| In order to correctly calculate the amount of VAT payable to the budget, you need to correctly and timely determine the tax base. It would seem that nothing could be simpler: everything a taxpayer needs to know is in the provisions of the Tax Code of the Russian Federation (Articles 153 – 162). | Articles on the topic: —Fixed assets: assessing tax risks. —How to reflect VAT in financial statements —New in the Tax Code since 2014 |

However, oddly enough, there is still an opinion among managers that, for example, in trade this tax is levied on a markup. They firmly believe in this and use their “knowledge” when planning expenses. It can be extremely difficult to convince them, and the importance of this task often fades into the background for the accountant, but when, at the end of the period, “suddenly” the amount of VAT payable appears that does not correspond to the initial calculations of the entrepreneur, for some reason it is the accounting service employee who is to blame. To avoid such misunderstandings, in the author’s opinion, it is necessary to conduct a small educational program with the manager on the issue of determining the tax base for VAT.

How is VAT deduction applied?

Value added tax is paid by organizations and entrepreneurs operating on the special purpose tax system, as well as other categories of taxpayers in accordance with the requirements of Chapter 21 of the Tax Code of the Russian Federation.

Tax payable is calculated on sales transactions and similar ones.

The taxpayer has the right to reduce the amount of the calculated tax by a tax deduction.

It represents the amount of tax presented to the taxpayer by suppliers of goods (works, services) and indicated in the invoice.

To apply the deductible amount, the following conditions must be met:

- The purchased goods (works, services) are registered.

- Purchased goods (works, services) must be used in transactions subject to VAT.

- The supplier submitted a correctly executed invoice.

- No more than three years have passed since the goods (works, services) were registered.

Increasing the tax base.

But the least amenable to planning, perhaps, should be recognized as VAT, calculated on amounts that increase the tax base in accordance with paragraph 1 of Art. 162 of the Tax Code of the Russian Federation. This article establishes a list of situations in which amounts of money received by the seller must be included in the tax base of the tax period in which these amounts were actually received [5]. And although the specific weight of this “item of tax expenses” can hardly be large, I think it still makes sense to dwell on it in detail: there is too much in connection with the application of Art. 162 of the Tax Code of the Russian Federation, questions and disputes arise.

First of all, it is important to remember that the VAT tax base increases by amounts received by the seller only if they are related to payments for goods (work, services) sold, that is, they are actually part of the proceeds received from sales. Let us carefully consider the mentioned list. According to paragraphs. 2 p. 1 art. 162 of the Tax Code of the Russian Federation, the tax base for VAT is increased by the amounts of money received for goods (work, services) sold: in the form of financial assistance; to replenish special purpose funds; to increase income; otherwise related to payment for goods (work, services) sold.

Financial assistance to the seller associated with payment for the goods purchased from him is, perhaps, stronger than Goethe’s Faust... Replenishment of funds specially created by the seller, obviously for the purpose of accumulating funds to pay off customers’ debts, is from the same opera, and within the framework We are also not particularly interested in this article. But the funds received by the seller, which increase his income from the transaction, as well as otherwise related to payment for goods sold, are closer to the topic. What do you mean by increasing income? More specifically, what buyer payments can actually increase the seller's income received from the sale? The only things that come to mind are compensation, sanctions, and bonus payments, and perhaps those associated with an increase in the price of the product. As for the increase in price, the provisions of Art. 162 of the Tax Code of the Russian Federation do not apply; they are directly regulated by clause 10 of Art. 154 of the Tax Code of the Russian Federation (but more on that later), but the remaining types of payments can be considered in the context of using precisely the rules established by Art. 162 of the Tax Code of the Russian Federation.

For example, according to financiers, VAT is imposed on funds that an organization performing work (selling goods, providing services) receives from a customer (buyer) as compensation for its expenses for the execution of a contract, including travel expenses, transport, and insurance [6 ]. But if the compensation payments are not related to the sale (for example, amounts received by the lessor of the vehicle as compensation for administrative fines paid for violations committed by the lessee [7], or as compensation for losses of the seller in connection with the buyer’s refusal of the goods [8 ], as well as the amount of compensation for damaged (lost) property [9]), they do not need to be included in the VAT tax base.

Another example: pp. 4 paragraphs 1 art. 162 of the Tax Code of the Russian Federation is prescribed to increase the base by the amount of insurance payments received by the seller, but only under insurance contracts for the risk of non-fulfillment by the buyer of contractual obligations and provided that the insured contractual obligations provide for the supply by the insured of goods (works, services), the sale of which is subject to taxation (very, by the way , a strange norm, if you think about it: the seller charged VAT upon shipment, the buyer did not pay him for the delivered goods, the insurance company compensated the seller for the cost of this goods and for some reason the seller must calculate the tax again - but the law is the law [10]), insurance payments , received by the taxpayer for other reasons, for example, upon the occurrence of an insured event as a result of an accident or theft, are not included in the tax base [11].

With bonuses, in principle, everything is clear: if the seller receives additional remuneration for the work done (service provided or, for example, for the quality (or quantity) of the goods delivered), then the amount of such remuneration and the seller’s income increases, and is associated with the sales operation directly, therefore, there is no reason not to apply the provisions of paragraphs to these receipts. 2 p. 1 art. The taxpayer does not have Article 162 of the Tax Code of the Russian Federation [12].

Now let’s move smoothly to sanction payments, that is, penalties, which, according to Art. 330 of the Civil Code of the Russian Federation includes fines and penalties. At first glance, the amount of penalties collected from buyers can be qualified as amounts related to payment for goods, work or services (which cannot be said about the same sanctions applied to the seller). And they definitely increase the recipient’s income - what’s not a reason to increase the VAT tax base? For a long time, controllers (at the instigation of financiers) were guided by precisely this logic, but now they are instructed to more carefully assess the issue of including fines in the VAT tax base: to consider the financial sanctions applied to the buyer from the point of view of their relationship to the pricing element [13 ]. Ministry of Finance officials include fines imposed on the buyer of transportation services for excess downtime of vehicles as one of these elements [14]. According to the author, this position is very controversial, since, from the point of view of the arbitrators, penalties and other types of liability provided for by civil law, by virtue of the provisions of Chapter. 21 of the Tax Code of the Russian Federation are not recognized as subject to VAT [15], therefore, the chances of proving in court the unjustified inclusion of the amounts of sanction payments in the VAT tax base are very high.

There is another type of payment to which financiers and local tax authorities are persistently trying to apply the provisions of paragraphs. 2 p. 1 art. 162 of the Tax Code of the Russian Federation. We are talking about funds received by the seller from the buyer as interest for providing a commercial loan in the form of installment payment for the property being sold [16]. It would seem that how many times have they heard in response from arbitrators that the amounts of interest accrued for the provision of installment plans are payment for a commercial loan, and not for the sale of property, and therefore are not included in the VAT tax base [17], controllers continue to tax additional assessments, taxpayers – to challenge such decisions of fiscal officials, and arbitration practice – to be replenished with decisions made in favor of taxpayers [18].

By the way, about percentages. According to paragraphs. 3 p. 1 art. 162 of the Tax Code of the Russian Federation, the tax base for VAT is increased by monetary amounts in the form of a percentage (discount) on those received as payment for goods sold (work, services)

[19] bonds and bills, as well as in the form of interest on trade credit. Moreover, these amounts are subject to taxation only when their amount exceeds the amount of interest calculated in accordance with the refinancing rates in force in the periods for which such calculations are made, and the tax is calculated only on the amount of this excess.

In general, the list of situations when the amount of funds received increases the tax base of the seller is open, but, as already mentioned, the transferred amounts are only taxed when they are associated with the sale of goods (work, services), moreover, subject to taxation (not exempt from taxes) VAT. This is stated in paragraph 2 of Art. 162 of the Tax Code of the Russian Federation. Such amounts are taxed at the calculated rate of 18/118 or 10/110 (clause 4 of Article 164 of the Tax Code of the Russian Federation), but in the case where the sales operation is subject to VAT at a rate of 0%, the amounts of money associated with the payment for these goods (works, services) are taxed at a zero rate [20].

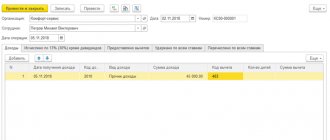

The organization received a bonus from the customer in the amount of 295,000 rubles for early completion of work.

On the day the remuneration amount appears on the current account, the organization must calculate VAT on this receipt (45,000 rubles (295,000 rubles x 18/118)) and reflect this operation in accounting as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| Received bonus amount from the customer | 51 | 76 | 295 000 |

| The amount of the premium is reflected in other income | 76 | 91 income | 295 000 |

| VAT charged on the premium amount | 91 consumption | 68 VAT | 45 000 |

Criterion “Share of VAT deductions” for conducting an on-site tax audit

When selecting organizations for an on-site tax audit, Federal Tax Service specialists evaluate their activities according to certain criteria.

For each criterion there is a threshold value.

If a company's score on this criterion goes beyond the threshold, then its chances of becoming a candidate for an on-site audit increase.

With regard to VAT, the main criterion for tax authorities is the share of VAT deductions in the calculated VAT amount for taxable items

The share of VAT deductions is a percentage characterizing the amount by which a company reduces the amount of tax payable.

In other words, the value of the share of VAT deductions shows what percentage of the accrued VAT the company claims for deduction.

It is this that the tax authorities will compare with the threshold indicator in order to draw a conclusion about the degree of tax risks of the company for VAT.

If the share of VAT deductions according to the taxpayer’s return is greater than the threshold value, then this immediately attracts the attention of tax inspectors.

What is this tax and how much is it subject to?

VAT is considered quite difficult to calculate, so many accounting professionals use calculators to determine it. This is convenient and allows you to save time.

The problem is that the calculation may involve different interest rates. Therefore, only with correct calculation can you get financial benefits. Accounting often makes mistakes in VAT, which causes additional costs.

This type of tax represents the difference received from the sale of individual goods. We are talking about the number that is obtained by subtracting the funds spent on purchasing the goods from the selling price. VAT is calculated from this difference. It does not matter whether this was an improvement in the primary product or whether the price increase was caused by a simple increase in cost.

The obligation to pay VAT does not fall on all entrepreneurs. This is most often encountered by organizations that operate under a general taxation system. They are required to submit reports every quarter. This can be done electronically.

Share of tax deductions for VAT: how to calculate

Here the question arises: the share of VAT deductions - how to calculate?

For calculations, you must refer to the value added tax return.

For calculations, we need two numbers from section 3 of the report:

- line 118: total tax amount calculated taking into account the restored tax amounts;

- line 190: total tax amount to be deducted.

The share of VAT deductions is calculated using the formula:

Share of VAT deduction = Amount of tax deduction (line 190 of section 3) / Amount of total calculated VAT (line 118 of section 3)

Let us remind you that tax authorities analyze the value of the indicator not for one quarter, but for at least 12 months.

Considering that the share is calculated for 12 months, the taxpayer should determine the coefficient at the end of each quarter, and not be limited only to the calendar year.

For example, based on the results of the 1st quarter of 2021, you need to take into account data on accrued VAT and deductible tax for the 2nd-4th quarters of 2021 and the 1st quarter of 2021.

This means that to calculate the safe share of VAT deductions, the formula can be presented as:

DB = (B1 + B2 + B3 + B4) / (H1 + H2 + H3 + H4)

whereB1, B2, B3, B4 - the amount of VAT deductions for 4 consecutive quarters in the last 12 months;

N1, N2, N3, N4 - the amount of accrued VAT for 4 consecutive quarters in the last 12 months.

Once the share of deductions in the total amount of calculated VAT for four quarters has been determined, it should be compared with the share of deductions established by the Federal Tax Service of the Russian Federation.

To calculate the share of VAT deductions, you need to divide all deductions for the tax period by the entire accrued tax and multiply by 100 percent.

Please note: a low tax burden in itself is not evidence of non-payment of taxes.

The Federal Tax Service can only assess additional taxes and fine you for non-payment if, based on the results of a tax audit, violations of the Tax Code of the Russian Federation are established.

From 18% to 20%

A VAT tax rate of 20% is applied to goods (work, services), property rights shipped (performed, rendered), transferred starting from January 1, 2019 .

At the same time, there are no exceptions for contracts concluded this year and continuing in nature with the transition to 2021 and subsequent years.

Therefore, for shipments starting from January 1, 2019, a VAT rate of 20% is applied, regardless of the date and conditions of the conclusion of contracts.

In this case, the seller, in addition to the price of goods (work, services) shipped starting from 01/01/2019, is obliged to present to the buyer for payment the amount of tax calculated at a rate of 20%.

In this regard, amendments to the agreement regarding changes in the VAT rate are not required. At the same time, the parties to the agreement have the right to clarify the calculation procedure and the cost of goods sold (works, services), transferred property rights in connection with changes in the VAT tax rate.

It is also necessary to take into account that changing the tax rate does not change for the taxpayer the procedure and time for determining the tax base for VAT.

Example. Calculation of the safe amount of VAT deduction

Let’s assume that during the reporting period, a taxpayer from Moscow paid VAT in the amount of 100,000 rubles.

According to the company’s declaration, for the specified period the amount of calculated VAT, taking into account the restored amounts, is 1,500,000 rubles (section 3, line 118).

The tax deduction for the same period amounted to 1,400,000 rubles (section 3, line 190).

Substituting these figures into the above formula 1,400,000/1,500,000, we find that the share of VAT deductions in the amount of accrued tax in the period under review was 93.33%.

This is more than the threshold value of 88.08% for Moscow (as of August 1, 2019), which means that there is a possibility that the organization will be included in the on-site inspection plan.

What should be the amount of VAT in the considered example for Moscow, so as not to attract increased attention from tax authorities?

It can be calculated using the inverse formula:

VAT accrued * (100 - VAT safe) / 100 = = 1,500,000 * (100 - 88.52) / 100 = 172,200 rub.

Based on the criteria used by the Federal Tax Service, the company in our example needs to pay at least 172,200 rubles in VAT in order not to leave the “safe” zone.

Electronic services of foreign companies

According to paragraph 3 of Article 174.2 of the Tax Code, foreign organizations providing services in electronic form specified in paragraph 1 of this article, the place of sale of which is recognized as the territory of the Russian Federation, calculate and pay tax if the obligation to pay tax in relation to transactions for the sale of these services is not assigned to tax agent, that is, a foreign intermediary organization carrying out business activities involving participation in settlements directly with buyers of services on the basis of agency agreements, commission agreements, agency agreements or other similar agreements with foreign organizations. The above rule comes into force on January 1, 2021.

Thus, when, starting from January 1, 2021, foreign organizations provide services in electronic form specified in paragraph 1 of Article 174.2 of the Tax Code, the place of sale of which is recognized as the territory of the Russian Federation, the obligation to calculate and pay VAT to the budget rests with the foreign organization , regardless of whether who is the buyer of these services, an individual or legal entity.

In accordance with paragraph 2 of Article 174.2 of the Tax Code, when foreign organizations provide a number of services in electronic form, the place of sale of which is recognized as the territory of the Russian Federation, the tax base is determined as the cost of services, taking into account the amount of tax, calculated on the basis of the actual prices of their sales. In this case, the moment of determining the tax base is the last day of the tax period in which payment (partial payment) for such services was received.

Based on paragraph 5 of Article 174.2 of the Tax Code, the amount of tax is calculated by foreign organizations subject to registration with the tax authorities in accordance with paragraph 4.6 of Article 83 of the Tax Code, and is determined as the percentage of the tax base corresponding to the estimated tax rate of 16.67%.

Taking into account the above, if, when foreign organizations provide services in electronic form, payment (partial payment) for these services was received starting from 01/01/2019, then the taxation of such services is carried out by foreign organizations taking into account the following features:

- if services were provided in electronic form before 01/01/2019, then VAT is calculated at the estimated tax rate in the amount 15,25 %.

- if services are provided in electronic form starting from 01/01/2019, then VAT is calculated at the estimated tax rate in the amount 16,67 %.

If payment is received by foreign organizations before 01/01/2019 for the provision of services in electronic form, starting from the specified date, VAT is not calculated by foreign organizations. In this case, the responsibility for calculating and paying VAT to the budget rests with the buyer - an organization (IP) that is a tax agent .

Can the share of VAT deductions exceed the safe share of VAT deductions legally?

The mere statement of a high percentage reduction in value added tax is not an absolute reason for including an organization in the plan of desk or on-site inspections.

The company's activities are considered comprehensively. A thorough pre-check analysis is carried out in its regard.

Note that sometimes in practice tax authorities ask the taxpayer to explain the reasons for the high share of VAT tax deductions.

At this point, it is important to clearly and reasonably explain why the company has declared a high percentage of reduction in value added tax.

If such reasons are objective in nature, then there is a possibility that the provision of appropriate explanations can reduce the risk of including the taxpayer in the plan of on-site tax audits.

The question often arises: can the share of VAT deductions legally exceed the safe share of VAT deductions?

The answer is, of course it can.

There is no ban on this.

Moreover, if, after a desk audit, the declared amount of tax to be refunded is found to be correct, the Federal Tax Service is obliged to return the excess amount to the taxpayer.

This situation may arise, for example, if:

- the company purchased a large volume of goods, sales of which will occur only in the next quarter;

- the manufacturing enterprise purchased expensive equipment;

- the customer refused to purchase a large batch of products, and the purchase of components for its production had already been made;

- in other reasonable circumstances.

Actions if the safe share is exceeded

If, after submitting the declaration, you consider that the share of deductions exceeds the regional average or 89%, then there are two options for action:

Submit an updated declaration

The taxpayer always has the right to submit an amended return. In it, declare for deduction an amount less than in the primary report. Most deductions can be claimed within 3 years without any problems.

Important! Make sure your deductions are transferrable.