In 2021 - a new form of payment

Officials from the Federal Tax Service have developed a new form for calculating insurance premiums. The new form has been published on the Unified Portal for posting draft legal acts. But to be more precise, the project intends to approve a new edition of the form for calculating insurance premiums, and not a new form.

As for the changes, for example, in the updated form there is no annex that includes information about the application of the reduced tariff established for the period until 2021. In Appendix 2 “Calculation of the amount of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity” new fields have appeared.

The changes also affected, for example, section 3, which is required for personalized information of individuals. It has a new attribute “Adjustment type”. Accountants, as in SZV-M, will put a mark in it indicating which form they are submitting: original, correcting or canceling. In the order of filling out, it was indicated that the calculation should not contain numbers with minuses. And in Appendix 2 to Section 1, the field “Payer’s tariff code” was added. The changes also affected other calculation applications.

However, the draft provides that the new order will come into force on January 1, 2021 and will be applied starting with the submission of calculations for insurance premiums for the first quarter of 2021.

What is a DAM report and who submits it?

Since 2021, tax authorities have been administering insurance premiums. Therefore, the DAM report is currently an analogue of a tax return, filled out for three mandatory payments at once: insurance contributions for pension, social and compulsory health insurance.

This report is submitted by all economic entities that make payments to employees (legal entities, entrepreneurs and “ordinary” individuals). An exception is made for individuals who pay for tutoring, childcare, nursing, and housekeeping services.

Deadlines for submitting calculations for insurance premiums in 2018: table

Submit your invoice no later than the 30th day of the month following the reporting (billing) period. If the due date falls on a weekend, the payment can be submitted on the next working day.

Such rules are established by paragraph 7 of Article 431, paragraph 7 of Article 6.1 of the Tax Code of the Russian Federation.

The reporting period for calculating insurance premiums is the first quarter, half a year, nine months. The billing period is a calendar year. This is provided for in Article 423 of the Tax Code of the Russian Federation.

Below we provide a table with the deadlines for submitting calculations of insurance premiums to the Federal Tax Service in 2021. The table shows the deadlines no later than which the calculation must be submitted:

| Reporting period | Deadline |

| Calculation for 2021 | January 30, 2021 |

| Calculation for the 1st quarter of 2021 | May 3, 2021 |

| Calculation for the first half of 2021 | July 30, 2021 |

| Calculation for 9 months of 2021 | October 30, 2021 |

Heads of peasant (farm) households without hired workers submit payments once a year before January 30 of the calendar year that follows the expired billing period. Therefore, no later than January 30, 2021, they submit the calculation for 2021.

Responsibility for late submission of reports

Penalties for late submission of reports vary depending on the type of report itself . The amounts of fines directly applied to each reporting form are determined below.

| Reporting | Fine |

| Declaration on UTII | 5% of unpaid tax on time; Warning or fine 300.00-500.00 rubles; Blocking of account for overdue for more than 10 days |

| Declaration on Unified Agricultural Tax | |

| Single simplified declaration | |

| VAT declaration | 5% of the tax not paid on time for each month of delay (but not more than 30%), minimum - RUB 1,000.00. |

| Income tax return | |

| Property tax declaration | |

| Land tax declaration | |

| Transport tax declaration | |

| Water tax declaration | |

| Declaration on mineral extraction tax | |

| Declaration according to the simplified tax system | |

| Declaration 3-NDFL | |

| Accounting Report | From 3000.00 to 5000.00 rub. |

| 2-NDFL | From 100.00 to 500.00 rub. |

| 6-NDFL | 1000.00 rub. for each month of delay |

| Information on the average number of employees | RUB 200.00 for each document not submitted; 300.00-500.00 per manager |

| Calculation of insurance premiums | 5% of the tax not paid on time for each month of delay (but not more than 30%), minimum - RUB 1,000.00. |

| SZV-STAZH | RUB 500.00 for each insured person |

| SZV-M | |

| 4-FSS | 5% of the tax not paid on time for each month of delay (but not more than 30%), minimum - RUB 1,000.00. |

| Confirmation of main activity | No penalties, but the insurance premium rate will be maximum |

As you can see, any mistake in providing a report risks punishment. There is a practice when regulatory authorities do not issue fines for late payments. This depends on the reputation of the taxpayer (is it an isolated case or repeated violations), the form of the report, as well as the human factor. It is the employees of the authorities who make the decision to punish the violator, so in this case it is important to take the initiative on your part: call the tax and other authorities, explain the reason for not submitting the report, and also try to correct the current situation within the deadline. Only generating and submitting reports on time will help you avoid such significant troubles that threaten not only the loss of money, but also time.

Appendix 3 to Section 1

It deciphers the insurer's expenses for the purposes of compulsory social insurance. Each line can include up to four indicators:

- Number of cases of payments or their recipients.

- Number of payment days.

- The amount of payments.

- Including paid from the federal budget (if this category of payments provides for this possibility).

Lines Adj. 3 correspond to the types of benefits paid:

- On page 010, the amounts of sick leave are given without taking into account payments to foreign citizens and stateless persons, but including citizens of the states of the Eurasian Economic Union (EAEU).

- On page 011 of them, payments are allocated for external part-time workers.

- Line 020 reflects sick leave paid to foreigners and stateless persons, excluding citizens of the EAEU states.

- On page 021, information on external part-time workers is highlighted, similar to page 011.

- Line 030 reflects payments of maternity benefits.

- On page 031 of them, payments for external part-time workers are allocated.

- On page 040, the amounts of one-time benefits for early registration of pregnant women are indicated.

- On page 050, information is provided on payments of a one-time benefit for the birth of a child.

- On page 060 indicate the amount of monthly child care benefits.

- On page 061 of them, payments for the first child are allocated.

- On page 062 - payments for caring for the second and subsequent children.

- On page 070, they provide payment for additional days to care for disabled children.

- Line 080 reflects insurance premiums accrued for payment from line 070.

- On page 090 they show the amount of the funeral benefit.

- On page 100, all the above types of payments are summed up.

- On page 110 from page 100, unpaid benefits are allocated.

Sample filling subsection 1.1 and subsection 1.2

Subsections 1.1 and 1.2 of the ERSV decipher information about the payment of contributions to the Pension Fund and Medical Insurance. The fields of the subsections are completely identical, with the exception of lines 021, 061 and 062. These lines are present only in subsection 1.1. All other columns of the designated sections are filled out equally.

Subsection 1.1 contains data on the Pension Fund;

Subsection 1.2 contains data on Medical Insurance.

| Line no. | What does it include |

| 01 (fare code) |

|

| 010 | Total number of insured physicists January - September 2021, and monthly from July to September 2021 |

| 020 | Number of persons for whom contributions were paid total amount from January to September 2021, and monthly from July to September 2021 |

| 021 | The number of persons whose contribution base exceeds the maximum possible |

| 030* | Amount of employee income |

| 040 | The amount of employee income from which contributions are not taken |

| 050 | Basic income for paying contributions (must be equal to the difference in columns 030 - 040) |

| 060 | Amount of contributions |

| 061 | Amount of contributions whose base does not exceed the maximum |

| 062 | Amount of contributions whose base exceeds the maximum |

*In lines 030 - 062, all amounts are indicated from the beginning of the year, that is, the total for January - September 2021, as well as monthly for July, August, September.

Completing subsections 1.1 and 1.2

How the tax office checks the RSV

In the DAM, 311 control ratios must be fulfilled in accordance with the Letter of the Federal Tax Service of the Russian Federation dated December 29, 2017 from GD-4-11 / [email protected] and 186 formulas in accordance with the Letter of the Federal Tax Service of the Russian Federation dated June 15, 2017 No. 02-09-11/04 -03-13313.

The tax office checks whether the amount of pension contributions for the 2nd quarter matches the personal accounting information. If there is a discrepancy, it is necessary to correct the error (clause 7 of Article 431 of the Tax Code of the Russian Federation).

Tax officials also check the consistency of the individual information provided with the Federal Tax Service database. If there are errors, the RSV must be retaken.

In order to determine the correctness of calculation of insurance premiums, inspectors add the amount of calculated contributions for the 2nd quarter to the amount for the 1st quarter. If the result is less than the total amount, you need to look for and correct the error.

Example of filling out the DAM for the 2nd quarter of 2018.

Let's look at a specific example of how to fill out the DAM for the 2nd quarter of 2021.

Section 3

Alternatively, you can start filling out the DAM from section 3, which will reflect individual information for each employee, as well as calculated remunerations and insurance contributions. This sheet must be completed for each individual with whom an employment or civil employment agreement has been concluded. Section 3 includes 2 pages, the first of which displays the employee’s personal information, and the second - the amounts of payments and insurance premiums.

On page 010, you must indicate “0” if the DAM is surrendered for the first time during the specified period. If adjustment calculations are made, you must enter 1-, 2-, etc. on the line. depending on the correction number.

On page 020 the code of the billing period is written down, in our case - 31.

On page 030 the year is entered - 2021.

On page 040, you need to reflect the serial number of information about the employee. You can use a personnel number, but it is much more convenient to put exactly the serial number of the sheet of section 3, since, for example, workers under civil and industrial agreements do not have a personnel number at all.

On page 050 the date of transfer of the RSV is entered.

On pp. 060-150, individual information is indicated, including full name, date of birth, INN, SNILS, passport data.

On pp. 160-180, code 1 is entered when the employee is insured in the insurance system (OPS, compulsory medical insurance, OSS), and 2 when he is not insured.

A sample of filling out the first page of Section 3 is presented below:

The second page of section 3 is for totals.

Page 190-250 are used to reflect information on pension insurance (at general or reduced rates), and pp. 260-300 - to enter data on pension insurance at additional tariffs.

For each month, columns 220, 230 and 240 are used, arranged in a column.

In gr. 190, information is entered about the serial number of the three reporting months, in our case it will be 04, 05, 06.

In gr. 200 must reflect the category code of the insured person, which can be selected from this table. The most common is HP - hired employee.

In gr. 210 indicates the total amount of payments to the employee for the six months.

In gr. 220 the pension insurance base is entered within the limit.

In gr. 240, contributions calculated from the specified base are recorded.

On page 230 payments to employees under the contract are entered. If there are none, you need to enter zeros.

In gr. 250 reflects the general values of the total indicators for the last 3 months.

An example of filling out the specified information is presented below:

Subsections 1.1 and 1.2 of Appendix 1 of Section 1

Subsection 1.1 is intended to reflect pension contributions, and subsection 1.2 is intended to reflect medical contributions.

On page 001, the tariff code is indicated in accordance with Appendix 5 of the Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/551. For organizations with a general tariff, code 01 is used.

Subsection 1.1 differs from subsection 1.2 by the inclusion of lines 021, 051, 061, 062, since they reflect information on contributions in excess of the established limit of the taxable base.

On page 030 in accordance with paragraph 1 of Art. 420 of the Tax Code of the Russian Federation indicates the specific amount of payments subject to contributions.

Line 040 reflects payments that are not subject to contributions.

On page 050 you need to indicate the taxable base for contributions.

On page 060 the amount of the contributions themselves is indicated.

In the DAM for the 2nd half of 2021, the total amount of contributions to mandatory pension insurance should be equal to the amount of contributions for all employees for each month. Otherwise, the tax authorities will not accept the DAM (Clause 7, Article 431 of the Tax Code of the Russian Federation). This reference ratio must be checked before submitting the calculation.

An example of filling out subsection 1.1 is presented below:

An example of filling out subsection 1.2 is presented below:

Appendix 2 section 1

This application shows calculations for social insurance contributions. In gr. 001 you need to put code 1 if there is a pilot project with the Social Insurance Fund in the region, and code 2 if employers pay benefits themselves and then reimburse them from the Social Insurance Fund.

Appendix 2 must be filled out in the same way as subsections 1.1 and 1.2 with some exceptions:

- in page 010 there is no need to indicate employees on civil and industrial contracts, since they are not insured;

- on pages 020 and 030 you need to indicate the remuneration paid to employees under GPC agreements;

- on page 070 you need to reflect expenses incurred at the expense of the Social Insurance Fund. In this case, the first 3 days of sick leave are not taken into account (Letter of the Federal Tax Service of the Russian Federation dated December 28, 2016 No. PA-4-11 / [email protected] ), since they are paid for by the employer. In addition, the amount is indicated taking into account personal income tax.

An example of filling out Appendix 2 is presented below:

Appendix 2 continues below:

Appendix 3

The application is necessary to detail information on employee benefits. If they have not been paid, you do not need to fill out the form.

On pp. 010-090, for each type of benefit, the number of cases or paid days is reflected, and, in addition, the amount of these expenses.

On pages 010 and 011, benefits are recorded for citizens of Russia and from the EAEU countries (clauses 12.6, 12.7 of the Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/551).

Lines 020 and 021 record benefits for temporarily staying foreigners.

An example of filling out Appendix 3 is presented below:

Section 1

This section is intended to display information on contributions for transfer to the Federal Tax Service based on the results of the 2nd quarter of 2021.

First, you need to write down the OKTMO code, and then the amount of contributions for each individual BCC, more details about which can be found in this article. Amounts must be indicated separately for the total calculation period from the beginning of the year, and, in addition, for each month of the reporting period (second quarter).

If it is necessary to indicate several BCCs, you need to draw up several sheets of section 1 with all lines 060-073.

An example of filling out section 1 is presented below:

Section 1 continues below:

Title page

Information about the company is filled out on the title page, including name, INN, KPP, OKVED code.

In the “adjustment number” column, you must enter 0 if a primary calculation is submitted. Then indicate the billing period code - 31, year - 2021, code for the location of the company - 214.

The full name and signature of the director, as well as the date of formation of the DAM, are indicated in the lower left part of the title page. If the report is signed not by the director, but by an authorized representative, a copy of the supporting document must be attached.

An example of filling out a title page is presented below:

Optional sections to fill out

In this chapter we will talk about those sections of the DAM that are intended for a limited number of enterprises, organizations and individual entrepreneurs.

| Optional sections of the ERSV for the 2nd quarter of 2018 | Who should apply |

| Subsection 1.3 | Payers of contributions on additional tariffs |

| Subsection 1.4 | Airline enterprises and organizations involved in coal mining |

| Appendix 3 | Employers who paid sick leave benefits during the reporting period |

| Appendix 4 | Budgetary organizations whose staff includes employees who are victims of the Chernobyl nuclear power plant |

| Appendix 5 | IT enterprises with preferential tariffs |

| Appendix 6 | USNO |

| Appendix 7 | NPO on the simplified tax system |

| Appendix 8 | Businessmen with a patent |

| Appendix 9 | Companies whose staff includes foreign workers temporarily residing in the Russian Federation |

| Appendix 10 | Companies that employ students |

| Section 2 and its Appendix | Farmers and peasant farms |

RSV filling mechanism

The DAM must be filled out in rubles and kopecks, and all indicators must be entered from left to right, starting from the very first cell. In calculations submitted electronically or when created through a computer program, dashes are not placed in empty cells (Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/551).

The field “Last name ________I.___O.___” is intended to be filled in by individuals who are not registered as individual entrepreneurs and have not indicated their TIN in the DAM. Organizations do not fill out this field.

Section 1

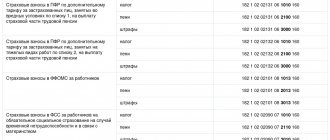

This section contains general information about insurance premiums of all types that the payer is required to transfer to the funds. It begins with the OKTMO code corresponding to the municipality where the fees are paid.

A separate block is dedicated to each type of contribution. The first four of them are filled out according to the same rules, so let’s look at them using the example of pension contributions (lines 020-033):

- On page 020 the BCC for this type of contribution is indicated.

- On page 030, the total amount payable for the billing period is given (in this case, for the 1st half of 2021)

- Pages 031-033 separately show the insurance premiums that must be paid for the last three months of the period (April, May, June).

Similarly, fill out the blocks for the following types of contributions:

- For compulsory health insurance (pp. 040-053)

- For compulsory pension insurance at an additional tariff (p. 060-073).

- For additional social security (pp. 080-093).

According to special rules, fill out part of section. 1, dedicated to social insurance in case of illness or in connection with pregnancy and childbirth. This block consists of two parts, since the employer can independently make social expenses (pay sick leave or maternity benefits).

It starts on page 100, in which the BCC for this type of contribution should be entered. Further, if the amount of contributions accrued for the period is greater than the employer’s social payments, then fill in the following lines:

- Page 110 - the total amount of contributions payable for the reporting period, taking into account the employer’s expenses.

- Page 111-113 - amounts payable for the last three months of the period.

If expenses on social payments exceed the amount of accrued contributions, then the excess amount is entered on pp. 120-123 according to a similar principle.

It is clear that in each case only one of the corresponding lines should be filled in, i.e. lines 110 and 120, 111 and 121, 112 and 122, 113 and 123 cannot be filled in simultaneously.

Title page

This section of the report contains information about the originator and the form itself:

- The TIN code allows you to identify the report preparer as a taxpayer. For legal entities it consists of 10 characters, for individuals - of 12.

- The KPP code (reason for registration) is assigned only to legal entities. The fact is that organizations can be registered in several divisions of the Federal Tax Service - not only at the place of primary registration, but also where the branch, real estate, etc. are located. The basis for registration in this inspection is indicated by the checkpoint code.

- The correction number indicates whether the submitted report is primary or corrected. For primary, indicate the code 0–, then 1–, 2–, etc.

- The billing (reporting period) is indicated by a two-digit code. He is chosen from App. 3 to Order. For the report for the second quarter of 2021 (or rather, for the half-year, since reporting periods are determined on an accrual basis), code 31 is used.

- The calendar year is indicated in four-digit format; for the current year it is 2021.

- Field “Provided to the tax authority” - here the code of the department of the Federal Tax Service of the Russian Federation is given in a four-digit format.

- Field “At location (registration)” - indicate the basis for submitting the form to this inspection. Codes are taken from Appendix. 4 to Order. For example, for a report provided by a Russian organization at the place of registration of the parent company, this is 214, and at the location of the branch - 222.

- Field “Name (full name)” - we provide the full name of the organization (branch) in accordance with the charter. For an individual, you must indicate your full name without abbreviations.

- The code for the type of economic activity is indicated in accordance with the all-Russian classifier OKVED-2.

- The fields “Form of reorganization (liquidation)” and “TIN (KPP) of the reorganized organization” are filled in if the report is submitted by the legal successor. The reorganization form code is selected from Appendix. 2 to Order. In this case, you need to keep in mind that for the successor’s report in App. 3 provides separate codes for reporting periods.

- Contact phone number.

- The number of sheets of the report itself and supporting documents (if any).

- Information about the person who signed the report (full name, signature, date). For an organization, this must be a manager or other person who has the right to sign. The individual signs the report independently. A representative can also sign the form on behalf of the payer; in this case, in the appropriate field, you must indicate the representative code - 2 and fill out information about the power of attorney.

Which sections of the RSV should I fill out?

The RSV includes a title page and 3 sections, the 1st of which contains 10 applications, and the 2nd - one application. The title page, section 1 (subsections 1.1, 1.2 of appendix 1, appendix 2) and section 3 are required for completion by organizations and individual entrepreneurs that have hired employees.

Other sheets need to be completed only if necessary, for example:

- if benefits were paid, you need to fill out Appendix 3 of Section 1;

- if the company has established harmful and dangerous working conditions, you need to fill out subsections 1.3.1, 1.3.2 of Appendix 1 of Section 1;

- if an organization uses reduced rates for calculating insurance premiums, you need to fill out appendices 5, 6, 7 of section 1, depending on the basis for paying insurance premiums.