The essence and types of the document

The specifics of the bonus are determined by 2 points:

- This is a voluntary act of the employer, i.e. This is his right, not his duty. As a rule, the employment contract stipulates that the company can provide bonuses to the employee, which in practice implies only one possible case - the initiative of the employer.

- On the other hand, there are no uniform rules for calculating bonuses: i.e. The legislation does not provide for the mode, amount and specifics of payment (on the day of salary or advance payment).

Thus, as for the very fact of paying the bonus, the procedure for this procedure, all this is the good will of the company, and specifically of the authorized persons who have the right to make the appropriate decision. Therefore, responsibility arises only for the correct execution of this financial transaction in the documentation. Exceptions are those cases when the employment contract initially specified the amount of the bonus and the procedure for paying it to the employee.

NOTE. According to labor law, the bonus is a component of the salary. Accordingly, it can only be issued on those days specified in the employment contract.

The procedure for drawing up an order largely depends on the size of the enterprise and the number of its staff: if bonuses for employees in a small company can be organized literally in 1 day, then in a large division the procedure is much more complicated. In general, the order is as follows:

- All heads of branches and separate divisions are notified of the need to prepare for bonuses and, in response, draw up initial lists of employees indicating the position, full name and grounds for the possible accrual of bonuses.

- According to the declared employees, authorized persons are studying the possibility of bonuses in each specific case in accordance with the internal regulations of the companies (fulfillment of the plan, performance indicators, etc.).

- Based on this analysis, the list is adjusted or left unchanged and distributed to all departments.

- The final version is transferred to the draft order, after which the finally approved document on bonuses for employees is printed.

- Each employee included in the list familiarizes himself with the document and must sign.

If some types of bonuses are awarded annually, quarterly and even monthly, others may be allocated on an extraordinary basis. Therefore, the classification of orders depends specifically on the order in which bonuses are issued:

- mass and isolated cases – i.e. immediately to the entire team (or department) or individual colleagues for individual successes;

- planned (periodic) and unscheduled (irregular) - depending on the financial capabilities of the company, bonuses can be issued constantly or only in individual cases.

These payments are classified depending on the reason for the premium:

- Holidays – this often includes corporate gifts in the form of additional payments for the New Year, March 8, as well as a professional holiday.

- Production – i.e. for services related to the implementation of the plan, the implementation of effective measures that improve the work process, optimize production, help save resources, etc.

- Organizational in nature – i.e. awards for successful preparation and implementation of certain events in the interests of the company. For example, a seminar, a round table on an issue, a meeting of clients or guests from abroad, organizing a corporate event, etc.

NOTE. The bonus can be awarded not only in connection with labor successes, but also in connection with holidays, i.e. the employer himself has the right to choose the basis. However, such payments are not intended to help an employee in a difficult life situation. Then we are talking about providing financial assistance. Therefore, most often a bonus is understood as an additional payment exclusively for labor achievements, which, at the same time, can be timed to coincide with holidays.

What dates are considered anniversary dates for the organization?

Hello, in this article we will try to answer the question “What dates are considered anniversary dates for an organization.” You can also consult with lawyers online for free directly on the website.

The Holy Gate (Santa Porta) is a special door installed next to the main one and open only during the established jubilee year.

Thus, all accrued amounts can only be written off from one’s own sources or collected in accordance with the procedure established by law from persons guilty of violating the law, which led to such consequences.

What dates are considered anniversary dates?

It is known that after the Great October Revolution our party raised and educated numerous remarkable cadres of party, state, economic, military, scientific, social, cultural and other figures.

Party bodies not only do not stop such squandering of state and public funds, but often themselves oblige Soviet bodies to allocate significant sums of money for these purposes, although in the overwhelming majority of cases it would be advisable not to hold this or that anniversary or to celebrate it modestly, using personal funds , without spending funds from public organizations.

The fact is that followers of the teachings of Sergius of Radonezh settled here. And the monastery founded by him also celebrates its anniversary. The history of the Kirillo-Belozersky monastery begins with Kirill Belozersky, who in 1397 dug a cave near Lake Siverskoye and settled in it.

Year of life, first decade, 20 years. 30 years is the golden mean. A person desires a lot and is strong enough to achieve his goals. The most important anniversaries are 50 and 60 years.

Invited guests, friends, colleagues and relatives, pay tribute to a wise, professionally accomplished man with respect and gratitude.

Among programmers, 16, 32 and 64 years are also considered anniversaries, since in the binary system they are read as 10,000, 100,000 and 1,000,000 years, respectively.

Rules for paying anniversary bonuses

We have a collective agreement in which anniversary dates begin at 45 years. In June, a decree was found where anniversary dates begin at 25 years. At the beginning of August, I wrote an application for financial assistance to 2 minimum wages (the anniversary date was in January of this year), the manager signed and made an order, where I read that I should be paid 15,000.

If we approach strictly by definition, then anniversaries are considered dates that are multiples of 25 in event terms (375 years of the Zimbabwe Prosecutor’s Office) and multiples of 50 in human terms (30 years is definitely not an anniversary). But in everyday life you can easily see posters “We are 7 years old and we are still alive!! ! Happy holiday to you and us! “.

Nowadays, anniversaries are usually celebrated on the following occasions: this is, of course, a birthday, wedding anniversaries, companies celebrate the anniversaries of their founding.

The wedding ceremony has always been one of the most important celebrations in people's lives. In the past, much attention was paid to this holiday. The modern world has changed little. We simply began to abandon traditions more, moving the wedding celebration to another - secular plane.

Birthday anniversaries according to labor law

Establish that memorable dates of historical events, anniversaries of mass public organizations, individual large enterprises, scientific institutions and educational institutions are celebrated only with the permission of the Central Committee of the CPSU and the Council of Ministers of the USSR in the presence of particularly outstanding achievements or important significance of events in the history of our state.

I thought that this was an infringement of the rights of other celebrants aged ending in 5 who were passed over. Well, in general, an anniversary is a round date from fifty and older: 60, 70, 80, etc.

The word comes from the Hebrew YOVILE. And it meant the date of fifty years of age. Anniversary is not only 50 years. There are other anniversaries. An anniversary is a ten-year anniversary of some significant event.

The smallest anniversary is 10 years.

In addition to the types of material incentives provided for by law, that is, bonuses, allowances and additional payments, each specific employer, depending on financial capabilities, can establish its own employee incentive systems, for example, payment of bonuses or payment of a share from the organization’s profits (the so-called “profit sharing” system ").

It is very important that such important components of the wedding as the groom, bride, parents and witnesses on the wedding day are freed from unnecessary hassle in holding the event, and simply enjoy the holiday along with the guests. In the modern understanding, a professional wedding toastmaster is, first of all, the leader, and in most cases, the organizer of the wedding celebration.

A one-time bonus, in this case for the anniversary date, does not reduce the tax base for income tax. And this bonus is not specified in your bonus regulations.

Each of them must have a fishing rod. They are put on panties in advance, the elastic in which is loosened. Underneath, men will wear regular underpants with one phrase written on them. These are “congratulations”, “happy” and “anniversary”.

Along with the indicators, bonus conditions can also be established, that is, additional requirements, if not met, the bonus will not be awarded to the employee or its amount will be reduced.

Each of them must have a fishing rod. They are put on panties in advance, the elastic in which is loosened. Underneath, men will wear regular underpants with one phrase written on them. These are “congratulations”, “happy” and “anniversary”.

Many joyful events happen in a person's life. Some dates, such as birthdays or wedding days, are usually celebrated annually. A holiday is always a pleasant event. But anniversaries are celebrated especially solemnly.

Similar questions

The Federal Compulsory Medical Insurance Fund provides guidance in practical work with clarifications from the Ministry of Labor of the Russian Federation on the following issues.

The first step when preparing an event is to appoint someone responsible for the holiday. If the anniversary is quiet, modest, with a small number of participants, you can entrust this important mission to one of the employees. He will order a restaurant and select a menu. As for the competition program, such celebrations usually take place over quiet, friendly conversations.

An email with instructions to reset your password has been sent to the email address you provided.

It was said on the radio that on the anniversary of breaking the siege of Leningrad, deputies of the city assembly decided to pay cash rewards to the siege survivors in the amount of 7,000 rubles and to children of war in the amount of 3,000 rubles. I belong to the category Children of War.

Please answer what is needed (what documents and where to submit) to receive the above amount? Withholding unreasonably paid amounts from the employee’s salary in this situation is very problematic. Article 107 of the Labor Code determines that wages overpaid to an employee by an employer, incl.

in case of incorrect application of the law, it cannot be recovered from him, except in cases of counting error.

More details in the System materials: 1. Legal basis: CENTRAL COMMITTEE OF THE CPSU COUNCIL OF MINISTERS OF THE USSR DECISION of December 12, 1958

The bonus system for employees of an organization can be established in collective or employment contracts, agreements, and local regulations of the organization.

Nearby there is a box with a bow, which they point to. The wife, dressed in a peignoir, appears from the gift wrapping to the music. She has a bottle of cognac and a plate of pies in her hands.

Actually, in Greek JUBI means 50, LEI means year, that is, the classic anniversary is the fiftieth anniversary. In general, in the mass consciousness, an anniversary is a round date (divisible by 10). Less often - if it is divisible by 5. Another approach is when dates with repeating numbers (22, 33, 44, 55, etc.) are also included in anniversaries.

The law (Torah) was read to the people and the land rested from field work. This “year of freedom” came every fifty years, after seven weeks, that is, seven seven years. The number seven in the Bible is considered sacred, and multiplied by seven is sacred squared.

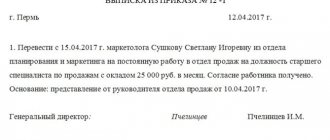

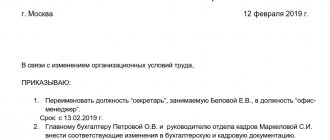

Sample and examples of filling out an order 2019

There are 2 possible forms of this document recommended by law:

The employer has the right to use any form or develop an independent design option . The main thing is to correctly reflect the transaction in accounting documents and other financial papers. The main requirement for content is to whom the bonus is awarded, in what exact amount and on what basis. Usually the order also reflects the name and position of the person who is responsible for its implementation.

Read more Composition of the interim liquidation balance sheet

An example of a bonus order (in the case of payment to two employees) could be like this.

Thus, the document includes:

- Title - a header with the usual information: full name of the company, number, date and name of the order.

- The main part, which lists the persons awarded the bonus (full name, position, personnel number), the basis for the issuance and the amount of the amount. In this case, the size can be indicated either in numbers or as a percentage (for example, 10% of the salary). It is also stated here on the recommendation of which employee the bonus is awarded if there was a business recommendation.

- Signature of the manager, date and annex with the signatures of all awarded employees confirming the fact of their familiarization with the award.

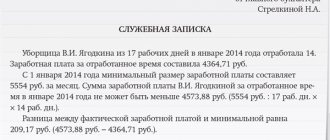

Grounds for bonuses for accountants

What are the grounds for paying a bonus to the accounting department, which contributes to the coherence of all processes of the enterprise:

- An accountant, for example, can be motivated and rewarded for the intensity of work in a certain reporting period, based on the results of which a payment should be made. The workload may increase during the preparation and submission of reports, the deadlines of which cannot be missed. In addition to his main job, an accountant prepares, for example, annual reports for submission; the employer can take this fact into account.

- Payment can be made for replacing another accountant and performing his duties in whole or in part. Typically, employees replace each other during vacations or during illness, since the work process cannot be stopped.

- You can award a bonus to an accountant for work that is unusual for his professional duties. For example, an employee spends some time correcting or preparing primary documents, which managers or operators should do; perhaps he is teaching the work process to a newly hired employee. In practice, what most often happens is that accountants have to identify managers’ mistakes, although this should be done by their immediate supervisor. Instead of analyzing data for accounting, preparing reports, and processing primary data, accountants waste time on the shortcomings of other employees.

Indicators

The absence of errors in work and the coherence of the actions of the entire accounting department are the main criteria for calculating the bonus. It is also important to understand that in the work of an accountant, like any other employee, mistakes cannot be avoided, but how quickly they can be eliminated without consequences for the enterprise is of great importance.

The bonus indicators for an accountant at an enterprise must be correctly established; for example, you can take the following list:

- absence of complaints from other employees regarding the performance of official duties by the accountant;

- improvement of accounting through the introduction of new software;

- high-quality and timely inventory of the enterprise;

- taking the initiative to attract investors;

- timely and high-quality preparation of reports on personalized data to the Pension Fund, other funds, tax and regulatory authorities;

- absence of comments on the results of various inspections;

- compliance with the requirements of the Accounting Policy Regulations;

- high results when performing complex unscheduled work;

- absence of errors when calculating wages and timeliness in issuing pay slips to employees;

- high speed when performing various functions when it is necessary to make calculations with the budget, develop new programs or regulations;

- maintaining financial discipline;

- other.

Indicators for calculating bonuses to an accountant most often do not have a clear framework.

Labor participation rate

If the company employs only one accountant, then the allocated bonus will go entirely to him. If there are several employees in the accounting department, then the bonus should be distributed among them. The labor participation rate is applied based on how much work was performed by each accountant.

Labor participation is not only the coordinated performance of certain work by the entire team, but also replacing an absent employee. In this case, the bonus should be awarded to the accountant who worked for a sufficiently long time, performing the duties of two employees.

Payment for additional features

Often the accounting department has to perform additional functions, especially if there are currently not enough “personnel” at the enterprise. By order of the director, responsible employees are assigned the duties of secretary, manager, operator, and other employees. If an accountant does not systematically receive payment for performing additional work duties, he needs to be given bonuses from time to time.

A sick leave certificate for a deceased employee is provided in any case, because on its basis, payment will go to the relatives of the deceased.

Experts will also tell you when it is permissible to suspend work due to non-payment of wages.

For mentoring

The chief accountant most often has to transfer his knowledge to new employees of the accounting department. Therefore, its systematic encouragement is most often found in the Regulations on bonuses, which are developed by enterprises independently.

Mentoring is an unusual function for an accountant, since he was not specifically trained in these skills. A competent employer motivates the accountant’s desire to help “newbies” through bonuses.

Which is better – a ready-made form or your own?

As a rule, it is more convenient to use a ready-made form, since it provides:

- convenience in terms of design - no need to waste time developing your own sample;

- ease of working with the document in the accounting department - all key details are already registered;

- and most importantly, thanks to the indication of details, the inspectors will have fewer questions about bonus payments, which in large companies can amount to large amounts - on the order of hundreds of millions of rubles.

Employee bonuses: 6 risks for the employer

Since issuing a bonus is a financial transaction, there are certain risks on the part of the inspection inspectors. They concern, first of all, tax inspectors, but often come from representatives of the labor inspectorate.

Risk 1. Incorrect wording in the employment contract

Often, an employer indicates that its employee with whom the contract is concluded is entitled to a monthly or quarterly bonus in a set amount, for example 15% of his salary. In this case, the bonus in fact becomes an integral part of the salary, since the employer pays it within the agreed terms and in the established amounts, the obligations of which he himself has assumed. It is more correct to reflect the fact of payment in the category of “right” rather than “obligation” of the employer - otherwise, in essence, it is no longer a bonus, but a salary.

Risk 2. Payments of “13 salaries”

A bonus at the end of the year in the amount of the entire average salary or a significant part of it is traditionally called the “13th salary.” There is no such concept in the law; accordingly, such a bonus is the exclusive goodwill of the employer. But again, it is important to correctly reflect it in the employment contract (individual and collective), as well as in the local internal acts of the enterprise. At the same time, only references to these acts can be indicated in contracts, and the payment procedure must be spelled out in as much detail as possible in the acts:

- connection between salary payment and employee performance indicators;

- the possibility of non-payment of this type of premium with a detailed description of the entire list of reasons, including due to an economically unfavorable situation;

- It is especially important to pay attention to the procedure for payment upon dismissal: should the employee work the whole year or not, how to pay if the dismissal occurs due to layoffs, liquidation of the company, etc.

Risk 3. Holiday bonuses

Such payments are considered by most managers as symbolic gifts in the amount of 500-1000 rubles. Therefore, attention is often not paid to this point, and everything comes down to the wording “The employer pays each employee a bonus of 1000 rubles annually by March 22 – the company’s Founding Day.” In this case, it is better to protect yourself from financial risks and indicate that the company undertakes to do this only if possible, and also reserves the right not to pay a bonus if the employee grossly violated the work schedule, etc.

Risk 4. Bonus amount and working hours

One should also take into account the important point that not all employees work the standard/quarterly/monthly hours due to various circumstances - vacations at their own expense, sick leave, maternity or child care leave, etc. Therefore, the amount of the bonus, as well as the very possibility of its payment, should be closely and unambiguously linked to a certain norm: for example, at least 180 working days.

Risk 5. Deduction of bonuses and deprivation of the right to a bonus

Read more Divorce without children by consent terms

These concepts are widely present in real labor practice, however, confusion often arises with the interpretation both in documents and at the level of oral explanation by management of company standards for employees. In an employment contract, collective agreement and other documents, it is important to clearly distinguish both concepts. If deprivation of bonuses is a measure that is legally taken by the employer in the event of a significant mistake made by an employee while performing his duties, then deprivation of the right to a bonus may also have purely economic, objective reasons. Usually all these nuances are spelled out in detail in local acts.

Risk 6. How to properly develop premium reduction mechanisms

Both the grounds for accrual/non-accrual of the premium and the grounds for its justified reduction should be specified in the local act in great detail. It is best to give not specific numbers (a reduction of 500 rubles, etc.), but percentages - for example, “if an error is made when servicing a client, which leads to his refusal to cooperate, the monthly premium is reduced by 10% from the initially established amounts." Most often, the size of the reduction is set using a simple formula - proportional to the extent to which the plan was fulfilled, and it is important to take into account not only individual indicators, but also the connection with the performance indicators of the department and the entire unit. This is especially true for large companies.

Thus, it is better to foresee all the key points given in advance. The main criterion for the correct procedure for awarding bonuses to an employee is drawing up orders and contracts in such a way that he himself can calculate the amount of payment at any time. Those. The calculation of the premium must be extremely transparent, and the grounds for payment or non-payment must be extremely clear.

Birthday anniversaries according to labor law

Does anyone know which dates are legally considered anniversary dates? The collective agreement simply states “bonuses for anniversaries.” They always paid at 40, 50, 60.

And then the gene got the idea: let’s give so-and-so a bonus at 55. I thought that this was an infringement of the rights of other celebrants aged ending in 5 who were passed over.

I'm interested in the regulations: are there any specifics about anniversaries? I have not found.

I'll find it tomorrow at work, I'm sure it's there.

Resolution of the Central Committee of the CPSU and the Council of Ministers of the USSR of December 12, 1958 No. 1361 “On establishing order in the celebration of anniversaries”

The Central Committee of the CPSU and the Council of Ministers of the USSR note that recently there have been numerous instances of holding anniversaries of enterprises, institutions, societies, educational institutions and individuals at arbitrary dates and often regardless of the merits of the celebrants to the state and people. Quite often, anniversary dates are determined incorrectly.

In order, for example, to celebrate the anniversary of some large enterprises newly built during the years of Soviet power, the period of their existence is artificially increased by adding the history of small workshops, on the site of which one or another large enterprise later arose.

In this way, all kinds of anniversary dates are unreasonably and arbitrarily established.

It is known that after the Great October Revolution our party raised and educated numerous remarkable cadres of party, state, economic, military, scientific, social, cultural and other figures.

Over the years, tens of thousands of first-class factories, factories, power plants, scientific institutions, higher educational institutions have been built in the country, new branches of the national economy have been created, and if we celebrate the anniversaries that are now coming for these organizations and many figures, we would have to take the path of continuous anniversary celebrations.

However, many party and Soviet bodies do not take this into account and, instead of modestly celebrating this or that anniversary date in the local press or at a team meeting, they strive to give almost every anniversary all-Union or republican significance and celebrate it on a large scale, with great pomp. To celebrate anniversaries, anniversary committees and commissions are created that develop extensive events, invite numerous guests, including from foreign countries, make decisions on the issuance of all kinds of anniversary medals, badges, postage stamps, anniversary collections, widely advertise anniversaries in the press, organize exhibitions, filming, purchasing gifts for anniversaries and guests at state expense, distracting many people to prepare anniversary celebrations. Party bodies not only do not stop such squandering of state and public funds, but often themselves oblige Soviet bodies to allocate significant sums of money for these purposes, although in the overwhelming majority of cases it would be advisable not to hold this or that anniversary or to celebrate it modestly, using personal funds , without spending funds from public organizations.

The Central Committee of the CPSU and the Council of Ministers of the USSR receive numerous requests from party, Soviet, economic, public organizations and individuals for the awarding of orders, medals, bonuses for workers and the allocation of funds in connection with various anniversaries.

The Central Committee of the CPSU and the Council of Ministers of the USSR consider this situation to be abnormal and draw the attention of party, Soviet, economic, scientific and public organizations to the fact that the passion for holding anniversaries of each organization, enterprise, institution, individual figures without sufficient grounds is unnecessary narcissism and arrogance, leads to unacceptable waste of public funds.

The Central Committee of the CPSU and the Council of Ministers of the USSR decide:

1. Oblige the Central Committee of the Communist Parties of the union republics, regional committees, regional committees of the CPSU, Councils of Ministers of the union and autonomous republics, regional (territory) executive committees to eliminate the shortcomings noted in this resolution and to establish strict order in the celebration of anniversaries.

2.

Establish that memorable dates of historical events, anniversaries of mass public organizations, individual large enterprises, scientific institutions and educational institutions are celebrated only with the permission of the Central Committee of the CPSU and the Council of Ministers of the USSR in the presence of particularly outstanding achievements or important significance of events in the history of our state. In such cases, the anniversary is celebrated on the fiftieth anniversary, centenary, and then fifty years from the date of the existence of the organization or the completion of the event.

3.

The anniversary of outstanding party, state and public figures, outstanding representatives of science, culture, heroes of labor, as well as honoring the memory of great people who glorified our Motherland with their government activities, discoveries and achievements in the field of science, technology, literature and art, can be celebrated if this will be deemed necessary, with the permission of the Central Committee of the CPSU and the Council of Ministers of the USSR. The anniversary date for individuals is considered to be the fiftieth anniversary of their birth or another subsequent decade.

4. The Central Committee of the CPSU and the Council of Ministers of the USSR emphasize that anniversaries must be celebrated modestly, with the participation of the local community, as a rule, without spending funds from state and public organizations. The anniversary date of a particular figure can also be celebrated at the expense of personal funds.

Actions

Source: https://lawsexp.com/juridicheskie-sovety/jubilejnye-daty-dnej-rozhdenija-po-trudovomu.html

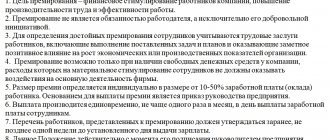

Regulations on bonuses

The features of the procedure can be reflected in the following documents:

- Regulations on bonuses.

- Individual and collective labor contracts.

- Relevant local acts.

At the same time, the contracts do not need to spell out in detail the entire procedure, which itself should take up several printed pages, but only refer to a document that contains the relevant information. At the same time, it is important to familiarize each employee with the Regulations on bonuses against signature .

Thus, the scheme for establishing a bonus procedure may look like this.

A ready-made example of a standard Bonus Regulation is presented below.

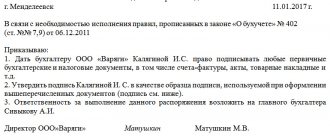

Drawing up promotion documentation

The grounds for incentives are collective agreements, labor agreements and internal regulations of the enterprise. This form of remuneration may be provided:

- in labor rules;

- wage regulations;

- a separate award document.

The documentation setting out the rules of the incentive system must contain the following information:

- types of awards;

- conditions, procedure and indicators for issuing the additional amount;

- bonus amounts;

- payment procedure;

- the frequency with which additional payments may occur;

- a list of cases of reduction in the amount of the bonus or its deprivation.

Let us remind you once again that it is imperative to specify the incentive motive in the order. An example is an increased number of sales or manufactured products over a certain period of time.

Taxation of premiums

Since a bonus is a type of salary, i.e. in fact, this is part of it, then it also belongs to the tax base, like the salary itself. Those. As a general rule, personal income tax and insurance premiums are withheld from the premium amount . Exceptions include the following cases:

- Foreign or domestic awards for achievements in science, education, literature, art, technology (inventions, Nobel Prize, UNESCO Prize, etc.).

- Payments as financial assistance, which can be paid no more than 4,000 rubles per year for each employee. Accordingly, taxes and contributions are paid on all excess amounts.

And finally, video instructions for drawing up a document, as well as an analysis of the possible consequences in case of its absence.

Watch our video about why such an order is needed and how to draw it up correctly.

Find out on the forum how your colleagues prepare documents for awards. For example, on this thread you can read how and when an order for bonuses for employees is created/

When is an order to pay bonuses to employees issued?

An order for bonuses for employees is usually issued based on work results for a certain time period: month, quarter, year. Additionally, other types of bonuses may be paid with varying regularity and one-time payments.

In order for the bonus to have a legal form, the possibility of its payment is provided for in an internal local act - the regulation on bonuses or on remuneration.

Read about how wage regulations are drawn up here.

The algorithm for processing an order for bonus payments to employees includes several stages:

- formation of initial lists for bonuses by department;

- checking compliance with bonus conditions;

- adjustment of the list of employees worthy of material remuneration, due to the presence of grounds for deprivation of bonuses for some of them;

- coordination and clarification of the final amount of bonus payment personally for each employee on the list with the heads of departments;

- Submitting the final version of the order to the manager for approval.

To learn about the grounds on which an employee can be deprived of a bonus, read the article “What are the grounds in the Labor Code of the Russian Federation for depriving an employee of a bonus?”

Criteria and procedure for bonuses for chief and ordinary accountants

Labor productivity directly depends on the incentive (bonus) system (SP) at the enterprise. If it is designed well, it will really increase employee engagement. Encouragement should be understood as recognition of an employee’s success in professional activities, which is performed publicly.

If the enterprise's labor incentive system (LIS) is not sufficiently developed, this leads to the fact that careless and conscientious employees are in equal positions. In modern society, joint venture in enterprises depends on the financial situation of a particular employer.

When providing incentives, the employer is obliged to be guided by the norms of labor legislation. Incentives should be available to any employee of the enterprise and be systematic. Moreover, employees should know for what results in their professional activities they are rewarded.

The higher the productivity of a particular employee compared to others, the greater the amount of his incentive should be. It is necessary to carry out incentives publicly and openly based on the results of work for a month or a week, because longer periods lead to a loss of interest in work.

When any incentive is offered, all employees must be notified of it. Despite the fact that the nature and amount of incentives depend on the degree of participation of a particular employee in the work of the entire enterprise, the entire joint venture as a whole must be fair to everyone. The joint venture must combine 2 types of incentives for workers to work: moral and material.

Labor legislation provides for the encouragement of employees in the form of announcements of gratitude, payment of bonuses, presentation of valuable gifts, presentation of certificates or awarding the title of the best. Salary (salary), together with compensation and incentive payments, constitutes remuneration for work.

The most effective and widespread type of financial incentive is a bonus. Thus, the correctness of accounting and tax accounting, timely filing of reports and much more depend on the efficiency of accountants, which allows you to avoid penalties. But bonuses for an accountant cannot differ from rewards for other employees, although this particular category of employees does not bring profit to the enterprise.

Types of “premium” orders

The types of bonus orders are as follows:

1. By volume of information:

- mass - compiled in the case of bonuses for a group of workers or the majority of members of the workforce;

- single - issued when rewarding an individual employee for certain achievements or merits.

Read more A private practitioner is prohibited from prescribing

2. According to the regularity of registration:

- planned - issued with the frequency established by internal local acts (orders on monthly, quarterly or annual bonuses);

- unscheduled - issued if necessary by decision of management.

3. Based on the basis for remuneration:

- production - for achieving production indicators, rationalization developments, etc.;

- organizational - for active participation in the public life of the team, sporting achievements, etc.;

- holidays - for a professional holiday, anniversary and in connection with other similar dates.

All of these types of “bonus” orders, despite the different wording of their grounds and different frequency of publication, have a common structure

Regulations for issuing bonuses to employees

Thus, bonuses for professional holidays can be taken into account when taxing profits if they are included in the remuneration system, are established by a labor (collective) agreement and are issued for production achievements. This opinion is shared by the Russian Ministry of Finance (Letter dated 02/05/2008 N 03-03-06/1/81).

Other types of incentives are also allowed, which are prescribed in the regulations of enterprises, collective agreements, as well as other documents (Part 2 of Article 191 of the Labor Code of the Russian Federation).

The basis for issuing an order is a memo, presentation or petition from the employee’s immediate supervisor or the head of another service or department.

Sample order for a bonus for good work

An order for bonuses can be issued either on a unified form (T-11, T-11a) or in a free form (taking into account the required details).

Structure of the bonus order:

- header part (name of the employer, number and date of the order, its subject);

- main section (wording of the manager’s order on bonus payments to employees);

- final part (signature of the manager, signatures of employees indicating familiarization).

If the first and final parts of the order are familiar and do not require additional explanation, then it is necessary to dwell on the content of the main section in more detail. The following important nuances should be clear from the text:

- who is subject to bonuses (full name, position, personnel number);

- for what achievements and merits;

- how much remuneration is provided;

- for what period is the premium paid?

In this case, it is better to avoid unclear wording. For example, the phrase “for good work” should be replaced with a more precise one, for example, “due to the completion of the planned task on time.”

A sample bonus order may look like this:

Limited Liability Company "A April 2021 No. 126/K

On bonuses based on performance results for the 1st quarter of 2021.

In accordance with clause 3.4 of the regulations on bonus payments to Atmosfera LLC in connection with the achievement of planned production indicators for the mechanical assembly shop based on the results of the 1st quarter of 2021, I order:

An employee’s salary is his remuneration for his work, depending on the qualifications of such an employee, the complexity, quantity, quality and conditions of the work performed, as well as compensation and incentive payments (Part 1 of Article 129 of the Labor Code of the Russian Federation). Incentive payments also include bonuses. In general, a bonus is an additional incentive for work. But bonuses can be given to employees not only for labor achievements, but also in connection with other circumstances. This includes, for example, a holiday bonus. In our consultation we will provide a form for an order for a holiday bonus and a sample of how to fill it out.

What are the employee incentive measures?

To increase labor discipline and production indicators, various organizations often practice comprehensive measures of incentives for work and punishments for shoddy work. If we rely on the Labor Code of the Russian Federation, in particular Article 191, on the part of the employer, incentives for employees can be expressed in the following:

- appointment of a bonus;

- formal thanks;

- donation of a valuable item;

- highlighting the employee as the best in the team;

- issuance of a certificate.

Holiday bonus: order

Payment of bonuses for holidays may be provided for in employment contracts with employees, a collective agreement, or local regulations of the employer (for example, the Regulations on Bonuses). Although even the absence of a mention of the bonus in the specified documents is not an obstacle to its payment.

The inclusion of a condition for the payment of a holiday bonus in employment, collective agreements or LNA will affect the procedure for accounting for this type of bonus when calculating average holiday earnings. The holiday bonus provided for by the remuneration system is included in the calculation of the employee’s average earnings for calculating his vacation pay, but the one not provided for is not. But when calculating sick leave, holiday bonuses are always taken into account, because they are subject to insurance premiums (Letter of the Ministry of Finance dated 02/07/2017 No. 03-15-05/6368, Article 14 of the Federal Law dated 12/29/2006 No. 255-FZ).

As for income tax expenses, it will not be possible to take into account the holiday bonus, even if it is provided for in the employment contract (Determination of the Supreme Arbitration Court dated March 18, 2013 No. VAS-2487/13 in case No. A53-2286/11, Letters of the Ministry of Finance dated April 24 .2013 No. 03-03-06/1/14283, dated 03/15/2013 No. 03-03-10/7999).

Regardless of whether or not the payment of holiday bonuses is provided for in employment contracts or LNA, the employer must issue a “bonus” order. As an order form, you can use unified forms No. T-11 “Order (instruction) on rewarding an employee,” No. T-11a “Order (instruction) on encouraging employees” or use a independently developed form.

Types of employee incentives

An employee can be rewarded not only in material form. The main types of incentives used in practice:

- announcement of gratitude;

- cash bonus;

- nomination for the title of the best in the profession;

- issuance of a valuable gift;

- awarding a certificate of honor.

The list, in accordance with Art. 191 of the Labor Code of the Russian Federation, is not closed; the bonus system is established for each specific enterprise in local regulations. For special achievements, a presentation for state awards may follow.