Russian companies and businessmen are given the opportunity to use one of several types of special tax regimes, the characteristic features of which are a lower tax burden and a minimum amount of reporting. The most popular is the simplified taxation system (STS), in which at the end of the tax period a special reporting form is submitted to the Federal Tax Service - a declaration. Let's find out what this document is and how it should be compiled.

Filing a declaration under the simplified tax system in 2021

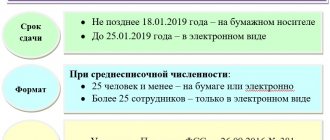

The developed declaration form for “simplified” is essentially a calculation of the tax payable to the budget, and therefore must be completed and submitted to the Federal Tax Service within the established time frame. The frequency of submitting the form is once a year, but the deadlines depend on the organizational form: companies using the simplified tax system are required to report no later than March 31 of the year following the reporting year (due to the coincidence with a holiday, the reporting deadline for 2021 is 04/01/2019 .), for individual entrepreneurs the deadline is no later than April 30.

Tax payment is made by quarterly transfer of advance payments (for 1 quarter, half a year, 9 months). These calculations are not declared, they are taken into account in the annual document drawn up, and then the final amount of tax payable is calculated based on the results of work for the year.

Read also: Insurance premiums for the simplified tax system in 2021

Reporting for 9 months of 2021. Nuances

Elmira Bagautdinova

practicing expert, tax consultant, full member of the Chamber of Tax Consultants of Russia, certified teacher of IPB and PNK of Russia, MBA programs at UlSTU

– The income limit for simplified taxation is 150 million rubles. Is this limit reduced if the organization has been operating for several months? What income should be taken into account when calculating the limit?

No, it is not decreasing. Organizations and entrepreneurs using the simplified tax system must comply with the income limit of 150 million rubles. (clause 4 of article 346.14 of the Tax Code of the Russian Federation). The Tax Code of the Russian Federation does not provide for such a reduction if the company has not been operating since the beginning of the year.

If, based on the results of the first quarter, half year, 9 months or year, income exceeds 150 million rubles, the right to apply the simplified tax system is lost (clause 4 of article 346.13 of the NKRF). From the beginning of the quarter in which the limit is exceeded, you should switch to the general regime.

– What income is taken into account when calculating the limit for applying the simplified tax system?

Income includes revenue from the sale of goods (work, services) - Art. 249 of the Tax Code of the Russian Federation, advances received as non-operating income (Article 250 of the Tax Code of the Russian Federation). The calculation does not include income listed in Art. 251 of the Tax Code of the Russian Federation, for example, loans received, deposits of founders, etc.

Do not forget that the simplified tax system uses the cash method of recognizing income and expenses (clause 1 of article 346.17 of the Tax Code of the Russian Federation). In practice, tax authorities try to increase revenue using the simplified tax system if buyers are late in payment at the end of the year. They believe that if money were received on time, income would exceed the limit - 150 million rubles. The company is deprived of the right to a special regime and must pay taxes according to the general system. This is illegal.

– The organization transferred an advance payment to the simplified tax system in June for equipment repairs. The contractor completed the work in September, and the acceptance certificate was signed. In what period should repair costs be included?

Advance payments that the simplifier transfers for upcoming work are not taken into account in expenses under the simplified tax system. The company has the right to write off as expenses the cost of work paid in advance after the contractor completes the work and the parties sign the work completion certificate.

Therefore, in the situation under consideration, expenses must be taken into account in September when calculating the advance payment for the single tax for 9 months of 2021.

– Is it possible to take into account the costs of fire safety, for example, the installation of a fire-fighting device, under the simplified tax system?

Yes. Base: pp. 10 p. 1 art. 346.16 Tax Code of the Russian Federation. Expenses are reflected in the Accounting Book after payment and commissioning of the facility (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). If the cost of a fire-fighting device does not exceed 100,000 rubles, then the device is not included in the OS (clause 4 of article 346.16 and clause 1 of article 256 of the Tax Code of the Russian Federation).

Simplified workers have the right to take into account other costs associated with ensuring fire safety of premises.

Expenses should be written off under the simplified tax system only if they are specified in clause 1 of Art. 346.16 Tax Code of the Russian Federation. Otherwise, the simplifier will underestimate the tax and you will have to pay penalties and fines.

A company may be exempt from a fine if it fails to pay tax due to a technical or similar error that is unintentional. These conclusions were made by the Constitutional Court of the Russian Federation (Resolution No. 6-P dated 02/06/2018)

– Is the cost of travel packages for employees taken into account in tax expenses?

Companies will have this right only from January 1, 2021. To do this, the employer must enter into an agreement with either a travel agent or a tour operator.

If the employer transfers money directly to providers of travel services (carriers, hotels, etc.), then the costs cannot be taken into account.

– Does an individual entrepreneur have the right to take into account travel expenses for himself in tax expenses?

Not entitled. Explanations in the Letter of the Ministry of Finance of the Russian Federation dated February 26, 2018 No. 03-11-11/11722.

A business trip is a trip by an employee at the direction of the employer outside the place of work (Article 166 of the Labor Code of the Russian Federation). Individual entrepreneurs do not belong to the category of employees; they do not have an employer. Therefore, an individual entrepreneur cannot send himself on a business trip. Accordingly, he does not have the right to write off expenses for his travel and accommodation.

– Can an individual entrepreneur take into account the costs of the simplified tax system for property that he bought before his registration?

Not entitled. Under the simplified tax system, individual entrepreneurs take into account only expenses for activities aimed at generating income. Costs before registering an individual entrepreneur are not such.

If an individual entrepreneur uses, for example, a previously purchased car for transportation in other commercial activities, he has the right to include in expenses the cost of gasoline, repairs, washing and other costs of maintaining the car (Letter of the Ministry of Finance of the Russian Federation dated 02/08/2018 No. 03-11-11/7503) .

– The organization issued cash on account, but the employee wants to pay for the hotel and train ticket from the card. Will there be problems with accounting for expenses for tax purposes?

If the employee paid by card, then he should be provided with slips (receipts for payment from the card). Therefore, there should be no problems taking into account expenses. Explanations are given in the Letter of the Ministry of Finance of the Russian Federation dated 04/06/2015 No. 03-03-06/2/19106.

– If a company paid for rent and utilities, but did not transfer personal income tax, will the tax authorities fine it?

Yes, they will be fined. The tax agent violated the deadline for paying personal income tax. I did this on purpose, because... transferred other payments. These actions do not relieve you of responsibility.

– Is it necessary to charge insurance premiums for payments to individuals from whom the company leases property?

Regarding this situation, the Federal Tax Service of Russia issued a Letter dated June 25, 2018 No. BS-4-11/ [email protected] Conclusion of the tax authorities: rent payments are exempt from contributions (clause 2 of Article 420 of the Tax Code of the Russian Federation). Justification: an individual transfers property for use, and does not perform work or services.

If a company enters into a vehicle lease agreement, under which the individual - the lessor - also undertakes to provide management services (Article 632 of the Civil Code of the Russian Federation). This is already a lease agreement with the crew. Moreover, if the contract specifies fees separately for rent and services, then contributions must be calculated from the cost of services.

– Do I have to pay insurance premiums if the company issued an interest-bearing loan to the employee, and then forgave the debt by drawing up a gift agreement?

In a letter from the Federal Tax Service dated May 30, 2018 No. BS-4-11/ [email protected] , the tax authorities explained that the forgiven amount is exempt from contributions. Justification: it remained with the employee under a property transfer agreement.

– What should be clarified in the calculation of insurance premiums and the calculation of 6-NDFL in a situation where the reports were drawn up correctly, but the data changed after submission?

There may be several situations. For example, the ERSV should be clarified if the company accrues additional salaries. Explanations are given in the letter of the Ministry of Finance dated August 21, 2018 No. 03-15-07/53488. In subsections 1.1, 1.2 and Appendix 2, it is necessary to reflect income and contributions, taking into account additional accrued salaries, and in section 1, additional contributions payable. Section 3 should be completed only for those employees to whom additional salaries and contributions have been accrued.

Important point! Tax authorities will not accept ERSV with negative indicators.

In the calculation of 6-personal income tax, you need to increase the income in line 020 and the entire accrued personal income tax in line 040. The indicator for line 070 does not need to be adjusted, because it reflects personal income tax at the moment when the tax was withheld, that is, on the date of payment of income.

– What form of UTII declaration for the third quarter of 2021 should be submitted to the Federal Tax Service?

The Federal Tax Service of Russia, in Letter No. SD-4-3/ [email protected] , brought to the attention of inspectors the recommended form of declaration for UTII. According to the clarifications following the results of the third quarter in October, tax authorities are required to accept two forms - the old one and the recommended new one.

In the new form, the Federal Tax Service included section 4 for entrepreneurs who reduce UTII for cash expenses. The amount of expenses for cash register systems must be indicated in line 040 of section 3.

If you submit the old form, then in this case explanations about the amount of the cash deduction are attached to the declaration (Letter of the Federal Tax Service dated February 20, 2018 No. SD-4-3/ [email protected] ). The UTII declaration for the third quarter should be submitted no later than October 22 (postponement from the 20th).

– The individual entrepreneur opened two hairdressing salons, but at different addresses. When calculating UTII, how many times should the individual entrepreneur be taken into account?

Explanations are given in the letter of the Ministry of Finance dated June 21, 2018 No. 03-11-09/46. If these hairdressing salons are located in different municipalities, then the individual entrepreneur will have to be taken into account when calculating UTII twice. If both hairdressers are located at different addresses, but in the same municipality, the individual entrepreneur is counted once.

REMINDER: In the UTII declaration, you will need to fill out separate sections for each hairdresser. At the same time, choose which point to assign the individual entrepreneur to when calculating the tax.

Finally

Firms and individual entrepreneurs have the right to receive free clarifications on reporting from tax authorities. The problem is that inspectors take a long time to respond to written requests. And during the reporting period, answers are needed urgently. Please note that if you ask over the phone, there is a risk of getting the wrong answer.

New rules for working with online cash registers

Online cash register is a new phenomenon, but all Russian businesses know that it is mandatory to use it. Legislators have established different deadlines for the transition to a “smart” cash register by type and category of taxpayers, which raised many questions in practice. Let's figure it out.

What did the summer changes of 2021 bring to business?

In summer, news should be holiday and leisurely. But not in 2018. This summer brings with it many changes, clarifications, demands from inspectors, changes in anticipation of new bills, as well as an endless stream of plans by officials to “redraw everything and everyone.” This article is about significant changes.

Declaration under the simplified tax system for 2021

The document form was approved by order of the Federal Tax Service dated February 26, 2016 No. ММВ-7-3/99 and is still relevant. The simplified taxation system is used in two “modifications”, depending on the selected tax object:

- simplified tax system “Income” with a tax of 6% of the income received during the year on the simplified tax system;

- STS “Income minus expenses” with a tax of 15% of the difference between income and expenses.

This division is also reflected in filling out the declaration. The form is universal and contains sheets for both types of simplified taxation system, but depending on the option used, different pages are filled out:

- “Simplers” on the simplified tax system “Income” draw up the title page and sections 1.1, 2.1.1, 2.1.2 (when paying the trade fee) and 3 (if there were targeted income).

- For the simplified tax system “Income minus expenses”, sections 1.2, 2.2 and 3 are provided.

Only completed sheets should be included in the declaration, numbering them consecutively.

Who is required to submit a simplified taxation system declaration?

In principle, we have already answered this question. All individual entrepreneurs who were once registered as a payer of the simplified tax system must report. This obligation applies to all individual entrepreneurs who:

- Does not engage in business at all, but only pays insurance premiums for himself (in this case, you need to submit a zero declaration);

- Combines different taxation systems, but does not receive any income within the framework of the simplified tax system;

- Successfully works on a simplified system and receives income from its activities.

| ✏ Advice: if you know for sure that you will not work for the simplified tax system, then you need to submit a notification to the Federal Tax Service in accordance with form 26.2-8. You will not be automatically deregistered as a single tax payer, except in the situation of complete cessation of business activity, i.e. closure of IP. |

Filling out a declaration according to the simplified tax system

We will briefly list all the details that need to be filled in by the “simplified” and will focus on calculating the tax and reflecting its amount in the document.

The title page contains information about the declarant. The TIN of companies contains 10 categories, individual entrepreneur – 12. The checkpoint is assigned only to legal entities, so the entrepreneur crosses out this field.

The title of the report is followed by the number of the adjustment - the primary report is “0”, the clarifying report is in numerical order, for example, the first adjusting report is numbered as “1”, the second – “2”, etc.

The period code for the declaration for the year is “34”; the same line indicates the year for which the report is being submitted. Below is the number of the Federal Tax Service Inspectorate, and on the right is encrypted its location, for example, code “120” indicates that the report is sent to the Federal Tax Service Inspectorate at the place of residence of the individual entrepreneur, and “210” - at the location of the company.

Next, indicate the name of the company or full name of the entrepreneur, the code of the main type of activity according to OKVED. If the company was reorganized, then in the following fields indicate its form before the transformation and the details of the former organization. Be sure to record the contact telephone number of the declarant, the number of sheets making up the declaration, as well as the number of sheets of documents attached to it, if any.

The lower third of the title page on the left is filled in by the declarant. It reflects information about who certifies the information specified in the declaration (“1” is the payer himself, “2” is his representative), the right part is intended for marks from the Federal Tax Service.

Having filled out the title, they proceed to the preparation of sections of the declaration, which, as we mentioned, are filled out in different ways and this depends on the form of the special regime applied.

Read also: Do I need to submit KUDIR to the tax office in 2021?

Declaration of the simplified tax system 2021: sample filling for the simplified tax system “Income”

Section 1.1 is divided into reporting periods (quarters), in each of them the OKTMO code is indicated (lines 010, 030, 060, 090) at the place of registration of the individual entrepreneur or location of the company. If its value remains unchanged (i.e. the address of activity does not change), only line 010 is allowed to be filled in, the rest are crossed out.

Tax amounts payable by quarter (pages 020, 040, 070, 100) are calculated indicators that are calculated according to a specific algorithm. This involves data on income received, insurance premiums paid and advance payments. Let's look at the calculation of tax and its reflection in the declaration using an example:

summed up the results of work for 2021 and issued a declaration:

| Period | Income in rub. | Insurance premiums listed in rub. | Tax amount (6%) in rub. | An advance payment in rubles was transferred. | ||||

| Amount according to KUDIR | Page in Section 2.1 | Sum | Page in Section 2.1.1 | Sum | Page in Section 2.1.1 | Sum | Page in Section 1.1 | |

| 1 sq. | 620 000 | 110 | 15 500 | 140 | 37 200 | 130 (page 110 x 6%) | 21 700 | 020 (p.130 – p.140) |

| half year | 1 330 000 | 111 | 30 600 | 141 | 79 800 | 131 (page 111 x 6%) | 27 500 | 040 (131 – 141 – 020) |

| 9 months | 1 860 000 | 112 | 45 900 | 142 | 111 600 | 132 (page 112 x 6%) | 16 500 | 070 (132 – 142 – 020 – 040) |

| year | 2 410 000 | 113 | 63 000 | 143 | 144 600 | 133 (page 113 x 6%) | 15 900 | 100 (133 – 143 – 020 – 040 – 070) |

The declaration is filled out based on the credentials. Formula for calculating tax payable:

- in the 1st quarter - the amount of tax 6% of income is reduced by the amount of insurance premiums paid during the reporting period, but not more than 50% (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation);

— for the following quarters, the calculated indicator is also reduced by the amount of the transferred tax advances.

In the sample declaration completed according to this example, the amount of additional tax paid on the listed advances in 2021 amounted to 15,900 rubles:

The procedure for filling out section 2.1.1 of the simplified tax system declaration “income”

Section 2.1.1 is filled out as follows:

| Line numbers | Information to fill out | Note |

| 102 | 1 - if the company or individual entrepreneur has employees; 2 - if the individual entrepreneur does not have employees | A simplifier who has employees reduces advances and tax under the simplified tax system on insurance premiums and employee benefits by no more than half. A simplified individual entrepreneur without employees can reduce the tax on insurance premiums completely |

| 110-113 | Amounts of income received on an accrual basis for the 1st quarter, half year, 9 months, year | Income is determined in accordance with Art. 346.15 Tax Code of the Russian Federation |

| 120-123 | Tax rate | Indicated in accordance with Art. 346.20 Tax Code of the Russian Federation. May be reduced by regional legislation |

| 130 | Advance amount for the 1st quarter of 2021 | Line 110 * line 120 /100 |

| 131 | Cumulative advance amount for the 1st half of 2021 | Line 111 * line 121 /100 |

| 132 | Cumulative advance amount for 9 months of 2021 | Line 112 * line 122 /100 |

| 133 | Cumulative tax amount for the year | Line 113 * line 123 /100 |

| 140-143 | The amounts of insurance premiums paid to employees of disability benefits and the amount of contributions for voluntary insurance for the 1st quarter, half a year, 9 months and 2021, respectively | Individual entrepreneurs without employees indicate the amounts of pension and health insurance contributions paid for themselves for the 1st quarter, half-year, 9 months and year, respectively |

Declaration of the simplified tax system 2021: sample filling for the simplified tax system “Income minus expenses”

With this object, the tax base changes, therefore the tax calculation algorithm will change - costs must be taken into account, and the tax is calculated from the difference between income and expenses. The tax calculation is carried out in section 1.2, and the data necessary for it is entered in section 2.2, where, unlike section 2.1, the amounts of costs incurred are reflected on a quarterly basis.

Let's continue the example, taking the initial data on income from it, adding expenses and applying the simplified tax system 15% of the difference between income and expenses:

| Period | Income in rub. | Expenses in rub. | The tax base | Tax amount (15%) | ||||

| Amount according to KUDIR | Page Section 2.2 | Amount according to KUDIR | Page Section 2.2 | Sum (gr. 2 – gr. 4) | Page Section 2.2 | Sum (gr.6 x 15%) | Page Section 2.2 | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 1 sq. | 620 000 | 210 | 380 000 | 220 | 240 000 | 240 | 36 000 | 270 |

| half. | 1 330 000 | 211 | 720 000 | 221 | 610 000 | 241 | 91 500 | 271 |

| 9 months | 1 860 000 | 212 | 900 000 | 222 | 960 000 | 242 | 144 000 | 272 |

| year | 2 410 000 | 213 | 1 200 000 | 223 | 1 210 000 | 243 | 181 500 | 273 |

Based on the calculations carried out, supported by accounting data, fill out section 1.2: - page 020 = page 270 (advance payment for 1 quarter is listed);

— page 040 = page 271 – page 240 = 55,500 rub. (advance for 2 quarters);

— page 070 = page 272 – page 241 = 52,500 rub. (advance payment for Q3);

— page 100 = page 273 – page 242 = 37,500 rub.

The company must pay an additional simplified tax in the amount of 37,500 rubles. This calculation is presented in section 1.2 of the declaration:

15.png

Let us remind you that the declaration must be submitted to the Federal Tax Service even in the absence of activity and non-receipt of income (if there is no official record of termination of activity in state registers). It is not difficult to fill out a zero declaration under the simplified tax system 2021 - they draw up a title page, listing all the required details of the company and the Federal Tax Service, enter zeros in the calculation sheets (where the amounts should be indicated) and dashes in the remaining fields.

The declaration under the simplified tax system 2021 (form) can be downloaded below.