This article will consider a sample of filling out sheet 3 of the 3-NDFL declaration, which will help taxpayers dealing with securities or derivative financial instruments to cope with the preparation of a document of this kind much easier and faster.

[sc:docObr id=”https://grazhdaninu.com/wp-content/uploads/2017/06/3-ndfl.pdf” mytext=”new tax return form 3-NDFL”]

In addition, the article will provide examples of filling out sheets D1 and D2 of the tax return.

- You can download the 3-NDFL declaration form for 2021 here.

- A sample of the 3-NDFL form, including sheets Z, D1 and D2, can be downloaded here.

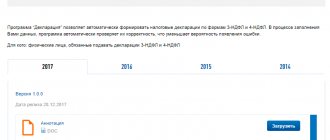

- The program for filling out the declaration is available at this link.

Sheet d1 of personal income tax declaration 3 sample of filling out property deduction

A tax return drawn up in form 3-NDFL includes many sheets, including an example of sheet D1 for calculating property tax deductions.

Most taxpayers who want to reduce their tax base in connection with the purchase of real estate encounter difficulties at the stage of filing a declaration.

In this regard, we propose to discuss in detail the procedure necessary for filling out a document of this kind. Table of contents

- Example for calculation When to submit sheet D1 for verification

- Who should fill out

- When purchasing what property is a document drawn up?

- Filling out the sheet

When it comes to preparing a document such as a tax return, an individual, first of all, should understand that absolutely all data relating to his expenses and income is entered there.

Sheet D1 of the 3-NDFL tax return - sample filling

Attention: On Sheet D1, property tax deductions are calculated for expenses on new construction or the acquisition of a real estate object (objects) provided for in Article 220 of the Code. 10.3.

If the taxpayer, according to the Declaration, claims property tax deductions for expenses associated with the acquisition (construction) of several (different) real estate objects, then the required number of pages of Sheet D1 are filled out, containing information about the objects and expenses incurred on them (item 1 of Sheet D1).

In this case, the calculation of property tax deductions (clause 2 of Sheet D1) in this case is reflected only on the last page based on the sum of the values of clause 1 of Sheet D1. 10.4.

Online magazine for accountants

Code, was provided to the taxpayer in previous tax periods, the value of subclause 2.10 is determined as the difference between the value of subclause 1.12 and the sum of the values of subclauses 2.1, 2.5 and 2.8. (as amended by the Order of the Federal Tax Service of Russia dated November 25.

2015 N ММВ-7-11/ [email protected] ) If the taxpayer did not use the property tax deduction in previous tax periods, the value of subclause 2.10 is determined as the difference between the value of subclause 1.10 and the sum of the values of subclauses 2.5 and 2.8; in subparagraph 2.

11 indicates the balance of the property tax deduction for the cost of paying interest on targeted loans (credits) received from credit and other organizations of the Russian Federation, as well as on loans received for the purpose of refinancing (on-lending) loans (loans) for new construction or acquisition of an object, carried over to the next tax period.

Procedure for filling out 3-NDFL

Important Sheet G “Calculation of professional tax deductions established by paragraphs 2, 3 of Article 221 of the Tax Code of the Russian Federation, as well as tax deductions for the sale of shares in the authorized capital and for the assignment of the right of claim under an agreement for participation in shared construction” XV.

The procedure for filling out Sheet 3 “Calculation of taxable income from transactions with securities and transactions with financial instruments of futures transactions” of the Declaration form XVI.

The procedure for filling out Sheet I "Calculation of taxable income from participation in investment partnerships" of the Declaration form Appendix No. 1 Directory "Taxpayer Category Codes" Appendix No. 2 Directory "Codes of Types of Documents" Appendix No. 3 Directory "Codes of Regions" Appendix No. 4 Directory "Codes of Types of Income" » Appendix No. 5 Directory “Object name codes” Appendix No. 6 Directory “Codes of persons claiming property tax deduction” X.

Declaration sheet d1 - example of calculating property deductions

Sheet D1 of Declaration 3-NDFL - the amount of property tax deduction for expenses on new construction or acquisition of an object, which was filed in the reporting tax period by the tax agent (employer) based on a notification from the tax authority;

- in sub. 2.6 Sheet D1 of Declaration 3-NDFL - the amount of property tax deduction for the cost of paying interest on targeted loans that were received from credit and other organizations of the Russian Federation, and on loans that were received to refinance loans for new construction or the acquisition of an object that was submitted in the reporting tax period by a tax agent (employer) based on a notification from the tax authority;

- in sub.

Sample 3-NDFL declaration for deduction when buying an apartment

After all the sheets of the document are completed, the taxpayer must submit them for verification to the tax office, and not just any one, namely the one located at the place of his registration. When do you need to submit sheet D1 for verification? Russian tax legislation establishes a certain time limit on the preparation and submission of documentation.

Information must be entered into the tax return and, accordingly, its sheet D1 only after the end of the year in which the property was acquired.

Thus, if an individual purchased an apartment in 2021, then he will need to wait until the end of this year, then enter into the document all the data on his income and expenses for this period and submit a declaration for consideration (in 2021).

Repeated declaration of 3-personal income tax for property deduction

220 Tax Code of the Russian Federation. 10.3.

If the taxpayer, according to the 3-NDFL Declaration, declares property tax deductions for expenses that are associated with the acquisition/construction of several (different) real estate properties, then you need to fill out the appropriate number of pages of Sheet D1 of the certificate in the 3-NDFL form, which will contain information about the objects and expenses incurred on them (item 1 of Sheet D1).

Sheet Z;

Source: https://sv-groups.ru/list-d1-deklaratsii-3-ndfl-obrazets-zapolneniya-imushhestvennyj-vychet/

New form 3-NDFL in 2021

The Federal Tax Service of Russia issued an order dated October 3, 2020 No. ММВ-7-11/ [email protected] “On approval of the tax return form for personal income tax (form 3-NDFL), the procedure for filling it out, as well as the format for submitting the tax return on personal income tax in electronic form.” (Registered 10/16/2020 No. 52438).

You can take the declaration form from the tax office at your place of residence or download it from the Internet and fill it out manually. This type of work requires a lot of attention and certain skills. Responsibility for the correct entry of each figure in the form lies entirely with the taxpayer.

Sheet D1 of tax return 3-NDFL - sample filling

Sheet D1 of the 3-NDFL declaration - a sample filling will be needed for those who have purchased or built residential real estate and want to receive a tax deduction for the expenses incurred for this. Our article will tell you how to fill out this declaration sheet correctly.

NOTE! The declaration for 2021 must be submitted using the new form from the Federal Tax Service order dated 10/03/2018 No. ММВ-7-11/ [email protected] you can here.

Who makes the calculations and why in sheets D1 and D2 of form 3-NDFL

How to correctly fill out 3-NDFL for filing a tax deduction

The procedure for filling out sheet D1 of the 3-NDFL tax return, if the deduction is issued for the first time: section 1

Filling out sheet D1 if the deduction is issued for the first time: section 2

Sheet D1 of the 3-NDFL declaration - sample filling if the deduction is issued again

Results

Who makes the calculations and why in sheets D1 and D2 of form 3-NDFL

Sheets with the letter D in 3-NDFL are filled out by individual taxpayers who:

- are tax residents of the Russian Federation;

- carried out an operation (operations) with real estate, which gives them the right to a tax deduction in the reporting year in accordance with Art. 220 Tax Code of the Russian Federation.

However, at the same time:

- in sheet D1, the deduction associated with the purchase of property specified in subparagraph is calculated. 3 and 4 clauses 1 art. 220 Tax Code of the Russian Federation;

- Sheet D2 reflects the formation of a deduction associated with the sale of property named in subparagraph. 1 and 2 paragraphs 1 art. 220 Tax Code of the Russian Federation.

In this material we will look at the procedure for forming sheet D1, which is filled out in the following cases:

- if the personal income tax payer purchased residential real estate (apartment, house, etc.);

- if the personal income tax payer purchased land under a residential building or suitable for building such a house on it;

- if the payer built the house himself;

- if for the purposes of the above purchase or construction the payer took out a loan at interest and paid the interest.

For all these reasons, the personal income tax payer can reduce the amount of tax withheld from him and request a refund from the budget of the personal income tax amounts previously transferred for him.

To receive a tax deduction (and refund), the payer needs:

- submit to your tax office documents confirming his expenses on the grounds set out in subparagraph. 3 and 4 clauses 1 art. 220 Tax Code of the Russian Federation;

- write an application for deduction (refund) of personal income tax amounts for the period;

- draw up and submit a 3-NDFL declaration indicating your income (for example, by place of work in the reporting year) and calculating the amount of the deduction due to him in sheet D1 of the 3-NDFL declaration.

How to correctly fill out 3-NDFL for filing a tax deduction

The rules for the formation of 3-NDFL are established by the procedure approved by the order of the Federal Tax Service dated December 24, 2014 No. ММВ-7-11 / [email protected] (hereinafter referred to as the Procedure).

Regarding filing 3-NDFL for the purpose of obtaining a tax deduction under Art. 220 of the Tax Code of the Russian Federation, the following main points can be highlighted:

1. The declaration must contain a cover page containing the information required by the Procedure.

2. Section 1 is formed, which indicates:

- line 002 - the total amount that the payer intends to return from the budget, and KBC and OKTMO for which there was an overpayment in the reporting year;

- page 003 - calculation of the resulting overpayment. As a rule, this occurs due to the fact that during the year tax agents withheld personal income tax from the payments of the person applying for deduction and sent it to the budget. Information about such total payments and deductions is disclosed on page 3 of the form.

IMPORTANT! For the calculation on page 3, it is also recommended to stock up on documents confirming income and deductions (for example, 2-NDFL certificates from employers).

3. Transcript sheets are filled out:

- A - income from a source in the Russian Federation (as many sheets A are filled in as there were sources in the reporting year);

- D1 - calculation of the property deduction for the acquisition (construction) of a residential real estate property (also filled out for each object separately, that is, there will be as many sections of 1 sheet D1 as there were purchased or built objects);

- D2 - calculation of the deduction due when selling real estate (information for each object is filled out by analogy with sheet D1).

NOTE! The amounts of income that are transferred from section 2 to sheets D1 and D2 should already be reduced by the amount of standard and social deductions for personal income tax (under Articles 218 and 219 of the Tax Code of the Russian Federation). If such deductions are present in the period for which 3-NDFL is compiled, you should fill out another sheet - E1.

The procedure for filling out sheet D1 of the 3-NDFL tax return, if the deduction is issued for the first time: section 1

Sheet D1 consists of 2 sections:

- in the 1st, information is entered about the property and the types of expenses incurred on it (payment for the purchase (construction) itself or interest on the loan);

- in the 2nd, the calculation itself is made taking into account the maximum permissible deduction amount (for the purchase of real estate - this is 2,000,000 rubles (clause 3 of Article 220 of the Tax Code of the Russian Federation)).

As noted earlier, the procedure for filling out the form provides for as many sections 1 (and, accordingly, sheets D1) as there are objects declared by the payer. But section 2 will be one, consolidated on the last sheet of D1.

Rules for entering data into the 1st section of sheet D1:

1. Subsection 1.1 - encoding is established as an appendix to the filling procedure:

- 1 - house (residential);

- 2 - apartment;

- 3 - room;

- 4 - share in objects from paragraphs 1–3;

- 5 - land for individual residential development;

- 6 - land under finished housing (house);

- 7 - house on a plot of land (in the complex).

2. Subsection 1.2 - type of ownership:

- 1 - sole;

- 2 - shared;

- 3 - joint;

- 4 – property of a minor.

3. Subsection 1.3 - the taxpayer’s attribute is entered:

Subscribe to our accounting channel Yandex.Zen

Subscribe

- 01 - the owner himself;

- 02 - spouse of the owner (for cases when the right to deduction is divided between spouses);

- 03 - parent of the minor owner;

- other code options for various situations are attached to the filling procedure.

4. Subsection 1.4 serves to indicate information about whether the payer has the right to transfer the deduction to previous tax periods. Those who have retired but decide to take advantage of the required deduction have this right.

Accordingly, such a person no longer has personal income tax withholding from employers at the moment. Therefore, he was given the right to issue a deduction for those periods (years) when he was still working and personal income tax was paid on him.

If the payer has the right to compensate personal income tax for earlier periods, we put 1 in section 1.4, in all other cases - 0.

5. Subsections 1.5 to 1.10 contain information transferred to them from official documents that will be submitted along with 3-NDFL to confirm the deduction. Please note that subsection 1.10 should be left blank if the documents for shared ownership are dated after 01/01/2014.

6. Subsection 1.11 at the first application for deduction remains empty. It is intended for entering information only if the application for a deduction is submitted again and the deduction was partially made according to the previous application. Then subsection 1.11 indicates when the previous appeal was submitted.

7. Subsection 1.12 reflects the total amount of the deduction that the applicant can claim. An upper limit has been set for it - 2,000,000 rubles (clause 3 of Article 220 of the Tax Code of the Russian Federation).

That is, the amount claimed for deduction may be less (based on actually incurred and confirmed expenses), but not more.

If actual expenses exceed the upper limit of 2 million rubles, the subsection still indicates the limit value.

IMPORTANT! If several sheets of D1 are filled out for several objects, the total value for deduction in subsection 1.12 should still not exceed 2 million rubles.

8. Subsection 1.13 contains the amount of accumulated, but not used for deduction of, interest on credits (loans) spent on the purchase (construction) of residential real estate. For interest, a limit has also been established in which you can take advantage of the personal income tax deduction - this is 3,000,000 rubles.

https://www.youtube.com/watch?v=UhqbdZOiS0s

NOTE! Clause 1.13 indicates the amount of only the interest actually paid on borrowed funds. To confirm them, you need to take a certificate from the credit institution that provided the loan and received interest.

Filling out sheet D1 if the deduction is issued for the first time: section 2

Section 2 calculates the deduction amount. Actually, this is the section for which the entire declaration is filled out. And it is this that causes the greatest difficulty for those who are not used to filling out tax forms.

Some tax authorities working with payers on personal income tax returns verbally recommend that those who submit 3-personal income tax, filled out manually on paper, make entries in section 2 of sheet D1 with a simple pencil so that they can correct something and circle it with a pen in the presence of the inspector.

The first thing anyone applying for a deduction should know is that the deduction is provided not from the personal income tax amount (as many mistakenly believe), but from the tax base. To make it clearer, let's look at an example.

Example

Petrov purchased an apartment for 3,000,000 rubles. The maximum deduction for this purchase, due to him under Art. 220 of the Tax Code of the Russian Federation - 2,000,000 rubles. In total, during the period specified in the declaration, Petrov earned 800,000 rubles, personal income tax on them amounted to 104,000 rubles. These 800,000 rubles are Petrov’s tax base.

And it is precisely this that should be reduced by the amount of the deduction. In this case, the tax base can be reduced in full: 800,000 – 800,000 = 0. That is, Petrov will receive a tax refund in the amount of 104,000 rubles (800,000 × 13%).

And Petrov can transfer the deduction balance of 1,200,000 (2,000,000 – 800,000) rubles to the following years.

When filling out sheet D1 for the first time, section 2 indicates:

- page 2.7 - tax base (from section 2) (Petrov from the example will put 800,000 there);

- page 2.8 - confirmed amounts of expenses by which the tax base for the period is reduced (Petrov confirmed with documents all 2,000,000 due to him, which means he will put the value that he actually uses - 800,000);

- lines 2.10 and 2.11 - the balance of the deduction carried forward to the following periods (years) (Petrov will put 1,200,000 in line 2.10, intended for the deduction that is given specifically for the purchase (construction) of the real estate itself).

Sheet D1 of the 3-NDFL declaration - sample filling if the deduction is issued again

When carrying forward the balance that can be deducted to subsequent years, in these subsequent years:

- the procedure for applying for a deduction (remainder) will remain the same - again to the tax office with an application, documents and a new 3-NDFL declaration;

- There will be nuances in filling out section 2 of sheet D1 of the declaration.

How to fill out sheet D1 of the 3-NDFL declaration in case of transferring the balance of the required deduction to another period, let's look at an example.

Example

Toporkov P.B. purchased an apartment in 2015 for 4,000,000 rubles. At the same time, Toporkov took out a loan for part of the amount, which he repaid in 2015 and 2021. In 2016, for the first time I submitted an application for a deduction under subsection. 3 p. 1 art. 220 of the Tax Code of the Russian Federation (purchase of real estate) and received it in the amount of 514,200 rubles.

He also declared and confirmed the interest for 2015 paid to the bank on the loan that he spent on buying an apartment - 120,000 rubles. In 2021, Toporkov will apply for the deduction again. The amount of income from which tax was withheld by Toporkov’s employer is 702,540 rubles (Toporkov will reflect the same amount in section 2 of the declaration and decipher it on sheet A).

In addition, Toporkov includes in the declaration and draws up documents for the second part of the interest that he paid on the loan - 240,000 rubles.

How all this will be reflected in sheet D1, see here:

Thus, next year Toporkov will have the right to again apply for deduction and return of personal income tax in the amount of 783,260 rubles under sub. 3 p. 1 art. 220 of the Tax Code of the Russian Federation (purchase of an apartment) and in the amount of 360,000 rubles under sub. 4 paragraphs 1 art. 220 of the Tax Code of the Russian Federation (interest on a loan for the purchase of an apartment).

Results

Sheet D1 in 3-NDFL is formed in cases where the personal income tax payer has the right to a tax deduction as a result of transactions to improve housing conditions. The rules for filling out the sheet are established by order of the Federal Tax Service dated December 24.

2014 No. ММВ-7-11/ [email protected] and have not changed significantly since 2014.

There are nuances to filling out D1 in cases where a tax deduction declaration is submitted for the first time or is submitted again for the balance of the confirmed deduction for previous periods (years).

Learn more about the nuances of forming 3-NDFL from the article “Tax return 3-NDFL: features in 2016–2017.”

Find the current declaration form here: “Tax declaration 3-NDFL in 2021 - form.”

Read more about the specifics of registering a deduction when purchasing real estate in the article “Procedure for compensation (return) of personal income tax when purchasing an apartment.”

Source: https://nalog-nalog.ru/ndfl/deklaraciya_ndfl/list_d1_nalogovoj_deklaracii_3ndfl_obrazec_zapolneniya/

Sample of filling out the personal income tax sheet for the year

This section exists so that individuals can document the amount that the state is obliged to reimburse them as a deduction or, conversely, they must pay themselves. In addition, certain codes are entered on this sheet - KBK (intended for grouping the profits and costs of various budgets) and OKTMO (necessary for identifying the territory of the municipality).

That is, no specific deadlines have been established; you can start filling out the report as early as January, and this is exactly what a larger number of citizens are doing. The sooner you submit the documents, the faster the refunded amount will be received.

An example of filling out sheet D1 of personal income tax declaration 3 with carryover balance

If the taxpayer did not use the property tax deduction in previous tax periods, the meaning of sub. 2.10 is calculated as the difference between the value of sub. 1.12 and the sum of the values of subparagraphs 2.5 and 2.8;

- in sub. 2.11 Sheet D1 of Declaration 3-NDFL - the balance of the property tax deduction for the cost of paying interest on targeted loans that were received from credit and other organizations of the Russian Federation, and on loans that were received to refinance loans for new construction or the acquisition of an object that is being transferred to next tax period.

The sum of the values of subclauses 2.8 and 2.9 cannot be greater than the value of subclause.

RF, as well as for loans that were received to refinance loans for new construction or acquisition of an object).

If more than one sheet of D1 is filled in, then the total sum of the indicators on lines 120 of all sheets of D1 should not exceed the maximum permissible amount of property tax deduction that can be received by the taxpayer (the amounts that are used to repay interest on targeted loans that were received from credit and other organizations of the Russian Federation, as well as for loans that were received to refinance loans for new construction or acquisition of an object);

Sample of filling out 3-personal income tax when transferring the balance of the deduction

Sheet D1 in 3-NDFL for 2021). Basic rules First of all, Sheet D1 of the 3-NDFL declaration for 2021 and other periods is intended to be filled out only by Russian tax residents for personal income tax. Also see

“Who must submit 3-NDFL for 2021: list and new rules.” In one 3-NDFL, property deductions can be claimed for the costs of purchasing/constructing several different real estate properties at once.

In this case:

- item No. 1 of Sheet D1 (data about the object and costs for it) - fill out according to the number of objects;

- item No. 2 of Sheet D1 (calculation of deductions) - fill out only once on the last page of D1, as if on an accrual basis.

The absolute right of an individual is to include or not include this or that object in 3-NDFL. Of course, in the first option it makes sense when the income tax from a given declarant stably and in the required amount fell into the budget.

Tax return 3-personal income tax: samples of sheet 3, d1 and d2

Sheet Z;

- the amount of expenses associated with participation in investment partnerships, which are specified in clause 7.3 of sheet I;

- the amount of professional tax deductions provided for in Art. 221 of the Tax Code of the Russian Federation and tax deductions, which are provided for in sub. 1 and 2 paragraphs 1 art. 220 of the Tax Code of the Russian Federation, which are specified in sub. 3.2 Sheet B, item 4 of Sheet D2, sub. 6.1 Sheet Zh;

- the amount of property tax deduction for expenses for new construction or acquisition of an object, which was submitted in the reporting tax period by the tax agent (employer) based on the notification of the tax authority, which are specified in subparagraph.

Taxation in industries:

Attention

If the right was issued in 2015, and the first deduction was issued in 2016, then what to put? 2015 Reply with quotation

Source: https://vip-real-estate.ru/2018/05/06/primer-zapolneniya-lista-d1-deklaratsii-3-ndfl-s-perehodyashhim-ostatkom/

In what cases should it be filled out?

For 2021, individuals who are required by law to independently submit a report on their income and/or want to return personal income tax (and there are reasons for this) do this using the 3-NDFL declaration form, approved by order of the Tax Service of Russia dated December 24, 2014 year No. ММВ-7-11/671.

This form was last updated on October 10, 2021. At the same time, Sheet D1 3-NDFL for 2021 remained the same. It looks like this:

Essentially, it consists of 2 points:

- in the first - they provide data about the object and the costs incurred for it;

- in the second, they calculate the deduction for this object.

Let’s say right away that sheet D1 in the 3-NDFL declaration for 2016 and other periods is a completely optional element. It serves exclusively for calculating property deductions for personal income tax, which:

- enshrined in Article 220 of the Tax Code;

- the declarant has the right to them;

- costs are confirmed by documents.

For more information about this, see “Which sheets need to be filled out in 3-NDFL for 2021.”

Simply put, filling out sheet D1 of the 3-NDFL declaration for 2016 tells the tax authorities that the person wants to return the personal income tax already transferred to the treasury by himself or for him by a tax agent at the expense of the actual costs incurred for:

- new building;

- purchase in Russia:

- residential building;

- apartments;

- rooms;

- shares or interests in them;

- land plots for individual housing construction;

- plots on which the purchased houses/share(s) in them are located.

Moreover: Sheet D1 3-NDFL for 2021 also covers:

- interest on targeted loans/credits received from domestic companies or individual entrepreneurs for new construction or purchase of specified objects;

- interest on loans from domestic banks taken for the purpose of refinancing/on-lending (more gentle interest repayment regime).

Separate lines are provided to reflect interest on loans in Sheet D1. But if an individual has not contacted credit money at all, then zeros with dashes are entered in their fields (see at the end of the article for an example of filling out Sheet D1 in 3-NDFL for 2016 ).

how to correctly fill out sheet D1 of the 3rd personal income tax declaration for 2021

30.03.2018

the amount of expenses (losses) on transactions with securities and transactions with derivative financial instruments, including those accounted for on an individual investment account, in accordance with Articles 214.1, 214.3, 214.4, 214.9 of the Code, specified in subclause 11.3 of Sheet 3;

New declaration 3-NDFL in 2021

- the declaration must be filled out strictly according to the form adopted in the given reporting period (calendar year). The form adopted for reporting for 2021 can be easily distinguished by the index located in the upper left corner of the first page: 0331 4012. Each sheet has such an index and it is different for all sheets. But to “identify” the required form, it is enough to know its designation on the first, title page;

- All necessary documents or copies thereof must be attached to the declaration.

Declaration 3-NDFL in 2021: form

Form 3-NDFL is a Tax return for personal income tax. Based on the results of 2021, individual taxpayers who are specified in Art. 227, 227.1 and paragraph 1 of Art. 228 of the Tax Code of the Russian Federation (Article 216, paragraph 1 of Article 229 of the Tax Code of the Russian Federation).

Persons required to submit a 3-NDFL declaration include, in particular, individual entrepreneurs who apply the general taxation system (clause 1, clause 1, clause 5, article 227 of the Tax Code of the Russian Federation), as well as citizens who sold their inherited property before the expiration of 3 years. or an apartment donated by a family member (Clause 17.1, Article 217, Art.

217.1, paragraphs. 2 clause 1, clause 2 art. 228 of the Tax Code of the Russian Federation).

Step-by-step instructions: how to fill out the 3-NDFL declaration in the program - Declaration 2021 - in 2021

Individuals who want to pay income tax on their own or receive a property deduction when selling or buying an apartment, a social deduction for education or treatment, need to fill out the third tab from the top of the “Declaration 2017” program called “Income received in the Russian Federation.”

Tax return in form 3-NDFL

Every year, minor changes are made to the structure and rules for filling out the 3-NDFL declaration. We try to take them into account and promptly update this information on our website. However, the general rules for filling out the form generally remain the same from year to year.

Sheet D1 of tax return 3-NDFL - sample filling

5. Subsections 1.5 to 1.10 contain information transferred to them from official documents that will be submitted along with 3-NDFL to confirm the deduction. Please note that subsection 1.10 should be left blank if the documents for shared ownership are dated after 01/01/2014.

How to fill out the new form 3-NDFL

Where to submit? The declaration should be submitted to the territorial office of the Federal Tax Service at the place of registration, permanent or temporary. The income statement can be submitted to the Federal Tax Service in person, by mail, or by filling out the document online. For example, if you need help filling out the 3-NDFL declaration, you can fill it out online on the official website of the Federal Tax Service with detailed tips.

How to fill out the 3-NDFL declaration yourself in 2021

- certificate in form 2-NDFL, received at the place of employment;

- a photocopy of the certificate confirming the ownership of the apartment;

- a copy of the agreement concluded between the seller and the buyer;

- payment document or bank statement confirming the transfer of funds to the seller;

- other documents.

How to fill out 3-NDFL correctly

- Passport of a citizen of the Russian Federation - 21;

- Birth certificate - 03;

- Military ID - 07;

- Temporary certificate issued instead of a military ID - 08;

- Passport of a foreign citizen - 10;

- Certificate of consideration of an application for recognition of a person as a refugee on the territory of the Russian Federation on the merits - 11;

- Residence permit in the Russian Federation - 12;

- Refugee certificate - 13;

- Temporary identity card of a citizen of the Russian Federation - 14;

- Temporary residence permit in the Russian Federation - 15;

- Certificate of temporary asylum in the Russian Federation - 18;

- Birth certificate issued by an authorized body of a foreign state - 23;

- Identity card of a Russian military personnel/Military ID of a reserve officer - 24;

- Other documents - 91.

We recommend reading: I want to take my husband’s last name a year after the wedding

Instructions for filling out a declaration for personal income tax refund for an apartment

It should be noted that if the 3-NDFL form for a property tax discount is drawn up on behalf of the wife/husband of the apartment owner, then the taxpayer’s attribute code is no longer “01”, but “02”.

If the parents of a minor owner want to reimburse the tax - “03”, if an individual owns the property on an equal basis with the child - “13”, and if the apartment belongs simultaneously to the taxpayer, his child and spouse - “23”.

how to correctly fill out sheet D1 of the 3rd personal income tax declaration for 2021 Link to the main publication

Source: https://onejurist.ru/ipoteka/kak-pravilno-zapolnit-list-d1-deklaratsii-3-ndfl-za-2018-god

Form 3-NDFL for tax deduction in 2020: where and how to fill out

In the item “TIN” on the title and other sheets to be filled out, the identification number of the taxpayer - an individual is indicated or 000 is entered if the declaration is submitted for the first time this year.

On the title page, indicate the total number of completed pages and the number of attachments - supporting documents or their copies. In the lower left part of the first page, the taxpayer (number 1) or his representative (number 2) signs the document and indicates the date of signing. The representative must attach a copy of the document confirming his authority to the declaration.

How to correctly draw up sheet D1 in 3 personal income tax for a mortgage

The sheet indicates:

- Tax rate (13%).

- Code of type of income (for work under an employment contract - 06).

- Information about the employer (name, TIN, KPP, OKTMO).

- Amount of income (total and taxable).

- The amount of tax (accrued and actually withheld by the employer).

The information listed in paragraphs. 3–5 of our list must correspond to the data from the 2-NDFL certificate issued by the employer. If the taxpayer received income from several sources during the year, for each of them you need to fill out a separate block on sheet A. Confirmation of property deduction Sheet D1 serves to substantiate the right to property deduction. It reflects:

- Identification of a taxpayer from the point of view of receiving this deduction. This may be the owner of the purchased property, the spouse or parent of the owner.

- Application of paragraph 10 of Art. 2 Tax Code of the Russian Federation.

The following are common mistakes:

- filling out a declaration using an outdated model (i.e., for example, 2010 or 2015);

- if there is no electronic signature on it (discussed in detail above);

- also the absence of your signature on the paper version;

- registration of personal income tax-3 in violation of the established rules, i.e., for example, incomplete provision of information about yourself (see our instructions for how to fill out everything without errors).

Documents attached to the declaration

- application to the tax office about the desire to receive a tax refund;

- personal income tax certificate-2;

- last year's personal income tax declaration-3;

- apartment purchase and sale agreement (copy);

- certificate of registration of property rights (copy).

Now you are familiar with the process of filling out the personal income tax form-3 from A to Z.

Filling out 3-NDFL when returning tax on an apartment with a mortgage

So, for such persons you need to take both SZV-M and SZV-STAZH!

But be careful: the procedure for paying for “children’s” sick leave remains the same! Important Online cash register: who can take the time to buy a cash register Individual business representatives may not use online cash register until 07/01/2019. However, for the application of this deferment there are a number of conditions (tax regime, type of activity, presence/absence of employees).

So who has the right to work without a cash register until the middle of next year? → Accounting consultations → Personal income tax Current as of: January 15, 2018

Declaration of 3-personal income tax: return of mortgage interest

It's fast and free!

- Who draws up this document?

- How to prepare the personal income tax-3 registration for a tax deduction for the purchase of an apartment with a mortgage?

- document

- Calculations

- What sections need to be completed?

- How to fill out personal income tax-3 for the return of mortgage interest (filling example)

- Common errors

- Documents attached to the declaration

Who draws up this document? This document is filled out by taxpayers - citizens who independently calculate the amount of tax that they subsequently pay on their income. These include entrepreneurs, persons receiving taxable income and specialists engaged in private practice.

Form 3-NDFL for tax deduction in 2020: where and how to fill out

On the title page, indicate the total number of completed pages and the number of attachments - supporting documents or their copies. In the lower left part of the first page, the taxpayer (number 1) or his representative (number 2) signs the document and indicates the date of signing. The representative must attach a copy of the document confirming his authority to the declaration.

“Reporting tax period” - in this paragraph, indicate only the previous year for which you want to declare income. In the “Submitted to the tax authority (code)” field, enter the 4-digit number of the tax authority with which the submitter is registered for tax purposes.

Right to deduction

To obtain an NV you must:

- The buyer was a tax resident (paid tax at a rate of 13%).

- The ownership of the apartment was registered.

- The cost of the apartment has been fully paid.

- The purchase of the apartment was made at the expense of the buyer’s personal funds.

- The purchase transaction was made between independent persons.

NV is not provided if the apartment was purchased at the expense of the employer, at the expense of maternity capital or other budget funds. No deduction is given if an apartment is purchased from close relatives or other dependent persons. Persons under 18 years of age, unemployed people, and pensioners are not entitled to a property deduction.