April 07, 2021

Is your employee sick? Good health for him, of course, but you also have an added headache - you have to fill out a sick leave form. And at the same time, do not forget about the changes that came into force on December 14, 2020. We have already talked in detail about how to correctly draw up sick leave certificates, and now we will focus on innovations.

The main change is that from now on sick leave will be filled out electronically and will be placed in the Social Insurance Fund database; an application from the employee will not be required. These changes will take effect on January 1, 2022. And 2021 will be considered a transitional year: both electronic and paper sick leave will be taken into account.

Why does the HR manager need to follow the rules for filling out sick leave?

Issuing sick leave is a procedure strictly regulated by the legislator.

This follows from the fact that sick leave must be issued exclusively on a secure form. Its form was approved by order of the Ministry of Health and Social Development of Russia dated April 26, 2011 No. 347n. In addition, it is important to follow the rules for filling out sick leave in 2021 by the employer, established for him by order of the Ministry of Health and Social Development of the Russian Federation dated September 1, 2020 No. 925n. The document contains a list of general requirements for filling out sick leave, which are still relevant today.

The employer enters information only into some of the items on the sick leave form, which are combined into the “To be completed by the employer” block.

IMPORTANT! The sick leave certificate must correctly indicate the data filled in by both the doctor and the employer.

If the responsible person of the employer, before filling out the sick leave certificate, discovers errors in the block drawn up by the doctor, it makes no sense for the employer to fill out the part. Most likely, the FSS will not pay for it. It is necessary to request a new document from the medical organization.

Let us remind you! Since 2021, the FSS “direct payments” project has been operating throughout the Russian Federation. For more information, see our memo for accountants.

ConsultantPlus experts explained in detail what an employer participating in the pilot project of the Social Insurance Fund of the Russian Federation needs to do. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

The FSS sanction can be just as severe for mistakes made due to ignorance of how the employer fills out sick leave. Let's look at how they can be avoided.

Procedure for processing documents

Correctly filling out an individual entrepreneur’s sick leave form is one of the conditions for receiving funds from the Social Insurance Fund.

Grounds for issuing a document of incapacity for work:

- illness or injury;

- pregnancy and childbirth;

- disability of a relative requiring care;

- quarantine.

A sick leave certificate is an official confirmation of an employee’s absence from work for a valid reason. It is issued by a medical organization that has a license for this type of activity.

How and in what order is the document filled out? The upper part of the sheet is intended for the medical worker, the lower part for the policyholder. The doctor is the first to issue a sick leave certificate . The individual entrepreneur fills out the document taking into account the requirements of the 2011 order of the Ministry of Social Development.

The form looks like this:

Filling out the sick leave certificate by the employer of the individual entrepreneur is carried out in a certain place in the section: “To be filled out by the employer.”

Instructions for filling out sick leave in 2021 by an employer

Taking into account the requirements set out in regulatory documents, the instructions for filling out a sick leave certificate will look like this. The employer enters on the sick leave:

- Information about the employee’s place of work by indicating:

- the name of the company (full or abbreviated) in accordance with the constituent documents, if the employer is a legal entity;

- Full name of the entrepreneur, if the employer is an individual entrepreneur.

- A note indicating whether the work is primary for the employee or not by checking the appropriate box.

- Employer registration number in the Social Insurance Fund.

- Code of subordination of the FSS body that issued the registration number to the employer.

- TIN of the employee for whom sick leave is issued (not indicated for women receiving maternity benefits for pregnancy and childbirth, as well as after registration with a medical institution in the early stages of pregnancy).

- SNILS of the employee.

- Code indicating the conditions for calculating sick leave (1 or more) - on the reverse side of the sheet:

- 43, if the employee has benefits as a victim of radiation exposure;

- 44, if the employee worked in the regions of the Far North or in territories equivalent to them before 2007;

- 45 if the employee has a disability;

- 46, if the term of the employee’s employment contract with the employer is less than 6 months (not recorded if the cause of disability is indicated on the sick leave as corresponding to code 11);

- 47, if the employee went on sick leave within 30 days after dismissal;

- 48, if going on sick leave was accompanied by a violation of the regime for a good reason (subject to marking this in the appropriate column of the form);

- 49, if the illness of an employee who has a disability at the time of going on sick leave lasts 4 consecutive months or more (not entered if code 11 is indicated in the column where the cause of disability is given);

- 50, if under the same conditions the sick leave lasts 5 or more months in a calendar year;

- 51 if the employee is employed part-time.

- Details of the report in form N-1 (about an accident during work), if it was drawn up.

- The start date of work of the employee whose contract was canceled, but he went on sick leave before the cancellation. If the employment contract with the employee is valid, the corresponding column does not need to be filled out.

- Length of insurance period in full years and months.

Read more about calculating length of service and its impact on the amount of disability benefits here.

- The duration of non-insurance periods for a citizen to serve in the army, law enforcement agencies, and fire service.

- The period for which benefits must be paid to the employee.

- The employee’s average earnings on the basis of which sick leave is calculated.

- The employee's average daily earnings.

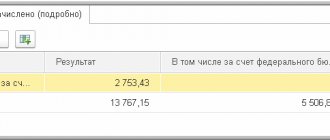

- The amount of compensation for sick leave, paid from the funds of the Federal Social Insurance Fund of the Russian Federation.

- The amount of compensation paid at the expense of the employer.

- The total amount of sick leave.

- Full name of the manager and chief accountant of the employer.

For more information about the procedure for calculating the total amount of sick leave, read the material “Maximum amount of sick leave in 2021 - 2021”.

What data does the medical institution enter?

Order of the Ministry of Health No. 925N specifies the procedure for filling out a certificate of incapacity for work. It is from the medical institution that the sick leave begins to be filled.

The doctor fills out his part of the document first:

— enters information about whether the document is a primary document or a duplicate;

— fills in the data of the medical institution: name, address and OGRN:

— enters the patient’s data: full name, date of birth, place of work, whether this is the main place of work or part-time. In the latter case, you can issue several sick leave certificates at once for each employer.

- if sick leave is issued to care for a relative, the doctor indicates the degree of relationship,

- indicates the period for which the employee is released from work,

— puts the name of the attending physician, signature and seal.

Certificate-calculation as a mandatory attachment to sick leave

It should be borne in mind that just knowing how to fill out a sick leave certificate correctly is not enough. In addition to the sick leave certificate itself, the employer must submit a certificate to the Social Insurance Fund indicating the calculation of benefits. It is needed to confirm the correctness of the numbers indicated on the sick leave.

The legislator did not approve a unified form of payment certificate. The employer will have to develop it independently.

The main thing is that the certificate includes:

The calculation certificate is usually signed by the manager and chief accountant of the employer.

We need an agreement with the FSS

If an entrepreneur intends to receive payments for sick leave or maternity leave, then he must enter into an agreement with the Social Insurance Fund.

This is easy to do - you just need to submit an application. Don't forget to take a set of necessary documentation with you when you visit the Foundation. This:

- Passport

- OGRNIP (main state registration number of an individual entrepreneur)

- TIN

- Extract from the Unified State Register of Individual Entrepreneurs

After concluding the contract, you will need to begin paying insurance premiums and maintaining reports on them. That is, in fact, the entrepreneur takes out insurance for himself.

As for reporting, it is submitted in the FSS-4 form no later than the 15th day of the reporting period. Payment of contributions can occur no later than December 31 of the current year. If these conditions are not met, the individual entrepreneur will be deprived of the opportunity to receive government benefits.

What pen, what ink and what color to fill out a sick leave form

Entering data into sick leave forms created on paper is usually done manually using a pen - capillary, gel or black fountain pen. Entering data into a sick note with a ballpoint pen is not allowed.

In principle, you can fill out the form on a PC using a special program that can transfer data from a digital form to a paper one, transferring the data to the printer into which the official form is inserted. Moreover, it is permissible to fill out 1 part of the sick leave with a pen, and the other on a PC (letter of the Federal Social Insurance Fund of the Russian Federation dated October 23, 2014 No. 17-03-09/06-3841P).

How to fill out the document

When filling out the sick leave sheet for 2021, it should be taken into account that the data must be entered into it in capital letters, starting from the first cell available on the left in the field being used. If the employer puts a stamp on the form, it should not go to the corresponding cells.

If errors are found in the sick leave columns, they can be corrected. To do this you need:

- cross out the incorrect entry;

- on the back of the document, enter the correct data in the format “form column name: correct information”;

- Make a note next to it: “Believe the corrected”;

- certify the record with the signatures of the director, chief accountant of the employer, as well as the seal (if used).

Regardless of the number of corrections on the sick leave, it is enough to make a note on the form: “Believe the corrected one”, affixing the signatures of the director, chief accountant, and a seal once.

Where to fill out the new sample sick leave for 2021

The document is available at the link below. The calculation data in it are given based on the employee’s work experience, ranging from 5 to 8 years (i.e., 80% of average earnings are taken into account).

ConsultantPlus experts provided a line-by-line comment on how an employer fills out a sick leave sheet. If you don't have access to K+, sign up for free and follow the instructions.

Calculation of sick pay for individual entrepreneurs

To ultimately understand how much you will be paid for sick leave, you need to use the formula:

Benefit amount = (minimum wage * 24/730) * percentage of work experience for which insurance premiums were paid * number of days of sick leave validity

It would seem that everything is clear, but let’s give an example:

Conditions: an individual entrepreneur went on sick leave and stayed there for 7 days. Moreover, he has 6 years of experience.

Calculation:

(6203 * 24/730) * 0,8 * 7

Answer: for a week on sick leave, an entrepreneur receives 1,142 rubles.

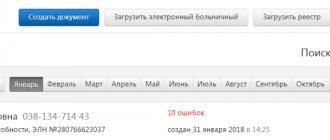

Electronic sick leave

On July 1, 2017, the use of an electronic sick leave form began (law dated May 1, 2017 No. 86-FZ), which is used on a par with a regular paper document.

The following distinguishes an electronic sick leave from a regular one:

- creation in an automated electronic system that provides the ability to work with it for all interested parties;

- certification by enhanced qualified electronic signatures of persons drawing up the document;

- protection from counterfeiting.

The employer will also need to fill out an electronic sick leave. Find out how to do this correctly in ConsultantPlus. Get free demo access to K+ and go to the material to find out all the details of this procedure.

Read more about organizing the interaction of the parties when working with sick leave in the materials:

- “Electronic sick leave for transfer to the Social Insurance Fund online”;

- “Electronic sick leave: a new order”;

- “Step-by-step guide to working with electronic sick leave certificates.”

How to apply for sick leave

So, an individual entrepreneur registered as a volunteer, completed all the paperwork and began making contributions to the social insurance fund. And suddenly, as luck would have it, he fell ill. How to properly apply for sick leave?

It is necessary to clarify how much time has passed since registration with the fund. If an entrepreneur filed documents in 2021 and fell ill in 2018, he will not be able to receive compensation. But from January 1, 2019, he will be able to qualify for a full disability payment.

Attention! If an entrepreneur registered with the Social Insurance Fund in 2021 or earlier, he can calmly prepare documents for compensation.

How to receive a payment: step-by-step instructions

First of all, the entrepreneur must go to the clinic and receive a certificate of incapacity for work - the notorious sick leave. Without it, it is simply impossible to receive payment. Even if an individual entrepreneur comes to the fund, covered in mustard plasters, and shows a thermometer with a temperature of 39, without a piece of paper they will not believe in his illness. And it’s better to contact the fund after the acute phase of the disease has passed.

You should write an application to the Social Insurance Fund requesting payment for sick leave. It must indicate the number of days of temporary disability and the current account of the entrepreneur. All receipts that confirm the fact of full and timely payment of contributions to the fund should be attached to the application. And, of course, don’t forget your sick leave.

How to fill out sick leave as an individual entrepreneur

A certificate of incapacity for work for an individual entrepreneur will be slightly different from what employers file for their employees. The first part of the paper contains standard information, for example, the start and end date of the illness. But the entrepreneur will have to fill out the second part himself (ordinary employees do not have to deal with this - the employer does it for them). In the “Employer” column, he will have to indicate his full name, that is, the lines indicating the person receiving the document and the indication of his employer will coincide. And the recipient must sign his sick leave himself.

The rest of the requirements for the design of the sheet are standard:

- black gel pen;

- legible handwriting (capital block letters);

- each letter is in its own cell, does not go beyond its boundaries, does not come into contact with others;

- no blots or corrections.

You need to contact the fund with a set of documents and wait for your benefits to be calculated.

Results

The procedure for issuing sick leave in 2021 is still strictly regulated by the legislation of the Russian Federation - both in terms of requirements for the appearance of the document and in terms of the algorithm for filling it out.

An employer, like a medical institution, must clearly understand how to fill out a sick leave sheet correctly, and mistakes must not be made when filling out a sick leave note, otherwise the Social Insurance Fund will not accept it as a basis for compensating the employer’s expenses for paying benefits. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Insurance contributions to the Social Insurance Fund

An equally interesting question, because you will need to pay regularly. And as for the size of these contributions, the income of the entrepreneur is already important here. If the annual income does not exceed the amount of 300 thousand rubles, then the following formula is applied:

Minimum wage*0.026*12 = 1935 rubles.

As we can see, with such a contribution, registration of illness will be beneficial only if the entrepreneur is ill for at least two weeks.

The question is logical. How useful is sick leave in reality then? If you, as an entrepreneur, decide to be sick for two weeks just to win the difference between the annual contribution and the payment, then it is extremely doubtful. After all, during these two weeks, what will be the total cost of business downtime? You are behind schedule, slowing down the work process - for most Russian entrepreneurs this is completely unacceptable.

As we can see, being sick in our country is unprofitable, even if you are an individual entrepreneur.