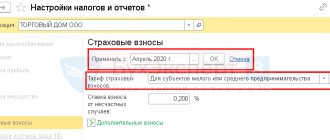

In most cases, insurance premiums are calculated automatically and do not cause problems. For this purpose, the program has a whole system of settings. And yet, questions arise, and sometimes are calculated incorrectly - due to the fact that the accountant does not know where and how to set the required tariff or benefit.

To prevent such cases, consider:

- how to set insurance premium rates;

- what cost items to indicate for them;

- what to do if contributions are not calculated automatically.

The taxpayer has the right to independently determine the list of direct expenses

In accordance with paragraph 1 of Art.

318 of the Tax Code of the Russian Federation, production and sales costs incurred during the reporting (tax) period are divided into direct and indirect. Direct costs may include, in particular: - material costs determined in accordance with paragraphs. 1 and 4 paragraphs 1 art. 254 Tax Code of the Russian Federation; - expenses for remuneration of personnel involved in the production of goods, performance of work, provision of services, as well as expenses for compulsory pension insurance, used to finance the insurance and funded parts of the labor pension, for compulsory social insurance in case of temporary disability and in connection with maternity , compulsory medical insurance, compulsory social insurance against industrial accidents and occupational diseases, accrued on the specified amounts of labor costs;

- the amount of accrued depreciation on fixed assets used in the production of goods, works, services. Indirect expenses include all other amounts of expenses, with the exception of non-operating expenses determined in accordance with Art. 265 of the Tax Code of the Russian Federation, carried out by the taxpayer during the reporting (tax) period. In paragraph 1 of Art.

318 of the Tax Code of the Russian Federation states that the taxpayer has the right to independently determine the list of direct expenses associated with the production of goods (performance of work, provision of services), securing his choice in the accounting policy. Thus, the taxpayer has the right to independently determine the list of direct expenses, securing it in the accounting policy.

Chapter 25 of the Tax Code of the Russian Federation does not contain provisions limiting the taxpayer in attributing certain expenses to production and sales, incl. expenses in the form of insurance premiums, direct or indirect expenses. This is indicated in the Letter of the Ministry of Finance of Russia dated May 25, 2010 N 03-03-06/2/101. In this case, the taxpayer can use the list of direct expenses approved in accounting for profit tax purposes.

In accordance with paragraph 3 of Art. 1 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting”, one of the main tasks of accounting is the formation of complete and reliable information about the activities of the organization and its property status, necessary for internal users of accounting statements - managers, founders, participants and owners of property organization, as well as external investors, creditors and other users of financial statements.

Thus, according to financiers, when forming the composition of direct expenses in tax accounting, the taxpayer can take into account the list of direct expenses associated with the production and sale of goods (performance of work, provision of services), used for accounting purposes. This conclusion was made in Letter of the Ministry of Finance of Russia dated December 19, 2011 N 03-03-06/1/834.

It should be noted that the organization does not have the right to artificially reduce the list of direct expenses. When assigning expenses to one or another group (type), one should proceed from their nature. Thus, the court found that in the accounting policy the taxpayer classified as direct expenses the wages of personnel involved in the production of finished products (works, services), the amount of unified social tax and the costs of compulsory pension insurance used to finance the insurance and funded part of the labor pension accrued for amounts related to direct labor costs.

The organization has not approved the mechanism for distributing direct costs using economically justified indicators for tax accounting purposes. For accounting purposes, the order-by-order method of accounting for production costs is used to group production costs, calculate production costs and generate production results.

For the purpose of maintaining tax and accounting records, the organization has defined various methods for allocating production costs. At the same time, for accounting purposes, expenses are recorded on the basis of primary accounting documents, and for tax purposes, expenses are written off in an arbitrary manner (irrespective of the relevant accounting documents).

At the same time, the organization’s choice of a method for distributing direct and indirect costs must be justified by the technological process and be economically justified. Types of material costs are named in paragraphs. 1 and 4 paragraphs 1 art. 254 of the Tax Code of the Russian Federation. Firstly, these are the costs of purchasing raw materials and (or) materials used in the production of goods (performance of work, provision of services) and (or) forming their basis or being a necessary component in the production of goods (performance of work, provision of services ).

Secondly, these are the costs of purchasing components that undergo installation, and (or) semi-finished products that undergo additional processing from the taxpayer. This list (wages, depreciation, raw materials, components and semi-finished products) can be narrowed down at its discretion by the organization, and expand it.

There are no restrictions. However, according to the requirements of Art. 252 of the Tax Code of the Russian Federation, the taxpayer’s decision must be justified and depends primarily on the type of activity being carried out. Taking into account the foregoing, the court found that the enterprise unlawfully narrowed what was given in paragraph 1 of Art. 318 of the Tax Code of the Russian Federation, a list of direct expenses, excluding from direct expenses the costs of the enterprise for the acquisition of raw materials and materials used in the production of products (performance of work, provision of services) and (or) forming their basis or being a necessary component in the production of products (performance of work, provision of services) services), without any economic justification.

Thus, materials and purchased components, the cost of which is written off as the cost of orders for the main production, are directly included in the composition of the manufactured product, forming its basis, or are a necessary component in the manufacture of products, i.e. should be classified as direct expenses and subject to income tax.

These conclusions were made in the Resolution of the Federal Antimonopoly Service of the Ural District dated May 6, 2010 N F09-3091/10-C3 in case N A71-12937/2009-A25. A similar position is given in another court verdict. In particular, the court found that the taxpayer unlawfully narrowed the provisions given in paragraph 1 of Art. 318 of the Tax Code of the Russian Federation, a list of direct expenses, excluding the material costs of the enterprise from direct expenses for profit tax purposes without any economic justification.

Thus, materials and purchased components, the cost of which is written off as the cost of orders for the main production, are part of the manufactured product, forming its basis, or are a necessary component in the manufacture of products. Consequently, these types of costs for materials are direct costs, because .

they can be attributed directly to the product being manufactured, the work being performed, and they cannot be attributed for the purposes of Ch. 25 of the Tax Code of the Russian Federation to indirect expenses (Resolution of the Federal Antimonopoly Service of the Ural District dated February 25, 2010 N F09-799/10-C3 in case N A71-8082/2009-A5). So, giving the taxpayer the opportunity to independently determine accounting policies, including the formation of the composition of direct expenses , the Tax Code of the Russian Federation does not consider this process as depending solely on the will of the taxpayer.

On the contrary, these standards classify direct costs as costs directly related to the production of goods (performance of work, provision of services). Attention is drawn to this in the Determination of the Supreme Arbitration Court of the Russian Federation dated May 13, 2010 No. VAS-5306/10 in case No. A71-8082/2009. From the norms of Art. Art. 252, 318, 319 of the Tax Code of the Russian Federation, it follows that the taxpayer’s choice regarding expenses that form the cost of manufactured and sold products in tax accounting must be economically justified (Letter of the Ministry of Finance of Russia dated December 29, 2011 N 07-02-06/260).

We suggest you read: How can you find out your medical insurance policy number?

The Ministry of Finance of Russia emphasized that the taxpayer has the right to independently determine a justified list of direct expenses associated with the production of goods (performance of work, provision of services), which relate to the expenses of the current reporting (tax) period, as products, works, and services are sold (Letter of the Ministry of Finance of Russia from 29.11.

2011 N 03-03-06/1/785).List of direct expenses provided for in paragraph 1 of Art. 318 of the Tax Code of the Russian Federation, is not closed, but includes types of direct expenses that can be taken into account by all organizations that are payers of corporate income tax. Moreover, on the basis of paragraph. 10 p. 1 art. 318 of the Tax Code of the Russian Federation, the taxpayer has the right in his accounting policy for tax purposes to determine, along with those provided for in paragraph 1 of Art.

318 of the Tax Code of the Russian Federation and other direct expenses associated with the production of goods (performance of work, provision of services), which, taking into account the specific type of activity of the taxpayer, can also be considered as his direct expenses when calculating corporate income tax. The lists of direct and indirect expenses must be determined in accounting policies for tax purposes.

Without this, it will be problematic for the organization to justify classifying certain expenses as indirect. To illustrate the above, consider the following example from the practice of arbitration courts. During the audit, the tax inspectorate found that the company, for profit tax purposes, as part of expenses associated with production and sales, took into account as indirect expenses the costs of compulsory pension insurance, used to finance insurance and the funded parts of the labor pension to be included in direct expenses.

The court found that the procedure for accepting expenses for compulsory pension insurance for tax purposes by an enterprise has not been determined. In its accounting policy, the company established that direct costs are determined by it in accordance with Art. 318 Tax Code of the Russian Federation. A special procedure for allocating costs to direct and indirect expenses and a specific list of direct expenses is not defined in the accounting policy.

Based on the foregoing, the court concluded that the controversial costs of compulsory pension insurance, used to finance the insurance and funded parts of the labor pension, the enterprise should have taken into account as part of direct expenses (Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated November 20, 2009 in case No. A82-7247 /2008-99).

The Tax Code of the Russian Federation is not rules, but guidelines

expenses for remuneration of personnel involved in the production of goods, performance of work, provision of services, as well as insurance payments accrued on such amounts; depreciation of fixed assets used in the production of goods, work, services.

However, it is important for an accountant to know that this list is only a guideline. After all, the Code directly states “may be attributed, in particular.”

Simply put, the taxpayer has the right to classify even the costs directly named in this list as indirect in his accounting policy. Conversely, any other costs not directly named in Article 318 of the Tax Code of the Russian Federation can be included in direct costs.

However, such “transfers” cannot be made arbitrarily. The classification of expenses as direct or indirect must be justified.

This requirement is made by both the tax authorities (letter of the Federal Tax Service of Russia dated February 24, 2011 No. KE; see “Federal Tax Service: the distribution of expenses into direct and indirect must be justified”) and the courts (see.

Classification of costs

These include expenses that are incurred during the direct process of production and sale of products, works or services. These include the wages of production workers, as well as insurance premiums calculated from it;

These costs include expenses that are not related to the main production process and the sale of goods, works and services. In other words, such expenses are not directly included in the cost price, but their implementation is necessary for the normal functioning of the company as a whole. For example, indirect costs include the salary of a management staff or a nurse at a medical center and, accordingly, insurance premiums from them.

Such expenses include costs, the volume of which remains constant when production volumes change. It is customary to consider, for example, the salaries of employees on a salary system as fixed costs. Insurance premiums calculated on such remuneration are also considered fixed costs;

Costs of this nature include expenses, the size of which changes with a decrease or increase in the volume of production and sales of products. An example is the salary of workers on a piece-rate wage system. In this case, insurance premiums from it will also be classified as variable costs.

Insurance premiums from employee salaries must be assigned to certain cost groups. In accordance with the presented classification, insurance premiums have two characteristics and can belong to the following groups:

- straight and permanent;

- direct and variable;

- indirect and permanent;

- indirect and variable.

In accordance with Art. 318 of the Tax Code of the Russian Federation, costs for tax accounting purposes are divided into direct and indirect. At the same time, insurance premiums for employees engaged in the production and sale of goods, works and services are classified as direct costs, while others are indirect. However, it is important that the company has the right to establish the list of production expenses independently, and it must be fixed in the accounting policy for tax purposes.

It is necessary to pay attention to which costs by group are included in the specified groups in the 1C program. Let us note that the assignment of insurance premiums to one group or another directly depends on the specifics of the company’s activities and permission in terms of the formation of accounting policies, and therefore it is necessary to adjust the computer program to the nuances of its accounting and tax accounting.

Introductory information

One of the conditions that the legislator requires to be included in the accounting policy for income tax purposes is the procedure for classifying expenses as direct and indirect (Article 318 of the Tax Code of the Russian Federation).

And there is no need to treat this requirement formally. Correctly consolidating this procedure is important because it directly affects the amount of tax paid.

After all, indirect costs can be taken into account in full during the period of their implementation. Direct payments are recognized as products, works, and services are sold, in the cost of which they are taken into account.

Therefore, the taxpayer must clearly understand which expenses (and, most importantly, why) he classified as indirect and which as direct. You can clearly state your position on this issue in your accounting policy.

Features of accounting for wages and salaries

Expenses for remuneration of personnel involved in the production of goods, performance of work, provision of services are included in the approximate list of direct expenses (clause 1 of Article 318 of the Tax Code of the Russian Federation). At the same time, the taxpayer has the right to classify expenses for remuneration of employees of the management apparatus as indirect expenses .

This is confirmed by judicial practice. Thus, in the opinion of the inspectorate, the taxpayer unreasonably included in expenses the costs of maintaining production personnel. The court recognized as erroneous the conclusions of the tax authority regarding the classification of management staff as production personnel (chief engineer, head of the technical department, site manager, head of the estimate and contract department).

In accordance with paragraph 1 of Art. 318 of the Tax Code of the Russian Federation, direct costs to be distributed between work in progress and completed work include the cost of remunerating personnel involved in the process of performing work, i.e. blue-collar professions that are not on the taxpayer's staff. All other labor costs relate to indirect costs, which, in accordance with clause 2 of Art.

We invite you to familiarize yourself with: Medical insurance in Georgia for Russians online. Insurance for a trip to Georgia from Russia. Get insurance in Georgia.

318 of the Tax Code of the Russian Federation in full relate to the expenses of the current reporting (tax) period. The arbitration court concluded that the taxpayer lawfully fully included in the costs for profit tax purposes the expenses for remuneration of personnel (Resolution of the Federal Antimonopoly Service of the Volga Region dated 29.01.

2009 in case No. A55-8550/2008). As practice shows, some organizations classify the costs of paying personnel involved in the production process of goods as indirect costs. This approach is associated with high tax risks. Let us illustrate this with the following example from arbitration practice.

The Tax Inspectorate found it unlawful for the taxpayer to include expenses for remuneration of personnel involved in the production process of goods, including the amounts of the unified social tax and expenses for compulsory pension insurance accrued on these amounts, as part of indirect expenses.

The enterprise, taking advantage of the right granted to it, in its accounting policy classified the costs of wages, unified social tax and insurance contributions for compulsory pension insurance as indirect expenses. Meanwhile, the right to independently determine the list of expenses when choosing the distribution of direct and indirect expenses simultaneously requires the enterprise to justify the decision made based on the specifics of the taxpayer’s activities, the technological process, and such distribution must be economically justified.

The taxpayer produces and sells alcoholic products. Since the technological process of producing alcoholic products is impossible without the workers who are involved in its production, the arbitration court indicated that the costs of paying personnel involved in the production process are attributed directly to the manufactured products.

At the same time, the court correctly noted that an organization has the right, for tax purposes, to classify the costs of remuneration of personnel involved in the production process of goods as indirect costs only if there is no real possibility of classifying these costs as direct costs, using economically justified indicators.

Considering that the enterprise did not provide evidence that there was no real possibility of classifying these costs as direct costs, as well as no economic justification for classifying them as indirect costs, the court came to the conclusion that such costs were unlawfully excluded from direct costs without any economic justification.

Article 318 of the Tax Code of the Russian Federation cannot be interpreted as allowing the taxpayer to independently and without any justification decide the issue of classifying incurred costs as indirect or direct costs. By providing the taxpayer with the opportunity to independently determine the accounting policy, including the formation of the composition of direct expenses, the Tax Code of the Russian Federation does not consider this process as depending solely on the will of the taxpayer.

On the contrary, these standards classify as direct expenses costs directly related to the production of goods (performance of work, provision of services) (Definition of the Supreme Arbitration Court of the Russian Federation dated May 13, 2010 N VAS-5306/10). The position of the court is reflected in the Resolution of the Federal Antimonopoly Service of the West Siberian District dated April 23, 2012 in case No. A27-7287/2011.

At the same time, in another situation, the taxpayer was able to confirm the legality of classifying labor costs as indirect expenses. Thus, the tax authority decided that the organization’s actions to attribute direct expenses on wages and deductions for the unified social tax to expenses of the current period in full (as indirect expenses) without taking into account the sale of products in the cost of which they are taken into account are unlawful.

The inspectorate considered that the costs of paying employees, regardless of their job responsibilities, are in any case included in the cost of production, i.e. are direct costs; in this case, it is not necessary to determine the share of participation of each employee in the production of a separate batch of goods. However, the court came to the conclusion that the enterprise correctly and justifiably accounted for the disputed expenses as indirect expenses.

This accounting procedure does not contradict Art. Art. 318, 319 of the Tax Code of the Russian Federation, the company’s accounting policy. The taxpayer provided a reasoned justification for the need for just such an accounting of expenses. The enterprise included in the composition of indirect expenses (tax accounting) the wages of employees engaged in the main production;

deductions from the salaries of such employees; the amount of depreciation of fixed assets not directly involved in the production process (shop buildings, buildings containing production equipment, workplaces - tables). The taxpayer, by virtue of Art. Art. 254, 318 and 319 of the Tax Code of the Russian Federation provide the right to exclude certain costs from the list of direct costs with the provision of appropriate justification.

When assigning expenses to a particular group (type), one should proceed from their nature, and the taxpayer has the right to classify material costs as indirect costs in the absence of a real possibility of classifying them as direct costs, using economically justified indicators. The organization’s choice of method for distributing direct and indirect costs must be technologically sound and economically justified.

In the case under consideration, the taxpayer provided the appropriate justification. According to the position of the Constitutional Court of the Russian Federation (Resolution dated February 24, 2004 N 3-P) and the Presidium of the Supreme Arbitration Court of the Russian Federation (Resolutions dated February 26, 2008 N 11542/07 and dated December 9, 2008 N 9520/08) business entities independently choose ways to achieve results from entrepreneurial activity.

The enterprise indicated that, due to the production specifics of the enterprise, workers are forced to constantly move within the structural unit, therefore they cannot be strictly tied to work on any one equipment or to the production of a certain type of product. Therefore, determine the share of the wages of a specific employee (group of employees) in the cost each specific sold batch of products is impossible.

We suggest you read: Taxation of sick leave with insurance contributions

The technological cycle of product manufacturing sometimes lasts several months, a large number of employees from several departments are involved in its production, and the wages of each employee are calculated based on their fulfillment of the standard (plan) in the reporting period. At the same time, the employee’s fulfillment of the production standard is only part of a long process of product production , when the completion of one stage is the basis for the beginning of each subsequent operation in the chain until the release of the finished product.

Additional payments to employees (payment for vacations, preferential hours for teenagers, breaks from work for nursing mothers, time spent performing state and public duties, medical examinations) also cannot be reliably correlated with the production process. In relation to fixed assets (depreciation amounts), namely buildings of workshop buildings, buildings in which equipment is located, workplaces (tables), the enterprise explained that the area of workshops is occupied by equipment no more than 30 - 50%, and therefore the operation of these fixed assets does not directly affect the production of products by the enterprise - in contrast from fixed assets directly used in production (presses, furnaces, machine tools, equipment, mills, drying drums), depreciation on which is classified as direct expenses.

The court found the procedure used by the taxpayer for calculating indirect expenses to comply with the requirements of the provisions of Chapter. 25 Tax Code of the Russian Federation. Taking into account the peculiarities of the enterprise’s production process, the court recognized the proven need to take into account as indirect expenses the wages of workers involved in the main production, deductions from it, and depreciation on fixed assets not directly involved in the production process. These conclusions were made in the Resolution of the Federal Antimonopoly Service of the North-Western District dated March 30, 2012 in case No. A44-1866/2011.

Settlement and reporting periods

For insurance premium payers, periods are established for summing up the payment of premiums - settlement and reporting periods.

The calculation period for insurance premiums is a calendar year.

Based on its results, the formation of the base for insurance premiums for the year is completed, and the amount of contributions payable to the fund budgets is determined.

Reporting periods are the first quarter, half a year, nine months, and a calendar year.

Based on the results of reporting periods, policyholders making payments to individuals must submit calculations of accrued and paid insurance premiums to extra-budgetary funds.

Accounting for the cost of purchasing licenses

As practice shows, the taxpayer has the right to include the costs of purchasing licenses as indirect expenses. For example, the taxpayer included the full cost of a license for retail trade in alcoholic beverages, which is valid for five years, as non-operating expenses.

The inspectorate considered that the cost of paying the fee and the cost of paying the state duty should reduce the accounting profit evenly over the period of validity of the license. The court found that in the taxpayer's accounting policy, the costs of acquiring a license are indirect. According to paragraph 2 of Art. 318 of the Tax Code of the Russian Federation, the amount of indirect costs for production and sales incurred in the reporting (tax) period is fully included in the expenses of the current reporting (tax) period.

The date of non-operating and other expenses is the date of accrual of taxes (fees) for expenses in the form of amounts of taxes (advance payments for taxes), fees and other obligatory payments (clause 1, clause 7, article 272 of the Tax Code of the Russian Federation). Moreover, in accordance with clause 1 art. 272 of the Tax Code of the Russian Federation, expenses accepted for tax purposes are recognized as such in the reporting (tax) period to which they relate, regardless of the time of actual payment of funds and (or) other forms of payment and are determined taking into account Art. Art.

318 - 320 Tax Code of the Russian Federation. In this regard, the court found justified the one-time attribution of the disputed expenses to the cost of production (Resolution of the Federal Antimonopoly Service of the Moscow District dated December 20, 2011 in case No. A41-2253/11). A similar approach to resolving the issue under consideration can be seen in another court verdict. The tax inspectorate excluded from expenses that reduce the amount of sales revenue the costs of obtaining a license valid for five years and the costs of issuing a certificate of conformity issued for three years.

At the same time, the inspection came to the conclusion that the taxpayer included certification costs as a lump sum as a violation of Art. 264 Tax Code of the Russian Federation. However, the court noted that according to paragraph 1 of Art. 318 of the Tax Code of the Russian Federation, the costs of acquiring licenses and the costs of product certification are indirect costs subject to in accordance with clause 2 of Art.

Object of taxation of insurance premiums

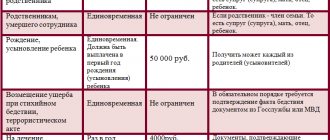

For organizations and individual entrepreneurs, the object of taxation is payments and other remuneration accrued:

- in favor of individuals working under civil law contracts and employment contracts, the subject of which is the performance of work, provision of services, with the exception of remunerations accrued in favor of individual entrepreneurs, lawyers, notaries and other persons who carry out private practice;

- under contracts:

- author's order;

- on the alienation of the exclusive right to works of science,

- literature, art;

- publishing license agreement;

- license agreement granting the right to use

- works of science, literature, art;

- in favor of individuals subject to compulsory social insurance in accordance with current legislation.