To generate documents for individual entrepreneur registration, you can use the free online service directly on our website. With its help, you can prepare a package of documents that meets all the requirements for completion and legislation of the Russian Federation.

To start a cargo transportation business, there is no need to register an organization. It is quite enough to obtain the status of an individual entrepreneur. Find out how to open an individual entrepreneur for cargo transportation and choose the optimal tax system.

Free consultation on individual entrepreneur registration

Taxation for cargo transportation in 2021

Many entrepreneurs who outsource their accounting do not even know what they pay taxes for. In the case of UTII, everything is very simple: the required tax is calculated not on real income, but on a fixed amount established by the state. For cargo transportation, the implied basic profitability of one truck is 6,000 rubles per month. Let's multiply this amount by the annual inflation coefficient (2.005) and get 12,030 rubles - such income should be generated by one car per month. The entrepreneur must pay 15% tax on this amount; if he has one car, he will pay only 1,805 rubles monthly. But even this small payment can be reduced by the amount of contributions for pension and health insurance of employees or yourself.

Thus, an individual entrepreneur working on his own truck does not actually pay taxes: he only makes social contributions, most of which go to his own account in the Pension Fund.

It is not difficult to fill out UTII reports: the only drawback is that you need to submit it 4 times a year.

Also known as self-employment tax. It appeared quite recently and is suitable only for private individuals: companies with several machines cannot use it, since the NAP does not require the presence of hired employees.

NAP is good for its simplicity: you don’t need to go to the tax office to register and submit reports; all this can be done through a special application for a smartphone. In the same application, you can set up auto-payment, and reporting will be generated automatically. Another advantage is that there is no obligation to pay contributions to pension insurance. Whether to pay or not to pay them is up to everyone to decide for themselves, but if you decide to pay, the NAP will not allow you to reduce the tax by the amount of contributions paid.

However, there are several obstacles that make NAP an unsuitable regime for motor carriers.

The system is attractive because it does not oblige you to register as an individual entrepreneur. However, the carrier will not be able to protect itself from huge fines for RTO and tachographs, since the Motor Transport Charter states:

carrier - a legal entity, individual entrepreneur who has assumed under a transportation contract...

The second minus is the amount of tax itself (4% when paid by individuals and 6% when paid by individual entrepreneurs and companies). It will not be possible to reduce the tax base for expenses, and the expense portion of transportation is high. So if you are paid 100 thousand rubles for transportation, then the tax will be calculated directly from this amount and will be 6 thousand.

The third disadvantage is the limitation of the maximum income in the amount of 2.4 million rubles, i.e. 200 thousand rubles per month. If you work closely, you may not be able to meet this amount.

Transition from UTII for road carriers

The differences between these organizational and legal forms are serious, and one of them may begin to appear as early as 2021, when the next edition of the work and rest regime comes into force. It will apparently indicate that the RTO is valid not only for hired drivers, but also for individual entrepreneurs who drive the truck themselves. And any violation (overtime, lack of paper in the tachograph, etc.) can result in fines of tens of thousands of rubles for entrepreneurs. That's why

Many drivers wonder: shouldn’t they become mercenaries, teaming up with other individual entrepreneurs in an LLC?

But LLC also has disadvantages for small companies. This is complex accounting and difficulties with withdrawing money for personal use. An individual entrepreneur can spend his earnings without restrictions, and the founder of an LLC, when withdrawing money for his own needs, must pay personal income tax.

Having analyzed all the pros and cons of various taxation systems, the author of the blog “Dalnoboi PRO” comes to the following conclusions:

- In most cases, the most profitable system is the Patent (PSN)

. To switch to it, an LLC can re-register as an individual entrepreneur. - If it is possible to work with expenses and VAT, you can choose OSNO,

but it is worth remembering that accounting costs will increase. - The simplified tax system is also possible if the tax rate is reduced in the future.

Regional authorities have the right to do this: check the information, perhaps your tax office has already made such a decision.

A truly simplified mode with basic calculations. There is no need to confirm or verify expenses. You can reduce the amount of tax on fixed individual entrepreneur contributions and salary contributions. The only mandatory things in tax accounting are the book and the declaration. But even in this case, we recommend taking it into account in the program - it’s faster, easier and you won’t need to monitor changes in the law.

- Knowledge base

- How to fill out reports

- Primary document formats

- Electronic work books

- Electronic sick leave

- How to switch your office to remote work

- What is important to know about 54-FZ

- EDI and how it works

- How can individual entrepreneurs participate in tenders?

- Electronic auction under 44-FZ

- What is and how to open a special account

There is a lot said on the Internet about extending the “tax holiday” for small and medium-sized businesses. It was stated that cargo carriers on the PSN also have the right to take advantage of benefits. However, the relaxations will apply exclusively to industries affected by COVID-2019: hotel business, catering, tourism and some other areas. The additional tax deferment does not apply to entrepreneurs involved in road transportation

From January 1, 2021, the single tax on imputed income will be cancelled.

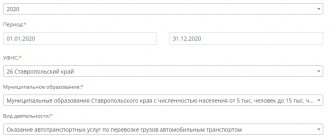

To switch to the patent regime, an entrepreneur must notify the territorial body of the Federal Tax Service of the Russian Federation about this no later than 10 days in advance

before the expected start date of work. This can be done through the department’s website using your personal account.

An individual entrepreneur must meet a number of mandatory requirements:

- The average number of employees is no more than 15 people;

- Maximum income – no more than 60 million rubles;

- Notification of the Federal Tax Service authority at the place of activity (i.e. you cannot be registered in Tula, but work in Moscow);

If the first and/or second condition is no longer met, the entrepreneur must choose a different taxation system. 10 days are allotted for this from the date of the legal event. The maximum income of an individual entrepreneur should not exceed 60 million rubles. and in the event that the PSN and simplified tax system are used simultaneously.

Advantages of PSN:

- No other taxes (no need to fill out reports and pay VAT, property and income taxes);

- Minimum reporting;

- Possibility of combining with other tax regimes;

- The right to provide services to individuals and corporate clients.

If the patent is purchased for a period

, not exceeding 6 months, then the amount must be paid no later than the end of the period specified when submitting the application. If for 6-12 months, then 1/3 is paid within 90 days from the beginning of the PSN validity period, and the remaining amount is paid before the end of the period.

This rule will not change in 2021. By the way, if an individual entrepreneur paid for a patent for a certain period, but worked less (for example, due to termination of activity), the balance can be returned upon his application.

So, no global changes are planned in the PSN in the field of cargo transportation in 2021

, which in itself is good news. This taxation system is optimal for a small business, it is flexible and scalable. However, some points remain unresolved.

For example, an individual entrepreneur is registered in the Moscow region, but sometimes provides services to clients from the capital: what law should he follow? Or are regional residents not allowed to enter into legal relations with Muscovites? After all, it is much more profitable to buy a patent in an area where the approach is more flexible than in the capital. And yet, it is worth recognizing that the PSN remains one of the few taxation systems adapted for small business entities.

Yes, transportation by road is covered by a patent. This is a convenient transition option, but it is suitable only for individual entrepreneurs, subject to the following conditions:

- no more than 15 employees

- income no more than 60 million rubles per year.

Organizations cannot apply a patent.

What documents are needed

When traveling, the driver must have a completed waybill. It must be provided by the customer.

Since the driver can use his own or rented car, he must have documents that confirm the rights to use and drive (driver’s license, vehicle registration certificate, insurance policy, power of attorney if the vehicle is rented).

When checking, an individual entrepreneur may be required to provide a forwarding agreement, if one has been drawn up.

It is important to choose the right tax system

Cargo transportation in 2021: which taxation system to choose for individual entrepreneurs

If an individual entrepreneur is engaged in cargo transportation, then he will not dare to apply the general taxation system - this is difficult in terms of taxes (payment of personal income tax and VAT) and in terms of the workload on the accountant (you will have to employ several people to account for all documents). Therefore, individual entrepreneurs choose special tax collection modes.

Until 2021, an individual entrepreneur in the field of cargo transportation could choose the following special taxation regimes: simplified taxation system, patent, UTII.

Starting from 2021, UTII has been abolished, so for individual entrepreneurs with cargo transportation there are only two modes left:

- patent;

- USN.

Below we will consider all the pros and cons, pitfalls of both modes.

A program from Class365 will become an assistant in maintaining tax and accounting records. It simplifies filling out documents, eliminates errors and helps control the flow of finances in the company. You can try the full functionality of the Class365 program for business automation right now >>

Any individual entrepreneur with a patent is required to work in accordance with the requirements of this taxation system:

- no more than 15 employees;

- income should not exceed 60 million;

- You must work at your place of registration.

If any of these conditions do not work, then the IP should be changed or a different system should be initially selected. For example, the simplified tax system, where the possible income is higher and is not tied to registration.

The tax office has an ambiguous attitude towards individual entrepreneurs who work on a patent and transport goods to other cities. In most regions they turn a blind eye to this, while in others they may threaten to revoke the patent. However, for the last five years there have been no reports of trials in such cases. Court decisions in favor of entrepreneurs are publicly available, but these are old cases (2014).

If you have decided on the type of taxation, you need to write an application. An important difference between a patent and the simplified tax system is that you can apply for a patent on any day of the year, the amount of the patent is calculated in proportion to the remaining time of the year (or the period for which you took out the patent).

When filling out an application, the most popular questions are about the vehicle code and OKVED. We'll explain the details below.

This field is for selecting transport:

01 - road transport for the transportation of goods;

02 - motor transport for the carriage of passengers;

03 - water transport for the carriage of passengers;

04 - water transport for the transportation of goods.

How can an individual entrepreneur work on a patent when providing cargo transportation services?

Sheet B is filled out for each unit of cars.

The vehicle type code is recorded (01 for motor vehicles, 04 for water transport).

The “Identification number” column indicates the VIN for vehicles, IMO for ships.

It is also necessary to write down the vehicle make, registration plate and carrying capacity in tons (rewrite the information from the registration certificate).

For cargo transportation, the field with the number of seats remains empty.

Whether a tax regime can be applied depends on the organizational and legal form, revenue, availability of employees and their number, types of activities and other conditions. Thus, for the application of the simplified tax system, limits are established on revenue and the number of employees, the cost of fixed assets, and the share of participation of organizations in the authorized capital.

The individual entrepreneur provides household services in Moscow - repairs clothes, shoes, metal products and makes keys. Its annual revenue is 2,500 thousand rubles (including VAT - 416.67 thousand rubles), expenses - 1,400 thousand rubles (including VAT - 150 thousand rubles), of which taken into account when STS - 1,300 thousand rubles. He has one employee with a salary of 40 thousand rubles per month.

Let's look at 5 tax regimes and determine which one will be more profitable.

On OSNO, income and expenses to determine the tax base for personal income tax are taken without VAT. The tax base will be 2,083,333 - 1,250,000 = 833,333 rubles, and the tax amount of 13% of it will be 108,333 rubles. VAT payable will be 266,667 rubles = 416,667 - 150,000.

Let's determine the amount of insurance premiums.

Insurance premiums for an employee will be 12 × (12,392 × 30.2% + (40,000 - 12,392) × 15.2%) = 95,265.60 rubles per year, where:

- 12 - number of months;

- 12,392 - minimum wage for 2021;

- 30.2% - total contribution rate (including injuries);

- 15.2% - the aggregate reduced rate of contributions for payments above the minimum wage.

“For itself,” the individual entrepreneur will pay contributions in a fixed amount - 40,874 rubles, as well as a “variable” part to the Pension Fund - 1% × (833,333 - 300,000) = 5,333.33 rubles.

The amount of contributions for the employee and fixed contributions of the individual entrepreneur “for himself” will be the same in all options.

VAT is not allocated from income, and expenses are taken into account for taxation in amounts that include VAT. Thus, the tax base for personal income tax will be 2,500,000 - 1,400,000 = 1,100,000 rubles. And the tax itself is 13% of it - 143,000 rubles. In this case, VAT payable will be zero. The “variable” part of the contributions will be 1% × (1,100,000 - 300,000) = 8,000 rubles.

Set of documents for cargo transportation

Today, there are two forms issued for the transportation of goods.

The first is a consignment note in form N 1-T (approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 N 78, hereinafter referred to as Resolution N 78). The second is a waybill (hereinafter referred to as TN) without a form number. TN is given in Appendix No. 4 to the Rules for the Transportation of Goods, approved by Decree of the Government of the Russian Federation of April 15, 2011 No. 272 (hereinafter referred to as the Rules). These Rules came into force on July 25, 2011.

From the same date, a new form is in effect, in turn, form N 1-T has not been cancelled.

Three forms

When purchasing goods, a merchant needs documents confirming the transfer of valuables, and in some cases, their delivery. The transfer of goods (sale) is accompanied by the execution of a consignment note in form N TORG-12 . It is drawn up by the seller in two copies.

The first copy remains with the seller to write off the valuables from the register and confirm their transfer to the client. The second is transferred to the buyer for acceptance of the purchased goods for accounting (the individual entrepreneur makes a corresponding entry in the book of income and expenses).

The consignment note in form N 1-T is intended for recording valuables (goods) and paying for their transportation by road . The form includes two sections. The commodity section defines the relationship between the shipper and the consignee.

Based on this section, the consignor will write off the goods, and the consignee will capitalize the received values. In fact, the information in this section repeats the information contained in TORG-12. The second section is devoted to transportation issues.

Here information about the cargo, its characteristics, accompanying documents is indicated, and information about loading and unloading operations is provided. Roughly speaking, form N 1-T is TORG-12, supplemented by a transport section.

Because of this, disputes often arise: is it enough to draw up form N 1-T when selling goods, because it contains information about the goods, and there is no need to duplicate them in TORG-12. Controllers require both forms to be completed. Although regulations allow you to get by with just a TTN, having forms NN 1-T and TORG-12 in hand, a businessman will avoid possible claims.

The regulations propose a new form for confirmation of carriage. of waybill (hereinafter referred to as TN) differs from form N 1-T primarily in that it does not have a product section. The new TN does not replace the consignment note in form N TORG-12; it exclusively regulates transportation issues.

The appearance of a new form will theoretically remove questions about the registration of TTN and TORG-12. Now everything is clear: the transfer of goods is confirmed by TORG-12, and the delivery is confirmed by TN. The TTN has not been cancelled, and officials have not approved any instructions on when the TTN needs to be issued. For now, businessmen have to figure out these issues on their own.

Rules for transporting cargo by road

Cargo transportation is carried out on the basis of a contract of carriage , under which the carrier undertakes to deliver the cargo entrusted to him by the sender to the destination and deliver it to the recipient, and the sender undertakes to pay the established fee for the carriage of cargo (clause 1 of Article 785 of the Civil Code of the Russian Federation).

The conclusion of a contract for the carriage of goods is confirmed by the preparation and issuance to the sender of the goods of a waybill, bill of lading or other document for the goods provided for by the transport charter or code (clause 2 of Article 785 of the Civil Code of the Russian Federation). In other words, there is no need to draw up a separate agreement.

The mere execution of a waybill (or other transportation document) already indicates the existence of a contract. As you can see, the Code does not require the drawing up of technical specifications, but allows for “another document”. The old TTN form may well become this.

According to the Rules, a contract of carriage can be concluded through the carrier’s acceptance of an order (clause 6 of the Rules). The person who needs to organize transportation (this can be either the buyer or the seller, depending on the terms of sale of the goods) sends an order to the carrier.

If there is an agreement on the organization of cargo transportation, when systematic transportation is carried out (Article 798 of the Civil Code of the Russian Federation), the cargo owner sends an application to the carrier.

The Rules do not offer a unified order and application form. This can be any document, letter, message that would indicate the intention of the cargo owner. The submission of an order (application) does not yet indicate the conclusion of an agreement, but only the intention to conclude it. The carrier, having received the order (application), within three days informs the shipper of consent or refusal (with written justification of the reasons). Next, the shipper will issue a waybill, and this already indicates the existence of a contract.

So, a waybill is drawn up when the transportation of goods is carried out under a contract for the carriage of goods. Let's consider the possible options.

Delivery will be organized by the seller

The supplier may include the cost of delivery in the price of the product or provide customers with an additional service - delivery. In the first case, the buyer pays for the goods, and delivery for him under the terms of the deal will be free. This scheme is often used by “imputators”.

If in the contract the cost of delivery is highlighted as a separate line and is not included in the cost of goods sold, then the provision of delivery services is considered an independent type of activity.

Accordingly, UTII will have to be paid not only for retail trade, but also for cargo transportation services.

When delivery for the buyer is “free”, that is, included in the price of the goods and not indicated as a separate line in the documents, then no additional type of activity arises, sales and delivery are carried out within the retail framework (Letter of the Ministry of Finance of Russia dated April 28, 2005 N 03-06 -05-04/112).

Source: https://www.mosbuhuslugi.ru/material/komplekt-dokumentov-dlya-perevozki-gruza

Individual entrepreneur for cargo transportation in 2021 USN or Patent?

Expenses for tax purposes are not taken into account, therefore the tax base is equal to the amount of income - 2,500,000 rubles, and the calculated tax amount is equal to 6% of it - 150,000 rubles.

The “variable” part of the contributions will be 1% × (2,500,000 - 300,000) = 22,000 rubles. At the same time, the tax calculated when applying the simplified tax system can be reduced by the amount of insurance premiums, but only by 50%. As a result, the amount of contributions “to be counted” will be 75,000 rubles.

The base for calculating tax is the sum of the potential annual income for each type of activity. In this case, there are three of them, for each of them this amount is 660,000 rubles. This means that the tax will be 6% × (660,000 × 3) = 118,000 rubles. You cannot take into account expenses, but from 2021 you can reduce the tax on the amount of insurance premiums for yourself and your employees.

The “variable” part of the contributions will be 1% × (2,500,000 - 300,000) = 22,000 rubles.

The tax can only be reduced by 50%. Therefore, you need to pay for the patent in the amount of 59,400 rubles.

- An individual entrepreneur, without employees, carries out cargo transportation throughout the country using his own car. How many patents do you need to obtain when providing cargo transportation services to different regions?

- In regional legislation, for obtaining a patent there is a concept of basic profitability for cargo transportation per 1 car; for a patent there is a limit of 60 million rubles. How can this data be combined if the amount of basic profitability is significantly less?

- Can an individual entrepreneur on PSN (cargo transportation) provide services to legal entities?

- Can an individual entrepreneur apply PSN from 01/01/2021 if the type of activity is cargo transportation with an average headcount of 16 people and the number of cars is 12?

- An individual entrepreneur with employees has 2 patents: cargo transportation and retail trade. There are hired employees only for cargo transportation. How can you reduce the patent on insurance premiums?

- How to calculate the load capacity on a patent (Tomsk region)?

- If you rent a car, can you be self-employed?

The entrepreneur knows that if you don’t pay extra, or what’s worse, try to circumvent the rules, the consequences will be disastrous. Therefore, we used completely legal methods to reduce the amounts. First of all, this is the choice of taxation system. Conducting the same activity, deductions can change significantly, simply by choosing a different tax regime.

At one time, the UTII (Unified Tax on Imputed Income) system prevailed in the field of cargo transportation. Our previous article was about this: Choosing a taxation system for individual entrepreneurs in cargo transportation in 2020. However, as of January 2021, this system has been abolished. This was a blow to entrepreneurs who had hoped that the UTII would still be retained. Many had to urgently choose a new tax system. Main options: simplified tax system and purchase of a patent.

How much taxes do you need to pay?

The types of taxes and their amounts are determined by what system the individual entrepreneur uses. On the general system, you must pay income tax and value added tax. Under the simplified tax system, payment is made in accordance with the chosen work option (6% of the amount of income or 15% of the difference between income and expenses).

Which taxation system is better for individual entrepreneurs in retail trade - what to choose

Note! When using a patent or UTII, they pay only the amount established by regulations.

Interregional road transportation: how many patents to buy?

Of the tax regimes operating in the Russian Federation, four are suitable for freight transportation:

- general taxation system (OSNO);

- simplified taxation system (STS);

- patent tax system (PTS);

- professional income tax (PIT).

All four modes are available to individual entrepreneurs; legal entities can choose OSNO or simplified tax system.

Tax systems other than PSN cannot be combined. OSNO and PSN, simplified tax system and PSN can be used simultaneously.

Transition from UTII to another taxation system

“My Business” will take on all the work of switching to another mode.

The replacement of UTII with a general taxation system for cargo transportation will take place automatically if the payer of the imputation does not notify the Federal Tax Service of the transition to another tax regime. If UTII is combined with the simplified tax system, the payer will switch to a simplified system.

OSNO is characterized by a large number of taxes accrued and paid:

- for individual entrepreneurs - this is personal income tax, property tax, VAT, land and transport taxes, as well as mandatory insurance contributions;

- for legal entities - income tax, property tax, VAT, land and transport taxes, and mandatory insurance contributions.

Each tax has its own declaration, so you can imagine how much work an accountant will have to do. Individual entrepreneurs are required to fill out a ledger for accounting income and expenses (KUDiR), and legal entities are required to prepare an annual balance sheet and appendices to it.

At the same time, OSNO is the only taxation system without restrictions. They are not there either in terms of revenue or number of employees. It is mandatory for all individual entrepreneurs and companies with revenue of more than 150 million rubles per year.

For cargo carriers, OSNO will be of interest when working with clients who pay VAT. It is more profitable for individual entrepreneurs and legal entities on OSNO to buy from the same VAT payers, so that this tax can be taken into account or reimbursed from the budget. In all other cases, the application of this tax regime is inappropriate.

It can only be used by carriers who provide services while driving their own vehicle. If you are self-employed, you cannot hire workers. The NAP payer does not pay insurance premiums and does not use cash register equipment. The maximum permitted revenue is 2.4 million rubles per year. Tax is charged on income at a rate of 6% for settlements with legal entities, and 4% for settlements with individuals. You can register as self-employed at any time through the special “My Tax” application.

It is up to the entrepreneur to decide what to choose for cargo transportation. It seems to us that instead of UTII from 2021 it is advisable to use a patent: they have similar calculation bases, the ability to quickly switch to the tax regime and back, and are compatible with other tax regimes.

Instead of UTII for LLCs and individual entrepreneurs, it is also possible to use the simplified tax system with the object “Income reduced by the amount of expenses.” The conditions are the same as for the simplified tax system Income, only the rates differ:

- 15%, until the amount of revenue exceeds 150 million rubles from the beginning of the year or the average annual number of employees is 100 people;

- after that the rate increases to 20% until the end of the year.

In our example, the rate is 15%. Let's calculate the tax burden for an LLC:

- tax amount – (10,440,000 – 6,456,000) x 15% = 597,600 rubles;

- minimum tax (1% of income) – 10,440,000×1% = 104,400 rubles. This is less than the amount calculated above, so we pay 597,600 rubles;

- In total, the LLC will pay taxes and contributions - 597,600 + 270,000 = 867,000 rubles.

For an entrepreneur using the expense simplified tax system, the calculation is as follows:

- the amounts of the initial and minimum tax are the same - 597,600 rubles and 104,400 rubles;

- the amount of own contributions is calculated as follows - (10,440,000 – 6,456,000 – 300,000) x 1% + 40,874 = 77,714 rubles;

- in total the individual entrepreneur will pay – 597,600 + 77,714 + 270,000 = 945,314 rubles.

| ✏ As we can see, it is more profitable for the businessman from our example to switch to the simplified tax system of 6% than to switch to the simplified tax system of 15%. Practice confirms this - it is believed that this regime is suitable for a business if costs amount to up to 70% of income. Indeed, in our example the costs are about 61.8% (6,456,000 / 10,440,000×100). |

It is clear that, first of all, the individual entrepreneur is interested in the size of the individual entrepreneur’s insurance premiums “for himself,” since they change every year.

- Individual entrepreneur contributions for compulsory pension insurance “for themselves” - 32,448 rubles.

- Individual entrepreneurs’ contributions to health insurance “for themselves” are 8,426 rubles.

- Total: 40,874 rubles for the full year 2021.

- And, of course, do not forget about the additional contribution to the Pension Fund in the amount of 1% of the amount exceeding 300,000 rubles of annual income.

Individual entrepreneurs with more than 5 years of experience remember such an interesting event called “continuous statistical observation.” The last one was in 2021, and I wrote about it several times on my blog, and I myself submitted this questionnaire to Rosstat. What to expect?

In short, by the end of 2021, Rosstat will collect statistical data on all small and medium-sized businesses (including individual entrepreneurs).

Interesting news for those who use (or will use) online cash registers.

It turns out that the Ministry of Finance has prepared a new bill, according to which the famous 54th federal law will be repealed from January 1, 2021.

But this does not mean that the Federal Tax Service will forget about the numerous rules and restrictions on the use of online cash registers.

Of course, this is not true.

The law has already been passed. It is called this: Federal Law No. 266-FZ of July 31, 2020 “On Amendments to Chapter 26-2 of Part Two of the Tax Code of the Russian Federation and Article 2 of the Federal Law “On Amendments to Part Two of the Tax Code of the Russian Federation”

This is what is written in the second article of the bill:

In Part 3 of Article 2 of the Federal Law of December 29, 2014 No. 477-FZ “On Amendments to Part Two of the Tax Code of the Russian Federation” (Collected Legislation of the Russian Federation, 2015, No. 1, Art. 30), replace the numbers “2021” with the numbers “ 2024."

Let me remind you that it was 477-FZ that introduced tax holidays for individual entrepreneurs on the simplified tax system and PSN, which were opened for the first time and fulfilled a number of other conditions.

First, in order to understand what to switch to, let’s remember where to switch from, that is, what is UTII and why this taxation system is so popular. Otherwise, many of those who use the services of third-party companies for tax reporting do not know where and what they pay for.

And with UTII everything is very simple: from the very name “Unified Tax on Imputed Income” it is clear that the tax required for payment is calculated not on actually received income, but on a fixed amount established by the state, that is, imputed, amount of income.

For example, for cargo transportation in 2021 it looks basically like this: imputed Basic Profitability of 6,000 rubles per unit of transport ✕ annual inflation coefficient of 2.005 = it turns out 12,030 rubles per month - such income should be generated by one car. The entrepreneur must pay 15% tax on this amount. That is, if, for example, there is only one car - only 1805 rubles per month. Moreover, these small payments can also be reduced by the amount of contributions for pension and health insurance paid for yourself and for employees (in the second case, however, only by 50%). In total, for example, a private driver working on his own truck as an individual entrepreneur on the UTII system actually pays only social contributions, most of which goes to his own account in the Pension Fund. At the same time, the reporting is an easy-to-fill declaration, which, however, must be submitted 4 times a year.

This is such a simple and undoubtedly beneficial taxation system for the entrepreneur-carrier. But, as was said, its effect should cease on January 1, 2021. So, let’s look at other taxation systems that can be used in road transportation, and try to find out which one is more profitable for the owner of one car or a small fleet (let me remind you that UTII could only be used if the amount of equipment was no more than 20).

Registration procedure

Becoming an entrepreneur today is very simple - it does not require large financial expenses or time. The registration process is practically independent of the chosen field of activity. Everything happens in several stages.

Step 1. Preparation

Before opening an individual entrepreneur for cargo transportation activities, you need to determine your registration authority. Not every inspection registers entrepreneurs and companies. In order not to make a mistake with your choice, we recommend using the special service of the Federal Tax Service.

Next, you need to select activity codes (OKVED). For cargo transportation services, code 49.41 is suitable. You can add additional codes if desired.

Free selection of OKVED

Step 2. Payment of state duty

The state fee for registering an individual entrepreneur is 800 rubles. To generate a receipt for payment, you can use the tax service service.

The state charges a fee for the fact that Federal Tax Service specialists review the documents of the future entrepreneur. However, you only need to pay a fee if they are submitted in paper form. Therefore, before opening an individual entrepreneur for freight transportation services, it is better to determine the specific registration method:

- on paper - in person, through a representative, by mail or through the MFC;

- in electronic form with an electronic signature, yours or the MFC (if the center interacts with the Federal Tax Service in electronic form).

Step 3. Application for registration of individual entrepreneurs

The application is submitted in form P21001, approved by order of the Federal Tax Service dated January 25, 2012 No. ММВ-7-6/ [email protected] Filling it out is not very difficult, you just need to enter all the personal data of the entrepreneur and the previously selected activity codes. Particular attention should be paid to two points:

- indicate your email on the last page of the application - documents will be sent to it after registration;

- You cannot sign the application; you must sign either in the presence of a Federal Tax Service employee who accepts the documents, or at a notary. The second option is for those who cannot visit the tax office in person.

Create documents for individual entrepreneurs for free

Step 4. Going to a notary

If a future entrepreneur submits documents for registration in person or sends them electronically with an electronic signature, then this step can be skipped.

If documents are submitted by mail or with a representative, the signature on form P21001 is certified by a notary.

Step 5. Formation of a set of documents

The contents of the kit will depend on how the documents are submitted. If in person at the Federal Tax Service or MFC, you will need:

- statement;

- receipt of payment of state duty;

- passport of the future entrepreneur.

When sending the kit by mail, you will also need a notarized copy of your passport. If the documents are sent with a representative, then a notarized power of attorney must be added to all of the above. It, like a copy of your passport, can be issued by a notary during the same visit when the signature on the application is verified.

Step 6. Registration with the Federal Tax Service

The completed package of documents is transferred to the Federal Tax Service or the MFC. On the fourth working day after receiving them, the tax authority sends the registration result. The entrepreneur will receive it by email. There can be two options:

- The individual entrepreneur has been registered - then he will receive a USRIP registration sheet;

- registration was refused - then he will receive a reasoned decision to refuse.

The reasons for refusal vary, but usually this is due to the execution of the application or shortcomings in other documents. In this case, it will be possible to reapply for registration within 3 months, correcting all errors. There is no need to pay the state fee again. But you will be able to correct yourself only once; you will have to pay again for the third registration attempt.

So, we looked at what you need to think about and do to open an individual entrepreneur for cargo transportation. Now let’s pay attention to a particularly important point - the choice of tax system. Ideally, this should be done in advance. The tax burden in different regimes varies greatly, and business profits will not least depend on taxes. But first you need to determine what expenses your future business will require.

What expenses will you face in your business?

Several taxation systems are suitable for cargo transportation, but which one is more profitable? This must be calculated based on business conditions. But first, let’s talk about what the main cost items are expected during cargo transportation. Here is their list:

- Rent a Car;

- maintenance, repair;

- depreciation;

- petrol;

- car insurance costs;

- drivers' salaries;

- taxes and insurance premiums.

In modern economic conditions, a good result is considered if the profit-to-revenue ratio is 15-20%. For calculations, we will focus on the lower threshold - 15%. That is, let’s take it for granted that the share of expenses will be approximately 85% of revenue. But this figure is arbitrary; its exact value will depend on many factors.

In particular, before opening an individual entrepreneur for cargo transportation and choosing a tax regime, you need to understand whether the work will be carried out on your own car or whether the car will be purchased, rented or leased. Costs will largely depend on this.

Free tax consultation