What is a consignment note (waybill)?

CTN (Consignment note) is a document accompanying the cargo, which confirms the agreement between the shipper and the carrier and regulates their relationship during the transportation of the cargo.

It reflects information about the transported goods and gives ownership of it to the recipient specified in the document. The recipient is usually the organization to which the cargo is delivered. The bill of lading that accompanies the shipment is usually signed by the carrier when he picks up the cargo. The signature confirms that the goods were loaded into the carrier's vehicle - a truck, freight car, aircraft or ship. When the document is signed by the consignee, who is sometimes identified as the "addressee", it serves as confirmation that the goods received correspond to the description on the waybill. The signature also certifies the fact of delivery.

Types of consignment notes

There are several types of consignment notes that have standardized forms. The basic form (Standard Interindustry Form No. 1-T), approved by Decree of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78, is used for most goods. In addition, there are TTN forms specifically introduced for registration of operations for sending and receiving grain, animals, dairy raw materials, fruit and berry products, and wool. All of them were approved by Decree of the State Statistics Committee of the Russian Federation dated September 29, 1997 No. 68.

On July 25, 2011, a new form of consignment note comes into force. It was introduced by the Rules for the transportation of goods by road, approved by Decree of the Government of the Russian Federation dated April 15, 2011 No. 272. The new form of consignment note confirms the fact of concluding a cargo transportation contract, and there are no fields for writing off and recording goods.

What is included in the waybill?

The waybill includes the following information:

- purchase order and/or invoice number;

- date of shipment;

- name and address of the shipper;

- name and address of the consignee;

- number of units of goods in the batch;

- description of the goods being delivered;

- declared value of goods;

- packaging method (cardboard boxes, containers, pallets, etc.);

- warning if the cargo contains hazardous materials that are subject to special requirements;

- cargo class;

- exact weight;

- special loading or delivery conditions.

The consignment note is used in both domestic and international cargo transportation.

Waybill (Bill of Lading)

Consignment note (Bill of Lading) - designed to record the movement of inventory items (TMV) and pay for cargo transportation by road.

A consignment note (Bill of Lading) is used for the transportation of commodity-type goods. The shipper provides the carrier with a bill of lading (BW) for the transported cargo. According to the waybill (Bill of Lading), the cargo is written off by the consignor and capitalized by the consignee after delivery.

The waybill (BW) consists of a commodity and transport section:

Commodity section of the TTN - according to this, inventory items (TMV) are written off from the consignor, and their registration by the consignee.

The transport section of the TTN is intended for payment for services rendered for the transportation of goods.

A consignment note (BW) is drawn up by the shipper individually for each consignee, separately for each cargo transportation by car, making sure to fill in all the details.

The joint preparation of a consignment note (BWB) between the shipper and the carrier organization is carried out during centralized transportation of cargo.

In cases where one vehicle transports several cargoes, regardless of the number of consignees, a consignment note (BW) is issued separately for each cargo and for each consignee.

The consignment note is created in 4 copies:

- The shipper keeps the first TTN for further write-off of inventory items; the remaining copies are given to the cargo carrier.

- The cargo carrier, after delivery of the cargo, gives the second TTN to the consignee for capitalization of inventory items. The remaining two copies are certified by the consignee and handed over to the transport company that transported the cargo.

- The cargo carrier company sends the third TTN to the shipper along with an invoice for transport services.

- The fourth TTN remains with the transport company, is attached to the waybill, and is the basis for calculating wages to the driver transporting this cargo.

The number of Waybills (BWBs) can be more than four; this nuance is discussed with the cargo carrier.

In the case of non-commodity cargo, for which the consignee does not keep records of inventory items (inventory items), but records are made by measurements and weighing, the consignment note (BW) is issued in three copies:

The first copy of the waybill (Bill of Lading) remains with the shipper.

The remaining two copies are sent to the cargo carrier company, one for invoicing the company for the transportation of goods to the shipper, the second for accounting for transport work and payroll for the carrier driver.

Depending on the nature of the cargo being transported, other documents are added to the waybill (BWB), which go along with the cargo to the consignee. In such cases, the consignor provides documents establishing the quality of the cargo, various certificates and invoices, etc., in turn, the driver transporting the cargo is obliged to transfer these documents to the consignee, but the consignee does not have the right to demand delivery of the cargo according to these documents.

After delivery of the cargo, the driver provides the remaining copies of the bill of lading (Bill of Lading) to the consignee.

If the delivered goods correspond to the quantity and quality specified in the accompanying documents, the seal of the consignee’s organization and the signature of the goods receiver are affixed to the TTN and other documents attached to the cargo.

If the delivered cargo does not correspond to the goods specified in the contract in terms of quality or availability, an act is drawn up, which is a legal document for sending a claim to the shipper. In all accompanying documents, a note about the preparation of the act is also made.

- 0.2 Filling out the consignment note (BWB) by the consignee:

- 0.3 Filling out the consignment note (Bill of Lading) by the transport company:

TTN

Consignment note, according to Post. Goskomstat No. 78 dated 11/28/97, should be used to account for the work of vehicles and special vehicles in the construction industry. Information No. PZ-10/2012 The Ministry of Finance has actually abolished this form as mandatory since 2013, but many organizations continue to use it in accounting. In addition, according to current legislation, in some cases the use of Form 1-T is still mandatory. This will be discussed later.

The document has two sections, reflected in the name: commodity and transport. The first indicates the data necessary for the sender and the recipient of the transported goods and materials: one for deregistration, the other for registration. The second records the information necessary for the carrier and the customer of the service (sender): physical indicators, loading and unloading activities and their duration, data for calculating for the service, including the driver’s salary.

In general, TTN is an optional form; therefore, its use is subject to reflection in the company’s accounting policies.

The consignment note is issued by the sender of the goods in 4 original copies:

- to the shipper's accounting service as a document for writing off inventory items;

- to the consignee's accounting service for capitalization of inventory items;

- to the ATP accounting service - 2 copies (one is then transferred to the customer of the service as the basis for payment, and the other remains with the carrier as the basis for paying the driver).

The sender signs three copies and gives them to the driver (forwarder), who passes them on to other contractors.

Question: On the deduction of VAT presented upon the purchase of goods (work, services) and the preparation of invoices and delivery notes N TORG-12. View answer

Waybill

Art. 785 Civil Code of the Russian Federation:

“The conclusion of a contract for the carriage of goods is confirmed by the preparation and issuance of a waybill to the sender of the goods

(bill of lading or other document for cargo provided for by the relevant

transport charter

or code).”

The transport consignment note was developed by the Government for the Charter of road transport and urban ground electric transport (clause 1 of article 3 of the Federal Law of November 8, 2007 N 259-FZ).

- Letter of the Ministry of Finance of the Russian Federation dated April 23, 2013 N 03-03-06/1/14014;

- Letter of the Ministry of Finance of the Russian Federation dated January 28, 2013 N 03-03-06/1/36;

- Letter of the Federal Tax Service of the Russian Federation dated May 17, 2016 N AS-4-15/ [email protected]

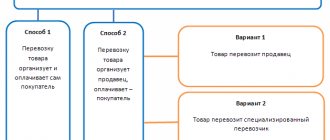

Who should apply

Transport documents are issued by the shipper

(unless otherwise provided by the contract) when:

- the goods are delivered by the supplier and delivery is a separate service;

- The product is delivered by a third party carrier.

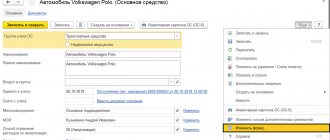

Settings for printing TN and TTN

Main - Functionality - Trade tab

How to indicate the trailer number in 1C

Directories - Vehicles

Sales (act, invoice) - link Delivery

Printed form TTN

Implementation (deed, invoice) - Print button

Trailer number in TN and TTN

Why in 1C information about the trailer is entered only in the waybill form 1-T (TTN) and not entered in the TN?

Automatic filling of the waybill with trailer data is implemented only for the TTN, since it provides this information. Additional details can be entered into the TN manually.

Pickup

Do we need a technical document to justify the costs of purchasing goods if we remove the goods from the supplier’s warehouse using our own transport (on a pickup basis)?

If the goods are exported by our own transport, i.e. Without an agreement with a third-party carrier (supplier), a document confirming the costs of purchasing goods for income tax will be:

Official position

- TORG-12 + Waybill (Letter of the Ministry of Finance of the Russian Federation dated December 22, 2011 N 03-03-10/123).

Safe position

- TORG-12 + Waybill + TN - proves the reality of the delivery (Resolution of the Federal Antimonopoly Service of the North-Western District dated September 28, 2011 in case No. A13-8941/2010).

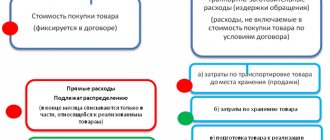

Delivery is included in the price of goods

Is a technical documentation needed to justify the costs of purchasing goods if the supplier delivered the goods to our warehouse on their own? Delivery is included in the price of goods under the contract.

If the cost of transportation is taken into account in the cost of the goods, the document confirming the costs of purchasing goods for income tax will be:

Official position

- TORG-12 - TN is not needed (Letter of the Ministry of Finance of the Russian Federation dated June 15, 2010 N 03-03-06/1/413).

Safe position

- TORG-12 + TN (copy) (Resolution of the AS of the East Siberian District dated April 14, 2016 N F02-1543/2016).

See also:

- Consignment note (Bill of Lading) in 1C 8.3

- Typical document flow for commodity transactions

- [04.10.2018 recording] Supporting seminar 1C BP for September 2018

- Registration of technical documentation

- In 1C, changes have been made to the printed form of the Waybill

- [08/18/2020 recording] Supporting seminar 1C BP for July 2020

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Are transport documents required for export to the EAEU? ...

- Transport extras expenses, documents received via EDI Good afternoon. Please tell me how to “link” the costs of delivery of goods...

- How to reflect transportation expenses in accounting if the amount of expenses is indicated in the consignment note and the act is not provided? ...

- What documents are needed from self-employed people to confirm expenses? Tax officials told us what documents organizations and individual entrepreneurs should retain...

TN vs TTN

07/25/2011 Government Resolution No. 272 dated 04/15/2011 approved the form of the Consignment Note (TN) (Appendix N4).

TN

— a contract for the carriage of goods and a primary document to confirm transportation services. At the same time, the TTN in form 1-T (approved by Resolution of the State Statistics Committee of November 28, 1997 N 78) was not canceled.

Is it possible in the accounting policy to approve the consignment note (form 1-T) as a document confirming the transportation of goods and not use the Waybill (TN)?

No you can not. The use of the Consignment Note approved by Government Decree No. 272 dated April 15, 2011 is mandatory. TTN (Form 1-T) can be drawn up as an additional document, but as part of the document flow with the TTN.

For transportation of ethyl alcohol, alcoholic and alcohol-containing products, it is necessary to fill out form 1-T (TTN) (Letter of the Ministry of Finance of the Russian Federation dated 08/11/2017 N 03-14-17/51775, Explanation of the Federal Alcohol Regulation Agency dated 07/08/2011).