Shareholders' equity can also be expressed as a company's share capital plus retained earnings, less the value of treasury shares. However, this method is less common. Although both methods should produce the same figure, using total assets and total liabilities provides a clearer indication of a company's financial health.

According to Order of the Ministry of Finance of Russia No. 84n, that net assets and equity capital are the same thing, their essence can be determined based on the criteria of Russian regulatory legal acts.

In turn, obligations must also be taken into account, except for some future income, namely, those associated with receiving assistance from the state, as well as the gratuitous receipt of certain property.

Calculation of net assets, and therefore equity capital according to the Ministry of Finance method, assumes information from lines 1400, 1500 and 1600 of accounting. balance.

You will also need information showing the amount of debts of the founders of a business company (DUO), if any (they are reflected by posting Dt 75 Kt 80), as well as deferred income, or DBP (account credit 98).

- The structure of the formula for determining net assets and at the same time equity capital is as follows: (Line 1400 + line 1500)

- Next, you should subtract from the resulting number the amount that corresponds to the credit of account 98.

- Next, calculate the indicators on line 1600 according to the posting Dt 75 Kt 80.

- From point 3, point 2 is calculated.

Thus, the formula for determining the value of the insurance premium using the Ministry of Finance method will look like this:

Sk = (line 1600 – DUO) – ((line 1400 + line 1500) – DBP)

By comparing specific numbers that reflect everything a company owns and all its liabilities, the net worth equation reveals a clear picture of a company's financial health that is easily interpreted by laymen and professionals alike.

In accordance with the method of the Ministry of Finance, the structure of assets accepted for calculation must contain absolutely all assets, with the exception of those that reflect the debt of the founders and shareholders for contributions to the authorized capital of the company.

Example of calculating invested capital

GFK-X's balance sheet is as follows.

Some of the equipment used in the company's operations was obtained as a result of an operating lease agreement that will be valid for the next 5 years. Expected lease payments are as follows:

- at the end of the 1st year 2,350 thousand.

- at the end of the 2nd year 2,550 thousand.

- at the end of the 3rd year 2,600 thousand.

- at the end of the 4th year 2,800 thousand.

- at the end of the 5th year 2,750 thousand.

An operational approach will be used to calculate the amount of invested capital.

The company's balance sheet contains items that relate to current non-interest-bearing liabilities, namely: accounts payable, accrued liabilities, advances received and accrued taxes payable.

NIBCLs = 5,680 + 1,890 + 1,770 + 1,230 = 10,570 thousand.

To estimate the value of off-balance sheet assets, we calculate the present value (PV) of future operating lease obligations using the weighted average cost of capital as the discount rate.

And finally, it is necessary to make the last adjustment, namely, subtracting deferred tax liabilities in the amount of CU 40 thousand.

Invested capital = 13,100-10,570+36,850+8,649.33-40 = 48,061.08 thousand.

Optimal average value

Equity is important because it represents the true value of a share in the share capital. Investors who own shares in a company are usually interested in their own personal equity in the company represented by their shares.

However, such personal capital is a function of the total capital of the company itself, so a shareholder interested in his own earnings will necessarily have an interest in the company.

Owning shares in a company provides capital gains for the shareholder and potential dividends over time. It also often gives the shareholder voting rights at the founders' meeting. All these benefits further increase shareholder interest in the company.

Most often, the average value for the year is used to assess equity capital, which allows you to most accurately determine its variations over time.

The formula for calculation is as follows:

Sk = (Sk at the beginning of the year + Sk at the end of the year) / 2

The data is taken from the balance sheet for the relevant reporting periods.

Shareholders have voting rights and other privileges that come only with ownership, since capital represents a claim to a proportionate share of the company's assets and earnings. These claims are generally those of creditors, but only shareholders can truly participate in and benefit from the growth in the value of the enterprise.

Some financial instruments have the characteristics of equity, but are not actually equity. For example, convertible debt instruments are loans that convert into equity when the company (the borrower) crosses certain thresholds, thereby turning the lender into an owner in certain cases.

Stock options also act like shares in that their value changes with the value of the underlying shares, but option holders generally do not have voting rights and cannot receive dividends or other financial instruments.

It's important to understand that while equity represents a company's net worth, a company's stock is ultimately only worth what buyers are willing to pay for it.

It is highly desirable that the amount of equity capital or net assets be higher than the amount of the company's authorized capital. This criterion is important from the point of view of maintaining the investment attractiveness of the business.

A business must pay for itself and ensure an influx of new capital. Sufficient equity capital is one of the most significant indicators of the quality of a company’s business model.

What is own working capital? Details are in this article.

Standard indicator value

Financial analysis does not offer an exact value for the optimal level of profitability of funds invested in core activities:

- firstly, it depends on the industry, operating characteristics and other factors;

- secondly, it should be assessed in dynamics or in comparison with other enterprises in the industry.

Important point! Most often, a high ROIC indicates effective management of invested resources. However, it can also be a consequence of management's desire to squeeze maximum profits out of the business in the short term, which has a negative impact on the company's value in the long term.

If, according to the results of the calculation, the RIC turns out to be negative, then the project, startup, or business is unprofitable. A high positive value of the indicator in practice contributes to an increase in the value of the corporation's shares.

What is equity

In economic science and practice, there are two definitions of the essence of equity capital (SC):

- assets of an enterprise recorded without taking into account the obligations of the relevant entity;

- a set of indicators that make up the capital of an enterprise.

The approach based on the first definition is reflected in some legal acts. So, for example, in paragraph 3 of Art. 35 of the Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ states that in banking and insurance organizations, as well as in non-state pension funds, equity capital is calculated instead of net assets. In paragraph 29 of the order of the Ministry of Agriculture of the Russian Federation dated January 20, 2005 No. 6, it is noted that the generally accepted understanding of the capital cost as the difference between the value of property and the company’s liabilities corresponds to the essence of the net value of property or net assets.

Thus, it is quite legitimate to consider the concepts of net assets and equity capital as interchangeable or as the same economic category, corresponding to the volume of a company's assets minus liabilities.

Now about the second definition of equity in the balance sheet - this concept (in accordance with another concept) contains a set of the following indicators:

- authorized, additional, and reserve capital;

- own shares purchased from shareholders;

- the firm's retained earnings;

- the result of the revaluation of the organization’s non-current assets.

It may be noted that these items correspond to lines 1310-1370 of the balance sheet.

Many experts consider this concept traditional. A similar approach is used not only in the Russian Federation, but also in other countries of the world (in this case, foreign economists may use indicators similar to those present in the lines of the Russian balance sheet).

The use of 1 or 2 approaches depends on the specific purpose of calculating equity capital. In particular, the company's management may be given a recommendation to use one or another method by investors, banks making decisions on loans, or the owners of the company. The choice of one approach or another may depend on the subjective preferences of management, the influence of a particular management or scientific school on the development of appropriate decisions by the company’s management.

The approach to defining the concept of equity capital is also predetermined by the traditions that have developed in the legal and expert environment of a particular state. In Russia, in principle, both approaches are common. We outlined possible factors for choosing 1 or 2 above.

Where to invest

On the part of the investor, investments in fixed assets must be justified, and their attractiveness must be proven by figures and calculations. The most interesting investments in fixed capital are in the following areas:

- healthcare;

- construction;

- service maintenance;

- private and public services;

- sales and other areas.

The effectiveness of investments varies significantly in different areas of activity. In addition, the following factors influence the number of investments and their performance:

- country's tax system;

- social situation of the selected territory or state;

- economic forecasts that calculate risks for investors;

- government investment policies that attract or repel investors;

- characteristics of the project - competitiveness of the product, resources used, efficiency.

Government policy regarding investment activities plays a major role in making decisions about investment . The attractiveness of a country or a chosen region helps attract not only domestic but also foreign investors, which has a positive effect on business development.

In addition to government policy, investors carefully evaluate the entrepreneur's proposal and the effectiveness of his project. The performance indicators calculated by analysts are compared with the indicators of other projects, after which the most optimal option is selected. The index of physical volume of investment in fixed capital is also assessed.

Investments in fixed assets must be economically justified. You should not invest in questionable activities or without a clear understanding of the level of future profit. Although investments in fixed capital are long-term investments, after some time they will have to be repeated by updating the fixed assets. Information on investments in fixed capital must include an assessment of the efficiency of their distribution. To do this, experts evaluate the following parameters:

- wear rate;

- renewal date and expiration dates;

- fund capacity;

- real value coefficient.

What is included in equity capital on the balance sheet: calculation according to the Ministry of Finance

If we take into account that net assets are essentially equivalent to equity capital on the balance sheet, this will allow us to determine their essence based on the criteria given in Russian legal regulations. There are quite a lot of relevant documents. Among those that are most widely used is Order No. 84n of the Ministry of Finance of Russia dated August 28, 2014.

Read more about the provisions of Order No. 84n of the Ministry of Finance.

In accordance with the method of the Ministry of Finance, the structure of assets accepted for calculating equity capital must contain absolutely all assets, with the exception of those that reflect the debt of the founders and shareholders for contributions to the authorized capital of the company.

In turn, obligations must also be taken into account, except for some future income, namely those associated with receiving assistance from the state, as well as the gratuitous receipt of this or that property.

Accounting for capital investments on account 08: OS production

Accounting for funds produced by an enterprise independently in an economic way is carried out during the following business transactions:

1. Payment of wages to employees involved in the production of fixed assets. This payment is made by posting:

Dt 08.03 Kt 70 - the accrual of the actual salary is reflected;

Dt 08.03 Kt 69.01 (02, 03, 04) - the accrual of contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund, and the Federal Compulsory Medical Insurance Fund is reflected on wages.

2. Acceptance of equipment into the production workshop for the purpose of installing it on the fixed asset facility being created. This operation is reflected in the register using the following entries:

Dt 08.03 Ct 07.

3. Acceptance of materials into the production workshop for the purpose of their use in the creation of fixed assets. The following correspondence applies here:

Dt 08.03 Kt 10.

4. Implementation of other expenses not classified within the above operations, but directly related to the creation of an item of fixed assets, which characterize the corresponding operations. For example, these may be costs associated with paying for the services of transport companies. They are reflected in the registers by posting:

Dt 03/08 Kt 60.

Thus, the main accounting objects within the framework of investing in fixed assets will be:

- expenses for labor, equipment, materials;

- expenses for third party services.

In turn, if an enterprise, investing in the production of fixed assets, attracts contractors, then the cost of work performed by these contractors (excluding VAT) is reflected in the debit of account 08 and the credit of account 60. VAT is reflected in the debit of account 19.01.

Another way to invest in OS is to purchase ready-made assets.

Which line of the balance sheet contains the equity indicator

Calculating equity capital in the balance sheet using the Ministry of Finance method is a procedure that involves using data from the following sections of the balance sheet:

- lines 1400 (long-term liabilities);

- lines 1500 (current liabilities);

- lines 1600 (assets).

Also, to calculate equity capital, you will need information showing the amount of debts of the founders of a business company (let’s agree to call them DOO), if any (they correspond to the debit balance of account 75 as of the reporting date), as well as deferred income, or DBP (account credit 98 ).

For information on what kind of transactions are reflected in the accounting operations of the insurance company, read the material “Procedure for accounting for the equity capital of an organization (nuances).”

The structure of the formula by which net assets and at the same time equity capital in the balance sheet are determined is as follows. Necessary:

- Add the indicators along lines 1400, 1500.

- Subtract from the number obtained in paragraph 1 those that correspond to the credit of account 98 (for income in the form of assistance from the state and gratuitous receipt of property).

- Subtract the debit balance of account 75 from the number on line 1600.

- Subtract the result obtained in step 2 from the number obtained in step 3.

Thus, the formula for equity capital according to the Ministry of Finance will look like this:

Sk = (line 1600 – DUO) – ((line 1400 + line 1500) – DBP).

For information about who should apply this calculation procedure and how its result is formalized, read the article “The procedure for calculating net assets on the balance sheet - formula 2018-2019.”

Accounting for capital investments: purchasing OS

Business transactions that characterize this option for investing in fixed assets are reflected on almost the same principle as in the case of registration of transactions involving the services of contractors during the construction of fixed assets. That is, provided:

- reflecting expenses for the purchase of fixed assets in the debit of account 08 and the credit of account 60;

- when accounting for VAT on the debit of account 19.01.

In addition, if additional spare parts and tools are supplied to fixed assets, their cost can be reflected in the debit of account 10.05. If necessary, other subaccounts of account 10 can be used. For example, subaccount 10.03, if gasoline is supplied along with the fixed asset represented by a car. Or - subaccount 10.09, if the main asset, for example represented by a tractor, is also supplied with agricultural implements (mowers, winnowers).

Fixed assets are accepted for operation at the generated initial cost, and the corresponding business transaction is reflected by posting Dt 01 KT 08. After this, the enterprise accounts for the fixed asset accepted on the balance sheet according to the standards established by the above federal regulations.

You can learn more about the features of accounting using postings to account 08 in the article “08 accounting account (nuances)” .

What is the optimal average equity capital

Net asset figures must be at least positive. The presence of negative equity values in the balance sheet of an enterprise is most likely a sign of significant problems in the business - mainly in terms of the credit burden, as well as the sufficiency of highly liquid assets.

For information on how the insurance company is analyzed, read the material “How to analyze the equity capital of an enterprise?”

Most often, the average value of equity capital for the year is used for assessment, which makes it possible to most accurately determine its fluctuations over time. The formula for calculating the indicator is:

Sk = (Sk at the beginning of the year + Sk at the end of the year) / 2.

The data is taken from the balance sheet for the relevant reporting periods.

It is highly desirable that the amount of equity capital or net assets be higher than the amount of the company's authorized capital. This criterion is important primarily from the point of view of maintaining the investment attractiveness of the business. A business must pay for itself and ensure an influx of new capital. Sufficient equity capital is one of the most significant indicators of the quality of a company’s business model.

You can familiarize yourself with other approaches to assessing the quality indicators of a company’s business model in the article “How to read a balance sheet (a practical example)?”

There is one more aspect to the importance of equity in the balance sheet. If we mean net assets by it, then it must be equal to or exceed the size of the authorized capital. Otherwise, the company, if it is an LLC, is subject to liquidation (Clause 4, Article 90 of the Civil Code of the Russian Federation). Or it will be necessary to increase the authorized capital of the LLC to the amount of net assets. A similar scenario is also possible in relation to JSC (subclause 2, clause 6, article 35 of Law No. 208-FZ).

Read more about these situations and their consequences in the material “What are the consequences if net assets are less than the authorized capital?”

What are the disadvantages of the coefficient?

The basis for calculating Return on Invested Capital is the data of the financial statements - balance sheet (Form No. 1) and profit and loss statement (Form No. 2). This creates some difficulties in its analysis:

- it is impossible to determine how the profit was made: its basis can be regular effective activity or one-time random income;

- company directors can artificially influence the operating profit indicator and, thereby, unreasonably inflate the RIC;

- The indicator is influenced by inflation, exchange rates (for international companies), as well as the internal accounting policies of the enterprise.

Important point! Analysis of an indicator for 1 year, as a rule, requires comparison with other enterprises in the same industry. If we consider it within one company, it is important to track its dynamics over a period of at least 3 years.

Results

An idea of the amount of equity in the balance sheet is given by the value indicated in its line 1300. However, in its essence, equity corresponds to the concept of “net assets”. To calculate net assets, there is a formula approved by the Russian Ministry of Finance, based on balance sheet data, but taking them into account taking into account some nuances. The amount of equity capital is extremely important for assessing the financial position of the company. Of particular importance is its relationship with the size of the authorized capital.

Capital and reserves: lines

Section III “Capital and Reserves” is intended to reflect the organization’s own sources of financing the activities and includes the following indicators (clause 66 of Order of the Ministry of Finance dated July 29, 1998 No. 34n, Order of the Ministry of Finance dated July 2, 2010 No. 66n):

| Indicator name | Code |

| Authorized capital (share capital, authorized capital, contributions of partners) | 1310 |

| Own shares purchased from shareholders | 1320 |

| Revaluation of non-current assets | 1340 |

| Additional capital (without revaluation) | 1350 |

| Reserve capital | 1360 |

| Retained earnings (uncovered loss) | 1370 |

Let us recall that organizations that have the right to use simplified accounting have the right to prepare simplified reporting, in which the “Capital and Reserves” section is shown rolled up in one amount, without a breakdown by type of capital and reserves.

Why invest in fixed capital

Beginning entrepreneurs are often full of ideas, but lacking money. For an investor, it’s the other way around: he’s looking for good ideas in which to invest his available funds. When these two people meet, there is a need to invest in fixed capital, which will be beneficial to both parties. Often, without such infusions of funds, an entrepreneur cannot start his own business for a long time.

Investment conditions may differ and are determined by the wishes of both parties. The general principles are:

- The entrepreneur receives money and the opportunity to start his own business, which he cannot yet financially organize on his own.

- The investor receives monthly passive income from someone else's business activities.

Similar articles:

- how to conduct an economic assessment of investments

- signs of the investment attractiveness of the enterprise

- what are investment risks

- investment project analysis

How to fill out section III

We present in the table information about which accounting accounts are used to fill out the indicators in Section III “Capital and Reserves” of the balance sheet (Order of the Ministry of Finance dated October 31, 2000 No. 94n). In this case, for example, “K80” will mean the credit balance of account 80 “Authorized capital” as of the reporting date, and, accordingly, “D81” will mean the debit balance of account 81 “Own shares (shares)” as of the same date:

| Indicator name | Code | Which account data is used? | Algorithm for calculating the indicator |

| Authorized capital (share capital, authorized capital, contributions of partners) | 1310 | 80 | K80 |

| Own shares purchased from shareholders | 1320 | 81 | D81 (shown in parentheses on the balance sheet) |

| Revaluation of non-current assets | 1340 | 83 “Additional capital” | K83 (in terms of amounts of additional valuation of non-current assets) |

| Additional capital (without revaluation) | 1350 | 83 | K83 (except for amounts of additional valuation of non-current assets) |

| Reserve capital | 1360 | 82 “Reserve capital” | K82 |

| Retained earnings (uncovered loss) | 1370 | 99 “Profits and losses”, 84 “Retained earnings (uncovered loss)” | Or K99 + K84 Or D99 + D84 (the result is reflected in parentheses) Or K84 - D99 (if the value is negative, reflected in parentheses) Or K99 - D84 (if the value is negative, reflected in parentheses) |

Please note that money and other property received from participants to increase the authorized capital, before registering changes to the charter, is shown under a separate article in Section III (Letter of the Ministry of Finance dated 02/06/2015 No. 07-04-06/5027).

In addition, interim dividends paid during the year are reflected separately in Section III. They are shown in parentheses, for example, on line 1371 "incl. interim dividends" (Letter of the Ministry of Finance dated December 19, 2006 No. 07-05-06/302).

Information in section III, as well as for other sections of the balance sheet, is presented simultaneously in 3 columns (Order of the Ministry of Finance dated July 2, 2010 No. 66n):

- at the reporting date;

- as of December 31 of the previous year;

- as of December 31 of the year preceding the previous one.