In what cases is a transfer from a legal entity to an individual acceptable?

Transfer of funds to an individual from a legal entity is possible only in three cases:

- if the company issues a loan or loan;

- if the company buys any products or services from an individual;

- if a citizen receives a salary from a legal entity.

Money transfers for other purposes are not provided for by the legislation of the Russian Federation and are considered illegal.

Credit or loan

Transfer of a loan from a legal entity is possible both to an employee of this enterprise and to other individuals. The limit on transfers to its employees is not regulated by regulations: the organization can issue any amount.

In the case of third-party citizens, frequent transfers of large sums may arouse suspicion among regulatory authorities: only companies that have registered a new type of economic activity in the register and with statistical authorities have the right to lend.

To transfer money to a card as a loan, you need to draw up an appropriate agreement. It should indicate:

- borrower data;

- complete information about the company issuing funds;

- loan amount;

- additional information: payment terms, obligations of the parties, interest.

Important: debt repayment is not subject to taxation, but you must prove that the money received is a repayment and not income. To do this, when transferring, you need to indicate the purpose of the payment and, if necessary, confirm the transaction with documents.

Repurchase of products or payment for services rendered

If a transfer to a card to an individual from a legal entity is carried out for the purpose of purchasing products or paying for services rendered, then an agreement for the transaction must also be drawn up. In this case, personal income tax is withheld from the recipient and transferred to the budget at a rate of 13%.

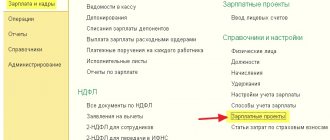

Wage

If a citizen has an employment relationship with the company, which is confirmed by a signed employment contract, then the transfer of funds to the card to an individual from a legal entity can be processed as a payment of wages. Such transfers must also be subject to personal income tax at a rate of 13%.

Important: in the annual declaration, a legal entity must account for all transfers, including to individuals to bank accounts, and pay income tax. If the company does not do this, then personal income tax is levied on the citizen who receives the money.

Payment by an organization for an individual

Uzbekistan and Russia signed the following document:

Migrants from Uzbekistan will go to Russia on a special order.

Workers from Uzbekistan will know in advance where they will work in Russia, how much they will be paid and where they will live. In Uzbekistan, they will be selected based on their health, level of education and trustworthiness.

A special agreement on organizational recruitment and attraction of citizens for temporary work has come into force between Russia and Uzbekistan. The document determines the procedure for selecting citizens of Uzbekistan who want to work on the territory of the Russian Federation, as well as the responsibilities of the ministries and departments of the two countries in organizing centralized labor migration. This will protect guest workers from swindlers and slavery in Russia, and will also protect their rights. Employers will receive employees who have been screened in their homeland.

Uzbekistan has traditionally been the main supplier of labor migrants for Russia. As of February 1, 2021, about 1.5 million Uzbeks entered our country. This is three times more than from all EU countries combined. Basically, citizens of Uzbekistan go to work and transfer the money they earn to their homeland. Thus, according to official data, in 2021, individuals transferred more than $2.7 billion from Russia to Uzbekistan. According to this indicator, Uzbekistan is the leader among all CIS countries. The average amount of one transfer at the end of the year was $279.

According to the new international agreement, only citizens over 18 years of age will be able to participate in the selection process for the right to work in Russia. At the same time, migrants will have to comply with all the rules already in force: the right to reside in Russia must be properly formalized, and there must be a patent for work activity. But participants in the organized selection will have priority when finding employment in Russia.

“The priority of organized recruitment and attraction of citizens of the Republic of Uzbekistan for temporary work in the Russian Federation is recognized over other forms of employment of migrant workers,” the text of the agreement says.

A special agency under the Ministry of Labor of Uzbekistan will supervise organizational recruitment. It is this organization that should organize the training of fellow citizens according to the programs of the Russian Ministry of Education. The agency will organize medical examinations, as well as verify the qualifications and work experience of migrant workers.

The agency in Uzbekistan must also monitor the content of employment contracts concluded between Russian employers and workers traveling to Russia. As part of the recruitment, the agency will also arrange transportation for migrants to their place of work.

Before sending citizens to Russia, the Ministry of Internal Affairs of Uzbekistan is obliged to check everyone to see if he is on the international or interstate wanted list. Applicants must not have outstanding or unexpunged convictions for crimes in Uzbekistan, which are also recognized in Russia.

On the territory of Russia, labor migrants from Uzbekistan should be controlled by the Ministry of Labor and Social Protection. It will collect information from Russian employers about the availability of vacancies, the nature of the work, wages, and the required qualifications of workers. And all this data will be sent to partners in Uzbekistan, who will look for candidates for this job.

The Russian Ministry of Education, in accordance with the agreement, can enter into agreements with organizations in Uzbekistan that will conduct exams for labor migrants in the Russian language, the history of Russia and the basics of legislation. Such exams can also be held on the territory of the Russian Federation. In this case, the authorized bodies of Uzbekistan must have a clear list of organizations that will be involved in testing migrants.

The Russian Ministry of Internal Affairs also has obligations under the international agreement. It must organize the activities of its departments for processing and issuing permits to migrants who will centrally come to work from Uzbekistan. He is also entrusted with the responsibility of monitoring the life and work activities of migrants in Russia.

The document pays special attention to employers who intend to invite migrants from Uzbekistan. They must have places for visitors to stay. Moreover, the conditions of such housing must comply with the sanitary and hygienic standards in force in Russia. Guaranteed wages for migrants should not be lower than the subsistence level. The employer must necessarily conclude an agreement with the sending party, which will spell out all the nuances of the stay of a citizen of Uzbekistan in Russia.

A mandatory condition for a labor migrant to stay in Russia will be the availability of a voluntary health insurance agreement. The employer will have to conclude it with a medical organization in his region. In the event of death or injury to the health of a migrant at work, the employer will be required to pay for the delivery of the body to the homeland or treatment.

How much does the money cost?

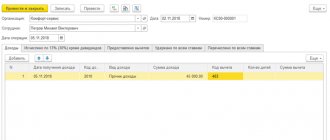

After the sending company generates payment registers and submits a transfer order, the bank will begin to process the payment. This can take from one to several days, depending on what time the documents are submitted and how correctly they are completed.

All settlement transactions are carried out during the banking day, which most often ends at 16:00.

Important: the exact time depends on the bank branch, region and currency in which the transfer is made.

Be sure to ask for a check

When making payments to self-employed people, you do not need acts. They are officially replaced by a check, which the self-employed person generates in the “My Tax” application and sends to you by email or any messenger. The receipt can be attached to the accounting documents and used as proof that you accepted and paid for the work. There is no need to sign it.

By law, the self-employed must send you the check themselves.

If he forgot, remind him. If it still doesn’t send, complain to the Federal Tax Service on the tax website .

If you are afraid that there will be problems with accounting, you can still draw up an act. Send the self-employed your standard form and exchange signed copies.

Commissions

The size of the commission for a transfer to an individual from a legal entity depends on the bank through which the transfer takes place. The percentage can vary from 0.5 to 10% of the total amount.

Important: the maximum commission amount is not limited

For example, at Sberbank the transfer fee is 1.1% of the amount, but not less than 115 rubles per transaction. The commission fee does not apply to the payment of wages, as well as to social and insurance contributions.

At VTB24 , the commission depends on the transfer amount. So, if you send up to 6 million rubles per month, the bank will take 1% of the transaction. Transfers over this amount are subject to a 10% commission.

Important: if an enterprise has concluded an agreement with VTB on a salary project, then the transfer of wages to employees is not subject to a commission.

Additionally, for any transfer to a card that the tax office may accept as undeclared income of an individual, you need to make 13% deductions.

Receive an invoice from the freelancer

Self-employed people have the right to receive payment without issuing an invoice. But it will be better for your accounting department if the freelancer still issues an invoice: this way there will be fewer problems with payment to an individual.

A self-employed person does not have tools for issuing an invoice in “My Tax” or a personal bank account. Therefore, offer him a template, for example, based on the invoices that the individual entrepreneur issues to you. The invoice must include:

- Self-employed details

- Date and account number

- Name of the payer organization, its TIN

- List of all services with prices

- Total invoice amount

- Signature of the self-employed

Typically the invoice is sent in PDF format. To make it convenient to fill out, you can create the invoice itself in Word or Excel, and then save it as PDF.

Fines

The bank is obliged to report all suspicious deductions in favor of an individual to the Central Bank or the Federal Tax Service. The transaction will be subject to verification. If it turns out that a citizen received income from a legal entity, but neither party made the appropriate mandatory payments, a fine of 20% of the amount of unpaid taxes .

Important: in such situations, you yourself must prove that the funds received on the card were not income.

If intentional non-payment of tax is proven, the fine may reach 40% of the unpaid amount. In addition, penalties will be charged - 9% per annum.

In cases where legal entities illegally cash out funds by transferring them to the cards of ordinary citizens, the company may be subject to criminal liability, which will entail either a fine of up to 300 thousand rubles or imprisonment for 6 months.

Correctly indicate the purpose of payment

When transferring money to a self-employed person, you must indicate the purpose of the payment. It is better to do this in this format: “Payment on account No. 111. Advance payment for writing texts.” There is no need to list all the work. If you pay without an invoice, you need to indicate the work itself in more detail.

In the purpose of payment, in no case should you write “salary”, “bonus” or other words that hint at an employment relationship. Salaries and bonuses can only be paid to employees, and you are obliged to employ the employee under an employment contract and pay taxes and deductions for him. As a self-employed freelancer, you simply pay for a specific job, and you cannot call it a salary - otherwise the bank will block the account, and the tax office will fine you for non-payment of taxes and contributions.

Nuances

Before transferring money from a legal entity’s account to an individual’s card, you need to draw up an agreement that explains for what purpose the money was transferred. If the agreement does not stipulate which party must pay the tax, the payment will be levied on the individual (subject to his receipt of income).

In cases where funds are transferred to pay off a debt, the payment is not subject to tax, but relevant documents confirming the issuance of the loan must be provided.

Particular attention from banks and the Federal Tax Service is drawn to:

- transfers over 600,000 rubles;

- frequent provision of borrowed funds;

- transactions with securities (provided that the recipient is not a citizen of the Russian Federation).

It is worth noting that if banks consider ongoing transactions suspicious, they are obliged to report them to the Central Bank, while banks are prohibited from notifying an individual or legal entity about the notification.

Specify the chosen payment method and procedure in the contract

The contract must indicate:

- Payment method: cash or bank card.

- Time range for payment, for example within 5 days after accepting the job.

- Terms of prepayment and postpayment.

Also, do not forget to state that the performer applies tax on professional income - this will explain why you do not pay taxes and fees for him.

In the section with contacts and details, you need to indicate the full name, TIN and address of the freelancer, as well as the full details of his bank card.

If the company is paid for by an individual entrepreneur holding the position of its director

First of all, you should understand two small “buts”:

- The position of director (general director) is taken on by an individual, even one who has the status of an individual entrepreneur. A regular employment agreement is concluded with the specified employee. The presence of a civil law contract is excluded, since it covers full-fledged labor relations (Part 4 of Article 11, Part 2 of Article 15 of the Labor Code of the Russian Federation). In this situation, it does not matter whether the future manager has the status of an individual entrepreneur. An agreement is concluded with him on labor, and not on entrepreneurial activity;

- It is the individual entrepreneur who takes on the position of manager. In this case, the individual entrepreneur becomes a manager, not a director. But this is only possible if the LLC Charter stipulates the possibility of transferring directorial functions to a third-party legal entity or individual entrepreneur.

What should a supplier of goods (works, services) do with a cash register during non-cash payments with such managers? In both cases, the participation of the CCP is implemented in the general manner, taking into account clause 9 of Article 2 of Law 54-FZ. Here, payment is made on behalf of the enterprise and at its expense. After all, any employee, even one with individual entrepreneur status, can be an accountable person. Do not forget that an employee of an enterprise, according to clause 5 of Directive 3210-U, for the purposes of spending accountable money, is recognized as a person with whom either an employment or civil law contract has been concluded. The main thing is that the accountable person has a power of attorney from the enterprise, which allows him to be identified with this enterprise. Then the payment will be from the company, and not from an ordinary citizen.