An employee's stay on a trip by order of the head of the organization and for carrying out official assignments is paid taking into account the average salary and daily allowance for all calendar days spent on a business trip.

In the current year 2021, the government has not changed the procedure for paying business trips abroad.

Normative base

Business trips are regulated by Article 166 of the Labor Code of the Russian Federation. The duration and purposes of official trips are established by order, signed by the director. Let's consider the nuances of business trips specified in the law:

- The employee retains his place of work and salary in the established amount throughout the trip.

- An employee has the right to receive sick leave payments on the basis of Article 167 of the Labor Code of the Russian Federation.

The procedure for registering a business trip is regulated by the following regulations:

- Federal Law “On Currency Regulation” dated December 10, 2013. This law specifies the conditions of the procedure, as well as the features of this process;

- Labor Code of the Russian Federation;

- Tax Code of the Russian Federation;

- Government Decree No. 173 of October 13, 2008;

- Local regulations (for example, collective agreements).

The employer is recommended to regularly monitor all changes in laws in order to correctly arrange a business trip.

Who can be sent on a business trip?

Some employees cannot be sent on business trips. This:

- Pregnant women.

- People with disabilities that prohibit travel.

- Persons under 18 years of age.

- Employees on study leave.

Some employees can be sent on foreign trips only with their written consent. This category of workers includes:

- Women with babies under 3 years old.

- Single fathers and single mothers with children under 5 years old.

- Parents with minor children with disabilities.

- People caring for incapacitated close relatives.

If there is no written consent, the employer cannot send the employee on a business trip. Otherwise, sanctions may be imposed on the company.

Daily allowances for business trips abroad: expense norms and accounting procedures

Carrying out its business, an economic entity, in order to expand it and find new clients, enters into various contracts abroad.

Therefore, the company's management has to either travel themselves or send certain officials on official trips abroad.

At the same time, you need to remember daily allowances for trips abroad in 2018 - the norms and accounting have some differences from trips within the country.

Main changes in 2017-2018

- In this regard, the rules that were used for personal income tax purposes have been extended to travel expenses and the procedure for rationing daily allowances.

- Therefore, when calculating the base for insurance premiums, it is necessary to remember that deductions are accrued for amounts in excess of the established standards for daily allowances on business trips abroad.

- Let us recall that an enterprise has the right to independently determine the amount of daily allowance for business trips abroad, and it may be greater than the standard determined by the Tax Code of the Russian Federation.

It must be approved in existing local acts, for example, in the Regulations on Business Travel, Collective Agreement, etc. This procedure for calculating contributions also applies to reimbursement of expenses for one-day business trips.

Attention! The old rules apply only when calculating contributions for insurance against accidents at work, since they remained under the administration of the Social Insurance Fund. No announced innovations regarding the regulation of business trips abroad are expected in 2021.

The legislation determines that the enterprise sets the amount of daily allowance independently, focusing on its financial capabilities and goals that must be achieved as a result of the trip. When determining the size, you can proceed from the current standards established by the relevant Decree on foreign travel, mandatory for budgetary organizations.

- You can also take into account the experience of expenses incurred on business trips to certain countries, which either the company itself or its partners have.

- To approve the amount of daily allowance, a business entity fixes a certain amount in its internal regulations, for example, in the Regulations on Business Travel.

- In addition, daily allowances for business trips abroad in 2021 have certain standards that must be taken into account when determining the tax base for income tax and when deducting tax to the Pension Fund and the Social Insurance Fund.

Attention! The Tax Code of the Russian Federation establishes daily allowance standards for business trips abroad in the amount of 2,500 rubles for each day of such a trip. This rule should be followed when calculating personal income tax and insurance premiums.

The Russian government has approved Resolution No. 812, which determines daily allowance standards for trips to foreign countries. It is mandatory for all organizations and institutions, the source of financing expenses in which the budget of the country or municipalities is.

This defines per diem rates expressed in US dollars for each foreign host country for one day.

Let's consider the main directions of business trips abroad:

| Foreign country - place of business trip | Daily allowance expressed in US dollars |

| Great Britain | 69 |

| Germany | 65 |

| China | 67 |

| Türkiye | 64 |

| USA | 72 |

Attention! In addition, this act also establishes allowances to the standards for certain categories of workers sent on foreign trips. Commercial companies can use the standards of this Resolution, or apply their own standards developed on its basis.

Registration procedure

Registration of a business trip involves the creation of a number of papers. The first most important document is an order. The employee must be familiarized with it. The employee signs to confirm familiarization. An order will need to be issued. The business trip is taken into account in the time sheet, as well as in the journal. Accepted by Fr. Let's consider all the stages of registration of a business trip:

- Report to the manager on the travel arrangements.

- Issuance of an order specifying the purposes of the trip, its objectives and duration.

- Issuance of a travel certificate if an employee is sent to the CIS countries.

- Familiarization of the employee with the completed documents.

- Calculation of travel costs. This takes into account advances and exchange rates.

IMPORTANT! The procedure for registration of one-day trips is similar to registration of multi-day trips.

ATTENTION! The employee’s obligation to go on business trips must be established in the employment contract. If this condition is not specified in the agreement, the person may refuse the trip.

Stages of preparation for a business trip

First you need to find out all the conditions offered by the receiving party. For example, a foreign company can pay for an employee’s accommodation. You need to find out from the employee whether he has a foreign passport. Let's consider all the stages of preparing for the trip:

- Visa registration, if required.

- Booking a hotel room.

- Preparation of all necessary documents.

- Calculation of travel expenses and daily allowances to determine the amount of the advance.

- Salary calculation for the business trip period.

- Payment of personal income tax and contributions.

Our calculator will help you calculate the amount of travel allowance, knowing your earnings for the billing period, the number of days worked during the billing period, the number of days on a business trip and the amount of daily allowance in the organization.

IMPORTANT! Until 2021, restrictions on the duration of business trips were established. They have now been removed. Long trips must be economically justified. In particular, the income from the trip must exceed the expenses.

ATTENTION! All primary documents related to the business trip are attached to the advance report after the end of the trip. It must be submitted within 3 days after the employee arrives.

Confirmation of spending

Employees must confirm all their expenses at the end of their trip. Checks, plane tickets, etc. can be used for this. The accounting department must accept the advance response and then reimburse the existing expenses. The advance payment issued before the business trip is first deducted from the amount of expenses.

Who can become a foreign business traveler and who cannot?

- are on maternity leave;

- have formalized student contractual agreements;

- are on disability with limited traveling activities;

- are minors, but perform certain job duties in the company.

But workers engaged in creative activities, journalists, singers, actors, including athletes who are not yet 18 years old, are allowed to travel outside the country for work matters.

Workers of certain categories can be sent on a business trip abroad, with their consent in writing. This applies to the following employees:

- women with children under three years of age, or men left with children of the same age without a mother, also women as single mothers;

- who have a disabled child;

- if they are looking after or caring for a sick close family member;

- with an established disability group, performing program procedures to restore the body.

The listed categories of employees may refuse to travel abroad for work. This right must be stated in the written consent to travel, which confirms their awareness of this possibility.

Often, experts ask questions about how to arrange a work trip outside the country for an official if he is employed part-time within the organization. Such employees can travel for work purposes, but this must be correctly reflected in the documents relating to the second place of work.

In accordance with Decree of the Government of the Russian Federation No. 812 of December 26, 2005, the established daily allowances for the duration of a business trip differ depending on the countries where the employee will perform his work duties. They can be represented in a table.

Established normsAmount of daily allowance, in US dollars

| Belarus | 57 |

| Ukraine | 53 |

| USA | 72 |

| Germany | 65 |

| Great Britain | 69 |

| France | 65 |

| Abkhazia | 54 |

| Georgia | 54 |

| Latvia | 55 |

| Tajikistan | 60 |

| Moldova | 53 |

Size table

In accordance with Decree of the Government of the Russian Federation No. 812 of December 26, 2005, the established daily allowances for the duration of a business trip differ depending on the countries where the employee will perform his work duties. They can be represented in a table.

Differences from daily allowances in Russia

The amount of travel allowances for stays in territories outside the Russian Federation is no more than 2,500 rubles for one employee. For work trips within the Russian state, their value does not exceed 700 rubles per employee.

Payment of daily allowances when a business trip outside Russia lasted only one day is made in the amount of 50% of the total cost assigned by the internal rules of the organization.

A trip for work purposes, of the same duration, but within the Russian Federation, implies no daily allowance payments. Heads of organizations can establish, by local regulations, reimbursement to employees of expenses associated with this trip.

The main difference between daily allowances is that in Russia they are provided in rubles, and abroad - in a currency specific to the country.

When going on a business trip, he must have money on hand. The deadlines for issuing travel allowances are regulated by law.

But the employee must confirm all travel-related expenses immediately on the day of return to the workplace. He provides checks and receipts to the accounting department, according to which appropriate payments are made for expenses incurred.

Before going on a business trip, budget employees must familiarize themselves with the Decree of the Government of the Russian Federation No. 812, adopted on December 26, 2005. This legislative act provides for the amounts of compensation per day and accommodation established by two Ministries: foreign and financial.

Expenses of foreign organizations are also taken into account when calculating travel allowances. A company hiring an employee from Russia can provide him with funds for personal needs. In this case, the organization that sent the employee on a work trip does not pay his daily allowance.

When a foreign enterprise does not compensate for the personal needs of a traveler in foreign currency, but compensates him for food, then a daily allowance is paid, the amount of which will be 30% of the norm. Reimbursement for accommodation is calculated according to the price for a single room in a mid-range hotel.

How to calculate

The head of the enterprise independently decides which currency to use for transferring daily allowances outside his country. However, the employee is given the corresponding amount in rubles, equivalent to the currency.

Daily allowances are calculated in the following order:

- If an employee was sent on a work trip abroad, payment for his accommodation must be made in accordance with legal regulations corresponding to foreign business trips and the countries where the employee is sent.

- The return of an official from abroad to the workplace is accompanied by the payment of daily allowances in accordance with Russian standards. The organization must make payment before the moment when it crosses the border, namely, the day before.

- If you visit several countries during a work trip, the daily allowance is calculated according to government regulations, taking into account the employee’s location on the last day of the trip.

Payment procedure

Reimbursement of travel expenses to an official is made for each day of travel. In particular, compensation applies to holidays, weekends, as well as those days when the employee was on the road, including inevitable stops.

When an official on a business trip falls ill, he is paid for his accommodation for the entire period of his incapacity for work according to a sick leave certificate issued by a medical institution.

The employee reflects the list of expenses for the entire period of the business trip in an advance report, confirming them with documents. Travel costs are justified by:

- railway or electronic tickets, route receipts;

- airline tickets or control coupons, boarding passes.

To confirm living expenses, the employee only needs to present management with a hotel invoice translated in detail into Russian. The reasons for using per diem do not need to be proven with receipts or receipts.

Features of taxation and insurance premiums

There is no need to set daily allowances for business trips in foreign countries to calculate taxes and transfers to the insurance fund. The dependence of norms and accounting is expressed by the amounts provided for in internal documents, namely, in the collective agreement, regulations on business trips.

If the daily allowance was reimbursed in foreign currency, the calculation of income tax in this case is carried out by converting this amount into Russian rubles, according to the official exchange rate of the Central Bank at the time of provision of compensation. This rule is spelled out in paragraph 10 of Article 272 of the Tax Code of the Russian Federation.

Calculation of personal income tax involves standardization of daily allowances.

Business trips outside our country do not provide for taxation on the employee’s expenses for accommodation, if they do not exceed 2,500 rubles in one day, according to the same article of the Tax Code.

For example, if the daily allowance paid by an organization is 2,700 rubles, then 200 rubles of this amount are taxed.

Pension payments, medical contributions, compensation for sick leave and child care are made in a similar way.

Thus, compensation to an employee for being on a foreign business trip is provided for in Article 168 of the Labor Code of the Russian Federation. If the organization is budgetary, then the amount of daily allowance is calculated in accordance with legislative acts. Other organizations set their own size.

Detailed information on business trips abroad is presented in this seminar.

We recommend other articles on the topic

Procedure for providing an advance

Before sending an employee on a business trip, you need to draw up an estimate to determine the amount of the advance. It may include the following areas of expenditure:

- Directions

- Accommodation.

- Payment of daily allowances.

- Issuance of insurance.

- Transporting luggage.

- Telephone conversations.

- Registration of a foreign passport.

- Expenses when exchanging currency.

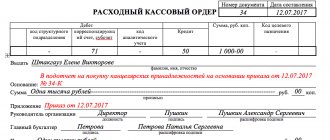

The estimate must be attached to the expenditure slip.

IMPORTANT! Currency exchange in the employee’s country of residence is difficult and involves additional expenses. Therefore, it is recommended to issue an advance in the currency of the state to which the employee is sent.

Who pays for obtaining a passport?

The employee himself must apply for a foreign passport. The associated fee is reimbursed by the company's accounting department. The employee must first present the appropriate receipt, as well as a copy of the passport. The costs of obtaining a foreign passport can be included in travel expenses. However, this point must be included in local acts.

Business trip abroad in 2021 - daily allowance, duration of business trip abroad - Business

- Business trips are business trips, for the days during which the employee receives a salary with allowances for accommodation, food, transportation costs and other expenses caused by business needs.

- In economic terms, payment for such expenses is called daily or travel allowances, which have certain calculation rules.

- What will be the daily travel expenses in 2021?

Daily allowances and their limits

Per diem is the name given to additional expenses incurred by a person during his business trips to another city. Expenses associated with paying for food, housing, and so on, therefore the employer is obliged to reimburse the employee for all his expenses for each day of a business trip.

If the business trip falls on a weekend (travel time at this point is also considered a business trip), the employer pays for the work at an increased rate.

Taxation of travel expenses

Let's consider all the lists of costs, as well as the features of their taxation:

- Daily allowance. Must be recorded as an expense. If their amount does not exceed 2,500 rubles, the daily allowance will not be subject to personal income tax.

- Accommodation. Expenses will be included as expenses. Exception - the amount is highlighted as a stand-alone line in the invoice. An amount not exceeding 2,500 rubles per day will not be subject to personal income tax. Insurance premiums are not charged.

- Directions Expenses supported by documentation will be taken into account. If documents are missing, the amount will not be subject to personal income tax. Insurance premiums are also not charged.

- Taxi expenses. If taxi costs are justified and supported by papers, they are included in expenses. Expenses are not subject to personal income tax. Insurance premiums are charged.

- Medical insurance. Expenses for it will also be included in expenses. The amount will not be subject to personal income tax. Insurance premiums are charged.

These rules may change, and therefore you need to monitor all innovations in the Tax Code and related acts.

Per diem allowance for a business trip abroad in 2021: examples and how to calculate | Legal consultation online

Reading time: 3 minutes

The need to send subordinates on business trips abroad arises, as a rule, from employers who have branches in other countries, or the presence of foreign partners obliges them to systematically appear at organized conferences/councils.

Despite the fact that Government Decree No. 812 sets out the daily allowance standards for foreign business trips for each foreign country, the employer has the right to set his own standards, fixing them in the provisions of local documentation.

In this article, we will look at an example of calculating daily allowance for an employee sent abroad, and also present a table of the amount of daily allowances that are established at the legislative level in relation to workers sent to a particular country.

The standard amount of daily accruals, which is fixed in the Tax Code of the Russian Federation in relation to employees sent to the territory of another state, provides for an amount of 2,500 rubles per day .

This amount is the maximum possible, from which tax deductions are not levied.

If the employer provides a different amount of accruals, then insurance premiums and income tax will be deducted from the amount exceeding the legal norm.

When determining the total amount of the advance payment that should be accrued to the posted worker, the accountant must take into account not only the country of destination, but also the duration of the trip, the specifics of the person’s work activity, as well as the purpose of working abroad.

Daily allowances are calculated from the moment the employee departs abroad until the moment he returns home. To make correct calculations, an accounting employee needs to know the specific dates of departure and entry of a person, which are recorded in his travel documentation.

During business trips to the CIS countries, no border crossing marks are placed in the passport, so the dates are determined in accordance with the tickets purchased.

When traveling to other foreign countries, the dates will be determined by the corresponding marks entered into the foreign passport at the time of entry/exit from the country.

The daily allowance rates in each foreign country, established by tax legislation, are presented in the file, which can be viewed at the link below.