What are the main criteria for controlled transactions in 2020 - 2021

Controlled transactions are subject to verification by the Federal Tax Service to determine the presence or absence of intentions of the participants in the relevant transactions to evade taxes (reduce them) through unjustified manipulations with prices for goods and services that are the subject of agreements.

Thus, by reducing the price in the contract, the payer can reduce the tax base, and by increasing it, it can increase the base for calculating VAT deductions and inflating expenses. These actions are illegal. In the general case, transactions between related parties and transactions equivalent to such are considered controlled (clause 1 of Article 105.14 of the Tax Code of the Russian Federation). At the same time, dependent companies for the purpose of determining the controllability of transactions include companies that meet the criteria specified in Art. 105.1 of the Tax Code of the Russian Federation, and for the purposes of recognizing transactions between them as controlled by Art. 105.14 of the Tax Code of the Russian Federation establishes certain criteria. The range of these criteria is very wide. Further in special sections of the article we will consider their essence in more detail.

Transactions in which “unnecessary” intermediaries are involved, transactions in the field of foreign trade in goods of global exchange trade, and some others can be considered controlled. In addition, the court may recognize the transaction as controlled at the request of the Federal Tax Service (clause 10 of Article 105.14 of the Tax Code of the Russian Federation).

Subjects of controlled transactions in various combinations may be interdependent or equivalent to such:

- tax residents and non-residents of the Russian Federation;

- Russian companies;

- foreign companies.

It is worth noting that the subjects of control by the Federal Tax Service (for the same violations that we mentioned at the beginning of the article) can, theoretically, be not only interdependent persons, but also any other persons who have given reason to the tax authorities to draw attention to themselves - for example, having carried out an unreasonable underestimation or overestimation of prices in contracts (letter of the Federal Tax Service dated November 2, 2012 No. ED-4-3/18615). However, the courts are not very friendly towards inspections by the Federal Tax Service of persons who are not dependents (decision of the Supreme Court of the Russian Federation dated 01.02.2016 No. AKPI15-1383).

Check whether you have correctly defined the criteria for controlled transactions using the Ready Solution from ConsultantPlus. If you don't have access to the system, get a free trial online.

Controlled transactions - 2020-2021: criteria in tabular form

Our specialists have developed a special table for you, which details the grounds for classifying certain categories of participants in legal relations in business (tax residents of the Russian Federation, non-residents of the Russian Federation, interdependent persons, equivalent to dependent persons) as subjects of controlled transactions. This table, adapted for controlled transactions, contains criteria for 2020-2021 that a business owner can use to evaluate his contracts for additional interest from the Federal Tax Service.

| Subjects of transactions | What kind of transaction can be considered for controllability? | Criteria for classifying a transaction as controlled | Sources of law that collectively establish the procedure for classifying transactions as controlled |

| Interdependent persons who are residents of the Russian Federation | Any transactions between such persons, if the amount of income on them for the year exceeds 1 billion rubles. and one of the conditions specified in the following column is met |

| Art. 105.1 Tax Code of the Russian Federation; subp. 1 item 2 art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation |

| Art. 105.1 Tax Code of the Russian Federation; subp. 2 p. 2 art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 3 p. 2 art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 4 p. 2 tbsp. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 6 paragraph 2 art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation; Art. 275.2 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 8 paragraph 2 art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 9 paragraph 2 art. 105.14 Tax Code of the Russian Federation clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 10 paragraph 2 art. 105.14 Tax Code of the Russian Federation clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Any persons in transactions equivalent to transactions between related parties | Transactions involving intermediaries | Transactions are considered controlled if:

| Clause 1 Art. 105.14 Tax Code of the Russian Federation; subp. 1 clause 1 art. 105.14 Tax Code of the Russian Federation |

| Transactions with global exchange trade goods | Transactions are considered controlled if:

| Clause 3 Art. 105.14 Tax Code of the Russian Federation; sub. 2 p. 1 art. 105.14 Tax Code of the Russian Federation; clause 5 art. 105.14 Tax Code of the Russian Federation; clause 7 art. 105.14 Tax Code of the Russian Federation; letters of the Ministry of Finance of the Russian Federation dated 02.19.2019 No. 03-12-11/1/10545, dated 03.19.2018 No. 03-12-11/1/16985, dated 10.03.2012 No. 03-01-18/7-135, dated 04.09 .2015 No. 03-01-11/51070 | |

| Transactions between persons, one of whom is registered or operates in a country from the list approved by Order of the Ministry of Finance of the Russian Federation dated November 13, 2007 No. 108n | Transactions are considered controlled if their turnover exceeds 60 million rubles. in year | Art. 105.1 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation; subp. 3 p. 1 art. 105.14 Tax Code of the Russian Federation; clause 7 art. 105.14 Tax Code of the Russian Federation | |

| Any persons who are interdependent (equated to interdependent) with a person who is not a tax resident of the Russian Federation | Any transactions between persons who are recognized as interdependent in accordance with Art. 105.1 of the Tax Code of the Russian Federation or equated to interdependent ones in accordance with paragraph 1 of Art. 105.14 Tax Code of the Russian Federation | Transactions are considered controlled if their turnover exceeds 60 million rubles. in year | Clause 1 Art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation; letters of the Ministry of Finance of the Russian Federation dated October 3, 2012 No. 03-01-18/7-135, dated September 4, 2015 No. 03-01-11/51070 Letter of the Federal Tax Service dated August 17, 2017 No. ZN-4-17/ [email protected] |

ConsultantPlus experts inform: From March 17, 2021, changes come into force, according to which transactions with ferrous metals, mineral fertilizers and precious stones are planned to be checked, the rules are changing... Read the continuation of the news by getting trial access to the K+ system. It's free.

The transactions specified in clause 4 of Art. 105.14 of the Tax Code of the Russian Federation, in particular:

- between participants of one consolidated group of taxpayers;

An exception is transactions with extracted mineral resources, taxed at a percentage rate, as well as transactions for which income (expenses) are taken into account when calculating the tax base for the tax on additional income from hydrocarbon production.

- between persons who simultaneously:

- registered in one subject of the Russian Federation;

- do not have OP in other constituent entities of the Russian Federation, outside the Russian Federation;

- do not pay income tax to the budgets of other constituent entities of the Russian Federation;

- there are no conditions for recognizing transactions as controlled according to the criteria established by sub. 2-6 p. 2 tbsp. 105.14 Tax Code of the Russian Federation;

- have no losses (including losses from previous periods carried forward to future periods);

- for the provision of sureties (guarantees), if all parties are non-banking Russian organizations;

- for the provision of interest-free loans between interdependent persons - residents of the Russian Federation, etc.

Having considered what criteria are established for controlled transactions in 2021 - 2021, we will study such an aspect of the relationship between taxpayers and the Federal Tax Service as reporting under relevant contracts.

Table. Criteria for controlled transactions 2021

Several factors influence the recognition of a transaction as controlled. Including income from the transaction, tax regime of the company, type of activity, nature of the relationship between the parties to the transactions. For your convenience, we have collected the main criteria in a table (Article 105.14 of the Tax Code of the Russian Federation). Please review it to determine whether you need to report 2021 controlled transactions in 2021. The same criteria were in effect for transactions completed in 2021 and will continue to be in effect for transactions in 2021.

| Nature of the controlled transaction | Signs indicating a controlled transaction | Transaction amount to recognize it as controlled |

| Participants in the transaction are interdependent persons who are residents of the Russian Federation (Clause 2 of Article 105.14 of the Tax Code of the Russian Federation) | Sum of transaction prices for the year | The total income from transactions for the year is at least 1 billion rubles. |

| The parties to the transaction apply different income tax rates to the activities for which the transaction was concluded (except for the rates provided for in paragraphs 2-4 of Article 284 of the Tax Code of the Russian Federation) | ||

| One of the parties to the transaction pays the mineral extraction tax, and the subject of the transaction is the extracted mineral, which is recognized as an object of taxation for the specified party and is taxed at the interest rate | ||

| One of the parties to the transaction applies the unified agricultural tax or UTII, and the transaction was completed within the framework of this activity. One of the other parties to the transaction does not apply these regimes | ||

| One of the parties is exempt from income tax | ||

| One of the parties to the transaction is the taxpayer who produces hydrocarbons in an offshore field. The other party to the transaction is not engaged in this activity or is engaged, but does not take into account the income and expenses of such a transaction in the tax base for income tax | ||

| One of the parties to the transaction is a corporate research center specified in Federal Law No. 244-FZ or a participant in the project “On Innovative Scientific and Technological Centers” and is exempt from VAT. | ||

| One of the parties to the transaction applies an investment tax deduction during the tax period | ||

| One of the parties to the transaction pays additional tax. income from hydrocarbon production. In this case, income and expenses from the transaction are taken into account when calculating the base for this tax. | ||

| Any persons participating in transactions equivalent to transactions of related parties | Transactions with intermediaries that:

| The total income from transactions for the year is at least 60 million rubles. |

| Transactions in the field of foreign trade in goods of world exchange trade | ||

| Transactions in which one of the parties is registered, resides or is a tax resident in a state or territory that is included in the list of the Ministry of Finance | ||

| One of the interdependent parties to the transaction is not a tax resident | Transactions between persons who are recognized as interdependent or equated to interdependent (Article 105.1 and Article 105.14 of the Tax Code of the Russian Federation), if the transaction is not included in the closed list from clause 4 of Art. 105.14 Tax Code of the Russian Federation | The total income from transactions for the year is at least 60 million rubles. |

A transaction between related parties, residents of the Russian Federation, can be considered controlled if at least one of the criteria listed in the corresponding section of the table is met. At the same time, transactions that meet the specified criteria, but whose parties:

- registered in one region of the Russian Federation;

- do not have separate divisions in other regions of the Russian Federation and outside the Russian Federation;

- do not pay income tax to the budgets of other regions;

- do not have losses that reduce taxable profit.

These criteria apply to transactions for which income and expenses are recognized for calculating the income tax base from January 1, 2020. In this case, the date of conclusion of the contract does not matter. However, if you paid taxes before the beginning of 2021, there is no need to recalculate.

What kind of reporting is established for controlled transactions (“1C” and unified forms)

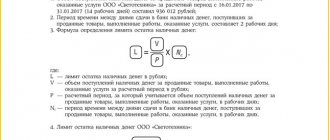

In accordance with clause 2. Art. 105.16 of the Tax Code of the Russian Federation, participants in controlled contracts must send a reporting document - a notification - to the tax service. The deadline for sending it at the end of the year is May 20 of the year following the reporting year. In 2021, this document is drawn up according to the form that was approved by the order of the Federal Tax Service dated 05/07/2018 No. ММВ-7-13/ [email protected] as amended by the order dated 07/26/2019 No. ММВ-7-13/ [email protected] You can download it at on our website in the material “Notification of controlled transactions: new form”.

This form includes:

- a title page that reflects information about the taxpayer - individual entrepreneur or legal entity;

- sections 1A and 1B, which record information about each of the controlled transactions (groups of transactions);

- sections 2 and 3, which record data on the taxpayer’s counterparties under controlled contracts (groups of contracts).

You can fill out the notification either manually or using popular accounting programs such as 1C. You can send it to the Federal Tax Service on paper or electronically via TKS.

Notification of a controlled transaction

A few words about controlled transactions

Let us remind you that controlled transactions are certain transactions between interdependent persons (as well as persons equated to them), in particular transactions for which the annual amount of income exceeds 60 million rubles, and at the same time two conditions are met simultaneously: place of registration / residence / residence all parties to the transaction are the territory of the Russian Federation; one of the parties to the transaction is a profit tax payer, and the other is not. The essence of such transactions is that for tax purposes, the tax authorities will accept the market price of the transaction even if the parties have agreed on a different price.

In this case, a notification about a controlled transaction is submitted at the place of registration of a legal entity or place of residence of an individual entrepreneur in the form established by the Federal Tax Service of Russia, in electronic form or on paper no later than May 20 of the year preceding the year of the controlled transaction (respectively, for transactions completed in 2021, such notice must be filed with the tax office by May 20, 2017).

If a person fails to provide such notification in a timely manner, he or she faces a fine in the form of a fine under Art. 129.4 Tax Code of the Russian Federation. However, the application of this rule of law causes many heated disputes and lawsuits.

In order to clarify the application of the rules, on February 16, 2021, the Presidium of the Supreme Court of the Russian Federation prepared a new Review of judicial practice, which allows to shed light on the nuances of the procedure for cooperation of interdependent persons.

Are penalties imposed for each failure to provide notice or is a person subject to a single penalty?

According to the case materials, the company appealed to the arbitration court to challenge the decision of the tax authority, according to which it was held liable for failure to submit notifications about controlled transactions on time. The company did not dispute the fact of delay, but tax authorities assessed fines for each transaction separately, which, in the opinion of the company, was unlawful.

The court concluded that the amount of the fine was determined incorrectly by the tax authority and satisfied the society's demands. According to the court decision, the taxpayer is liable for failure to submit notification of controlled transactions on time in the same way as for failure to submit one of the tax reporting documents, therefore the amount imposed in accordance with Art. 129.4 of the Tax Code of the Russian Federation, the fine is fixed (as in the case of tax reporting) and does not depend on the number of controlled transactions that were to be indicated in the notification.

You must be careful when filling out the notification.

However, please note that you must be careful when filling out the notification. Thus, in a decision on another case, the Supreme Court of the Russian Federation indicated: if the notification of controlled transactions contains incorrect information and such errors could prevent the determination of a controlled transaction, then this will be the basis for holding the taxpayer liable.

The company sent a notification about the completion of more than two hundred controlled transactions; in relation to four of them, erroneous information was provided about the type of subject of the transaction (goods instead of services) and the place where it was completed (the place where the service was provided). The tax authority brought the company to tax liability under Art. 129.4 Tax Code of the Russian Federation.

According to the taxpayer, the mistake he made did not lead to the unreliability of the declaration of the information specified in paragraph 3 of Art. 105.16 of the Tax Code of the Russian Federation, therefore, there is no event of an offense in his actions.

The court sided with society, noting that the essence of the declaration, which includes the submission of a notice of controlled transactions, is to provide information that will be sufficient for an initial analysis and decision-making on the need for in-depth control. The tax authority could request expanded information provided for in Art. 105.15 of the Tax Code of the Russian Federation, and documents confirming the relevant circumstances.

The list of information that must be provided by the taxpayer for these purposes, by virtue of clause 3 of Art. 105.16 of the Tax Code of the Russian Federation, is limited to four groups of information: 1) the calendar year to which the notification relates; 2) subjects of transactions; 3) information about their participants; 4) the amount of income received from transactions and (or) expenses incurred.

Consequently, in order to apply tax liability for the provision of false information, provided for in Art. 129.4 of the Tax Code of the Russian Federation, it is necessary that an error made by the taxpayer in filling out the relevant details of the notification creates obstacles to the identification of a controlled transaction, especially its subject.

Having considered the case, the court found that the incorrect indication of the type of subject of the transaction (goods instead of services) and the place of its execution should not have prevented the identification of a controlled transaction, since the error in indicating this information was corrected by correctly filling out other information - the name of the subject of the transaction, information about the service provider.

Thus, the mistake made by the company could not prevent the initial analysis of the notification and the adoption of a reasoned decision. Which inspectorate should the notification be submitted to?

In addition to correctly filling out the notification, it was not the most obvious for companies which inspectorate it should be submitted to.

The company submitted a notification to the interregional inspectorate at the place of its registration, but did not reflect in it a number of transactions made with companies whose place of registration is the British Virgin Islands, considering that such transactions relate to the accounting of the Federal Tax Service of Russia, for which it was brought to tax liability .

According to the taxpayer, such a decision was made by the interregional tax inspectorate in excess of its competence, since by virtue of Art. 105.17 of the Tax Code of the Russian Federation, verification of the completeness of calculation and payment of taxes is assigned to the exclusive powers of the Federal Tax Service of Russia.

The court did not agree with such arguments and refused to satisfy the society's demands. In accordance with Art. 101.4 of the Tax Code of the Russian Federation, upon discovery of facts indicating violations of the legislation on taxes and fees, an official of the tax authority draws up an act, and the head makes a decision on the issue of bringing to tax liability, after which such notification is sent by the tax inspectorate to Federal Tax Service of Russia.

Thus, the question of bringing the company to tax liability under Art. 129.4 of the code was lawfully decided by the head of the tax inspectorate.

Results

The legislation of the Russian Federation defines a wide range of potential subjects of controlled transactions. They can be both Russian and foreign companies operating in the Russian Federation. In most cases, they will be interdependent with or equivalent to interdependent with their transaction partners. Until May 20 of the year following the reporting year, taxpayers must report to the Federal Tax Service on controlled transactions.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service dated July 26, 2019 No. ММВ-7-13/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.