01/25/2016 34 550 23 Reading time: 7 min. Rating:

Author

: Konstantin Bely

Today I would like to consider a very important question: who are the residents and non-residents of the country . These concepts are very relevant in many financial areas, for example, in banking, when paying taxes, withdrawing funds abroad, registering an inheritance and in other cases, so you need to very clearly understand who is a resident, who is a non-resident, and what is between them difference. This, in relation to individuals, will be discussed in today’s article.

Relations with the tax office

— Many people believe that by moving abroad, they automatically become free from tax obligations to their country. But that's not true.

1. Monitor your tax status.

In the taxation of individuals, the main role is played by such a concept as the tax status of an individual: that is, his tax residence. In effect, tax residence determines the country in which a person must pay taxes on their worldwide income.

| Ekaterina Popova Lawyer REVERA | Olga Polozova Lawyer REVERA |

You are recognized as a tax resident of Belarus if you spent more than 183 days in the country in a calendar year.

Example. If you move to the USA in October 2021, then in 2021 you will still be considered a tax resident of Belarus, since you stayed here for more than 183 days. This means that for income received in 2021 from any sources, you need to report to the Belarusian tax office by submitting a declaration before March 1, 2019 inclusive.

2. File your taxes. In the same situation - when you have moved abroad and earn income there, but are still a tax resident of Belarus - you will need to file a return and pay income tax in Belarus. Such income could be, for example, dividends or salaries.

If you received income from foreign sources, you first need to file an income tax return with the Belarusian tax authority at your place of registration no later than March 1 of the year following the year in which you received the income. After this, no later than May 1, you will receive a notice with the amount of income tax due and then, no later than May 15, you will pay the tax.

3. Prepare a power of attorney in advance. After you leave the country, issues may arise that require your presence, such as filing a tax return. It can be sent remotely by mail or a power of attorney can be made to a person you trust (parents, close relatives, friends).

The power of attorney should include such basic powers as signing and submitting applications, appeals, declarations to tax and other government authorities, receiving responses and certificates from them. Specify in detail which bodies you authorize the authorized person to represent interests in. As a rule, this is the tax office, the state customs committee, or a bank.

4. Get a certificate in advance stating that you are a tax resident of Belarus. This will help you save on taxes. The country in which you work or receive dividends from a local company may have a double tax treaty with Belarus. Such an agreement may state that your income is taxed in your place of tax residence.

Example. If you are still a tax resident in Belarus and receive dividends from a UK company, the treaty is that tax is payable only in Belarus. To do this, in the UK (that is, at the place where dividends are received), you need to provide a certificate stating that you are a tax resident of Belarus - it is issued by the Belarusian tax office. Such a certificate will help you save on dividend taxes, since you will only need to pay it in Belarus.

Photo from lifestyle website. abs-cbn.com

But even if the tax was paid or withheld abroad, you can submit a certificate certified by a foreign tax authority to the Belarusian tax office. It must indicate the amount of income and tax paid. Such a certificate will either equivalently reduce the amount of tax in Belarus, or you will not have to pay it at all.

Is it always possible to make such an offset? No. If income is received from a territory that Belarusian legislation recognizes as offshore (for example, the American state of Delaware), tax will still have to be paid in Belarus at a rate of 13%. The fact that it has already been paid in offshore territories will not be taken into account.

You can check whether there is a special agreement with the country or whether it is recognized as an offshore on the website of the Ministry of Taxes and Duties.

5. Sell the car in advance and plan other major transactions. Even if you are no longer a resident of Belarus or Russia, you will still have to pay taxes on income earned here.

For example, if you sell your car. Residents have the right to sell 1 car per calendar year and not pay income tax on such income. If you lose your resident status, you will have to pay tax. What conclusion follows from this? It is worth selling your car in advance, before moving and before losing your tax resident status.

If you still did not manage to sell the car on time, when calculating the tax, documented expenses for the purchase of the same car will be taken into account, and the tax amount will be less.

Or you can give the car to a close relative. In this case, there will be no income tax.

And those who have lost their tax resident status in Russia will face an unpleasant surprise when selling real estate. For non-residents, the income tax rate on such income will be 30% instead of 13%. Therefore, it is more profitable to sell real estate while still a tax resident of Russia.

6. For some time, keep documents that will confirm that you are no longer a tax resident of Belarus. That is, those that confirm that you were outside Belarus for more than 183 days a year (for example, air, road and railway tickets; an old passport with visas and entry and exit stamps; an employment contract with a condition on a place of work abroad and etc.).

The fact is that during the transition period, when you change countries and the tax office does not have all the data about your new status, questions may arise. In a controversial situation, with documents in hand, you will be able to prove that you are not a tax resident of Belarus - and, therefore, you do not need to pay tax here on income from abroad.

Contact the Federal Tax Service

If the option with a broker does not suit you - for example, you did not have time to notify your broker before the end of the year - then at the end of the year you can send a declaration to the tax office yourself.

We wrote more about this in the article “How to pay personal income tax yourself.”

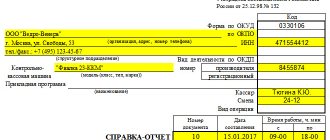

First of all, you will need a 2-NDFL certificate from your broker. Usually it can be ordered through your personal account, by phone or by mail. If you did not notify the broker of the change in status and left enough free money in the brokerage account in January to withhold taxes, the certificate from the example above would look like this:

At the time of writing this answer, you can fill out the 3-NDFL declaration for 2018 regarding income from securities only in paper form or in the “Declaration 2018” program. The 3-NDFL declaration completed in the program can be sent through the taxpayer’s personal account.

When filling out, you must select the type of declaration “3-NDFL non-resident”.

The data from the 2-NDFL certificate must be transferred to the section of the declaration “Income received in the Russian Federation”: fill out a separate line for each rate, each month and each income code.

Let's fill out the declaration in the program using the 2-NDFL certificate from the example above. All income of a non-resident received under brokerage agreements is taxed at a rate of 30%, except for dividends. Dividends are subject to a tax rate of 15%, and deductions under code 601 for non-residents are not taken into account.

The “Declaration 2018” program from the Federal Tax Service website. Income taxed at 30%

Dividend income

The program will determine the amount of tax to be paid automatically. The amount received will have to be transferred to the budget independently by July 15 - clause 4 of Art. 228 tax code

Foreign bank account

If you open an account in a foreign bank, make sure that you do not violate the currency legislation of Belarus.

According to currency legislation, if a Belarusian opens a bank account abroad or carries out operations related to the movement of capital (buys shares, securities, real estate, places funds in foreign banks), he must obtain the appropriate permission from the National Bank.

When you move abroad, this does not mean that you automatically lose your status as a currency resident of Belarus and are not required to request permission from the National Bank.

Permission does not need to be obtained only in certain cases.

- When opening an account abroad while you are legally residing there on the basis of a visa, temporary residence permit or residence permit

- For operations related to the movement of capital, if you have continuously resided outside Belarus for more than one year; At the same time, it is important that the operations are not related to business activities on the territory of Belarus

Let's say you have been continuously living and working in Lithuania for more than a year. You decide to place a deposit in a local bank or buy securities. If these operations are not related to your business activities on the territory of Belarus, you do not need to obtain permission from the National Bank.

Photo from jp.wsj.com

According to the latest information, the National Bank is going to cancel the requirement for individuals to obtain permission to open a bank account abroad, but for now it is still in effect.

Let's look at an example that often occurs in our practice.

You have been living abroad for some time and have decided to buy shares from the foreign company for which you work. In order to pay for them, you plan to open an account in this country. How do you know if you need permission to open an account and pay for shares?

As for paying for shares , calculate how long you have been living abroad: if it is more than a year and this can be easily confirmed with immigration documents, then you do not need to obtain permission.

As for opening an account , if you have immigration documents that allow you to legally stay abroad, you also do not need permission.

In our practice, there was a case when a client needed to buy shares of a foreign company. At the same time, he had been outside Belarus for about 10 months - he was working there. The transaction had to be carried out quickly; there was no way to wait 2 months until his period of residence abroad was more than 1 year. As a result, we decided to apply to the National Bank for permission to pay for the shares in order to be on the safe side and avoid being held liable for a transaction without permission.

Personal income tax rate for non-residents and residents

Of course, all rates are different, so we will analyze each one separately:

- A rate of 30% applies to tax non-residents, which takes into account all income with the exception of: dividends from Russian enterprises (in this case, 15% tax).

- Highly qualified specialists, regardless of whether a person is a resident or not, taxation will be 13%.

- A nine percent tax rate applies to residents of the country who receive dividends from Russian organizations and enterprises.

- Mortgage-backed bonds that were issued before the beginning of 2007.

There are special coefficients that are set by the state annually. For example:

- 1.329 property tax for individuals.

- 1.154 trade tax.

- 1.514 personal income tax.

Registration of migration status

Correctly register your immigration status and decide whether you need to apply for permanent residence abroad. Let's start with something simple. When you move abroad, even for a short time, you need to obtain immigration status in the new country (get a work visa, apply for a residence permit).

As a rule, your status depends on how long you will stay abroad and the purpose of your move. To do everything correctly and not violate foreign immigration laws, we recommend contacting local immigration consultants.

If you know you're moving for a long time, you also need to decide whether to apply for permanent residence abroad. It is issued in Belarus, as a result you will be issued a passport of the RR series and will be registered with the consulate.

This question is very individual, it has its pros and cons, advantages and concerns. Here are some of the common disadvantages.

1. In order to receive a RR passport, you need to deregister at your place of residence , that is, check out of your apartment. If you do not have ownership rights to your home, and relations with your relatives are tense, there is a risk that you will not be allowed back. For many, this is the main argument against.

Photo from the site pravo.by

2. It is necessary to close the individual entrepreneur - this is also one of the conditions for obtaining a PP passport. A possible compromise, if you still want to continue doing business in Belarus, is to close the individual entrepreneur, but register a legal entity (for example, an LLC with one participant).

3. Meet tax and child support obligations : This does not mean that you have to pay taxes or child support in advance. It is important that at the time of issuing a RR series passport you do not have any debt on these payments.

The advantages of the PP series passport are obvious.

1. Security and ensuring rights: if you are registered with the consulate, it is easier for the Belarusian state to ensure your rights and interests in the host country, including in crisis situations, to guarantee the implementation of electoral and other civil rights.

2. Transporting personal goods across the border and processing them will be easier and faster.

3. Additional confirmation of the status of a tax non-resident of Belarus: in controversial situations in practice, a RR series passport and consular registration are additional arguments when determining status.

From all this we can draw the following conclusion: the longer you plan to stay abroad and the thinner the connection with Belarus, the more profitable it is to obtain permanent residence abroad.

Read about what rules you should follow when leaving to work abroad from Russia in the following material.